Peter Clausi on how CBLT has used creative M&As in gold and battery metals to make money for their shareholders - InvestorIntel

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Peter Clausi on how CBLT has used creative M&As in gold and battery metals to make money for their shareholders In a recent InvestorIntel interview, Tracy Weslosky asks Peter Clausi, President, CEO and Director of CBLT Inc. (TSXV: CBLT) to explain what he meant by his line that “a mining company can make more money with a pen than with a drill bit.” He responds on how this works with market cycles and then adds that as a result of their focus on strategic M&A activities that “CBLT has not had to do financing since 2016.” He then goes on to explain how CBLT has found creative M&As to make money for their shareholders. In this InvestorIntel interview, which may also be viewed on YouTube (click here to subscribe to the InvestorIntel Channel), Peter went on to say, “Two years ago, CBLT bought a portfolio of assets for little over $1 million in stock. Northshore gold was one of the assets in the portfolio which was sold for $1.45 million.” He also provided an update on the Big Duck Lake gold property on which Peter said “…is analogous to the Moose Lake Porphyry which hosts the Hemlo Gold Camp.” Commenting on the cobalt market Peter said, “If you believe that we are going to greenify the world, if you believe that there is a run on Lithium — then you have to believe that there is a run on cobalt.” To watch the full interview, click here About CBLT Inc. CBLT Inc. is a Canadian mineral exploration company with a proven leadership team, targeting cobalt and gold in reliable mining jurisdictions. CBLT is well-poised to deliver real

value to its shareholders. To learn more about CBLT Inc., click here Disclaimer: CBLT Inc. is an advertorial member of InvestorIntel Corp. Vital Metals’ Geoff Atkins on how Australia has a big part to play in the global rare earths supply chain challenge In a recent InvestorIntel interview, Tracy Weslosky speaks with Geoff Atkins, Managing Director of Vital Metals Limited (ASX: VML), about how Joe Biden’s victory will affect the critical materials market and how Australia has a big part to play in the global rare earths supply chain. In this InvestorIntel interview, which may also be viewed on YouTube (click here to subscribe to the InvestorIntel Channel), Geoff went on to say that Biden’s victory, combined with the rising demand for electric vehicles and is going to be a positive for the critical minerals industry overall — “We are in a bit of a perfect storm with regards to critical materials.” Geoff then goes on to say, “We have a large consumer driven demand for energy efficiency, electrification, and miniaturization which all require critical minerals. At the same time, you have statutory and regulatory pushes for reduced emissions. Lastly you have a geopolitical situation

which is also driving the need for diversified supply chain in these minerals.” Adding, “You add all of those three things together and you are left with a significant increase in demand and interest in the critical minerals space.” To watch the full interview, click here About Vital Metals Limited: Vital Metals is an explorer and developer with highly prospective mineral projects, focusing on the world-class rare earth Nechalacho project in Canada. They plan to commence production at Nechalacho in 2021, and aims to produce a minimum 5,000 tonnes of contained REO by 2025. Vital Metals aims to become the lowest cost producer of mixed rare earth oxide outside of China by developing one of the highest grade rare earth deposits in the world and the only rare earth project capable of beneficiation solely by ore sorting. Vital’s other projects include the high-grade Wigu Hill rare earth resource in Tanzania. To learn more about Vital Metals Limited, click here Disclaimer: Vital Metals Limited is an advertorial member of InvestorIntel Corp. The lithium miners are making a comeback as the EV boom begins The lithium miners are making a comeback and investors are again flocking to the sector with most lithium stock prices recovering sharply the past month. As a result today I review

the lithium sector and briefly cover 5 of the most promising

lithium miners.

A series of recent events has lifted sentiment and stock

prices for the lithium miners. These are:

Lithium prices appear to have finally bottomed as supply

stalls and demand picks up again.

Lithium demand forecasts continue to increase. Benchmark

Mineral Intelligence is forecasting a more than 6x

increase in lithium demand this decade. My model

suggests we may see a 9.9x increase this decade,

assuming electric car sales hit 70% market share by

2030.

