The Financial Technologist - businessFeaturing The Seven Habits of Highly Effective Financial Technology Leaders Our biggest DEI Section to ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

The Financial

Technologist

ISSUE 2 .. 2021

Back to

business Featuring

■ The Seven Habits of Highly Effective Financial Technology Leaders

■ Our biggest DEI Section to date! ■ The return of our most extensive Salary Survey ever!The Financial Technologist | Issue 2 | 2021

Contents

04 Introduction by Toby Babb, CEO of the 28 Focus on people and manage what you measure 46 Eventus embraces global expansion, 64 Vortexa and Covid-19: Navigating

Harrington Starr Group - the keys to building a FinTech unicorn digital assets to fuel rapid growth mental health awareness in the grip

Waseem Daher Pilot Eric Einfalt Eventus of a global pandemic

08 The seven habits of highly effective Jessica Irvin Vortexa

financial technology leaders 30 Turning tough times into opportunity 48 Resolving data trauma through optimisation

Colin Slight Realization Group Anders Liu-Lindberg BPI and innovation 66 Taking a punt: using tactical action to

Philip Miller Solidatus achieve your goals

16 Lessons learned over the last twelve months 32 Digital transformation and its cloud-based Michelle Johnson Fexco FX & Payments

James Done Tail operation helped Euromoney TRADEDATA 50 Growing a company in a Pandemic

survive - and even thrive - under 2020’s Alicia Ariffin SteelEye 68 Company growth during a pandemic

17 Volopa - Turning the negatives of the volatile market conditions Nicola Breyer OptioPay

past year into positives Mark Woolfenden Euromoney 53 D I V E R S I T Y,

Graham Smith Volopa EQUITY AND 70 DEI: Is it really that important?

34 The post pandemic market infrastructure INCLUSION Dilyana Valcheva Fnality International

18 The three principles of High-Growth FinTechs growth opportunity

Carrie Osman Cruxy & Co. Hirander Misra GMEX Group 55 An Encompass view of the last 18 months 72 Progress despite the Pandemic

Wayne Johnson Encompass Jeni Trice Get with the Program

21 Fixed income automation- adoption not 36 Payments 2030: building the industry’s core

derailed by Covid market infrastructure 56 A new approach to Company Culture in the 75 SALARY GUIDE

Steve Toland TransFICC Alex Knight Baton Systems crypto space

Dagmara Aldridge Zumo 87 About Harrington Starr

22 The keys behind the growth of the company 38 The pandemic push

James Maxfield Ascendant Strategy Remonda Kirketerp-Møller Muinmos ApS 58 Pursuing balance in a brave new world 89 Contact Us

Dr. Leda Glyptis 10x Future Technologies

24 Productivity in Financial institutions: releasing 40 Customer experience in retail banking:

value and the keys behind the growth of it’s not just finance any more 60 Designing for women: the story of the female

AccessFinTech over the past twelve months Andrew Lawson Zendesk finance research series

Roy Saadon AccessFinTech Dr Anette Broløs and Dr. Erin B. Taylor EWPN

42 Why aligning innovation and creativity with

principles and purpose delivers rapid growth and 62 Outsourced sales deliver higher returns

25 Virtual velocity: how Baymarkets the chance to build back better for clients

powered ahead despite a pandemic Chris Murphy Ediphy Jon Carp, Kenzy Goodwin, David Sayers

Tore Klevenberg Baymarkets and Carl Rogers Finceler8

44 FINBOURNE:Market conditions

27 Why innovation doesn’t stop after 40 years facilitating growth 63 Adaption in the face of uncertainty

Peer Joost DIGITEC Thomas McHugh FINBOURNE Technology Liza Russell iNBOTiQA

0 2 0 3TOBY BABB, CEO,

T H E H A R R I N GT O N STA R R G R O U P

“So, will the City thrive again?

Will we see a return to packed

Welcome to the commuter trains and a thriving

Financial Technologist!

metropolis? How will the split of

work from home and the office gel?”

life never the same again and a strong lean These companies listened to their customers.

Harrington Starr’s financial technology

W

to hybrid or fully remote working, particularly They spent time looking at the issues that the

news, commentary, insight and features. for developers. market faced. They adapted, innovated,

pivoted, or did all three and came out stronger.

So, will the City thrive again? Will we see a They invested in headcount, pulled in more

from “freedom day” where the UK once again return to packed commuter trains and a investment and funding, attacked new

starts to unlock its doors. thriving metropolis? How will the split of territories and played offence. They looked at

work from home and the office gel? Perhaps, their employee value proposition and attracted

Back to Business? It’s going to be interesting. just as was the case when everyone was the best talent. They communicated, thought

sent home last year, we face a time with even about culture, and invested in their people.

Firstly, it could be argued that the financial more questions and even fewer answers … They committed to their strategy, invested in

technology sector has never been busier. Right yet! What the last 18 months has taught us is marketing and added value to their customers.

from March 2020, there have been market that with every difficulty comes an

conditions that have favoured many. Despite opportunity. Behind every negative lies a The key ingredients shone through again and

lockdowns, work from home orders and market positive. As we head back to business, the again, both in the leaders interviewed by The

carnage in early 2020, we have seen an office or whatever the new normal looks like, Realization Group in their blog series that

incredibly robust performance from many. we will see the best in the industry listen follows this intro, but also in the many fast

Whilst companies are once again set to to their customers and find world class growth companies who share their thoughts

open their doors and welcome staff back, it solutions. and insights in the pages that followed. All of it

elcome to the Financial Technologist. In the has not been a case of batten down the is common sense but rarely is it executed as

second issue of 2021 we bring you a magazine hatches but instead, the ships have been There lies the key ingredient of the pages that common practice. I have picked up so much in

packed with content from some of the fastest sailing with real purpose. follow. This issue shines a light on the fast the pages that follow and trust that you enjoy

growing names in FinTech, an insight into the growth icons of FinTech. This year has seen the insight shared as much as I have.

