ANALYSTS' IDEAS OF THE WEEK - KONTROL'S COVID DETECTION UNIT TESTED AT A MCDONALD'S LOCATION - BAYSTREET.CA

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Analysts' Ideas of the Week

Kontrol’s COVID Detection Unit Tested at a McDonald’s Location

November 30, 2020

www.researchfrc.comPage 2

FRC Top Picks

The following table shows last week’s top five performers among our Top Picks,

including three resource companies and two cannabis companies. The top performer,

Noram Ventures (TSXV: NRM), was up 73% WoW. The company is drilling its Zeus

lithium project in Clayton Valley, Nevada. An updated resource estimate is expected in

Q1-2021. NRM’s shares are up 100% since we initiated coverage on September 23,

2020. Our initiation report on NRM can be viewed here.

Top Five Performers Last Week

Source: FRC

Overall, our portfolio (equally weighted) was up 1.5% in the past week versus the

benchmark’s (TSXV) 1.2%. As shown below, our portfolio has outperformed the TSXV

in five out of seven time periods we track:

Source: FRC

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 3

Performance by Sector

Source: FRC

Our complete list of top picks (updated weekly) can be viewed here.

Weekly Mining Commentary

Markets continued to rally based on encouraging developments surrounding vaccines in

the past week. Sources indicate that the U.K. is expected to approve Pfizer’s (NYSE:

PFE) vaccine within days. Moderna (NASDAQ: MRNA) stated that their first vaccine

shots could be ready by December 21st. In anticipation of approvals, pharma

companies have already started preparations to distribute their vaccines.

Goldman Sachs (NYSE: GS) came out with a projected vaccine timeline, which showed

that half of the U.S. and Canada’s population will be vaccinated by April 2021, and 70%

of the population in developed markets by Fall 2021.

Another positive development in the past week was that most of Europe, the U.S. and

India experienced a decline in new cases. Brazil, Mexico, and Canada are on their

second-wave, and experiencing a surge in new cases.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 4

Source: https://www.worldometers.info/coronavirus/

As a result of all the positive developments in the past week, stock markets and

copper continued to gain strength. Not surprisingly, the US$, gold and silver reported

losses, as demand for safe haven assets typically rises when there is global economic

uncertainty and vice versa.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 5

Five of the seven indices we track are up WoW (orange bars), and four are trading

higher than pre-COVID19 levels (blue bars).

Source: FRC / Various

Copper inventory levels continued to decline on a WoW basis, both on the LME

(London), and on the SHFE (Shanghai). We believe that China is the primary demand

driver. China recently announced several positive macroeconomic data, including strong

industrial production, retail sales, and lower unemployment.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 6

Inline with commodity prices, valuations of base metals increased, while that of

gold declined in the past week.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 7

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 8

As the rollout of vaccines is expected to take three to six months, we do not

expect the economy to recover to pre-COVID levels until mid-2021. We believe that

gold prices will remain volatile in the coming months, and gain strength in the second

half of 2021, when inflation kicks-in from the stimulus packages and economic growth.

We are raising our base metal price forecasts for 2021 based on positive developments

surrounding vaccines. That said, we believe that the recent run-up in base metal

prices is an overreaction. Our commodity price forecasts (unchanged) are shown

below:

In the following section, we review companies that announced key developments in the

past week.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 9

Mining / Exploration

Company Ticker Current Share FRC Fair Value Date of PR:

Name: Symbol Price: Estimate:

Azarga TSX: AZZ $0.22 $0.79 Nov 25, 2020

Uranium Corp.

