Masterplan Review 2017 - Consultation Paper January 2017 www.dublinport.ie/masterplan - Dublin Port

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Contents

Foreword 03

Executive Summary 06

Review of the Masterplan’s Rationale and Objectives 09

Review of Forecasts to 2040 22

Review of Infrastructure Development Options 35

Environmental Aspects Review 49

Implementation Review 52

Invitation to Comment 54

01Foreword

Dublin Port Company (DPC) adopted the Masterplan 2012 to 2040 • Economic recovery leading to a return to annual compounding The Masterplan was originally produced in order to provide all of

on 26th January 2012 following an extensive public consultation, growth in port volumes the Port’s stakeholders with a clear view as to how the Port will be

stakeholder engagement and environmental assessment process. • Commencement of the Alexandra Basin Redevelopment developed in the long-term.

(ABR) Project which, in itself, includes about one-third of the

The Masterplan provides a vision as to how Dublin Port could be infrastructure development options originally identified in the Now, five years on, there is more clarity as to how Dublin Port

developed to cater for an anticipated doubling in port volumes Masterplan should be developed in order to meet the objectives set out in the

over the 30 years from 2010 to 2040. It provides strategic guidance Masterplan.

• Recovering control over 11.2 hectares of Port lands making

and direction on land use within Dublin Port recognising that the

them available for redevelopment

optimal use of a scarce land and quayside resource remains an This review is intended to update and refine the infrastructure

important factor against which future development of Dublin Port • Completion of a number of site redevelopments in Dublin Port to development options for Dublin Port and, in doing this, to ensure

must be carefully planned. provide an additional 16.1 hectares of accessible port lands that the Masterplan continues to provide the best solution for the

• Redevelopment of 720m of quay walls future sustainable development of Dublin Port through to 2040.

Since its introduction, the Masterplan has in fact played a • Purchase by DPC of a 44 hectare site adjacent to Dublin Airport

significant role in providing guidance and strategic context on the for the development of a new Dublin Inland Port facility The land areas covered in this review are shown in Drawing 1 and

future of the Port not only to DPC but also to National and Local comprise:

• Publication of the National Ports Policy, March 2013

Government, statutory agencies and planning and development • Port lands on the North Side of the River Liffey

agencies. The Masterplan has informed National Ports Policy, • Publication by the Competition Authority of its report

Competition in the Irish Ports Sector, November 2013 • Port lands on the Poolbeg Peninsula

Transport Policy and guided the Planning and Permitting

Authorities in determining policies and specific proposals • Publication of DPC’s Franchise Policy, May 2014 • Recently acquired lands adjacent to Dublin Airport to be

concerning Dublin Port. developed as Dublin Inland Port

• Publication by NTA of its Transport Strategy for the Greater

Dublin Area, 2016 to 2035 • The road connections linking these three separate land areas

It was recognised that the Masterplan needed to be kept under including the Dublin Port Tunnel and the last mile connection

• Creation of the Dublin Bay Biosphere in June 2015 as a joint

review to ensure that it remains relevant and achieves its central between it and the south port area to be developed as part of

initiative by:

objective of providing a clear vision for the development of the Port the NTA’s Transport Strategy for the Greater Dublin Area 2016-

into the future. –– DPC 2035

–– Dublin City Council

Changes in the demand levels for port infrastructure were –– Fingal County Council A detailed view of the core Port lands north and south of the River

recognised as the key element impacting on the timing of a review –– Dun Laoghaire Rathdown County Council Liffey is shown in Drawing 2.

of the Masterplan. At this juncture in early 2017 it is clear that the

–– Department of Arts, Heritage and the Gaeltacht

level of demand for port infrastructure will likely be greater than

originally anticipated due to a higher than originally envisaged level –– Fáilte Ireland

of growth in cargo volumes for the period to 2040. • Creation of the Poolbeg West Strategic Development Zone,

Since the Masterplan was published in 2012, there has been a May 2016

number of significant developments which support this timely • Publication by Dublin City Council of the Dublin City

review of the Masterplan. These developments include: Development Plan 2016 to 2021

03Executive Summary

1. D

ublin Port remains a key facilitator of merchandise trade in

Ireland handling 44% of all port volumes in the country. The

5. It remains imperative that DPC takes a realistic and strategic view

on the provision of additional port capacity. Port infrastructure “DPC believes that the

Port also plays a significant role from a tourism perspective as a projects need to be identified long in advance given the

gateway for visitors to Ireland. The real value of Dublin Port’s lands long permitting and construction lead times. Infrastructure Port can be developed

is the contribution that they make to the national and regional development proposals need to be realistic mindful of the

economy as a piece of strategic infrastructure. principles of proper planning and sustainable development. to cater for anticipated

2. S

ince its introduction in 2012, the DPC Masterplan has played

a significant role in providing guidance and strategic context on

6. D

PC believes that the Port can be developed to cater for

anticipated volumes through to 2040 within the Port’s existing

volumes through to

the future of the Port both to DPC and to a range of external

stakeholders. The Masterplan has informed National Ports Policy

footprint and without significant major infill works. This will require

the maximum utilisation of brownfield sites and adjacent river

2040 within the Port’s

and Transport Policy as well as planning and permitting authorities berthage.

in determining policies and specific proposals concerning Dublin existing footprint and

Port.

7. T

here are eight Strategic Objectives which underpin both the

Masterplan and this Review; without significant major

3. T

he Masterplan provided for a review mechanism linked to • Port functions

changes in the demand for port infrastructure. It is clear now that

• Investment and growth

infill works. This will

the level of demand for port infrastructure will likely be greater

than originally anticipated in the Masterplan. There have also been

some significant developments in national and regional policies

• Integration with the City

• Movement and access

require the maximum

as well as progress with individual projects and initiatives which

make this review in early 2017 timely.

• Environment and heritage

• Recreation and amenity

utilisation of brownfield

4. T

his review is intended to inform the further development of

• Security sites and adjacent river

• Future review

Dublin Port with inputs from all stakeholders so that the vision in

the Masterplan remains the best solution for the future sustainable 8. A

n analysis of progress against each of these areas in Section berthage.”

development of the Port, the City and the Bay in the period to 3 (Tables 3.1 to 3.8) indicates how the Masterplan continues

2040. to guide DPC in achieving the overall objective of servicing

anticipated trade volumes through to 2040 in a manner that

conforms with proper planning and sustainable development.

