GUIDELINES FOR COMPETITION IN THE SOUTH AFRICAN - AUTOMOTIVES AFTERMARKETS DECEMBER 2020

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

competition commission

south africa

GUIDELINES FOR COMPETITION

IN THE SOUTH AFRICAN

AUTOMOTIVES

AFTERMARKETS

DECEMBER 2020

a growing, deconcentrated and inclusive economy

www.compcom.co.zaTABLE OF

CONTENTS

1. PREFACE 03

2. DEFINITIONS 03

3. INTRODUCTION 06

4. OBJECTIVES AND LEGISLATIVE FRAMEWORK 12

5. IN-WARRANTY SERVICE, MAINTENANCE AND REPAIRS BY ISPS 13

6. APPOINTMENT OF MOTOR-BODY REPAIRERS BY OEMS 14

7. APPOINTMENT OF SERVICE PROVIDERS AND ALLOCATION OF WORK 16

BY INSURERS

8. APPOINTMENT OF DEALERS BY OEMS 17

9. PREVENTING ANTI-COMPETITIVE INFORMATION SHARING BY MULTI- 19

BRAND DEALERSHIPS

10. FITMENT AND ACCESS TO SPARE PARTS 20

11. THE BUNDLED SALE OF MOTOR VEHICLES WITH VALUE ADDED 23

PRODUCTS

12. ACCESS TO TECHNICAL INFORMATION AND OEM-TRAINING FOR ISPS 25

13. IMPLEMENTATION 26

14. MONITORING OF ADHERENCE TO THE GUIDELINES 27

15. DISPUTE RESOLUTION 27

16. REVIEW OF THE GUIDELINE 27

17. CONCLUSION 28

22 Guidelines for Competition in the Automotive Aftermarket1. PREFACE

1.1. These Guidelines have been prepared in to ISPs; high barriers to entry that exclude

terms of section 79(1) of the Competition small and medium enterprises (SMEs)

Act No. 89 of 1998, as amended (“Act”) which and historically disadvantaged individuals

provides that the Competition Commission (HDIs) from becoming Approved Motor-

(“Commission”) may prepare Guidelines to body Repairers and Approved Dealers; and

indicate its approach on any matter falling a lack of competition and consumer choice

within its jurisdiction in terms of the Act. in the sale and fitment of Spare Parts.

These Guidelines are not binding on the

Commission, the Competition Tribunal, 1.3. The Commission has been working with

or the Competition Appeal Court in the the industry since early 2017 to resolve

exercise of their respective discretion, or these market issues. The Commission

their interpretation of the Act. initially facilitated an advocacy program

towards an industry voluntary Code of

1.2. Over the past decade, the Commission has Conduct. After two years of engagements

received complaints regarding allegations and consultation, the stakeholders failed

of anti-competitive conduct in the to reach consensus and/or to commit to

aftermarket value chain. The allegations meaningful pro-competitive reforms in

include exclusionary agreements and/ response to the challenges posed.

or arrangements between OEMs and

Approved Motor-body Repairers; the 1.4. These Guidelines therefore provide

exclusion or foreclosure of Independent practical guidance for the automotive

Service Providers in the markets for the aftermarkets industry, intended to

service and maintenance and Mechanical promote inclusion and to encourage

Repairs for In-Warranty Motor Vehicles; competition through greater participation

unfair allocation of work by Insurers; of small businesses as well as historically

restrictions on the sale of Original Spare Parts disadvantaged groups.

2. DEFINITIONS

2.1. “Act” means the Competition Act no. 89 2.3. “Automotive Aftermarket” means for

of 1998, as amended. these Guidelines, the after-sale market

which includes maintenance and repair

2.2. “Agreement” means any consensus, services and related value added

contract, arrangement, understanding products, Mechanical Repairs, Structural

between two or more parties that purports Repairs and Non-Structural Repairs to

to establish a relationship between them, Motor Vehicles, the sale of motor vehicle

whether or not legally enforceable, that Spare Parts, tools and components and

the parties consider binding upon them.

Competition Commission South Africa • www.compcom.co.za 33the sale and administration of Motor into operation, were disadvantaged by

Vehicle Insurance. unfair discrimination on the basis of race;

2.4. “Commercially Sensitive Information” 2.10.1. an association, a majority of whose

means trade, business, industrial members are individuals referred

information and data stored electronically to in paragraph 2.10.

or in the cloud that has economic value to

a firm and its business strategy and that 2.10.2. a legal person, other than an

is generally not available to or known by association, and individuals

others. referred to in paragraph 2.10.1

own and control a majority of its

2.5. “Commission” means the Competition issued share capital or members’

Commission of South Africa. interest and are able to control a

majority of its votes: or

2.6. “Consequential Damage” means injury

or harm that does not ensue directly and 2.10.3. a legal person or association, and

immediately from the act of a party, but persons referred to in the above

only as a result of a consequence or from paragraphs that own and control a

some of the results of such act, and that majority of its issued share capital

may be compensated by a monetary or members’ interest and are able

award. to control a majority of its votes.

2.7. “Dealer” means a business enterprise 2.11. “Independent Service Providers” or

whose business is in the retail of new “ISP” means all Dealers and Motor-body

and/or used motor vehicles, the sale and Repairers, who are not appointed as an

resale of Spare Parts and the service, Approved Dealer or Approved Motor-

maintenance, and Mechanical Repairs of body Repairer as defined herein.

motor vehicles but excludes Motor-body

Repairers, as defined herein. For purposes 2.12. “Information Barriers” means measures

of these Guidelines, an Approved Dealer within an organization that are created

means a Dealer that is appointed by an to prevent exchanges of Commercially

OEM. Sensitive Information or communication

that could lead to conflicts of interest

2.8. “Designated Geographic Area” means and/or constitute a prohibited practice in

a local (municipal), district, regional or terms of the Act.

provincial area.

2.13. “Insurer” means a legal person licensed

2.9. “Extended Warranty” is an optional and as an insurer in terms of the Insurance

additional Warranty that a consumer can Act, No. 18 of 2017, that provides and

purchase to extend the application of a sells motor insurance cover for loss or

Warranty. damage to a Motor Vehicle, and any

person acting on their behalf including

2.10. “Historically Disadvantaged Indi- brokers, intermediaries, underwriters and

vidual” or “HDI” means one of a assessors.

category of individuals who, before the

Constitution of the Republic of South 2.14. “Liability” means responsibility for the

Africa, 1993 (Act No. 200 of 1993), came consequences of one’s acts or omissions,

44 Guidelines for Competition in the Automotive Aftermarketenforceable by a civil (damages) or and includes an importer of Motor

criminal remedy. Vehicles.

