Ranking the biggest franchise owners in the U.S.

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Units shift as M&A fuels growth

among Restaurant 200 operators

T

he Restaurant 200 reflects operators, the largest franchisee

many of the major trends groups continued rapid growth.

in the restaurant industry, The top 10 companies now The Top 2OO Operators Command

one being the big continue to account for $11 billion in sales

grow. But the industry is facing with an additional $158 million • $42.0 billion in revenue

real change and difficulty even added in 2019. There was also • 30,124 restaurants

at the top. These year-end 2019 plenty of growth beyond the top

numbers serve as one final bench- 10. In fact, the next 190 restau- • Top 5 firms combine for $7.5 billion in sales

mark for the industry before the rant operators grew even faster.

COVID-19 pandemic changed The percentage of sales in the

everything. top 10 accounted for 27 percent

Flynn Restaurant Group of the overall sales in the group The 10 Sellers of the Restaurant 200

maintains its No. 1 position for of $42 billion, down slightly

the ninth year in a row. But it was from 28 percent last year. That

Rank LY Company Units 2018

a down year for the California- marks a switch in a five-year

based restaurant giant. The com- sales trend that heavily favored 76 QK Holdings 91 Denny’s, 9 Del Taco

pany shed seven Applebee’s and the largest operators. Diversified

78 64 Buffalo Wild Wings

sales dipped by $5 million. Flynn The average operator on the Restaurant Holdings

added one Arby’s, five Taco Bell Restaurant 200 has $210 mil- 95 Four Foods Group 72 Little Caesars, 49 Kneaders

units and a single Panera. lion in revenue and oversees 151

NPC International retains the locations. That’s up from $202 Wisconsin

128 34 Applebee’s, 31 Pizza Hut

Hospitality Group

No. 2 spot even as it struggled million and 143 units last year.

with finance issues in 2019. The 147 Ultra Steak 22 Little Caesars, 13 Texas Roadhouse

company grew to $1.6 billion All together now 160 McEssy Investment Co. 23 McDonald’s

in sales, a $67 million increase Mergers and acquisitions

in the self-reported numbers. shifted hundreds of restaurants 161 Ocedon 62 Burger King

But even that wasn’t enough to around on the Restaurant 200 185 Southwest Deli Group 33 McAlister’s Deli

stave off liquidity issues. The list. In all, 10 of the top 200 com-

company faced a credit rating panies sold the entirety of their 191 FOR Northwest 38 Burger King

downgrade from Moody’s and operations. The largest was QK 195 Lunan Corporation 37 Arby’s

filed for bankruptcy protection Holdings, which reported $154

midway through 2020. million in sales in 2018 and

Carrols Restaurant Group ranked No. 76 on last year’s list- Others on the list of sellouts largest Burger King operator and

continued to expand, and the ing. The Denny’s and Del Taco or near sellouts were McEssy No. 3 on the ranking, added 187

company was the top sales operator sold all of its 94 Denny’s Investment Co., which sold many BK restaurants and 65 Popeyes,

grower in the rankings. The mas- locations to WKS Restaurant of its 23 McDonald’s locations. contributing to its sales growth.

sive Burger King operator added Group (No. 17). The next largest, No. 165 Ocedon sold most of the Sun Holdings’ acquisition of

$273 million in sales. For some Diversified Restaurant Holdings Burger King locations it operated, 51 McAlister’s locations repre-

context, that level of sales alone (No. 78), was taken private and No. 195 Lunan Corp. sold sented another trend as the larg-

would put an operator solidly at when private equity firm ICV most of its Arby’s stores. est operators diversify with new

No. 39 on the ranking. Partners took over the company’s The common theme among brands within their markets. The

The Dhanani 64 Buffalo Wild that group was great prices for Dallas-based company run by

Group in Sugar Wings locations. active consolidation companies. Guillermo Perales already has

Land, Texas comes By Nicholas Upton Four Foods Despite ongoing industry hard- 290 Burger Kings, so taking on

in at No. 4 with Research by Group, the No. 95 ships, including rising labor costs a new concept, complex or not,

an estimated $1.1 Matt Haskin operator last year, and lagging traffic, prices for the starts to make sense.

billion in sales, unloaded all of its right brands remained high. The WKS Restaurant Group added

and Max Wolf

and Sun Holdings franchise locations decision between investing in $169 million in sales, much of

jumps to No. 5 and became a pri- remodels and updates or cash- that from its Denny’s acquisition,

from the No. 9 position last vate equity fund itself. The Salt ing out has been top of mind for along with six Krispy Kremes

year. The company added $206 Lake City-based operator behind operators in the last few years. and five El Pollo Loco restau-

million in sales (the second the expansion of Kneaders and In all, 24 companies on the rants. The operator grew sales by

most aggressive sales growth) also a major Little Caesars fran- Restaurant 200 opted to sell all nearly 60 percent, making it the

through 2019 as it acquired 51 chisee now invests in fledgling or the vast majority of their oper- strongest percentage sales growth

McAlister’s Delis. restaurant and food-retail con- ations in the last two years. Large leader within the top 200.