069. If the infrastructure development options outlined in the 12. It is expected that passenger volumes will continue to grow to 15. T

his review is supported by an accompanying Environmental

Masterplan, as revised in this review, are not brought forward for 2040, both from ferry passenger traffic and cruise vessels. Dublin Report prepared by RPS Consulting Engineers for DPC which

development in a timely fashion to meet anticipated capacity, Port has the potential to become a home port for the cruise is a detailed summary of the assessments carried out for

DPC will need to review additional options to meet that demand. industry although this will require increased hotel capacity in the the Masterplan and describes in some detail the permitting

City to be viable. A growth in cruise visitors from 159,000 in 2016 applications and consents secured since 2012. The Report also

to 610,000 by 2040 is seen as reasonably achievable. details the environmental monitoring and mitigation initiatives

10. A

key question in reviewing the Masterplan is to determine what

undertaken by DPC since 2012 and can be accessed at

will be the long run growth assumption in cargo volumes to 2040.

www.dublinport.ie/masterplan.

The Masterplan originally estimated that annual growth would 13. T

he infrastructure development options identified in the

average 2.5% from 2010 to 2040 leading to a doubling to 60.m Masterplan remain largely valid. However, there are three

gross tonnes by 2040. Experience since 2010 leads DPC to interrelated factors which necessitate some changes to the 16. P

roposals presented by DPC in this review of the Masterplan

believe that volumes will double by 2032 and that by 2040 will options originally envisaged: will significantly reduce the potential environmental impact of the

have grown to 77m tonnes, equating to a revised annual average • DPC’s belief that volumes to 2040 can be met within the next implementation phase of the DPC Masterplan 2012 to 2040.

growth rate of 3.3%. existing footprint of the Port without the need for the eastern These include the redevelopment of brownfield sites within the

infill adjacent to the north Port lands. Port’s existing footprint, the relocation of non-core activities to

Dublin Inland Port and the absence of infill adjacent to the North

11. W

ithin different cargo modes, the following growth profiles are • NTA proposals to improve connectivity between the Dublin Port

Port area or further deepening of the navigation channel to below

expected in the period to 2040: Tunnel and the South Port open up the possibility of significant

-10m CD.

• Ro-Ro is expected to grow most, increasing from 0.7m additional port capacity on the Poolbeg Peninsula.

units to 2.2m units by 2040 with a particular increase in • The acquisition by DPC of 44 hectares of land 14km from the

unaccompanied Ro-Ro and containers which tend to require Port opens up the prospect of large areas of port land currently 17. D

PC is implementing the Masterplan by a series of six five year

more land. used for port related but non-core activities being redeveloped strategic plans, which are detailed in Table 7.1. DPC is also

for core port activities. confident that its financial strength is sufficient to allow future

• Lo-Lo is expected to grow from 0.6m TEU in 2010 to 1.6m

projects required to meet the objectives of the Masterplan to be

TEU by 2040.

financed.

• Bulk liquid is likely to stabilise at about 4.0m tonnes per 14. S

ection 5 of this document outlines revised infrastructure

annum. development options which have evolved from the original

• Bulk solid is likely to increase from 2.1m tonnes to 3.5m tonnes Masterplan proposals. This includes a summary of the original

in 2040. Masterplan proposals in 2012 and the updated perspective from

2017. Revised Masterplan infrastructure development options are

• It is expected that Break Bulk volumes will be negligible in

set out and illustrated in Drawing 6.

Dublin Port by 2040.

07Review of the Masterplan’s

Rationale and Objectives

Introduction Drawing No. / Rev EA

ST

HWM

321010900/MP1/2-Rev6 Ship Key

WA

LL East

(71-1

Point

Lighth

56) ouse

Busine

ss

Apts Park

RO

HWM

AD

Portside Business Centre

The Masterplan was originally prepared in 2011 in the depths of the Environmental enhancements/

(1-70) M

50

- Ro-Ro Ship - Bulk Carrier - Cruise Ship

HWM

boundary softening

7

D

ROA

M

50

138

SEAV

- Lo-Lo Ship - Oil Tanker - Tug/Pilot Boat

IEW 1

RCH

AVEN

130

UE

ROAD

HWM

CHU

EAST

152

131

recession, a time of deep pessimism when it was uncertain whether

118

53

Presbytery

52

162

56

134

57

BOND

164

48

M

50

29

HWM

New dedicated Key

ROAD

138

82

62

SHEL

30

Access bridge

21

43

114

174

MALIE

Y

BARG

R 63 19

112

COUR

T

72

22

ROAD

29

39

ROAD

HWM

20

110

186

64

access/exit road 1

28

63

Area Reference Numbers: To be read in conjunction

188

62

17

35

65

H

FORT

106

67

15

BARG

and how quickly economic recovery might happen.

13

18 27 Y

105

with Master Plan Document

72

49

202

16

26

47

74

25 ROAD

R

60 73

MALIE

1

2

58

24

SHEL

Car Import Storage

PROM

71

10 80 125

37

6

8 ENAD

58

2

35

48

81 8

E

11

20

ROAD

19

2

53

48

46

25

RAVE

15

16

1

NSDA

AD

LE 10

46

23

RO

32

14

NEW CUSTOMS

Facility

ND

M 50

36

30

15

BO

M 50

HWM

HOUSE

34

16

ROAD School

4

29

14

28

22

26

2

1

26

15

90

2

HWM

30

PROMENADE

ROAD HWM

1

82

19 Dockland's Innovation

4

Park

32

5

D

1

1

HWM

72

ROA

36

47-79 Silo PROMENADE ROAD

HWM

HWM HWM HWM HWM

16-17

Port

CAL

62

Pump

EDO 5

17 69

CAL 6-7 Station

Pre check-in area (yard)

131

EDO N 19-46

67

ROAD

111

N 15

T

109

The challenges facing Dublin Port to have the capacity to cater

UE

EAS

15

AVOG

13

Tank

1-18

(1-54 1)

42

10 Island (Block

(Block

BOOL

)

Alexandra Place

6)

47

Key

COU 9 Tank

ROA 12

Bulk

EXTENSION

239

RT

D 240

3

2)

237

AD

Centric

Warehouse

Bulk

12)

14

(Block

238

22

RO

(55-1

DRIVE

(Block

ROAD

1

5)

27

79

ND

28 77

21 Apts. 11 Tanks

BO

232 Tanks

1-14 231

3)

229

166)

10

(Block

80 230

2

(113-

'S

HWM

ST Warehouse

HANT

84

7

Seán O'Casey

MERC

Community

Liquid

ROAD

27

1

Centre Apts. 55 Tanks

MA

4)

10 15-48 52 53

167)

18 86

(Block

RY' 9 50

Liquid

(228-

S Tanks

No 2 NTH

6 Church 92

Entrance/check-in booths

Tanks

Environmental enhancements/

RO 5

for future growth in throughput volumes did not appear to be as

25 Court 40

AD

16

17 38

39 Tanks Tanks

2

KILLAN ROAD

37

BOND

23

16 1

NO

RTH 4

2

9-62

TOLKA QUAY ROAD Tank

TOLKA

Apts.4

63 20 QUAY

9

12 7

- 72 18

21

23 ROAD

3

boundary softening

10 Tank

)

ROAD

(63-72

Ro-Ro

8

TOLKA

'S

Tanks

4 QUAY

HANT

5 55 2

8

4

Tank

MERC

11

ROAD

Killan Court 3

Exit booths, Customs,

5 1

12

12 Lo-Lo

13

64 TOLKA

NORTH

Bulk

QUAY ROAD

KILLAN

D

ROA

1

1

54 Warehouse

Bulk

1 43 TOLKA QUAY ROAD

TOLKA QUAY ROAD

immediate then as they do now.

