Monetary policy and consumer prices: evidence from the Swiss franc unpegging - Alex Oktay

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Oktay

SJES SUBMISSION - JULY 2021 VERSION

Monetary policy and consumer prices: evidence

from the Swiss franc unpegging

Alex Oktay

Abstract

This paper uses a difference-in-differences strategy on the Swiss franc increase of January 2015 to quantify the

one-year impact of a currency appreciation on the prices of goods and services for each category of the

Harmonized Index of Consumer Prices. The results suggest a positive relationship between indirect exchange

rates and prices with an average implied elasticity of 0.128 for all categories, such that a currency appreciation

reduces prices. Oil, tourism, and durable goods are the most impacted sectors with some elasticities ranging

from 0.649 to 1.111. The estimated transmission of importers price differentials to retail prices is 57%. Most

services (excluding tourism) and fast-moving consumer goods are only slightly affected by the changes in

exchange rate. The results confirm that the import share and foreign-currency invoicing share could be the

main determinants of exchange rate elasticity, while also pointing towards expenditure switching as an

important mechanism. The analysis outlines an important heterogeneity in how different goods and services

react to exchange rate fluctuations following monetary policy changes.

Keywords: Prices; Currency appreciation; Monetary policy; Short-term inflation; Exchange rates

JEL Classification: E31; E52; F31

1 Introduction Swiss National Bank (SNB) decision to remove their

Exchange rate fluctuations can have a large impact exchange rate ceiling caused a large and unexpected

on prices. By shaping agents expectations about their appreciation of the domestic currency, which can be

currency, monetary policy is thus able to change short- studied as a shock on prices. A difference-in-differences

term prices and influence the domestic economy. How- (DID) estimation is carried by comparing prices of

ever, even if the general effect of exchange rate policies each category of goods and services in Switzerland

on inflation is well-known, the specific results for each with respect to the rest of Europe. The DID estimates

category of products have only started to be studied are then used to compute implied elasticities of prices

recently. to indirect exchange rate fluctuations.

This paper estimates the impact of currency fluctu- Measuring the specific elasticity of each category of

ations on the prices of each type of goods and ser- products is crucial to understand the connection be-

vices using data from a 2015 monetary policy change tween exchange rate policies and inflation. A nega-

in Switzerland. Doing so allows to understand which tive relationship between a currency appreciation and

sectors, industries, services, and products are most im-

prices has already been observed in empirical data

pacted by exchange rate policies. Such information

across multiple countries (Bhattarai, 2011; Carranza

greatly benefit central banks policymaking by helping

et al., 2009; Nguyen, 2012; Pindiriri, 2012; Umeora,

them plan how exchange rate interventions and policy

2010). Despite the complexity of monetary transmis-

changes can affect specific groups of agents. Under-

sion mechanisms, the most likely channel in this case

standing the specific effects of their policies on prices

becomes even more important given the prevalence of is for the appreciation to cause an increase in the pur-

price stability objectives in modern central banking chasing power of households together with a higher

(De Gregorio, 2012). demand for imports, leading to an overall negative

The Swiss franc appreciation of 2015 provides a fit- domestic inflation (Leitemo and Söderström, 2008).

ting empirical framework to study these relations. The However, this general result lacks details on which

types of goods and services are most impacted by this

Correspondence: alex.oktay@unil.ch

University of Lausanne, Lausanne, Switzerland

negative relationship. While considering inflation as a

Full list of author information is available at the end of the article whole works for inflation forecasting (Hubrich, 2005),Oktay Page 2 of 9

it proves to be limited for other purposes such as eval- country, I used the HICP, a collective effort by nations

uating the macroeconomic impact of the policies or to standardize their observations of CPI to allow for

the persistence of inflation, which differ for each cate- comparisons. The data are provided by the Statistical

gory of goods (Lunnemann and Mathä, 2004). As such, Office of the European Union. There is currently no

general inflation underestimates the heterogeneity be- scientific evidence of a bias in the HICP (Wynne and

tween different industries, regions and products, lead- Rodriguez-Palenzuela, 2004).

ing to potential adverse effects if not considered in pol- This dataset of prices was cleaned for easier anal-

icymaking. ysis and interpretation. For the purpose of my anal-

Recent literature started to analyze the effect of ex- ysis, I used monthly HICP panel data from January

change rates on specific prices. Breinlich et al. (2019) 2014 to December 2015 for 34 countries in the Eu-

studied import costs in the context of Brexit, which ropean region[1] . Due to some data not being avail-

confirms the heterogeneity of products reaction based able in some countries, I averaged all 33 countries (ex-

on their import share. One step further, Auer et al. cluding Switzerland) in a single ”Euro-Average” vari-

