Low Interest Rates, Market Power, and Productivity Growth

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Low Interest Rates, Market Power, and

Productivity Growth∗

Ernest Liu

Princeton University

Atif Mian

Princeton University and NBER

Amir Sufi

University of Chicago Booth School of Business and NBER

August 18, 2020

Abstract

This study provides a new theoretical result that a decline in the long-term in-

terest rate can trigger a stronger investment response by market leaders relative to

market followers, thereby leading to more concentrated markets, higher profits, and

lower aggregate productivity growth. This strategic effect of lower interest rates on

market concentration implies that aggregate productivity growth declines as the in-

terest rate approaches zero. The framework is relevant for anti-trust policy in a low

interest rate environment, and it provides a unified explanation for rising market

concentration and falling productivity growth as interest rates in the economy have

fallen to extremely low levels.

∗

We thank Manuel Amador, Abhijit Banerjee, Nick Bloom, Timo Boppart, V. V. Chari, Itay Gold-

stein, Andy Haldane, Chad Jones, Pete Klenow, Erzo Luttmer, Christopher Phelan, Thomas Philippon,

Tomasz Piskorski, Tommaso Porzio, Ali Shourideh, Michael Song, Kjetil Storesletten, Aleh Tsyvinski, Venky

Venkateswaran, David Weil, Fabrizio Zilibotti and seminar participants at the NBER Productivity, Innova-

tion, and Entrepreneurship meeting, NBER Economic Fluctuations and Growth meeting, NBER Summer

Institute “Income Distribution and Macroeconomics” session, Barcelona Summer Forum, Minnesota Macro

Workshop, Stanford SITE, University of Chicago, Wharton, HBS, Bocconi, HKUST, CUHK, JHU and LBS for

helpful comments. We thank Sebastian Hanson, Thomas Kroen, Julio Roll, and Michael Varley for excellent

research assistance and the Julis Rabinowitz Center For Public Policy and Finance at Princeton for financial

support. Liu: ernestliu@princeton.edu; Mian: atif@princeton.edu; Sufi: amir.sufi@chicagobooth.edu.Interest rates have fallen to extreme lows across advanced economies, and they are

projected to stay low. At the same time, market concentration, business profits, and

markups have been rising steadily. The rise in concentration has been associated with

a substantial decline in productivity growth; furthermore, the productivity gap between

leaders and followers within the same industry has risen. This study investigates the

effect of a decline in interest rates on investments in productivity enhancement when

firms engage in dynamic strategic competition. The results suggest that these broad secu-

lar trends—declining interest rates, rising market concentration, and falling productivity

growth—are closely linked.

In traditional models, lower interest rates boost the present value of future cash flows

associated with higher productivity, and therefore lower interest rates encourage firms to

invest in productivity enhancement. This study highlights a second strategic force that

reduces aggregate investment in productivity growth at very low interest rates. When

firms engage in strategic behavior, market leaders have a stronger investment response

to lower interest rates relative to followers, and this stronger investment response leads

to more market concentration and eventually lower productivity growth.

The model is rooted in the dynamic competition literature (e.g. Aghion et al. (2001)).

Two firms compete in an industry both intra-temporally, through price competition, and

inter-temporally, by investing in productivity-enhancing technology. Investment increases

the probability that a firm improves its productivity position relative to its competitor. The

decision to invest is a function of the current productivity gap between the leader and the

follower, which is the state variable in the industry. A larger productivity gap gives the

leader a larger share of industry profits, thereby making the industry more concentrated.

The model includes a continuum of industries, all of which feature the dynamic game be-

tween a leader and follower. Investment decisions within each industry induce a steady

state stationary distribution of productivity gaps across markets and hence overall indus-

try concentration and productivity growth.

The theoretical analysis is focused on the following question: What happens to ag-

gregate investment in productivity enhancement when the interest rate used to discount

profits falls? The model’s solution includes the “traditional effect” through which a de-

cline in the interest rate leads to more investment by market leaders and market followers.

However, the solution to the model also reveals a “strategic effect” through which market

leaders invest more aggressively relative to market followers when interest rates fall. The

central theoretical result of the analysis shows that the strategic effect dominates the tra-

ditional effect at a sufficiently low interest rate; as the interest rate approaches zero, it is

guaranteed that economy-wide measures of market concentration will rise and aggregate

1productivity growth will fall.

The intuition behind the strategic effect can be seen through careful consideration of

the investment responses of market leaders and market followers when the interest rate

falls. When the interest rate is low, the present value of a persistent market leader be-

comes extremely high. The attraction of becoming a persistent leader generates fierce

and costly competition especially if the two firms are close to one another in the produc-

tivity space. When making optimal investment decisions, both market leaders and market

followers realize that their opponent will fight hard when their distance closes. However,

they respond asymmetrically to this realization when deciding how much to invest. Mar-

ket leaders invest more aggressively in an attempt to ensure they avoid neck-and-neck

competition. Market followers, understanding that the market leader will fight harder

when they get closer, become discouraged and therefore invest less aggressively. The re-

alization that competition will become more vicious and costly if the leader and follower

become closer in the productivity space discourages the follower while encouraging the

leader. The main proposition shows that this strategic effect dominates as the interest rate

approaches zero.

The dominance of the strategic effect at low interest rates is a robust theoretical re-

sult. This result is shown first in a simple example that captures the basic insight, and

then in a richer model that includes a large state space and hence richer strategic consid-

erations by firms. The existence of this strategic effect and its dominance as interest rates

approach zero rests on one key realistic assumption, that technological catch-up by mar-

ket followers is gradual. That is, market followers cannot “leapfrog” the market leader

in the productivity space and instead have to catch up one step at a time. This feature

provides an incentive for market leaders to invest not only to reach for higher profits but

also to endogenously accumulate a strategic advantage and consolidate their leads. This

incentive is consistent with the observations that real-world market leaders may conduct

defensive R&D, erect entry barriers, or engage in predatory acquisition as in Cunning-

ham et al. (2019). This assumption is also supported by the fact that gradual technological

advancement is the norm in most industries, especially in recent years (e.g., Bloom et al.