habits of outstanding FinTech leaders, our Alongside that, despite easing of restrictions, it companies double and triple revenue,

biggest ever DEI section and the 2021 salary seems many are playing a cautious game with headcount, investment, logos, and every bit of Diversity, equity and inclusion also form an ever

survey presenting to you some fascinating data September a date that companies are set to data that points in the right direction. We speak stronger part of the jigsaw of success for

on where packages currently lie in the sector. see their staff return to a new office normal. to some of those companies who have risen to companies looking to grow, build and sustain

That said, we also see many who have the challenges the market threw and knocked great futures. This magazine also features a

At the time of writing, we are just hours away completely re-shaped their policies with office them straight out of the park. host of trailblazers in the space sharing what it

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

0 4 0 5“A great workplace is more than

TOBY BABB, CEO,

T H E H A R R I N GT O N STA R R G R O U P

just cash in the bank and it has

been good to see sense prevail in

how companies have reacted to

the talent arms race.”

takes to create truly inclusive environments and, in many ways, created a far more better balance, perks, flexibility, training and growth section.

with a diversity of thought that allows exciting future. career opportunities.

companies to shine. I am incredibly proud of So, as we pass the turn of the year and lurch

the work that Nadia Edwards-Dashti has done Financial technology companies have hired at Our next magazine will focus on the best towards 2022, we face another exciting period

in this space and she continues to be a levels well above pre-pandemic levels in a foot workplaces in the sector. Without question for the financial technology sector. Fast growth

powerhouse, lighthouse and so much more to race for the best talent. In some instances, this we will see strong, fair salaries as an important will be a feature, but sustainable growth even

drive real change in the industry. has created a bidding war, in others, companies factor, but so too will be the culture, mission, more important. I am confident that anybody

have looked at innovative ways to stand out as values, perks and environment that is created. reading the pages that follow will be able to

As mentioned, the market has reacted employers to compete for the best. What is A great workplace is more than just cash in take away a host of golden nuggets that will

incredibly well to the challenges thrown up by perhaps surprising, is that we have not seen a the bank and it has been good to see sense help their business or career thrive. If I can

Covid-19 and one of the most fascinating and wholesale change in the salaries being paid in prevail in how companies have reacted to the connect you to anyone who you thought was

unexpected of those has been the incredible the market. talent arms race. The salary survey that follows particularly interesting or whose story could

competition around hiring in the space. As the looks at data collected from several thousand help you in your career, this is what we love to

owner of a recruitment business, if I had been In development, devops, data, security, change hiring companies and job seekers in the sector. do. Please reach out to me.

told in March 2020, as the team left the office and transformation, infrastructure, support, There remains great money to be made for

to work from home, that none of our customers testing and sales, we have seen outliers and people entering the FinTech space but, equally Thank you for reading and enjoy the issue.

or candidates would be in offices again for the companies who have attempted to outbid the as importantly, there are also some great

Toby

best part of 18 months, I would have had competition by over-paying. Overwhelmingly, companies who are truly standing out as

serious concerns over the viability of the however, companies have held their ground, exceptional workplaces. Those that get both

business. What has happened has shocked me paying fair packages but also providing far parts right are heavily featured in our fast

POWERED BY

HARRINGTON STARR

FINTECH

FOCUS TV

FinTech’s Most Innovative

Leaders Speak to Toby Babb

NEW EPISODES EVERY MONDAY, WEDNESDAY AND FRIDAY

0 6 0 7The seven habits

Founder, Cassini Systems), Philip as a connector of the financial And these financial technology

Miller (Co-CEO & Co-Founder, markets community. In many firms also have their own

Solidatus), and Thomas McHugh cases, the pandemic highlighted employees, who have been

of highly effective

(CEO & Co-Founder at Finbourne the importance of financial carrying on the development of

Technology). We learn how they technology. Technology, of products and services, sales to

used these habits to face 2020’s course, underpinned successful new customers and support for

challenges - and to find the new remote working and collaboration existing ones, all whilst dealing

opportunities that lie ahead. across a number of industries. For with the same challenges

financial technology

financial institutions, however, a around home working and family

The Covid-19 pandemic has key differentiator of resilience and commitments. Their leaders,

created challenges at all levels success arose from the extent to pioneers and entrepreneurs with

of society and the economy. The which they had adopted best- visionary aspirations, have had

leaders

financial services community of-breed financial technology to motivate – and sometimes

has faced a particular pressure, solutions; whether these were build – teams and share their

in continuing to perform and AI / ML based chatbots and visions, goals and company

to support and underpin other tools augmenting their culture in a remote working

economic activity, whilst sales and trading or compliance environment. For many, it’s been

individual employees cope functions, cloud-based market an extremely challenging time,

with the demands of working data solutions, trading platforms under circumstances they had

from home; including home- and connectivity suites, or previously never considered or

schooling and caring for children, operational and process-driven planned for. However, the nature

social isolation and uncertainty automation solutions. For the of financial technology firms has

also given them advantages over

other firms in the past year, some

“Financial technology now of which are readily apparent,

others slightly more unexpected.

