Determining the COST of Vacancies in Baltimore - BY BOB WINTHROP AND REBECCA HERR

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

A

s the number of home foreclosures rises nationwide, The cost of the extra safety effort was determined based on

cities face mounting costs related to vacant and 911 call data, a list of properties designated as vacant and

abandoned properties. Aside from subsidizing these unsafe for at least one month, and police and fire department

costs through general funds, fees and fines, cities are suing budgets, all for fiscal 2008.The call data and vacant property

mortgage financing companies and banks to recover costs, information was used to construct an econometric model

charging that irresponsible lending practices have led to that measured the statistical relationship between the number

increased foreclosures and vacancies. However, with any of of properties designated as vacant and unsafe on a block and

these measures, it is necessary to demonstrate that there are the amount of time police and fire personnel spent on that

specific costs associated with vacancies. block. In the analysis,“officer minutes” and “fire fighter min-

utes” were the base measures used, indicating one minute of

STATISTICAL ANALYSIS time for one officer called to a specific block. For police offi-

In 2008, the city of Baltimore, Maryland, used econometric cers,the officer minutes were calculated from the time an offi-

analysis to rigorously quantify the cost of police and fire serv- cer was dispatched until he or she left the scene,multiplied by

ices associated with vacant properties. Many studies have the number of officers who responded. For fire fighters, the

addressed the cost of vacant properties in a general sense,but number of staff responding was not broken out in the data, so

Baltimore was the first city to undertake a detailed study of the Fire Department provided an estimated number of fire

this nature. Working with a consultant, the city determined fighters who responded, based on the type of call.The econo-

that the cost per block of police and fire services showed an metric model used zip codes as a proxy control for geo-

annual increase of $1,472 for each vacant and unsafe proper- graphic differences in public safety costs (i.e.,areas with more

ty on that block (vacant and unsafe is a technical designation or less crime).The analysis determined a positive relationship

used by the City of Baltimore Housing and Community between vacant and unsafe properties and the officer and fire

Development Department). fighter minutes spent on a given block.

To calculate the cost of one officer or fire fighter minute,the

Ohio Study Shows High Cost portion of police and fire department budgets dedicated to

of Abandoned Properties responding to 911 calls — known as the response budgets —

was divided by the total police and fire response minutes.

A recent study of eight cities in Ohio conservatively identified These response budgets included most, but not all, of the

nearly $64 million in total costs to local jurisdictions related to departments’ activities. They excluded, for example, police

vacant and abandoned properties.* This included nearly $15 special investigative teams and the fire prevention inspectors.

million in city service costs and more than $49 million in lost This cost per officer or fire fighter minute was multiplied by

tax revenues from demolitions and tax delinquencies. Another the marginal increase in public safety response minutes asso-

study identified 26 distinct, foreclosure-related municipal costs ciated with each additional vacant and unsafe designated

that fall into categories such as building inspection and code property on a given block, as calculated by the model. The

enforcement, boarding and demolition costs, tax loss from results of this analysis are shown in Exhibit 1. The analysis

demolition and unpaid property taxes, utility (water/sewer) indicates a correlation between vacant and unsafe properties

bill delinquency, trash removal and mowing costs, and fire and and increased police and fire cost,and it measures the size of

police services.** that increase. But the analysis does not address whether the

vacant properties caused the increase in cost or whether

* Community Research Partners, $60 Million and Counting: the cost of vacant increased criminal activity might have caused an increase in

and abandoned properties to eight Ohio cities (Columbus, Ohio: ReBuildOhio,

vacancies. Further analysis would be needed to answer the

February 2008).

causality question.

** William C. Apgar and Mark Duda, Collateral Damage:The Municipal Impact

The statistical results for police and fire fighter minutes

of Today’s Mortgage Foreclosure Boom (Minneapolis, Minnesota:

Homeownership Preservation Foundation, May 11, 2005). yielded by the econometric model are shown in Exhibit 2.The

coefficients are the incremental number of minutes spent for

each vacant and unsafe property by block for police officers

June 2009 | Government Finance Review 39one month, out of 236,569 properties in the real property file.

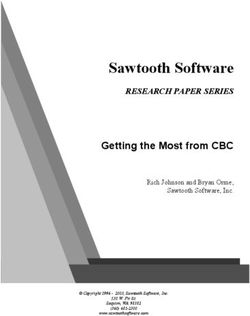

Exhibit 1: Summary Results —

Of the addresses in the real property file, those that had

Public Safety Direct Cost

descriptive names rather than address identifiers were

Total Police Budget $311,044,000 removed,leaving in 229,020 addresses as the universe of prop-

Response Budget $241,059,100 erties in Baltimore.

