2021 Comparison Of Statewide Plans - Effective July 1, 2021 or October 1, 2021 - Manassas City Public ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

The Local Choice 2021 Comparison of Statewide Plans

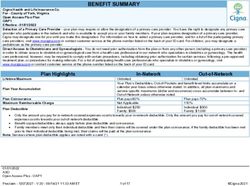

Key Advantage Expanded Key Advantage 250

Plan Year Deductible In-Network: In-Network:

(Key Advantage: Applies to Certain Medical Services One Person Two People Family One Person Two People Family

as Indicated on Chart) $100 See Family $200 $250 See Family $500

(HDHP: Applies to Medical, Behavioral Health, Out-of-Network: Out-of-Network:

and Prescription Drug Services) $200 See Family $400 $500 See Family $1,000

Plan Year Out-of-pocket Expense Limit In-Network: In-Network:

One Person Two People Family One Person Two People Family

$2,000 See Family $4,000 $3,000 See Family $6,000

Out-of-Network: Out-of-Network:

$3,000 See Family $6,000 $5,000 See Family $10,000

Out-of-Network Benefits Yes. Once you meet the out-of-network deductible, Yes. Once you meet the out-of-network deductible,

you pay 30% coinsurance for medical and behavioral you pay 30% coinsurance for medical and behavioral

health services. Copayments do not apply to medical health services. Copayments do not apply to medical

and behavioral health services. Copayments and and behavioral health services. Copayments and

coinsurance for routine vision, outpatient prescription coinsurance for routine vision, outpatient prescription

drugs and dental services will still apply. drugs and dental services will still apply.

Medical Care When Traveling (BlueCard) Included Included

Lifetime Maximum Unlimited Unlimited

Covered Services In-Network You Pay In-Network You Pay

Ambulance Travel 20% coinsurance after deductible 20% coinsurance after deductible

Autism Spectrum Disorder Copayment/coinsurance determined by Copayment/coinsurance determined by

service received service received

Behavioral Health and EAP

Inpatient treatment

• Facility Services $300 copayment per stay $400 copayment per stay

• Professional Provider Services $0 $0

Outpatient Professional Provider Visits $15 copayment $20 copayment

Employee Assistance Program (EAP) $0 $0

4 visits per issue (per plan year)

Dental Care

Preventive Dental Option (diagnostic and preventive $0 $0

services only for lower premium)

Comprehensive Dental Option

(for higher premium) One Person Two People Family One Person Two People Family

Dental Plan Year Deductible $25 $50 $75 $25 $50 $75

Plan Year Maximum (Except Orthodontics) $1,500 $1,500

• Preventive Dental Care $0 $0

• Primary Dental Care 20% coinsurance after dental deductible 20% coinsurance after dental deductible

• Major Dental Care 50% coinsurance after dental deductible 50% coinsurance after dental deductible

• Orthodontic Services (Includes Adult Ortho) 50% coinsurance, no dental deductible, 50% coinsurance, no dental deductible,

with $1,500 lifetime maximum with $1,500 lifetime maximum

2Key Advantage 500 Key Advantage 1000 High Deductible Health Plan

In-Network: In-Network:

One Person Two People Family One Person Two People Family One Person Two People Family

$500 See Family $1,000 $1,000 See Family $2,000 $2,800 See Family $5,600

Out-of-Network: Out-of-Network: Deductible is combined for In-Network and

$1,000 See Family $2,000 $2,000 See Family $4,000 Out-of-Network services.

In-Network: In-Network: In-Network:

One Person Two People Family One Person Two People Family One Person Two People Family

$4,000 See Family $8,000 $5,000 See Family $10,000 $5,000 See Family $10,000

Out-of-Network: Out-of-Network: Out-of-Network:

$7,000 See Family $14,000 $9,000 See Family $18,000 $10,000 See Family $20,000

Yes. Once you meet the out-of-network deductible, Yes. Once you meet the out-of-network deductible, Yes. Once you meet the combined deductible

you pay 30% coinsurance for medical and behavioral you pay 30% coinsurance for medical and behavioral you pay 40% coinsurance for medical, behavioral

health services. Copayments do not apply to medical health services. Copayments do not apply to medical health and prescription drug services from

and behavioral health services. Copayments and and behavioral health services. Copayments and Out-of-Network providers.

coinsurance for routine vision, outpatient prescription coinsurance for routine vision, outpatient prescription

drugs and dental services will still apply. drugs and dental services will still apply.

Included Included Included

Unlimited Unlimited Unlimited

In-Network You Pay In-Network You Pay In-Network You Pay

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

Copayment/coinsurance determined by Copayment/coinsurance determined by 20% coinsurance after deductible

service received service received

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$0 $0 20% coinsurance after deductible

$25 copayment $25 copayment 20% coinsurance after deductible

$0 $0 $0

$0 $0 $0

One Person Two People Family One Person Two People Family One Person Two People Family

$25 $50 $75 $25 $50 $75 $25 $50 $75

$1,500 $1,500 $1,500

$0 $0 $0

20% coinsurance after dental deductible 20% coinsurance after dental deductible 20% coinsurance after dental deductible

50% coinsurance after dental deductible 50% coinsurance after dental deductible 50% coinsurance after dental deductible

50% coinsurance, no dental deductible, 50% coinsurance, no dental deductible, 50% coinsurance, no dental deductible,

with $1,500 lifetime maximum with $1,500 lifetime maximum with $1,500 lifetime maximum

3The Local Choice 2021 Comparison of Statewide Plans (continued)

Key Advantage Expanded Key Advantage 250

Covered Services In-Network You Pay In-Network You Pay

Diabetic Education $0 $0

Diabetic Equipment 20% coinsurance after deductible 20% coinsurance after deductible

Diabetic Supplies - See Outpatient Prescription Drugs

Diagnostic Tests and X-rays 20% coinsurance, no deductible 20% coinsurance after deductible

(for specific conditions or diseases at a doctor’s office,

emergency room or outpatient hospital department)

Doctor Visits – on an Outpatient Basis

Primary Care Physicians $15 copayment $20 copayment

Specialty Care Providers $25 copayment $35 copayment

Early Intervention Services Copayment/coinsurance determined by Copayment/coinsurance determined by

service received service received

Emergency Room Visits

Facility Services $250 copayment per visit $350 copayment per visit

(waived if admitted to hospital) (waived if admitted to hospital)

Professional Provider Services

– Primary Care Physicians $15 copayment $20 copayment

– Specialty Care Providers $25 copayment $35 copayment

Diagnostic Tests and X-rays 20% coinsurance, no deductible 20% coinsurance after deductible

Home Health Services $0 $0

(90 visit plan year limit per member)

Home Private Duty Nurse’s Services 20% coinsurance after deductible 20% coinsurance after deductible

Hospice Care Services $0 $0

Hospital Services

Inpatient Treatment

• Facility Services $300 copayment per stay $400 copayment per stay

• Professional Provider Services

– Primary Care Physicians $0 $0

– Specialty Care Providers $0 $0

Outpatient Treatment

• Facility Services $100 copayment $150 copayment

• Professional Provider Services

– Primary Care Physicians $15 copayment $20 copayment

– Specialty Care Providers $25 copayment $35 copayment

Diagnostic Tests and X-Rays 20% coinsurance, no deductible 20% coinsurance after deductible

LiveHealth Online $0 $0

(Online doctor’s visits)

4Key Advantage 500 Key Advantage 1000 High Deductible Health Plan

In-Network You Pay In-Network You Pay In-Network You Pay

$0 $0 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$25 copayment $25 copayment 20% coinsurance after deductible

$40 copayment $40 copayment 20% coinsurance after deductible

Copayment/coinsurance determined by Copayment/coinsurance determined by 20% coinsurance after deductible

service received service received

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$25 copayment $25 copayment 20% coinsurance after deductible

$40 copayment $40 copayment 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$0 $0 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$0 $0 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$0 $0 20% coinsurance after deductible

$0 $0 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$25 copayment $25 copayment 20% coinsurance after deductible

$40 copayment $40 copayment 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

$0 $0 Determined by services received

$

5The Local Choice 2021 Comparison of Statewide Plans (continued)

Key Advantage Expanded Key Advantage 250

Covered Services In-Network You Pay In-Network You Pay

Maternity

Professional Provider Services (Prenatal &

Postnatal Care)

– Primary Care Physicians $15 copayment $20 copayment

– Specialty Care Providers $25 copayment $35 copayment

If your doctor submits one bill for delivery, prenatal and postnatal care services, there is no

copayment required for physician care. If your doctor bills for these services separately, your

payment responsibility will be determined by the services received.