Colin Slight underpins all aspects of our financial Organisations are defined by

Joint MD and Co-Founder ecosystem, front to back within their leadership. Leadership

sets the culture, tone and values

The Realization Group organisations, and as a connector of which then permeate down and

through the wider organisation.

the financial markets community.” The strongest organisations are

O

those with leaders who actively

define the culture and values

ver the past year, of the common characteristics of 4. They reduce friction and about the future. For financial general public as well, the that they want to espouse to both

the advent of the leaders who have thrived through create efficiency in complicated institutions, the importance of all availability of consumer-focussed employees and clients and take

global pandemic the pandemic, setting their teams processes employees – not just sales and financial technology in the form steps to ensure that these are

has challenged us up for lasting success in the 5. They are masters of engaging traders, but also middle and back of mobile banking and payment instilled across the organisation.

all to demonstrate new era. We speak to a group of teams and driving purpose office, technology and support apps, and other innovative These leaders also typically

our resilience, to call upon our financial technology pioneers 6. They are investing in growth staff, and legal and compliance financial products and services, demonstrate the seven key traits

unique strengths and to show about how they have survived and playing offence rather than teams – was vital in ensuring their eased the rapid transition during we’ve identified. Whilst they

leadership as we struggle to face and thrived in the Covid era. defence smooth continued operation. lockdown, towards a more digital don’t always consciously strive

up to the enormous upheaval in While they come from a variety 7. They are constantly innovating And, often unrecognised and and online-based economy. A for these traits, they do become

our personal and professional of different businesses, financial and challenging the norm overlooked, behind the scenes common thread across financial apparent when we look at the

lives brought about by Covid-19. technology leaders tend to share these institutions and teams technology firms is their constant drivers behind their success. And

Entrepreneurs and innovators the following key traits: We talk to six leading are supported and enabled by pursuit of innovation and their many of these traits have served

have been no exception to the entrepreneurs in the field: an array of financial technology desire to apply technology to them well through the turmoil

rule but arguably these individuals 1. They capitalise on market Jennifer Nayar (CEO, Vela providers. the challenges, operational and uncertainty of the pandemic

have been better equipped to opportunity Trading Systems), Leda Glyptis inefficiencies and barriers to – although, for some, there have

adapt to change, due to the 2. They listen to customers and (Chief Client Officer, 10x Future Financial technology now market access and to optimal been unexpected changes in the

inherent nature of what they do. look to solve their problems Technologies), Remonda Z. underpins all aspects of our performance facing their extent to which they’ve utilised

3. They look to add value Kirketerp-Møller (Founder & CEO, financial ecosystem, front to customers - be they individual certain traits for success during

In this article, we examine some throughout the customer journey Muinmos), Liam Huxley (CEO & back within organisations, and consumers or large institutions. this time!

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

0 8 0 9Let’s now take a look at each for the firm, it’s been a hugely their customer base, and spot risk management. As that sort of them. That trust creates a financial technology leader to

of the seven traits, and the successful year. the opportunities to address stress in the market came to the bedrock on which to grow the have. However, it’s also one that

ways in which our interviewees these. The pandemic didn’t only fore, it emphasised, for Cassini business over time.” has evolved and developed in

have exhibited them – and The pandemic created a perfect create new market opportunities; and its clients, the role that their new directions during the

been served by them – over storm around demand for the it also highlighted certain client product could play in addressing 4. They reduce friction pandemic. “My immediate

the past year. services that Solidatus offers. needs that had been there all these challenges and solving and create efficiency in reaction was that this is all you’ve

How did they capitalise on it? And along but were exacerbated by clients’ problems. complicated processes got to do as a leader, distilled

1. They capitalise on market how have they continued to market conditions, and gave The ability to identify and down to its essence. Everything

opportunity develop sales relationships and financial technologists the Liam Huxley, CEO and Founder effectively analyse the root else stems from it. But when I

In more prosaic times, new client relationships under opportunity to respond to these of Cassini Systems, describes the cause of complex problems, thought about it in the context of

“capitalising on market pandemic working conditions, and to strengthen their client importance of listening and in order to reduce friction the pandemic, the world has

opportunity” typically involves whilst still capitalising on the relationships. adding value to customers: “I and to create efficiency, is Liam Huxley completely changed. As a

identifying a potential gap or think that listening to customers CEO & Founder,

opportunity? Phillip Miller, fundamentally important in the financial technology leader, your

Cassini Systems

opportunity to be filled in the Co-CEO and Co-Founder of The phased introduction of is in our DNA. We position financial technology space. It’s main job is to think about how

market, and then taking steps Solidatus, comments that “For the new regulatory requirements ourselves to our customers as a key leadership attribute when your customers are served

to research it and to develop an first six or seven months, we let around margin and collateral for partners, rather than as a vendor assessing client and market efficiently, how people can get

offering around it. In pandemic the opportunities come to us. We uncleared trades has created – we want to create a long-term challenges and opportunities, as what they need from your

times, however, “market were almost bewildered by the a need, amongst financial engagement with them, and to well as when turned internally, organisation efficiently, how your

opportunity” became a rather number of incoming leads we had institutions that are subject to employees can efficiently get the

more unexpected target, involving not deliberately built. We were those Uncleared Margin Rules answers and resources they need

rapid mobilisation and movement

towards capitalising on it.

stunned. Our natural growth led

us to bring on more sales

(UMR), for a better understanding

of margin and collateral data “In order to fully understand to solve the problems that they

want to solve, how your teams are

Solidatus is a firm whose product

personnel, but demand still

outstripped our capacity. We then

and exposures. In order to fully

understand the cost of trading,

the cost of trading, firms need operating efficiently, and all the

metrics and KPIs we have around

empowers organisations to

effectively map, manage and

actively invested in building out

our team, and at the beginning of

firms need to be able to assess,

on a pre-trade basis, comparative

to be able to assess, on a pre-trade those kinds of efficiency. Now,

however, it’s become much more

monetise their key asset: data. At

the beginning of 2020, Solidatus

this year, we started making a

conscious effort to reach past

trading routes on different

exchanges or with different

basis, comparative trading routes about making sure that people

are on the same side and on the

entered the pandemic in rude

health. It was already capitalising

those incoming leads and to start

generating leads for ourselves.

Philip Miller

counterparties, and the costs

of collateralising each of those

on different exchanges or with same team, so that we can build

relationships both amongst our

different counterparties, and

Co-CEO &

on a huge market opportunity We’ve also adapted our strategy, Co-Founder, options. own team and with our clients

– the ability for firms to reaching out beyond financial Solidatus that are strong, even if we’re only

understand their data estate and

associated intellectual property,

services to the insurance sector,

and to the Treasury operations

Cassini Systems provides a

margin analytics platform that

the costs of collateralising each able to interact over Zoom. It’s

through those improved

in a disparate, fragmented

environment of systems,

within large multinationals as well.

