Sri Lanka Treasury Management Profile 2018 - Together we thrive - HSBC Group

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

2 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 3

Contents Introduction and

Purpose

Introduction and Purpose 3 Sri Lanka

This is one of a series of Treasury Management Profiles designed for finance and treasury professionals worldwide. By providing a

Legal and Regulatory 6 snapshot of banking, payments and cash management in selected locations, these profiles can help treasury managers to make

informed decisions, manage risks effectively and take advantage of new opportunities. However, this information is not intended to

Taxation8 be comprehensive and does not constitute financial, legal, tax or other professional advice. Accordingly you should not act upon the

information contained in this document without obtaining your own independent professional advice. The materials contained in this

Banking13

document were assembled in June 2017 (unless otherwise dated) and were based on the law enforceable and information available

Payment Instruments 14 at that time.

Payment Systems 17

Facts and Figures

Cash Management 19 Capital/Other major cities: Colombo (Sri Jayawardenepura Business hours: 09:00–17:00 (Mon–Fri)

Kotte is the administrative

Electronic Banking 20 Banking hours: 09:00–15:00 (Mon–Fri)

capital)/Dehiwala-Mount

Trade Finance 22 Lavinia, Moratuwa, Jaffna, Note: some banks open on Saturdays.

Negombo

Stock exchange: Colombo Stock Exchange (CSE)

Useful Websites 24 Area: 65,610km2

Leading share index: The All Share Price Index (ASPI)

Population: 22.05m

Sectoral distribution Agriculture 7.8%,

Languages: Sinhala, Tamil of GDP (% of GDP): Industry 30.5%,

Source: https://www.cia.gov/library/

Services 61.7%

Currency: Sri Lankan rupee (LKR) publications/resources/the-world-

factbook/index.html. (2017 estimate)

Country telephone code: 94

* The date shown may vary by plus or minus one day. These dates are derived

Weekend: Saturday and Sunday by converting from a non‑Gregorian calendar (e.g., Muslim or Hindu) to the

Gregorian calendar. Some of these dates cannot be determined in advance with

National holidays: 2018 — 15 Jan, 5 Feb, 30 Mar, absolute accuracy, even by the governing authorities. In the case of Muslim dates

in particular, the feast days are determined by the sighting of a new/full moon.

Source: www.goodbusinessday.com. 13, 14 Apr, 1 May, 15 Jun*, 22

Aug*, 8, 20 Nov*, 25 Dec

2019 — 15 Jan, 4 Feb, 13, 14,

19 Apr, 1 May, 5 Jun*, 11 Aug*,

29 Oct*, 9 Nov*, 25 Dec

Government Head of state and political leader

Legislature Maithripala Sirisena, president (head of state and government)

Republic with a unicameral parliament. since 9 January 2015.

®® Parliament: 225 members are elected to serve six‑year terms. ®® The president is elected by popular vote every five years.

The next presidential election is scheduled to be held in

The next elections are scheduled to be held in August 2020. January 2020.4 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 5

Country credit rating

Fitch Ratings rates Sri Lanka for issuer default as:

Term Issuer Default Rating

Short B

Long B+

Long-term rating outlook Stable

Source: www.fitchratings.com, May 2018.

Exchange rate & Interest rate (%) Consumer inflation & GDP volume growth (%)

Economy Sri Lanka Sri Lanka

2016 2017

2011 2012 2013 2014 2015 160 160 10.0 10.0

Q4 Year Q1 Q2 Q3

Exchange rate* (LKR/USD)** 110.565 127.603 129.069 130.565 135.857 147.842 145.582 150.781 152.308 153.255 7.5 7.5

120 120

Interest rate (MMR) (%)

* **

8.97 9.83 7.66 6.21 6.40 8.42 8.42 8.54 8.73 NA

5.0 5.0

Unemployment (%) 4.0 NA 4.4 4.3 4.6 4.2 4.4 NA NA NA 80 80

Consumer inflation*** (%) + 6.7 + 7.5 + 6.9 +2.8 + 2.2 + 4.2 + 4.0 + 6.5 + 6.3 NA

40 40 2.5 2.5

GDP volume growth*** (%) + 8.2 + 9.1 + 3.4 + 5.0 +4.8 + 5.3 + 4.4 + 3.8 + 4.0 NA

0.0

GDP (LKR bn) 6.544 8.732 9.592 10,448 10,952 – 11,839 – – – 0 0 0.0

2012 2013 2014 2015 2016 2012 2013 2014 2015 2016

GDP (USD bn) 59,187 68,345 74,318 80,025 80,788 – 81,323 – – –

Exchange rate (LKR/USD) Consumer inflation %

GDP per capita (USD) 2,828 3,243 3,494 3,731 3,838 – 3,910 – – – Interest rate (local currency MMR) GDP volume growth %

BoP (goods/services/income) as % GDP - 15.6 - 13.7 - 11.0 - 10.3 - 10.0 – - 10.3 – – –

* Market rate. ** Period average. *** Year on year. Sources: IMF, International Financial Statistics, December 2017 and 2017 Yearbook; Sources: IMF, International Financial Statistics, December 2017 and 2017 Yearbook;

and the Sri Lankan Department of Census and Statistics. and the Sri Lankan Department of Census and Statistics.6 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 7

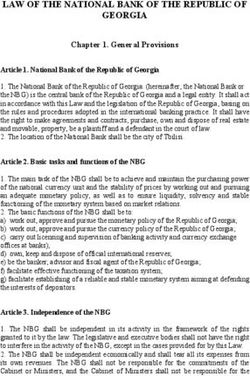

Legal and Non‑residents can open RGRCAs

– investors accounts. These have a

Regulatory minimum deposit of the equivalent of

USD 35,000 and require approval from

the Controller of Exchange.