Delivery

– Primary Care Physicians $0 $0

– Specialty Care Providers $0 $0

Hospital Services for Delivery (Delivery Room, $300 copayment per stay* $400 copayment per stay*

Anesthesia, Routine Nursing Care for Newborn)

Outpatient Diagnostic Tests 20% coinsurance, no deductible 20% coinsurance after deductible

Medical Equipment, Appliances, 20% coinsurance after deductible 20% coinsurance after deductible

Formulas, Prosthetics and Supplies

Outpatient Prescription Drugs -

Mandatory Generic

Retail up to 34-day supply* Tier 1 – $10 copayment Tier 1 – $10 copayment

*You may purchase up to a 90-day supply at a Tier 2 – $30 copayment Tier 2 – $30 copayment

retail pharmacy by paying multiple copayments, Tier 3 – $45 copayment Tier 3 – $45 copayment

or the coinsurance after the deductible Tier 4 - $55 copayment Tier 4 - $55 copayment

Home Delivery Services (Mail Order) Tier 1 – $20 copayment Tier 1 – $20 copayment

Covered Drugs for up to a 90-Day Supply Tier 2 – $60 copayment Tier 2 – $60 copayment

Tier 3 – $90 copayment Tier 3 – $90 copayment

Tier 4 - $110 copayment Tier 4 - $110 copayment

Diabetic Supplies 20% coinsurance, no deductible 20% coinsurance, no deductible

Routine vision - Blue View Vision Network

(Once Every Plan Year)

Routine Eye Exam $25 copayment $35 copayment

Eyeglass Lenses $20 copayment $20 copayment

Eyeglass Frames Up to $100 retail allowance** Up to $100 retail allowance**

Contact Lenses (In Lieu of Eyeglass Lenses)

• Elective Up to $100 retail allowance Up to $100 retail allowance

• Non-Elective Up to $250 retail allowance Up to $250 retail allowance

Upgrade Eyeglass Lenses (Available for Additional Cost)

• UV Coating, Tints, Standard Scratch-Resistant $15 $15

•Standard Polycarbonate $40 $40

• Standard Progressive $65 $65

• Standard Anti-Reflective $45 $45

• Other Add-Ons 20% off retail 20% off retail

Shots – Allergy & Therapeutic Injections 20% coinsurance, no deductible 20% coinsurance after deductible

(At Doctor’s Office, Emergency Room or

Outpatient Hospital Department)

*This plan will waive the hospital copayment if the member enrolls in the maternity management pre-natal program within the first 16 weeks of pregnancy,

has a dental cleaning during pregnancy and satisfactorily completes the program.

**You may select a frame greater than the covered allowance and receive a 20% discount for any additional cost over the allowance.

6Key Advantage 500 Key Advantage 1000 High Deductible Health Plan

In-Network You Pay In-Network You Pay In-Network You Pay

$25 copayment $25 copayment 20% coinsurance after deductible

$40 copayment $40 copayment 20% coinsurance after deductible

If your doctor submits one bill for delivery, prenatal and postnatal care services, there is no

copayment required for physician care. If your doctor bills for these services separately, your

payment responsibility will be determined by the services received.

$0 $0 20% coinsurance after deductible

$0 $0 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

Tier 1 – $10 copayment Tier 1 – $10 copayment 20% coinsurance after deductible

Tier 2 – $30 copayment Tier 2 – $30 copayment

Tier 3 – $45 copayment Tier 3 – $45 copayment

Tier 4 - $55 copayment Tier 4 - $55 copayment

Tier 1 – $20 copayment Tier 1 – $20 copayment 20% coinsurance after deductible

Tier 2 – $60 copayment Tier 2 – $60 copayment

Tier 3 – $90 copayment Tier 3 – $90 copayment

Tier 4 - $110 copayment Tier 4 - $110 copayment

20% coinsurance, no deductible 20% coinsurance, no deductible 20% coinsurance after deductible

$40 copayment $40 copayment $15 copayment

$20 copayment $20 copayment $20 copayment

Up to $100 retail allowance** Up to $100 retail allowance** Up to $100 retail allowance**

Up to $100 retail allowance Up to $100 retail allowance Up to $100 retail allowance

Up to $250 retail allowance Up to $250 retail allowance Up to $250 retail allowance

$15 $15 $15

$40 $40 $40

$65 $65 $65

$45 $45 $45

20% off retail 20% off retail 20% off retail

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

7The Local Choice 2021 Comparison of Statewide Plans (continued)

Key Advantage Expanded Key Advantage 250

Covered Services In-Network You Pay In-Network You Pay

Skilled Nursing Facility Stays

(180-Day Per Stay Limit Per Member)

Facility Services $0 $0

Professional Provider Services $0 $0

Spinal Manipulations and Other

Manual Medical Interventions

(30 Visits Per Plan Year Limit Per Member)

Primary Care Physicians $15 copayment $20 copayment

Specialty Care Providers $25 copayment $35 copayment

Surgery – See Hospital Services

Therapy Services

Infusion Services, Cardiac Rehabilitation Therapy,

Chemotherapy, Radiation Therapy,

Respiratory Therapy, Occupational Therapy,

Physical Therapy, and Speech Therapy

Facility Services 20% coinsurance after deductible 20% coinsurance after deductible

Professional Provider Services

– Primary Care Physicians 20% coinsurance after deductible 20% coinsurance after deductible

– Specialty Care Providers 20% coinsurance after deductible 20% coinsurance after deductible

Wellness services

Well Child (Office Visits at Specified Intervals

Through Age 6)

– Primary Care Physicians; No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

– Specialty Care Providers;

– Immunizations and Screening Tests

Routine Wellness – Age 7 & Older

• Annual Check-Up Visit (One Per Plan Year) No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

– Primary Care Physicians

– Specialty Care Providers

– Immunizations, Lab and X-Ray Services

• Routine Screenings, Immunizations, Lab No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

and X-Ray Services (Outside of Annual

Check-Up Visit)

Preventive Care (One of Each Per Plan Year) No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

• Gynecological Exam

• Pap Test

• Mammography Screening

• Prostate Exam (Digital Rectal Exam)

• Prostate Specific Antigen Test

• Colorectal Cancer Screenings

8Key Advantage 500 Key Advantage 1000 High Deductible Health Plan

In-Network You Pay In-Network You Pay In-Network You Pay

$0 $0 20% coinsurance after deductible

$0 $0 20% coinsurance after deductible

$25 copayment $25 copayment 20% coinsurance after deductible

$40 copayment $40 copayment 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

20% coinsurance after deductible 20% coinsurance after deductible 20% coinsurance after deductible

No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible No copayment, coinsurance, or deductible

9Health & Wellness Programs

Be your healthy best! The TLC plans include access to a host of health and wellness programs to help you manage

your health issues.

