QUANTITATIVE EASING AND STOCK PRICES - DIVA PORTAL

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Quantitative Easing and Stock Prices An analysis of the impact of US Quantitative Easing on Chinese Stock Prices BACHELOR THESIS WITHIN: Economics NUMBER OF CREDITS: 15 ECTS PROGRAMME OF STUDY: International Economics AUTHOR: Yuxiang Cao/Edvin Hygrell JÖNKÖPING 5/2022

Bachelor Thesis Project in Business Economics Title: Quantitative Easing and Stock Prices Authors: Yuxiang Cao/Edvin Hygrell Tutor: Helena Nilsson Date: 2022-06-13 Key terms: Quantitative Easing, Stock Prices, MFD Model, VAR Model. Abstract Following the financial crisis of 2008, the United States (US) Central Banks were placed in an unfamiliar circumstance. The interest rates were nearly zero, implying that most conventional monetary policies would be ineffective in enhancing the economy. As only a few alternatives were available, Central Banks chose to implement Quantitative Easing (QE), a type of unconventional monetary policy representing large-scale asset purchases, also called LSAP´s. This monetary policy has the intention of increasing liquidity in the economy, thus increasing money supply and boosting the economy. The purpose of this paper is to analyse the impact of changes of US Money Supply on stock prices in China. The size of the money supply in the US directly corresponds to the application of Quantitative Easing and is thus utilized as the measurement of Quantitative Easing. The stock index used in this paper is the Shanghai SSE Composite Index, which is composed of all stocks traded in the Shanghai Market. To assess the correlation between US QE and stock prices in China, a Vector Autoregression Model was performed. Findings reflect the positive and statistically significant correlation between US money supply and Chinese stock prices. i

Table of Contents 1. Introduction .......................................................................... 1 1.1 Background ............................................................................................. 3 1.2 Purpose ................................................................................................... 5 2. Literature Review .................................................................. 5 3. Theoretical Framework ......................................................... 6 3.1 Theoretical Analysis ................................................................................. 6 4. Hypothesis ........................................................................... 10 5. Empirical research............................................................... 11 5.1 Methodology.......................................................................................... 11 5.2 Data selection ........................................................................................ 11 5.3 VAR Model ........................................................................................... 12 6. Results................................................................................. 13 6.1 Stationarity ............................................................................................ 13 6.2 Inverse Roots of AR Characteristic Polynomial ......................................... 13 6.3 Granger Causality Test ............................................................................ 14 6.4 Impulse Response Analysis ..................................................................... 16 6.5 Variance Decomposition ......................................................................... 17 7. Discussion ........................................................................... 18 8. Conclusion........................................................................... 20 Reference list .................................................................................. 23 Appendix ........................................................................................ 27 ii

1. Introduction The 2008 financial crisis arose due to housing price bubble brought about by record low- interest rates and lending standards. Millions of people obtained loans in order to purchase homes, and to keep up with this, the banks sold mortgages on the secondary market, which subsequently allowed them to grant further mortgages. The financial establishments, which represent the major purchaser of these mortgages, collected them in instalments and resold them to investors. Another name for these tranches is mortgage-backed securities. When the mortgages started to default, it eventually became obvious to holders of mortgage-backed securities that the papers they held had no value (Hellwig, 2008). The financial crisis forced the US Central Banks to take unconventional measures in order to avoid a liquidity trap, a risk that exists when interest rates approach the Zero Lower Bound. In response to the crisis, the Federal Reserve Bank committed to large-scale asset purchases in order to stimulate the economy (Gerlach & Lewis, 2013). This form of the unconventional method is equally referred to as Quantitative Easing (QE) and is interchangeable in this paper with increasing money supply. From the open market, the Central Bank buys long-term securities and subsequently injects new money into the economy. It aims to ensure the stimulation of the economy through the promotion of investment and credit. The vast increase in money supply as a response to the financial crisis brought about declining interest rates and depreciation of the United States dollar (USD) and caused holders of assets denominated in USD to experience a reduction in income. Since the USD denotes the primary currency used for international settlements and international reserves, it becomes essential and there are a considerable number of USD holders around the world, ranging from governments to financial institutions. Following the gradual depreciation of the USD, a considerable proportion of these holders opted to convert their USD into bullish currencies, thereby subjecting the USD to a situation referred to as “Hot money” which signifies a currency that frequently oscillates between financial markets, typically from markets with low-interest rates to markets with high-interest rates (Chari & Kehoe, 1997). This tends to cause an asset pricing and real estate bubble. 1

From the perspective of economic globalization, the primary purpose for selecting China over the United States is because China represented the world's third-largest economy as of 2008 and occupied the first rank position in emerging markets (World Bank, 2020). Moreover, among developing countries, China is also the largest holder of US Treasuries in 2018 making the link between China and the US stronger in comparison to other emerging economies (Economic Commission for Latin America and the Caribbean, 2019). China's closer economic relations with various countries globally following its accession to the World Trade Organization have made it a prime choice for international capital seeking investment opportunities. The period 2003-2014 will be assessed. This period will be divided into two sub-periods, the first from 2003 to 2008, and the other from 2008 to 2014. The period between 2008- 2014 is selected in this study to ensure that the effects of quantitative easing are isolated as much as possible, since the implementation of the first round of quantitative easing, referred to as QE1 was executed in November 2008 and the concluding round, also called QE3, ended in October 2014. The money supply in the United States during those years will be analyzed, in order to determine whether it directly impact Chinese stock prices during those years. Furthermore, the sub-period 2003-2008 will also be analyzed. During this period, no quantitative easing was implemented in the US. The start year is selected so that the potential effects of the dotcom bubble in the early years of the 2000’s do not affect our results. By comparing the two periods, the goal is to provide a more intuitive response to whether quantitative easing in the US had an impact on the Chinese equity market. We aim to determine the impacts of QE by analyzing high-frequency data, where large spikes in volumes of trade or returns are identified and could be attributed to increases in US QE. This will assist in establishing a relationship between the changes in monetary policy and stock prices. Previous research has been analyzing the impact of quantitative easing on various economic and financial variables, but these have tended to focus on the impact on the US or European countries. The novelty of this study is that it concentrates on the impact on stock market prices in China, which have not been analyzed to the same extent prior to this research. The study examines the impact of the implementation of quantitative easing 2