While there were shifts and cepts with an aim to scale under franchisees, meanwhile, continue

disruptions among the top the name Savory. to buy more scale. Carrols, the

August 2020 | Franchise Times 3315 K-Mac Enterprises

Franchise Times Fort Smith, AR

$484,988,000

Restaurant 200: Top 20 289 Taco Bell

6 Golden Corral

11 YUM! Multi

Sun Holdings secured

16 Meritage

1 Flynn Restaurant Group 10 Pacific Bells a spot in the top 5

Hospitality Group

San Francisco, CA Vancouver, WA this year. The Burger

Grand Rapids, MI

$2,338,356,000 $652,000,000 King operator added

$467,700,000

451 Applebee’s 240 Taco Bell 51 McAlister’s in a

331 Wendy’s

369 Arby’s 67 Buffalo Wild Wings diversifying acqui-

264 Taco Bell 17 WKS Restaurant Group sition—one of the

11 GPS Hospitality Cypress, CA brand’s largest deals

2 NPC International Atlanta, GA $466,063,000 so far. The company

Leawood, KS $623,097,000 127 Denny’s also added $206

$1,611,849,000 402 Burger King 66 El Pollo Loco million in sales to

1,229 Pizza Hut 73 Pizza Hut 54 Wendy’s become the second-

393 Wendy’s 19 Popeyes largest sales grower.

18 Doherty Enterprises

3 Carrols Restaurant Group 12 Yadav Enterprises Allendale, NJ

Syracuse, NY Fremont, CA $464,341,000

$1,452,516,000 $596,421,000 96 Applebee’s 25* Charter Foods

1,036 Burger King 221 Jack in the Box 42 Panera Bread Morristown, TN

65 Popeyes 81 Denny’s 3 Quaker Steak & Lube 227 Taco Bell

66 TGI Friday’s

4* Dhanani Group 36 Long John Silver’s

19 Ampex Brands

Sugar Land, TX 13 Tacala Richardson, TX 26 Desert de Oro Foods

$1,150,000,000 Vestavia Hills, AL $432,000,000 Kingman, AZ

516 Burger King $506,516,000 202 KFC 172 Taco Bell

294 Popeyes 317 Taco Bell 141 Pizza Hut 88 Pizza Hut

42 La Madeleine 1 KFC 39 Long John Silver’s

1 YUM! Multi 27 Franchise Management

5 Sun Holdings 20 Sizzling Platter Woodstock, NB, Canada

Dallas, TX 14 Manna Murray, UT 196 KFC

$994,500,000 Louisville, KY $429,442,000 107 Pizza Hut

290 Burger King $500,000,000 304 Little Caesars

161 Popeyes 157 Wendy’s 62 Wingstop 28 Palo Alto

99 Arby’s 83 Fazoli’s 27 Dunkin’ Donuts Denver, CO

27 Golden Corral 200 Taco Bell

6 MUY! Companies

32 Pizza Hut

San Antonio, TX

$980,852,000 $325-$425 Million 29* Hamra Enterprises

373 Pizza Hut Springfield, MO

317 Wendy’s 91 Wendy’s

80 Taco Bell 21 Boddie-Noell Enterprises 70 Panera Bread

Rocky Mount, NC

7 KBP Investments 342 Hardee’s 30 Border Foods

Overland Park, KS New Hope, MN

Carrols Restaurant 22 HAZA Foods

$923,600,000 201 Taco Bell

Group moved up a Sugar Land, TX

767 KFC

spot to No. 3 after 250 Wendy’s 31 RMH Franchise Holdings

128 Taco Bell

it added an incred- 26 Taco Bell Atlanta, GA

8 Summit Restaurant Group ible 252 restaurants 131 Applebee’s

Richardson, TX through 2019. It 23 Quality Dining

$800,000,000 acquired or built 187 Mishawaka, IN 32 Cotti Foods Corp.

310 IHOP Burger Kings and 65 188 Burger King Rancho Santa

117 Applebee’s Popeyes units. It was 40 Chili’s Margarita, CA

17 Sonny’s also the sales growth 104 Wendy’s

leader, adding $273 24 Diversified 84 Taco Bell

9 Covelli Enterprises million in topline Restaurant Group

Warren, OH sales. Sonoma, CA 33 JAE Restaurant Group

$674,200,000 214 Taco Bell Pompano Beach, FL

303 Panera Bread 16 Arby’s 207 Wendy’s

8 Dairy Queen

5 O’Charley’s

34 Franchise Times | August 202034 Mitra QSR 47* Premier Kings

Plano, TX Montgomery, AL

$175-$225 Million

179 KFC 198 Burger King

28 YUM! Multi 22 Popeyes

56* ADF Restaurant Group

35* Harman 48 TEAM Schostak Fairfield, NJ

Management Corp. Family Restaurants 218 Pizza Hut

15 Panera Bread WKS jumped 19

Campbell, CA Livonia, MI

spots on the list

122 KFC 65 Applebee’s

57* Cave Enterprises with a big Denny’s

153 YUM! Multi 56 Wendy’s

Chicago, IL acquisition. The

49 Ghai Management 169 Burger King company grew sales

Services by 57 percent in

$225-$325 Million Livermore, CA 58 American Franchise 2019 numbers. Read

112 Burger King Holdings more about Roland

36 Taco Bell Atlanta, GA Spongberg’s company

36* D.L. Rogers Corp. 71 Taco Bell on page 41.