(2020)).

The exploration of the supply side of the economy is embedded into a general equi-

librium framework to explore whether the mechanism is able to quantitatively account

for the decline in productivity growth. The general equilibrium analysis follows the lit-

erature in assuming that the long-run decline in interest rates is generated by factors on

the demand side of the economy, which is modeled as a reduction in the discount rate

of households. We conduct a simple calibration of the model and show that the model

2generates a quantitatively meaningful rise in the profit share and decline in productivity

growth following the decline in the interest rate from 1984 to 2016 in the United States.

The insights from the model have implications for anti-trust policy. Policies that tax

leader profits or subsidize follower investments are less effective than one that dynami-

cally facilitates technological advancements of followers. Furthermore, more aggressive

anti-trust policy is needed during times of low interest rates. The baseline model abstracts

from financial frictions by assuming that market leaders and market followers face the

same interest rate. We believe that the introduction of financial frictions that generate a

gap between the interest rates faced by market leaders and market followers would lead

to even stronger leader dominance when interest rates fall.1 For example, using data on

interest rates and imputed debt capacity, we show that the decline in long-term rates has

disproportionately favored industry leaders relative to industry followers.

The model developed here is rooted in dynamic patent race models (e.g. Budd et al.

(1993)). These models are notoriously difficult to analyze; earlier work relies on numerical

methods (e.g. Budd et al. (1993), Acemoglu and Akcigit (2012)) or imposes significant

restrictions on the state space to keep the analysis tractable (e.g. Aghion et al. (2001) and

Aghion et al. (2005)). We bring a new methodology to this literature by analytically solving

for the recursive value functions when the discount rate is small. This new technique

enables us to provide sharp, analytical characterizations of the asymptotic equilibrium as

discounting tends to zero, even as the ergodic state space becomes infinitely large. The

technique should be applicable to other stochastic games of strategic interactions with a

large state space and low discounting.

This study also contributes to the large literature on endogenous growth.2 The key

difference between the model here and other studies in the literature, e.g. Aghion et al.

(2001) and Peters (forthcoming), is the assumption that followers have to catch up to the

leader gradually and step-by-step instead of being able to close all gaps at once. This

assumption provides an incentive for market leaders to accumulate a strategic advantage,

which is a key strategic decision that is relevant in the real world. We show this key

“no-leapfrog” feature overturns the traditional intuition that low interest rates always

promote investment, R&D, and growth; instead, when interest rates are sufficiently low,

this strategic effect always dominates the traditional effect, and aggregate investment and

productivity growth will fall.

1

For related work on financial constraints and productivity growth, see Caballero et al. (2008), Gopinath

et al. (2017) and Aghion et al. (2019a).

2

Recent contributions to this literature include Acemoglu and Akcigit (2012), Akcigit et al. (2015), Akcigit

and Kerr (2018), Cabral (2018), Garcia-Macia et al. (2018), Acemoglu et al. (forthcoming), Aghion et al.

(forthcoming), and Atkeson and Burstein (forthcoming), among others.

3In contemporaneous work, Akcigit and Ates (2019) and Aghion et al. (2019b) respec-

tively argue that a decline in technology diffusion from leaders to followers and the ad-

vancement in information and communication technology—which enables more efficient

firms to expand—could have contributed to the rise in firm inequality and low growth.

While we do not explicitly study these factors in the model here, the economic forces high-

lighted by our theory suggest that low interest rates could magnify market leaders’ incen-

tives to take advantage of these changes in the economic environment. More broadly, the

theoretical result of this study suggests that the literature exploring the various reasons

behind rising market concentration and declining productivity growth should consider

the role of low interest rates in contributing to these patterns.

This paper is also related to the broader discussion surrounding “secular stagnation”

in the aftermath of the Great Recession. Some explanations, e.g., Summers (2014), focus

primarily on the demand side and highlight frictions such as the zero lower bound and

nominal rigidities.3 Others such as Barro (2016) have focused more on the supply-side,

arguing that the fall in productivity growth is an important factor in explaining the slow

recovery. This study suggests that these two views might be complementary. For example,

the decline in long-term interest rates might initially be driven by a weakness on the

demand side. But a decline in interest rates can then have a contractionary effect on

the supply-side by increasing market concentration and reducing productivity growth.

An additional advantage of this framework is that one does not need to rely on financial

frictions, liquidity traps, nominal rigidities, or a zero lower bound to explain the persistent

growth slowdown such as the one we have witnessed since the Great Recession.

1 Motivating Evidence

Existing research points to four secular trends in advanced economies that motivate the

model. First, there has been a secular decline in interest rates across almost all advanced

economies. Rachel and Smith (2015) show a decline in real interest rates across advanced

economies of 450 basis points from 1985 to 2015. The nominal 10-year Treasury rate

has declined further from 2.7% in January 2019 to 0.6% in July 2020. This motivates the

consideration of extremely low interest rates on firm incentives to invest in productivity

enhancement.

Second, measures of market concentration and market power have risen substantially

over this same time frame. Rising market power can be seen in rising markups (e.g., Hall

3

See e.g., Krugman (1998), Eggertsson and Krugman (2012), Guerrieri and Lorenzoni (2017), Benigno

and Fornaro (forthcoming), and Eggertsson et al. (2019).

4(2018), De Loecker et al. (2020), Autor et al. (2020)), higher profits (e.g., Barkai (forthcom-

ing), De Loecker et al. (2020)), and higher concentration in product markets (e.g., Grullon

et al. (2019), Autor et al. (2020)). Diez et al. (2019) from the International Monetary Fund

put together a firm-level cross-country dataset from 2000 onward to show a series of

robust facts across advanced economies. Measures of markups, profitability, and concen-

tration have all risen. They also show that the rise in markups has been concentrated in

the top 10% of firms in the overall markup distribution, which are firms that have over

80% of market share in terms of revenue.

Third, productivity growth has stalled across advanced economies (e.g., Cette et al.

(2016), Byrne et al. (2016)). It is important to note that this slowdown in productivity began

before the Great Recession, as shown convincingly in Cette et al. (2016). The slowdown in

productivity growth has been widespread, and was not initiated by the Great Recession.