(2021a) outlines the role of the invoice currency in able weighted by their respective GDP. The dataset is

the elasticity of prices to exchange rates, with foreign- originally separated in 468 multi-levels types of goods

invoiced goods being more affected by the fluctuations. but has to be trimmed down to 76 (shown in table

Both of these papers provide convincing explanations 3) because multiple subcategories are not available

of price movements, together with estimates of import-

for Switzerland before 2015. Moreover, some subcat-

share (Breinlich et al., 2019, pp. 45–47) and invoice

egories must be removed due to a low frequency (usu-

currency (Auer et al., 2021a, pp. A10–A14) for vari-

ally quarterly and yearly). While this removes some

ous types of products. The purpose of this paper is to

precision in the analysis of which goods are most af-

contribute to this recent literature by providing esti-

fected by the shock, it does not create a bias in the

mates of the elasticity of prices on the exchange rate

results. The final input data is a panel dataframe of

for different categories of goods and services.

My results outline the important differences in how the prices of 76 types of goods and services, over two

various industries are affected by currency fluctuations regions (Switzerland and Europe), on a monthly fre-

following changes in exchange rate policies. They show quency from January 2014 to December 2015.

that liquid fuels (such as gasoline, kerosene, and diesel)

are the most impacted goods, with prices dropping af- 2.2 The Swiss franc appreciation of 2015

ter a currency appreciation. The tourism sector also The SNB introduced an exchange rate ceiling on the

greatly relies on exchange rates, with holiday prod- Swiss franc in 2011. This change of policy followed

ucts and services related to holidays and accommo- how the currency came under much upward pressure

dation dwindling soon after the SNB announcement. due to capital inflows resulting from the European

The last category to be actively impacted is small- debt crisis. The commonly accepted safe haven posi-

sized durable goods (such as books), which prices suf- tion of Switzerland (Baltensperger and Kugler, 2016)

fer from cross-border shopping and international on- plays an important role in the appreciation pressure on

line delivery. Most categories of services (excluding the Swiss franc, which tends to attract foreign capitals

tourism) and fast-moving consumer goods have much following external crises and uncertainty (Ranaldo and

lower elasticities than these products. The full results Söderlind, 2010). Consequently, the sovereign debt cri-

are presented in table 3. sis that started in 2010 with the Greek budget deficits

The paper is organized as follows. Section 2 intro- led to much volatility that was anticipated to make

duces the data, empirical context, and identification the Swiss franc appreciate. With interest rates already

strategy. Section 3 presents the results of the currency close to the zero lower bound, the SNB decided to re-

appreciation on prices. In section 4 I discuss the re- spond with foreign exchange interventions and to in-

sults in the context of monetary policymaking. Section troduce an explicit ceiling on the EUR/CHF exchange

5 concludes. rate at CHF 1.2 per Euro to prevent a domestic ap-

preciation (Hui et al., 2016).

2 Methodology

2.1 Data List of countries: Belgium, Bulgaria, Czech Republic,

[1]

The analysis presented in this paper is based on the Denmark, Germany, Estonia, Ireland, Greece, Spain,

Harmonized Index of Consumer Prices (HICP). The France, Croatia, Italy, Cyprus, Latvia, Lithuania,

more widely known Consumer Price Index (CPI) pro- Luxembourg, Hungary, Malta, Netherlands, Austria,

vides the perfect framework to analyze the price evo- Poland, Portugal, Romania, Slovenia, Slovakia, Fin-

lution of a wide range of products and services. How- land, Sweden, Iceland, Norway, Switzerland, United

ever, as its methodology often differs from country to Kingdom, North Macedonia, Serbia, TurkeyOktay Page 3 of 9

This ceiling was maintained until January 15, 2015, and foreign economies for multiple years (Lleo and

when the SNB surprised the market by suddenly re- Ziemba, 2015). However, the results of Auer et al.

nouncing to maintain its peg. The underlying reason (2021a) point toward a one-year impact of the shock

for this can be traced back to the European Cen- on prices, which motivate the use of data from January

tral Bank (ECB) quantitative easing program, which 2014 to December 2015 for this analysis. Doing so al-

made the peg too expensive to maintain as it required lows one year before the shock for pre-trend analysis

large amounts of foreign reserves (Lleo and Ziemba, and one year after the shock to infer the pseudo-causal