Lithium supply continues to decrease in 2020. The past 3

year lithium bear market has reduced lithium supply with

several lithium producers going bankrupt (Tawana

Resources (later Alita Resources), Nemaska Lithium,

Altura Mining) and most reducing production and scaling

back CapEx for future expansion.

EV sales are surging globally. Record global electric

car sales were reported for Sept. 2020, up 91% YoY, with

4.9% market share (3.4% YTD). In Sept. 2020, Europe

sales surged 166% YoY reaching 12% market share. For

Oct. 2020, China electric car sales rose 120% YoY. Also

in Oct, 2020, Germany electric car sales hit a record

and reached a staggering 18% market share.

UBS recently forecast that electric cars’ market share

would reach 17% by 2025 and 40% by 2030. My models are

forecasting 20% by 2025 and 70% by 2030.

The UK ban on new gasoline and diesel cars and vans from

2030 was announced last month.

In the US President Biden was elected with his pro-green

(including EVs) plan for the USA. Biden wants to ensure

the U.S. has a carbon pollution-free power sector by

2035, which means Li-ion energy storage should do very

well as solar and wind require energy storage.In the USA a new trade group called Zero Emission

Transportation Association (ZETA) is calling for reduced

emissions and 100% EVs by 2030 in the USA.

Tesla (TSLA) plans to rapidly accelerate production and

is currently building/expanding 3 new factories in 3

countries (USA, China, Germany) with plans to produce 20

million EVs pa by 2030. That would be a 54x increase on

2019, or a 40x increase on the 2020 target.

Lithium deficits are forecast from 2022/23 growing

significantly towards 2030

Source

5 pure play lithium miners with potential to do well this

decade as lithium demand booms

1) Jiangxi Ganfeng Lithium [SHE: 002460] [HK: 1772] (GNENF)

Ganfeng Lithium is in the top 3 global lithium producers.

Ganfeng is the most vertically integrated lithium producer

with JVs in lithium mines, lithium conversion and chemical

production, some battery products (including solid state

batteries), and battery recycling. No other lithium company

globally has expanded their lithium assets portfolio and off-

take/equity agreements as much as Ganfeng has the past 5

years. Examples of this include JVs and off-take deals with

Mineral Resources, Pilbara Minerals, Lithium Americas,

Bacanora Lithium, International Lithium as well as localsources in China. Ganfeng will most likely become the new lithium super power this decade. 2) Galaxy Resources [ASX: GXY] (OTCPK: GALXF) Galaxy Resources is an Australian pure play lithium miner with 3 lithium projects globally – Mt Cattlin (Australia), Sal de Vida (Argentina), and James Bay (Canada). Mt Cattlin is already producing lithium spodumene and the later two projects are still under development with SDV being quite advanced. This means Galaxy Resources has enormous potential to expand lithium production this decade. 3) Pilbara Minerals [ASX: PLS] (OTCPK: PILBF) Pilbara Minerals owns the massive Pilgangoora Lithium-Tantalum producing mine in Western Australia. The mine is only operating at Stage 1 capacity, but there are plans for Stage 2 and eventually Stage 3 expansions. Pilbara Minerals has top notch off-take and/or equity partners. These include General Lithium, Ganfeng Lithium, Great Wall Motors, POSCO, CATL and Yibin Tianyi. Finally, it is looking possible that Pilbara Minerals may swoop up the Altura Mining asset next door as part of a liquidation deal. 4) Lithium Americas [TSX: LAC] (LAC) Lithium Americas is likely to be the next significant lithium brine producer. Partnered with industry leader Ganfeng Lithium (51% share) at their Caucharí-Olaroz Project in Argentina construction is fully funded and well underway with lithium production forecast to begin by early 2022. Added to this is their 100% owned Thacker Pass lithium clay project in Nevada, USA. 5) Neo Lithium Corp. [TSX: NLC] [GR: NE2] (OTCQX: NTTHF) Neo Lithium looks set to possibly be the next major lithium brine producer following Lithium Americas. Neo Lithium 100%