2.15. “Maintenance Plan” refers to a non- 2.21. “Safety Systems” refers to parts,

insurance product, covering the regular components or systems, the failure of

maintenance and repairs of a Motor which may directly or indirectly endanger

Vehicle on components and parts that the life or limb of passengers in the

include wear and tear. A Maintenance vehicle.

Plan is used at specified pre-determined

times or stipulated mileage. 2.22. “Security Systems” refers to anti-theft

devices which prevent the operation

2.16. “Mechanical Repair” means the of a Motor Vehicle without the fob (an

restoration or replacement of the electronic device used typically in place

working parts of a Motor Vehicle, such of a key) programmed for that Motor

as the engine and operational software, Vehicle including the transponder chip,

including diagnosing and detecting faults sensors and other devices that disable

in Motor Vehicles, and the replacement or protect the Motor Vehicle. Security

and programming of a Motor Vehicle’s Systems include but are not limited to the

electric and electronic components. coding of keys, engine control unit, body

control unit, audio or infotainment unit,

2.17. “Motor Vehicle” means any vehicle instrument cluster, injector pump, which

designed or adapted for propulsion or share a rolling code program to prevent

haulage on a road by means of fuel, gas theft or start-up and driving of the Motor

or electricity or any other means. Vehicle.

2.18. “Motor-body Repairer” means a 2.23. “Service Plan” refers to a non-insurance

business enterprise that performs product covering the service of a Motor

Structural Repairs and Non-Structural Vehicle and components and parts of a

Repairs to Motor Vehicles but excludes Motor Vehicle that may need replacing

Dealers, as defined herein. For purposes when it is due for a service, exclusive of

of these Guidelines, an Approved Motor- normal wear and tear. A Service Plan is

body Repairer means a Motor-body used at specified pre-determined times

Repairer that is appointed by an OEM or a stipulated mileage.

(OEM Approved Motor-body Repairs) or

an Insurer (Insurer Approved Motor-body 2.24. “Small and Medium Enterprise” or

Repairs). “SME” means a small business as defined

in the National Small Enterprise Act No.

2.19. “Non-Structural Repair” means work 102 of 1996.

undertaken to restore the damaged

interior and exterior parts of a Motor 2.25. “Spare Parts” means replacement

Vehicle, that do not have an intrinsic products for worn, defective or damaged

bearing on the mechanical functioning components or parts of a Motor Vehicle.

of the Motor Vehicle, including plastic,

aluminium, and steel parts. 2.25.1. “Original Spare Parts”, for

purposes of these Guidelines,

2.20. “OEM” means an original equipment are replacement Spare Parts

manufacturer as well as any legal person produced by, on behalf of or

over which it has direct or indirect control under the instructions/order of

Competition Commission South Africa • www.compcom.co.za 55an OEM and in accordance with Vehicle repairs, such as Maintenance

specifications and production Plans, Service Plans, Extended Warranty

standards provided by the OEM, and scratch and dent cover.

as well as those Spare Parts

distributed by the OEM or any 2.28. “Vehicle Service Book” refers to a

other authorised distributors physical book or the electronic equivalent

of the OEM or marked with the including data stored electronically or in

trademark of the OEM. the cloud which is used to keep a record

of any work performed on the Motor

2.25.2. “Non-Original Spare Parts”, for Vehicle, when it was done, and by whom.

purposes of these Guidelines, are

Spare Parts that carry a Warranty 2.29. “Warranty” is an obligation by the

from its manufacturer and are OEM to replace or repair certain

legitimate and traceable for sale components or parts of a Motor Vehicle

in the aftermarket, but that are that need replacement or repair due to a

not Original Spare Parts. Non- manufacturing or factory defect:

Original Spare Parts exclude

2.29.1. “In-Warranty” means the period in

counterfeit Spare Parts.

which an OEM has an obligation to repair

2.26. “Structural Repair” means the work or replace any component or part of the

undertaken to mend, restore, refinish, Motor Vehicle which proves defective in

and replace, inter alia, the bodywork, materials or workmanship.

frames, painting and treating the surface

2.29.2. “Out-of-Warranty” means the period in

and fixing the glass (if undertaken as

which a Warranty (or Extended Warranty)

part of the foregoing activities) of Motor

has expired and in which the OEM has no

Vehicles.

obligation to repair or replace defective

2.27. “Value-added Products” means add-on components or parts.

cover for maintenance, service, and Motor

3. INTRODUCTION

The Automotive Value Chain

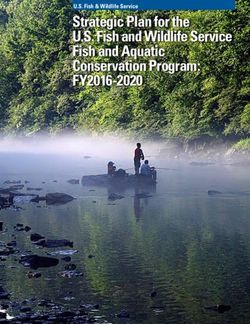

3.1. Generally, the automotive sector is divided 3.2. The automotive value chain is depicted in

into two related markets, the market for Figure 1 below:

the manufacturing of new Motor Vehicles

(usually referred to as “the primary market”)

and the after-sales or aftermarket (referred

to as “the secondary market”).

66 Guidelines for Competition in the Automotive AftermarketFigure 1: The Automotive Value Chain

Raw material suppliers: goods supplied: Steel and PU (Polyurethane), aluminium,

leather, platinum group metals, plastics, brass and chemicals. Suppliers:

ArcelorMittal, Huletts Aluminium, Anglo American platinum.

Tier 3 Suppliers: Low value Components. Close to raw material suppliers. Mostly

South African owned companies that sell sub-components and parts to Tiers 1 and

Components

Manufacturing

Tier 2 supplies to make their specialised products, systems and components.

Tier 2 Suppliers: Manufacture of sub-components for number of basic automotive

components. Well integrated in the supply chain of major Tier 1 suppliers. Example

of goods produced in this level are; Seals, hoses, flanges, fasteners, nuts, clamps,

valves, computer chips etc. suppliers; Precision press (Pty)ltd (metal pressing, sub-

assemblies), C&J services (engine components, washers, nuts etc.)

Tier 1 Suppliers: Make major components for the OEM’s. - Highly integrated into

the supply chain of major OEMs. Usually dedicated supply to a major OEM. Supply

components or systems directly to the OEMs and has global recognizable brands.

Examples of goods supplied are Catalytic converters, braking systems, engines

exhausts systems. Examples of Tier 1 suppliers are Festo, Johnson Matthey,

Mothersons, Yazaki, Simito, Robert Bosch and Behr.