Fourth, the decline in productivity growth has been associated with a widening pro-

ductivity gap between leaders and followers and reduced dynamism in who becomes a

leader. Andrews et al. (2016b) show that the slowdown in global productivity growth is

associated with an expanding productivity gap between “frontier” and “laggard” firms.

In addition, the study shows that industries in which the productivity gap between the

leader and the follower is rising the most are the same industries where sector-aggregate

productivity is falling the most.

Berlingieri et al. (2017) use firm level productivity data from OECD countries to esti-

mate productivity separately for “leaders,” defined as firms in the 90th percentile of the la-

bor productivity distribution for a given 2-digit industry, and “followers,” defined as firms

in the 10th percentile of the distribution. The study shows that the gap between leaders

and followers increased steadily from 2000 to 2014. Both the Andrews et al. (2016b) and

Berlingieri et al. (2017) studies point to the importance of the interaction between market

leaders and market followers in understanding why productivity growth has fallen over

time. Andrews et al. (2016a) show that the tendency for leaders, which they call frontier

firms, to remain market leaders has increased substantially from the 2001 to 2003 period

to the 2011 to 2013 period. They conclude that it has become harder for market followers

to successfully replace market leaders over time.

As shown below, these facts are consistent with the model’s prediction of what hap-

pens when interest rates fall to low levels. Furthermore, even the timing of these pat-

terns is consistent with the results of the model. As shown below, the model predicts

that market power increases as the interest rate declines, but productivity growth has an

inverted-U relationship and only declines when the interest rate becomes sufficiently low.

In the real-world, the decline in real interest rates began in the 1980s, and measures of

5market concentration began rising in the late 1990s. The trends in productivity growth,

in contrast, began later. Most studies place the beginning of the period of a decline in pro-

ductivity growth between 2000 and 2005, and the rising productivity gap between market

leaders and followers also emerged at this time.

2 A Stylized Example

Declining interest rates in advanced economies have been associated with a rise in market

power, a widening of productivity and markups between market leaders and followers,

and a decline in productivity growth. This section begins the theoretical analysis of the

effect of a decline in interest rates on market concentration and productivity growth. More

specifically, we begin by presenting a stylized example to illustrate the key force in the

model: low interest rates boost the incentive to invest for industry leaders more than for

industry followers. Section 3 below presents the full model.

Consider two firms competing in an industry. Time is continuous and as in the dy-

namic patent race literature, there is a technolgoical ladder such that firms that are further

ahead on the ladder are more productive and earn higher profits. The distance between

two firms on the technological ladder represents the state variable for an industry. To

keep the analysis as simple as possible, we assume that an industry has only three states:

firms can compete neck-and-neck (state=0) with flow profit π0 = 1/2 each, they can be

one step apart earning flow profits π1 = 1 for the leader and π−1 = 0 for the follower, or

they can be two steps apart. If firms are two steps apart, that state becomes permanent,

with leader and follower earning π2 = 1 and π−2 = 0 perpetually.

Firms compete by investing at the rate η in technology in order to out-run the other

firm on the technological ladder. The firm pays a flow investment cost c (η) = −η 2 /2

and advances one step ahead on the technological ladder with Poisson rate η. Starting

with a technological gap of one step, if the current follower succeeds before the leader,

their technological gap closes to zero. The two firms then compete neck-and-neck, both

earning flow profit 1/2 and continue to invest in order to move ahead on the technological

ladder. Ultimately each firm is trying to get two steps ahead of the other firm in order to

enjoy permanent profit of π2 = 1.

Given the model structure, we can solve for equilibrium investment levels. At an in-

terest rate r, the value of a permanent leader is v2 ≡ 1/r and the value of a permanent

follower is v−2 ≡ 0. Firms that are zero or one-step apart choose investment levels to max-

imize their firm values, taking the other firm’s investment level as given. The equilibrium

6firm value functions satisfy the following HJB equations:

rv1 = max π1 − η 2 /2 + η (v2 − v1 ) + η−1 (v0 − v1 ) (1)

η

rv0 = max π0 − η 2 /2 + η (v1 − v0 ) + η0 (v−1 − v0 ) (2)

η

rv−1 = max π−1 − η 2 /2 + η (v0 − v−1 ) + η1 (v−2 − v−1 ) (3)

η

where {η−1 , η0 , η1 } denote the investment choices in equilibrium.

The intuition behind the HJB equations can be understood using equation (1) that

relates the flow value rv1 for a one-step-ahead leader to its three components: flow profits

minus investment costs (π1 − η 2 /2), a gain in firm value of (v2 − v1 ) with Poisson rate η

if the firm successfully innovates, and a loss in firm value of (v0 − v−1 ) with Poisson rate

η−1 if the firm’s competitor successfully innovates.

Both firms compete dynamically for future profits and try to escape competition in

order to enjoy high profits π2 indefinitely. Suppose the industry is in state 1. Then the

investment intensity for the leader and the follower are given by the first order conditions

from HJB equations, η1 = v2 − v1 and η−1 = v0 − v−1 , respectively. Intuitively, the magni-

tude of investment effort depends on the slope of the value function for the leader and the

follower. The follower gains value from reaching state=0 so it has a chance to become the

leader in the future; the leader gains value from reaching to state=2 not because of higher

flow profits (note π1 = π2 = 1) but, importantly, by turning its temporary leadership into

a permanent one.

The key question is, what happens to equilibrium investment efforts in state 1 if there

is a fall in interest rate r? The answer, summarized in proposition 1, is that the leader’s

investment η1 rises by more than the follower’s investment η−1 as r falls. In fact, as r → 0,

the difference between leader’s and follower’s investment diverges to infinity.

Proposition 1. A fall in the interest rate r raises the market leader’s investment more than

it raises the follower’s, and their investment gap goes to infinity as r goes to zero. Formally,

dη1 /dr < dη−1 /dr with limr→0 (η1 − η−1 ) = ∞.