2015). This decision came together with the imple- impact of the appreciation on prices.

mentation of negative interest rates, which questions

the zero lower bound position of Switzerland in 2011 2.3 Identification strategy

(Berhold and Stadtmann, 2018). The market reacted A naive comparison of Swiss prices before and after

with a sudden appreciation of the Swiss franc, with the shock would produce biased results. Prices are af-

fected by a variety of factors that make the identifi-

the EUR/CHF decreasing as low as 0.975 on the day

cation of the unpegging shock impossible without a

of the announcement. The Swiss franc then depreci-

counterfactual due to endogeneity, making the results

ated and stabilized at around 1.04 to 1.09 for the rest

uninterpretable (Antonakis et al., 2010). For instance,

of the year, which represents approximately a 10% ap-

oil prices depreciated largely in 2014-2015 due to for-

preciation in the medium term. This sudden reaction

eign policy and financial changes (Baffes et al., 2015)

demonstrates how the SNB decision clearly surprised

which makes it impossible to identify the portion of

the market, with no evidence of expectations for this

price change attributable to the SNB announcement.

announcement (Mirkov et al., 2019).

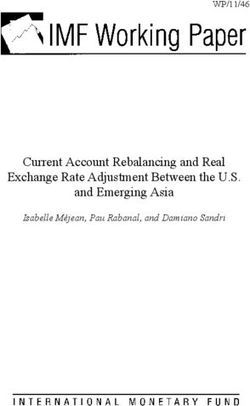

Moreover, as seen in figure 1, the shock came in a

period of inflation for Europe due to the quantita-

102 Prices tive easing program of the ECB. As such, computing

only the slight negative inflation that was observed

in Switzerland would underestimate the real negative

101 effect of the shock on prices, as it would fail to con-

sider the inflation that would have happened otherwise

in Switzerland as a spillover from the Euro inflation

100

(Falagiarda et al., 2015). Given how the United King-

dom faced similar inflation as other countries despite

99 not using the euro, it is likely that the ECB inflation

jan14 jul14 jan15 jul15 spreads to Switzerland as well despite not using the

United Kingdom France Denmark Switzerland same currency. Due to the wide range of factors im-

pacting prices of various goods and services, control

Figure 1 Inflation in selected countries. Notes: HICP all-items variables would most likely not be able to significantly

aggregate with prices normalized to January 2014. Dotted line

at January 2015 level indicate the time of the SNB unpegging decrease the bias (Clarke, 2005).

announcement and ECB quantitative easing program This paper uses the difference-in-differences method-

ology as a solution to endogeneity. By using the rest

of Europe as a counterfactual to Switzerland, identi-

The rest of Europe can be used as an imperfect coun-

fication of the effect of the exchange rate policy on

terfactual for this shock. As a small exporting coun- prices can be made. A necessary condition for this in-

try, Switzerland relies heavily on its exchange rate ference is for both Switzerland and Europe prices to

for economic growth, so that the shock had signifi- follow parallel paths before the shock (Abadie, 2005).

cant implications for the Swiss economy. On the other This assumption is verified for general prices (figure

hand, Switzerland is only a small trading partner for 2), as well as for the most affected categories of goods

the whole of Europe, so that the overall continent (figure 3). Even if this assumption remains robust for

was only slightly impacted by these local fluctuations. most of the 76 types of goods and services presented in

Even though there were some negative consequences table 3, a small number of them exhibit unpredictable

for CHF-denominated loans in foreign countries, espe- non-parallel trends. This can mostly be explained by

cially regarding mortgages in Central and Eastern Eu- their prices having a larger volatility, resulting in non-

rope (Vassileva, 2020), taking the Euro-average prices significant p-values for the categories concerned. All in

makes these specific cases marginal. all, the DID can be tested for the prices of all types of

My analysis focuses on 24 months of data: one year goods and services (k) using the SNB announcement

before the shock and one year after. The announce- as the treatment with equation 1.

ment had many positive and negative financial effects

on different agents that are likely to impact the Swiss priceik = αk + βk CHik + γk tik + δk DIDik + ik (1)Oktay Page 4 of 9

Where CHik is a dummy for Switzerland, tik is and post-treatment general prices, as seen on figure 2,

a dummy for the post-treatment period (after Jan- outlines how Europe faced inflation while Switzerland

uary 2015), and DID is the multiplication of the two prices decreased. As such, a naive comparison of pre-

(DIDik ≡ CHik ∗ tik ), run for both Switzerland and treatment and post-treatment prices in Switzerland

Europe (i).Under this regression, δ will thus measure would underestimate the effect of the SNB decision,

the DID effect of the monetary appreciation on prices as it misses the inflation that would have happened

for a specific category of goods or services k. without the treatment, as seen elsewhere in Europe.