OEMs assemble the various components of a motor vehicle to produce a complete

Automobile unit. For the purposes of assembly, the components may also be

imported from other countries. Examples of OEMs who undertake assembly work

in SA include Mercedes-Benz, BMW, Ford, Toyota and Volkswagen.

Assembly &

Distribution

The automotive aftermarket is the automotive industry’s after-sale market. It

includes the retail of vehicles and the sale of vehicle spare parts and equipment

(e.g. replacement tyres, accessories). The aftermarket also includes the service,

maintenance and repairs of motor vehicles.

Aftermarkets

Source: Commission’s own compilation from publicly available data

Competition Commission South Africa • www.compcom.co.za 77Manufacturing The Approved Dealers form part of listed

retail groups which have several divisions,

3.3. The manufacturing process includes the including automotive, fleet management,

following elements: foundry operations, warehousing, transportation, financial

which, whether integrated with Motor services, and car rental.

Vehicle assembly facilities or independent

shops, cast metal products for the 3.6. Dealerships are dedicated points of sale for

production of Motor Vehicles and Motor each OEM; they represent the OEM to the

Vehicle equipment metal shaping and customer and act as their agents. Examples

machining, where vehicle parts, including of Dealerships in South Africa include CMH

bumper bars, hubcaps and body parts are Group, Lazarus Group, BB group Lindsay

manufactured in metal galvanizing and Saker and McCarthy Group.

electroplating shops which also provide

metal coating to inhibit oxidation, prevent Aftermarket: Financing and Insurance

corrosion and extend the life of the product

Motor Vehicle assembly and Motor Vehicle 3.7. Financial institutions (banks) typically

painting and finishing.1 provide consumers with finance for the

purchase of Motor Vehicles. As a value-

Aftermarket: Motor Vehicle Retail, Service, added service, Dealerships can sometimes

Maintenance and Repairs act as intermediaries for accessing finance,

when requested by a consumer. At the

3.4. The key players in the aftermarket include point of sale, new motor vehicles are

Repairers (e.g. mechanical, motor-body, covered by a warranty of the OEM, which

structural, non-structural), Dealers and can be applicable to the entire vehicle

spare- parts suppliers. These parties may and to particular parts and components

either be appointed by an OEM to provide of the vehicle; OEMs also offer (or sell)

services to their customers or operate value-added products, such as service and

independently of such arrangements. maintenance plans, to consumers. There

are also 3rd party providers of service

3.5. The retail market comprises OEMs, Dealers, and maintenance plans and extended

importers and distributors. Dealers are warranties for vehicles out of the warranty

often contracted or owned by OEMs and period. Finally, Insurance companies cover

act as agents of the OEMs to sell their Motor the costs of repairs to a Motor Vehicle and

Vehicles and provide services to customers. loss of a Motor Vehicle.

Overview of the South African Industry

3.8. In South Africa, the automotive industry manufacturing output. It is the country’s

contributes 6.4% to the country’s fifth-largest exporting sector out of all 104

gross domestic product (GDP) (4.0% sectors and accounts for 13.9% of total

manufacturing and 2.4% retail) and exports.2

accounts for 30.1% of the country’s

1 Who owns Whom: The Motor Vehicle Industry, October 2018.

2 NAAMSA submission to the Competition Commission on the Draft Guidelines for Competition in the South

African Automotive Aftermarket Industry dated 30 June 2020.

88 Guidelines for Competition in the Automotive Aftermarket3.9. The manufacturing segment of the industry with three OEMs (BMW, Ford and Nissan),

currently employs more than 110,000 and approximately 40% of the South

people across its various tiers of activity African automotive components industry.5

(from component manufacturing to vehicle

assembly).3 3.14. Table 1 outlines the number of brands and

model derivatives in respect of new Motor

3.10. The South African automotive industry Vehicles, available to consumers in South

consists of twenty-two (22) companies Africa.

involved in the production of Motor

Vehicles (OEMs). In addition, there are Table 1: The number of brands and model

twenty-one (21) companies that import derivatives of new Motor Vehicles in South Africa

and distribute new Motor Vehicles in (2017)

the country. There are approximately five

hundred (500) automotive component Model

Segment Brands

suppliers, including 180 first-tier suppliers.4 derivatives

New cars 55 3458

3.11. The South African industry value chain Light commercials 26 739

is primarily driven by seven (7) OEMs: Medium commercials 17 185

BMW; Ford; Isuzu; Mercedes Benz; Nissan; Heavy commercials 12 132

Toyota; and Volkswagen. Extra-heavy commercials 11 540

Buses 9 55

3.12. These companies make a huge impact on

Source: NAAMSA6

the economies of Gauteng, the Eastern

Cape and KwaZulu-Natal. Along with their

suppliers, these OEMs are at the centre 3.15. There were an estimated 2078 dealerships

of the three regional clusters and their in South Africa at the beginning of 2017.7

socio- economic contribution is vital in

contributing to the social upliftment of the 3.16. The largest portion of the aftermarket is the

communities they serve. vehicle servicing, repairs and parts supply

channels, which form approximately 80%

3.13. The OEMs are clustered into four primary of the entire automotive aftermarket

geographic areas, each home to one industry, both in employment and rand

or more OEMs. For instance, Gauteng value contributions to the economy.8

(Rosslyn, Silverton and Ekurhuleni), has Motor-body repair encompasses spend in

the second-largest concentration of the region of R10 Billion per annum.9

automotive manufacturing in South Africa,

3 https://naamsa.net/employment-and-skills/

4 NAAMSA, SA Automotive industry structure. Available at: https://www.naamsa.co.za/papers/Manufacturer_

and_Importers_Location.pdf

5 NAAMSA Website at https://naamsa.net/industry-overview/ .

6 NAAMSA submission to the Competition Commission on the Draft Guidelines for Competition in the South

African Automotive Aftermarket Industry dated 2 November 2017, page 2.

7 NAAMSA submission to the Competition Commission on the Draft Guidelines for Competition in the South

African Automotive Aftermarket Industry dated 2 November 2017, page 3.

8 Tyre, Equipment, Parts Association (TEPA) submission to the Competition Commission on the Draft Guidelines

for Competition in the South African Automotive Aftermarket Industry dated 13 March 2020, page 1.

9 Collision Repairers Association (CRA) submission to the Competition Commission on the Draft Guidelines for

Competition in the South African Automotive Aftermarket Industry dated 2 November 2017, page 1

Competition Commission South Africa • www.compcom.co.za 993.17. Motor insurance is said to account departments in the three spheres of

for approximately 45% of the non-life government (national, provincial and

insurance business in the country.10 local).