Central bank Non-resident domestic currency accounts are permitted for Sri Lankan nationals are permitted to import or export up to ®® Convention on the suppression of Terrorist Financing ACT ,

The Central Bank of Sri Lanka is a semi-autonomous institution certain non‑residents. Central Bank approval is required. LKR 20,000 in domestic currency banknotes. Individuals are No 25 of 2005;

operating in accordance with the Monetary Law Act No 589 of Non‑residents can also open resident guest rupee current required to declare imports of foreign currency banknotes ®® Prevention Of Money Laundering Act (No 5 of 2006), as

1949 and its amendments. accounts – investors (RGRCAs – investors). These accounts have equivalent in value to USD 15,000 or above. The export of foreign amended in 2011; and

a minimum deposit of the equivalent of USD 35,000 and require currency banknotes exceeding USD 10,000 must be declared to ®® Financial Transactions Reporting Act, No 6 of 2006 (FTRA).

Bank supervision approval from the Controller of Exchange. customs.

The Central Bank of Sri Lanka’s Bank Supervision Department Sri Lanka is a member of the Asia/Pacific Group on Money

supervises the banking sector in Sri Lanka. Non-resident domestic currency accounts are convertible into Residents issuing or selling securities require prior approval from Laundering (APG). The financial intelligence Unit (FIU), an

foreign currency with Central Bank approval. the Ministry of Finance and Planning. Residents are permitted to independent entity within the Central Bank, is a member of the

Resident/non-resident status purchase securities abroad worth up to USD 500,000 per annum, Egmont Group.

A company is considered resident in Sri Lanka if it is incorporated Reporting in the case of listed companies, and USD 100,000 per annum, in

in or has its principal office or place of effective management and All transactions between residents and non-residents must be the case of unlisted companies. Investments in excess of these Account opening procedures require formal identification of the

control in Sri Lanka. reported to the Central Bank for balance of payments purposes. limits require authorisation from the Ministry of Finance and account holder and beneficial owners.

Planning. Non-residents are not permitted to issue debt securities

Bank accounts Commercial banks are responsible for submitting transactions in Sri Lanka. Every institution within the meaning of the Financial Transaction

Resident data to the Central Bank directly via an online web-based system. Reporting Act, No 6 of 2006 shall report to the FIU every

Foreign exchange accounts and domestic currency (LKR) Resident entities require authorisation from the Exchange Control electronic fund transfer made at the request of a customer,

accounts can be held by residents both domestically and abroad. Exchange controls Department before they can borrow in foreign currency from where the amount of such transfer exceeds INR 1 million, or its

Restrictions apply and prior approval from the Central Bank is Sri Lanka is a member of the Asian Clearing Union (ACU), which abroad. Permission is currently only considered for incorporated equivalent in foreign currency.

required. Resident domestic currency accounts are convertible aims to facilitate payments and promote trade among member companies. Approval from the Ministry of Finance and Planning is

into foreign currency, with Central Bank approval. countries. The ACU comprises Bangladesh, Bhutan, India, Iran, required for all outward investment. Financial institutions must report all cash transactions of

Myanmar, Nepal and Pakistan. Transactions between Sri Lankan LKR 1 million, or its equivalent in foreign currency.

In 2016, Sri Lanka lifted a number of restrictions on resident residents and residents of other ACU member countries are Non-resident investment is prohibited in sectors such as money

foreign currency accounts, including permitting outward carried out in AMU dollars (equivalent to USD) or AMU euros lending, coastal fishing, security management and some Banks are not permitted to issue more than USD 500 in currency

remittances, allowing the withdrawal in foreign currency of notes (equivalent to EUR) with the exception of current transactions and consulting services. Investment is restricted to 40% in sectors notes when issuing foreign currency for travel and other

up to USD 10,000, or equivalent, for any purpose, and authorising settlements that are carried out in USD. such as the production of goods for export under international purposes, without prior approval from the Central Bank.

unrestricted transfers of funds for permitted investment in Sri quota restrictions, cocoa, coconuts, rice, rubber, spices, sugar,

Lanka. The Sri Lankan rupee (LKR) is Sri Lanka’s official currency. Financial institutions in the broadest sense must record and

tea, mining, processing of non-renewable natural resources,

report suspicious transactions within two days of the suspicion

timber, deep-sea fishing, mass communications, freight, travel,

Non-Resident ®® Foreign exchange controls are administered by the Central being formed to the FIU.

shipping agencies and education. The government sets individual

Non-resident bank accounts in foreign currency are available for Bank’s Exchange Control Department. Transactions between

investment limits for sectors such as shipping, air transportation,

Sri Lankans who have worked, or are currently working, abroad Sri Lankan residents must be carried out in LKR. All records must be kept for a minimum of six years after account

arms, aircraft, alcohol, narcotics and waste.

and nationals of other countries who originate from Sri Lanka. closure or the date of the last transaction.

Forward foreign exchange transactions are permitted. Forward Personal loans between residents and non-residents are

Special foreign investment deposit accounts (SFIDAs) and Individuals crossing the border with foreign currency equivalent

foreign exchange contracts are not permitted to have maturity prohibited.