PR Content FRC Opinion

Received Final Class III and Class V Positive – This is another key milestone for

underground injection control permits for AZZ, and brings the company one step

the Dewey Burdock project in South closer to becoming the next uranium

Dakota, from the United States producer in the U.S. With federal permits

Environmental Protection Agency. now in place, the company just needs to

finalize the state permitting process to

commence construction. Note that the

South Dakota Department of Environment

and Natural Resources (“DENR”) staff have

already recommended approval of the key

state permits. Board hearings to finalize the

state permits were deferred until the federal

permits were issued. With federal permits

now place, AZZ will recommence the state

permitting process right away. The project is

planned to be an in-situ recovery operation,

which has a significantly lower

CAPEX/OPEX relative to conventional

open-pit/underground uranium operations. A

recent PEA had returned an After Tax–

Internal Rate of Return (“AT-IRR”) of 50%,

and an After Tax – Net Present Value (“AT-

NPV”) at 8% of US$148M. AZZ’s market

capitalization is $44M.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 10

Company Ticker Current Share FRC Fair Value Date of PR:

Name: Symbol Price: Estimate:

Cornerstone TSXV: CGP $5.45 $7.44 Nov 25, 2020

Capital

Resources Inc.

PR Content FRC Opinion

Pursuing a $7.7M private placement at $5 Positive – This financing is on the back of a

per share. failed attempt by SolGold (LSE: SOLG) to

acquire CGP. We continue to believe that

Cascabel is an excellent acquisition target,

and would not be surprised if BHP (ASX:

BHP) or Newcrest / ASX: NCM (who are

also significant shareholders of SOLG) have

a go at SOLG and CGP at the same time.

Company Ticker Current Share FRC Fair Value Date of PR:

Name: Symbol Price: Estimate:

Grid Metals TSXV: GRDM $0.11 $0.54 Nov 24, 2020

Corp.

PR Content FRC Opinion

Drilled eight holes (1,400 m) on its 100% Positive - These results are promising,

owned East Bull Lake ("EBL") palladium especially considering that EBL is an early

property in Ontario, and announced stage/relatively untested property in

results of five. Key results presented Sudbury. Grid intends to conduct another

below: drill program in Q1-2021. The company’s

flagship asset is an advanced stage nickel-

➢ 43.0 m averaging 0.37 g/t Pd, 0.14 copper-palladium asset in Manitoba, which

g/t Pt and 0.03 g/t Au, including 3.0 has an indicated resource of 201 Mlbs

m of higher-grade values such as 1.43 nickel, 276 Mlbs copper, and 0.2 Moz

g/t Pd, 0.54 g/t Pt and 0.08 g/t Au palladium. A 2014 PEA had returned an AT-

➢ 29.6 m averaging 0.32 g/t Pd, 0.10 g/t NPV of $97M, and an AT-IRR of 16%,

Pt and 0.02 g/t Au, including 3.6 m of based on US$3.4 per lb copper, and

higher-grade values such as 0.99 g/t US$8.5/lb nickel. Grid’s current market

Pd, 0.27 g/t Pt and 0.03 g/t Au capitalization is just $6M.

➢ 5 m of 1.66 g/t Pd, 0.34 g/t Pt and

0.06 g/t Au (2.05 g/t combined Pd + Pt

+ Au), including 1 m of 5.41 g/t Pd and

0.89 g/t Pt.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 11

Company Ticker Current Share FRC Fair Value Date of PR:

Name: Symbol Price: Estimate:

Sirios TSXV: SOI $0.14 $0.41 Nov 26, 2020

Resources Inc.

PR Content FRC Opinion

Announced a $2.1M financing at $0.15 Positive – This financing follows a highly

per unit. Each unit will consist of a encouraging recently updated resource

common share and one-half warrant estimate (1.96 Moz at 0.65 gpt gold) on the

(exercise price of $0.23 per share for 1.5 Cheechoo gold property, located 10–15 km

years). from Newmont Goldcorp’s (TSX: NEM)

Éléonore gold mine.