3.18. Further to this, it is important to note that 3.19. An important stakeholder in the sector is

there are various industry bodies and the consumer, who purchases the Motor

associations which represent the interests Vehicle for use and makes use of the service

of the various players in the sector, at all offered in the aftermarket. It is estimated

levels of the value chain. It is also notable that approximately a third of households

that there are various regulators that are in the country own a Motor Vehicle.

relevant in the different aspects of the

automotive sector as well as government

Policy Developments in the Sector

3.20. The South African automotive industry a) Grow domestic vehicle production

has been guided by policy objectives as to 1% of global output (projected to

articulated initially in the Motor Industry reach 140 million units annually by

Development Programme (MIDP) which 2035).

was subsequently replaced by the b) Increase local content in South African

Automotive Production and Development assembled vehicles to 60% (from 39%

Programme (APDP) in 2013. Now, the in 2015).

South African Automotive Masterplan c) Double total employment in the

(“Masterplan”), which is expected to come automotive value chain (from 112,000

into effect in January 2021 and run until to 224,000).

2035 provides the policy objectives for the d) Improve automotive industry

next coming period. The Masterplan aims competitiveness levels to that of

to create a framework to secure greater leading international competitors.

levels of investments and production. e) Achieve industry transformation

across the value chain.

3.21. The vision of the Masterplan is stated as f) Deepen value addition across selected

‘A globally competitive and transformed commodities or technologies.11

industry that actively contributes to

the sustainable development of South 3.22. The objectives articulated in the Masterplan

Africa’s productive economy, creating align with the objectives of this Guideline,

prosperity for industry stakeholders and particularly to transformation (inclusion)

broader society’. To achieve the vision of and growth in the sector. Stakeholders are

the Masterplan, the Department of Trade encouraged to read these Guidelines with

Industry and Competition (DTIC) set the view of the broader policy objectives

development objectives that will need to of the country.

be met. These include objectives to:

10 South African Insurance Association. Annual Review 2020

11 Minister Rob Davies: South African Automotive master plan and Extended Automotive Production and

Development Programme. Available at: https://www.gov.za/speeches/minister-rob-davies-media- state-

ment-south-african-automotive-masterplan-2035-and-extension. Accessed on [08/02/2019].

10

10

Guidelines for Competition in the Automotive AftermarketCompetition Issues in the Sector

3.23. The Commission notes that similar c) Authorized repairers are free to

constraints to competition in the procure original parts or parts of

Automotive Aftermarket Industry have matching quality from authorised

been identified in other jurisdictions. parts suppliers or independent parts

suppliers.

3.24. In developing these Guidelines, the d) Independent repairers should have

Commission conducted a review and access to the vehicle manufacturers’

comparison of the work being undertaken original parts to allow independent

by competition authorities in other repairers to properly maintain and

jurisdictions, including by the National repair vehicles and to compete with

Development and Reform Commission the authorized repairers.

of China, Federal Anti-monopoly Service e) Vehicle owners have the right to use

of Russia, the European Commission, the any repair shop for non-warranty

Federal Trade Commission in the United work, during the warranty period.

States and the Australian Competition f) Vehicle manufacturers may not make

and Consumer Commission. In these the warranties conditional on the

jurisdictions, such complaints have been repair and servicing of a motor vehicle

approached in several ways, including within their network or the use of their

enforcement and interventions which have own branded spare parts.

led to the promulgation of regulations or g) Vehicle manufacturers are required

voluntary codes of conduct or Guidelines. to make available to authorized and

These initiatives have emphasised independent repairers’ technical

the importance of ensuring effective information and training required to

competition and facilitating transparency service/repair motor vehicles.

and consumer choice.

3.26. The principles outlined in these

3.25. To address these concerns the various Guidelines are based on the Commission’s

Competition Authorities adopted various experience through its advocacy and

regulations which include, among others, investigative work relating to various anti-

the following: competitive concerns identified in the

Automotive Aftermarket Industry, broader

a) The authorized repairers/service policy objectives of the country as well

providers are obliged by regulation as guidance from other jurisdictions

to not only use original parts from concerning competition between OEMs,

approved manufacturers but to also Insurers, Approved Dealers, Approved

use matching quality parts procured Motor-body Repairers and ISPs.

from any other supplier.

b) Vehicle manufacturers may not hinder

their original parts or component

suppliers from also supplying their

products as spare parts to independent

distributors or authorized distributors.

Competition Commission South Africa • www.compcom.co.za 11

114. OBJECTIVES AND LEGISLATIVE

FRAMEWORK

4.1. These Guidelines pertain to all Motor 4.4. These Guidelines seek to achieve these

Vehicles within the Republic of South Africa. objectives by encouraging stakeholders to

adopt measures that:

4.2. In line with the spirit, intent and purpose

of the Competition Act, these Guidelines 4.4.1. Widen the pool of Approved

are directed at promoting competition in Dealers and Approved Motor- body

the Automotive Aftermarket, specifically to Repairers;

promote economic access, inclusion and

greater spread of ownership for Historically 4.4.2. Promote the entry (ownership) of

Disadvantaged Individuals (HDIs). HDIs as Approved Dealers;

4.3. The objectives of the Guidelines are to: 4.4.3. Ensure that ISP’s can undertake In-

Warranty service, maintenance and

4.3.1. Lower barriers to entry and repair work;

ensure that a greater number

of firms, especially firms owned 4.4.4. Allow for greater consumer

and operated by HDIs and SMEs choice and product competition

have an opportunity to undertake in the retail of Service Plans and

service, maintenance and repair Maintenance Plans; and

work of Motor Vehicles within the

period covered by a Motor Vehicle’s 4.4.5. Ensure the fair allocation of work

Warranty; by Insurers to service providers on

insurance panels.

4.3.2. Increase transparency and facilitate

consumer choice on the service,

maintenance and repairs of Motor

Vehicles;

4.3.3. Increase consumer choice and

facilitate competition in the markets

for Spare parts and Value-Added

Products.