monetary policy on China's stock price index, and the analysis reveals the pathways through which the implementation of quantitative easing monetary policy has affected China's stock market, which presents a theoretical basis for regulators to respond to quantitative easing monetary policy in the United States and promotes the stable development of capital markets in China, as well as in developing countries, with important practical implications. The variables of interest are US M2 (United States money supply), China M2(Money supply), SSE Composite Index (also known as Shanghai Composite Index, SCI), S&P500 and US Federal Funds Rate. US money supply M2 and the Chinese money supply M2 represents the broad money supply, commercial banks repurchase agreements, etc. and contains the widest range of data compared to M1 (Fred, 2022). SCI is one of the largest stocks indices in China, and contains all stocks traded in the Shanghai market (Google Finance, 2022). S&P 500 is an American stock index containing 500 of the leading US publicly traded companies (Encyclopedia Britannica, 2022). The US Federal Funds Rate is the interest rate in the U.S. interbank lending market refers to the target interest rate that is decided by the Federal Open Market Committee (Fred, 2022). In this paper, data from the first to the last quantitative easing policy in the US, i.e., monthly data from November 2008 to October 2014, are selected for the empirical study. The first part will introduce the background of the 2008 financial crisis. The second part denotes the theoretical framework, in which we mainly utilize the Mundell-Fleming- Dornbusch Model (MFD). The third part is the empirical part. Data analysis processes and analyzes the data through the application of vector Autoregression (VAR) and the result is assessed in the final section. Further, the paper offers suggestions on how to respond to the U.S. quantitative easing policy, as well as suggestions for future research. 1.1 Background The need for QE generally implies a sustained economic downturn when marketing interest rates are near zero and cannot be lowered any further. Hence the Central Bank is unable to enhance the economy by adjusting interest rates (Joyce et al., 2012). To avoid a recession, the central bank uses QE to purchase medium and long-term government bonds from the market, thus expanding the money supply and stimulating the real economy. The main difference QE and conventional monetary policy, it is the fact that 3

conventional monetary policy is generally applied for boosting the economy through the adjustment of interest rates. Hence, in the case of a chronic recession, for example, when the nominal interest rates drop to a near zero level, conventional monetary policy fails, and special methods are required for reviving the economy. For instance quantitative easing, direct purchases of medium and long-term government bonds by the central bank (Learning, 2022). Japan was the first to utilize quantitative easing due to the continued weakness of the Japanese economy prior to 2001 and the turmoil in the capital markets, the Japanese government implemented an expansionary fiscal policy and lowered interest rates, however, since nominal interest rates were reduced to zero, the Japanese economy still failed to recover. Therefore, Japan resorted to quantitative easing in 2001 in the hope of gaining ground from an economic perspective, to counter deflation and to stimulate economic growth (Wieland, 2009). In response to the 2008 financial crisis, the United States adopted Japan's quantitative easing policy in the hope that by doing the same, it could escape the impacts of the financial crisis on the capital markets. Quantitative easing denotes a relatively aggressive monetary policy that assist in easing tight credit conditions and plays a crucial role in the country's economic recovery. By enhancing the supply of base money and flooding global markets with liquidity, the United States equally sowed the seeds of global inflation. Thus, the quantitative easing monetary policy of the United States has pros and cons (Hausken & Ncube, 2013). Following the 2008 subprime mortgage catastrophe, three quantitative easing measures were applied by the United States. The implementation of the first quantitative easing measure occurred on November 25, 2008 (Yardeni Research, 2020). During the period the Federal Reserve launched its first round of quantitative easing and made its intention known to purchase real estate-related debt directly from government banks and mortgages-backed securities in which both the banks alongside the National Mortgage Association of the federal government-backed up. Around April 2010, when the first round of quantitative easing ended, the Fed had brought approximately $100 billion of direct debit. It cut the federal funds rate to a record low of 0.08% in late 2008 (Macrotrends, 2022). 4

1.2 Purpose The purpose of this paper is to research the impact of the Federal Reserve's quantitative easing policy on stock prices in China to increase understanding of the impact of one country's use of quantitative easing on another country, in addition to providing some policy recommendations on how to respond to another country's use of quantitative easing. 2. Literature Review A strong relation exists between changes in the money supply and the volatility of stock prices, with world capital markets becoming increasingly connected. As the US dollar is considered the 'world currency', changes in US policy tend to have a marked impact on capital markets. Stock markets, as an essential component of capital markets, can also be greatly affected. The first piece of previous literature that is relevant for this paper is Bernanke & Kuttner (2005). In the paper, they analyse how unexpected changes in monetary policies affect stock prices, with the intention of comprehending the economic sources of the reaction of the stock markets to changes in monetary policies. Similarly to this paper, they adopted a vector autoregression (VAR) model and subsequently realized the outcome that a 1% increase in broad equity indices is brought about by a 0.25% increase in federal funds interest. Furthermore, they observed that for a considerable part of the stock prices response, the impacts of monetary policy actions that are unanticipated on expected returns have a dominant effect. Another similar study was carried out by Balatti et al. (2017), which empirically examines the effectiveness of Quantitative easing as a tool for recovery following the financial crisis. The data used spanned from 1982 until 2014 for the UK, and 1971 to 2015 for the US. They conducted a six-variable VAR model, inclusive of the following variables: output, inflation, QE amounts, equity prices, stock market volatility and liquidity. The major discovery made by this article was that the significant impact of exogenous shocks in QE is only reflected on financial variables. Additionally, they observed that stock market reactions appear to reflect a "V" shape, suggesting there will be a drastic drop in equity prices following a QE announcement, but subsequently recover their losses and increase above their initial levels. Moreover, Koijen 5

