Year 2017 in Review. Year 2018 in Preview - CommSec

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economics | December 28 2017

Year 2017 in Review. Year 2018 in Preview

Economic & financial markets

With only a few days of the calendar year remaining, we can get a good sense about how the economy and

financial markets performed in 2017. And it’s not too early to look into the crystal ball for 2018.

Big Picture: The Economy

Investors braced for surprises in 2017, especially given the large number of European elections to be held over

the year and the new era of the Trump presidency in the United States.

But there was a clear absence of surprises. The global economy strengthened and sharemarkets generally rose

across the globe. Volatility fell, rather than rose.

The global economy probably grew by 3.6 per cent in 2017, above the 40-year average of 3.5 per cent. Growth of

3.7 per cent is tipped for 2018.

The Australian economy probably grew around 2.5 per cent in 2017, down from the decade average of 2.7 per

cent. The current annual economic growth rate is 2.8 per cent.

The annual inflation rate stands at 1.8 per cent. Once volatile factors are removed, underlying inflation is also

around 1.8 per cent.

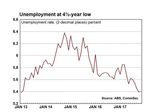

The unemployment rate stands at 5.4 per cent, a 4½-year low and down from 5.8 per cent at the end of 2016. In

the year to November, 383,300 jobs were created, the biggest annual gain for over 12 years.

Wages grew by 2.0 per cent in the year to September, up from a record (20-year) low of 1.9 per cent.

The Federal Government now expects a budget deficit of $29.4 billion in 2017/18 (1.3 per cent of GDP), down

from the earlier estimate of $37.1 billion.

Australia’s population grew by 1.60 per cent in the year to June, down from the decade average of 1.69 per cent.

According to the NAB monthly survey, business conditions are close to the best they have been for 20 years.

Consumer confidence is improving as people adapt to the ‘new black’: slower growth of wages and prices in the

economy.

Craig James, Chief Economist

Twitter: @CommSec

Produced by Commonwealth Research based on information available at the time of publishing. We believe that the information in this report is correct and any opinions, conclusions or

recommendations are reasonably held or made as at the time of its compilation, but no warranty is made as to accuracy, reliability or completeness. To the extent permitted by law, neither

Commonwealth Bank of Australia ABN 48 123 123 124 nor any of its subsidiaries accept liability to any person for loss or damage arising from the use of this report.

The report has been prepared without taking account of the objectives, financial situation or needs of any particular individual. For this reason, any individual should, before acting on the information

in this report, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice. In the

case of certain securities Commonwealth Bank of Australia is or may be the only market maker.

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399 a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia.

This report is approved and distributed in the UK by Commonwealth Bank of Australia incorporated in Australia with limited liability. Registered in England No. BR250 and regulated in the UK by the

Financial Services Authority (FSA). This report does not purport to be a complete statement or summary. For the purpose of the FSA rules, this report and related services are not intended for

private customers and are not available to them.

Commonwealth Bank of Australia and its subsidiaries have effected or may effect transactions for their own account in any investments or related investments referred to in this report.Economic Insights: Year 2017 in Review. Year 2018 in Preview

New car sales stand at record highs on an annual

basis.

The annual trade surplus stands at a record high of

$19.9 billion.

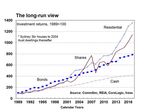

Australian home prices grew by around 4.5 per cent in

2017 after lifting by 5.8 per cent in 2016.

Financial markets

The Reserve Bank left the cash rate at a record low of

1.50 per cent in 2017.

The US Federal Reserve lifted interest rates three

times in 2017, each time by a quarter of a percent,

with the federal funds rate at 1.25-1.50 per cent at the

end of 2017.

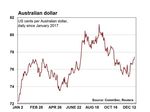

The Aussie dollar started the year near US72 cents

and is ending the year near US78 cents. The actual range in 2017 was US71.60c to US81.24c.

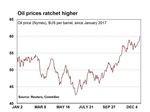

Commodity prices generally lifted over 2017 in response to stronger world economic growth. Base metals lifted

with annual gains averaging around 25 per cent. Wool lifted 30 per cent and ended the year just off record highs.

The Nymex oil price recently lifted to a 2½-year high near US$60 a barrel.

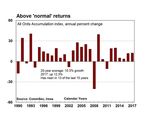

The Australian sharemarket (ASX 200) has lifted by 7.1 per cent so far in 2017 (All Ordinaries has lifted 7.9 per

cent).

Total returns on Australian shares (share prices plus dividends) have lifted by 12.3 per cent in 2017 after rising by

11.6 per cent in 2016. Returns on government bonds have risen by 3 per cent.