12

12

Guidelines for Competition in the Automotive Aftermarket5. IN-WARRANTY SERVICE, MAINTENANCE

AND REPAIRS BY ISPs

5.1. The Guidelines in this section introduce 5.4.2. In instances where a consumer

measures for the service, maintenance chooses to use an ISP during the In-

and repairs of Motor Vehicles during the Warranty period, there shall be no

In-Warranty period. obligation on the OEM to pay for

any service and maintenance work

5.2. Independent Service Providers in South undertaken by the ISP.

Africa have been over the years excluded

from undertaking the service, maintenance 5.4.3. The Motor-body repairs of

and mechanical repairs on Motor Vehicles consumers who have insurance

that are In-Warranty. One of the reasons cover shall be undertaken by an

for this is that when a Motor Vehicle which Approved Motor-body Repairer

is In-Warranty is serviced, maintained during the In-Warranty period,

or repaired by a party other than an as allocated by an Insurer to the

Approved Dealer, there is the potential consumer.

risk that certain provisions of the Warranty

on the Motor Vehicle may become invalid 5.4.4. Consumers who do not have

or void. insurance cover may repair their

Motor Vehicles at a service provider

5.3. The Commission has found that there are of their choice at any point during

information asymmetries and knowledge the Motor Vehicle’s lifespan.

gaps concerning the rights of consumers

and the legal framework regarding 5.4.5. To ensure that all the work done on

warranties. a Motor Vehicle is traceable ISPs are

obliged to record such In-Warranty

5.4. The following principles will be applicable work undertaken by them in their

concerning the service, maintenance customers’ Vehicle Service Books

and repairs of Motor Vehicles during the or equivalent record-keeper.

warranty period:

5.4.6. Accordingly, ISPs shall disclose to

5.4.1. OEMs shall recognise and not consumers, in clear and explicit

obstruct a consumer’s choice to terms, the risk of damage that

seek service, maintenance and could arise from the ISP’s work,

mechanical repair work for their including Consequential Damage

Motor Vehicles at a service provider to the Motor Vehicle, which may

of their choice, regardless of potentially void certain obligations

whether that service provider is an of the OEM in terms of the Warranty.

Approved Dealer or an ISP.

5.4.7. ISPs must disclose to consumers,

whether they have adequate

Competition Commission South Africa • www.compcom.co.za 13

13commercial insurance cover to own cost, to ascertain such damage

perform the work that they will be and liability.

undertaking on the Motor Vehicle.

5.4.9. If there is a dispute, a consumer can

5.4.8. If any damage is caused to a Motor approach the relevant authority to

Vehicle from work done by an ISP, investigate the matter. A consumer

there is a risk that certain provisions who suffers harm from a defective

of the OEM Warranty will be voided. product can bring a claim against

However, other provisions of the any party in the supply chain in

Warranty may remain severable and terms of section 61 of the Consumer

enforceable. The OEM concerned Protection Act No. 68 of 2008.

may conduct an assessment, at its

6. APPOINTMENT OF MOTOR-BODY

REPAIRERS BY OEMs

6.1. OEMs typically appoint a select number Repairers is only applicable during the In-

of Motor-body Repairers to undertake Warranty period of the Motor Vehicle.12

repair work on their brand’s Motor

Vehicles during the In-Warranty period 6.3. In practice, there are instances where

(i.e. Approved Motor-body Repairers). a Motor-body Repairer can attain the

Approved Motor-body Repairers are accreditation of more than one OEM to

accredited to repair Motor Vehicles of repair their Motor Vehicles. There are

that particular OEM, should they meet the also instances where Approved Motor-

standards and specifications set by the body Repairers enter into a exclusive

OEM. To attain accreditation and to meet contracts with a particular OEM, often as

the standards and specifications set by a condition of the accreditation. There are

OEMs, prospective Motor-body Repairers also many instances where the contracts

are typically required to make large between OEMs and Approved Motor-

financial, infrastructure and operational body Repairers are for an indefinite period

investments. (“evergreen”). Some of these contracts

have been in place for multiple decades.

6.2. The allocation of repair work to these

Approved Motor-body Repairers is 6.4. It is also common that OEMs can place

administered by Insurers if the Motor limits on the number of Motor-body

Vehicle is insured, upon a claim made by Repairers that it approves in a particular

their client. The allocation of repair work Designated Geographic Area. The

by Insurers to Approved Motor- body rationale advanced by OEMs for limiting

12 Insurers appoint separate panels of service providers for the repairs of vehicles out of the warranty period,

using Insurer-standards and specifications, rather than the OEM-standards and specifications for the appoint-

ment criteria.

14

14

Guidelines for Competition in the Automotive Aftermarketthe number of repairers is typically related amongst others, expanding the

to cost/investment justification viz-a-viz number of Approved Motor-body

market saturation or insufficient volume of Repairers per geographic area.

work available in the area concerned.

6.9.2. OEMs shall approve any Motor-

6.5. The outcome of these arrangements is body Repairer applicant that meets

such that, in a large geographic area, there their standards and specifications.

may be only one Approved Motor-body

Repairer who can service the vehicle of the 6.9.3. OEMs may not enter into exclusive

OEM’s brands; further the same Repairer arrangements, either with one

may also be undertaking repair work of or more Approved Motor-body

other OEM brands if they are appointed Repairers, for effecting repairs on

by multiple OEMs. an OEM’s Motor Vehicles within a

Designated Geographic Area.

6.6. With few options available for insured

consumers, the arrangements can be 6.9.4. To promote entry and eradicate

inefficient, often leading to delays for long-term legacy arrangements

appointments to repair their Motor between OEMs and Approved

Vehicles (long lead times). Further, many Motor-body Repairers, OEMs shall

consumers are compelled to travel outside not appoint and/or authorise any

of their geographic locations to have Approved Motor-body Repairers

their Motor Vehicles repaired at often far- for a period exceeding five (5)

located Approved Motor-body Repairers. years, and must not continuously

renew the appointment of the same

6.7. Importantly, the arrangements between Approved Motor-body Repairers, if

the OEMs and Approved Motor-body such appointment or renewals are

Repairers, as described above, can lead to to the unreasonable exclusion of

foreclosure of prospective new entrants. the appointment of ISPs capable

Given South Africa’s history of economic of effecting repairs on an OEM’s

exclusion for the majority of the population, Motor Vehicle within a Designated

the long-term, exclusive contracts, serve to Geographic Area.

perpetuate exclusion.

6.8. The Commission believes that such

constraints to effective entry and

participation by ISPs must be avoided by

OEMs. The OEMs should also not engage

in conduct which is exclusionary.

