The Rising Tide May 2019 - Marine Money

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

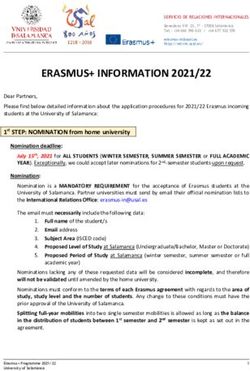

Agenda

Contact Details

Underlying Drivers 3

Gregory Brown

Echoes from the Past 7

Associate Director - Offshore

The Shape of Things to Come 12

gregory.brown@msiltd.com

Where Could it All Go Wrong 16 +44 (0) 20 7940 7190

© Maritime Strategies International www.msiltd.comUnderlying Drivers

Moving in the right direction

© Maritime Strategies International 3 www.msiltd.comState of the Nation

US Gulf of Mexico Drilling Fleet US Gulf of Mexico OSV Fleet

# of Rigs # of Vessels

30 300

In Service Laid-up In Service Laid-up

25 250

20 200

15 150

10

100

5

50

0

0

Jack-up

Semi-sub

Drillship

PSV

AHT(S)

US Gulf of Mexico Drilling Fleet US Gulf of Mexico OSV Fleet

# of Rigs # of Vessels

18 100

Semi-sub Jackup Drillship PSV AHT(S)

16 90

14 80

70

12

60

10

50

8 40

6 30

4 20

2 10

0 0

Adriatic Marine

SEACOR

Harvey Gulf

Edison Chouest

Tidewater

Otto Candies

Hornbeck

Crosby Tugs

GIS Marine

Ensco

Diamond

Atlantic Drilling

Spartan

Maersk

Rowan

Enterprise

Seadrill

Pacific Drilling

ADES

Noble

Transocean

© Maritime Strategies International 4 www.msiltd.comOffshore Contract Awards

Offshore Project Awards

$ Bn

50

Middle East Europe Asia Pacific Americas Africa

45 Offshore awards increased by

around 5% in 2018

40

35 Awards to market tracking more

30 than 30% higher y-o-y after robust

Q1 for subsea and LNG

25

20 Gulf of Mexico accounted for around

15

10% of incremental investment in

2018 – 15% y-t-d

10

5 If you’ve made it this far…

0

2018

2014

2015

2016

2017

2019

© Maritime Strategies International 5 www.msiltd.comGlobal Benchmarks

Employment Rate

100%

PSV AHTS Jack-Up Floater

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2000

2001

2003

2004

2007

2008

2011

2012

2014

2015

2018

2019

2002

2005

2006

2009

2010

2013

2016

2017

© Maritime Strategies International 6 www.msiltd.comEchoes from the past

The 1980s reborn?

© Maritime Strategies International 7 www.msiltd.comA Throwback to the 80s

Jack-Up Employment Floater Employment

Employment Employment

Rate Rate

95% 95%

Jack-Up Employment 81-88 Floater Employment 81-88

Jack-Up Employment 12-19 Floater Employment 12-19

85% 85%

75% 75%

65% 65%

55% 55%

45% 45%

35% 35%

1

2

3

4

5

7

8

6

1

2

3

4

5

7

8

6

Year Year

© Maritime Strategies International 8 www.msiltd.comA Throwback to the 80s

1981-1988 2012-2019

# Active Rigs # Active Rigs

600 800

Floater Demand Floater Demand

Jack-Up Demand

Jack-Up Demand 700

500

600

400

500

300 400

300

200

200

100

100

0 0

1981

1982

1983

1984

1985

1986

1987

1988

2012

2013

2014

2015

2016

2017

2018

2019

© Maritime Strategies International 9 www.msiltd.comAfter the Goldrush

Rig Fleet 1980-2008

# of Rigs

700 120

Floater Fleet

Jack-Up Fleet

Deliveries (RHA)

Retirements (RHA)

600

100 After the 1980s boom in drilling newbuilds,

the market entered a twenty year downturn

500

80

Rates were more solid…

400

60 A steady stream of retirements, and lower oil

300 volatility propped the market up, but there

was little to excite the market until…

40

200

20

100

0 0

1980

1981

1982

1984

1985

1986

1987

1989

1990

1991

1992

1993

1994

1995

1997

1998

1999

2000

2002

2003

2004

2005

2006

2007

2008

1983

1988

1996

2001

© Maritime Strategies International 10 www.msiltd.comAfter the Goldrush… The Harvest?