• Sydney: The Sydney mobile app acts like a personal health • MyHealth Advantage: Receive personalized health-related

guide, answering your questions and connecting you to the suggestions, tips, and reminders via mail or email to alert you

right resources at the right time. And you can use the chatbot of potential health risks, care gaps or cost-saving opportunities.

to get answers quickly. Download from the App Store (iOS) or • Staying Healthy Reminders: Receive yearly reminders of

Google Play (Android). important checkups, tests, screenings, immunizations, and

– Find care and check costs other preventive care needs for you and your family.

– View and use digital ID cards

– Check all benefits and view claims • 24/7 NurseLine & Audio Health Tape Library:

Sometimes you need health questions answered right away

• ConditionCare: Take advantage of free and confidential – even in the middle of the night. Call 24/7 NurseLine

support to manage these conditions: (800-337-4770) to speak with a nurse. Or use the Audio Health

– Asthma – High cholesterol Library if you want to learn about a health topic on your own.

– Heart failure – Coronary artery disease (CAD) Your call is always free and completely confidential.

– Diabetes – Metabolic syndrome

– Hypertension – Obesity • CommonHealth is the employee wellness program for

–C hronic obstructive The Local Choice. The main objective of CommonHealth is

pulmonary disease (COPD) to promote wellness in the workplace. Yearly programs

You may receive a call from ConditionCare if your claims cover a variety of health and wellness subjects and are

indicate you or an enrolled family member may be dealing presented in a variety of formats - including onsite programs

with one or more of these conditions. While you’re encouraged and video presentations that make it easy to participate.

to enroll and take advantage of help from registered nurses Not only are the programs educational and fun, they help

and other healthcare professionals, you may also opt out of you stay fit and healthy. For more information, visit

the program when they call. www.commonhealth.virginia.gov/tlc.

• Future Moms: Enroll and receive pre- and post-natal support.

Access a nurse coach and other maternity support specially

See more information on Health & Wellness

designed to help women have healthy pregnancies and

healthy babies. programs at www.anthem.com/tlc.

LiveHealthOnline.com Employee Assistance

LiveHealth Online lets you have a face-to-face doctor visit from

your mobile device or computer with a webcam at no cost. Go to Program (EAP)

livehealthonline.com or download the app so you’ll be ready

whenever you need these LiveHealth Online services. Your EAP gives you, your covered dependents and members of your

household up to four free confidential counseling sessions per

• LiveHealth Online Medical – Use your smartphone, tablet or issue each plan year.

computer to see a board-certified doctor in minutes, any

Turn to your EAP for information and resources about:

time, day or night. It’s a fast, easy way to get care for common

medical conditions like the flu, colds, allergies, pink eye, sinus • Emotional well-being

infections, and more. • Addiction and recovery

• Work and career

• LiveHealth Online Psychology – Use your device to make an

appointment to see a therapist or psychologist online. • Childcare and parenting

• Helping aging parents

• LiveHealth Online Psychiatry – Unlike therapists who provide • Financial issues

counseling support, psychiatrists can also provide medication (including free credit monitoring and identity theft recovery)

management. Use your device to set up a visit online. • Legal concerns

• LiveHealth Online EAP – You can access your free EAP • Smoking cessation

counseling sessions from your device. Contact your EAP to

learn more.

102021

KAISER PERMANENTE

BENEFITS SUMMARY

Effective July 1, 2021 or October 1, 2021This guide is only an overview. For a complete description of benefits, exclusions, limitations, and

reductions, please see the Kaiser Permanente Group Evidence of Coverage.

BENEFIT HIGHLIGHTS The Local Choice is a unique health benefits program managed by

the Commonwealth of Virginia Department of Human Resource

Management (DHRM). Your employer has selected the Kaiser

How The Plan Works . . . . . . . . . . . . . . . . . . . . . . . 2

Permanente plan from The Local Choice Health Benefits Program to

Summary of Benefits . . . . . . . . . . . . . . . . . . . . . . . 3 offer you and your eligible family members.

Using Your Benefits To Kaiser Foundation Health Plan of the Mid-Atlantic States, Inc.

(KFHP-MAS), is a federally qualified HMO. Health care services

The Best Advantage . . . . . . . . . . . . . . . . . . . . . . . . 5 are provided or arranged by the Mid-Atlantic Permanente Medical

Get Help in Your Language . . . . . . . . . . . . . . . . . 6 Group, P.C. (MAPMG) at one of Kaiser Permanente’s 38 medical

centers located in the Washington metropolitan area.

If You Need Assistance . . . . . . . . . . . . . . . . . . . . . 8

Access to your KP microsite:

https://my.kp.org/commonwealthofvirginia/

SERVICE AREA

Kaiser Permanente’s service area includes the District of Columbia and the following cities and counties in Virginia and Maryland:

Virginia Counties: Arlington, Caroline, Culpeper, Fairfax, Fauquier, Hanover, King George, Louisa, Loudoun, Orange, Prince William,

Stafford, Spotsylvania, Westmoreland

Cities: Alexandria, Fairfax, Falls Church, Fredericksburg, Manassas, Manassas Park

Maryland Counties: Anne Arundel, Baltimore, Calvert (partial), Carroll, Charles (partial), Frederick (partial), Harford, Howard,

Montgomery, Prince Georges

Cities: Baltimore

HOW THE PLAN WORKS

n Use your Directory of Providers to choose a convenient Kaiser Permanente medical center.

Then select a primary care physician for you and for each enrolled family member.

n Your Kaiser Permanente physician provides or arranges all services.

n Specialty care is provided on a referral basis by a MAPMG physician.

n Members make appointments directly with the Kaiser Permanente medical center by calling:

Metropolitan Washington, D.C. (703) 359-7878 or toll free at 1-800-777-7904 (TTY 711)

Outside Washington Area 1-800-777-7902

If you are registered on kp.org, you are able to make or cancel appointments.

EAP Services through Beacon Health Options (866) 517-7042 www.achievesolutions.net/kaiser

Dental Services through Dominion National 1-855-733-7524

n Outside the service area, you are covered for emergency and urgent care anywhere in the world. For information or assistance while

traveling, call the 24/7 Away from Home Travel Line at 951-268-3900 or visit kp.org/travel.

Email your doctor’s office with nonurgent questions, have a phone/video visit with your primary care physician, or connect with a

licensed care provider 24/7 for medical advice.

If you need urgent care in a state without Kaiser Permanente, go to the nearest MinuteClinic or urgent care facility. If you need

urgent care while traveling internationally, go to the nearest urgent care facility or hospital.

2 KAISER PERMANENTEKAISER PERMANENTE 2021 BENEFITS

Remember, your primary care physician must coordinate all your health care services. Your primary care physician will

refer you to a specialist if necessary. There are no benefits for services received out of your plan’s network, except for

emergency services in a life-threatening situation, and urgent care when traveling out of the area.