RCH

46 49 9

22

CHU

23

42 48 11

ROAD

Facility

Tanks

32 25

Bulk immigration check

NORTH

39 MERCHANT'S

SQUARE 18

Facility Relocated Tern colonies

38 19

BRANCH

NORTH

Liquid

25

29

ROAD

33

Liquid

TERMINAL ROAD NORTH

34

ROAD

IRVINE

ROAD

5

COTTAGES

3

1

1

3

Liquid

BRANCH

11

EAST

CE

ALEXANDRA

BREAKWATER

ROAD

TERRA

IRVIN 8

E Tank

Tank

7 East Wall Yard

ROAD

HWM

ALEXANDRA ROAD

3

WALL

Tank

Castleforbes Business Park Platform

ALEXANDRA ROAD EXTENSION

7

Environmental enhancements/

ALEXANDRA

SOUTH

EAST

ROAD ALEXANDRA ROAD

SOUTH

SOUTH

Power

Port

ROAD

Tanks

Bulk

Centre

ROAD

Warehouse

HWM

Bulk

ROAD

boundary softening

Industrial Units

Grain Store

BRANCH

BRANCH

Lo-Lo

With rapid growth a reality over the past four years and every

BRANCH

Station

SOUTH

Solid

1

3

2

Bulk

SOUTH

Coal Yard

Solid

165-182

3

SHERIFF

STREET

UPPER

Transit Shed

ROAD

Facility

163

ROAD

Area under construction

Ro-Ro

The Liffy Trust

Centre

North Bank Tanks

BRANCH

Apartments

BREAKWATER

Liquid

Warehouse

Ro-Ro

HWM

TERMINAL ROAD SOUTH

prospect that growth will continue in the years ahead as it had done

5 4

Warehouse 1

Alexander

Terrace Paper Store

Facility Relocated Tern colonies

Tank Castleforbes

Square

HWM

Facility

ROAD

Mh

HWM

Ro-Ro

Castleforbes Square

Lo-Lo

CASTLEFORBES

ROAD

2

LS HWM

9 10 HWM HWM

120m

for decades before the recession, DPC must bring infrastructure

HWM

Berths designed to -15m &

LS

LS

HWM

HWM

WALL

LS

LS

The Point

LS

Facility Berths to accommodate

HWM

MAYOR

STREET

Elevated Ramp

dredged to not less than -11m

EAST

UPPER Freight Terminal

Facility

HWM

Luas Line Area under construction

240m long Ro-Ro ships

Tanks

Area under construction

ES

LS

development projects forward and secure the necessary consents for

HWM

LS HWM

Elevated Ramp

Warehouses

8

Jetty

HWM

HWM

HWM

HWM

HWM

HWM

73

Warehouse

81 82

7

HWM

NORTH WALL Transit Shed

these projects if port capacity is to keep pace with demand.

QUAY

HWM

Berths designed and

89-90

6

HWM

HWM

94

HWM

HWM

NORTH

WALL

HWM

HWM

Cruise Terminal, Tourist Information

QUAY

dredged to -11m

HWM

HWM

HWM

Crane

HWM

HWM

HWM

Rails

HWM

HWM

HWM

Interpretative Centre

HWM

HWM

HWM Elevated Elevated Elevated

Ramp Ramp Ramp

HWM

HWM

HWM

Transit Sheds

Crane Rails

Crane Rail

HWM

HWM

HWM

HWM

HWM

HWM

HWM

SIR Platform

JOHN HWM

ROGERSON'S

Elevated Ramp

QUAY MPs

The infrastructure development options originally proposed in the

Butlers

Court

Ship Turning Area

Campshire

Berths designed and dredged to -11m

House

Butlers Block A

Dredged to

13

Place

QUAY

MP

Possible wildlife observation

Park

House

HWM

MP

Channel Depth

HWM

Tank

STREET

BRITAIN

Masterplan are illustrated in the drawing reproduced here as Figure

HWM

South ber

MP

New bridge over existing platform/ viewing gallery

EAST LINK

Proposed north-south Port Tern colonies

Port View TOLL BOOTH

ths design

1-14

37-51

GREEN YORK

ed to -15

STREET

EAST 15-30 43

ROAD

36 40

m

41

The Waterfront

Apartments 35 60 38 1-4

31 34 52 Hall

BENSON

5-7

cooling water channel

8-19

interconnector bridge

58

to be relocated

PEMBROKE

Factory Ringsend 104

54

20-31

House 44 Alexandra

108-116 55 57

45 Quay HWM

30

MP

31 Technical

MP

32 School

MP

105-106 Fisherman's HWM

Crane Rail

Relocated Tern colonies

MP

Wharf

3.1.

MP 48

HANOVER 117-129 35 E 1A

QUAY RIDG 1 Yacht Club

MP

23 22 ROAD

CAMB

20

HWM

21 103

MP PIGEON

51 14

MP

52

15

HOUSE Crane Rail

THORNCASTLE

102 101

25-56

MP Crane Rail

ROAD

COTTAGES

83 HWM

108 82

57-88

13

12 ls 22 106 29

30

Schoo 105

RINGSEN

Cambridge

D

Square Crane Rail

PARK 64 63

32-35 44

O'Rahilly House

(Flats) 4 ROAD

CAMBR

HWM

36-38

46

8 11 2 E

HWM

Cambridge 3

RIDG 123 45 51

IDGE

Court

South berths designed to -15m

STREET

7 12 1 CAMB

Crane Rail

STREET

1-40 HWM

4 15 1-31 Crane Rail

1-24

137 62

89-112

New quay wall for cruise ships

64

Lo-Lo

17 1

2

PIGEON

1

Canon Mooney Gardens

8

(Flats) 2

1 HOUSE HWM

26 HWM

7

AVENUE

Waterside

Apts 4

ROAD

Bulk 5

6 Cambridge

Freight Yard

Park 1-17 70

Bulk

1-98 7 41-80 71

ry (1-11) 3 Crane Rail

205-242 1

Presbyte Caroline

Old Row

80

dredged to not less than -10.5m

The POOLBEG QUAY

PLA

GE

The Tanks 24

Anchorage

ROPEWALK 11

22 1-46 CE

CAMBRID

Facility

12

Grand

1B-38B

HWM

Canal

HWM

Wharf

1A-38A

PARKV

-18

11

16 18-62

IEW

Whelan House

28 'S LANE 8

(Flats) 26

PLACE

TYRREL 9 25

Solid

14

36

10

Unlike major ports elsewhere in Europe, such as Rotterdam and

26

Solid

35

12 28 29 27

VILLAS 1

23 K'S 2

ROAD

22 PATRIC

ST

HWM

Bus Depot

FITZWIL

20 17

15

18

13 12

HWM

1-21 17 36

LIAM

35

Church 15 7

9

14 Ringsend Park 34 PIGEON

2A

(Cath)