Rig Fleet 2008-2030E

# of Rigs

1000 60

Floater Fleet

Jack-Up Fleet

900

Deliveries (RHA)

Retirements (RHA) We think it’s different this time round

50

800

Scrapping at record levels

700

40

Tomorrow’s drilling requires different rigs –

600

automation, high pressure drilling, winterised

500 30 etc

400

Increasing environmental pressure

20

300

200

But – recovery is bifurcated – Floaters far

10 more robust relative to Jack-Ups

100

0 0

2009

2010

2011

2012

2013

2015

2016

2017

2018

2019

2021

2022

2023

2024

2025

2027

2028

2029

2030

2008

2014

2020

2026

© Maritime Strategies International 11 www.msiltd.comThe Shape of Things to Come

The rising tide will not lift all boats

© Maritime Strategies International 12 www.msiltd.comHow to make offshore competitive

An Engineers Influence

The downturn has been sufficient in length to enact

real structural change

Major Influence Decreasing Influence Low Influence

Technological innovations are changing the way

Project

Management

fields are developed

Next generation equipment is smaller, lighter and

features fewer component pieces

Expenditure

Influence

Construction

Management Fixed infrastructure moving towards unmanned

facilities

Detailed

Engineering

Floating platforms formed of modular equipment

from product catalogues – replica FPSOs to be

Conceptual and FEED

increasingly common

Drilling has a part to play – integrated drilling

contracts increasingly prominent

Plan Select Define Engineer Procure Construct Commissioning

OSVs – difficult to integrate services on vessel,

but still supply chain integration

© Maritime Strategies International 13 www.msiltd.comImplications for the Supply Chain

Contracted Units

Indexed at 2014 = 100

120

100

80

Jack-up

60 Floater

PSV

40 AHTS

20

0

2008

2009

2011

2013

2015

2017

2019

2021

2022

2023

2024

2010

2012

2014

2016

2018

2020

© Maritime Strategies International 14 www.msiltd.comImplications for the Supply Chain

Employment Rate

100%

Jack-Up Floater PSV AHTS

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2010

2011

2014

2015

2018

2019

2023

2024

2008

2009

2012

2013

2016

2017

2020

2021

© Maritime Strategies International 15 www.msiltd.comCloser to home

Active Units – US & Canada

2014=100

250

Jack-up Floater PSV AHTS

In the Gulf of Mexico – expect more

consolidation

200

Energy transition – IOCs to focus on

150

greenfield investment, plenty of room

for independents

100 Supply chain has a role to play – but

volumes will not match prior cycles

50

End market evolution – growth of

renewables

0

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2021

2022

2023

2024

2019

2020

© Maritime Strategies International 16 www.msiltd.comWhere could it all go wrong?

Earnings, prices and positioning

© Maritime Strategies International 17 www.msiltd.comEarnings and Prices

Floating Drilling Rig Earnings Jack-Up Drilling Rig Earnings

k $/Day

700 k $/Day 250

UDW Drillship Dayrate Semi-Sub Dayrate Standard Jack-Up Dayrate

600 High-Spec Jack-Up Dayrate

200

500

400 150

300 100

200

50

100

0 0

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

MSI View OSV Earnings

If you’ve made it this far…. 30 k $/Day

12-16 k BHP AHTS 3-4 k dwt PSV

25

Recovery is underway

20

Slow pace relative to history and unlikely to reach 15

peaks of last cycle

10

5

0

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

© Maritime Strategies International 18 www.msiltd.comWhere could it all go wrong?

MSI Oil Price Scenarios Drillship Scenarios

$/bbl $/bbl k $/Day

120 200 1000

Oil Price HC

180 Oil Price LC 900

100 Ultra Deepwater Drillship Dayrate HC (RHA)

160 800

Ultra Deepwater Drillship Dayrate LC (RHA)

140 700

80 617.5

120 600

60 100 500

80 400

40 60 300

Oil ($/bbl) 40

187.6

200

20 Base Case Scenario

High Case Scenario 20 100

Low Case Scenario

0 0 0

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

AHTS Scenarios Jack-Up Scenarios

$/bbl k $/Day $/bbl k $/Day

200 60 200 Oil Price HC 500

Oil Price HC

180

Oil Price LC

180 Oil Price LC 450

Dayrate - 9-11 k BHP AHTS - SE Asia - HC (RHA)