Covered Services You Pay

Outpatient Primary Care n Physician, x-ray, and other diagnostic services $25 copayment

Physician (PCP) Visits n Immunizations

n Pre-admission testing

n Voluntary family planning

n Laboratory, pathology, radiology, and diagnostic testing $0 copayment

Preventive Services n Periodic checkups $0

n Routine gynecological exam (Pap smear, pelvic exam, and breast exam — no referral needed)

n Well baby care and primary care services for children up to age 5 $0

n Women’s Preventive Care $0

Specialty Care Physician Visits Includes physician and outpatient facility services $40 copayment

Outpatient Surgery Free-standing ambulatory surgery center or hospital outpatient facility $75 Copayment

Inpatient Hospital Services n Includes semi-private room, intensive or coronary care unit $300 per admission

(For admissions arranged (no maximum number of days)

through your PCP and n Private room–if ordered by participating physician and

authorized by the HMO) approved by the HMO as medically necessary

n Physician services

n Surgery

n Anesthesia

n Diagnostic services such as lab and x-ray

n Blood transfusion procedures, drugs

n Physical therapy, chemotherapy, radiation therapy

Maternity Care n All routine outpatient pre- and postnatal care of the mother rendered by the OB/GYN $0

n Hospital care of mother and child $300 per admission

n Diagnostic testing (such as ultrasounds and fetal monitor procedures) $0

Emergency Services For n Hospital emergency room $75 copayment per visit

Life-Threatening Conditions (waived if admitted)

(Such as heart attacks, $40 copayment for urgent

hemorrhaging, poisoning, care center

loss of consciousness, or

convulsions — no referral needed)

Mental Health And n Outpatient visits when medically necessary Group visits - $12 copayment per visit

Substance Abuse Services Individual visits - $25 copayment

(A primary care physician per visit

referral is not needed. Instead, n Inpatient treatment when medically necessary $300 per admission

you must contact the plan n Detoxification $300 per admission

to coordinate care except in a

life-threatening situation.)

Complementary Alternative n Includes chiropractic and acupuncture services when $40 copayment per visit

Medicine medically necessary up to 30 visits

KAISER PERMANENTE 3Covered Services You Pay

Family Planning And n Sperm count 50% of allowable charges

Infertility Services n Hysterosalpinography

n Endometrial biopsy

n Vasectomy (male sterilization) $75 copayment

n IUD insertion (No charge, part of women’s health)

n Oral contraceptives (subject to prescription drug copayments)

No charge, part of women’s health

Therapy Services n Physical therapy (up to 30 visits per incident) $40 copayment

n Chemotherapy and radiation therapy $40 copayment

Skilled Care n Home health care, nursing, and other services in your home $0

n Skilled nursing facility (up to 100 days maximum per member $300 per admission

per calendar year)

Durable Medical Equipment n Rental or purchase of plan approved durable medical equipment $0

Diabetic Supplies n Diabetic Equipment and Supplies 20% of allowable charges

Prescription Drugs

Generic program (up to 30-day supply). Brand name drugs are Per prescription at a Kaiser Permanente

covered when prescribed by a physician. on-site pharmacy:

$15 generic/$25 brand formulary/

$40 non-brand formulary

When prescriptions are filled at a network pharmacy, your program Per prescription at a participating

covers the following: community pharmacy:

n Medically necessary drugs and medications prescribed by a participating physician $20 generic/$45 brand formulary/

n Any medication which by law requires a prescription, including birth control pills $60 non-brand formulary

Per prescription:

Maximum copay per 30-day supply of

insulin is $50

Specialty drugs 50% up to $75 Maximum

Mail Service Benefit n Maintenance drug prescription (up to 90-day supply for $13 generic/$23 brand formulary/

medications prescribed for 6 months or more) filled through $38 non-brand formulary

the mail service pharmacy for 2x copay.

Out-Of-Area Urgent Care n Physician’s office visit $40 copayment

(For unexpected conditions n Kaiser Permanente urgent care center/after hours care center $40 copayment

requiring immediate attention n Emergency room $75, waived if admitted

such as high fever, vomiting, or

sprains — no referral needed)

Additional Information

Lifetime maximum n None

Annual deductibles n None

n Benefits administered Per contract year

n Annual maximum out-of-pocket expense (does not include $1500 per individual

adult dental benefits, only pediatric dental benefits) $3000 per family

DENTAL

PLAN (Provided by Dominion National) You Pay

The plan pays an annual maximum of $1,000 per person for in-network services and

$500 for out-of-network services

Annual Deductible n PPO (in-network) $25 individual / $75 family

n Out-of-network $50 individual / $150 family

Diagnostic and n PPO (in-network) 0%

Preventive Services n Out-of-network 40%

Basic Services n PP0 (in-network) 20%

n Out-of-network 50%

Major Services n PP0 (in-network) 50%

n Out-of-network 65%

Orthodontics n PP0 (in-network) 50%

(age 19 and under) n Out-of-network Not covered

4 KAISER PERMANENTEUSING YOUR BENEFITS TO THE BEST ADVANTAGE

You have responsibilities to make sure that your health benefits plan works to your advantage. By following the

directions outlined below you can make sure you and enrolled family members receive the highest level of benefits.

PRIMARY CARE PHYSICIAN n You do not need a referral from your primary care physician

to receive services within the Kaiser Permanente program

You will receive comprehensive medical care primarily within for the following: OB/GYN, Optical, and Mental Health and

the Kaiser Permanente medical centers. Always contact Substance Abuse services.

your primary care physician when you or an enrolled family n If you see a provider outside of Kaiser Permanente without a

member needs care. Your primary care physician will provide referral, you will be responsible for the total cost.

or coordinate all medical services, including specialty and

inpatient care. To schedule a routine or urgent appointment

FOR LIFE-THREATENING

in metropolitan Washington, D.C., Maryland, or Virginia, call

(703) 359-7878 or toll free at 1-800-477-7904 (TTY 711).

EMERGENCIES

Outside the metropolitan Washington, D.C. area, call (such as heart attacks, hemorrhaging, poisoning, loss of

1-800-777-7902. consciousness, or convulsions)

However, there are exceptions: n Call 911 and go to the nearest emergency room for treatment.

n Contact your primary care physician as soon as possible.

n For a life-threatening emergency, call 911 and go to the nearest

emergency room for treatment. Contact your primary care

physician as soon as possible. MENTAL HEALTH AND

n For mental health or substance abuse treatment, call the SUBSTANCE ABUSE CARE

number shown on page 6 to schedule an appointment.

Before you or an enrolled family member receives inpatient,

Always remember, you pay the total cost of care when partial day, or outpatient services, you must call

services are not coordinated by your primary care Kaiser Permanente to coordinate your care:

physician or approved by the health plan.

n Behavioral Health Access Unit: 1-866-530-8778

n For Medical Emergencies (Washington, D.C.,

FOR MEDICAL, SURGICAL, OR

Maryland, and Virginia): 1-800-677-1112

HOSPITAL CARE

kp.org/selfcareapps

Always contact your primary care physician to receive medical

care. In urgent situations such as high fever, vomiting, sprains, or OUTPATIENT

broken bones, call:

PRESCRIPTION DRUGS

For appointments:

Always ask that your prescription be filled with a generic drug.

(703) 359-7878 or toll free at 1-800-777-7904 (TTY 711) —

Remember, the Kaiser Permanente plan primarily covers generic

5:30 a.m.-7:30 p.m., Monday through Friday

drugs unless your doctor requests a brand name, or a generic

7:30 a.m.-11:30 a.m., weekends and holidays

substitution is not permitted by law.

1-800-777-7902 — outside the metropolitan Washington, D.C. area.