et al. (2016), conducted a corresponding study, but focused on more recent application of QE, namely when utilized by the European Central Bank (ECB), as a response to the low inflation rates leading up to 2015, and its subsequent impact on asset prices in countries within Europe. In early 2015, the ECB announced a QE program with the goal of enhancing inflation to a rate close to 2%. The study utilizes a micro-level data set from Eurosystem, inclusive of data on security level portfolio holdings of the main investor sectors of various European countries, in combination with the QE of the ECB, in order to answer the question of how QE affects asset prices. Among the previous literature, the work of Bhattarai et al. (2020) could perhaps denote the most relevant piece of literature. The paper examines the impacts of US QE on the markets of developing economies in the wake of the financial crisis, including the following countries: Chile, Colombia, Brazil, India, Indonesia, Malaysia, Mexico, Peru, South Africa, South Korea, Taiwan, Thailand, as well as Turkey. They started by conducting a VAR model for estimating how a 1 deviation shock in US QE impacts US variables, then utilize the identified response for deducing the spillover effects on the emerging market economies. They found that an increase in US QE led to an appreciation of the emerging market economies currencies, as well as a significant stock price increase. The previous pieces of literature discussed in this section provides empirical support for a positive correlation between QE and stock prices. Nevertheless, they concentrate mainly on the US, the UK, and European countries, with the exception of Bhattarai et al (2020) which examines the impacts on emerging economies. Regarding the impact of US QE on Chinese stock prices, few studies have been conducted and it is this aspect that this article intends to contribute to previous research works by providing an assessment of how Chinese stock prices are impacted by the US QE. 3. Theoretical Framework 3.1 Theoretical Analysis This chapter aims to evaluate the international transmission mechanism of monetary policy and expounds on the Mundell-Fleming-Dornbusch (MFD) model. On the basis of this, the paper expounds the ways that the QE used by the United States impacted the Chinese stock market over a specific time. 6

The MFD model can be used to analyse the impact of the implementation of macroeconomic policies in one country on another (Barbosa, 2018). The analysis of our paper is focused on the effects of monetary policies. For the analysis, it is categorized into two major frameworks. The first concerns a floating exchange rate regime, in which the implementation of an accommodative monetary policy in the United States is supposed to benefit residents, but with the drawback of bringing about a decline in China’s incomes. As for the second, it is under an exchange rate regime that is fixed. Assuming an accommodative monetary policy is applied by the US, it will invariably enhance the output and lower interest rates in both countries. IS represents that the equilibrium condition of the product market IS comprised of the sum of consumption, exchange rate, government spending and net exports. LM stands for equilibrium in the money market. Figure 1 International transmission of monetary policy under a floating exchange rate Table 1: Variables of the MFD model IS C (Y – T) + I(r*) + G + NX(e) LM L (r*, Y) Y National income I Exchange rate r Domestic rate of interest r* World rate of interest C Real consumption 7

NX Real net exports G Real government spending L Real money demand T Real taxes Source: Adapted from Frenkel & Razin (1987) Figure 1 depicts the impact of a change in monetary policy in one country on the economies of two countries under a floating exchange rate regime. During the initial state, the interest rates of the two countries are equal, 0 = 1 =0, and the two countries attain equilibrium at points A and B. After the United States utilizes expansionary monetary policy, the money supply increases, and the LM curve shifts to the right to 1 , as depicted on the left. Here, US interest rates will drop and there will be an increase in the market liquidity, which will result in an increase in US production, which will move the US equilibrium point to the right from point A to the new point at point B following the implementation of the expansionary monetary policy in the United States. If the output of the United States increases, the national income increases, and the propensity to import in the United States remains static. The United States will then increase the number of imports, which will result in an increase in China’s exports well as increase in China national income. The equilibrium point of China will move from point D to point E, which will result in an increase in the China’s interest rate and output since the United States implements an expansionary monetary policy. Nevertheless, points B and E are not equilibrium points, because under the floating exchange rate system, the interest rate in the US is lower compared to China, capital will transfer from the low interest rate in the US to the high interest rate in China to gain profits. Capital outflow from the United States leads to short-term balance of payments deficit, thus resulting in a certain depreciation of the dollar, which will improve the competitiveness of American products and promote the increase of American exports, while the competitiveness of China’s products will decline and China's exports will decrease. This causes the IS curve of the United States to deviate to IS1 and the 1∗ curve of China to shift to 2∗ . The equilibrium points for the US and China are points C and F, respectively. Thus, under the floating exchange rate, the United States implements an expansionary monetary policy, which enhances the money supply, increases national income, and lowers interest rates. As readily observed, 8