Dayrate - 9-11 k BHP AHTS - SE Asia - LC (RHA)

High-Spec Jack-Up Dayrate HC (RHA)

50 High-Spec Jack-Up Dayrate LC (RHA)

160 44.6 160 400

140 140 350

40

120 120 300

100 30 100 250

209.9

80 80 200

16.5 20

60 60 150

40 40 68.9

100

10

20 20 50

0 0 0 0

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

© Maritime Strategies International 19 www.msiltd.comMSI – FMV Online Service

• MSI Forecast Marine eValuator (FMV) is the first web-based tool to provide forecast and historical price

data covering virtually all of the deepsea shipping fleet.

• Data includes forecasts of newbuilding, second-hand prices, 1 year timecharter rates and operating costs

for specific vessels.

• MSI FMV draws on MSI’s proven, proprietary models and a consistent cross-sectional view across all

principal shipping sectors. It puts asset values in the context of the near term market to enable reliable

benchmarking with outputs based on annual averages.

Crude Oil Tanker Chemical Tanker Multi Purpose

Product Oil Tanker LPG Carrier Containership

Dry Bulk Carrier LNG Carrier PCC/PCTC

Jack-Up - NEW

AHTS PSV

© Maritime Strategies International 20 www.msiltd.comThank you

The Rising Tide

© Maritime Strategies International 21 www.msiltd.comMSI Offshore Team

James Frew Gregory Brown Dr. Ferenc Pasztor

Director of Consultancy Associate Director - Offshore Senior Offshore Analyst

+44 (207) 940 7194 +44 (207) 940 7190 +44 (207) 940 7196

james.frew@msiltd.com gregory.brown@msiltd.com ferenc.pasztor@msiltd.com

James has more than ten years experience Gregory leads the development of MSI’s Oil Ferenc is responsible for analysing the

of analysing maritime markets, and takes and Gas Project Tracker, as well as offshore oil & gas industry and related

overall responsibility for MSI’s analysis of delivering market consultancy, analysis and vessel markets as well as developing MSI's

the container shipping and offshore oil and commercial modelling to MSI’s offshore offshore support vessel and drilling rig

gas markets. In addition, James takes a client base of contractors, operators and the market forecast models. He is involved in

lead role in larger bespoke consultancy and financial community. bespoke research and consultancy projects

research projects across shipping sectors. and provides valuations for specialised

Gregory received his degree in 2008 from offshore vessels.

James holds an M.Sc. in International the University of Surrey’s School of

Trade, Finance and Development from the Management where he read Business Before taking this role at MSI, Ferenc

Barcelona Graduate School of Economics, a Management. Gregory is also an Authorised worked as a post-doctoral researcher at the

Graduate Diploma in Economics from Person with Part 4A permission under Commission of Atomic and Alternative

Birkbeck College, London and an M.A. in section 31 of the FSMA, 2000 and was Energy (CEA) in France. He has a Ph.D. in

Modern History from the University of admitted to the Association of Surrey with Natural Resources from BOKU, Vienna.

Oxford. He is a member of the Baltic Distinction. He is a member of the Society of

Exchange. Petroleum Engineers.

© Maritime Strategies International 22 www.msiltd.comMSI Background & Disclaimer For over 30 years, MSI has developed integrated relationships with a diverse client base of financial institutions, ship owners, shipyards, brokers, investors, insurers and equipment and service providers. MSI’s expertise covers a broad range of shipping sectors, providing clients with a combination of sector reports, forecasting models, vessel valuations and bespoke consultancy services. MSI’s team is comprised of professionals with extensive academic credentials, deep industry knowledge and many years experience of delivering successful client projects. MSI balances analytical power with service flexibility, offering a comprehensive support structure and a sound foundation on which to build investment strategies and monitor/assess exposure to market risks. While this document has been prepared, and is presented, in good faith, MSI assumes no responsibility for errors of fact, opinion or market changes, and cannot be held responsible for any losses incurred or action arising as a result of information contained in this document. The copyright and other intellectual property rights in data, information or advice contained in this document are and will at all times remain the property of MSI. © Maritime Strategies International 23 www.msiltd.com

You can also read