Securities Investment Accounts (SIAs) are available to certain to the value of USD 10,000 or above, must declare this to the

that exceeds that of the underlying transaction and contracts

non-residents. customs authorities.

are only permitted for foreign exchange payments and receipts Anti-money laundering/counter-terrorist financing1

related to trade in goods and services or permitted capital Sri Lanka has implemented anti-money laundering and counter-

In 2016, Sri Lanka lifted a number of restrictions on non-resident transactions. terrorist financing legislation. Notable legislation includes:

foreign currency accounts, including permitting outward 1.

Data as at June 2017.

remittances outside Sri Lanka, allowing the withdrawal in Profits are not required to be remitted back to Sri Lanka, provided ®® Financial Institutions (Customer Due Diligence) Rules, No 1 of

foreign currency of notes up to USD10,000, or equivalent, for the funds are not used to acquire property or other capital assets 2016;

any purpose, and authorising unrestricted transfers of funds for abroad.

permitted investment in Sri Lanka.8 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 9

Taxation

1

Resident/non-resident The standard rates of corporation tax up to 31 March 2018 are:

Withholding tax (subject to tax treaties) Effective from 1 April 2018:

A company is resident for tax purposes in Sri Lanka if it is

incorporated or formed under the laws of Sri Lanka or it is ®® A higher rate of 40% on business of lottery or betting or Payments to: Interest Dividends Royalties Other income Branch remittances

registered or the principal office is in Sri Lanka or at any time gaming, liquor and/or tobacco;

Resident companies 5%* 0%/14% 14% 10%/14% NA

during the year the management and control of the affairs of the ®® A lower rate of 12% on sectors such as SME, export of goods

company are exercised in Sri Lanka. & services, undertaking for promotion of tourism, agricultural Non-resident companies 5% *

0%/14%† 14% 14% ‡

14%

business and 10% on sectors such as educational services,

* Paid by financial institutions. WHT is not applicable to interest paid to a financial institution on the ordinary loans and advances provided by it.

Tax authority information technology services and agricultural business; and † Dividends paid from listed shares to non-resident companies are exempt from withholding tax. From 1 April 2018, the WHT rate on dividends paid to resident as well as non-

®® Inland Revenue Department. ®® A standard 28% rate on profits and income on all other sectors resident shareholders will be increased from 10% to 14%.

‡ From 1 April 2018, the WHT rate on royalties and technical services will be 14% for non-residents.

including banking and finance, insurance, leasing and related

Tax year/filing activities.

The tax year runs from 1 April to 31 March. A trust or company

may apply to the Commissioner-General for a change to its year Effective 1 April 2018 (year of assessment 2018/2019), a three tier ®® Non-resident companies are taxed on income from activities Capital gains tax

of assessment (Y/A). corporate income tax structure will implemented. in Sri Lanka. Non-resident companies are liable to remittance Effective from 1 April 2018, capital gains tax will be imposed

tax at a rate of 10% on profits remitted abroad (revised to at the rate of 10% on gains from the realisation of investment

Tax returns are required to be filed not later than eight months ®® A higher 40% rate on income from betting and gaming, liquor, 14% effective from 1 April 2018). assets. The sale of shares in a quoted company is not subject to

after the end of each year of assessment. and tobacco; capital gains tax.

®® A lower 14% rate on income from small and medium Losses incurred in the operation of a trade or business may

An instalment payer shall pay instalments of tax:

enterprises (SMEs) having an annual turnover up to LKR 500 be carried forward indefinitely, but may offset only up to 35% Withholding tax (subject to tax treaties)

million, exports of goods or services, agricultural business, of statutory income. The carryback of losses is not permitted. For the period up to 31 March 2018: As a general rule,

®® (a) in the case of a person whose Y/A is a 12 month period

undertaking for promotion of tourism, information technology (Effective from 1 April 2018, restrictions on claiming leasing and withholding tax (WHT) is not applicable to interest paid to a non-

ending on the 31 day of March, on or before the 15 day

services and educational services subject to having 80% or insurance losses and the ceiling of 35% of statutory income have resident, if the non-resident recipient is a bank or if the interest is

respectively of August, November and February in that Y/A and

more gross income from such sector; and been removed. Unrelieved losses can be carried forward only up paid by a Foreign Currency Banking Unit in Sri Lanka. (Effective

the 15 day of May of the next succeeding year of assessment;

®® A standard rate of 28% on income of all other sectors to six years. Any unrelieved loss in respect of a long-term contract from 1 April 2018, the exemption given for foreign currency

or

including banking and finance, insurance, leasing and related can be carried back and set off against the profit made from the and foreign currency converted accounts has been removed.

®® (b) in any other case, on or before the 15 day after each 3

activities. contract in such year. Long-term contract means a contract for However, WHT is not applicable to interest paid to a financial

month period commencing at the beginning of each Y/A and

manufacture, installation or construction or, in relation to each, institution on the ordinary loans and advances provided by it.)

a final instalment on or before the 15 day after the end of each

Dividend tax (for the period up to 31 March 2018): the performance of related services; and which is not completed

Y/A, unless it coincides with the end of one of the 3 month Royalties and fees for technical services will be taxed at the rate

within 12 months of the date on which work under the contract

periods. ®® Resident companies are liable for dividend tax at 10% at the of 14% for non-residents.

commences.)

time of distribution of dividends (revised to 14% effective from

Consolidated returns are not permitted and each company must Tax treaties/tax information exchange agreements (TIEAs)

1 April 2018). Deemed dividend tax at 15% is applicable unless Advance tax ruling availability

file a separate return. Sri Lanka has tax treaties with over 38 countries, including the

10% or more of the distributable profits of the prior tax year Rulings on the interpretation of tax laws are available. Advance

are distributed by 30 September following the end of the tax tax rulings on transfer pricing issues are negotiable with the main EU countries and the USA and information is exchanged

Corporate taxation

year (deemed dividend tax is not applicable effective from 1 Inland Revenue Department. under the provisions of such treaties. Sri Lanka has not yet signed

Resident companies are taxed on their worldwide income.