We’ve moved into a bigger pond

addresses precisely this need,

having identified it as a growing

of those options.” relationships that we can

maintain a focus on efficiency.”

applications, processes and now, by seeing the opportunity problem for clients, as the rollout

people that is subject to a high and making investment to of the UMR progressed. In the have an ongoing understanding of to focus on the organisation’s The link between relationships

degree of change. The pandemic capitalise on it.” early stages of the pandemic, their needs and how we can own areas for improvement. The and efficiency, particularly during

served to further reinforce these markets became extremely evolve to address them. We have transition to remote teams and to the pandemic, is taken to the

sorts of intellectual property 2. (and 3) They listen to volatile, all over the world. This quarterly review sessions with our working from home, maintaining extreme for those who are trying

problems amongst Solidatus’ customers and look to solve created huge spikes in demand clients, and actively respond to a collaborative and effective to establish a new regulated

client base; workforces became their problems, and they look for margin and collateral and them in terms of the types of data work environment whilst also business, new partnerships and

even more spread out, it became to add value throughout the made collateral liquidity a front and analytics that they recognising and dealing with the relationships, and build a new

even more difficult to speak to customer journey and centre issue for market need. That’s not just about Covid, logistical challenges, was called team, in the midst of a series of

the subject matter experts and to A business of any kind would participants. Firms were being it’s our general business out by all of our participants. lockdowns. Many entrepreneurs

understand what was happening not have a market, if it didn’t called for hundreds of millions of approach – but as a principle it Thomas have found themselves in exactly

with data across an organisation. understand customer needs and dollars in collateral and having has served us and our clients very For Thomas McHugh, CEO and McHugh this position of recruiting and

The firm found itself with a huge wants, and how to add value to to unwind huge portions of well during this time and enabled Co-Founder at Finbourne CEO & Co- hiring people they have never

Founder at

volume of inbound leads, at the the customer throughout their their book just to free up cash us to better respond to their Technology, a firm specialising in Finbourne

met in person. It has created

exact time it was also having to journey. In financial technology, to meet their margin calls. This needs. Customers need to know portfolio management systems Technology many challenges in terms of

adapt to new working conditions. leaders need to keep their helped to emphasise Cassini’s that they're going to get a great and investment data building relationships but also

With 50% planned growth and ear close to the ground to key message, around visibility level of support, and that they can management solutions, this is the some positives in terms of

another 50% demand-led growth understand the challenges facing of data, cost management and trust us to deliver and to help single most important habit for a employees’ efficiency and focus.

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

1 0 1 1With no water cooler

conversations at the office and

necessary, and the transition was

fairly seamless. What they weren’t

and to maintain a sense of

common purpose and

with other people in meetings and

on screen, you lose your lateral “We have not been surprised by

the need to juggle multiple

competing priorities at home, it

accustomed to was doing it for

long, indefinite periods, amidst

membership of a wider team.

They acted swiftly to reassure

vision. When I was in the office, I

could sense a ‘disturbance in the any regulatory frameworks, or

can mean that everyone is more

focused on the task at hand.

the personal stress and

uncertainty of a global pandemic.

staff that there would be no

pressure to return to the office.

Force’, even if I wasn’t in a

meeting with anyone affected by commercial drivers. The pandemic,

5. They are masters of “In terms of the mechanics of

Nayar adds “Dealing with a

different type of anxiety across

said disturbance, just from

noticing what was going on yes, that’s come as a surprise to

engaging teams and driving

purpose

moving to remote, that was pretty

straightforward. And certainly, I

the organisation was a new

challenge for me. People were

around me, who was talking to

whom, who wasn’t interacting,

the market. But for us, actually, the

Whilst financial technology

leaders are entrepreneurs and

think our clients appreciated that

because there was no impact on Jennifer Nayar

dealing with family members

getting sick, and in some cases

who was looking upset, and who

was having a birthday. There’s no

entire foundation of the company

visionaries, none of that can be

translated to success in the real

service. It was a very different

situation from a hurricane or

CEO, Vela

Trading Systems

losing those family members.

That was a real challenge, I think,

science to this, but it’s really

important to understand how the

was simply an understanding that

world without the ability to

mobilise, inspire and guide teams

some other natural disaster – that

gets cleaned up and you head

for everyone around the globe,

but also being a head of an

team is engaging with each other

and emphatically not via you as

the financial sector could not survive

of people. It’s not a habit that

comes naturally to everyone, but

back into the office. The real

challenge was all the uncertainty

organisation in which some of

these things are happening. You

their leader.” in the state it was in at that time.”

successful leaders who are less Glyptis tries to address this lack

naturally talented in this area will of information by making a lot of happy to be in other people's RegTech space, the firm had to

identify those within their

organisation to whom they can “The business will get done, the personal time for her team

members. It’s time consuming,

company.” invest heavily in R&D in order to

grow their product and bring it to

delegate and drive this important

form of internal engagement. The contracts will get signed, the deal will and exhausting, but pays

dividends in the long run. Miller

6. They are investing in growth

and playing offence rather than

a market that largely did not even

yet see the need for it. Kirketerp-

pandemic has required all of our

financial technology leaders to

be closed – especially as your clients has put in place similar strategies

to manage the same challenges,

defence

Financial technology is not always

Møller, however, had a clear vision

of the future. “Everything we

lean in more when engaging with

their staff and teams. Without the

and your suppliers are all in the same in the context of a growing

organisation. “For me, it’s been a

an easy sell. It’s often about

solving problems that not

predicted back in 2012 has come

into play. We have not been

nuances of day-to-day

interactions, driving teams

situation as you are, and keen to matter of keeping people in touch

with other people, becoming

everyone has yet fully

acknowledged and recognised,

surprised by any regulatory

frameworks, or commercial

towards a single purpose

becomes impossible without

keep things moving. The far more much more of a servant-leader, a

kind of facilitator, than perhaps I

or introducing efficiencies to

processes and organisations that

drivers. The pandemic, yes, that’s

come as a surprise to the market.

taking the time to make sure

that everyone is engaged, clear

difficult aspect was maintaining a would have been otherwise.