All proofs are in the appendix. The intuition for (η1 − η−1 ) → ∞ is as follows. Since

η1 = v2 − v1 , a fall in r increases investment for the leader as the present value of its

monopoly profits (v2 ≡ 1/r) is higher were it to successfully innovate. However, for the

follower η−1 = v0 − v−1 , and the gain from a fall in r is not as high due to the endoge-

nous response of its competitor in state=0 were the follower to successfully innovate. In

particular, a fall in r also makes firms compete more fiercely in the neck-and-neck state

7zero. A fall in r thus increases the expectation of a tougher fight were the follower to suc-

cessfully catch up to s = 0. While the expectation of a more fierce competition in future

state-zero disincentivizes the follower from catching up, the possibility of “escaping” the

fierce competition through investment raises the incentive for the leader. This strategic

asymmetry continues to amplify as r → 0, giving us the result.

The core intuition in this example does not depend on simplifying assumptions such

as exogenous flow profits, quadratic investment cost, state independent investment cost,

or limiting ourselves to three states. For example, the full model that follows allows for an

infinite number of possible states, microfounded flow profits with Bertrand competition,

investment cost advantage for the follower, and other extensions. Also note that we do

not impose any financing disadvantage for the follower vis-a-vis the leader as they both

face the same cost of capital r. Any additional cost of financing for the follower, as is

typically the case in practice, is likely to further strengthen our core result.

The key assumption for the core result is that follower cannot “leapfrog” the leader.

As we explained, the key intuition relies on the expectation that the follower will have to

“duke it out” in an intermediate state (state zero in our example) before it can get ahead

of the leader. This expectation creates the key strategic asymmetry between the response

by the leader and the follower to a lower interest rate. The follower is discouraged by

the fierce competition in the future if it were to successfully close the technological gap

between itself and the leader. The same is not true for the leader. In fact for the leader in

state s = 1, the expectation of more severe competition in state s = 0 makes the leader

want to escape competition with even greater intent. All of this gives the leader a larger

reward for investment relative to the follower as r falls. We discuss the plausibility and

applicability of the no-leapfrogging assumption in more detail below, and we show that

the idea of incremental innovation applies to a wide range of settings in the real world.

The next section moves to a more general setting with a potentially infinite number

of states. This breaks the rather artificial restriction of the simple example that leader-

ship becomes perpetual in state 2. In the general set up, the leader can continue to create

distance between itself and the follower by investing, but it cannot guarantee permanent

leadership. Adding this more realistic dimension to the framework brings out additional

important insights: not only does a fall in r increase the investment gap between the

leader and the follower, but for r low enough, the average follower stops investing all to-

gether thereby killing competition in the industry. Therefore, while the example imposed

permanent leadership exogenously, the full model shows that leadership endogenously

becomes permanent. And as in the example, the expectation of permanent leadership

makes the temporary leader invest more aggressively in a low interest rate environment.

8As a result, a fall in the interest rate to a very low level raises market concentration and

profits, and ultimately reduces productivity growth.

3 Model

The model has a continuum of markets with each market having two firms that compete

with each other for market leadership. Firms compete along a technological ladder where

each step of the ladder represents productivity enhancement. The number of steps, or

states, is no longer bounded, so firms can move apart indefinitely. Firms’ transition along

the productivity ladder is characterized by a Poisson process determined by the level of

investment made by each firm.

We aggregate across all markets and define a stationary distribution of market struc-

tures and the aggregate productivity growth rate. Section 4 characterizes the equilib-

rium and analyzes how market dynamism, aggregate investment, and productivity growth

evolve as the interest rate declines toward zero. This section and Section 4 evaluate the

model in partial equilibrium taking the interest rate and the income of the consumer as

exogenously given. Section 5 then endogenizes these objects by embedding the model

into general equilibrium.

3.1 Consumer Preferences

Time is continuous. At each instance t, a representative consumer decides how to allocate

one unit of income across a continuum of duopoly markets indexed by v, maximizing

Z 1 h σ

i σ−1

(4)

σ−1 σ−1

max exp ln y1 (t; ν) σ + y2 (t; ν) σ dν

{y1 (t;ν),y2 (t;ν)} 0

Z 1

s.t. p1 (t; ν) y1 (t; ν) + p2 (t; ν) y2 (t; ν) dν = 1,

0

where yi (t; ν) is the quantity produced by firm i of market v and pi (t; ν) its price. The

consumer preferences in (4) is a Cobb-Douglas aggregator across markets ν, nesting a

CES aggregator with elasticity of substitution σ > 1 across the two varieties within each

market. R 1

Let P (t) ≡ exp 0 ln p1 (t; ν)1−σ + p2 (t; ν)1−σ 1−σ be the consumer price in-

1

dex. Cobb-Douglas preferences imply that total revenue of each market is always one,

i.e. p1 (t; ν) y1 (t; ν) + p2 (t; ν) y2 (t; ν) = 1. Hence firm-level sales only depend on the

9relative prices

within

−σ each market and are independent of prices in other markets, i.e.

y1 (t;ν)

y2 (t;ν)

p1 (t;ν)

= p2 (t;ν) . This implies that all strategic considerations on the firm side take

place within a market and are invariant to prices outside a given market.

3.2 Firms: Pricing and Investment Decisions

The two firms in a market are indexed by i ∈ {1, 2} and we drop the market index ν

to avoid notational clutter. Each firm has productivity zi with unit cost of production

equal to λ−zi for λ > 1. Given consumer demand described earlier, each firm engages in

Bertrand competition to solve,

max pi − λ−zi yi s.t. p1 y1 + p2 y2 = 1 and y1 /y2 = (p1 /p2 )−σ . (5)

pi

The solution to this problem can be written in terms of state variable s = |z1 − z2 | ∈

Z≥0 that captures the productivity gap between the two firms. When s = 0, two firms

are said to be neck-and-neck; when s > 0, one firm is a temporary leader while the

other is a follower. Let πs denote leader’s profit in a market with productivity gap s, and

likewise let π−s be the follower’s profit of the follower in the market. Conditioning on the

state variable s, firm profits πs and π−s no longer depend on the time index or individual

productivities and have the following properties.