Special Situations and Technology

Kontrol Energy Corp. (CSE: KNR / Current Share Price: $3.42 / FRC Fair Value

Estimate: $6.72)

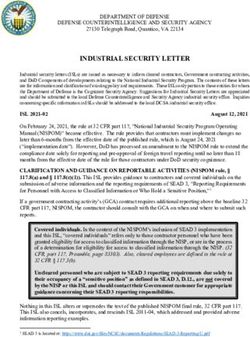

Kontrol announced today that it filed patent applications for its BioCloud technology in

the U.S. and Canada. On another positive note, we found that a McDonald’s (NYSE:

MCD) location in London, Ontario, gave BioCloud a test run last week. We reached out

to the location’s management (ended up talking to a shift supervisor), and learned that

KNR’s device was installed for a day to screen employees prior to checking in to work.

The device did not detect virus on any of the employees. Although we were unable to

find details of the arrangement between Kontrol and MCD’s location, we were informed

by the supervisor that the location is likely to conduct further testing, which we believe is

an encouraging sign.

BioCloud installed at McDonald’s (Highbury and Hamilton, London, Ontario)

Source: Twitter

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 12

In KNR’s Q3 earnings call today, management did not confirm or deny any of the above

information, and refrained from providing any details as they are under non-disclose

agreements. However, management did indicate that there are multiple units currently

being tested at various locations. We believe the fact that KNR’s units are being

tested by various entities speaks for the market interest for detection devices,

despite the rollout of vaccines. We will publish an update report shortly on the Q3

results.

Cannabis

Company Ticker Current Share FRC Fair Value Date of PR:

Name: Symbol Price: Estimate:

Captiva Verde CSE: PWR $0.23 $0.95 Nov 29, 2020

Land

Corporation

PR Content FRC Opinion

Announced that it has completed Positive – We are pleased to see the

processing of the first harvest from its company complete processing within our

outdoor facility in New Brunswick. expected timeline. Our revenue projections

Management stated that their cost was from the facility (unchanged) for 2020 and

$0.22/gram for dried cannabis, which 2021 are $1.6M and $16.5M, respectively.

consisted of 21.53% THC and 2.7% OPEX of $0.22 is well below management’s

terpenes. original guidance of $0.25, and our

conservative forecast of $0.35. Also, THC

levels are on the higher end (typically 15-

20% is considered high), and terpenes are

in line with average levels (typically 2-5%).

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 13

Weekly Cannabis Commentary

Cannabis Industry Performance

November 30, 2020

Company YTD 1-Week 1-Year

Aphria Inc. 65% 23% 74%

Aurora Cannabis Inc. -54% 26% -63%

Canopy Growth Corp. 43% 8% 55%

Cronos Group Inc. 17% 11% 30%

Tilray Inc. -45% 28% -52%

HEXO Corp. -42% 21% -56%

Organigram Holdings Inc. -43% 14% -51%

The Supreme Cannabis Co., Inc. -77% 0% -78%

Indiva Limited 0% 5% 5%

AVERAGE -15% 15% -15%

MIN -77% 0% -78%

MAX 65% 28% 74%

Indexes YTD 1-Week 1-Year

HMMJ 3% 10% -2%

MCAN 15% 10% 12%

XCAN -17% 15% NA

Source: TMX Money, FRC

Over the past week, the Horizons Marijuana Life Sciences ETF (TSX: HMMJ / “HMMJ”),

the Standard & Poor’s/MX International Cannabis Index (“MCAN”), and the Standard &

Poor’s/TSX Cannabis Index (“XCAN”) generated a return of 10%, 10%, and 15%,

respectively, as most cannabis stocks rallied due to optimism around the U.S. House’s

upcoming voting on ending the federal ban on marijuana.

Valuation of Select Canadian LPs

The following chart shows the average Enterprise Value to Revenue (“EV/R”) of the

Canadian cannabis companies that we track.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 14

Average EV/R (October 2019 – November 2020)