own their Tres Quebradas (“3Q Project”) lithium project in Argentina. The 3Q Project is widely regarded as one of the best, if not the best, undeveloped lithium projects globally. This is because the lithium grade is very high and the impurities very low, and they own 100% of a very large salar. Management is top tier and Neo Lithium look well placed with their strategic equity partner CATL (the world’s largest Li- ion battery manufacturer) to make it to production by late 2022 or 2023. You can read more in my very recent article on Neo Lithium here. The above 5 lithium miners are set to do well, but in a market where lithium demand increases 3-9 fold in a decade all the quality lithium miners can do very well indeed. This includes the leading diversified chemicals companies that sell lithium (Albemarle (ALB) and SQM), US lithium producer Livent (LTHM), and a list of other lithium miners as well as the lithium junior miners yet to make it to production. A booming Li-ion battery market from the booming electric vehicle (EV) and energy storage (ES) markets should create an incredible tailwind for lithium stocks this decade. Electric vehicles sales are forecast to surge from end 2022 as purchase price parity with conventional cars kicks in

Source Closing remarks Assuming the EV boom continues to take off and we get rapid adoption of EVs and/or lithium-ion based energy storage, then the demand for lithium will increase several fold this decade. This will more than likely cause lithium prices to rise and huge opportunities for existing lithium miners to expand production as well as lithium juniors to succeed to be the next wave of producers needed from 2025 to 2030. After the past 3 year lithium bear market (due to short term lithium oversupply and a trade war/Covid-19 induced EV sales slowdown) it is understandable that investors remain a bit cautious; however just imagine any mining sector facing a 3x-9x surge in demand in only a decade. This is what we call a mining super-cycle. Hold on to your lithium miners and enjoy the ride as the EV boom begins!

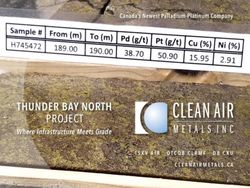

Making a $BULL.C run on critical materials, Canadian Palladium has platinum and rhodium too… With the current palladium price at US$2,338/oz finding palladium is even more valuable than finding gold (at US$1,804). More valuable than almost anything else on the planet is rhodium, at US$16,100/oz. It therefore makes sense to look for junior miners in good locations that are having exploration success for these highly valuable metals. One such junior is Canadian Palladium Resources Inc. (CSE: BULL | OTCQB: DCNNF | FRANKFURT: DCR1). Canadian Palladium is focused on growing a resource at their 100% optioned East Bull Palladium (PGM’s) Property. The Property covers 992 hectares and is in the Sudbury Mining Division in Ontario, Canada. Past exploration has resulted in a 43-101 compliant resource estimate of 11.1 million tonnes of ore at a grade of 1.46g/t palladium equivalent (Pd Eq) for a total of 523,000 ounces Pd Eq. Canadian Palladium are now working diligently to grow the resource and to identify the higher grade sections. Canadian Palladium’s East Bull Project 43-101 Resource estimate summary from 2018 Canadian Palladium’s East Bull PGM Project location and key highlights

Source

During 2020 Canadian Palladium have repeatedly announced solid

drill results and extended their mineralized zone at East

Bull. Here is the recent news summarized:

Nov. 23, 2020 – Canadian Palladium intersects 2.97 Pd Eq

over 12.0 metres expanding East Bull mineralization west

and down-dip.

Oct. 28, 2020 – Canadian Palladium continues to extend

mineralization.

Oct. 21, 2020 – Canadian Palladium drilling continues to

extend near surface deposit to over 1.6km of strike

length.

Oct. 26, 2020 – Canadian Palladium reports preliminary

assay results for additional drill holes at East Bull

Palladium Project, Sudbury Area, Ontario: Wide

intersections of palladium mineralization including 22.0

metres at 2.24 g/t Pd-equivalent.

Aug. 18, 2020 – Canadian Palladium reports complete

assay results for first ten drill holes at East Bull

Palladium Project, Sudbury Area, Ontario: Intersects

high-grade palladium including 4.0 metres with 8.15 g/tPalladium Equivalent.

June 24, 2020 – East Bull Property – Palladium results

show 2.68 g/t over 3 .0 metres and 2.28 g/t over 3.0

metres within a broader interval of 1.32 g/t over 20

metres.