for the US national income to increase, it will generally result in a decrease in the national income of another nation. Figure 2 International transmission of monetary policy under a fixed exchange rate. Figure 2 denotes the transmission mechanism of monetary policy between internationals in a fixed exchange rate regime. The analysis is similar to that of a floating exchange rate regime. The moment the United States implements an expansionary monetary policy, the LM of the United States shifts to the right to 1 , causing US production to increase and interest rates to drop, after which point B is called the equilibrium point. The increase in national income is enhanced by the increase in national output, stimulating imports. As China’s exports increase, the foreign IS* curve shifts to the right to 1∗ , and there is an increase in China's interest rate and output. Under the premise of a fixed exchange rate, the United States interest rate is lower compared to China's interest rate. A significant amount of capital will flow abroad, thereby causing the United States currency to depreciate. The central bank will maintain a tight monetary policy with the aim of reducing the money supply to ensure that the US currency exchange rate remains unfavorable and 1 will be moved to the left of 2 , subsequently bringing about a reduction in the money supply. For the purpose of maintaining the exchange rate stability owing to the considerable proportion of capital inflow, the government of China will ensure money supply is increased China will increase, and thus the ∗ curve will shift to the right towards 1∗ . At this point, the two economies attain a new equilibrium at points C and F. At this point, the interest rates in both countries drop, but output increases. Under a fixed exchange rate regime, an accommodative monetary policy in one country 9

will ultimately result in an increase in output and a decrease in interest rates in both countries (Boughton, 2002). The Mundell-Fleming-Dornbusch model is a macro research method, which is suitable at analysing the correlation between macroeconomic policies and exchange rates. The quantitative easing monetary policy of the United States represents a policy measure implemented by the Federal Reserve to save the American economy. Moreover, the position of the largest economy in the world is occupied by the United States and the dollar denotes the main globally accepted currency for international trade. The implementation of this policy will inevitably affect the exchange rate and therefore have a significant impact on the global economy. Therefore, the theoretical analysis of the international transmission mechanism of monetary policy in the United States demonstrates that the implementation of quantitative easing monetary policy in the United States may affect the stock prices in China. The MFD model has for many years been at the forefront of analysis of policy making, and rightfully so. However, while it captures turning points in monetary policy extremely well, an underlying issue with the model that should not be overlooked is the fact that the model fails to capture exchange rate swings caused by factors other than policy making. (Rogoff, 2002). The implications of this are difficult to grasp, as drastic changes in exchange rates can come from many different factors. In the case of the financial crisis of 2008, it is likely that there would be factors outside of monetary policies that could play a role in affecting exchange rates that the MFD model would then fail to capture. 4. Hypothesis Based on the previous literature analyzing the impacts of QE on stock prices, a hypothesis can be made on the impacts of US QE on stock prices in China. The previous works were unanimous in the fact that QE does have an impact on stock prices, and in addition, that it impacted the stock prices positively. Hence, the hypothesis that we can draw are the following: H1: US QE has an impact on stock prices in China H2: Increases in M2 of the US through QE has a positive relationship with Chinese stock prices. 10

5. Empirical research 5.1 Methodology In order to determine the extent to which the application of Quantitative Easing influences stock prices, the statistical VAR model will be implemented. VAR denotes a multivariate forecasting algorithm that measures how two or more time-series influence each other. This is accomplished through modeling each time series as a function of past values. VAR is bidirectional, meaning it measures how the two variables influence each other rather than the effect of one variable on the other, which distinguish it from other autoregression models, which are usually unidirectional (Juselius, 2009). The empirical research methodology is based on a quantitative analysis of the extent to which quantitative easing of US monetary policy variables impacts Chinese stock prices through the construction of a VAR model with impulse response function analysis. Impulse response analysis is mainly set to describe changes in one variable as it affects other variables. The variance decomposition is subsequently utilized. Variance decomposition in the VAR is an analysis of the contribution of structural shocks impacting the endogenous variables. Financial variables are often time series data and if the time series are not smoothed, a "pseudo-regression" may occur when building a VAR model, i.e. no cointegration relationship exists between the smoothed time series. Thus, the data should be assessed for smoothness and after performing the smoothness test, a VAR model can be built for causality testing and impulse response analysis. 5.2 Data Selection Since the focus of this paper is to determine whether QE in the United States has had an impact on stock prices in China, in this study, data for each month from November 2008 to October 2014 were selected. Monthly data is selected to provide a more vivid picture of data changes and it was the first QE introduced in the US since November 2008 to deal with the financial crisis (Blinder, 2010). The following variables are selected namely: the money supply in the US, the money supply M2 in China, the closing price of the S&P 500, the closing price of the Shanghai Composite Index (SCI), and the US Federal Funds Rate. The M2 of the US and China, as well as the Federal Funds rate, is extracted from 11

the St. Louis Fed economic database, and the data on the stock prices for the S&P 500 as well as the SCI is extracted from Yahoo Finance. Table 2: Variables used Variable Abbreviation Explanation US Money Supply M2 US A measure of US money stock. China Money Supply M2 CN A measure of China´s money stock. SSE Composite Index SCI One of the largest stock indices in China. Standard & Poor’s 500 S&P 500 One of the largest stock indices in the US. Federal Funds Rate FED Rate Interest rates in the U.S. interbank market. 5.3 VAR Model The VAR model was initially presented by Christopher Sims in 1980 and represents a multivariate forecasting algorithm that is applicable when multiple time series influence each other. This is essential for this article because our goal is to determine whether the money supply has affected the stock market over a period of time. The autoregressive element comes from the fact that each individual time series is modelled based on previous values, therefore the essence of an optimal lag length. A typical VAR model can be mathematically presented using the following formula: 1. = + 2 −2 + … + − + Here, α is the intercept, 2 till p are coefficients of the lags of Y till order p, and is the error term. If there were to have two-time series at a given time t, for example, 1 and 2 , the VAR model would use the past values from Y1 as well as Y2 in order to calculate 1 , and vice versa for the calculation of 2 (Juselius, 2009). 12