April 2018). There is no surtax or alternative minimum tax. any separate agreement on exchange of information.

Non-resident companies are taxed on profits from sources in Sri

Lanka.

1.

All tax information supplied by SJMS Associates (www.sjmsassociates.lk), an

independent correspondent firm to Deloitte Touche Tohmatsu, Deloitte Highlight

(www.deloitte.com), and Sri Lanka Inland Revenue, 2017.10 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 11

Thin capitalisation Sales taxes/VAT/excise duty ESC is payable quarterly at 0.5% of total turnover. The payment

For the period up to 31 March 2018: Deductions for interest paid VAT is payable on goods and services, including imports. Certain is due before the 20th day after the end of every quarter. This

by a subsidiary on loans obtained from a holding company or goods and services are exempt from VAT, and exports of goods & charge may be set off against the income tax payable and carried

another subsidiary, or vice versa, are restricted to debt-to-equity services are zero-rated. The standard VAT rate is 15%. Input tax is forward for two subsequent years, but no refund is available. No

ratio of 3:1 for manufacturers and 4:1 for other companies. limited to 100% of output tax. ESC is payable if quarterly turnover is LKR 12.5 million.

(Effective from 1 April 2018, thin capitalisation will apply to

interest paid by any person other than a bank or financial Businesses with a taxable supply of less than LKR 3 million Nation building tax

institution.) per quarter or LKR 12 million per annum do not have to register Nation building tax is payable by importers, manufacturers,

for VAT. service providers and retail and wholesale businesses.

Transfer pricing

Income, gains and profits arising, derived from or accruing from, Excise duties apply to tobacco products, alcohol, motor vehicles The tax is 2% of the turnover of the amount received or receivable

or any loss incurred in, international transactions between two and oil products. in respect of manufacturers and service providers, 2% of the

associated parties must be determined with regards to the arm’s- value of the imports in respect of importers, and 2% on 50% of

length price. Financial transactions/banking services tax the turnover in respect of retail and wholesale businesses. The

Financial services supplied by a bank or financial institution in threshold for registration is LKR 3 million per quarter or

Income, gains and profits arising, derived from or accruing from, Sri Lanka are subject to VAT. LKR 12 million per annum.

or any loss incurred in, international transactions between two

associated parties must be determined with regards to the arm’s- Payroll and social security taxes Payment is due every month by the 20th day of the following

length price. There is no payroll tax payable by employers. Employees are liable month. The final payment is due on or before the 20th day

for PAYE income tax. immediately following the end of the quarter.

Anti-avoidance

A general anti-avoidance rule applies when transactions do not Employers contribute 12% of employees’ salaries to the Local taxes

reflect economic reality. Employees’ Provident Fund (EPF) or to an approved private Local authorities collect taxes (rates) from owners of land and

provident fund. Employees contribute 8% of their salary to an property. They also collect annual business licence fees.

Stamp duty EPF.

Stamp duty is payable:

Employers contribute 3% of their payroll to the State Employee

®® To provincial councils on the transfer of immovable assets and Trust Fund. An employee is entitled to a gratuity payment at

Effective from 1 April 2018, the WHT

on certain documents. the time of leaving if the employee has had continuous service

®® On specified instruments that are executed, drawn or exceeding five years. The gratuity is an amount of 50% of the last

presented in Sri Lanka. drawn salary, multiplied by the number of years of service.

®® On instruments executed outside Sri Lanka that relate to

property situated in Sri Lanka at the time such instruments are

Generally, employers establish gratuity funds and contribute to exemption given for foreign currency and

them periodically according to the fund rules. The gratuity fund is

foreign currency converted accounts has

presented in Sri Lanka.

a separate legal entity.

Cash pooling

Economic services charge

Sri Lanka has no specific tax rules for cash pooling arrangements.

Economic services charges (ESC) is a tax that, in general, applies

to the turnover of companies arising from a trade or business.

been removed.12 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 13

Banking

Overview part of the Central Bank’s Master Plan, in the future foreign banks

There are 25 licensed commercial banks operating in Sri Lanka: are expected to play a greater role in the country’s economic

11 domestically owned commercial banks, two state-owned activities and to strengthen their operations within the country.

commercial banks and 12 foreign-owned banks. In addition,

there are eight licensed specialised banks and 45 registered Digital banking is still in the nascent stage in Sri Lanka, in terms

finance companies. There are also 1,600 cooperative rural banks of both delivery and adoption. There are approximately four

and 8,000 thrift and credit cooperative societies. These financial million internet bank users in the country, but online transactions

institutions are not required to be licensed by the Central Bank in account for just 10% of transactions.

order to accept deposits.

Construction has begun on a Colombo International Financial City

Sri Lanka’s banking sector is dominated by six banks, two of (CIFC), a special financial zone that the government hopes will

which are the state-owned Bank of Ceylon and People’s Bank. become a financial hub for the South Asian region.

These six banks controlled approximately 81% of all banks

assets at the end of 2016. The country’s two state-owned banks

accounted for 38.3% of all banking assets for the same period.