Trying to create a mesh of

aren’t always wanted and

accepted by all stakeholders

But for us, actually, the entire

foundation of the company was

on the mission, and has the

support they need.

connection to our people.” communication, and instilling that

kind of tight knit community, I

within the organisation. Some of

our most successful visionaries

simply an understanding that the

financial sector could not survive

think, has been the real challenge have been truly ahead of their in the state it was in at that time.

Vela Trading Systems is that the situation created for have to dig deep to get through over the last year. For me, it's time, recognising the wider trends And neither can it survive in the

headquartered in New York but people, the concern and anxiety some of these times.” been about presenting a human in the market landscape, seeing Remonda Z. state we are in now. There is more

has offices in London, Belfast, that people had around this face by trying to give people an how they are evolving, and acting Kirketerp-Møller change, and more pressure –

Founder & CEO,

Chicago and Manila. The firm pandemic, and in many cases, the For Leda Glyptis, Chief Client esprit de corps, you know, sort of to secure their place in the world Muinmos both regulatory and commercial

therefore experienced the onset fear that they would be asked to Officer at 10x Technologies, a real sense of family, while nearly of the future. This has meant that – to come. And we’re looking into

of lockdown as a wave, slowly return to the office when they leading a business in lockdown no one had met each other. It’s investment has been for the long that crystal ball, we’re prepared,

breaking across their offices weren’t actually ready. I certainly has been both easier than and often the small things, like making term, and their strategies are we’re ready for this.”

around the world. Remote took the approach that the first different to leading a team. “The sure a new joiner has met proactive rather than reactive.

working was already fully enabled thing we had to step up very business will get done, the someone before their first day, For Muinmos, the uphill battle has

via their business continuity quickly was our communication”, contracts will get signed, the deal even if it was three minutes on a Back in 2021, when Remonda really been around human

Leda Glyptis

plans, and given its global says Jennifer Nayar, Vela’s CEO. Chief Client will be closed – especially as your driveway, passing them Kirketerp-Møller founded behaviour, and the pandemic has

footprint, the firm had already Instead of holding town halls Officer, clients and your suppliers are all equipment across the fence, or, Muinmos - a RegTech company actually driven market demand for

experienced and learned from every quarter, these became 10x Future in the same situation as you are, when we've been able to get that developed an AI-driven the firm’s product. “There were

events such as 9/11, Hurricane monthly. Nayar sent out notes to Technologies and keen to keep things moving. together in groups - sometimes compliance engine for client still huge barriers to adoption of

Sandy, monsoons in Manila and the entire organisation, every The far more difficult aspect was larger groups, sometimes smaller on-boarding - RegTech wasn’t yet RegTech solutions before the

others. Staff were accustomed to week on a Friday, even if there maintaining a connection to our depending on the regulations at an articulated concept in the pandemic. Lawyers didn’t want it,

switching to remote working when was no news, to reassure them people. Because you only interact the time - that people have felt marketplace. A true pioneer of the because they saw it as a threat to

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

1 2 1 3their jobs. Neither did compliance resilience. Successful FinTech of communication, and to actively

officers, for the same reason. But leaders are aware that you can’t lead the charge in ensuring good

when we’d demo the solution to just introduce something new communication, teamwork,

executives, they were amazed, without considering the context morale and support frameworks in

and keen to bring it into their into which it fits, and how you’re their organisations.

organisations. And of course, going to ensure that it fits into the

there are still jobs for lawyers and organisational culture. “In order to manage a team, at the

compliance officers. RegTech just best of times, there are two things

frees them up to focus on the McHugh broadly agrees with this you need to be able to do well,

high-value and interesting work. sentiment. “I describe it slightly and those two things become

Regulators are now embracing differently; I really don’t like the both much more important, and

and encouraging it, having seen term ‘challenging the norm’ significantly harder, during a

the benefits. And it enables because that indicates disruption, pandemic. You’ve got to drive

organisations to be more resilient, and what most people don’t want results, and you’ve got to still be

during, for example, an in their life is disruption. And so I human. And that puts a burden on

unexpected pandemic.” look at it in the context of Habit you as a leader. But having that

#4, which was about creating human connection with your

7. They are constantly efficiency, rather than challenging teams, particularly in times of

innovating and challenging norms and bringing disruption to stress, is extremely important.

the norm people. I look at it differently. As And it's extremely important that

Innovation is in the nature of the leader of an organisation, you maintain that humanity while

financial technology. It’s all about you’ve got to set the tone from the driving results.”, says Glyptis.

finding new and better ways of top, and come up with a strategy

doing things, of challenging and lay out the plan. The most Miller agrees: “We’ve had to

existing conceptions of what is important quality of leadership is re-learn to trust the human

possible and feasible. It’s an recognising that you can always condition a little bit. And that’s

exciting space to be in, and an be wrong, that you will always be probably one of the best things to

inquisitive mind and spirit of getting new information and that come out of this. We’ve had to

challenge are vital traits for its you have to figure out how you recognise that we’re all in this

leaders. However, it’s all too easy bring that information into the together, that everyone’s got the

to innovate in a vacuum, without journey to make sure you don’t same worries and we’ve all been

thinking of how change can deviate too far off the path.” at home and locked away from

realistically be adopted and our colleagues. So that's one of

embedded within organisations Conclusion the biggest positives, that we will

and across the industry. All of our financial technology be more empathic as a group of

leaders emphasised the impact people when this is all over. I

Human beings fundamentally that the pandemic has had on don’t think that will disappear

don’t like change. A leader can their leadership of people – how too quickly. I think people will

come in and question, can they’ve had to adapt and evolve respect other people a little bit

challenge and innovate but this their people management skills, more. And I think that's going to

has to be done with sensitivity and to become more aware of the role be a good thing.”