March 2, 2020 – Canadian Palladium Hole EB-20-01

intersects: 3.32 g/t palladium over 7.0 metres, 2.50 g/t

palladium over 10 metres, 3.77 g/t combined palladium +

platinum + gold over 10 metres.

Note that palladium grades from 1.5 g/t to 5 g/t are

considered medium grade and anything above 5 g/t is considered

high grade. Most of the results in 2020 so far have been in

the medium grade with some occasional high grade results. Also

it should be noted the highly valuable by-products have the

effect of increasing the palladium equivalent grade.

What does this all mean you may ask? Essentially it means that

Canadian Palladium is steadily working towards growing a

potentially larger resource at the East Bull PGM Project. In

the latest news release from Nov. 23, 2020 Canadian palladium

summarize by stating:

“The Company’s 10,000 m drill program continues to extend the

Valhalla Zone resource down dip and towards the west. The

drilling in this section of the Valhalla Zone has produced

consistent results for over a kilometre strike length to

vertical depths of 150 metres. The mineralization widths

within this area varies from 6 to 71 metres core width….”

Building a resource takes time and money. During this stage

investors need to wait for drill results and ultimately a

resource upgrade. Canadian Palladium state that “the

independent analysis of the updated 43-101 also highlighted

the potential significant upside potential of the resource

estimate along 3.6km strike length.” 2020 drilling is slowly

working to confirming this.What is key is that the East Bull Project contains several highly valuable metals such as palladium, rhodium, platinum, gold, copper, nickel and cobalt. Source Looking further ahead, a valuable advantage of the East Bull Property is its proximity to the mining town of Sudbury. Extraction of mineralized material could be crushed on site and shipped by truck to Sudbury (90 km) for processing. The footprint would be minimal with only rock crushing on site allowing for a less complicated permitting process. It should also mean a lower initial CapEx. We will know a lot more down the track once we get to the PEA/PFS stage. Closing remarks Canadian Palladium is still in the early stages of potentially growing their resource at their East Bull Project. So far in 2020 drill results have extended the known mineralization and found medium grade palladium (and palladium equivalent) with occasional high grade. Should the success continue and the resource grow further, then the next steps should get easier due to the fact that

palladium and the other by-products are highly valuable and there is a relatively simple option towards production (open pit, crush, and ship 90 kms for processing). Vital Metals’ Geoff Atkins on the race to produce rare earths in 2021 In a recent InvestorIntel interview, Tracy Weslosky speaks with Geoff Atkins, Managing Director of Vital Metals Limited (ASX: VML), about the market interest in Vital Metals and signing a binding term sheet with the Saskatchewan Research Council (SRC) to negotiate a definitive agreements for the construction and operation of a rare earth extraction plant. In this InvestorIntel interview, which may also be viewed on YouTube (click here to subscribe to the InvestorIntel Channel), Geoff started, “We are moving full steam ahead towards getting into production at Nechalacho Project in 2021.” He continued by saying that Vital Metals is closest to production in the rare earths space which draws a lot of interest, he mentioned, only one rare earths project went into production in the last decade. Geoff also commented on the Vital Metals’ binding term sheet with the Saskatchewan Research Council (SRC). He said, “The Saskatchewan Research Council has a lot experience with rare earths and we have agreed with them that they will build and operate a rare earths extraction plant for us.” To watch the full interview, click here

About Vital Metals Limited: Vital Metals is an explorer and developer with highly prospective mineral projects, focusing on the world-class rare earth Nechalacho project in Canada. They plan to commence production at Nechalacho in 2021, and aims to produce a minimum 5,000 tonnes of contained REO by 2025. Vital Metals aims to become the lowest cost producer of mixed rare earth oxide outside of China by developing one of the highest grade rare earth deposits in the world and the only rare earth project capable of beneficiation solely by ore sorting. Vital’s other projects include the high-grade Wigu Hill rare earth resource in Tanzania. To learn more about Vital Metals Limited, click here Disclaimer: Vital Metals Limited is an advertorial member of InvestorIntel Corp. Search Minerals’ Greg Andrews on the electrification of vehicles and the “push” for rare earth magnets In a recent InvestorIntel interview, Tracy Weslosky speaks with Greg Andrews, President, CEO, and Director of Search Minerals Inc. (TSXV: SMY), about the electrification of vehicles and their collaboration agreements with the Saskatchewan Research Council (SRC) and USA Rare Earth. In this InvestorIntel interview, which may also be viewed on