6. Results 6.1 Stationarity For the purpose of verifying the smoothness of the time series variables we utilize a ADF unit root test. When the ADF test is performed on the time series we can conclude that the time series of all the data is rejecting the null hypothesis at the first difference level at the 1%, 5% and 10% confidence intervals. Hence, none of the five time series have unit roots and therefore it could be proven that all the data is smooth and there is no risk of spurious regression. (Dickey & Fuller, 1979). Granger causality tests can therefore be performed on this data. Table 3: ADF-test results 1% level 5% level 10% level P-value Result FED Rate -3.527 -2.904 -2.589 0.0000 Stable M2 CN -3.529 -2.904 -2.589 0.0000 Stable M2 US -3.527 -2.904 -2.589 0.0000 Stable S&P 500 -3.527 -2.904 -2.589 0.0000 Stable SCI -3.527 -2.904 -2.589 0.0000 Stable 6.2 Inverse Roots of AR Characteristic Polynomial When performing the inverse roots of an AR polynomial, it is readily observable that all roots of the VAR model lie within the unit circle. Thus, the data is stable. This is essential because assuming the VAR is not stable, the impulse response test (subsequently conducted in this section) will be invalid. Figure 3 Inverse Roots of AR Characteristic Polynomial 13

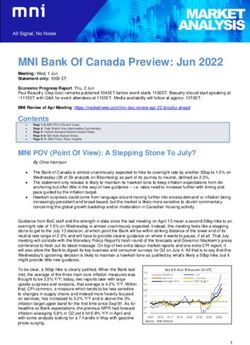

6.3 Granger Causality Test Subsequently, a Granger causality test is performed to consider whether and which of our time series are relevant in predicting the future values of other time series. A probability below 0.05 indicates that Granger causality exists and the hypothesis that "X does not Granger cause Y" could be rejected. The results of using the Granger causality test are depicted in Table 4, demonstrating the correlation between the US stock market and the China’s stock market, the US money supply and the Federal Funds Rate. From the graph it is observed that at the 5% level of significance all p-values are greater than 0.05 therefore it can be surmised that significant correlation exists between the US stock market, in the years 2008 to 2014. Table 4: Granger Causality test, period 2008-2014: M2 CN, FED Rate, M2 US, S&P 500, SCI. Null Hypothesis: Observation F-Statistic Probability M2 CN does not Granger Cause FED Rate 68 1.092 0.369 Fed Rate does not Granger Cause M2 CN 0.640 0.636 M2 US does not Granger Cause FED Rate 68 1.055 0.387 FED Rate does not Granger Cause M2 US 0.758 0.557 S&P 500 does not Granger Cause FED Rate 68 1.461 0.226 FED Rate does not Granger Cause S&P 500 0.275 0.893 SCI does not Granger Cause FED Rate 68 0.749 0.562 FED Rate does not Granger Cause SCI 2.948 0.027 Table 4 depicts the impact of the federal funds rate on other factors and the impact of other factors on the federal funds rate. The federal funds rate as depicted in the graph has a p-value of 0.027 < 0.05 at the 5% significance level against SCI, thus the original hypothesis that the federal funds rate does not Granger cause SCI in China is rejected and thus it could be stated that the federal funds rate has an impact on the China’s stock market. For the other factors the effects can be seen from the p-values which are all greater than 0.05 and therefore all accept the original hypothesis. 14

Table 5: Granger Causality test, period 2008-2014: M2 US, M2 CN, S&P 500, SCI. Null Hypothesis: Observation F-Statistic Probability M2 US does not Granger Cause M2 CN 68 1.860 0.129 M2 CN does not Granger Cause M2 US 1.289 0.285 S&P 500 does not Granger Cause M2 CN 68 0.475 0.754 M2 CN does not Granger Cause S&P 500 1.506 0.212 SCI does not Granger Cause M2 CN 68 1.361 0.258 M2 CN does not Granger Cause SCI 3.372 0.015 Table 5 depicts the correlation between China's money supply and other variables. From the table, it can be observed that at a 5% confidence interval, the Granger test for China's money supply and China's SCI is 0.015

subsequently surmise that other factors cannot influence the US money supply. The Granger test for the SCI and SP500 is equally greater than 0.05 and thus the SCI and SP500 are not significantly related to each other. Table 7: Granger Causality test, period 2003-2008: M2 US, SCI. Null Hypothesis: Observations F-Statistic Probability SCI does not Granger Cause M2 US 57 0.394 0.812 M2 US does not Granger Cause SCI 1.306 0.281 Furthermore, when conducting the Granger causality test on the control period between 2003 and 2008, it is observed that the value for “M2 US does not Cause SCI” is significantly greater than the confidence interval of 5%. This implies that the null hypothesis cannot be rejected, suggesting that it is not feasible for Granger's causality test to conclude that there is a statistically significant relationship between the variables during this time period. 6.4 Impulse Response Analysis The first graph depicts that China's stock market is mainly subject to a large own shock and that China's money supply, M2, has a positive shock to China's stock market in the third period reaching a maximum in the second period. A negative shock is generated after period 3. The impact of the US federal fund rate on China's stock market is positive up to period 6. Second, federal fund rates have consistently impacted China's money supply positively. This is brought about as a result of excessive inflationary pressures on China, which in the subsequent period led to a negative shock. 16