“In order to manage a team, at the best of times,

there are two things you need to be able to do

well, and those two things become both much

more important, and significantly harder, during

a pandemic. You’ve got to drive results, and

you’ve got to still be human.”

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

1 5Lessons learned over

V

The Tail platform can offer olopa is a one-stop which means we now have the

relevance and customer value shop for business The pandemic has provided us right support to focus on our

for all our sister company brands. expense with a brilliant opportunity to next phase of growth. Pooling

the last twelve months

With Volopa, for example, we have management and learn lessons about customer resources and sharing knowledge

already created a partnership international behaviour and what it is that across the business has been

where cashback can be earned at payments. It's a solution for SMEs customers want from us. We have especially important in the past

T

a range of restaurants in London. that need to issue company cards been able to take a step back, Graham 12 months, faced as we were by

to their employees, track their look at the data and base our Smith, a completely unprecedented

ail is a mobile However, there were some missed For merchants and brands spending and pay international decisions on these learnings. As change in market conditions. We

cashback app that opportunities as well. Those pubs alike, providing added value to suppliers in up to 38 different a result, we will be introducing

Managing very much feel that as a business

enables banks and that were adaptable enough their customers is essential in currencies covering 180 several new products and Director, we have come out of this period

merchants to provide to pivot their business model building loyalty and engagement territories around the world. It features in the near future such Volopa far stronger than before.

cashback, rewards, and and offer growlers of beer or a for the long-term and Tail is now was founded in 2011. as virtual cards and cashback

loyalty programmes to customers limited food menu on a click- emerging as a key solution for rewards, as well as a custom

in a seamless, automated manner and-collect basis could have James businesses wanting to strengthen The key to Volopa’s success has API integration so customers

- eliminating the need for loyalty boosted trade and loyalty through Done, their customer acquisition and always revolved around keeping can link our platform with their

cards or vouchers. As a loyalty- offering incentives targeting local loyalty strategy. a very close eye on what our preferred accounting package in

focused solution, we have been customers, but we didn't see this

CEO, Tail customers are doing and how a completely seamless way.

able to learn a number of lessons happening often enough. they use our platform. The last 12 Graham Smith is Managing Director at Volopa, where

about the nature of the months and beyond, going back This is something we have been his responsibilities include to oversee the company's

relationship between businesses There have been other lessons to the beginning of the Covid-19 doing continuously since the business operations, drive company growth, and

and their customers over the last we have learned over the past pandemic, have obviously company was founded – remain provide strategic guidance and direction to the board

12 months, as the full extent of year. We realised that whatever James Done, is CEO at TAIL, responsible for the provided some significant agile and customer centric in all to ensure that company achieves its mission and

the impact of the Covid-19 life throws at us, everyone does success of the business and leading the development, challenges for Volopa and its we do while ensuring we always objectives.

pandemic on all kinds of appreciate money working harder expansion opportunities, strategic partnerships, and customers. With international answer to the needs of the

industries becomes apparent. for them either through relevant the company’s short and long-term strategies whilst business travel coming to a highest quality market segments. Volopa is a one-stop shop for business expense

discounts or higher interest maintaining awareness of the competitive market complete standstill, card spend In B2B financial services, building management and international payments supporting

We’ve seen a number of levels. We offer a solution for one landscape, industry developments - with the goal of took a hit. However, some spend strong relationships and long- SMEs that need to issue company expense cards to

businesses, especially in the of these problems, as Tail offers increasing overall shareholder value. also shifted to other categories. term customer loyalty is key to our their employees, track their spending and pay

hospitality industry, have to users the ability to earn up to 20% SMEs needed to make sure their growth as a business. international suppliers in up to 38 different currencies

completely readjust their focus in cashback simply by spending TAIL, is a mobile cashback app that partners with staff had the ability to work from covering 180 territories around the world.

order to keep serving customers. at any of our partners, which is Banks to enable their customers to earn cashback at home, for example, so purchases Volopa, part of the Quantum

Many pubs and restaurants that paid into their Tail Wallet seven merchants through our platform in a seamless, of office equipment, monitors and Group, has been able to utilise the Previously, Graham was an international client facing

had previously catered only for on- days after purchase. We want to automated manner - eliminating the need for loyalty laptops became more frequent. group’s expertise and resources, Programme Director with a strong track record of

premises punters transitioned to continue to offer customers the cards or vouchers. successful client management, delivering strategic

takeaway. Others have had to shut opportunity to make more of programmes that enable companies to realise a

their doors entirely, and this has their money at a wider range James is a respected business leader, an inspirational healthy return on investment in the financial services,

caused massive problems when it of outlets, and to this end we corporate executive who excels in marketing, retail and card payments sector.

business development, product management, as well

Volopa -

comes to covering wages and rent have brought in new people to

payments. It was very heartening, the business to both focus on as in defining the business vision and ensuring Extensive knowledge of multi-channel B2B and B2C

then, to see a huge number of our growth and boost customer strategies are bought to life through collaboration and card payment solutions and regulatory requirements,

outlets undertake successful satisfaction. innovation. specialises in guiding boards, clients and suppliers to

Turning the

crowdfunding campaigns in order solutions that deliver business requirements and

to pay their bills, and it goes to The past 12 months has certainly With a strong knowledge and experience working in opens up sales opportunities.

show just how deep the bond of been a very active time for Tail, Retail, Financial Services, Travel and Entertainment

negatives of

loyalty between customer and as we were acquired by Quantum sectors, prior to joining TAIL James held key strategic Combines excellent programme director skills with

businesses can be. The learning Group in August 2020. One of the positions at Cornercard UK, Thomas Cook Money, strong bid management, sales and financial controls.

here is that there’s so much more other benefits of the acquisition American Express, Commonwealth Bank of Australia, A calm leader and coach, excels in building trusting

the past year

to loyalty than simply offering has been that we can tap into the Carnival Cruises and HMV. relationships at all levels that overcome traditional

one-size-fits all discounts, and vast experience and knowledge of barriers to change.

businesses that get their loyalty Quantum Group’s leadership team Considered an industry thought leader, he is often

into positives

programmes right will be able as well as the management of invited to speak at events such as Emerging Committed to succeeding through customer focus,

to depend on the goodwill of other Quantum Group companies: Payments Association, Loyalty 360, PayExpo just to staff development, and to maximise profitability

customers when times are tough. Volopa, Valkyrie, and Vantage. name a few.) across all areas of business.)