6.9. The following principles are applicable:

6.9.1. OEMs must adopt measures to

promote and/or support the entry

of new Motor-body Repairers, with

a preference for firms owned by

HDIs. Such measures can include,

Competition Commission South Africa • www.compcom.co.za 15

157. APPOINTMENT OF SERVICE PROVIDERS

AND ALLOCATION OF WORK BY INSURERS

7.1. The Guidelines in this section introduce within a Designated Geographic

measures for the appointment of service Area. Insurers’ rationale for the

providers by Insurers to undertake repairs appointment of limited service

and the allocation of work thereto. providers and the allocation

patterns is that there is saturation

7.2. When a claim is made by an insured or insufficient volume of work

consumer, Insurers typically use an available in the area concerned.

electronic system to allocate repair work

to a service provider. The system takes into 7.6. Further, the Commission has found that

consideration the closest supplier to the the application and selection process for

client and whether they are approved by the appointment onto insurance panels is

the OEM/Insurer to make the repairs on deemed unfair and not transparent. There

the insured Motor Vehicle. have been allegations that this process is

particularly biased against HDI applicants.

7.3. Insurers allocate repair work to an OEM-

approved service provider if the Motor 7.7. The guidelines that follow are designed

Vehicle is In-Warranty and to an Insurer- to encourage a fair allocation of work

approved service provider if the Motor and promote inclusivity in the selection

Vehicle is out-of-warranty. The standards of Motor-body Repairers onto panels of

and specifications required for Insurer- Insurers.

accreditation are different and less

stringent to those required by OEMs. 7.8. The following principles will be applicable

concerning Insurers:

7.4. Insurers can accredit a large volume of

service providers to undertake out- of- 7.8.1. Insurers must adopt measures to

warranty repairs onto their panels. Some promote the fair allocation of work

of the large Insurers can have up to 300 to Repairers on their panels, with

service providers, who meet the Insurer a preference for firms owned by

standard, appointed onto their panels. HDIs. Such measures can include,

amongst others, panel rotation or

7.5. From complaints received, the Commission preferential allocation to HDI firms.

found that some Insurers:

7.8.2. Insurers must approve any Repairer

7.5.1. appoint large numbers of service that meet their standards and

providers onto their panels, but specifications, to undertake repairs

allocate work to a few, repeatedly; on out-of-warranty Motor Vehicles.

7.5.2. limit the number of Motor-body 7.8.3. To ensure that the panel

Repairers whom they appoint appointment process is fair,

16

16

Guidelines for Competition in the Automotive AftermarketInsurers shall publish the standards 7.8.6. Insurers shall publish a list of all

used to accredit Repairers on their their Repairers on their websites

websites and/or other suitable and/or other suitable media.

media. Also, Insurers shall formally

disclose reasons to applicants fully 7.8.7. Insurers shall not appoint any

setting out why their applications Repairer to its panel for a period

for panel appointment were exceeding five (5) years and

rejected. should not continuously renew the

appointment of the same Repairer

7.8.4. Insurers shall offer consumers if such appointment or renewals

more choice of Repairers within are to the unreasonable exclusion

their geographic area, for out-of- of the appointment of other

warranty repairs. Repairers capable of effecting

repair and/or maintenance work on

7.8.5. Insured Motor Vehicles that are In- Motor Vehicles within a Designated

Warranty will only be allocated for Geographic Area.

repair to (OEM) Approved Motor-

body Repairers.

8. APPOINTMENT OF DEALERS BY OEMs

8.1. The Guidelines in this section introduce 8.4. South Africa’s Dealership culture is

measures for the appointment of Approved characterised by grand-scale, impressive

Dealers by OEMs. showrooms. It has been submitted to the

Commission that the costs of establishing

8.2. OEMs typically appoint Dealers for the sale a Dealership can be exorbitant, with start-

of their Motor Vehicles and related spare up costs for most brands averaging R60

parts (i.e. Approved Dealers). In addition million (ZAR) and upwards. Some of the

to retail activities, Approved Dealers costly requirements imposed by some

operate workshops where they undertake OEMs include the procurement of furniture,

service, maintenance and mechanical fittings and finishes internationally. OEM

work on their brand’s Motor Vehicles. Most requirements regarding the size and

OEMs appoint Dealers through a franchise location of premises and land are also

agreement, although some OEMs, such as cited as a contributor to the high start-up

Volvo, have OEM-owned Dealerships. costs. In this market, finance is thus a high

barrier to entry.

8.3. Dealerships tend to be located in prime

locations in large urban centres (cities and 8.5. Further, the Commission has found that

metros). There are few to none Approved application and selection process for

Dealers located in rural, peri-urban or the appointment of Approved Dealers is

township centres of the country. deemed unfair and not transparent. There

Competition Commission South Africa • www.compcom.co.za 17

17have been allegations that this process is 8.7.4. OEMs are required to inform

particularly biased against HDI applicants. applicants that were rejected on

quantitative grounds in a particular

8.6. The guidelines that follow are designed geographic area should an

to address some of the above concerns. opportunity for the establishment

The section includes measures targeted of a new dealership arising the

to reduce financial barriers created by the same geographic area within 12

requirements imposed by OEM; measures months of the date of rejection.

to promote pro-competitive procurement

processes by OEMs and measures to 8.8. The following principles will be applicable

promote the entry of HDIs into the concerning facilities of Dealerships:

Dealership market.

8.8.1. OEMs must adopt measures to

8.7. The following principles will be applicable lower financial barriers to entry and

concerning applications made by promote the participation of HDIs

prospective Dealers: in the Dealership market. These

measures can include, amongst

8.7.1. OEMs shall establish fair and others, offering varying iterations of

transparent proce sses for the Dealership options to prospective

s election of Approved Dealers applicants or locating Dealerships

who meet the specific OEM’s in under-serviced geographic

requirements. areas.

8.7.2. Approved Dealers shall be 8.8.2. OEMs shall not impose onerous

selected based on a realistic obligations on prospective Dealers.

evaluation conducted by the The requirements for Approved

OEMs of the market potential for Dealers must be reasonable and

Approved Dealers in a Designated have an economic rationale,

Geographic Area. In keeping with particularly concerning the size of

the transformation objectives for land, showrooms, furniture, fittings,

the industry, preference must and finishes.

be given to applicants who are

owned or controlled by HDIs who 8.8.3. OEMs shall not require Approved

objectively meet the specific OEM’s Dealers to make further investments

requirements. within established facilities if such

investments are not objectively

8.7.3. To ensure that the process is required as a fulfilment of the OEM

transparent, OEMs shall publish standard, such as, for example, due

the standards used to assess and to changes in corporate identity,

select Approved Dealers on their models of Motor Vehicles to be

websites and/or other suitable sold and/or technologies to be

media. Also, OEMs shall formally used by Approved Dealers (which

disclose reasons to applicants fully list is not exhaustive).