Figure: 4 Impulse Response Analysis 6.5 Variance Decomposition Table 8: Variance Decomposition of SCI, period 2008 - 2014 Period S.E. S&P 500 SCI M2 US M2 CN FED Rate 1 162.591 0.000 99.876 0.124 0.000 0.000 2 202.715 1.683 94.472 2.859 0.000 0.987 3 224.401 4.198 89.168 5.612 0.005 1.018 4 236.640 5.736 85.835 7.437 0.036 0.956 5 243.968 6.683 83.817 8.421 0.131 0.948 6 248.871 7.385 82.406 8.949 0.271 0.980 7 252.333 7.929 81.327 9.269 0.421 1.053 8 254.777 8.329 80.496 9.484 0.565 1.125 9 256.493 8.609 79.863 9.631 0.700 1.197 10 257.702 8.786 79.379 9.733 0.825 1.266 The variance decomposition of the VAR model is used to analyse the extent to which each structural shock contributes to changes in endogenous variables, further capturing the extent to which one variable is influenced by several other variables (Lütkepohl, 2005). As can be observed from table 8, US money supply has the most significant impact 17

on China's stock market prices (SCI) during the 10th period, accompanied by the S&P 500, and China's money supply was observed to have the least impact in this period. Table 9. Variance decomposition of SCI, period 2003 - 2008 Period S.E. S&P 500 SCI M2 US M2 CN FED Rate 1 275.737 17.235 82.765 0.000 0.000 0.000 2 367.622 18.189 75.387 0.041 1.692 4.691 3 467.359 25.455 66.579 0.086 1.077 6.803 4 558.543 32.110 58.590 0.143 0.759 8.397 5 651.792 38.690 51.214 0.168 0.611 9.317 6 745.827 44.441 44.787 0.152 0.663 9.957 7 841.882 49.327 39.198 0.122 0.928 10.424 8 939.999 53.369 34.335 0.099 1.385 10.811 9 1040.417 56.661 30.076 0.089 2.016 11.158 10 1143.188 59.295 26.328 0.094 2.797 11.485 When comparing it to the variance decomposition of Chinese stock prices over the period 2003 to 2008, it is easy to see that there are certain significant differences. At period 1, the largest influence on the SCI is the S&P 500, and other influential factors were 0. At period 10, the U.S. M2 has the least influence, or the least explanatory power for changes in the SCI. In this period, the S&P 500 has the greatest impact, as shown in Table 9. 7. Discussion Through comparison, it can be seen that from 2008 to 2014, the quantitative easing policy of the United States has a strong correlation with China's stock market, and the impact of the federal funds rate on China's stock market also exceeds the impact of China's money supply. According to the data from 2003 to 2008, during the period when quantitative easing was not implemented in the United States, the American stock market had the greatest impact on China's stock market, mainly because the decline or rise of the American stock market would affect the international flow of capital, thus affecting China's stock market. 18

Figure 5 SCI Composite Index, 2008-2014; Source Yahoo.com, own calculations. Shanghai Composite Index 4000 3500 3000 2500 Index 2000 1500 1000 500 0 01/02/2010 01/05/2014 01/11/2008 01/02/2009 01/05/2009 01/08/2009 01/11/2009 01/05/2010 01/08/2010 01/11/2010 01/02/2011 01/05/2011 01/08/2011 01/11/2011 01/02/2012 01/05/2012 01/08/2012 01/11/2012 01/02/2013 01/05/2013 01/08/2013 01/11/2013 01/02/2014 01/08/2014 Date From the figure 5, during the period of QE, there is an observable rise of the China's stock prices as the US conducts a round of QE, then there is an equally obvious drop as the round ends. Hence, every time the United States conducts this type of unconventional monetary policy, stock prices are promoted in the beginning, but begin to decline as the round of QE comes to an end. Regarding the second point, the issuance of dollars is the main tool of quantitative easing, subsequently enhancing the number of funds available in capital markets following the application of quantitative easing in the United States, as well as the reduction in the federal funds rate. This has deepened the impact on the China's equity market. The last point is China's money supply, which has influenced financial markets around the world due to the US quantitative easing policy and the US dollar as the base currency in the foreign exchange market. For China, to addressing the domestic impact of the US quantitative easing policy, the central bank issued 4 trillion yuan to enhance domestic demand (Wong, 2011). The massive issuance of base currencies in China has also had an impact on the Chinese stock market. This fueled the advent of the China's stock market. 19

Figure 6: Foreign direct investment of China, 2000-2020: Source World Bank, own calculations. Foreign direct investment of China 350,000,000,000.00 300,000,000,000.00 250,000,000,000.00 200,000,000,000.00 US$ 150,000,000,000.00 100,000,000,000.00 50,000,000,000.00 0.00 2000 2006 2012 2018 2001 2002 2003 2004 2005 2007 2008 2009 2010 2011 2013 2014 2015 2016 2017 2019 2020 Year Figure 6 shows the changes in China's outbound investment in the last 20 years, as previously mentioned in this paper, Chari & Kehoe (1997) proposed the concept of "hot money", which shows that China's foreign investment rose significantly after 2009, when the quantitative easing policy in the U.S. started to be implemented. After 2009, China received a significant increase in foreign investment, when quantitative easing began in the US. This confirms the conclusion of this paper that due to the impact of quantitative easing in the US, a large amount of capital chose to leave the US in search of more profitable investment opportunities, thus affecting the Chinese stock market. The US government ceases the implementation of quantitative easing, it will result in an extension of the US balance of payments deficit and massive capital outflows, posing a considerable risk to the financial system. This is the reason every country should be prepared to address sudden changes in international markets. 8. Conclusion According to the comparative results the current study, the quantitative easing policy of the United States has a positive impact on China's stock market, which is in line with previous studies such as Bhattarai et al. (2020), which proved that US QE has a significant positive effect on stock prices in emerging economies. Interestingly, the results from our control period, 2003 to 2008, where QE had not yet been conducted, show that US money 20