2020 Prescription Drug Benefit:

Emergency hotline: 1-800-677-1112

n Kaiser Permanente Medical Center Pharmacy (Up to 30-Day

When your medical center is closed, call the evening and

supply)

weekend medical advice lines at:

$15 Generic/$25 Brand formulary/$40 Brand Non-formulary

(703) 359-7878 or toll free at 1-800-777-7904 (TTY 711) —

n Community Participation Pharmacy (Up to 30-Day supply)

metropolitan Washington, D.C. area

$20 Generic/$45 Brand formulary/$60 Brand Non-formulary

1-800-777-7902 — outside the metropolitan Washington, D.C. area

n Mail Order (Up to a 90-Day Supply 2x copay)

$13 Generic/$23 Brand formulary/$38 Brand Non-formulary

FOR SPECIALTY CARE

n Specialty Drug 50% up to $75 Max

Your primary care physician will refer you to a specialist as

needed. Most specialty services are provided by members of the

Kaiser Permanente medical group.

Additional Benefits include discount gym membership as well as free ClassPass, MyStrength, Calm. kp.org/selfcareapps KAISER PERMANENTE 5Get help in your language Get help in your language

Curious to know what all this says? We would be too. Here’s the English version:

Curious to know what all this says? We

This notice has important information about your application or benefits. Look for important dates. You might need to take

This notice has important information ab

action by certain dates to keep your benefits or manage costs. You have the right to get this information and help in your

action by certain dates to keep your ben

language for free. Call the Member Services number on your ID card for help. (TTY/TDD: 711)

language for free. Call the Member Serv

Spanish

Spanish

Este aviso contiene información importante acerca de su solicitud o sus beneficios. Busque fechas importantes. Podría

Este aviso contiene información importa

ser necesario que actúe para ciertas fechas, a fin de mantener sus beneficios o administrar sus costos. Tiene el derecho

ser necesario que actúe para ciertas fec

de obtener esta información y ayuda en su idioma en forma gratuita. Llame al número de Servicios para Miembros que

de obtener esta información y ayuda en

figura en su tarjeta de identificación para obtener ayuda. (TTY/TDD: 711)

figura en su tarjeta de identificación par

Amharic

ይህ ማስታወቂያ ሰለማመልከቻዎ ወይም ጥቅማ ጥቅሞችዎ ጠቃሚ መረጃ አለው። አስፈላጊ ቀኖችን ይፈልጉ። ጥቅማ ጥቅሞችዎን Amharic

ለማቆየት ወይም ክፍያዎችን

ይህ ማስታወቂያ

ለመቆጣጠር በሆነ ቀን አንድ እርምጃ መውሰድ ያስፈልግዎ ይሆናል። ይህንን መረጃ እና እገዛ በቋንቋዎ በነጻ የማግኘት መብት አልዎት። ሰለማመልከቻዎ

ለእገዛ በመታወቂያዎ ላይ ወይም

ያለውንጥቅማ ጥቅሞች

ለመቆጣጠር በሆነ ቀን አንድ እርምጃ መውሰድ ያስፈልግ

የአባል አገልግሎቶች ቁጥር ይደውሉ። (TTY/TDD: 711)

የአባል አገልግሎቶች ቁጥር ይደውሉ። (TTY/TDD: 7

Arabic

Arabic

ﻗد ﺗﺣﺗﺎج إﻟﻰ اﺗﺧﺎذ إﺟراء ﻗﺑل ﻣواﻋﯾد ﻣﺣددة ﻟﻼﺣﺗﻔﺎظ ﺑﺎﻟﻣزاﯾﺎ. اﺣرص ﻋﻠﻰ ﺗﺗﺑﻊ اﻟﻣواﻋﯾد اﻟﻣﮭﻣﺔ.ﯾﺣﺗوي ھذا اﻹﺷﻌﺎر ﻋﻠﻰ ﻣﻌﻠوﻣﺎت ﻣﮭﻣﺔ ﺣول طﻠﺑك أو اﻟﻣزاﯾﺎ اﻟﻣﻘدﻣﺔ ﻟك

ج إﻟﻰ اﺗﺧﺎذ إﺟراء ﻗﺑل ﻣواﻋﯾد ﻣﺣددة ﻟﻼﺣﺗﻔﺎظ ﺑﺎﻟﻣزاﯾﺎ

ﯾُرﺟﻰ اﻻﺗﺻﺎل ﺑرﻗم ﺧدﻣﺎت اﻷﻋﺿﺎء اﻟﻣوﺟود ﻋﻠﻰ ﺑطﺎﻗﺔ اﻟﺗﻌرﯾف اﻟﺧﺎﺻﺔ ﺑك. ﯾﺣق ﻟك اﻟﺣﺻول ﻋﻠﻰ ھذه اﻟﻣﻌﻠوﻣﺎت واﻟﻣﺳﺎﻋدة ﺑﻠﻐﺗك ﻣﺟﺎ ًﻧﺎ.أو ﻹدارة اﻟﺗﻛﻠﻔﺔ

ﺎء اﻟﻣوﺟود ﻋﻠﻰ ﺑطﺎﻗﺔ اﻟﺗﻌرﯾف اﻟﺧﺎﺻﺔ ﺑك

.(TTY/TDD:711)ﻟﻠﻣﺳﺎﻋدة

Bassa

Bassa

Bɔ̃̌ i-po-po nìà kɛ ɓéɖé bɔ̃̌ kpaɖɛ ɓá nì ɖɛ-mɔ́ -ɖìfèɖè mɔɔ kpáná-ɖɛ̀ ɓě m̀ ké dyéɛ dyí. M� mɛ mɔ́ wé kpaɖɛ ɓě dyi. Ɓɛ́ nì kpáná-ɖɛ̀

Bɔ̃̌ i-po-po nìà kɛ ɓéɖé bɔ̃̌ kpaɖɛ ɓá nì ɖɛ-m

ɓě ké m̀ xwa se mɔɔ ɓɛ́ m̀ ké píɔ́ xwa ɓɛ́ ìn nyɛɛ, ɔ mu wɛ̃̀ ìn ɓɛ́ m̀ kéɔ́ ɖɛ ɓě ti kɔ̃ nyùìn. M� ɓéɖé dyí-ɓɛ̀ ɖɛ̀ ìn-ɖɛ̀ ɔ̀ ɓɛ́ m̀ ké bɔ̃̌ nìà kɛ

ɓě ké m̀ xwa se mɔɔ ɓɛ́ m̀ ké píɔ́ xwa ɓɛ́ ìn

kè gbo-kpá-kpá dyé ɖé m̀ ɓíɖí-wùɖùǔn ɓó pídyi. Ɖá Mɛ́ ɓà jè gbo-gmɔ̀ Kpòɛ̀ nɔ̀ ɓà nìà nì Dyí-dyoìn-bɛ̃̀ ɔ̃ kɔ̃ ɛ, ɓó gbo-kpá-kpá dyé

kè gbo-kpá-kpá dyé ɖé m̀ ɓíɖí-wùɖùǔn ɓó

jè. (TTY/TDD: 711)

jè. (TTY/TDD: 711)

Bengali

Bengali

আপনার আেবদন বা সুিবধার িবষেয় এই িব�ি�িটেত গর�পূণর্ তথয্ রেয়েছ। গর�পূণর্ তািরখগিলর জনয্ েদখুন। আপনার সুিবধাগিল

আপনার আেবদন বা সুিবধার িবষেয় এই িব�

বজায় রাখার জনয্ বা খরচ িনয়�ণ করার জনয্ িনিদর্ � তািরেখ আপনােক কাজ করেত হেত পাের। িবনামূেলয্ এই তথয্ পাওয়ার ও