Despite its benefits, the DID approach has some lim-

its and remains unusual in macroeconomics. Indeed, Table 1 Difference-in-differences estimate of the Swiss franc

this econometric method is mostly studied in microe- appreciation on Swiss general prices

conomic research due to its potential for causal in- HICP All-Goods index

ference, even though some issues such as serial cor- Intercept 101.06∗∗∗

relation often bias its results (Bertrand et al., 2004). (0.11)

Some studies have used the DID approach in the con-

Switzerland dummy −0.55∗∗∗

text of inflation and macroeconomic variables, either (0.16)

directly such as Takyi and Fosu (2019), or combined

with a vector autoregression approach such as Mishkin Post-treatment 0.47∗∗∗

and Schmidt-Hebbel (2007). The scarce usage of this (0.17)

methodology for such topics probably comes from the Diff-in-Diff estimate −1.29∗∗∗

need to have a shock that is completely exogenous from (0.24)

the counterfactual, which is uncommon in macroeco- Notes: DID regression following equation 1 on monthly general prices

nomic data and makes any identification strategy diffi- (CPI aggregate), with Switzerland as the domestic country and Europe

(GDP-weighted average of all European countries) as the counterfac-

cult (Nakamura and Steinsson, 2018). In the case of the tual. Respective prices are normalized to January 2015. Pre-treatment

Swiss franc unpegging, the shock certainly had some from January 2014 to January 2015, post-treatment from February

2015 to December 2015. ∗ pOktay Page 5 of 9

tive relationship between a currency appreciation and on oil prices. This high elasticity can be traced back

inflation. to the fact that Switzerland has to import all of its oil,

which should result in a high proportion of foreign-

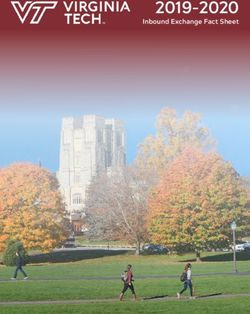

3.2 Most impacted goods denominated invoices. This result confirms the find-

A second analysis can be conducted on the specific ings of Auer et al. (2021a) that imports and invoice

prices of each category of goods and services. Equa- currencies are the largest determinant of the elasticity

tion 1 can be used to regress each of the 76 HICP of prices on exchange rates.

categories. The full results are presented through their Another heavily impacted industry is the travel and

implied elasticities in table 3. Most prices were affected tourism sector. This is true both for goods (such as

negatively by the currency appreciation, with only a package holiday, displayed in figure 3 and table 2) and

few non-significant positive ones. The three most im- services (such as holidays, accommodation, and restau-

pacted categories deserve a specific analysis in order rants displayed in table 3). While there are some sea-

to understand the common underlying factors to their sonality effects and a weaker parallel trend assump-

higher elasticity. Their regression results are presented tion, the exchange rate shock had a clear negative

in table 2. effect on this sector, with an estimated negative im-

Table 2 Difference-in-differences estimates of the Swiss franc pact of -8.92% for package holidays. This result is in

appreciation on selected Swiss goods line with current literature that a currency apprecia-

Type of goods: tion has major negative effects for domestic tourism

(Santana-Gallego et al., 2010), domestic airlines (Day,

Fuels Holidays Books

1986; Forsyth and Dwyer, 2010), and on the inter-

Intercept 123.19∗∗∗ 103.05∗∗∗ 98.63∗∗∗

(2.43) (1.45) (0.51)

nal holiday market (Greenwood, 2007). While the re-

sult partially confirms Auer et al. (2021a) intuition

Switzerland 7.60∗∗ −0.36 2.01∗∗∗ due to foreign companies invoicing domestic services

dummy (3.43) (2.05) (0.73)

in foreign currencies, it also outlines the importance

Post-treatment −18.84∗∗∗ 2.52 1.42∗ of expenditure switching as customers move to foreign

(3.58) (2.15) (0.76) booking services and international travel rather than

Diff-in-Diff −11.20∗∗ −8.92∗∗∗ −6.54∗∗∗

domestic agencies and internal travel.