Grapevine, TX 50 Fourteen Foods 49 Applebee’s

233 Sonic Minneapolis, MN

225 Dairy Queen 59 JRN

37* Manna Columbia, TN

Development Group 51* EYM Group 145 KFC

Encinitas, CA Irving, TX 15 YUM! Multi

69* PJ United

135 Panera Bread 155 Pizza Hut Birmingham, AL

35 KFC 60 TA Restaurant Group

Westlake, OH 194 Papa John’s

38 Wendy’s

of Colorado Springs 52* Team Lyders 69 Popeyes

70 Hospitality

Colorado Springs, CO Brighton, MI 40 Subway

Restaurant Group

181 Wendy’s 177 Taco Bell Traverse City, MI

8 Golden Corral 3 Arby’s 61 RPM Pizza

Gulfport, MS 91 Taco Bell

176 Dominos 17 Pizza Hut

39 American West 53 Romulus

Restaurant Group Restaurant Group 71 Carolina

Orange, CA 62 Starboard Group

Phoenix, AZ Restaurant Group

292 Pizza Hut Coral Springs, FL

105 IHOP Charlotte, NC

100 Wendy’s

40 Retzer Organization 110 Wendy’s

54* Fugate Enterprises

Greenville, MS 63 Redberry Restaurants

Wichita, KS 72* Caspers Company

104 McDonald’s Naperville, IL

168 Pizza Hut Tampa, FL

110 Burger King

75 Taco Bell 63 McDonald’s

41 Carlisle Corp. 23 Pizza Hut

Memphis, TN 55* JK&T Wings 73 Luihn Vantedge Partners

153 Wendy’s 64 B & G Food Enterprises

Shelby Township, MI Morrisville, NC

Morgan City, LA

84 Buffalo Wild Wings 90 Taco Bell

42 Sailormen 147 Taco Bell

Miami, FL 4 YUM! Multi 11 KFC

115 Popeyes 74* Meridian Restaurants

24 Burger King 65* Northwest Restaurants

Woodinville, WA South Ogden, UT

43* Ampler Group 109 Taco Bell 124 Burger King

Chicago, IL 42 KFC 10 Chili’s

83 Taco Bell 75* Rottinghaus Co.

81 Burger King 66 Celebration

Restaurant Group La Crosse, WI

Pacific Bells added

44 The Briad Group Celebration, FL 350 Subway

17 Taco Bell locations

Livingston, NJ and $35 million in 100 Pizza Hut

114 Wendy’s sales. The Vancouver, 39 Taco Bell

Washington-based

67 PR Restaurants

$150-$175 Million

45 BurgerBusters company now

Virginia Beach, VA controls 240 Taco Framingham, MA

132 Taco Bell 61 Panera Bread

Bell locations and 67 76 Wendy’s

5 Blaze Pizza Buffalo Wild Wings. of Bowling Green

68 Toms King

46 SSCP Management Palatine, IL Bowling Green, KY

137 Burger King 101 Wendy’s

Dallas, TX

75 Applebee’s

47 Sonic

* Denotes revenue estimate

August 2020 | Franchise Times 3577 Pizza Properties 113* BAJCO Global

El Paso, TX

$100-$125 Million Management

48 Peter Piper Pizza Canfield, OH

10 Applebee’s 137 Papa John’s

100 JEM Restaurant Group

78* Quality Restaurant Group Daniel Island, SC 114* Boj of WNC

Raleigh, NC 57 Taco Bell Arden, NC

The Ampler Group 34 Pizza Hut

192 Pizza Hut 66 Bojangles

made the largest

27 Arby’s

jump on the list, surg- 101* Paradise Companies 115 KC Bell

79* California Food ing from No. 102 to Natchez, MS Wichita, KS

Mangement No. 43. The company 39 Applebee’s 39 Taco Bell

Beverly Hills, CA added more than 80 17 IHOP 28 Freddy’s

142 Burger King Taco Bell locations,

one of the most popu- 102* PacPizza 116* Mas Restaurant Group

80 Southern Multifoods lar brands on the list. San Ramon, CA Houston, TX

Jacksonville, TX 155 Pizza Hut 70 Taco Bell

97 Taco Bell 5 PH Express

8 YUM! Multi 103 Potomac Family

Dining Group 117 Hallrich

81 The Saxton Group Herndon, VA Stow, OH

Dallas, TX 59 Applebee’s 130 Pizza Hut

90* Lemek

83 McAlister’s Deli Elkridge, MD 104 Kazi Management 118 Benton Properties

82 The RC Group 62 Panera Bread St. Croix Springdale, AR

Annapolis, MD Frederiksted, VI 72 Sonic

91 Metro Corral Partners

70 Taco Bell 55 KFC

Winter Park, FL 119 MRCO

22 YUM! Multi 23 Burger King

33 Golden Corral Brentwood, TN

83 Stine Enterprises 105 Summit Restaurant 55 Taco Bell

92 Apple-Metro

Phoenix, AZ Group, LLC 11 YUM! Multi

Harrison, NY

86 Jack in the Box Blue Springs, MO

29 Applebee’s 120 Wenspok Resources

11 Denny’s 124 Pizza Hut

2 Pizza Studio Spokane, WA

11 Long John Silver’s

84 The Rose Group 93 TD Food Group 56 Wendy’s

Newtown, PA 106 Phase Three Brands

Honolulu, HI 121 The Wolak Group

54 Applebee’s Tampa, FL

38 Pizza Hut Falmouth, ME

84 Hardee’s

85 T.L. Cannon Management 36 Taco Bell 97 Dunkin’ Donuts

2 Wingstop

Ponte Vedra Beach, FL 94 Rucker Restaurant