Annual Officer Minutes 107,262,204 Unfortunately, while the police and fire data were input in

Cost per Officer Minute $2.25 the same format, the real property file used slightly different

naming conventions. The following methodology was devel-

Additional Minutes for Each Vacancy on Block 445 oped to rectify these differences and match real property

Additional Police Cost for Each Vacancy $1,000 addresses to call data. Four pieces of the street address

were used to create a unique street address identifier: street

Total Fire Budget $137,761,000 name, house number, street type, and street direction (where

Response Budget $134,145,000 applicable). The resulting address code is a unique 11-digit

Fire Fighter Minutes 39,211,589 number.The first piece of the address code is the name of the

Cost per Fire Fighter Minute $3.42 street where the property is located.The consultant created a

unique four-digit identifier for each of the approximately

Additional Minutes for Each Vacancy on Block 13 2,500 street names in the real property file. The numbers

Additional Fire Cost for Each Vacancy $472 were assigned to streets in alphabetical order, starting at 1000.

The next digit of the address code was for the street direction.

Total Additional Public Safety Cost $1,472 A unique number was assigned to each cardinal direction

(i.e., North, South, East, and West), and for streets without

or fire fighters, respectively. The coefficients are positive, as a direction. For every street type (e.g., street, road, lane) in

one might predict (i.e., more time is spent servicing blocks the real property file, a two-digit value was assigned. Street

with vacant and unsafe properties than those without), and names that did not have a street type (e.g., Broadway) were

they are statistically significant.That is, there is a greater than assigned a value as well. The final piece of the address code

99 percent chance that these coefficients are not zero.The R2 was the house number. No house numbers were longer than

value indicates the amount of variation (in officer minutes) four digits, so each one was converted to a four-digit number

this equation explains.While vacant properties and zip codes (e.g., 300 would become 0300). In the real property file,

can explain 8.4 percent of the variation of officer time spent some of the addresses contained a range of house numbers;

on a specific block, 91.6 percent is explained by other vari- for the purposes of this analysis, the first house number in

ables such as poverty, density, transience, etc. the range was used.

As an example, the address code for the Baltimore Police

EVERY ADDRESS IN BALTIMORE Department headquarters, located at 601 E. Fayette St., is

Conducting the analysis required four city departments to 18491350601. The first portion of the code is for the street

work together. The Department of Housing and Community name, Fayette, which was assigned the number 1849.The next

Development (HCD) established which properties were number, 1, is the numeral assigned to the direction of East.

vacant and unsafe.The police and fire departments provided

specific call data, and the Department of Finance provided

Exhibit 2: Statistical Results

budget information. HCD also provided the real property file

to determine the universe of addresses and blocks within the Incremental Standard T Value R2

Minutes Error of the

city. Each of the four departments assigned staff to a steering (Coefficient) Coefficient

committee that guided the analysis. Police Officers 445.21 22.55 19.74 8.4 percent

Fire Fighters 137.86 14.5 9.51 2.4 percent

Over the 12 months of data, there were approximately

19,000 properties designated as vacant and unsafe for at least

40 Government Finance Review | June 2009Current Litigation

A number of jurisdictions are suing banks, mortgage compa- The City of Cleveland

nies, and related firms in an attempt to recoup some costs The City of Cleveland, Ohio, has seen in increase in foreclo-

related to foreclosures. sures over the past decade. Between 2004 and 2006, the

number of foreclosures has increased to 7,369 from 397.The

The City of Baltimore

city is suing 21 banking institutions for public nuisance costs,

The City of Baltimore, Maryland, filed suit in U.S. District

including maintenance and demolition of vacant properties and

Court, claiming a bank engaged in unfair lending practices that

the decrease in property tax revenues.

targeted minority communities in Baltimore, violating the fed-

eral Fair Housing Act and resulting in high rates of foreclosures The City of Minneapolis

and vacancies in minority communities.The city would like to The City of Minneapolis, Minnesota, filed a suit against a real

recoup some of the costs it has incurred due to illegal prac- estate company, claiming it purchased and flipped homes in

tices.These costs include: decreased property tax revenue, the north and northeastern areas of the city.The company

increased expenditures for public safety, as well as related was charged with inflating the values of the properties using

administrative and legal costs associated with foreclosures. fraudulent appraisals. Of the 140 homes purchased, more than

half are in foreclosure.The city wants to obtain the foreclosed

The City of Buffalo

properties and rehabilitate these homes and rental properties.