DOCK

15 32 33

HOUSE

37

PO

2

38

Ringsend T

29 VILLAS 32 10 9 ROAD

Lock 28

Camden Bridge STREE

K'S

SOUTH

44

19

45

26 20 PATRIC

ST HWM

24

STREE

RINGSEND 40-77 BRIDGE 29

HWM

CLONLARA

51

BS 16 8 HWM HWM HWM

52

Shelbourne ROAD 12-14 ROAD

HWM

22-39

T

Park Mews 4 10 11 NUE

1A 2

PINE

13A

HWM

27 1 21 9 AVE ARE 13

28 6

13-12

HWM

41 ROAD 2 11

VIEW

SQU

22 11 HWM

HWM

HWM

ROA

HWM

Library

HWM

THE 16 HWM

HWM

HWM

53 55 RINGSEND 24 5

26

3 FAIR 21

D

5

14 7B

4 HWM HWM HWM Vent

HWM

24

ROAD

HWM

7A HWM

9

Barcelona, Dublin does not have a single large expansion project

12

22

8 HWM

12 Tank

1

RA

HWM

NLA HWM

ROAD

1 HWM

HWM

CLO

7

21 PIGEON Tank(Elv)

2 13

ISOLDA

20

19 HOUSE

14

D 16 ROAD

Ringsend Park ROA

17

1

12 HWM

11 KOS

HWM

9

8 LEU

PINE 6 21

SOU Tank

TH Tank Tank Tank Tank

ROAD

BAN

1

AD

20

5

2 K

VE

ROA

Environmental enhancements/

RO

Tks

GRO

Tanks

D

1 1

ROKE

NK

2

1

KENN 5

E ROAD

BA

50

PEMB

6 16 1

ITE

EDY

COU Sports Ground PIGEON Tanks

WH

12 9 15

HOUSE

KYLE-CLARK

under development which can continually provide additional capacity

13 RT 10

ROAD

14 15 16 11

22

47 ROAD

6

Power

5

CYMRIC

Power

20 21 9

Tank

46

11 6 Tks

boundary softening

44

HWM

43

D

10

ROA

3-3A 5

9

2

7

4-4A 4

MEN

18-1

10-11 Tk

BRE

5 19

6

7

1 15-1

Bulk

37

Strasburg 14

22

Terrace

23

Station*

1 D

36

10

2 Tanks

Station*

1-2 ROA Sludge Drying

9

1 Plant

STRA MEN

28

BRE Tank

7

ND

6

10 31

30

E

2

3-4

LAN 29

4

1 S 5

18

in response to growing demand as and when required in the years

SON'

8

St 5

6

SIMP Jose STR

Liquid

EET BREMEN

ph's ROAD

22

1

1

3

NUE

2

Terra

8

Tanks

8

AVE

ce 51

9-10

17

20

1

10

D

55 Tks

ROA

7

Tanks

1

ROAD

19

RE

21

11

St Mary's Tanks

HWM

1

PEMB

MOO

EL 1

KERLO

Terrace

30

23

40

N

CHAP

ROKE

25

SEA

1 3

16

ANKS

23

GUE

SO

34

38

4

4

13

15

ia 15 5 UT

27

Victor ges 17

H

SHELLYB

38

Cotta 5

2

7 BA

35

6

1

NK

18

STRE

1 3 E 28 Tank

PLAC 35-34 33 31 RO

ET

34 9

1

6A-6B

AD

BATH

3

1 ERT 12A

36-37 38

22

11

3

10

ROAD

HERB 7 32 12

1

30

9 Tank

6 11/01/12 DPC Edits and Thematic Mapping JK JK EOR EOR

7-9

2

11 26-27 12

72

ahead.

13

28-29

STRE

11

E 53

26

25

42

ET

HWM

LAN

5

49

18

6

74

ACK

43-44

16

IRISHT

17-1

48

BARR

Purpose of revision

9

Rev Rev. Date Drawn Checkd Rev'd Apprv'd

45 54

22

OWN

9

36

Legend

18

21

82

27

19

ROAD

13 60 Tank

86

33 50

35

Clanna Gael Fontenoy

Church GAA Club

37

(C of I)

1

Lo-Lo (Lift On-Lift Off)

3

5 HWM

BRIDGE AVENUE

LONDON CHURCH

ROAD BEA HWM

1

CH

1

3A

4 7

8 ROA

D

Ro-Ro (Roll On-Roll Off) Multi usage berth to support

9

10

9 Consultant

16

TRITONVILLE

It is essential, therefore, that realistic infrastructure development

17

18 School

36

Ro-Ro/Lo-Lo/Bulk Solid/Break Bulk

16 HALL

LANSDOWNE Sean Moore Park

34 HWM

21

Bulk Liquid

1 72

6 1 21A 32

5

24

TRITO

16 2

30 10

NVILL

8

PLACE

ROAD

2

E

and wind energy

13 68

CRANFIELD

Merrion House, Merrion Road, Ballsbridge, Dublin 4,

29

17 12

7 11

5 9

AVEN

65

1 3 23

Tel:+353 1 268 5666 Fax:+353 1 2695706

UE

44

6 20

OSWALD

Bulk Solid

21 31 Irishtown

Nature Park

www.jacobs.com

BEAC

options are identified long in advance and that these options can be

21A 25

39 H

14 19 ROAD

1

HWM

ROAD

11

52 LEAHY'S

Project

Church TERRACE

(Cath) 50 HWM

3

HWM

49 49

2

GE

6

SANDYMO

BRID

Port Centric

NUE UNT

ROAD

Dublin Port Master Plan

NEW

AVE

48

UE 16

EN Steeple

School

HWM

53

AV Gate

UE

Church 43

AVEN

(Cath)

1

30

H

BEAC

GE 30A

New access road

brought forward for planning permission and other consents with

RID Tritonville

42

WB

9

28B

Close

Car Import

55 1

NE

8

28A 13

1

E

DRIV

St

28

Jame

8

7 E

Port area available for other

CENT Tritonville 36

s's

GROV

9

Close

Mews

Terra

lle CRES THE 42

5

H

Tritonvi

54

ce

41

BEAC

4

22

E 35

14

1

62 NVILL

RT

TRITO

COU

63A

1

TRITO

32

1

16

NEW

BEA

NVILL

Drawing title

BRID

31 CH

development / amenity Use

56

Power

E

39

GE

9

LANE

DRIV

7

10

2

UNT

E

71 26

YMO

30

SAND

8

reasonable certainty that they will succeed.