supply does not have a significant relationship to stock prices in China. This further suggest that the main impacting variable is indeed QE. According to MFD theory, if the quantitative easing monetary policy implemented by the US leads to a decrease in the exchange rate of the US dollar, thus increasing exports, China needs to reduce the impact on its exports by increasing the supply of money in China so that the exchange rate in China also decreases. The series of quantitative easing policies implemented by the US central bank for stimulating the economy after the 2008 financial crisis had a considerable impact not only on the US but likewise on the global financial system. Therefore, when the US decided to start tapering its bond purchases in 2014, it marked the completion of quantitative easing in the US (Board of Governors of the Federal Reserve System, 2013). Furthermore, while QE proved to be an effective tool in stimulating the economy and boosting stock prices, there are risks involved that should not be overlooked. For instance, the timing of the end of quantitative easing is very important, as each time it has been implemented in the US it has caused equity prices to fall after a period of time. If the US were to abandon the use of quantitative easing too soon, it would slow down or hinder the recovery of the world economy from the 2008 financial crisis. This is because abandoning the use of quantitative easing would lead to a reduction in market liquidity and an increase in market interest rates, which would affect the desire of individuals to consume and invest. On the other hand, if the US government abandons the use of quantitative easing too late, it may exacerbate global inflation. Each country should formulate reasonable policies in advance to deal with the quantitative easing of the United States, as the analysis results of the thesis mentioned the quantitative easing policy of the United States has promoted the prosperity of the Chinese stock market, but this is short-lived, so for the healthy development of the capital markets of other countries put forward the following suggestions, the first point is that at this stage the US dollar is the main currency of the capital market, the US government's massive increase in dollar issuance will lead to a devaluation of the dollar, but the transfer of the dollar to its debt is beneficial and has a huge impact on countries that hold the dollar as their main foreign exchange reserve. Therefore, to counter this, we should promote the internationalization of the Chinese currency and allow more countries to use it. Achieving 21

the internationalization of China's currency requires reducing the Chinese government's control over the capital markets and increasing their openness, strengthen economic cooperation with other countries and increase the convertibility of China's currency. The second point is that the essence of quantitative easing in the US is to put a large amount of money into the market, resulting in the depreciation of the US dollar and the appreciation of China's currency. The appreciation of the Chinese currency has had an impact on China's export sector, so in order to reduce the impact of US quantitative easing on China's export sector, China should expand domestic demand and transform the way China's economy grows, for example, the Chinese government can encourage the development of high-tech industries and give certain subsidies to this industry to enhance international competitiveness. Thus, to ensure the development of the country’s capital market is consistently maintained, it is necessary for the government to execute effective policies and measures, which will promote steady economic growth. Quantitative Easing is relevant for future research as it is starting to see more use around the world today, both by advanced economies as well as emerging economies. For example, as a response to the Covid-19 pandemic, a total of 166 central banks around the world resorted to QE. Out of these countries, sixty-five of them are developing countries that had never previously used QE. (Cavallino et al., 2021). This improves conditions for future research on this topic, since with a larger pool of data, a more precise analysis of the effects on QE on stock prices can be conducted. This also improves the possibility of establishing whether there is a long-term relation between these variables. 22

Reference list Balatti, M., Brooks, C., Clements, M. P., Kappou, K. (2016). Did quantitative easing only inflate stock prices? Macroeconomic evidence from the US and UK. SSRN. Barbosa, H. (2018, September 21). Economic fluctuation and stabilization in an open economy. Macroeconomic Theory (pp.267-304) Bhattarai, S., Chatterjee, A., Park, W. Y. (2020,). Effects of us quantitative easing on emerging market economies. Journal of Economic Dynamics and Control. Blinder, A. S. (2010, March). How Central Should the Central Bank Be? Journal of Economic Literature vol 48 No. 1. Board of Governors of the Federal Reserve System. (2013). Monetary Policy Report of July 2013. Annual report 2013. Boughton, J. M. (2002). On the origins of the Fleming-Mundell model. IMF Staff Papers. Cavallino et al. (2021). A global database on central banks' monetary responses to Covid- 19. Bank for International Settlements. Chari, V. V., Kehoe, P. J. (1997). Hot money. National Bureau of Economic Research. Dickey, D., Fuller, W. (1979). Distribution of the Estimators for Autoregressive Time Series With a Unit Root. Journal of the American Statistical Association. Economic Commission for Latin America and the Caribbean. (2019, May 8). Trends and major holders of U.S. federal debt in charts. Economic Commission for Latin America and the Caribbean. Encyclopedia Britannica. (2022). S&P 500. Retrieved June 11, 2022, from https://www.britannica.com/topic/SandP-500. Fred. (2019, November 11). M2 for China. FRED. Retrieved June 13, 2022, from https://fred.stlouisfed.org/series/MYAGM2CNM189N 23

Fred. (2022, June 1). Federal funds effective rate. FRED. Retrieved June 12, 2022, from https://fred.stlouisfed.org/series/FEDFUNDS Fred. (2022, June 1). Federal funds effective rate. FRED. Retrieved June 13, 2022, from https://fred.stlouisfed.org/series/FEDFUNDS Fred. (2022, May 24). M2. FRED. Retrieved June 11, 2022, from https://fred.stlouisfed.org/series/M2SL Fred. (2022, May 24). M2. FRED. Retrieved June 13, 2022, from https://fred.stlouisfed.org/series/M2SL Frenkel, J. A., Razin, A. (1987). The Mundell-Fleming Model: A quarter century later. National Bureau of Economic Research. Gerlach, S., Lewis, J. (2013, June 19). Zero lower bound, ECB interest rate policy and the financial crisis - empirical economics. SpringerLink. Google Finance. (2022). SSE Composite Index. Google Finance. Granger, C. W. J. (1969). Investigating Causal Relations by Econometric Models and Cross-spectral Methods. JSTOR. Hausken, K., Ncube, M. (2013). Quantitative easing and its impact in the US, Japan, the UK and Europe. SpringerLink. Hellwig, M. (2008). The causes of the financial crisis - max planck society. The causes of the financial crisis. CESifo Forum. Joyce, M., Miles, D., Scott, A., Vayanos, D. (2012, October 29). Quantitative easing and unconventional monetary policy – an introduction. OUP Academic. Juselius, K. (2009). The cointegrated Var model: Methodology and applications. Oxford University Press. Koijen, R. S. J., Koulischer, F., Nguyen, B., Yogo, M. (1970, January 1). Quantitative easing in the Euro Area: The Dynamics of Risk Exposures A. IDEAS. 24