setting out why their applications

for dealership were rejected. 8.8.4. OEMs shall approve multiple

suppliers for required branding

18

18

Guidelines for Competition in the Automotive Aftermarketand corporate identity elements of alternative suppliers if they are of

dealerships, from which Approved like kind and quality. In line with

Dealers can procure. the Commission’s transformation

objectives, preference must be

8.8.5. OEMs must not forbid or penalise given to alternative suppliers who

Approved Dealers from purchasing are owned or controlled by HDIs.

the said goods from such approved

9. PREVENTING ANTI-COMPETITIVE

INFORMATION SHARING BY

MULTI- BRAND DEALERSHIPS

9.1. The Commission is concerned about the 9.3.2. Approved Dealers that sell new Motor

exchange of Commercially Sensitive Vehicles and products of competing

Information between Approved Dealers OEMs shall ensure that no Commercially

that sell new Motor Vehicles and products Sensitive Information is provided or shared

of competing OEMs (i.e. multi-brand with competing OEMs.

dealerships).

9.3.3. Approved Dealers that sell new Motor

9.2. The guidelines that follow introduce Vehicles and products of competing

measures which OEMs and Approved OEMs shall implement Information

Dealers should heed regarding the Barriers and measures to ensure that there

management of Commercially Sensitive is no exchange of Commercially Sensitive

Information which may affect competition. Information between them and competing

OEMs. These Information Barriers include

9.3. The following principles will be applicable but are not limited to the following:

in relation to the exchange of Commercially

Sensitive Information: a) OEMs and Approved Dealers shall keep

separate, internal accounts for downstream

9.3.1. Approved Dealers that sell new Motor retail offerings in a way that permits the

Vehicles and products of competing OEMs profitability of these retail products to be

shall ensure that they do not engage in monitored.

price co- ordination. Specifically, the prices

of competing Motor Vehicles and products b) To the extent that an employee of

should be determined by different an Approved Dealer has access to

individuals within the dealership. Persons Commercially Sensitive Information about

setting prices for new Motor Vehicles and a specific OEM, that employee shall

products of competing OEMs must do so ensure that he/she does not communicate

independently of each other. such information to any competing OEM

or facilitate or permit the use of such

information by a competing OEM, other

Competition Commission South Africa • www.compcom.co.za 19

19than in aggregated, historical or summary d) OEMs and Approved Dealers shall

form. implement internal training to ensure that

its employees are aware of and understand

c) Employees of OEMs and Approved the provisions of the Act that are relevant

Dealers involved in the automotive value to the exchange of Commercially Sensitive

chain must sign undertakings not to share Information between competitors,

Commercially Sensitive Information with including the Guidelines on the Exchange

employees of competing OEM’s Approved of Information between Competitors and

Dealers. The undertakings must be stored section 4 of the Act (restricted horizontal

by the OEMs and Approved Dealers and practices) in particular.

be made available to the Commission on

request.

10. FITMENT AND ACCESS TO

SPARE PARTS

10.1. There are approximately between 30,000 parts’ specifications. Approved Dealers

and 60,000 parts and components in a and Approved Motor-Body Repairers are

Motor Vehicle. Spare parts in South Africa obliged to fit Original Spare Parts in the

are regulated by different regulators such repairs of motor vehicles.

as the South African Revenue Service

(SARS) which deals with customs, excise 10.4. The same manufacturer who produces

and tax of imported components and spare parts for OEMs can also produce

the National Regulation for Compulsory the same, but without the branding

Specification (NRCS), which regulates the of the OEM- these are regarded as

safety of the following parts: lights, brakes, “identical” spare parts in the market. Other

brake fluids and seals. As it currently stands manufacturers may also produce similar

the industry standards are aligned with the spare parts, sometimes referred to as

international standards such as European “equivalent” or “equal- matching” spare

Union regulations. parts. In the market for spare parts, there

are are also spare parts which are mined

10.2. The Commission recognises that within from damaged motor-vehicles, while

the aftermarket automotive industry, Spare functionally safe- regarded as “green”

Parts are disaggregated based on their spare parts.

origin or source.

10.5. In this Guideline, the Commission has

10.3. OEMs appoint manufacturers to decided to use a more simplified approach

manufacture replacement parts (“Original and refers to Original and Non-Original

Spare Parts”) for use in the repair of the Spare Parts. This Guideline’s reference to

OEMs brand. The OEM is the holder of Non-Original parts excludes “counterfeit”,

the intellectual property rights over the “grey” and all illegally-sourced spare parts.

20

20

Guidelines for Competition in the Automotive Aftermarket10.6. The Commission has received complaints on their motor vehicles during the In-

from ISPs and consumers regarding OEMs Warranty; should a Non-Original Spare Part

who refuse to sell them Original Spare be fitted in an In-Warranty Motor Vehicle,

Parts for use in the repair of motor vehicles. this may void the vehicle’s Warranty.

Such behaviour limits the ability of an ISP However, Original Spare Parts tend to be

to undertake the required repairs, and more expensive than Non-Original Spare

further limits a consumer’s choice to use parts and thus not affordable for some

Original or Non-original Spare Parts for consumers. The guidelines that follow

their vehicle. address issues related to access to spare

parts and the fitment of spare parts during

10.7. Further, consumers are also prevented the In-Warranty period.

from fitting Non-Original Spare Parts

Fitment of Non-Original Spare Parts for In-Warranty Motor

Vehicles

10.8. The principles that follow introduce the the damage and if the Warranty

concept of the use of Non-Original Spare is voided. If there is a dispute

Parts for In-Warranty Motor Vehicles. a consumer can approach the

The rationale is to increase consumer relevant authority to investigate

choice in the fitment of Spare Parts for In- the matter. A consumer that suffers

Warranty Motor Vehicles by allowing the harm from a defective product can

Motor Vehicle owners to choose between bring a claim against any party in

Original and Non- Original Spare Parts. the supply chain in terms of section

10.8.1. Consumers can fit Original or Non- 61 of the Consumer Protection Act No. 68 of

Original Spare Parts, at a service 2008. Approved Dealers and ISPs must

provider of their choice, whether make consumers aware, in clear and

an Approved Dealer, Approved explicit terms, the risk of damage, including

Motor-body Repairer, or an ISP, Consequential Damage, from the fitment

during the In-Warranty period. of Spare Parts by an ISP, potentially voiding

certain obligations of the OEM in terms of

10.8.2. If there is any damage to the Motor the Warranty.

Vehicle from the fitment of Spare

Parts by an ISP, there is a risk that 10.8.3. To ensure that all the work done on

certain provision in the Warranty a Motor Vehicle is traceable ISPs are

will be voided. However, other obliged to record such In-Warranty work

provisions of the Warranty may undertaken by them in their customers’

remain severable and enforceable. Vehicle Service Books.