estimate (5.07) (3.03) (1.07) The last of the most impacted category were de-

Notes: DID regressions following equation 1 on monthly liquid fuelds, liverable consumer goods. This category is illustrated

package holidays, and books prices with Switzerland as the domes- through the example of books in figure 3 and table 2,

tic country and Europe (GDP-weighted average of all European coun-

tries) as the counterfactual. Respective prices are normalized to Jan- as their price decreased by 6.54% due to the SNB an-

uary 2015. Pre-treatment from January 2014 to January 2015, post- nouncement. These types of goods reflect the ease of

treatment from February 2015 to December 2015. ∗ pOktay Page 6 of 9

a) Liquid fuels b) Package holidays c) Books

100 120 105

90 110

100

80 100

95

70 90

60 80 90

jan14 jul14 jan15 jul15 jan14 jul14 jan15 jul15 jan14 jul14 jan15 jul15

Euro−Zone Switzerland

Figure 3 Selected goods prices before and after the currency appreciation. Notes: prices normalized to January 2014. Dotted lines

are the respective fitted values before and after the treatment for both Switzerland and the counterfactual

must play a role in their price reaction. An important 4 Implications for monetary policy

distinction between these goods and the books men- There is a strong link between prices and welfare which

tioned earlier are that the import process is managed central banks are aware of. Indeed, retail prices are

by corporate agents and importers rather than the con- important components of household finance and wel-

sumer himself with cross-border and online shopping. fare (Massell, 1969; Turnovsky et al., 1980). While this

With the elasticity of books being 0.649 and the elas- explains the price stability objective of many central

ticities of vehicles, electrical appliances, and furniture banks, including the SNB, it also emphasizes the need

being 0.393, 0.334, and 0.38, one can infer that approx- to analyze the effect of exchange rate policies on prices.

imately 57% of the price differential is reflected in the As a result, understanding how goods and services re-

final consumer price if the importation is done by an act to policy changes proves to be critical for matters

importer rather than the consumer himself. This re- of economic inequality (Broda and Romalis, 2009).

sult is in line with the estimate of Auer et al. (2021a) The results of this paper outline specific short-term

that 55% of the import price differential at the border price instability resulting from exchange rate policy

is reflected at the retail level. changes. Indeed, my analysis showed that the one-year

Secondly, most fast-moving consumer goods (FMCG; price differential caused by a change of monetary pol-

such as food and beverages) reacted less than the aver- icy follows a heterogeneous pattern between types of

age elasticity. The fact that the currency appreciation goods. Even if the overall price level remained in an

only has a small effect on these products can be re- acceptable range following the Swiss Bank unpegging,

lated to the fact that many of them are produced and some goods such as liquid fuels, tourism products and

consumed locally, with only a small part relying on durable goods faced major price instability in the year

imports. This growing trend to consume local FMCG following the shock. As such, some industries and con-

goods can be linked to a preference for local foods dis- sumers were affected much more heavily than others

played by many consumers (Meyerding et al., 2019). in the year following the policy change.

As a result, the import share and foreign-currency in- However, the price stability objective of many cen-

voicing share for these types of goods are low, which tral banks refers to time horizons larger than one year.

confirms the findings of Breinlich et al. (2019) and Defining the timeframes behind the usual short-term,

Auer et al. (2021a). medium-term, and long-term inflation jargon can be

Lastly, it is interesting to note that most services achieved by looking at specific central bank policies.

(excluding those linked to tourism such as hotels and The ECB currently considers a one-year horizon to

restaurants) are also affected below the overall aver- be short, three to be medium, and above three to be

age, with elasticities ranging from 0.071 to 0.187. This long (Stanislawska and Paloviita, 2021), which means

can be explained by the local nature of most services that only short-term inflation is analyzed in this paper.