Learning, L. (2022). Federal Reserve Actions and Quantitative Easing. Lumen. Lütkepohl, H. (1993). New introduction to multiple time series analysis. SpringerLink. Macrotrends. (2022). Federal Funds Rate - 62 Year Historical Chart. Macrotrends. Retrieved June 9, 2022, from https://www.macrotrends.net/2015/fed-funds- rate-historical-chart Pesaran, H. (2015). Time Series and Panel Data Econometrics. Oxford Scholarship Online. Rogoff, K. (2002). Dornbusch's Overshooting Model After Twenty-Five Years. IMF. S. Bernanke, B., N. Kuttner, K. (2005). What Explains the Stock Market's Reaction to Federal Reserve Policy? The Journal of Finance, 60. Wieland, V. (2009, December 3). Quantitative easing: A rationale and some evidence from Japan. University of Chicago Press. Wong, C. (2011). The Fiscal Stimulus Programme and Public Governance Issues in China. OECD Journal on Budgeting. World Bank. (2020). World Development Indicators. The World Bank. Retrieved June 7, 2022, from https://databank.worldbank.org/reports.aspx?source=2&series=NY.G DP.MKTP.CD&country= World Bank. (2022). Foreign direct investment, net inflows (BOP, current US$). The World Bank. Retrieved June 10, 2022, from https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD?end=2020& amp;start=2001 Yahoo. (2022, June 10). SSE Composite index (000001.SS) historical data. Yahoo! Finance. Retrieved June 10, 2022, from https://finance.yahoo.com/quote/000001.ss/history/ 25

Yahoo. (2022, June 13). S&P 500 (^GSPC) historical data. Yahoo! Finance. Retrieved June 13, 2022, from https://finance.yahoo.com/quote/%5EGSPC/history/ Yahoo. (2022, June 13). SSE Composite index (000001.SS) historical data. Yahoo! Finance. Retrieved June 13, 2022, from https://finance.yahoo.com/quote/000001.ss/history/ Yardeni Research. (2020). Chronology of Fed’s Quantitative Easing; Tightening. Yardeni Research. Retrieved June 9, 2022, from https://www.yardeni.com/chronology-of-feds-quantitative-easing/ 26

Appendix 1. Stationarity In order to check for stationarity in our time series, the Augmented Dickey-Fuller test, or ADF is applied. Checking for stationarity is of significant importance since any non- stationarity can lead to unreliable or spurious results. the ADF test is implemented for assessing whether our variables have a unit root, which would notify us whether a non- stationary problem exists. This paper implements the ADF to test the null hypothesis that a given time series has a root of unity at the first difference levels for the 1%, 5%, and 10% significance levels. The ADF test can be represented mathematically. Where is the error term, ∆ is the first difference of , is the constant term, is the number of lags. and are the coefficients. (Dickey and Fuller 1979). . ∆ = + − + ∑ ∆ − + = : = : < 2. Granger Causality Test Another statistical concept applied in this study is the Granger Causality test. It is a hypothesis test assessing whether a given time series is practical in providing a prediction of another value. It is important for the purposes of this paper as a tool for investigating the correlation patterns between QE and stock prices and could help us in establishing whether a causal relationship between the variables exists. The main function of the Granger causality test is to focus on the causal relationship existing between two-time series, X and Y. Regarding its application, it is basically utilized for determining the extent to which variable Y can be explained using variable X. Y is asserted to be caused by X Granger if the variable X is beneficial in the prediction of Y or when the correlation coefficient between X and Y as a statistical significance. Below is the equation for the Granger causality test (Granger, 1969). 27

. = ∑ − + ∑ − + = − . = ∑ − + ∑ − + = = regarding the first formula, the null hypothesis for the test is 0 = 1 = 2 = 3……0 For the second formula, the null hypothesis for the test is: 0 = 1 = 2 = 3……0 There are four possible scenarios for the Granger test exist, which are: 1. When X has an effect on Y, the parameter α is not statistically significant overall in the first equation, while λ is statistically significant overall in the second equation. 2. When Y has an effect on X, the second formula has a statistically significant overall non-zero λ. The first formula has a statistically significant overall zero α. 3. If X and Y influence each other, then neither α nor λ is 0 4. if there is no influence between X and Y, then both α and λ are 0 (Granger 1969) 3. Inverse Roots of AR Characteristic Polynomial To further assess the stability of our VAR model, the inverse roots of the AR characteristics polynomial will be examined. The VAR is stationary assuming all the roots lay within the unit circle. This is assessed using EVIEWS (Lütkepohl, 1993). 4. Impulse Response Analysis Impulse response analysis applied for indicating the extent to which a variable is shocked and affected by another variable, and to see how this changes over time. The horizontal axis of an impulse response analysis graph shows the periods between the effects of shocks, the vertical axis shows the change in the explanatory variable, the red line in the middle shows the impulse response function, and the blue lines on either side show the plus or minus two standard deviation (Pesaran, 2015). 28

( , ∆, − ) = ( + | = ∆, + = , … . , + = ; − ) = ( + | = , + = , … . , + = ; − ) (Pesaran, 2022) :vector of variables being shocked Δ: vector of shocks t: Information set at time 5. Variance decomposition of VAR model The variance decomposition of the VAR model is used to analyze the extent to which each structural shock contributes to changes in endogenous variables, further capturing the extent to which one variable is influenced by several other variables (Lütkepohl, 2005). 29

You can also read