The OEM or Approved Dealer may

conduct an assessment at its own

cost to determine the cause of

Competition Commission South Africa • www.compcom.co.za 21

21Sale and distribution of Original Spare Parts

10.9. The guidelines that follow are to ensure protected by intellectual property

that OEMs and/or Approved Dealers make rights or are linked to a Motor

Original Spare Parts available to ISPs, Vehicle’s Security Systems.

where appropriate:

10.9.6. OEMs may not enter into any

10.9.1. OEMs and/or Approved Dealers agreements with manufacturers of

shall make Original Spare Parts Spare Parts, tools or equipment,

available through sales and that will restrain the manufacturer

distribution, to ISPs where required or supplier’s ability to place its

to perform service, maintenance or trademark or logo effectively and

repair work. in an easily visible manner on the

said item.

10.9.2. Conditional sale and distribution

of Original Spare Parts shall only 10.9.7. OEMs may not set minimum retail

be reserved for those items that prices for Spare Parts.

are linked to the Motor Vehicle’s

Security System. 10.9.8. There is no obligation on Approved

Dealers to supply Non-Original

10.9.3. OEMs may not restrict an ISP’s ability Spare Parts.

to procure Original Spare Parts,

when required for the purposes of

effecting service, maintenance and

repair work. OEMs may however

impose restrictions or prohibitions

on ISPs from on-selling Original

Spare Parts to 3rd parties.

10.9.4. An OEM shall allow an ISP access

to security-critical components

subject to the ISP meeting the

OEM’s accreditation requirements

and standards, as per the OEM’s

global practice.

10.9.5. OEMs may not enter into any

agreements with manufacturers

or suppliers of Spare Parts, tools

or equipment to restrict the

manufacturer or supplier’s ability

to sell those goods to ISPs or end

users, except for those Spare

Parts, tools or equipment that are

22

22

Guidelines for Competition in the Automotive Aftermarket11. THE BUNDLED SALE OF MOTOR

VEHICLES WITH VALUE ADDED

PRODUCTS

11.1. In South Africa, when consumers buy a of the Motor Vehicle and the price of the

new Motor Vehicle, they are typically sold Value-Added Products separately.

a Maintenance Plan and/or Service Plan,

included in the purchase price of the Motor 11.5. This will allow consumers to exercise

Vehicle. Most consumers are unaware that choice regarding whether to purchase

the purchase price of the Motor Vehicle is the Maintenance Plan or Service Plan and

bundled with these value-added products. make servicing a more affordable option

for South Africans, whilst allowing for more

11.2. OEMs and their Approved Dealers sell players to provide such Value-Added

these Service and/or Maintenance Plans Products for consumers whose Motor

through a variety of packages, typically as Vehicles are In-Warranty.

a combination of mileage and time such as

3 years / 60 000km; 4 years / 120 000km; 5 11.6. The following principles will be applicable

years /150 000km. The package will allow concerning Service and/or Maintenance

a customer to take their Motor Vehicle in Plans:

for service or maintenance when required

at regular intervals until they reach either 11.6.1. OEMs shall recognise and not

the mileage or time limit. hinder a consumer’s choice to the

following:

11.3. The Commission acknowledges that this

bundling may make the purchasing of 11.6.1.1. purchase Value-Added

these plans easier for some customers Products (such as

who would otherwise have to seek these Maintenance Plans, Service

out separately. However, the Commission Plans and Extended

notes that some customers can and do Warranties) concurrently and

purchase these Value-Added Products together with a new Motor

outside of the standard OEM provided Vehicle from Approved

plan from other third-party suppliers. Dealers;

11.4. The Guidelines that follow provide for the 11.6.1.2. purchase Value-Added

unbundling of Maintenance Plans and Products (such as

Service Plans at the point of sale from Maintenance Plans, Service

the purchase price of the Motor Vehicle. Plans and Extended

Therefore, it is imperative that at the point Warranties) separately from

of sale, OEMs, Approved Dealers, and a new Motor Vehicle from

financiers disclose to customers the price Approved Dealers;

Competition Commission South Africa • www.compcom.co.za 23

2311.6.1.3. purchase Value-Added 11.6.4.1. provide the consumer with

Products from any licensed complete disclosure of:

provider of their choice,

including independent/ a) the purchase price of the

third-party providers; Motor Vehicle;

11.6.1.4. not to purchase Value- b) the purchase prices of Service

Added Products (such and Maintenance Plans and

as Maintenance Plans, other Value-Added Products.

Service Plans and Extended

Warranties) when purchasing 11.6.4.2. disclose to consumers all

a Motor Vehicle. information regarding the

maintenance and repair of

11.6.1.5. purchase Value-Added their Motor Vehicle, as well

Products from a licensed as the terms and conditions

provider at any time after under which they are

the purchase of the Motor required and/or permitted

Vehicle. to maintain and repair their

Motor Vehicle.

11.6.2. OEMs and independent/ 3rd party

providers of Value-Added Products must 11.6.4.3. where appropriate, finance

adopt measures to promote competition providers must provide the

and consumer choice in their offerings. consumer with details of all

Such measures can include, amongst inclusions and exclusions

others, offering Service and Maintenance included in the Maintenance

Plans of varying durations of Service and Plans and Service Plans

Maintenance Plans; including the following

information:

11.6.3. OEMs and independent/ 3rd party

providers must transfer a Maintenance a) the average price for each

Plan and/or a Service Plan to a replacement service interval (at the time of

Motor Vehicle in the instance where the sale of the Motor Vehicle).

Motor Vehicle is written off by the Insurer.

In instances where there is no replacement b) the average price of the parts

Motor Vehicle after a write-off or it is not covered by the Maintenance

feasible to transfer a Maintenance Plan Plan and Service Plan

and/or a Service Plan to a replacement that commonly require

Motor Vehicle, the consumer shall be replacement at specific

afforded the right to cancel the Value- kilometre intervals or upon

Added contract and/or receive a refund of the Motor Vehicle attaining a

the value of the balance of the product. specific age.

11.6.4. To promote transparency and allow for 11.6.4.4. provide the consumer with

product comparisons by consumers at the complete disclosure of:

point of sale of a Motor Vehicle, Approved

Dealers are required to:

24

24

Guidelines for Competition in the Automotive AftermarketYou can also read