60 Applebee’s 107 Emerald City Pizza 122* Grand Mere

Holdings Restaurant Group

Mukilteo, WA

86 CKA Management Austin, TX Overland Park, KS

101 Pizza Hut

Hasbrouck Heights, NJ 60 Jack in the Box 146 Pizza Hut

69 Wendy’s 30 Denny’s 108* MVP Sonic Group

12 Taco Bell Ridgeland, MS

95 Quality Restaurant

92 Sonic

87 Southern Rock Concepts

Restaurants Birmingham, AL 109 Apple Investors Group

Franklin, TN 60 Applebee’s Chino Hills, CA

90 McAlister’s Deli 45 Applebee’s

96 Primary Aim

19 Pizza Hut

Zanesville, OH

73 Wendy’s 110 Branded TEAM Schostak

$125-$150 Million Management Group Family Restaurants

97 Janco continued its climb,

Worcester, MA

Cranston, RI jumping 18 spots

89 Dunkin’ Donuts

88 The Kades Corp. 82 Burger King this year as it added

Pasadena, TX 1 Popeyes 111 Den-Tex Central 56 Wendy’s locations

54 McDonald’s San Antonio, TX in its home state of

98 Strang Corp.

90 Denny’s Michigan to its multi-

89 Restaurant Cleveland, OH

brand portfolio. The

Management Co. 44 Panera Bread 112* RCO Limited group is based in

Wichita, KS Columbus, OH the Detroit suburb of

99* Ambrosia QSR

129 Pizza Hut 35 Raising Cane’s Livonia.

Portland, OR

6 KFC 102 Burger King

* Denotes revenue estimate

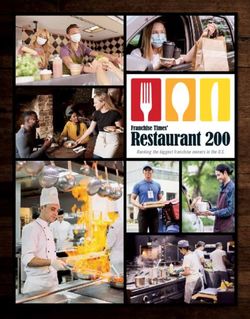

36 Franchise Times | August 2020Bulking Up: The Restaurant 200 in Numbers

The Franchise Times Restaurant 200 keeps growing.

The group now owns over 30,000 restaurants and commands $42.0 billion in revenue.

$42.0

Revenue (In Billions) $37.5 $40.4

$39.1

Locations $34.6

$31

30,124

$28.7 28,642

28,109

26,997

$26.3

25,176

$23.2

$21.8 21,831

$23.9

23,177

17,887

16,715 20,331

18,408

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

The top 5 fastest-growing operators added

more than $256.5 million collectively. The top 20 companies combined

Restaurant 200

for $16.5 billion in revenue,

Company Sales Y/E 2019 2019 Sales Growth Growth %

an increase of $403.2 million.

WKS Restaurant Group $466,063,507 $169,862,814 57.3%

Wenspok Resources $100,086,331 $30,908,331 44.7%

DYNE Hospitality Group $45,513,914 $11,992,504 35.8%

Legacy brands are the favorite for the Franchise

Rucker Restaurant

Holdings

$135,000,000 $35,000,000 35.0% Times Restaurant 200, and large operators are

Trident Holdings $33,993,254 $8,812,419 35.0% the favorites of legacy brands.

Rank Brand Companies # of Units Franchise %

The average revenue for a Restaurant 200 1 Pizza Hut 34 4,538 76%

operator is now $210.4 million—that’s up 2 Taco Bell 44 4,219 64%

by more than $8 million this year. 3 Burger King 28 4,135 57%

The additional eight locations on average helps grow revenue; 4 Wendy's 26 3,153 57%

the average operator now has 151 locations. 5 KFC 20 1,816 46%

6 Applebee's 16 1,381 86%

$210.4

$202.0 7 Panera Bread 11 915 78%

$173 $195.5

$187.5

8 Arby's 14 908 42%

143 151

135 141

9 Popeyes 13 888 36%

126

10 Subway 4 540 2%

2015 2016 2017 2018 2019

This table shows a breakdown of the most popular brands in

Avg. Revenue (In Millions) Avg. Units the Restaurant 200, the number of franchisees operating the

top brands, the number of locations operated by the franchisee

companies and the relative percentage of those locations to the

total U.S. franchised locations.

August 2020 | Franchise Times 37136 Bullard Restaurant Group 145* Tri-Arc Food Systems

$90-$100 Million Raleigh, NC Raleigh, NC

28 Moe’s Southwest Grill 51 Bojangles

19 Burger King

123 Rackson Restaurants 146* Maricopa

Bridgewater, NJ 137* Wenco /CNJ Austin Wings

55 Burger King Ashland, OH San Antonio, TX

Still in the $150

62 Wendy’s 83 Wingstop

124 Delight Restaurant Group million to $175

New York, NY 138* Schuster Enterprises 147 AES Restaurants million revenue range,

31 Wendy’s Columbus, GA Carmel, IN The Rose Group, with

26 Taco Bell 68 Burger King 72 Arby’s 54 Applebee’s and

based in Newtown,

125 DMAC81 139* ADT Pizza 148 Howley Bread Group Pennsylvania,

Van Wert, OH Westport, CT Westlake, OH dropped 10 spots

72 McAlister’s Deli 119 Pizza Hut 28 Panera Bread from No. 74 in last

year’s ranking.

126* Hielan Restaurant Group 140* JDK Management Co.