(such as housing, personal care, and communication) While the SNB does not provide an exact horizon, the

that greatly reduces imports and expenditure switch- Federal Reserve of the United States publicly targets

ing. Once again, this result is in line with the afore- medium-term inflation (Svensson, 2020). As a result,

mentioned studies. one can infer that the price stability objective of manyOktay Page 7 of 9

central banks refers to periods larger than one year, or An important development to this analysis would

even larger than three years. be to analyze the persistence of sector-specific infla-

Short-term instability of prices can sometimes be tion after the one-year time frame to determine the

necessary to achieve long-term stability. In the case mechanism of transition between short-term, medium-

of Switzerland, the SNB exchange rate policy change term, and long-term inflation. Another development,

was probably conducted with long-term objectives in which was already started by Auer et al. (2021b), is to

mind, knowing that short-term instability would fol- analyze expenditure switching heterogeneity as a po-

low. Indeed, the peg required large amounts of foreign tential complementary explanation for differences in

reserves, and the anticipated depreciation of the euro price reaction, as hinted by my results on tourism.

due to the ECB new quantitative easing policy led An additional analysis could be to use the same DID

to the unpegging choice of the SNB to avoid foreign methodology across multiple Swiss franc shocks, in or-

reserves problems in the long run (Lleo and Ziemba, der to understand if the same industries remain the

2015). Given the importance of foreign reserves for most impacted ones across time in Switzerland. Fi-

small open economies, long-term stability could have nally, replicating this empirical framework to shocks

been compromised without the exchange rate policy in other countries to analyze spatial variations in the

change. inflation arising from exchange rate fluctuations. All of

The results of this paper outline that specific short- these elements would allow to better understand the

term instability should also be considered in mone- monetary transmission mechanism in the context of

tary policymaking, with long-term objectives remain- large changes in monetary policy, which is of impor-

ing the first target. With prices being slow to adjust tance for central banks as well as for the general econ-

to monetary policies (Ireland, 2010) and the short- omy where short-term fluctuations also have much of

term instability concerning only a restricted number an impact on corporate and private budgets.

of sectors, these results do not suggest that central

banks should respond to these immediate fluctuations Appendix

or abstain from changing monetary policy. Medium- Table 3 Elasticities of prices to indirect exchange rates, implied

by difference-in-differences estimates

term price stability remains the most important goal of

inflation-targeting central banks, but changes of mon- Type of goods Elasticity

etary policy also need to take the short-term sector-

All-items HICP 0.128∗∗∗

specific fluctuations into consideration. More specifi-

Accommodation services 0.495∗∗

cally, the petroleum industry, the tourism sector and

Actual rentals for housing 0.154∗∗∗

the durable goods sector are expected to face more in-

Alcoholic beverages 0.187∗∗∗

flation than others following policy-induced exchange

Audio-visual equipment 0.508∗∗∗

rate fluctuations. Even though the general negative ef- Beer 0.304∗∗∗

fect on an economy may be small, this result has large Books 0.649∗∗∗

consequences on firms and customers in specific sec- Bread and cereals 0.024

tors. Understanding who will be affected and quanti- Carpets and other floor coverings −0.035

fying how the policy will impact their welfare should Cleaning, repair and hire of clothing 0.118∗∗∗

thus be two important considerations of monetary pol- Clothing −0.478

icymaking, which are partially answered through this Coffee, tea and cocoa 0.296∗∗∗

paper and emerging literature. Communications 0.073∗∗

Cultural services 0.241∗∗∗

5 Conclusion Education 0.041

Assessing whether inflation is general or specific, and Electrical appliances 0.334∗∗∗

whether the shock is transitory or permanent is not Electricity, gas and other fuels 0.495∗∗∗

an easy task for central banks, as perfectly isolating

the effect of a shock is close to impossible on macro-

level data. This paper, which manages to use some

degree of causal inference thanks to the difference-in-

differences methodology, shows that inflation impacted

some sectors much more heavily than others, outlining

the heterogeneity of prices and the need for central

banks to consider some industries more carefully than

others.Oktay Page 8 of 9

Energy 0.41∗∗ Services - miscellaneous 0.117∗∗∗

Equipment for sport and recreation 0.229∗∗∗ Services: communication 0.073∗∗

Fish and seafood 0.312∗∗∗ Services: housing 0.143∗∗∗

Food (aggregated) 0.105∗∗∗ Services: holidays and accommodation 0.681∗∗∗

Footwear −0.295 Services: recreation and personal care 0.187∗∗∗

Fruit 0.357∗∗ Services: transport 0.071

Fuels and lubricants for transport 0.306 Solid fuels 0.675∗∗∗

Furniture and furnishings 0.38∗∗∗ Spare parts and accessories for vehicles 0.316∗∗∗