40

16

10

12

ROA

17

HWM

8 Seafort Gardens

D

38

32

11A

68

51

11

5

Multi-Usage Berth

24

Summary of Engineering Options

SAN

10

Terrace 1

68A

DY

10A Prospect

MO

UN

9 6

T

33

85

RT

25

72 COU

DROMARD

87

To be developed in conjunction with DCC

18

ILLE 61

IVE

19

ONV 22

DR

RO

16

Lansdowne TRIT

ROAD

AD

20

63

Square

Cruise

59 23

4

21

5 E

21

24 23 RIN

TERRACE

7

3 MA

84

to create a public amenity area

1 52 43

10

1

71

TRITONVILLE

71A

5

2

6 35 46

76

19-20

71C

78

1

Amenity-Development

St

5 36

27

Jame

2

1

8 6

4

s

7

2

Place

E

3

AVENU

e

t Terrac

5

117

SEAFORT

6

24

29

Seafor

14

BEA

PARK

20 21 ORT

121 SEAF

COTT

CH

1

28

Drawing status

1

14

27

80

77

Claremont S

HER 26 House

RO

110

BER

AD

Merry Bush Roslyn Park

Map Base

11

T

10

1

PO

FARNEY

(Rehab) College

Revised and Edited by DPC

1

2

19

ROAD 131

86-88

3

5

5

Herbert 93

Mews 8

15 SEAF

120 93B

1

6 6 12

7 ORT 11

1 133 26 VILL

DO NOT SCALE

96

97 AS

Scale NTS

* Not part of DPC's Estate of 260 Hectares Jacobs No. 321010900

Client no. MP2011_2040

Drawing number Rev

321010900/MP1/2 6

19/01/2012 11:34:56, Produced by: J.Kelleher, Dublin Port Company, This drawing is not to be used in whole or part other than for the intended

OSi Data: (Licence No. EN0001612 © Ordnance Survey Ireland/Government of Ireland) purpose and project as defined on this drawing. Refer to the contract for full

terms and conditions.

Figure 3.1: Original Masterplan infrastructure development options

09Review of the Masterplan’s

Rationale and Objectives (continued)

The Masterplan infrastructure development options must, therefore, The purpose of the Masterplan Strategic Objectives underpinning the Masterplan

be consistent with national and local planning frameworks and & the Review

The original rationale for the Masterplan comprised five elements and

with a range of national policies. Port development projects must

all remain valid in this review: The Masterplan was originally prepared to meet key strategic

be formulated in line with the principles of proper planning and

• Growth – The Masterplan shows how Dublin Port can be objectives in eight areas:

sustainable development.

developed in future years to cater for foreseeable growth. • Port functions

One consequence of this is that DPC should focus primarily within • Land use – The Masterplan critically examines existing land use in • Investment and growth

the existing footprint of the Port and should maximise the utilisation of Dublin Port to determine how it can be optimised for mercantile • Integration with the City

brownfield sites before considering greenfield projects which inevitably trade purposes.

• Movement and access

involve infill and possibly development on an undeveloped and • Investment decisions – From the perspective of DPC, its

typically environmentally sensitive shoreline. DPC believes that the • Environment and heritage

shareholder and its financiers, the Masterplan provides a coherent

Port can be developed to cater for volumes through to 2040 within basis for large investments in expensive port infrastructure. • Recreation and amenity

the Port’s existing footprint. • Policies – Although non-statutory, the Masterplan provides a • Security

framework for the implementation of a range of EU, national and • Future review

This review of the rationale and objectives of the Masterplan and the local policies which frame developments in Dublin Port.

subsequent review of infrastructure development options in Section 5 The tables below identify the progress made to date in each of these

are centred around this core concept. • Customer certainty – The Masterplan provides customers and

users of Dublin Port with some certainty about future port capacity eight areas. They also summarise initiatives envisaged from 2017

and about developments in the Port which may impact their onwards. These initiatives are explained in greater detail in Section 5.

businesses.

The Masterplan addresses key issues around the future development

of the Port by examining land utilisation at Dublin Port in the context

of developments in merchandise trade and key sectors of the

economy. The Masterplan retains the core objective of outlining how

the Port will facilitate handling an appropriately assessed level of

tonnage by 2040.

10Table 3.1: Progress on strategic objectives - Port Functions

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Ensure the safe operation and sustainable development of the Port • ABR Project: • Completion of the ABR Project.

and its approach waters and provide appropriate infrastructure, –– Planning permission secured from An Bord Pleanála under • Completion of other projects derived from the infrastructure

facilities, services, accommodation for ships, goods, and Strategic Infrastructure legislation (8th July 2015). development options described in Section 5, including:

passengers to meet future demand.

–– Foreshore consent from the Department of the Environment –– Removal of port-related but non-core activities from Dublin Port

• Optimise the use of the lands on the Port Estate through (12th May 2016). (as envisaged in the Franchise Policy) to provide additional land

rationalising the distribution and location of specific areas of for the transit storage of cargo.

–– Dumping at Sea licence from EPA (14th September 2016).

activity such as Ro-Ro, Lo-Lo, Ferry Services, Cruise Ships, Liquid

–– IED licence from EPA (29th November 2016). –– Development of a Unified Ferry Terminal to rationalise the

/ Bulk Goods and storage areas with necessary reconfigurations of

existing three separate terminals and, in doing this, to maximise

service facilities as required. • Planning permission received from DCC for ten other significant

the use of Port lands.

• Recover lands that are not being used for critical port activity and port-related developments.

–– Development of the Port’s container terminals to maximise their

re-use for such activity. • Programme of recovery of Port lands: 11.2 hectares.

throughput capacities.

• Develop quaysides adjacent to deep water to their maximum in • Port lands redeveloped for the transit storage of cargo: 16.1

–– Development of necessary projects on the Poolbeg Peninsula

accordance with environmental / licensing requirements. hectares.

to increase the Port’s Ro-Ro and Lo-Lo capacity utilising Port-

• Use new and developing technology to increase throughput to its • Quay walls redeveloped: 720 metres. owned lands for port-related purposes.

maximum. • Land acquired for external port logistics zone: 44.1 hectares.

• Identify configurations for extending berthage and storage that

mitigate impact on adjacent environmentally sensitive / designated

areas.

• Provide adequate water depth to accommodate larger / deeper

draught vessels in accordance with environmental / licensing

requirements.

11Review of the Masterplan’s

Rationale and Objectives (continued)

Table 3.2: Progress on strategic objectives - Investment and Growth

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Utilise the Masterplan as a framework for investment and growth • €100m 20 year loan facility secured from EIB. • Development of partnerships to co-finance projects to support the

based on the Port’s projected demand forecasts. • €23m TEN-T grant secured for ABR Project. development of Dublin’s cruise tourism sector.