Nov 23, 2020 Nov 30, 2020

Company Ticker TEV/Revenue TEV/EBITDA TEV/Revenue TEV/EBITDA

Aphria Inc. TSX: APHA 4.3 33.0 5.4 41.4

Aurora Cannabis Inc. TSX: ACB 6.8 NM 9.4 NM

Canopy Growth Corp. TSX: WEED 22.4 NM 27.5 NM

Cronos Group Inc. TSX: CRON 55.8 NM 69.3 NM

Tilray Inc. NASDAQ: TLRY 7.3 NM 8.1 NM

HEXO Corp. NYSE: HEXO 4.5 NM 5.7 NM

Organigram Holdings Inc. TSX: OGI 4.0 NM 4.5 NM

The Supreme Cannabis Co., Inc. TSX: FIRE 3.3 NM 3.3 NM

AVERAGE 13.5 NM 16.6 NM

MEDIAN 5.7 NM 6.9 NM

MINIMUM 3.3 NM 3.3 NM

MAXIMUM 55.8 NM 69.3 NM

Source: S&P Capital IQ, FRC

The average EV/R, as of November 30, 2020, is 16.6x – an increase from 13.5x a week

ago. The average EV/R, from October 7, 2019 to date, is 11.67x.

Canadian Retail Cannabis Pricing

Province (As of 2020/11/30) Average Price per Gram Average Price per Gram THC Average Price per Gram CBD # of Products Min. Price Max. Price

B.C. $ 10.13 $ 10.21 $ 8.42 265 $ 3.93 $ 80.29

Ontario $ 9.81 $ 9.99 $ 8.20 308 $ 4.20 $ 23.98

Quebec $ 9.13 $ 9.09 $ 9.53 204 $ 4.85 $ 14.55

Alberta $ 11.41 $ 11.41 $ 11.39 317 $ 3.93 $ 22.00

N.B. $ 9.73 $ 9.96 $ 7.74 165 $ 3.50 $ 16.28

P.E.I. $ 9.80 $ 9.82 $ 9.49 151 $ 2.20 $ 23.30

Newfoundland $ 10.20 $ 10.17 $ 10.36 150 $ 4.62 $ 15.40

Yukon $ 14.98 $ 15.07 $ 13.95 12 $ 10.49 $ 16.15

N.S. $ 10.37 $ 10.43 $ 9.82 173 $ 5.36 $ 42.85

Nunavut $ 11.69 $ 11.80 $ 12.41 34 $ 5.19 $ 17.91

Northwest Territories $ 11.54 $ 11.54 3 $ 12.08 $ 13.00

Manitoba $ 11.64 $ 11.62 $ 11.62 311 $ 4.90 $ 20.43

Saskatchewan $ 12.89 $ 12.95 $ 12.08 171 4.95 38.50

CANADA $ 11.02 $ 11.08 $ 10.42

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 15

Province (As of 2020/11/23) Average Price per Gram Average Price per Gram THC Average Price per Gram CBD # of Products Min. Price Max. Price

B.C. $ 10.14 $ 10.22 $ 8.48 260 $ 3.93 $ 80.29

Ontario $ 9.77 $ 9.96 $ 8.20 304 $ 4.20 $ 23.98

Quebec $ 9.14 $ 9.10 $ 9.53 203 $ 4.85 $ 14.55

Alberta $ 11.44 $ 11.43 $ 11.39 311 $ 3.93 $ 22.00

N.B. $ 9.78 $ 10.01 $ 7.74 165 $ 3.50 $ 16.28

P.E.I. $ 9.85 $ 9.87 $ 9.49 149 $ 2.20 $ 23.30

Newfoundland $ 10.20 $ 10.17 $ 10.36 146 $ 4.62 $ 15.40

Yukon $ 14.98 $ 15.07 $ 13.95 12 $ 10.49 $ 16.15

N.S. $ 10.37 $ 10.43 $ 9.82 173 $ 5.36 $ 42.85

Nunavut $ 11.69 $ 11.80 $ 12.41 34 $ 5.19 $ 17.91

Northwest Territories $ 11.54 $ 11.54 3 $ 12.08 $ 13.00

Manitoba $ 11.64 $ 11.62 $ 11.62 311 $ 4.90 $ 20.43

Saskatchewan $ 12.89 $ 12.95 $ 12.08 171 4.95 38.50

CANADA $ 11.03 $ 11.09 $ 10.42

Source: Online Provincial Cannabis Stores, FRC

The average retail price per gram decreased by $0.01 week-over-week to $11.02.