Games, toys and hobbies 0.193∗∗∗ Spirits 0.257∗∗∗

Gardens, plants and flowers 0.181∗∗∗ Sugar, jam, honey and confectionery −0.08∗

Garments −0.565 Telephone and telefax equipment 0.115

Glassware, tableware and utensils 0.118∗∗∗ Telephone and telefax services 0.044

Heat energy 0.126∗ Tobacco 0.185∗∗∗

Household appliances 0.499∗∗∗ Tools and equipment for house+garden 0.192∗∗∗

Household maintenance 0.087∗∗∗ Vegetables 0.456∗

Household textiles 0.254∗∗∗ Wine 0.121∗∗∗

Industrial goods 0.205∗∗∗ Miscellaneous goods and services 0.071∗∗

Information processing equipment 0.234∗∗ Notes: DID regression following equation 1 on prices of each

Insurance connected with transport 0.419∗∗∗ subcategory of the HICP, with Switzerland as the domestic

country and Europe (GDP-weighted average of all European

Liquid fuels 1.111∗∗ countries) as the counterfactual. Implied elasticities are cal-

Maintenance and repair of dwelling 0.089∗∗∗ culated from equation 2 using the DID estimates. Respective

prices are normalized to January 2015. Pre-treatment from Jan-

Meat 0.007 uary 2014 to January 2015, post-treatment from February 2015

Medical products 0.206∗∗∗ to December 2015. Some names have been shortened from the