• Maximise throughput by means of structured charges for land • €50m medium-term debt facility agreed with a retail bank. • Restructuring of port charges, particularly for unitised cargo, to

usage and cargo storage. encourage competition and higher utilisation of Port lands.

• Franchise Policy published, May 2014.

• Restructuring of container terminal franchise agreements to

• New stevedoring licences issued.

remove anomalies which discourage the maximisation of the

efficiency of land utilisation.

• Development of co-operation agreements with other ports to offer

alternative facilities to operations in Dublin Port which are inherently

inefficient in terms of land utilisation.

12Table 3.3: Progress on strategic objectives – Integration with the City

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Achieve closer integration with the City and people of Dublin • Soft Values Strategic Framework approved by DPC Board, • Completion of the Opening Up Port Centre project which includes:

through a commitment to respect soft values associated with the September 2012. –– Public access to a new maritime garden at Port Centre.

location, operation and impact of the Port • Completion of the Diving Bell project on Sir John Rogerson’s Quay –– Commissioning of new works of art to be located in the new

• Promote movement linkages in the form of pedestrian and cycle to create a new and significant industrial heritage attraction in the maritime garden.

routes City’s public realm.

–– Installation of an old crane adjacent to Port Centre.

• Enhance the general aesthetics / visual impact of the Port around • Support for the Dublin Ships art installation on the Scherzer Bridge

–– Large illuminated corten steel wall feature along East Wall Road.

the interface with the City on North Wall Quay, January to December 2015.

–– Softened boundary from Alexandra Road to Sheriff Street.

• Continuation of the company’s long established CSR programme

to support local communities in the three areas of education, sport • Completion of the Port Heritage Trail as shown in Drawing 3.

and community events. • Port Perspectives visual arts project, 2017.

• Starboard Home music commissioning and concerts in the • Drama in the Docks theatre based project, 2018.

National Concert Hall as part of the Ireland 2016 centenary • Expansion of Riverfest to create an annual Tall Ships regatta in

programme. Dublin, co-ordinated with other ports (such as Belfast, Liverpool

• Development of Riverfest as an annual event on the river over the and Glasgow) as a joint initiative between Dublin Port and Dublin

June Bank Holiday weekend to attract large numbers of people City Council.

towards the Port: • Creation of new areas of public realm on the Poolbeg Peninsula

–– 2013 - 36,000 including the possible opening of access to the Great South Wall

–– 2014 - 58,000 eastwards from Pigeon House Harbour.

–– 2015 - 45,000

–– 2016 - 96,000

• Commencement of projects to improve the boundary between

Dublin Port and the City, notably the Opening Up Port Centre

project along East Wall Road and the commencement of the

project to create a pedestrian and cycle greenway on the northern

perimeter of the Port overlooking the Tolka Estuary.

1314

Table 3.4: Progress on strategic objectives – Movement and access

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Provide for a public transport route to serve passengers and those • Planning permission secured (DCC 3084/16) for a project to • Completion of the project to redevelop the Port’s internal road,

working within the Port to improve the modal transport split. redevelop the Port’s internal road network including: cycle and pedestrian network as shown in Drawing 4.

• Develop a transport plan for the Port Estate in conjunction with the –– Increasing the capacity of the Port’s road network to cater for • Provision of cycle lockers at Port Centre (as part of the Opening

National Transport Authority and Dublin City Council. projected volumes to 2040 Up Port Centre project) to facilitate workers in the Port to use

• Promote non-motorised sustainable transport modes, including –– Building of a new 4 km long pedestrian and cycle greenway on public transport.

cycling and walking. the northern perimeter of the Port overlooking the Tolka Estuary. • Development of an innovative and environmentally friendly (e.g.

• Maximise the use of rail transport for goods to and from the Port. –– A pedestrian and cycle cable-stayed bridge across Promenade electric or hydrogen fuelled) bus operation to service the Port

Road. estate, including passenger ferry terminals, and to link the Port to

• Promote the provision of future transport infrastructure that

Dublin City’s public transport networks.

facilitates shipping and related Port activities. –– Dedicated cycle ways throughout the Port to facilitate safe and

sustainable transport options. • Development of a partnership with Dublin City Council and the

• Enhance existing infrastructure to provide dedicated access / exit

Irish Nautical Trust to re-establish a Liffey ferry service using Ferry

routes to Port facilities.

Number 11 (the last remaining ferry).

• Closing of port access along East Wall Road and the opening of a

new access at Sherriff Street to service Port Centre and the river

berths where cruise ships will berth.

• Co-ordination with Dublin City Council to complete the Point

Roundabout Scheme to improve the public road network at the

junction between the Tom Clarke Bridge, East Wall Road and

North Wall Quay.

• Co-ordination with NTA and DCC to complete the project to

develop the road link connecting from the southern end of the

Dublin Port Tunnel to the South Port area to serve the South Port

and adjoining development areas.

1516

Table 3.5: Progress on strategic objectives – Environment and heritage

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Ensure a development framework that is compatible with the • Annual Sustainability Report first published in respect of the year • Development of a Time Ball installation on Britain Quay as an

adjoining areas with particular regard for areas in Dublin Bay 2013. industrial heritage project complementary to the Diving Bell.

which are designated under the Habitats Directive and the Birds • Founding member of Dublin Bay Biosphere along with local • Erection of an old crane on North Bank Quay as an industrial

Directive. This development framework will also take account of authorities, NPWS and Fáilte Ireland heritage project.

the recommendations and mitigation measures arising from the

• Partnership with BirdWatch Ireland to establish the Dublin Bay • Continuation of the Dublin Bay Birds Project into 2017 and

SEA, AA and other relevant plans for the protection of natural

Birds Project, 2014 to 2016. beyond.

resources, including the protection of water resources, designated

and non-designated sites, aquatic ecology and protection against • Preparation of a Tern Colony Management Plan as part of which • Refurbishment of the Kittiwake Lightship for use as a mobile

flood risk. two floating tern nesting platforms were deployed, one in the Tolka exhibition / entertainment venue on the River Liffey.

Estuary and one in the River Liffey. • Redevelopment of buildings on the Odlums site for industrial

• Integrate new development with the built and natural landscapes

of the surrounding area. • Development of the Diving Bell installation on Sir John Rogerson’s heritage or port interpretative purposes.

Quay, 2015. • Development of a Natural Capital policy to provide a framework for

• Promote sustainable design in the natural and built environment.

projects and initiatives which improve the natural environment and

• Secure the preservation of all Protected Structures within the Port

increase biodiversity in and around Dublin Port.

Estate.

• Linking of the range of industrial heritage projects to create the

• To promote in the development of future port facilities the

Port Heritage trail illustrated in Drawing 3.

principles of Universal Design to make environments inherently

accessible for those with and without disabilities.

• A promotion of excellence and focus on good quality in design

where possible.