বজায় রাখার জনয্ বা খরচ িনয়�ণ করার জ

আপনার ভাষায় সাহাযয্ করার অিধকার আপনার আেছ। সাহােযয্র জনয্ আপনার আইিড কােডর্ থাকা সদসয্ পিরেষবা ন�ের কল করন।

আপনার ভাষায় সাহাযয্ করার অিধকার আপ

(TTY/TDD: 711)

(TTY/TDD: 711)

Chinese

Chinese

本通知有與您的申請或利益相關的重要資訊。請留意重要日期。您可能需要在特定日期前採取行動以維護您的利益或管理費

本通知有與您的申請或利益相關的重要資

用。您有權使用您的語言免費獲得該資訊和協助。請撥打您的 ID 卡上的成員服務號碼尋求協助。(TTY/TDD: 711)

用。您有權使用您的語言免費獲得該資訊

Farsi

Farsi

. ﺑﮫ ﺗﺎرﯾﺨﮭﺎی ﻣﮭﻢ دﻗﺖ ﮐﻨﯿﺪ.اﯾﻦ اﻃﻼﻋﯿﮫ ﺣﺎوی اﻃﻼﻋﺎت ﻣﮭﻢ در ﻣﻮرد درﺧﻮاﺳﺖ ﯾﺎ ﻣﺰاﯾﺎی ﺷﻤﺎ اﺳﺖ

.ﺑﮫ ﺗﺎرﯾﺨﮭﺎی ﻣﮭﻢ دﻗﺖ ﮐﻨﯿﺪ

ﻣﻤﮑﻦ اﺳﺖ ﻻزم ﺑﺎﺷﺪ در ﺑﺮﺧﯽ ﺗﺎرﯾﺨﮭﺎی ﺧﺎص اﻗﺪاﻣﯽ اﻧﺠﺎم دھﯿﺪ ﺗﺎ ﻣﺰاﯾﺎی ﺧﻮد را ﺣﻔﻆ ﮐﻨﯿﺪ ﯾﺎ

ﺰاﯾﺎی ﺧﻮد را ﺣﻔﻆ ﮐﻨﯿﺪ ﯾﺎ

ﺷﻤﺎ اﯾﻦ ﺣﻖ را دارﯾﺪ ﮐﮫ اﯾﻦ اﻃﻼﻋﺎت و ﮐﻤﮑﮭﺎ را ﺑﮫ ﺻﻮرت راﯾﮕﺎن ﺑﮫ.ھﺰﯾﻨﮫھﺎ را ﻣﺪﯾﺮﯾﺖ ﮐﻨﯿﺪ

ﻤﮑﮭﺎ را ﺑﮫ ﺻﻮرت راﯾﮕﺎن ﺑﮫ

ﺑﺮای درﯾﺎﻓﺖ ﮐﻤﮏ ﺑﮫ ﺷﻤﺎره ﻣﺮﮐﺰ ﺧﺪﻣﺎت اﻋﻀﺎء ﮐﮫ ﺑﺮ روی ﮐﺎرت.زﺑﺎن ﺧﻮدﺗﺎن درﯾﺎﻓﺖ ﮐﻨﯿﺪ

اﻋﻀﺎء ﮐﮫ ﺑﺮ روی ﮐﺎرت

.(TTY/TDD:711) ﺗﻤﺎس ﺑﮕﯿﺮﯾﺪ،ﺷﻨﺎﺳﺎﯾﯽﺗﺎن درج ﺷﺪه اﺳﺖ

French

French

Cette notice contient des informations importantes sur votre demande ou votre couverture. Vous y trouverez également

Cette notice contient des informations im

des dates à ne pas manquer. Il se peut que vous deviez respecter certains délais pour conserver votre couverture santé

des dates à ne pas manquer. Il se peut

ou vos remboursements. Vous avez le droit d’accéder gratuitement à ces informations et à une aide dans votre langue.

ou vos remboursements. Vous avez le d

Pour cela, veuillez appeler le numéro des Services destinés aux membres qui figure sur votre carte d’identification.

Pour cela, veuillez appeler le numéro de

(TTY/TDD: 711)

(TTY/TDD: 711)

German

German

Diese Mitteilung enthält wichtige Informationen zu Ihrem Antrag oder Ihren Beihilfeleistungen. Prüfen Sie die Mitteilung

Diese Mitteilung enthält wichtige Inform

auf wichtige Termine. Möglicherweise müssen Sie bis zu einem bestimmten Datum Maßnahmen ergreifen, um Ihre

auf wichtige Termine. Möglicherweise m

Beihilfeleistungen oder Kostenzuschüsse aufrechtzuerhalten. Sie haben das Recht, diese Informationen und

Beihilfeleistungen oder Kostenzuschüss

Unterstützung kostenlos in Ihrer Sprache zu erhalten. Rufen Sie die auf Ihrer ID-Karte angegebene Servicenummer für

Unterstützung kostenlos in Ihrer Sprach

Mitglieder an, um Hilfe anzufordern. (TTY/TDD: 711)

Mitglieder an, um Hilfe anzufordern. (TT

05179VAMENMUB 06/16 Notice

6 KAISER PERMANENTE 05179VAMENMUB 06/16 NoticeHindi

इस सूचना म� आपके आवेदन या लाभ� के बारे म� महत्वपूणर् जानकार� है । महत्वपूणर् �त�थयाँ दे ख�। अपने लाभ बनाए रखने या लागत

का प्रबंध करने के �लए, आपको �निश्चत �त�थय� तक कारर् वाई करने क� ज़रूरत हो सकती है । आपके पास यह जानकार� और मदद

अपनी भाषा म� मुफ़्त म� प्राप्त करने का अ�धकार है । मदद के �लए अपने ID काडर् पर सदस्य सेवाएँ नंबर पर कॉल कर� ।

(TTY/TDD: 711)

Igbo

Ọkwa a nwere ozi dị mkpa gbasara akwụkwọ anamachọihe ma ọ bụ elele gị. Chọgharịa ụbọchị ndi dị mkpa. Ị nwere ike

ịme ihe n’ụfọdụ ụbọchị iji dowe elele gị ma ọ bụ jikwaa ọnụego. Ị nwere ikike ịnweta ozi a yana enyemaka n’asụsụ gị

n’efu. Kpọọ nọmba Ọrụ Onye Otu dị na kaadị NJ gị maka enyemaka. (TTY/TDD: 711)

Korean

이 공지사항에는 귀하의 신청서 또는 혜택에 대한 중요한 정보가 있습니다. 중요 날짜를 살펴 보십시오. 혜택을 유지하거나

비용을 관리하기 위해 특정 마감일까지 조치를 취해야 할 수 있습니다. 귀하에게는 무료로 이 정보를 얻고 귀하의 언어로

도움을 받을 권리가 있습니다. 도움을 얻으려면 귀하의 ID 카드에 있는 회원 서비스 번호로 전화하십시오. (TTY/TDD: 711)

Russian

Настоящее уведомление содержит важную информацию о вашем заявлении или выплатах. Обратите внимание

на контрольные даты. Для сохранения права на получение выплат или помощи с расходами от вас может

потребоваться выполнение определенных действий в указанные сроки. Вы имеете право получить данную

информацию и помощь на вашем языке бесплатно. Для получения помощи звоните в отдел обслуживания

участников по номеру, указанному на вашей идентификационной карте.