Major banks

Islamic finance accounts for approximately 3% of total financial Total assets (USD millions)

assets in Sri Lanka. Three banks currently operate an Islamic Bank

30 June 2017

banking window: MCB, Amana Bank and the state-owned

Commercial Bank of Ceylon. Bank of Ceylon 11,740

People’s Bank 9,568

The Sri Lankan financial sector is highly fragmented. The Central

Bank’s Master Plan on Consolidation of the Financial Sector Commercial Bank of Ceylon 7,118

requires larger banks to identify potential partners and initiate

National Savings Bank 6,211

mergers and acquisitions. The Central Bank envisages at least five

major banks in the financial sector with asset sizes of more than Hatton National Bank 5,713

LKR 1 trillion. All remaining banks will have a minimum asset size

Source: www.accuity.com, November 2017.

of LKR 100 billion. In its 2017 budget, the government suggested

voluntary consolidation for smaller banks inorder to meet the

Basel III requirements by 2019. The government also raised the

minimum capital of licensed commercial banks to LKR 20,000

million. From 1 July 2017, licensed banks in Sri Lanka will adopt

minimum capital standards.

Foreign banks play an active role in the country’s financial sector,

including Citibank, Deutsche Bank, HSBC, Standard Chartered

Bank and the State Bank of India. Foreign-owned banks account

for approximately 10% of the banking sector’s total assets. As14 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 15

Payment

Instruments

Payment statistics % volume of all cashless % value of all cashless

payments 2016 payments 2016

Thousands of transactions % change Traffic (LKR billions) % change

2015 2016 2016/2015 2015 2016 2016/2015

Cheques and bank drafts 49,326 51,996 5.4 8,434 9,601 13.8 Cheques and Bank Drafts 30.3% Cheques and Bank Drafts 9%

Debit Card Payments 22.4% Debit Card Payments 0.1%

Debit card payments 30,686 38,083 24.1 83 108 30.1

Credit Card Payments 18.5% Credit Card Payments 0.1%

Credit card payments 26,335 31,858 21 154 182 18.2 RTGS Credit Transfers 0.2% RTGS Credit Transfers 87.8%

SLIPS Transactions 15.5% SLIPS Transactions 1.4%

RTGS credit transfers 322 366 13.7 84,432 93,378 10.6

Postal Instrument 0.7% Postal Instruments Negligible

SLIPS transactions* 23,279 26,647 14.5 1,169 1,458 24.7 Internet Banking 10.6% Internet Banking 1.5%

Phone Banking 2% Phone Banking Negligible

Postal Instruments 1,262 1,244 – 1.4 7.0 7.0 0.0

Internet banking 13,725 18,164 32.3 1,205 1,589 31.9

Source: Central Bank of Sri Lanka, Annual Report 2016.

Phone banking 1,993 3,444 72.8 12 16 33.3

Total 146,928 171,802 16.9 95,496 106,339 11.3

* Includes credit transfers and direct debits. Source: Central Bank of Sri Lanka, Annual Report 2016.

Cash ®® Low-value, non-urgent and high-volume credit transfers are Cheques In 2016, 59,000 USD cheques were processed, with a value of

Cash remains an important payment medium in Sri Lanka, processed via SLIPS on a next-day basis. Low-value credit The cheque is the dominant cashless payment method for both LKR 39 billion, a 4.8% decline in volume terms, but a 14.7%

particularly for low‑value retail transactions, accounting for more transfers include payroll, supplier and third-party payments. retail and commercial payments. increase in value1.

than 90% of retail payments. Credit transfers processed via SLIPS accounted for 15.5% of

the volume of all cashless payments in 2016, but just 1.4% of Cheques are truncated into electronic items before being Cheques accounted for 30.3% of the volume of all cashless

The government is actively promoting electronic payments in the value1. cleared via the LankaClear system. Final settlement is via the payments in 2016, and 9% of the value1.

order to establish a less-cash dependent society. As part of this, it ®® Real-time electronic bank transfers can be made via the RTGS on a next-day basis.

is developing a payment platform to effect government payments Bank drafts, bills of exchange and promissory notes are also

CEFTS. Payments can be made via mobile phone, bank

through the CEFTS payment system. Foreign banks’ LKR-denominated cheques and drafts drawn available in Sri Lanka.

branch, online or at an ATM. Individual transfers are currently

on nostro accounts held at Sri Lanka’s commercial banks are

limited to LKR 5 million. Card payments

Credit transfers cleared via LankaClear’s Rupee Draft Clearing System (with

All credit transfers in Sri Lanka are automated. settlement via the RTGS system at 14:15 local time every Payment cards are an increasingly popular payment method in Sri

Direct debits

business day). Lanka. Credit and debit card transactions accounted for 18.5%

Direct debits are available in Sri Lanka for low-value recurring

®® High-value and urgent credit transfers are cleared and settled and 22% respectively of the volume of all cashless payments in

payments such as utility bills. They are processed via SLIPS on a

via the national LankaSettle RTGS system in real time. RTGS USD cheques and drafts are settled via LankaClear’s US Dollar 2015. The value of credit and debit card transactions over the

same-day basis.

credit transfers accounted for 87.8% of the value of all Cheque Clearing System. Settlement is typically made within same period was negligible (0.1%)1.

cashless payments in 2016, but just 0.2% of the volume1. In 2016, a direct debit facility was enabled via CEFTS. four days through participants’ USD accounts held at Sampath