YouTube (click here to subscribe to the InvestorIntel Channel), Greg started, “The recent Canadian government’s, the US government’s, the EU government’s rule on electrification and reducing internal combustion vehicles is a push in the right space for electrification which of course uses rare earth magnets.” He continued by saying that in the last year the OEMs have been investing a lot of capital in electrification of vehicles which again requires a secure supply chain of rare earths to make their business plans operable. “The collaboration agreements with both SRC and USA Rare Earth is a critical next step for us to turn our product into oxides.” Greg said. He added that Search Minerals is exploring the proven Solvent Extraction Process with SRC and Continuous Ion Exchange process with USA Rare Earth to get their projects off the ground. To watch the full interview, click here About Search Minerals Inc. Led by a proven management team and board of directors, Search is focused on finding and developing Critical Rare Earths Elements (CREE), Zirconium (Zr) and Hafnium (Hf) resources within the emerging Port Hope Simpson – St. Lewis CREE District of South East Labrador. The Company controls a belt 63 km long and 2 km wide and is road accessible, on tidewater, and located within 3 local communities. Search has completed a preliminary economic assessment report for FOXTROT, and a resource estimate for DEEP FOX. Search is also working on three exploration prospects along the belt which include: FOX MEADOW, SILVER FOX and AWESOME FOX. Search has continued to optimize our patented Direct Extraction Process technology with the generous support from the Department of Tourism, Culture, Industry and Innovation, Government of Newfoundland and Labrador, and from the Atlantic

Canada Opportunity Agency. We have completed two pilot plant operations and produced highly purified mixed rare earth carbonate concentrate and mixed REO concentrate for separation and refining. To learn more about Search Minerals Inc., click here Disclaimer: Search Minerals Inc. is an advertorial member of InvestorIntel Corp. Battery metals influencer Mitchell Smith on lithium-ion batteries, Tesla’s GigaFactory and GEMC In a recent InvestorIntel interview, Peter Clausi speaks with Mitchell Smith, President, CEO and Director of Global Energy Metals Corp. (TSXV: GEMC | OTCQB: GBLEF) (‘GEMC’), about the acquisition of an 85% interest in the Lovelock Mine and Treasure Box Projects located on the doorstep of the world’s largest lithium-ion battery production plant, the Gigafactory One that Tesla Motors Ltd. and partner Panasonic Corp. have built in Nevada, USA. In this InvestorIntel interview, which may also be viewed on YouTube (click here to subscribe to the InvestorIntel Channel), Mitchell started by saying that the COVID-19 pandemic “has highlighted the importance to regionalize supply and localization of new supply chain of critical minerals.” Mitchell, who was recently ranked as one of the top influencers in the battery minerals sector, continued by

saying that the projects have very high grades of nickel, cobalt and copper deposit and have historically produced materials grading 14% cobalt and 12% nickel. He added, “because of fragmented ownership the projects were never explored using modern technique.” To watch the full interview, click here Global Energy Metals Corp. Global Energy Metals is focused on offering investment exposure to the raw materials deemed critical for the growing rechargeable battery market, by building a diversified global portfolio of battery mineral assets including project stakes and sector specific equity positions. GEMC anticipates growing its business through the acquisition and development of battery mineral projects alongside key strategic partners. The Company holds 100% of the Millennium Cobalt Project and two neighbouring discovery stage exploration-stage cobalt assets in Mount Isa, Australia positioning it as a leading cobalt- copper explorer and developer in the famed mining district in Queensland, Australia. The Company has acquired 85% interest in two battery mineral projects, the Lovelock Cobalt Mine and Treasure Box Project. Additionally, the Company holds a 70% interest in the past-producing Werner Lake Cobalt Mine project in Ontario, Canada. To learn more about Global Energy Metals Corp., click here Disclaimer: Global Energy Metals Corp. is an advertorial member of InvestorIntel Corp.

You can also read