Mckinney, TX Bloomsburg, PA

42 Chili’s 48 Perkins $70-$80 Million

6 Quaker Steak & Lube

127 Daland Corp.

Wichita, KS 141* Southeast 149 Ansara Restaurant Group

107 Pizza Hut Restaurant Group Farmington Hills, MI $60-$70 Million

New Orleans, LA 22 Red Robin

128 S & L Companies 27 Taco Bell 4 Twin Peaks

Portage, WI 18 TGI Friday’s 160 Lehigh Valley

35 Culver’s 150 Parrish Restaurants Restaurant Group

142 Genesh Dallas, TX Allentown, PA

129 Brodersen Lenexa, KS 23 McDonald’s

Management Corp. 21 Red Robin

54 Burger King

Milwaukee, WI 22 Denny’s 151* Fourjay 161* Hishmeh Enterprises

60 Popeyes North Little Rock, AR Ventura, CA

143* Legacy Apple 48 Wendy’s 88 Dominos

130 Great American Wichita, KS 9 Slim Chickens

Chicken Corp. 41 Applebee’s 162 Denco Family

Los Angeles, CA 152* Janjer Enterprises Whittier, CA

59 KFC 144 Westaco Silver Spring, MD 30 Denny’s

11 YUM! Multi Scottsdale, AZ 37 Popeyes 8 Popeyes

47 Taco Bell

131 DRM 8 YUM! Multi 153 Carisch 163 S-Group Companies

Omaha, NE Wayzata, MN Sandusky, OH

93 Arby’s 63 Arby’s 33 Wendy’s

132* Marwaha Group 154* Oerther Foods 164* JS Fort Group

Anaheim, CA Orlando, FL Naperville, IL

148 Subway 24 McDonald’s 89 Jimmy John’s

1 Denny’s

155 North Texas Bells 165 Brumit Restaurant Group

133* Cowabunga Collyville , TX Asheville, NC

Alpharetta, GA Quality Restaurant 54 Taco Bell 56 Arby’s

114 Dominos Group comes in

at No. 78, where 156* Kergan Bros. Sonic 166 Awesome Doughnut

Diversified Restaurant Lafayette, LA Long Beach, CA

60 Sonic

$80-$90 Million Holdings sat last 18 Krispy Kreme

year. Diversified was 8 The Coffee Bean

157 Roaring Fork

one of the few public

Restaurant Group 167 Desert Taco

134 Platinum Corral companies and sold

Milwaukee, WI Scottsdale, AZ

Jacksonville, NC out last year, join-

57 Qdoba Mexican Eats 56 Del Taco

28 Golden Corral ing 9 of the top 200

companies that also 158 BMW Management 168 RoHoHo

135 Friendly did so. Temecula, CA Charleston, SC

Franchisees Corp. 23 Sizzler 56 Papa John’s

La Palma, CA 11 Jersey Mike’s

66 Carl’s Jr. 159* Hoogland Foods

Glenview, IL

104 Marco’s Pizza

38 Franchise Times | August 2020169 Creative Foods Corp. 182 J & S Restaurants

Garden City, NY

28 Burger King

Cleveland, TN

43 Hardee’s

About this Project

170* Vitaligent 183 Northwest Group

O

Saint Louis, MO Tigard, OR ur annual Restaurant 200 franchisee research, pre-

93 Jamba Juice 43 Jack in the Box pared by sister publication Restaurant Finance

14 Auntie Anne’s Monitor, includes questionnaires, phone surveys,

and in some cases, a review of public documents such as

annual reports, 10Ks and FDDs. We sincerely thank the

$40-$50 Million companies that responded to our surveys, as most of the

$50-$60 Million top 200 companies in this year’s ranking provided us with

their complete data.

184 Tria Company Our report consists of ranking companies according to

171 Century Fast Foods Grand Rapids, MI revenue generated by the company’s franchised restaurants.

Los Angeles, CA 32 Burger King If the company happens to operate a restaurant concept

33 Taco Bell 5 Arby’s that is not franchised, or is the franchisor of another con-

172 All Star Management 185 Las Vegas Pizza cept, we will not include that number in the overall reve-

Vourbonnais, IL Las Vegas, NV nue or unit count. In some cases where an acquisition took

36 Wendy’s 46 Pizza Hut

place during the year, we derive pro-forma revenue in cal-

culating the company’s ranking.

173 Womack Restaurants 186* Trigo Hospitality For companies that did not respond to our survey, we

Terre Haute, IN Stevensville, MI confirmed the number of units operated by their company,

36 Popeyes 30 Pizza Hut and then estimated the revenue. In the case of a tie in the

11 MOD Pizza 11 Sonic amount of total revenue, we settled the tie in favor of the

company with the most units.

174 Blue Ribbon Restaurants 187 JJB Brands If you believe your company might make the Restaurant

Walled Lake, MI Flowood, MS 200 list or we’ve missed you (or you know of another com-