17Review of the Masterplan’s

Rationale and Objectives (continued)

Table 3.6: Progress on strategic objectives – Recreation and amenity

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Promote Dublin Port for recreation and amenity by highlighting • Planning permission secured for a major development of Dublin • Creation of large new areas (circa three hectares) of public realm

walks and cycle routes offering facilities for bird watching Port’s internal transport networks including the provision of a 4 km on the Poolbeg Peninsula.

and viewing wildlife as well as views of the bay and the wider pedestrian and cycle greenway overlooking the Tolka Estuary. • Contribution to the opening up of Pigeon House Harbour to

environment as well as the activity within the Port. • New Seafarers’ Centre opened on Alexandra Road in an old provide permeability from the Poolbeg Peninsula to the River Liffey.

• Develop landmark attractions such as a Port Heritage Centre. refurbished canteen building to provide appropriate facilities for

• Maximise public access to the waterfront and enhance the public the Mission to Seafarers and Stella Maris to provide services to

realm by landscaping and by high cleanliness standards. seafarers.

• Promotion and support of river-based leisure and sporting activities

including long established events (such as sailing and rowing galas

and the Liffey Swim) and ad hoc regattas attracting leisure boats

into the River Liffey.

• Installation of 220m of publicly accessible pontoon ramps for

leisure craft on North Wall Quay.

18Table 3.7: Progress on strategic objectives – Security

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Ensure that key areas of the Port retain good security provision in • Initial discussions with the Office of Public Works and with An • Co-ordination with State bodies to design border requirements

accordance with ISPS requirements. Garda Síochána regarding the need for enhanced State facilities in post Brexit which minimally impact on the efficient use of port

Dublin Port. lands and on ferry operations.

• Development of a single project to meet the requirements of a

variety of State agencies in respect of Dublin Port’s status as

a Border Inspection Post, for immigration control and for State

security purposes.

• Delivery of this project as part of the development of a new Unified

Ferry Terminal.

19Review of the Masterplan’s

Rationale and Objectives (continued)

Table 3.8: Progress on strategic objectives – Future review

Masterplan objectives Relevant initiatives since 2012 Initiatives envisaged from 2017 onwards

• Identify a strategy for future review of the Masterplan against • First review process initiated January 2017. • Second review planned for between seven and ten years hence

underlying assumptions and performance of the Port business and (2022 to 2027).

also assess how the Masterplan is achieving its objectives and • Development of key performance indicators in conjunction with

targets. IMDO and EU initiatives (such as Portopia) to facilitate the long-

term planning and operation of port infrastructure.

20The Masterplan and the future Since its publication the Masterplan has been cited in a number The Masterplan was prepared following the adoption of the National

development of Dublin Port of important national, regional and local policy documents, as well Spatial Strategy (2002) and the Regional Planning Guidelines

as being referenced by statutory agencies with relevant powers (2010) and was informed by the key principles underpinning both

DPC believes that there is a sufficient range of infrastructure

impacting on the Port’s operations. These key references include: documents. These strategies are currently being reviewed through

development options to allow Dublin Port to cater for anticipated

the National Planning Framework (NPF) and the Regional, Spatial

growth for the lifespan of the Masterplan to 2040 and to do so largely

1. National Ports Policy 2013 (Department of Transport) – this and Economic Strategy (RSES) of the Eastern and Midlands Regional

within the Port’s existing footprint. These options were outlined in the

important statement of National Policy underpinning the development Assembly. The NPF will be the successor to the National Spatial

Masterplan and are revised and updated as part of this current review

and operation of Ireland’s Ports references the Dublin Port Masterplan Strategy, 2002. Its planning horizon to 2040 coincides exactly with

document.

and specifically states: that of Dublin Port’s Masterplan 2012 to 2040. Likewise, the RSES

for the Dublin and Midlands Region will be the successor of the

The infrastructure development options continue to be based on The Government endorses the core principles underpinning existing Regional Planning Guidelines for each of the three Regional

achieving development outcomes within the Port which do not involve the company’s Masterplan and the continued commercial Authorities in the former Eastern and Midland Region. The NPF and

the prospect of further infill of Dublin Bay. It remains the intention of development of Dublin Port Company is a key strategic the RSES will be finalised in parallel during 2017.

DPC to continue to develop Dublin Port within its current footprint to objective of National Ports Policy. (Page 24)

the maximum extent possible before any major infill works might be

Separately, Dublin City Council will be finalising a draft Planning

undertaken. Specifically, DPC no longer believes that the capacity

2. Dublin City Development Plan 2016 – 2022 – the recently Scheme for the Poolbeg West SDZ during 2017. Half of the lands of

of the previously mooted 21 hectares infill Dublin Gateway project is

adopted City Development Plan makes a number of specific the SDZ are owned by DPC.

needed to cater for the volumes projected up to 2040.

references to the Dublin Port Masterplan, noting that it is the Policy of

Dublin City Council; As has been the case with other national and regional strategies, the

If the infrastructure development options outlined in the Masterplan,

Masterplan will work to inform the development of the NPF, the RSES

as revised in this review, are not brought forward for development in To support and recognise the important national and regional and the Poolbeg West SDZ Planning Scheme as they are brought to

a timely fashion to meet anticipated capacity, DPC will need to review role of Dublin Port in the economic life of the city and the region conclusion during 2017.

additional options to meet that demand. This is something that will be and to facilitate port activities and development having regard to

assessed in each subsequent review of the Masterplan in the context the Dublin Port Masterplan 2012 – 2040. The Dublin Port Masterplan 2012 -2040 has also informed statutory

of the experience of developing planned initiatives outlined to date, (Policy SC 9 on Page 46) authorities in the context of specific development applications,

given future national policy objectives and the Port’s assessment

To recognise that Dublin Port is a key economic resource, including Dublin City Council, An Bord Pleanála, the Environmental

of the viability of future projects from a permitting, financial and

including for cruise tourism and to have regard to the policies Protection Agency and the Department of Housing, Community and

development perspective.

and objectives of the Dublin Port Masterplan. Local Government.

Planning and environmental policy context (Policy CEE 23 (iii) on Page 83)

The Masterplan has also been cited by the European Investment

The Masterplan is a non-statutory plan which sets out to identify, Bank and by the European Commission in their positive assessment

firstly, how Dublin Port might be developed to cater for a foreseeable 3. Article 4 (c) of SI 279 of 2016, which establishes Poolbeg of requests by DPC for financial support for the ABR Project.

growth in port volumes over the period to 2040 and, secondly, how West as a Strategic Development Zone, specifically states that

the Port can be better integrated with Dublin City and the natural one of the factors taken into account in the consideration of the

environment of Dublin Bay. designation of the development zone was the Dublin Port Masterplan

2012 – 2040.