Bank.16 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 17

Payment

Systems

There were approximately 1.3 million credit cards in circulation in Sri Lanka. The government has announced the implementation Type ®® The US Dollar Cheque Clearing System. This is a semi-

in April 2017 and 17 million debit cards (which are primarily used of a Common Mobile Switch (CMobs) to ensure interoperability The LankaSettle RTGS system, Sri Lanka’s national real-time computerised system used to clear USD-denominated

for ATM withdrawals)2. Visa and MasterCard are the principal between mobile wallets. gross settlement (RTGS) system, is owned and operated by the cheques and bank drafts within approximately four working

payment card brands issued, although American Express cards Central Bank of Sri Lanka. The RTGS system is one half of the days. Payment obligations among the 20 participant banks are

are also available. At the end of 2016, there were 35 licensed Other payments Lanka Settle system, along with LankaSecure, the securities settled across USD accounts held at Sampath Bank.

providers of payment cards. EMV-compliant cards are issued by Postal money transfers can be used for payments between settlement system. ®® JustPay. A mobile-phone initiated real-time retail payment

a number of banks and sector-wide migration to EMV-compliant individuals and for social security and pension payments. transfer system for transactions of LKR 10,000 or under.

cards is underway. ®® The RTGS processed 366 thousand transactions in 2016, with

Bank drafts, bills of exchange and promissory notes are also a value of LKR 93,378 billion, a 13.7% and 10.6% increase

Participants

Interbank obligations deriving from Visa and MasterCard available in Sri Lanka. respectively on 2015 figures.

The LankaSettle RTGS system has 24 licensed commercial

transactions are settled across the commercial banks’ accounts

A Common Mobile Switch (CMobs) will be implemented to banks participants, in addition to the Central Bank, eight non-

held at the state‑owned Bank of Ceylon and Standard Chartered SLIPS (Sri Lanka Interbank Payments System), an offline

ensure interoperability between mobile wallets. bank primary dealers, the Employees’ Provident Fund and the

Bank’s Colombo branch respectively. automated multilateral net settlement system, is operated Central Securities Depository.

by LankaClear (which is jointly owned by the Central Bank of

In June 2017, LankaClear, which is jointly owned by the

Mobile wallet

Sri Lanka and all licensed commercial banks). SLIPS participants include all licensed commercial banks, in

central bank and commercial banks, in partnership with JCB

addition to the Central Bank.

International, announced the launch of a national card scheme ®® SLIPS processed 26,647 thousand transactions in 2016,

issuing LankaPay-JCB cards, The cards will be issued by all

LankaClear participants. The launch is part of the government’s schemes such as eZ with a value of LKR 1,458 billion, a 14.5% and 3.4% increase

respectively on 2015 figures.

CIT participants include all licensed commercial banks, in

addition to the Central Bank.

National Card Scheme. A Common Point-Of-Sale Switch is being

developed to facilitate clearing and switching of payment cards

issued under the National Card Scheme.

Cash are available. CIT (Cheque Imaging and Truncation), a multilateral net

settlement system for paper-based payments, is operated by

CEFTS has 22 participants.

Transaction types processed

The government

LankaClear.

There were 3,820 ATMs and 44,000 EFTPOS terminals in The LankaSettle RTGS system processes high-value and

Sri Lanka at the end of 20161. All EFTPOS terminals are EMV- LankaClear is also responsible for operating: urgent LKR-denominated interbank transfers. In addition, the

has announced the

compliant. RTGS system effects the final settlement of participants’ net

®® The CEFTS (Common Electronic Fund Transfer Switch). This balances originating from Sri Lanka’s other clearing houses.

Sri Lanka’s Common ATM Switch (CAS) links ATMs in Sri Lanka. is a real-time electronic payment system for bank transfers

The system is operated by LankaPay, which also operates a

Shared ATM Switch (SAS), a National Card Scheme (NCS) and implementation of effected through channels such as ATM, online and mobile

banking and over-the-counter. In 2016, CEFTS processed

SLIPS processes low-value and bulk electronic credit and debit

transfers.

the recently launched Common Electronic Funds Transfer Switch 894,674 transactions, with a value of LKR 69.4 billion.

(CEFTS). There are 23 participants in CAS.

a Common Mobile ®® The Rupee Draft Clearing System. This system manually

clears foreign banks’ cheques and drafts in LKR drawn on

CIT processes cheques and other paper-based payments.

Electronic wallets CEFTS processes electronic bank transfers of up to

Electronic money schemes are available in the form of reloadable

pre-paid cards.

Switch to ensure nostro accounts and held with Sri Lanka’s commercial banks.

Clearing takes place between 11:30 and 12:15 local time each

LKR 5 million per day.

day. Final settlement takes place via the RTGS system at 14:15

Mobile wallet schemes such as eZ Cash and mCash are available interoperability between local time each working day; and

1.

2.

Central Bank of Sri Lanka, Annual Report 2016.

Central Bank of Sri Lanka, Monthly Economic Indicators, May 2017. mobile wallets.18 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 19

Cash

Management

Operating hours CIT Domestic ®® Commercial paper is issued by private companies. Maturities

The LankaSettle RTGS system operates from 07:30 to 17:30 Banks send deposited cheques to the main processing centre in Notional pooling of three months are the most common.

IST, Monday to Friday. Colombo or to one of LankaClear’s 11 regional processing centres Notional pooling is permitted in Sri Lanka. Cross-border notional ®® Certificates of deposit are offered by some

where they are processed via image exchange. Electronic files pooling is not permitted. commercial banks.

See Clearing cycle details for information on the SLIPS and CIT are transmitted by the regional centres to the Colombo-based ®® Treasury bills (T-bills) are issued at a discount via weekly

payment systems. processing centre to be cleared. Cash concentration

auctions by the Central Bank’s Public Debt Department.