18 Famous Dave’s 51 Pizza Hut pany that should be listed), please contact Matt Haskin

6 Penn Station 12 Checkers at (612) 767-3200 or mhaskin@franchisetimes.com.

175 Elbardi Group 188 Northcott Hospitality

of Companies Chanhassen, MN

Doral, FL 22 Perkins

55 Charley’s 3 Houlihan’s

Philly Steaks

2 Gyu Kaku 189 BAC Holdings

Bloomfield Hills, MI

176 Mosaic Management 33 Five Guys 191 Heartland Beef 196 Shamrock TBC

Atlanta, GA Bloomington, IN Hinsdale, IL

42 Arby’s 190 DYNE Hospitality Group

37 Arby’s 23 Taco Bell

4 Moe’s Southwest Grill Little Rock, AR

60 Tropical 197 The Restaurant Company

177* U.S. Restaurants Smoothie Cafe Richmond, VA

Blue Bell, PA $30-$40 Million 17 Arby’s

31 Burger King

198 Merbree Holdings

178* Sterling Restaurants 192 Viking Restaurants Ketchum, ID

Atlanta, GA Elmhurst, IL 17 MOD Pizza

56 Moe’s Southwest Grill 27 Burger King 11 Jersey Mike’s

179 Surfside Coffee Co. 193 Verlander Enterprises 199 LEV Restaurant Group

Miami, FL El Paso, TX Las Vegas, NV

56 Dunkin’ Donuts JEM Restaurant 11 Village Inn 24 Jamba Juice

3 Baskin Robbins Group landed in the 5 Corner Bakery Cafe 15 The Coffee Bean

top 100 for the first

180* Staab Management Co. time. The company 194 Trident Holdings 200 Square 1 Restaurants

Grand Island, NE acquired 21 Taco Bell Murfreesboro, TN Irving, TX

68 Pizza Hut locations in 2019 to 38 Captain D’s 43 Dairy Queen

fuel the move.

181 Vibe Restaurants 195 First Sun

Dallas, TX Management Corp.

78 Little Caesars Piedmont, SC

20 Wendy’s

* Denotes revenue estimate

August 2020 | Franchise Times 39Legacy Apple.................... 143 S-Group Companies........... 163

Alphabetical Listing Lehigh Valley

Restaurant Group.............. 160

Sailormen........................... 43

Schuster Enterprises.......... 138

Lemek................................ 90 Shamrock TBC.................. 196

LEV Restaurant Group........ 199 Sizzling Platter.................... 20

Company.......................... Rank Desert Taco....................... 167 Luihn Vantedge Partners...... 73 Southeast

ADF Restaurant Group......... 56 Dhanani Group...................... 4 Manna................................ 14 Restaurant Group.............. 141

ADT Pizza......................... 139 Diversified Manna Southern Multifoods............ 80

AES Restaurants................ 147 Restaurant Group................ 25 Development Group............. 38 Southern Rock

All Star Management......... 172 DMAC81.......................... 125 Maricopa Restaurants........................ 87

Doherty Enterprises............. 18 /CNJ Austin Wings............. 146 Square 1 Restaurants........ 200

Ambrosia QSR..................... 99

DRM................................ 131 Marwaha Group................. 132 SSCP Management.............. 46

American Franchise

Holdings............................. 58 DYNE Hospitality Group..... 190 Mas Restaurant Group........ 116 Staab Management Co....... 180

American West Elbardi Group Merbree Holdings.............. 198 Starboard Group.................. 62

Restaurant Group................ 40 of Companies.................... 175 Meridian Restaurants........... 74 Sterling Restaurants.......... 178

Ampex Brands..................... 19 Emerald City Pizza............. 107 Meritage Hospitality Group... 16 Stine Enterprises................. 83

Ampler Group...................... 44 EYM Group......................... 51 Metro Corral Partners........... 91 Strang Corp......................... 98

Ansara Restaurant Group.... 149 First Sun Mitra QSR........................... 35 Summit Restaurant Group...... 8

Apple Investors Group........ 109 Management Corp............. 195 Mosaic Management.......... 176 Summit Restaurant

Apple-Metro........................ 92 Flynn Restaurant Group.......... 1 MRCO.............................. 119 Group, LLC....................... 105

Awesome Doughnut........... 166 Fourjay............................. 151 MUY! Companies................... 6 Sun Holdings........................ 5

B & G Food Enterprises........ 64 Fourteen Foods................... 50 MVP Sonic Group.............. 108 Surfside Coffee Co............. 179

BAC Holdings.................... 189 Franchise Management........ 29 North Texas Bells............... 155 T.L. Cannon Management..... 85

BAJCO Global Friendly Franchisees Corp.. 135 Northcott Hospitality.......... 188 TA Restaurant Group............ 60

Management..................... 113 Fugate Enterprises............... 54 Northwest Group............... 183 Tacala................................. 13

Benton Properties.............. 118 Genesh............................. 142 Northwest Restaurants......... 65 TD Food Group.................... 93

Blue Ribbon Restaurants.... 174 Ghai Management NPC International.................. 2 Team Lyders........................ 52

BMW Management............ 158 Services.............................. 49 Oerther Foods................... 154 TEAM Schostak

Boddie-Noell Enterprises...... 21 GPS Hospitality................... 11 Pacific Bells........................ 10 Family Restaurants.............. 48

Boj of WNC....................... 114 Grand Mere PacPizza........................... 102 The Briad Group.................. 23

Border Foods....................... 31 Restaurant Group.............. 122 Palo Alto............................. 30 The Kades Corp................... 88

Branded Great American Paradise Companies........... 101 The RC Group...................... 82

Management Group........... 110 Chicken Corp.................... 130 Parrish Restaurants........... 150 The Restaurant Company.... 197

Brodersen Hallrich............................ 117 Phase Three Brands........... 106 The Rose Group................... 84

Management Corp............. 129 Hamra Enterprises............... 28 Pizza Properties................... 77 The Saxton Group................ 81

Brumit Restaurant Group.... 165 Harman PJ United........................... 69 The Wolak Group............... 121

Bullard Restaurant Group... 136 Management Corp............... 36 Platinum Corral................. 134 Toms King........................... 68

BurgerBusters..................... 45 HAZA Foods........................ 22 Potomac Family Tri-Arc Food Systems.......... 145