Lemma 1. Given productivity gap s, the solution to Bertrand competition leads to flow

profits

ρ1−σ

s 1

πs = 1−σ

, π−s = 1−σ ,

σ + ρs σρs + 1

(σρσ−1

s +1)

where ρs defined implicitly by ρσs = λ−s σ+ρsσ−1

is the relative price between the leader

σ+ρ1−σ σρ1−σ +1

and the follower. Equilibrium markups are ms = s

σ−1

and m−s = s

(σ−1)ρ1−σ

.

s

Lemma 2. Under Bertrand competition, follower’s flow profit π−s is weakly-decreasing and

convex in s; leader’s and joint profits, πs and (πs + π−s ), are bounded, weakly-increasing,

and eventually concave in s.4 Moreover, lims→∞ πs > π0 ≥ lims→∞ π−s .

Lemma 2 states that a higher productivity gap is associated with higher profits for the

leader and for the market as a whole. We therefore interpret markets in a lower state to

be more competitive than markets in a higher state. Markups are also (weakly) increasing

in the state s.

4

A sequence {as } is eventually concave iff there exists s̄ such that as is concave in s for all s ≥ s̄.

10Our main theoretical results hold under any sequence of flow profits {πs }∞ s=−∞ that

satisfy the properties in Lemma 2, as our proofs show. Such a profit sequence could be

generated by alternative forms of competition (e.g., Cournot) or anti-trust policies (e.g.,

constraints on markups or taxes on profits). For clarity, even though lims→∞ πs = 1 under

Bertrand, we let π∞ ≡ lims→∞ πs denote the limiting profit of an infinitely-ahead leader,

and we derive our theory using the notation π∞ .

As an example under Bertrand competition, when duopolists produce perfect substi-

tutes (σ → ∞), profits are πs = 1 − e−λs for leaders and π−s = 0 for followers and

neck-and-neck firms. As another example outside of the Bertrand microfoundation, our

main results hold for the following sequence of profits: πs = 0 if s < 1 and πs = π∞ > 0

if s ≥ 1, i.e. all leaders receive the identical flow profits whereas followers and neck-and-

neck firms have zero profit.

Investment Choice

The most important choice in the model is the investment decision of firms competing for

market leadership. A firm that is currently in the leadership position incurs investment

cost c (ηs ) in exchange for Poisson rate ηs to improve its productivity by one step and

lower the unit cost of production by a factor of 1/λ. The corresponding follower firm

chooses its own investment η−s and state s transitions over time interval ∆ according to,

s (t) + 1 with probability ∆ · ηs ,

s (t + ∆) = s (t) − 1 with probability ∆ · (κ + η−s ) ,

otherwise.

s (t)

where parameter κ ≥ 0 is the exogenous catch-up rate for the follower. There is a nat-

ural catch-up advantage that the follower enjoys due to technological diffusion from the

leader to the follower; this guarantees the existence of a non-degenerate steady-state and

is a standard feature in patent-race-based growth models (e.g., Aghion et al. (2001), and

Acemoglu and Akcigit (2012)).

Firms discount future payoffs at interest rate r which is taken to be exogenous from

the perspective of firm decision-making.5 Firm value vs (t) equals the expected present-

5

We illustrate in Section 5.1 how r is endogenously determined in general equilibrium and can be viewed

as coming from the household discount rate.

11discount-value of future profits net of investment costs:

Z ∞

vs (t) = E −rτ

e {π (t + τ ) − c (t + τ )} dτ s . (6)

0

Value function (6) illustrates the various incentives that collectively determine how a

firm invests. The basic problem is not only inter-temporal, but most importantly, strategic.

A firm bears the investment cost today but obtains the likelihood of enhancing its market

position by one-step which earns it higher profits in the future. However, there is also an

important strategic dimension embedded in (6), as a firm’s expected gain from investment

today is also implicitly a function of how its competitor is expected to behave in the future.

For instance, in the example of Section 2, intensified competition in the neck-and-neck

state has a discouragement effect on the follower’s investment and a motivating effect on

the leader’s.

We impose regularity conditions on the cost function c (·) so that firm’s investment

problem is well-defined and does not induce degenerate solutions. Specifically, we as-

sume c (·) is twice continuously differentiable and weakly convex over a compact invest-

ment space: c0 (ηs ) ≥ 0, c00 (ηs ) ≥ 0 for ηs ∈ [0, η]. We assume the investment space

is sufficiently large, c (η) > π∞ and η > κ—so that firms can compete intensely if they

choose to—and c0 (0) is not prohibitively high relative to the gains from becoming a leader

(c0 (0) κ < π∞ − π0 )—otherwise no firm has any incentive to ever invest.

We look for a stationary Markov-perfect equilibrium such that the value functions and

investment decisions are time invariant and depend only on the state. The HJB equations

for firms in state s ≥ 1 are

rvs = πs + (κ + η−s ) (vs−1 − vs ) + max [ηs (vs+1 − vs ) − c (ηs )] (7)

ηs ∈[0,η]

rv−s = π−s + ηs v−(s+1) − v−s + κ v−(s−1) − v−s

(8)

+ max η−s v−(s−1) − v−s − c (η−s ) .

η−s ∈[0,η]

In state zero, the HJB equation for either market participant is

rv0 = π0 + η0 (v−1 − v0 ) + max [η0 (v1 − v0 ) − c (η0 )] . (9)

η0 ∈[0,η]

These HJB equations have the same intuition as those in equations (1) through (3) in our

earlier example. The flow value in state s is composed of current profit net of investment

12cost, capital gain from successfully advancing on the technological ladder, and capital loss

if the firm is pushed back on the ladder.

Definition 1. (Equilibrium) Given interest rate r, a symmetric Markov-perfect equilib-

rium is an infinite collection of value functions and investments {vs , v−s , ηs , η−s }∞

s=0 that

satisfy equations (7) through (9). The collection of flow profits {πs , π−s }s=0 is generated

∞

by Bertrand competition as in Lemma 1.