The City of Buffalo, New York, sued more than 30 mortgage

companies and banks to recoup costs for nuisance abatement The State of New York

related to specific buildings that have gone vacant and are now The New York state attorney general filed suit against an

in disrepair.The city seeks reimbursement for the associated appraisal company for providing inflated appraisal values on

public nuisance costs, including demolition, associated with homes, allegedly in collusion with employees from one banking

approximately 60 properties. firm.The state seeks restitution for all individuals hurt by the

conspiracy and all fees and costs associated with the filing, as

well as reparations for all legal violations.

The value of 35 corresponds to the street type, in this case Originally, the analysis tried to match specific addresses to

“street.”The final portion is the four digit number for the house specific calls, but the Police Department does not always use

number, 0601. the exact address and at times uses what it calls an “implied”

Using this methodology, an 11-digit number was created for address.That is the first two digits of the address number with

each of the records in the real property file. In addition to the either an odd or even designation to indicate the specific side

longer address code created for the specific address, a block- of the block.To overcome this hurdle, the city’s budget direc-

level address was created as well. The block-level code is a tor suggested conducting the analysis on a block level rather

nine-digit number created by removing the last two digits in than a specific address level. Due to data irregularities, how-

the house number.The same methodology was used to create ever,not all records could be matched to a block.Once all the

the address code and block-level code for each record in the quality checking was complete, there were 870,201 police

police and fire call data. There were records, or about 90 percent, that

12,824 blocks identified in the City of The city is armed with financial infor- could be matched to a specific block

Baltimore real property file. in the real property file.

mation that will allow it to pursue

The police provided 1,103,091 call A similar process was conducted

additional action in fighting problems

records, of which approximately on the fire data (although there were

143,000 were designated as adminis- caused by vacant properties. no administrative codes in the fire

trative (i.e., lunch, transportation, etc.) data). The original file contained

and thus removed from analysis. 158,728 records, and once the quality

June 2009 | Government Finance Review 41of all the data was checked, 122,275 records remained, or

approximately 80 percent. Fees and Fines

Many cities require owners to pay an annual registration fee

CONCLUSIONS

for vacant properties. Examples include:

While a great deal of literature generally estimates or

hypothesizes the cost of police services associated with City Fee

vacant properties,the Baltimore study represents the first time Oak Forest, Illinois $200

direct public-safety costs have been rigorously measured with Albany, New York $250

statistical validation. Using this analysis, the city is armed with Chicago, Illinois $500

financial information that will allow it to pursue additional Wilmington, Delaware $500

action in fighting problems caused by vacant properties. City Saint Paul, Minnesota $1,000

staff are currently determining what type of program to use — Burlington,Vermont $2,000

an additional fee, fine (citation), or both to help defray the Minneapolis, Minnesota $6,000

costs of vacant and unsafe properties.Whichever path it pur-

sues, the city now has defensible data it can use to hold own- Many cities use a progressive fee structure to minimize the

ers who allow their property to become vacant and unsafe length of property vacancies. For example, the fee shown for

financially accountable. ❙ Wilmington, Delaware, is for the first year of vacancy.The fee

increases afterward: $1,000 for year 2; $2,000 for years 3-4;

BOB WINTHROP is scheduled to start later this summer as the sen- $3,500 for years 5-9; $5,000 for 10 years; and an additional

ior business operations manager for the City of Portland, Oregon, $500 for each year after 10. But often, cities also try work

Police Bureau. He has more than a decade of experience specializ- with owners. In Minneapolis, for instance, the fee can be

ing in improving government operations. Along with general govern- waived if there is an approved redevelopment plan in place.

ment financial analysis, he has worked on projects for police depart-

Along with fees, cities institute fines to defray or recover

ments throughout the country, including Saint Paul, Minnesota;

Pittsburgh, Pennsylvania; and Long Beach, California. He currently is a costs incurred because of improperly maintained property

member of the Public Strategies Group network and can be reached by charging fines for improperly maintained properties.

at bwinthrop@psg.us. REBECCA HERR is a consultant in the Strategic Examples include:

Consulting Group at Public Financial Management, Inc. (PFM). She

City Fine

joined the PFM team in 2007 and has worked with city and county

Burlington,Vermont $50-$500

governments on projects including arbitration support, workforce

Chicago, Illinois $200-$1,000 per day

analysis, budgeting, and revenue generation. She has worked with

Kansas City, Missouri $1,000

jurisdictions including New York City; Philadelphia, Pennsylvania; and

Baltimore, Maryland. She has a bachelor of arts in mathematics and

economics from Lafayette College.

42 Government Finance Review | June 2009You can also read