California Food Heartland Beef.................. 191 Dining Group..................... 103 Tria Company.................... 184

Mangement......................... 79 Hielan Restaurant Group.... 126 PR Restaurants................... 67 Trident Holdings................ 194

Carisch............................. 153 Hishmeh Enterprises.......... 161 Premier Kings..................... 47 Trigo Hospitality................. 186

Carlisle Corp....................... 42 Hoogland Foods................. 159 Primary Aim........................ 96 U.S. Restaurants............... 177

Carolina Restaurant Group.... 71 Hospitality Quality Dining..................... 24 Verlander Enterprises......... 193

Carrols Restaurant Group....... 3 Restaurant Group................ 70 Quality Restaurant Vibe Restaurants............... 181

Caspers Company................ 72 Howley Bread Group.......... 148 Concepts............................ 95 Viking Restaurants............. 192

Cave Enterprises.................. 57 J & S Restaurants.............. 182 Quality Restaurant Group..... 78 Vitaligent.......................... 170

Celebration JAE Restaurant Group.......... 34 Rackson Restaurants......... 123 Wenco.............................. 137

Restaurant Group................ 66 Janco.................................. 97 RCO Limited..................... 112 Wendy’s of Bowling Green.... 76

Century Fast Foods............ 171 Janjer Enterprises.............. 152 Redberry Restaurants........... 63 Wendy’s

Charter Foods...................... 26 JDK Management Co.......... 140 Restaurant of Colorado Springs.............. 39

CKA Management................ 86 JEM Restaurant Group....... 100 Management Co.................. 89 Wenspok Resources........... 120

Cotti Foods Corp.................. 33 JJB Brands........................ 187 Retzer Organization............. 41 Westaco............................ 144

Covelli Enterprises................. 9 JK&T Wings......................... 55 RMH Franchise Holdings...... 32 WKS Restaurant Group........ 17

Cowabunga....................... 133 JRN.................................... 59 Roaring Fork Womack Restaurants.......... 173

Creative Foods Corp........... 169 JS Fort Group.................... 164 Restaurant Group.............. 157 Yadav Enterprises................ 12

D.L. Rogers Corp................. 37 K-Mac Enterprises............... 15 RoHoHo............................ 168

Daland Corp...................... 127 Kazi Management Romulus Restaurant Group... 53

Delight Restaurant Group... 124 St. Croix........................... 104 Rottinghaus Co.................... 75

Den-Tex Central................. 111 KBP Investments................... 7 RPM Pizza.......................... 61

Denco Family.................... 162 KC Bell............................. 115 Rucker Restaurant

Desert de Oro Foods............. 27 Kergan Bros. Sonic............ 156 Holdings............................. 94

Las Vegas Pizza................. 185 S & L Companies............... 128

40 Franchise Times | August 2020WKS leader: ‘I can’t do this myself’

By Nicholas Upton McGuinness. “As minimum wage goes higher,

as the cost of compliance goes higher, it’s

W

hat does it take to jump 19 spots on becoming an increasingly margin-pressured,

the Restaurant 200? penny-profit business that you have to use the

A big acquisition helps. WKS best available tools. That takes a lot of work

Restaurant Group bought 97 Denny’s loca- to learn and then to actually use properly.”

tions in 2019, which contributed to sales The company’s size also allows for broader

growth in 2019 of $169 million and sent the support across divisions. In McGuinness’ case,

company from No. 36 on the 2019 rankings instead of keeping the books and reporting,

to No. 17 this year. he spends a lot of his time on strategy and

But as Roland Spongberg, founder and analysis. Scale also helped him hire a key

CEO of WKS, learned early on, growing to risk management person that few companies

such scale requires a central focus: people. under 100 units could utilize, let alone afford.

“When I started in the business, I had four “I think being able to hire people like that

partners. We built three restaurants in five is critical. When I got here in 2007, there was

years and we were losing money every year. nobody else on the senior leadership team

My partners said, ‘We learned our lesson and that had worked at a bigger company than

we’re out,’” said Spongberg. “I bought them WKS,” said McGuinness, a former CFO at

out and went to work in the restaurants. I two of his franchisors, Denny’s and El Pollo

thought, I see a lot of these restaurants, some Loco.

of them must make money.”

What he found in his three El Pollo Loco All in the family—with guardrails

restaurants, though, were a lot of young To keep folks like McGuinness and other Founder Roland Spongberg formed WKS in

workers who weren’t engaged, and plenty leaders, WKS is careful to avoid becoming a 1987 with a single El Pollo Loco location.

of quality issues. While El Pollo Loco was nepotistic empire. That’s a focus for Joanna

known for succulent marinated chicken, Blake, VP of people services and general they hire and keep good people, making it

for example, the chicken coming out of counsel for the company. clear that you don’t need to have the last

Spongberg’s restaurants was dry. “When I joined, they were really candid name “Spongberg” to succeed.

“I saw immediately the issue. I had no and said there’s an issue with a family mem- “We go out of the way to avoid nepotism.

experience but a little insight. I said, ‘We ber, this is how we want to deal with it. So, I’d say Roland expects more from me than

can’t serve dry chicken, we have to take care I wasn’t taking a stab in the dark or step- anyone. And I go out of my way to do such a

of people,’” explained Spongberg. “In 90 ping on toes,” said Blake. “It all worked out good job that he’d never have to think twice

days, we had a big turnaround. I got up to because there was a path through it that we about that,” said Jay. “One of the things that

six restaurants and I realized I was in the could find. Really the way we’re structured can be toxic to an organization is that you

people business and I can’t do helps guard against nepotism.” have to be related to the right person to get

this myself. If I want to grow, Given the size of WKS, it’s ahead.”