3.3 Aggregation Across Markets: Steady State and Productivity Growth

The state variable in each market follows an endogenous Markov process with transition

rates governed by investment decisions {ηs , η−s }∞ s=0 of market participants. We define

a steady-state equilibrium as one in which the distribution of productivity gaps in the

entire economy, {µs }∞ s=0 , is time invariant. The steady-state distribution of productivity

gaps must satisfy the property that, over each time instance, the density of markets leaving

and entering each state must be equal.

Definition 2. (Steady-State) Given equilibrium investment {ηs , η−s }∞ s=0 , a steady-state

is the distribution {µs }s=0 ( µs = 1) over the state space that satisfies:

∞ P

2µ0 η0 = (η−1 + κ) µ1 , (10)

| {z } | {z }

density of markets density of markets

going from state 0 to 1 going from state 1 to 0

= η−(s+1) + κ µs+1 for all s > 0. (11)

µs η s

|{z} | {z }

density of markets density of markets

going from state s to s+1 going from state s+1 to s

where the number “2” in equation (10) reflects the fact that a market leaves state zero if

either firm’s productivity improves.

We define aggregate productivity Z (t) as the inverse of the total production cost per

unit of the consumption aggregator:

σ

h i σ−1

R1 σ−1 σ−1

exp 0

ln y1 (t; ν) σ + y2 (t; ν) σ

λZ(t)

≡ R1 , (12)

0

λ−z1 (t;ν) y1 (t; ν) + λ−z2 (t;ν) y2 (t; ν) dν

where recall λ is the step size of productivity increments. Note that λ−Z(t) is also the ideal

cost index for the nested CES demand system in (4).

13The next lemma characterizes the steady-state productivity growth rate as a function

of the steady-state distribution in productivity gaps {µs }∞

s=0 and firm-level investments

{ηs , η−s }s=0 .

∞

d ln λZ(t)

Lemma 3. In a steady state, the aggregate productivity growth rate g ≡ dt

is

∞

!

X

g = ln λ · µs ηs + µ0 η0

s=0

∞

X

= ln λ · µs (η−s + κ) .

s=1

The productivity gap distribution is stationary in a steady state and, on average, the

productivity growth rate at the frontier—leaders and neck-and-neck firms—is the same

as that of market followers. Consequently, Lemma 3 states that aggregate productivity

growth g is equal to the average rate of productivity improvements for leaders and neck-

and-neck firms, weighted by the fraction of markets in each state (first equality), and that

g can be equivalently written as the average rate of productivity improvements for market

followers (second equality).

4 Analytical Solution

4.1 Linear Cost Function

The dynamic game between the two firms is complex and has rich strategic interactions,

with potentially infinite state-contingent investment levels by each player to keep track

of. To achieve analytical tractability, throughout this section we assume the cost function

is linear in investment intensity: c (ηs ) = c · ηs for ηs ∈ [0, η]. The model with a convex

cost function is solved numerically in Section 5, where we show that the core results carry

through. Because of linearity, firms generically invest at either the upper or lower bound

in any state; hence, investment effectively becomes a binary decision, and any interior

investments can be interpreted as firms playing mixed strategies. For expositional ease,

we focus on pure-strategy equilibria in which ηs ∈ {0, η}, but all formal statements apply

to mixed-strategy equilibria as well.

144.2 Market Equilibrium

The rest of this section solves for the equilibrium investment decisions by the leader and

the follower in a market, dropping the market index ν for brevity. When the interest

rate is prohibitively high, there may be a trivial equilibrium in which even the neck-and-

neck firms in state zero do not invest, and aggregate investment and productivity growth

are both zero in the steady state. Because the main result evaluates the effect of low

interest rates r, for expositional simplicity we restrict analysis to equilibria with positive

investment in the neck-and-neck state, and we present results that hold across all non-

trivial equilibria.

Let n + 1 ≡ min {s|ηs < η} be the first state in which the market leader does not

strictly prefer to invest, and likewise, let k + 1 ≡ min {s|η−s < η} be the first state in

which the market follower does not strictly prefer to invest.

Lemma 4. In any non-trivial equilibrium, the leader invests in more states than the follower,

n ≥ k. Moreover, the follower does not invest (η−s = 0) in states s = k + 2, ..., n + 1.

Figure 1: Illustration of Equilibrium Structure

Lemma 4 establishes that the leader must maintain investment in (weakly) more states

than the follower does. The structure of an equilibrium can thus be represented by Figure

1. States are represented by circles, going from state 0 on the left to state n+1 on the right.

The coloring of a circle represents investment decisions: states in which the firm invests

are represented by dark circles, whereas white ones represent those in which the firm does

not invest. The top row represents leaders’ investment decisions while the bottom row

represents followers’. The corresponding steady-state features positive mass of markets

in states {0, 1, . . . , n + 1}, and we can partition the set of non-neck-and-neck states into

two regions: one in which the follower invests ({1, . . . , k}) and the other in which the

follower does not ({k + 1, . . . , n + 1}). In the first region, the productivity gap widens

15with Poisson rate η and narrows with rate (η + κ). In expectation, the state s tends to

decrease in this region, and the market structure tends to become more competitive. For

this reason, we refer to this as the competitive region. Note this label does not reflect

competitive market conduct or low flow profits—leaders’ profits can still be high in this

region—instead, the label reflects the fact that joint profits tend to decrease over time.

In the second region, the downward state transition occurs at a lower rate (κ), and the

market structure tends to stay or become more monopolistic and concentrated. We refer

to this as the monopolistic region.

The formal proof of Lemma 4 is in the appendix; the intuition behind the n ≥ k proof

is as follows. Suppose the leader stops investing before the follower does, n < k. In this

case, the high flow payoff πn+1 is transient for the leader and the market leadership of

being n + 1 steps ahead is fleeting, because the follower invests in state n + 1 and the rate

of downward state transition is high (η + κ). This implies a relatively low upper bound

on the value for the leader in state n + 1. However, because firms are forward-looking

and their value functions depend on future payoffs, the low value in state n + 1 “trickles

down” to value functions in all states, meaning the incentive for the follower to invest—

motivated by the future prospect of eventually becoming the leader in state n + 1—is low.