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

1 6 1 7The three

“I’ll price how Bloomberg price

because that is what everyone 40k

knows. It will speed up our

35k

principles of

negotiations.”

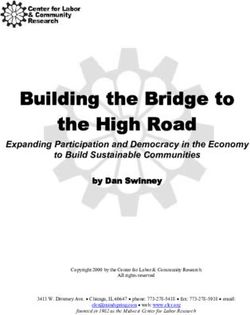

When did anything disruptive run 30k High Low

on principles which existed

before? Propensity to churn

25k

high-growth

AUM (£000)

One of our clients was aiming for 20k

that 8% conversion. When we

helped them take a step back and

FinTechs

15k

transform their product and

pricing, this jumped by c. 30%.

10k

For FinTechs, too often growth

stagnates due to principles 5k

viewed as necessary in large,

regulated and complex enterprise 0k

deals. But a disruptive approach

to your commercials, not just your 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36

tech, is proven to overcome this. Number of data sources

2. They are uncomfortably

Carrie Osman, Founder narrow

The lure of choice is most true in product for all the required data different contract cycles, often beliefs’ you have as a company

& CEO, Cruxy & Co. financial markets. Opportunities sources, or are we doing too remains a pipedream. based on the FinTech status-

to drive upside and cost savings many/not enough? quo. Are they true?

A

are everywhere - from the Those who win walk the line ■ Plot every single choice you

stringent regulatory requirements 3. The vision is water-tight, between selling what is on the have on growth, from a new

2x year-on-year When growth works, it is not at to the fragmented data bedrock. but they still sell what is on truck today and the long-term feature to a market, based on:

growth rate means any cost. Growth at any cost the truck today vision.

there are significant creates a desire to try everything, FinTechs start to dance from There are two ends to the ● How much can I make

choices for not think about the one or two market to market, use-case to spectrum: SteelEye were born from MiFID II from this?

FinTechs. things that will work. This slows use-case. But this is dangerous. with specific solutions to solve for

down time to revenue. What seems to be a simple flip this. But their vision of ● How long will it take to

It brings a pull towards multiple from buy-side to sell-side, or CRO Selling a Selling an compliance data driving yield this?

sub-segments as you move from Unprofitable growth is a to CTO, results in months of niche point- end-to-end competitive advantage remains

(e.g.) brokers to the buy-side. It benefit you receive when you configuration, new product end tool platform the driving force behind their ● What effort and cost is

creates a desire for new products prove you can grow profitably. developments, and new sales success. required for us to do this?

in a market laced with complexity. Proving that your choices yield collateral.

It demands choices on where to results must come before It’s the middle ground which wins Equally, PrimaryBid initially enable ■ Of every product feature

go when the lure of financial dipping into your bottom-line In this example, one of our maximum value. retail involvement in IPOs and you have today, rank them on a

markets such as New York or to guarantee fast growth. FinTech clients was focusing on ABBs. But with rising ESG scale of 1 – 3. 1: this will achieve

Shanghai is so strong. funds of all sizes. What became On the left of this scale, value is requirements looming, the our three-year vision. 3: this is

So what are the fast growth clear is they only won where the limited, headroom is low, long-term strategic demand from far removed from our three-

But with over 60,000 FCA principles that can ensure intersection of data-sources and stakeholders are technical and it investment banks to deploy is year vision. What should you

registered firms in the UK, and FinTechs thrive? AUM was middling. becomes difficult to claw your way imminent. PrimaryBid is well stop doing?

over one million Financial up as the product develops. positioned to take advantage

Services and Insurance 1. They reject the commercial This drives where you go next. of this shift.

companies in the US, each with status-quo Which new market has most But at the other end, the demand

nuanced demands and Things we hear all the time: funds like this? How many in our for a bank to rip and replace 26 So what can you do to uphold

expectations, this becomes “A good SaaS conversion rate is home market have we not even different systems, all with these principles?

difficult to navigate. 8%. That’s what we will aim for.” spoken to yet? Have we built a different stakeholders and ■ Identify the top 3 ‘limiting

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

1 8 1 9Fixed income

regarded as very difficult to

automate.

automation -

The good news is that the two

services complement each

other, offering a cross-sell

adoption not

Steve opportunity for new prospects

Toland, and our existing clients - which

includes six investment banks,

Co-

derailed by Covid

a global exchange and a market

Founder, data vendor.

TransFICC

F

Managing Growth

To manage this growth we had to

ive years ago, TransFICC to reduce costs, scale businesses increase headcount, and are still

was founded by two and manage risk. Additionally, doing so.