I needed a lot of good people.” a balance to both maintain the To help reinforce its culture, Blake has

Since then, a lot has qualities of a family business a seat at the leadership table. The com-

changed. The company when it comes to making deci- pany is also rolling out a major profit-shar-

expanded dramatically, ending sions, but also not looking the ing program, and every single GM in the

2019 with 66 locations of El other way when someone isn’t group’s close to 300 restaurants meets for

Pollo Loco, 127 Denny’s units, performing. With a company three hours each month during a “vital fac-

54 Wendy’s stores, 35 Krispy that’s 30 years old and has a tor team meeting.”

Kremes and 10 Blaze Pizzas. It lot of tenured people across There’s an hour of sharing results, an hour

grew from a modest California the org chart, Blake said that of setting goals and another hour of train-

chicken chain operator to fin- balance stretches from the top ing, recognition and problem solving. The

ish the year with more than to the store level. sessions always begin with how restaurant

$460 million in sales. “We have a lot of fam- and district leaders have seen the company

As WKS grew, efficiencies Joanna Blake ily members that are non values on display since the last meeting.

and key people came into the Spongberg, a lot of other fam-

fold. While it remains a family company, ilies that have come to WKS and brought Culture and COVID-19

with Spongberg at the top and his sons Jay their family in as well. And it’s lovely, but it The company’s culture faced an excep-

and Brian Spongberg as COO and mar- creates certain issues—but we’re open to it tional test when the COVID-19 pandemic

keting manager, respectively, the company because we see it work,” said Blake. “I think began. Roland Spongberg said it was like a

sought to bring in people such as CFO Matt you gain a lot of credibility and can keep punch in the gut.

McGuinness, who joined 13 years ago at 38 people, as well, if you’re responsive and take “When COVID hit over that weekend in

locations and has overseen a lot of growth. action when you say you will” and are con- the middle of March—when I looked at the

“Since that time, I would say environmen- sistent when applying policies. sales that Monday I was gasping for air,” said

tal factors for the QSR industry have cre- Jay Spongberg said he and the rest of the

ated a tailwind for larger operators,” said family put up guardrails for themselves so WKS group continued on 42

August 2020 | Franchise Times 41WKS group c ontinued from 41

Spongberg. “Denny’s was down 80 percent and every brand was

significantly down. Our business is not built to handle this kind

of shock, it couldn’t handle 40 percent let alone 80. We ended up

closing 60 Denny’s completely.”

He said sales at Wendy’s quickly came back, and Krispy Kreme

actually did better than normal. But dine-in focused Blaze and espe-

OPERATING

cially Denny’s were mired in difficulties. “Customers didn’t want

to come in, employees didn’t want to work. Everyone was fearful

of COVID and what might happen. So, it was—and is—tough,”

said Spongberg.

IN A VIRTUAL The company made a massive digi-

tal transformation, with more frequent

online meetings, a new video studio

ENVIRONMENT

and digital communications to reach

the 11,000 employees, some still work-

ing and some furloughed. Expenses

were cut by about 75 percent, along

Virtually nothing has changed with many employees. Spongberg said

those were hard conversations, but

ultimately the communication and sup-

port from the home office was well

received.

“I was pretty surprised how well

Matt McGuinness it went,” he said. “We try to explain,

our business is owned by my family.

We don’t have access to massive capital, so we can only do what

we can do. The bottom line is that restaurant has to make money.

Unfortunately, if you don’t make money you can’t stay open. They’ve

heard that from me many times.”

SPEED IN EXECUTION.

Instead of a full furlough, WKS kept managers on reduced hours,

ready to return and bring their teams when possible.

“For the stores that were closed, we said to the GM we can’t

pay you, but we’re going to furlough you to half, we’ll give you

20 hours and get you unemployment, so just stay in touch with

your team and just go check the restau-

CERTAINTY TO CLOSE. rant every few days,” said Spongberg.

Blake said her division turned

into a full-fledged benefits and relief

organization.

“A big focus was on how can we

provide them resources, so we cre-

COUNT ON US.

ated a website, we sent out text mes-

sages, and anything we could to apply

for unemployment, what charitable

funds might be available and what

resources were out there,” said Blake.

“It was making sure we were bring-

ing the field along with what we had

learned and communicating things as Jay Spongberg

best and as transparently as possible

so it wasn’t all on their shoulders. That’s a big part of our success

coming though COVID, but I think it all goes back to the culture.”

Jay Spongberg said there was a shared sacrifice across the orga-

nization, not just out in the field.

Your franchise finance experts “Roland, he quit taking a salary. We had some pay cuts across

the key people in our company so it was a shared sacrifice. We

For all your financing needs, visit had great cooperation from our lenders and other partners, but

if not for that faith in the brutal facts, we could be in a very dif-

wintrust.com/franchise. ferent situation.

“We tried to help people understand the situation and that it

really does suck for everybody, but if we don’t make these moves

Wintrust Franchise Finance is a division of Lake Forest Bank & Trust Company, N.A., a Wintrust Community there’s not going to be any jobs to come back to,” said Spongberg.

Bank. Banking products provided by Wintrust Financial Corp. banks.You can also read