Cash concentration is permitted in Sri Lanka, but only on savings

T-bills have maturities of three, six or 12 months. T-bills are

CEFTS operates 24/7 365 days a year. ®® 19:30 IST: cut-off time for cheque payments to be sent to account balances and from foreign currency banking units.

issued in denominations of LKR 1 million. The minimum

LankaClear by participant banks.

Clearing cycle details investment amount is LKR 5 million.

®® 08:30 T+1: final settlement takes place across participants’ Cross-border cash concentration is not permitted.

LankaSettle RTGS ®® Repurchase agreements are available.

accounts held at the Central Bank via the RTGS system. Funds

®® 08:00–16:30 IST: the LankaSettle RTGS system settles Collections ®® Money market funds are available.

are available to beneficiaries on a next-day basis.

transactions in real time and with immediate finality. Payment Banks in Sri Lanka offer a range of collections options to

instructions are submitted using SWIFT messages. corporate clients, including regular cash and cheque collection Custody and securities settlement1

CEFTS

®® 08:30: settlement in batches of payment obligations deriving services via security service providers. Depository

Users access the CEFTS system via ATMs, internet banking,

from SLIPS and the CIT system. ®® Central Depository Systems (Pvt) Limited (CDS).

mobile banking, kiosks and over-the-counter. Payments are

Cross-border ®® LankaSecure.

®® 14:15 IST: settlement of payment obligations deriving from Sri settled on real-time basis 24 hours a day, seven days a week.

Cross-border payment instructions are routed via SWIFT and

Lanka’s other payment systems.

settled through accounts held with correspondent banks abroad. The CDS provides central registration, clearing and settlement

®® 15:00/16:00 IST: cut-off time for customer/interbank payments.

services for equities, corporate bonds and government

Currency centre holidays Lifting fees securities.

Final settlement takes place across the participant banks’

Percentage-based fees are applied to funds transfers between

correspondent accounts at the Central Bank. 2018 15 Jan, 5 Feb, 30 Mar, 13, 14 Apr, 1 May,

resident and non-resident accounts. All securities traded on the Colombo Stock Exchange must be

15 Jun*, 22 Aug*, 8 Nov*, 25 Dec

lodged with the CDS (although use of the CDS is not mandatory

SLIPS

2019 15 Jan, 4 Feb, 13, 14, 19 Apr, 1 May, Short-term investments for other securities). Securities are held by the CDS in book-

All payment messages are submitted electronically via diskettes,

5 Jun*, 11 Aug*, 29 Oct*, 9 Nov*, 25 Dec ®® Interest can be earned on resident and non-resident savings entry form. Bonds settle on a delivery versus payment basis on

magnetic tapes or via electronic file transfers. Payments

accounts. a settlement date agreed upon by the parties.

submitted to SLIPS are usually settled on a net basis within two * The date shown may vary by plus or minus one day. These dates are derived by

converting from a non-Gregorian calendar (e.g., Muslim or Hindu) to the Gregorian ®® Demand deposit accounts are available in LKR or major foreign

working days, although value dates can range up to T+14.

calendar. Some of these dates cannot be determined in advance with absolute currencies. Banks are not permitted to pay interest on demand LankaSecure, established by the Central Bank of Sri Lanka,

accuracy, even by the governing authorities. In the case of Muslim dates in particular,

deposit accounts. manages a Scripless Securities Settlement System and Central

®® 15:30 IST: cut-off time for payment instructions to be sent to the feast days are determined by the sighting of a new/full moon.

®® Time deposits are available in LKR or major foreign currencies Depository System for T–bills, government bonds and central

LankaClear by participant banks.

Source: www.goodbusinessday.com. and in a range of maturities. bank securities. Settlement ranges from T to T+10 on an

®® 08:30 IST T+1 and 15:00 IST T+1: final settlement takes place

RTGS system.

across participants’ accounts held at the Central Bank via the ®® Special foreign investment deposit accounts (SFIDA) are

RTGS system. available to non‑residents in LKR or major foreign currencies.

Settlement cycle

SFIDA accounts must have a minimum balance of USD

®® T+3 for equities.

10,000. SFIDA accounts are exempt from withholding and

®® Variable for bonds.

corporation tax. Securities Investment Accounts (SIAs) enable

non-residents to make investments in LKR. All non‑resident

LKR investments in Sri Lanka must be conducted via SIAs.

1.

Data as at February 2017.20 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 21

Electronic

Banking

JustPay is a mobile Electronic banking is available in Sri Lanka and offered by the

country’s leading domestic and international banks. There is no

bank-independent electronic banking standard; each bank offers

phone-initiated its own proprietary system for corporate banking purposes.

Internet and mobile banking is offered by Sri Lanka’s larger

real-time retail commercial banks for both corporate and retail purposes,

although usage is low.

payment transfer ®® There were 18.1 million payments conducted via online

accounts in 2016, with a total value of

system for payments LKR 1,589 billion1.

eZ Cash and mCash are mobile phone-based e-money systems,

of LKR 10,000 and for mobile banking purposes. eZ Cash, launched by mobile

network operator Dialog, is available to those without a bank

account.

under. Customers JustPay, operated by LankaClear, is a mobile phone-initiated real-

time retail payment transfer system for payments of LKR 10,000

can make payments and under. Customers can use the service to make payments

from savings or current accounts via smartphone.

from savings or Sri Lanka has an in internet penetration rate of approximately

30%2. Mobile penetration is in excess of 126%3.

current accounts via

smartphone.