This generates a contradiction to the presumption that follower invests in more states

than the leader does.

Figure 2 shows the value functions for both the leader and the follower, which help

explain their investment decisions. The solid black curve represents the value function of

the leader, whereas the dotted black curve represents the value function of the follower.

The two dashed and gray vertical lines respectively represent k and n, the last states in

which the follower and the leader invest, respectively.

The firm value in any state is a weighted average of the flow payoff in that state and

the firm value in neighboring states, with weights being functions of the Poisson rate of

state transitions.6 Figure 2 shows that v0 − v−k is substantially lower than vk − v0 ; in fact,

the joint value of both firms is strictly increasing in the state: 2v0 < v1 + v−1 < · · · <

vn+1 + v−(n+1) . This is due to three complementary forces. First, joint profits (πs + π−s )

are increasing in the state (Lemma 2). Second, as both firms invest in the competitive

region, their investment cost further lowers the flow payoffs in the competitive region

relative to the later, monopolistic region, i.e., states k + 1 through n + 1. Third, again

because both players invest in the competitive region, a firm close to state 0 expects having

to incur investment costs for a substantial amount of time before it will be able to escape

6

For instance, for s in the competitive region (0 < s < k), vs = πs −cηs +ηs vs+1 +(η−s +κ)vs−1

r+ηs +η−s +κ , as implied

by equation (7).

16Figure 2: Value functions

the region and move beyond state k + 1.

The inequalities 2v0 < vs + v−s < vn + v−n hold for any s < n and imply that the

leader’s incentive to invest and move from state 0 to s is always higher than the follower’s

incentive to move from state −s to 0 (as vs − v0 > v0 − v−s ). Likewise, the leader’s in-

centive to move from state s to n is always higher than follower’s incentive to move from

state −n to −s. The valuation difference v0 − v−s is low precisely because both firms

compete intensely in states 0 through k, and their investment costs dissipate future rents.

This is the sense in which strategic competition serves as a deterrent to the follower. The

fact that competition serves as an endogenous motivator to the leader for racing ahead

manifests itself through the convexity of the value function of a leader in the competitive

region. As the leader approaches the end of the competitive region (s = k), its value

function increases sharply, as maintaining its leadership would become substantially eas-

ier once the leader escapes the competitive region and gets to the monopolistic region.

Conversely, falling back is especially costly to a leader within reach of the monopolistic

region, precisely because of the intensified competition when s < k.

Why does the leader continue to invest in states k + 1 through n, even though the

follower does not invest in those states? It does so to consolidate its strategic advantage.

Because of technological diffusion κ, leadership is never guaranteed to be permanent, and

a leader always has the possibility of falling back. As the value of being a far-ahead leader

is substantially higher than being in the competitive region—due to intense competition in

states 0 through k—it is worthwhile for the leader to create a “buffer” between its current

state and the competitive region. The further ahead is the leader, the longer it expects to

17stay in the monopolistic region before falling back to state k.

For sufficiently large s, both firms cease to invest. This happens to the follower because

it is too far behind—its firm value is low, and the marginal value of catching up by one

step is not worth the investment cost. This is known as the “discouragement effect” in

the dynamic contest literature (Konrad (2012)). The leader eventually ceases investment

as well, due to a “lazy monopolist” effect: the “buffer” has diminishing value, and once

the lead (n − k) is sufficiently large, an additional step of security is no longer worth the

investment costs.

4.3 Steady State

The steady-state of an equilibrium can be characterized by the investment cutoff states,

n and k.7 The aggregate productivity growth rate in the steady-state is a weighted av-

erage of the productivity growth rate in each market; hence, aggregate growth depends

on both the investment decisions in each state as well as the stationary distribution over

states, which in turn is a function of the investment decisions. Given the investment cut-

offs (n, k), equations (10) and (11) enable us to solve for the stationary distribution {µs }

in closed form. The following result builds on Lemma 3 and shows that the aggregate

growth rate can be succinctly summarized by the fraction of markets in the competitive

and monopolistic regions.

Lemma 5. In a steady-state induced by equilibrium investment cutoffs (n, k), the aggregate

productivity growth rate is

g = ln λ µC · (η + κ) + µM · κ ,

where µC ≡ ks=1 µs is the fraction of markets in the competitive region and µM ≡ n+1

P P

s=k+1 µs

is the fraction of markets in the monopolistic region. The fraction of markets in each region

7

Technically, because we do not assume leader profits {πs } are always concave, the leader may resume

investment after state n + 1. However, because market leaders do not invest in state n + 1, the investment

decisions beyond state n + 1 are irrelevant for characterizing the steady-state because there are no markets

in those states. Moreover, because {πs } is eventually concave in s (c.f. Lemma 2), all equilibria follow a

monotone structure when interest rate r is small.

18satisfies

µ0 + µC + µM = 1, µ0 ∝ (κ/η)n−k+1 (1 + κ/η)k /2,

1 − (κ/η)n−k+1

µC ∝ (κ/η)n−k (1 + κ/η)k − 1 , µM ∝

.

1 − κ/η

Lemma 5 follows from the fact that aggregate productivity growth is equal to the

average rate of productivity improvements for market followers (Lemma 3). It shows the

fractions of markets in the competitive and monopolistic regions are sufficient statistics

for steady-state growth, and that markets in the competitive region contribute more to

aggregate growth than those in the monopolistic region. Intuitively, both firms invest

in the competitive region, and, consequently, productivity improvements are rapid, the

state transition rate is high, dynamic competition is fierce, leadership is contentious, and

market power tends to decrease over time. On the other hand, the follower ceases to invest

in the monopolistic region, and, once markets are in this region, they tend to become more

monopolistic over time. The monopolistic region also includes state n + 1, where even

the leader stops investing. On average, this region features a low rate of state transition

and low productivity growth.