(TTY/TDD: 711)

Tagalog

May mahalagang impormasyon ang abisong ito tungkol sa inyong aplikasyon o mga benepisyo. Tukuyin ang

mahahalagang petsa. Maaaring may kailangan kayong gawin sa ilang partikular na petsa upang mapanatili ang inyong

mga benepisyo o mapamahalaan ang mga gastos. May karapatan kayong makuha ang impormasyon at tulong na ito sa

ginagamit ninyong wika nang walang bayad. Tumawag sa numero ng Member Services na nasa inyong ID card para sa

tulong. (TTY/TDD: 711)

Urdu

ﯾہ ﻧوﮢس ٓاپ ﮐﯽ درﺧواﺳت ﯾﺎ ﻓﺎﺋدوں ﮐﮯ ﺑﺎرے ﻣﯾں اﮨم ﻣﻌﻠوﻣﺎت ﭘر ﻣﺷﺗﻣل ﮨﮯ۔ اﮨم ﺗﺎرﯾﺧﯾں دﯾﮑﮭﯾﮯ۔ اﭘﻧﮯ ﻓﺎﺋدوں ﯾﺎ ﻻﮔﺗوں ﮐو ﻣﻧظم ﮐرﻧﮯﮐﮯ ﻟﯾﮯ ٓاپ ﮐو ﺑﻌض

ﺗﺎرﯾﺧوں ﭘر اﻗدام ﮐرﻧﮯ ﮐﯽ ﺿرورت ﮨوﺳﮑﺗﯽ ﮨﮯ۔ آپ ﮐو اﭘﻧﯽ زﺑﺎن ﻣﯾں ﻣﻔت ان ﻣﻌﻠوﻣﺎت اور ﻣدد ﮐﮯﺣﺻول ﮐﺎ ﺣق ﮨﮯ۔ ﻣدد ﮐﮯ ﻟﯾﮯ اﭘﻧﮯ آﺋﯽ ڈی ﮐﺎرڈ ﭘر ﻣوﺟود

(TTY/TDD:711) ﻣﻣﺑر ﺳروس ﻧﻣﺑر ﮐو ﮐﺎل ﮐرﯾں۔

Vietnamese

Thông báo này có thông tin quan trọng về đơn đang ký hoặc quyền lợi bảo hiểm của quý vị. Hãy tìm các ngày quan trọng.

Quý vị có thể cần phải có hành động trước những ngày nhất định để duy trì quyền lợi bảo hiểm hoặc quản lý chi phí của

mình. Quý vị có quyền nhận miễn phí thông tin này và sự trợ giúp bằng ngôn ngữ của quý vị. Hãy gọi cho Dịch Vụ Thành

Viên trên thẻ ID của quý vị để được giúp đỡ. (TTY/TDD: 711)

Yoruba

Àkíyèsí yìí ní ìwífún pàtàkì nípa ìbéèrè tàbí àwọn ànfàní rẹ. Wá déètì pàtàkì. O le ní láti gbé ìgbésẹ̀ ní déètì kan pàtó láti

tọ́jú àwọn ànfàní tàbí ṣàkóso iye owó rẹ. O ní ẹ̀tọ́ láti gba ìwífún yìí kí o sì ṣèrànwọ́ ní èdè rẹ lọ́fẹ̀ẹ́. Pe Nọ́mbà àwọn ìpèsè

ọmọ-ẹgbẹ́ lórí káàdì ìdánimọ̀ rẹ fún ìrànwọ́. (TTY/TDD: 711)

It’s important we treat you fairly

That’s why we follow federal civil rights laws in our health programs and activities. We don’t discriminate, exclude people,

or treat them differently on the basis of race, color, national origin, sex, age or disability. For people with disabilities, we

offer free aids and services. For people whose primary language isn’t English, we offer free language assistance services

through interpreters and other written languages. Interested in these services? Call the Member Services number on your

ID card for help (TTY/TDD: 711). If you think we failed to offer these services or discriminated based on race, color,

national origin, age, disability, or sex, you can file a complaint, also known as a grievance. You can file a complaint with

our Compliance Coordinator in writing to Compliance Coordinator, P.O. Box 27401, Mail Drop VA2002-N160, Richmond,

VA 23279. Or you can file a complaint with the U.S. Department of Health and Human Services, Office for Civil Rights at

200 Independence Avenue, SW; Room 509F, HHH Building; Washington, D.C. 20201 or by calling 1-800-368-1019

(TDD: 1- 800-537-7697) or online at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf. Complaint forms are available at

http://www.hhs.gov/ocr/office/file/index.html.

05179VAMENMUB 06/16 Notice KAISER PERMANENTE 7NOTE: This is a brief summary of benefits. For

a complete description of the plan, refer

IF YOU NEED ASSISTANCE

to your Kaiser Permanente Member Member Services (301) 468-6000

Handbook. These handbooks are available 1-800-777-7902 outside Washington, D.C. area

from your Benefits Administrator, or may

be obtained by calling Kaiser Permanente Appointments and (703) 359-7878

directly. or toll free at 1-800-777-7904 (TTY 711)

Medical Advice 1-800-777-7902 outside Washington, D.C. area

Dental Benefit Provider Dominion National: 1-855-733-7524

Mental Health And

Substance Abuse Care 1-866-530-8778

Employee Assistance Beacon Health Options: (866) 517-7042

Program (EAP) www.achievesolutions.net/kaiser

A10511 (12/2020)Your Advantage 65

Dental/Vision Benefits

Medical, Dental and Vision administered by

Anthem Blue Cross and Blue Shield

Effective January 1, 2021 - December 31, 2021The Local Choice is a unique health benefits program managed by the Commonwealth

of Virginia Department of Human Resource Management (DHRM). The Advantage 65 with

Dental/Vision plan may be offered to you if you are eligible for Medicare and to your

Medicare-eligible family members by your group. Benefits are administered on a calendar

year basis to coincide with your Medicare coverage. Changes in your monthly premium

are effective July 1 (or October 1 for certain school groups) to coincide with your former

employer’s The Local Choice (TLC) health plan renewal.

The Advantage 65 with Dental/Vision plan provides medical benefits that work with Medicare

Part A and Part B. It does not provide prescription drug coverage.

This guide is only an overview. For a complete description of the benefits, exclusions,

limitations, and reductions, please see the TLC Medicare Coordinating Plans Member

Handbook.

Service Area

Wherever retirees live.

Medical Benefits

To receive full benefits you must be enrolled under both Part A and Part B of Medicare.

Always show both your Medicare card and your Anthem identification card when you

receive care.

Advantage 65 covers the Medicare Part A hospital deductible (after you pay $100) and

copayment amounts, and the Part B coinsurance for Medicare-approved charges. It also

covers out-of-country Major Medical services.

Choose Healthcare Providers Carefully

Physicians

Ask your doctor if he or she is a Medicare participating physician. A

doctor who participates in Medicare agrees to:

n File claims on your behalf

n Accept Medicare’s payment for covered services

This means your coinsurance is limited to a percentage of the

Medicare-approved charge. Go to Medicare.gov for additional

information about Medicare-participating physicians.

This brochure describes benefits based on Medicare-approved charges. Doctors who

do not accept assignments may not charge you any more than 15% above what Medicare

considers a reasonable fee. This applies to all doctors and all services.

Hospitals

Hospitals that participate in the Medicare program are covered.

Admissions not approved by Medicare are not covered.