Engineers and a trading firms want applications

Salesperson, with plans deployed faster, with more We also had to change our

to create an API as a flexibility to work as part of a operational processes, making

service, for banks and asset modular solution. This is often them more robust, with better

managers to connect with the driven by clear legacy vendor forward planning and faster

hundreds of Fixed Income migration deadlines. onboarding of clients and

trading and data APIs offered venues. Using this new process,

by different venues. Perceptions of technology are combined with automated testing

also changing. Previously when and in some cases auto code

Since then, our firm has grown we mentioned that firms could generation, we haven’t missed a

quickly. But perhaps the greatest use The Cloud in workflows like deadline and are able to connect

period of growth was in 2020/21 RFQ, Axes, post-trade or manual clients with venue APIs in weeks

when we doubled the number of intervention, the usual response as opposed to the market norm of

employees to 30. Most of the new was, “trading businesses use co- six months.

hires are Engineers and Business location.” Now, TransFICC clients

Analysts, brought in to automate are split between those that host Clients are also getting faster,

workflows and reduce the time it trading infrastructure in the Cloud with one bank going live on a

takes to connect to a long list of and those that are hosted in co- venue with TransFICC within two

venue APIs. location data centres. weeks of starting work.

Fast Forward Evolving our Business The Key to Our Success

While initially, Covid lockdowns When we launched TransFICC It’s a cliché but it’s true – our

caused banks to focus on our focus was on our “One API” success comes from our people.

supporting traders working from service.

home, the need to adjust to the We have a very detailed hiring

fixed income changing market However, over the past two process, but once people have

structure was unaltered. More years we have increasingly been joined, we want them to stay.

than ever, firms need technology asked to also automate complex We give them autonomy, the

to navigate highly fragmented trading workflows. Because Fixed opportunity to learn, to see ideas

pools of liquidity, to manage Income has different asset types valued, to be involved in new

exploding market data rates with different workflows, much enhancements and to see the

and to comply with regulatory of the market (apart from Rates) end results deployed with clients.

reporting requirements. has been highly manual, which These values help to drive our

increases the cost of the trade, is continued growth.

Fast forward to today, and the slow, and introduces an increased

pace of change has accelerated, risk of human error. Now we are

as banks and the buy-side also deploying solutions for complex

focus on automating workflows, workflows that previously were

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

2 1W

hen we

launched

up taking hands-on leadership

roles to drive change forward. “Like many to the delivery of successful

outcomes we provide for them. “We produce a large amount of

Ascendant

Strategy back

This was the genesis of the

consulting model we wanted to entrepreneurs So, as I reflect on the journey thought leadership and white

focus was very much on

in 2017, the build.

who take the we have been on over the last 4

years, here are some of the keys papers as well as being quite

developing a niche gap in the

market that we had identified

Our early experience (or naivety)

was that whilst our product step outside to our success:

visible in the market where we

when working in investment

banks. Namely, that driving

was seen as an attractive

proposition, changing buyer the corporate 1. Brand Credibility

We have worked hard to de-

are often invited to sit on panels or

innovation and transformational

change across the post-trade

behaviour was extremely difficult.

And even though prospective world, we personalise the brand, making it

less around finding people that

write articles for trade publications.

environment was extremely

challenging, that industry-wide

clients were interested in how

we could help, translating that found that we know and more around clients

finding our brand. We produce

Clients appreciate our insights

cost cutting from the prior

decades had significantly

interest into revenue was a

lot more challenging than we building your a large amount of thought

leadership and white papers

and thought leadership, which

reduced leadership capability

within banks and the emergence

had anticipated. Like many

entrepreneurs who take the step own business as well as being quite visible in

the market where we are often

builds trust and credibility when

of FinTech was going to drive

wholesale transformation across

outside the corporate world,

we found that building your is very invited to sit on panels or write

articles for trade publications.

developing relationships.”

the industry. As historical buyers

of consultancy, we found these

own business is very different

from operating within a mature, different from Clients appreciate our insights

and thought leadership, which

skills hard to find and often ended established brand; where things

operating builds trust and credibility when

developing relationships.

within a 2. Consistent Messaging

ask for help (not just googling

a problem) and being open to

us a new sense of this, but this is

the most important factor I think

mature, Dedicating time and effort to

ensuring your message is out

constructive feedback has been

important as it has helped us

in running a business. It can be

very easy to get drawn into a cycle

established there in the marketplace was

something we missed out on at

learn as an organisation. And as

importantly, change our approach

of frustration – things not working

out as you hoped, LinkedIn awash

James Maxfield, brand.” inception. Being busy generating

revenue took priority, but we have

along the way. with everyone else’s success

stories, no-one returning your

learnt that your communication to 4. Think Like A CFO emails – but figuring out how to

Managing Director, the market has to be consistent It can be easy to get distracted take a step back is important.

Ascendant Strategy such as cash flow, business

development and sales are things

to support your brand growth and

ensure people know you are still

by potential collaborations or

exciting concepts, but these

How you do this – exercise,

fresh air, seeking out positive

that are taken for granted, as out there. We have a marketing can be a distraction that do people to talk to – is normally a

The keys

opposed to things you have to organisation that helps us with not actually help your business personal choice, but reminding

fight for. this, and it has been a wise progress. We wasted a lot of time yourself of your successes (you

investment. We as founders had in the early days on discussions have had them), what you are

But as we near our 4th year of very little experience in marketing and ideas that never actually good at (you are good at this) and

behind the

operation, I take great pride and it has played a critical role generated any revenue. Being when you have bounced back

and a sense of achievement in our growth, through helping honest around where you are from adversity (you have been

in our resilience and how the build our brand and maintaining spending your time is critical here before) are all important

organisation has grown over a consistent presence in the for a small organisation – and considerations.

growth of the

time. We added two significant market. not being afraid to ask ‘how do

investment banks as clients over we get paid from this’ is also an

the course of the last 12 months, 3. ‘Know What You Don’t Know’ OK question to ask. Time is a

which was no mean feat given A lot of great people have given precious commodity and how you

how lockdown limited business us some really valuable advice allocate your resources is key to

company

development and access to along the way, around things driving your success.

people. And we continue to win such as branding, financial

repeat business with our clients management and business 5. Keep A Perspective

as well, which is a testament development. Knowing when to The last 18 months has given all of

GLOBAL LEADERS IN FINANCIAL SERVICES AND COMMODITIES TECHNOLOGY RECRUITMENT

2 2 2 3You can also read