Equilibrium investment cutoffs (n, k) affect aggregate growth through their impact

on the fraction of markets in each region. Lemma 5 implies that holding n constant, a

higher k always draws more markets into the competitive region, thereby raising the

steady-state productivity growth rate. On the other hand, holding k ≥ 1 constant—that

followers invest at all—a higher n reduces productivity growth by expanding the monopo-

listic region and reducing the fraction of markets in the competitive region. We formalize

this discussion into a Corollary, and we further provide lower bounds for the steady-state

investment and growth rate when k ≥ 1.

Corollary 1. Consider an equilibrium with investment cutoffs (n, k). The steady-state

growth rate g is always increasing in k, and g is decreasing in n if and only if k ≥ 1.

Lemma 6. Consider an equilibrium with investment cutoffs (n, k). If k ≥ 1, then in a

steady-state, the aggregate investment is bounded below by c · κ, and the productivity growth

rate is bounded below by ln λ · κ.

4.4 Comparative Steady-State: Declining Interest Rates

The key theoretical results of the model concern the limiting behavior of aggregate steady-

state variables as the interest rate declines toward zero. Conventional intuition suggests

19that, when firms discount future profits at a lower rate, the incentive to invest should

increase because the cost of investment declines relative to future benefits. This intuition

holds in our model, and we formalize it into the following lemma.

Lemma 7. limr→0 k = limr→0 (n − k) = ∞.

The result suggests that, as the interest rate declines, firms in all states tend to raise

investment. In the limit as r → 0, firms sustain investment even when arbitrarily far

behind or ahead: followers are less easily discouraged, and leaders are less lazy.

However, the fact that firms raise investment in all states does not translate into high

aggregate investment and growth. These aggregate variables are averages of the invest-

ment and productivity growth rates in each market, weighted by the steady-state distri-

bution. A decline in the interest rate not only affects the investment decisions in each

state but also shifts the steady-state distribution. As Lemma 5 shows, a decline in the in-

terest rate can boost aggregate productivity growth if and only if it expands the fraction

of markets in the competitive region; conversely, if more markets are in the monopolistic

region—for instance if n increases at a “faster” rate than k—aggregate productivity growth

rate could slow down, as Corollary 1 suggests.

Our main result establishes that, as r → 0, a slow down in aggregate productivity

growth is inevitable and is accompanied by a decline in investment and a rise in market

power.

Theorem 1. As r → 0, aggregate productivity growth slows down:

lim g = ln λ · κ.

r→0

In addition,

1. No markets are in the competitive region, and all markets are in the monopolistic re-

gion:

lim µC = 0; lim µM = 1.

r→0 r→0

2. The productivity gap between leaders and followers diverges:

∞

X

lim µs s = ∞.

r→0

s=0

203. Aggregate investment to output ratio declines:

∞

X

lim c · µs (ηs + η−s ) = cκ.

r→0

s=0

4. Leaders take over the entire market, with high profit shares and markups:

∞

X

lim µ s πs = π∞ .

r→0

s=0

Under Bertrand competition, the average sales of market leaders converges to 1 and

that of followers converges to zero; aggregate labor share in production converges to

zero.

5. Market dynamism declines, and leadership becomes permanently persistent:

∞

X

lim Ms µs = ∞,

r→0

s=0

where Ms is the expected time before a leader in state s reaches state zero.

6. Relative market valuation of leaders and followers diverges:

P∞

µs vs

lim P∞s=0 = ∞.

s=0 µs v−s

r→0

The Theorem states that, as r → 0, all markets in a steady-state are in the monopolistic

region, and leaders almost surely stay permanently as leaders. Followers cease to invest

completely, and leaders invest only to counteract technology diffusion κ. As a result,

aggregate investment and productivity growth decline and converge to their respective

lower bounds governed by the parameter κ.

In the model, a low interest rate affects steady-state growth through two competing

forces. As in traditional models, a lower rate is expansionary, as firms in all states tend

to invest more (Lemma 7). On the other hand, a low rate is also anti-competitive, as

the leader’s investment response to a decline in r is stronger than follower’s response.

This anti-competitive force changes the distribution of market structure toward greater

market power, thereby reducing aggregate investment and productivity growth. Theorem

1 shows that the second force always dominates when the level of the interest rate r is

sufficiently low.

21In fact, the limiting rate of productivity growth, κ · ln λ, is independent of the limiting

profit lims→∞ πs and the investment cost c. Theorem 1 therefore has precise implications

for anti-trust policies. As we elaborate in Section 6, policies that raise κ can promote

growth, whereas policies that reduce leader profits or reduce the follower’s investment

costs are ineffective when r is low.

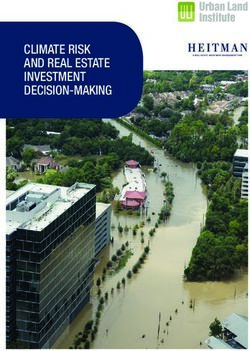

Because κ ln λ is the lower bound on productivity growth (c.f. Lemma 6), Theorem

1 implies an inverted-U relationship between steady-state growth and the interest rate,

as depicted in Figure 3. In a high-r steady-state, few firms invest in any markets, and

aggregate productivity growth is low. A marginally lower r raises all firms’ investments,

and the expansionary effect dominates. When the interest rate is too low, however, most

markets are in the monopolistic region, in which followers cease to invest, and aggregate

productivity growth is again low. The anti-competitive effect of a low interest rate also

generates other implications: the leader-follower productivity gap widens, the relative

leader-follower market valuation diverges, the profit share and markups rise, and business

dynamism declines.

Figure 3: Steady-state growth and the interest rate: inverted-U

Lemma 7 shows that, as r → 0, the number of states in both the competitive and

monopolistic regions grow to infinity, but n and k may grow at different rates. Theorem 1

shows that the fraction of markets in the monopolistic region µM converges to one, which

can happen only if the monopolistic region expands at a “faster rate” than the competitive

region, i.e., the leader raises investment “faster” in response to a low r than the follower

does. In the Appendix, we provide a sharp characterization on the exact rate of divergence

for k and (n − k) and the rate of convergence for µM → 1 (Lemma A.4).

To understand the leader’s stronger investment response, we again turn to Figure 2.

The shape of the value functions in the figure holds for any r. As the figure demonstrates,

22You can also read