HICP categories. Excludes categories for which monthly data

Milk, cheese and eggs −0.022 is not fully available in 2014-2015 for Switzerland. ∗ pOktay Page 9 of 9 References Ireland, P. N. (2010). Monetary transmission mechanism. In Monetary Abadie, A. (2005). Semiparametric difference-in-differences estimators. economics, pages 216–223. Springer. The Review of Economic Studies, 72(1):1–19. Khan, M. I. (2017). Falling oil prices: Causes, consequences and policy Antonakis, J., Bendahan, S., Jacquart, P., and Lalive, R. (2010). On implications. Journal of Petroleum Science and Engineering, making causal claims: A review and recommendations. The leadership 149:409–427. quarterly, 21(6):1086–1120. Leitemo, K. and Söderström, U. (2008). Robust monetary policy in a small Auer, R., Burstein, A., and Lein, S. (2021a). Exchange rates and prices: open economy. Journal of Economic Dynamics and Control, evidence from the 2015 swiss franc appreciation. American Economic 32(10):3218–3252. Review, 111(2):652–86. Lleo, S. and Ziemba, W. T. (2015). The swiss black swan bad scenario: Is Auer, R., Burstein, A., Lein, S., and Vogel, J. (2021b). Unequal switzerland another casualty of the eurozone crisis? International expenditure switching: Evidence from switzerland. Working paper. Journal of Financial Studies, 3(3):351–380. Baffes, J., Kose, M. A., Ohnsorge, F., and Stocker, M. (2015). The great Lunnemann, P. and Mathä, T. Y. (2004). How persistent is disaggregate plunge in oil prices: Causes, consequences, and policy responses. inflation? an analysis across eu 15 countries and hicp sub-indices. Technical report, World Bank Policy Research Note 15/01. Technical Report 415, European Central Bank. Baggs, J., Fung, L., and Lapham, B. (2018). Exchange rates, cross-border Massell, B. F. (1969). Price stabilization and welfare. The Quarterly travel, and retailers: Theory and empirics. Journal of International Journal of Economics, 83(2):284–298. Economics, 115:59–79. Meyerding, S. G., Trajer, N., and Lehberger, M. (2019). What is local Baltensperger, E. and Kugler, P. (2016). The historical origins of the safe food? the case of consumer preferences for local food labeling of haven status of the swiss franc. Aussenwirtschaft, 67(2):1–30. tomatoes in germany. Journal of Cleaner Production, 207:30–43. Berhold, K. and Stadtmann, G. (2018). Who put the holes in the swiss Mirkov, N., Pozdeev, I., and Söderlind, P. (2019). Verbal interventions and cheese? currency crisis under appreciation pressure. Journal of Central exchange rate policies: The case of swiss franc cap. Journal of Banking Theory and Practice, 7(1):43–57. International Money and Finance, 93:42–54. Bertrand, M., Duflo, E., and Mullainathan, S. (2004). How much should Mishkin, F. S. and Schmidt-Hebbel, K. (2007). Does inflation targeting we trust differences-in-differences estimates? The Quarterly journal of make a difference? Working Paper Series 12876, National Bureau of economics, 119(1):249–275. Economic Research. Bhattarai, K. (2011). Impact of exchange rate and money supply on Nakamura, E. and Steinsson, J. (2018). Identification in macroeconomics. growth, inflation and interest rates in the uk. International Journal of The Journal of Economic Perspectives, 32(3):59–86. Monetary Economics and Finance, 4(4):355–371. Nguyen, T.-P. (2012). Exchange rate policy and the foreign exchange Breinlich, H., Leromain, E., Novy, D., and Sampson, T. (2019). Exchange market in Vietnam, 1985-2009. PhD thesis, Griffith University. rates and consumer prices: Evidence from brexit. Working paper, CEPR Pindiriri, C. (2012). Monetary reforms and inflation dynamics in zimbabwe. Discussion Paper No. DP14176. International Research Journal of Finance and Economics, 90:207–222. Broda, C. and Romalis, J. (2009). The welfare implications of rising price Ranaldo, A. and Söderlind, P. (2010). Safe haven currencies. Review of dispersion. Working paper, University of Chicago. finance, 14(3):385–407. Campbell, J. R. and Lapham, B. (2004). Real exchange rate fluctuations Santana-Gallego, M., Ledesma-Rodrı́guez, F. J., and Pérez-Rodrı́guez, J. V. and the dynamics of retail trade industries on the us-canada border. (2010). Exchange rate regimes and tourism. Tourism Economics, American Economic Review, 94(4):1194–1206. 16(1):25–43. Carranza, L., Galdon-Sanchez, J. E., and Gomez-Biscarri, J. (2009). Stanislawska, E. and Paloviita, M. (2021). Medium-vs. short-term Exchange rate and inflation dynamics in dollarized economies. Journal consumer inflation expectations: evidence from a new euro area survey. of Development Economics, 89(1):98–108. Bank of Finland Research Discussion Paper, 10. Clarke, K. A. (2005). The phantom menace: Omitted variable bias in Svensson, L. E. (2020). Monetary policy strategies for the federal reserve. econometric research. Conflict management and peace science, Working paper, National Bureau of Economic Research. 22(4):341–352. Takyi, P. O. and Fosu, R. (2019). Inflation targeting monetary policy and Day, A. E. (1986). Impact of exchange rates on air travel. International macroeconomic performance: The case of middle-income countries. Journal of Hospitality Management, 5(3):115–119. Applied Economics and Finance, 6:1–9. De Gregorio, J. (2012). Price and financial stability in modern central Turnovsky, S. J., Shalit, H., and Schmitz, A. (1980). Consumer’s surplus, banking. Economia, 13(1):1–11. price instability, and consumer welfare. Econometrica, pages 135–152. Duch-Brown, N. and Martens, B. (2015). Barriers to cross-border Umeora, C. E. (2010). Effects of money supply and exchange rates on ecommerce in the eu digital single market. Technical report, Institute for inflation in nigeria. Journal of Management and Corporate Governance, Prospective Technological Studies, Digital Economy Working Paper 2. 2015/07. Vassileva, R. (2020). Monetary appreciation and foreign currency Falagiarda, M., McQuade, P., and Tirpák, M. (2015). Spillovers from the mortgages: Lessons from the 2015 swiss franc surge. European Review ecb’s non-standard monetary policies on non-euro area eu countries: of Private Law, 28(1). evidence from an event-study analysis. ECB Working Paper 1869, Wynne, M. A. and Rodriguez-Palenzuela, D. (2004). Measurement bias in European Central Bank. the hicp: what do we know and what do we need to know? Journal of Forsyth, P. and Dwyer, L. (2010). Exchange rate changes and the cost Economic Surveys, 18(1):79–112. competitiveness of international airlines: The aviation trade weighted index. Research in transportation economics, 26(1):12–17. Gomez-Herrera, E., Martens, B., and Turlea, G. (2014). The drivers and impediments for cross-border e-commerce in the eu. Information Economics and Policy, 28:83–96. Greenwood, C. (2007). How do currency exchange rates influence the price of holidays? Journal of Revenue and Pricing Management, 6(4):272–273. Hubrich, K. (2005). Forecasting euro area inflation: Does aggregating forecasts by hicp component improve forecast accuracy? International Journal of Forecasting, 21(1):119–136. Hui, C.-H., Lo, C.-F., and Fong, T. P.-W. (2016). Swiss franc’s one-sided target zone during 2011–2015. International Review of Economics & Finance, 44:54–67. Huntington, H. G. (2005). The economic consequences of higher crude oil prices. Energy modeling special report, 9.

You can also read