2 Advantage 65 with Dental/VisionAdvantage 65

What The Plan Covers

Plan Pays

PART A SERVICES

Hospital Inpatient n Medicare Part A hospital deductible less $100 per benefit period, days 1-60 In full

nM

edicare Part A daily hospital copayment amount, days 61-90 In full

n 100% of the allowable charge*, for eligible expenses for an additional 365 days. In full

nC

opayment amount for Medicare Lifetime Reserve Days (60 days available) In full

Skilled Nursing Facility n Medicare Part A skilled nursing facility copayment, days 21-100 In full

(Medicare covers days 1-20 in full.)

nA

daily amount equal to Medicare skilled nursing home copayment, In full

days 101-180 (Medicare provides no coverage beyond 100 days.)

Plan Pays

PART B SERVICES

Physician And Other Services n Part B coinsurance of Medicare-approved charges for services such as: In full

(after you pay the Medicare • Doctor’s care

Part B calendar year • Surgical services

deductible) • Outpatient x-ray and lab services

• Professional ambulance service

AT HOME n At-home recovery care for an illness or injury approved under a Medicare Up to $40 per

RECOVERY SERVICES home health treatment plan. Benefits include: visit (limited

•H ome visits up to the number approved by Medicare, not to exceed to $1,600 per

7 visits per week (This benefit applies to home health services, certified calendar year)

by a physician, for personal care during the recovery period)

Plan Pays

OUT-OF-COUNTRY

MAJOR MEDICAL

SERVICES n Lifetime maximum $250,000

(after you pay $250

n Annual restoration of lifetime maximum (limited to the amount of benefits $2,000

calendar year deductible)

used in any one year)

Covered Services n Medically necessary services received in a foreign country 80% AC*

Out-Of-Pocket Expense Limit n In a calendar year when your out-of-pocket expenses for covered services

reach $1,200, the plan pays 100% of the allowable charge for the rest of the

calendar year.

*Allowable Charge (AC) — The term has two meanings, depending on whether the service is provided by a doctor (or

other healthcare professional) or a hospital. For care by a doctor or other healthcare professional, the allowable charge is

the lesser amount of your plan’s allowance for that service, or the provider’s charge for that service. For hospital services,

the allowable charge is the amount of the negotiated compensation to the facility for the covered service or the facility’s

charge for that service, whichever is less. For complete information about the allowable charge, please see the Medicare

Coordinating Plans Member Handbook.

Advantage 65 with Dental/Vision 3Dental/Vision Benefits

Dental Benefits

The plan pays up to $1,500 per member per calendar year. It also pays 100% of the

allowable charge for diagnostic and preventive services, such as oral examinations and

dental x-rays. It pays 80% of the allowable charge for basic services, such as fillings,

re-cementing of crowns, inlays and bridges, or repair of removable dentures. The

remaining 20% is your responsibility. The plan also pays 5% for major services such as

crowns, dentures, and implants.

When you need services, simply present your plan identification card to your dentist. If you go to an Anthem Dental

Complete network dentist, you will be responsible only for your coinsurance. If services are provided by a non-network

dentist, you pay your coinsurance, plus the difference, if any, between the plan’s allowable charge for a covered service

and the dentist’s charge. Network dentists are listed on the Web at www.anthem.com/tlc, or call Anthem Dental Complete

at 1-855-648-1411 to determine if a dentist is in the network.

Plan Pays $1,500 Maximum Per Person Per Calendar Year In-Network You Pay

Diagnostic And Twice-a-year visits to the dentist for oral examinations, $0

Preventive Services x-rays, and cleanings

Basic Dental Care Fillings, oral surgery, periodontal services, scaling, 20% AC**

repair of dentures, root canals and other endodontic services,

and recementing of existing crowns and bridges

Major Dental Care Crowns (single crowns, inlays and onlays), prosthodontics 95% AC**

(partial or complete dentures and fixed bridges) and dental implants.

Out-Of-Network Care For services by a non-network dentist, you pay the applicable coinsurance plus any amounts

above the allowable charge.

**Allowable Charge (AC) — The allowable charge is the lesser amount of the Anthem Dental Complete plan allowance for

that covered service, or the provider’s submitted charge for that covered service. Participating Anthem Dental Complete

dentists have agreed to accept Anthem’s payment, plus any required coinsurance (if applicable) as payment in full for

covered benefits..

Routine Vision Benefits

Your routine vision benefits are through the Anthem Blue View Vision network. Available once per calendar

year, your vision benefits include a routine eye exam, eyewear and special eye accessory discounts. You may

receive services from any ophthalmologist, optometrist, optician and/or retail location in the Anthem Blue

View Vision network.

To locate an Anthem Blue View Vision provider, select Find A Doctor at www.anthem.com/tlc, or contact Member

Services at 800-552-2682 for assistance. To receive vision services, simply present your Anthem identification card to

your Blue View Vision provider when you receive your eye exam or purchase covered eyewear. Your Blue View Vision

provider will verify eligibility and file your claims.

While some vision benefits are also covered out-of-network, you will receive the

most value when you choose a Blue View Vision provider. If you use an out-of-

network provider, your benefits will be covered at a lower payment level. You will

need to pay for covered services and purchases at the time of your visit and send

an out-of-network claim form to Blue View Vision. The claim form is available at

anthem.com/tlc under Forms.

Certain non-routine vision care such as eye surgery may be covered under your

primary medical coverage under your Medicare plan. Refer to your Medicare and

You Handbook or contact Medicare for more information.

4 Advantage 65 with Dental/VisionVision Benefits Highlights

Routine vision care services In-Network You Pay

Routine eye exam (once per calendar year) $20 copayment

Eyeglass frames

Once per calendar year you may select any eyeglass frame1 and receive the following $100 allowance then 20% off

allowance toward the purchase price: remaining balance

Standard Eyeglass Lenses

Polycarbonate lenses included for children under 19 years old.

Once per calendar year you may receive any one of the following lenses:

n Standard plastic single vision lenses (1 pair) $20 copay; then covered in full

n Standard plastic bifocal lenses (1 pair) $20 copay; then covered in full

n Standard plastic trifocal lenses (1 pair) $20 copay; then covered in full

n Standard progressive lenses (1 pair) $85 copay; then covered in full

Upgrade Eyeglass Lenses (available for additional cost) Lens options Member cost for upgrades

When receiving services from a Blue View Vision n UV coating $15

provider, you may choose to upgrade your new n Tint (solid and gradient) $15

eyeglass lenses at a discounted cost. Eyeglass lenses n Standard scratch resistance $15

copayment applies, plus the cost for the upgrade. n Standard polycarbonate $40

n Standard anti-reflective coating $45

n Other add-ons and services 20% off retail price

Contact lenses Lens options

Prefer contact lenses over glasses? You may choose n Elective conventional lenses2 $100 allowance then 15% off

to receive contact lenses instead of eyeglasses the remaining balance

(frames and lenses) and receive an allowance n Elective disposable lenses2 $100 allowance (no additional

toward the cost of a supply of contact lenses once discount)

per calendar year. n Non-elective contact lenses2 $250 allowance (no additional

discount)

1 Discount is not available on certain frame brands in which the manufacturer imposes a no-discount policy.

2 Elective

contact lenses are in lieu of eyeglass lenses. Non-elective lenses are covered when glasses are not an option for

vision correction.

Options For Prescription Drug Coverage—

Medicare Part D

If you want prescription drug coverage, you must enroll in a

separate Medicare Part D prescription drug plan.

Several Medicare Part D plan options are being offered. To determine

what drug coverage option best meets your needs, consult the

Medicare and You Handbook, call 1-800-MEDICARE (1-800-633-4227)

or visit the Medicare Web site at www.medicare.gov.

Advantage 65 with Dental/Vision 5You can also read