Of the 21 sub-industry sectors, all but four have lifted over 2017. The Capital Goods sector has been the best

performer on the Australian market (up 44 per cent) from Food, beverages & tobacco (up 39 per cent). The worst

performer has been Telecom (down 26 per cent) from Retailing (down 13 per cent). The MidCap50 has been the

strongest size category (up 18 per cent) from the Small Ordinaries (up 16.5 per cent)

Financial markets: Global comparisons

In terms of global sharemarkets, we have tracked 73 bourses and so far and all but nine have recorded gains in

local currency terms over 2017. While the “best” performer has been Zimbabwe (up 120 per cent), the gains have

been driven by hyper-inflation. Next strongest has been Argentina (up 71 per cent) from Ghana (up 52 per cent)

and Vietnam (up 45 per cent).

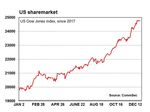

Of major markets, Hong Kong is up by around 34 per cent. The US Dow Jones is up by 25.4 per cent in 2017 with

the US S&P 500 index up by 19.8 per cent. In Europe, the UK FTSE is up by 6.7 per cent with the German Dax

up 13.8 per cent. In Asia, the Japanese sharemarket has lifted by 19.9 per cent. The Australian sharemarket is in

50th place, up by around 7 per cent.

For global currencies we tracked the movements of 120 currencies against the US dollar over 2017. And to date,

68 currencies are ending the year firmer against the greenback with 18 currencies largely unchanged while 34

currencies are weaker than at the start of 2017.

Eastern European currencies have been amongst the strongest against the greenback including the currencies of

Poland, the Czech Republic, Serbia and Croatia, with gains around 15 per cent.

December 28 2017 2Economic Insights: Year 2017 in Review. Year 2018 in Preview

The Euro has lifted around 11 per cent against the US

dollar in 2017 with the UK pound up around 8 per cent

and Aussie dollar up around 7 per cent.

Central and South American currencies have been

amongst the weakest against the US dollar over the year.

Economic outlook for 2018

Global Economy: The International Monetary Fund tips

global economic growth to lift from 3.6 per cent in 2017 to

3.7 per cent in 2018.

The key issue is whether the low growth rates of prices

and wages will continue, thus prompting central banks to

remain on the monetary policy sidelines.

Globalisation and technological change have been

influential in keeping inflation low. In short, consumers

can buy goods whenever they want and wherever they

are.

Investors will closely watch the path of the US economy in light of recent tax cuts as well as the intention of the

Trump administration to pursue increased spending on infrastructure.

China will remain in the spotlight as it attempts to define a sustainable course for the economy. Authorities want to

achieve a higher standard of material wealth for the Chinese people while at the same time reducing pollution and

congestion.

Australia: We expect the economy to grow by 2.50-3.00 per cent in 2018, slightly above the growth range for

2017.

Despite the economy approaching its sustainable ‘speed limit’, inflation is expected to drift higher towards 2.5 per

cent over 2018 but globalisation will continue to cap growth of prices.

The nature of the housing market ‘landing’ and path of unemployment to the ‘full employment’ level near 5.00 per

cent are key issues for 2018.

Financial markets outlook for 2018

Australian dollar: Last year we thought the Aussie dollar would hold in a tight trading range of US67-79 cents over

2017. The range was even tighter, with the Aussie broadly between US71-81 cents. Over the past 40 years, the

Aussie dollar has, on average, tracked in a US13.4 cent range. We expect a trading range in 2018 of US73-83

cents. Much will depend on whether US tax cuts prove stimulatory, leading the Federal Reserve to lift interest

rates.

Interest rates: Over 2017, the cash rate has averaged 1.50 per cent – a record low. But despite the low level of

rates, the Reserve Bank is in no rush to change rates in any direction. The Reserve Bank Governor agrees with

financial markets, believing that the next move in rates will most likely be up. But Governor Lowe adds that a

move is still some way off. Inflation is well controlled and is only expected to edge modestly higher over the

coming year.

Sharemarket: Last year we thought that the All Ordinaries would end 2017 between 5,850-6,100 points. The

prediction was largely realised, although we were clearly a little too conservative. Although it’s worth noting that

the All Ords lifted 400 points or around 7 per cent in the last three months of the year

December 28 2017 3Economic Insights: Year 2017 in Review. Year 2018 in Preview

We expect there will be consolidation of the

recent solid sharemarket gains during the

first half of 2018 before the market resumes

its push to reach the record highs set in

November 2007.

Both the Australian and global economies

are expected to grow slightly above their

longer-term average pace in 2018.

The All Ordinaries is expected to end 2018

between 6,500-6,700 points. But as always

the focus needs to be on total returns

(includes dividends).

Total returns on shares are tipped to lift by 10-12 per cent in 2018.

Craig, James, Chief Economist, CommSec

Twitter: @CommSec

December 28 2017 4You can also read