1.

Central Bank of Sri Lanka, Annual Report 2016.

2.

Colombo Digital Marketers.

3.

Research and Markets.22 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 23

Trade

Finance

There is a state Imports

Documents

Exports

Documents

Key import partners

In order to import goods into Sri Lanka, a customs declaration, In order to export goods from Sri Lanka, a customs declaration,

monopoly on the commercial invoice, bill of lading, certificate of origin, packing list,

letter of credit and delivery order are required.

commercial invoice, bill of lading, packing list and shipping note

are required. A clean pre‑shipment inspection report is also

India 28.3%

import of petroleum

required for items to be exported.

Licences Japan 9.2%

Import controls apply to 589 items for public health, Licences UAE 7.1%

products, which

environmental, cultural, moral or security reasons. Licences are required for exporting scrap metal, vintage motor Singapore 6.1%

vehicles, timber, ebony and ivory crafted items.

Licences are required for imports of used motor vehicle bodies/

includes liquefied parts, cigarette papers, and cashews in shells. Licences are also

required for unmilled rice, to protect against low prices.

Taxes/Tariffs and other fees

Export tariffs are applied to cinnamon and other selected spices, Key export partners

coconut, rubber and tea and scrap metal.

petroleum gas. Taxes/tariffs and other fees

Sri Lanka is a member of the South Asian Association for Prohibited exports

Regional Cooperation (SAARC), which aims to abolish most trade A negative list (of products that may not be exported) is in

The state imports tariffs between member states. SAARC comprises Afghanistan,

Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri

operation. USA

UK

28.8%

10.6%

Financing imports and exports

100% of petroleum

Lanka. India 6.6%

Imports Germany 4.9%

Sri Lanka is a signatory of the South Asia Free Trade Agreement Advance import payments are restricted to USD 50,000 per Italy 4.5%

products. (SAFTA), alongside Bangladesh, Bhutan, India, the Maldives,

Nepal and Pakistan. Sri Lanka has a free trade agreement with

shipment. There are no restrictions on payments from foreign

currency accounts.

Source: The World Factbook. Washington, DC: Central Intelligence Agency, 2017

India and Pakistan.

(https://www.cia.gov/library/publications/resources/the-world-factbook/index.html).

Exports

Imports are subject to four different tariff rates: 0%, 7.5%, 15% There are no financing requirements for exports.

and 25%.

Prohibited imports

A negative list (of products that may not be imported) is in

operation. It is prohibited to import certain commodities into

Sri Lanka, in order to protect fauna and flora, and for national

security and moral reasons.24 HSBC Treasury Management Profile 2018 | Sri Lanka HSBC Treasury Management Profile 2018 | Sri Lanka 25

Useful

Websites

Central Bank of Sri Lanka www.cbsl.gov.lk

Leading banks: Bank of Ceylon web.boc.lk

Commercial Bank of Ceylon www.combank.net

Hatton National Bank www.hnb.net

National Savings Bank www.nsb.lk

People’s Bank www.peoplesbank.lk

Association of Professional Bankers www.apbsrilanka.org

Ministry of Finance www.treasury.gov.lk

Department of Commerce www.doc.gov.lk/web

Ministry of Rural Economy reco.gov.lk/

Federation of Chambers of Commerce and Industry of Sri Lanka www.fccisl.lk

National Chamber of Commerce of Sri Lanka www.nationalchamber.lk Disclaimer

Ceylon Chamber of Commerce www.imexport.gov.lk

This document has been produced by HSBC Bank plc and members of the HSBC Group (“HSBC”), together with their third-party contributor, WWCP Limited. We make no

representations, warranties or guarantees (express or implied) that the information in this document is complete, accurate or up to date. We will not be liable for any liabilities

Department of Import and Export Control www.imexport.gov.lk arising under or in connection with the use of, or any reliance on, this document or the information contained within it. It is not intended as an offer or solicitation for business

to anyone in any jurisdiction. The information contained in this document is of a general nature only. It is not meant to be comprehensive and does not constitute financial,

Sri Lanka Export Development Board www.srilankabusiness.com legal, tax or other professional advice. You should not act upon the information contained in this document without obtaining your own independent professional advice. The

information contained in this document has not been independently verified by HSBC.

Invest in Sri Lanka www.investsrilanka.com

This document contains information relating to third parties. The information does not constitute any form of endorsement by these third parties of the products and/or

Securities and Exchange Commission of Sri Lanka www.sec.gov.lk services provided by HSBC or any form of cooperation between HSBC and the respective third parties.

Colombo Stock Exchange www.cse.lk/home.do Under no circumstances will HSBC or the third-party contributor be liable for (i) the accuracy or sufficiency of this document or of any information, statement, assumption

or projection contained in this document or any other written or oral information provided in connection with the same, or (ii) any loss or damage (whether direct, indirect,

LankaClear www.lankaclear.com consequential or other) arising out of reliance upon this document and the information contained within it.

HSBC and the third-party contributor do not undertake, and are under no obligation, to provide any additional information, to update this document, to correct any

inaccuracies or to remedy any errors or omissions.

HSBC website details

No part of this document may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or

HSBC Commercial Banking www.business.hsbc.co.mu otherwise, without the prior written permission of HSBC and the third-party contributor. Any products or services to be provided by HSBC in connection with the information

contained in this document shall be subject to the terms of separate legally binding documentation and nothing in this document constitutes an offer to provide any products

HSBC Global Banking and Markets www.gbm.hsbc.com or services.Together we thrive

You can also read