In doing this, the Masterplan takes account of and in turn plays a key

role in informing national, regional and local planning frameworks. It is 4. National Transport Authority Rail Review 2016 - comments

also important that the Masterplan, when subject to periodic review, that the principle of moving freight by rail aligns with National Ports

takes account of changes in relevant policies impacting on ports, Policy, the Dublin Port Masterplan and the emerging National Low

transport and connectivity, land use, and sustainable planning and Carbon Roadmap. (Paragraph 3.4, page 24)

development.

21Review of Forecasts to 2040

Introduction

Dublin is a gateway port for the national economy. It is located at the

On the other hand, if projects are not planned in advance of economic

growth, capacity delivery will be too late to cater for demand and “Cargo volumes through

there will be inevitable negative economic consequences for the

centre of the largest concentration of population. By comparison with

most other east coast ports, Dublin Port has relatively deep water

country. Dublin Port are directly

capable of handling the size of ships needed to efficiently service the

needs of the Irish economy.

The key question in reviewing the Masterplan is to review the long-run

growth assumption to 2040.

related to economic

Cargo volumes through Dublin Port are directly related to economic

activity which, in turn, is strongly driven by population. Just as the

The original assumption was that volumes would grow from 28.9m activity which, in turn,

gross tonnes1 in 2010 to 60.0m gross tonnes by 2040. This is

National Planning Framework is being prepared to cater for an

increase in population of one million, for 0.5m additional homes and

equivalent to an average annual growth rate of 2.5% over 30 years. is strongly driven by

The question to be answered now is whether the 2.5% assumption

for a working population of 2.2m, all by 2040, so also Dublin Port

must plan to provide the port infrastructure which such levels of

should be revised or not. population.”

growth will require.

Cargo volume forecasts

Historical trends over long periods and the belief that the underlying

drivers of economic activity will grow in the years to 2040, suggest The defining characteristic of Dublin Port is that volumes grow

that the only safe assumption for DPC to plan on is that the demand inexorably year on year.

for port infrastructure will increase exponentially in the years to 2040

as it has over many decades up to 2010. Figure 4.1 below shows that the average annual growth in the 30

years from 1950 to 1980 was 3.2%. In the following 30 years to

Within this assumption, there is an important safety valve. Port 2010, growth accelerated to 4.7%.

development projects take a long time to deliver. It can take up to

five years to get the necessary consents and a further five years to The Masterplan originally assumed average annual growth of 2.5%

build a major port project. If, over a decade, the assumptions of future each year from 2010 to 2040 resulting in a doubling to 60.0m gross

growth turn out to be over optimistic, the construction phase of major tonnes by 2010.

projects can be deferred.

We now believe it more likely that volumes will double by 2032 and

that, by 2040, will have grown to 77m gross tonnes. This would be

the outcome of an annual average growth rate to 3.3%.

1 Five year rolling average

22Table 4.1: Summary of Dublin Port’s past and projected future growth

Starting volume Ending volume

30 year time period Average annual growth rate Gross tonnes (five year rolling averages)

1950 to 1980 3.2% 2.9m 7.3m

1980 to 2010 4.7% 7.3m 28.9m

2010 to 2040 (original) 2.5% 28.9m 60.0m

2010 to 2040 (revised) 3.3% 28.9m 77.2m

An average annual growth rate of 3.3% is unremarkable by comparison to the rates seen in the 30 years to 1980 and in the following 30 years

to 2040.

The figure of 3.3% is the result of the actual growth rates from 2010 to 2016 (as shown in Table 4.2) and of relatively modest projections

thereafter to 2040 (as summarised in Table 4.3).

Table 4.2: Year on year growth rates from 2010 to 2016 Table 4.3: Year on year growth rates projected from 2017 to 2040

Year on year growth rate Year on year growth rate

2010 6.1% 2017 to 2019 5.0%

2011 -0.1% 2020 to 2029 4.0%

2012 -0.3% 2030 to 2040 3.0%

2013 3.0%

2014 7.0%

2015 6.4%

2016 6.3%

23Review of Forecasts to 2040 (continued)

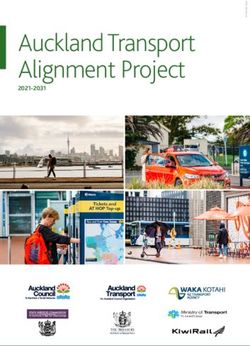

Figure 4.1 below puts the projected growth rates from 2017 to 2040

into context by showing the trend in Dublin Port’s volumes over the

Following the economic collapse in 2008, volumes reached a floor of

26.5m gross tonnes in 2010. However, growth resumed in 2013 and “The most remarkable

30 years from 1980 to 2010 and, subsequently, from 2010 to 2016. the record year of 2007 was equalled in 2014 with subsequent record

The most remarkable feature over this period is the long sustained years in both 2015 (32.3m gross tonnes) and 2016 (34.9m gross feature over this period

period of growth post the dock labour restructuring of 1992 when, for tonnes).

a period of 15 years, each and every year was a record year peaking

at 30.9m gross tonnes in 2007. Against this background, the original 2.5% projection in the

is the long sustained

Masterplan appears now to be too conservative and should be

revised. period of growth

40.0m

post the dock labour

34.9m restructuring of 1992

35.0m

30.9m when, for a period of 15

30.0m

years, each and every

25.0m

26.5m

year was a record year

20.0m

peaking at 30.9m gross

15.0m

tonnes in 2007.”

10.0m

7.9m

5.0m

6.7m

0.0m

8 8 8 8 9 9 9 9 0 0 00 0 0 1 01 1

0

2

4

6

8

0

2

4

6

8

0

2

4

6

8

0

2

4

6

8

9

1

19

19

19

19

19

19

19

19

19

19

20

20

20

20

20

20

20

2

2

Figure 4.1: Trend in Dublin Port volumes, 1980 to 2016

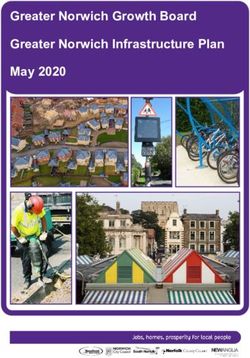

24Figure 4.2 below compares the actual trend in port volumes since Over a long planning period, the effect of a relatively small change in

2010 by comparison with the original trajectory projected in the the growth rate assumed (from 2.5% to 3.3%) is large in terms of the

Masterplan. capacity required.

Whereas the actual trend undershot the Masterplan trajectory in the Based on the evidence of recent years (2013 to 2016) it appears

early years of the Masterplan to 2013, growth has accelerated since more likely than not that annual growth will remain higher than 2.5% in

then and the gap between actual and projected has begun to close. future years.

34.0m

33.0m

32.0m

31.0m

30.0m

29.0m

28.0m

27.0m

26.0m

25.0m

2010 2011 2012 2013 2014 2015 2016

Actual Original Masterplan

Figure 4.2: Actual and projected gross tonnes, 2010 to 2016 (five year rolling averages)

25You can also read