The below chart shows Canadian retail dried cannabis flower pricing since we began

price coverage.

Canadian Retail Dried Cannabis Flower Pricing

Source: Online Provincial Cannabis Stores, FRC

Canadian Retail Cannabis Stores

As of November 30, 2020, there are 1,290 retail cannabis stores a week-over-week

increase of nine stores across Canada, including three each in Alberta, B.C., and

Ontario

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 16

Nationwide Store Count

Source: Provincial Websites, FRC

Nov-16-2020 Nov-23-2020 Nov-30-2020

Geographic Region Store Count Store Count Store Count Population Population / Store

Alberta 541 540 543 4,428,247 8,155

B.C. 275 276 279 5,120,184 18,352

Manitoba 30 38 38 1,379,121 36,293

N.B. 20 20 20 780,890 39,045

N.S. 15 20 20 978,274 48,914

Newfoundland 26 27 27 520,437 19,275

Northwest Territories 5 5 5 44,982 8,996

Nunavut n/a n/a n/a 39,486 N/A

Ontario 251 251 254 14,745,040 58,051

P.E.I. 4 4 4 158,717 39,679

Quebec 45 45 45 8,552,362 190,052

Saskatchewan 44 50 50 1,181,987 23,640

Yukon 5 5 5 41,293 8,259

CANADA 1,261 1,281 1,290 37,971,020 29,435

Source: Provincial Websites, FRC

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTPage 17

Disclaimers and Disclosure

The opinions expressed in this report are the true opinions of the analyst(s) about any companies and industries mentioned. Any

“forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we

believe to be correct, but we have not independently verified with respect to truth or correctness. There is no guarantee that our

forecasts will materialize. Actual results will likely vary. Companies mentioned in pages 2 and 9-12 are covered by FRC under an

issuer paid model. FRC or companies with related management, and Analysts, may hold shares in some companies mentioned in

this report including Indiva, MCD Barrick, and KNR. Distribution procedure: our reports are distributed first to our web-based

subscribers on the date shown on this report then made available to delayed access users through various other channels for a

limited time.

To subscribe for real-time access to research, visit https://www.researchfrc.com/website/subscribe for subscription options.

This report contains "forward looking" statements. Forward-looking statements regarding the Company, industry, and/or stock’s

performance inherently involve risks and uncertainties that could cause actual results to differ from such forward-looking statements.

Factors that would cause or contribute to such differences include, but are not limited to, continued acceptance of the Company's

products/services in the marketplace; acceptance in the marketplace of the Company's new product lines/services; competitive

factors; new product/service introductions by others; technological changes; dependence on suppliers; systematic market risks and

other risks discussed in the Company's periodic report filings, including interim reports, annual reports, and annual information forms

filed with the various securities regulators. By making these forward-looking statements, Fundamental Research Corp. and the

analyst/author of this report undertakes no obligation to update these statements for revisions or changes after the date of this

report.

Fundamental Research Corp DOES NOT MAKE ANY WARRANTIES, EXPRESSED OR IMPLIED, AS TO RESULTS TO BE

OBTAINED FROM USING THIS INFORMATION AND MAKES NO EXPRESS OR IMPLIED WARRANTIES OR FITNESS FOR A

PARTICULAR USE. ANYONE USING THIS REPORT ASSUMES FULL RESPONSIBILITY FOR WHATEVER RESULTS THEY

OBTAIN FROM WHATEVER USE THE INFORMATION WAS PUT TO. ALWAYS TALK TO YOUR FINANCIAL ADVISOR BEFORE

YOU INVEST. WHETHER A STOCK SHOULD BE INCLUDED IN A PORTFOLIO DEPENDS ON ONE’S RISK TOLERANCE,

OBJECTIVES, SITUATION, RETURN ON OTHER ASSETS, ETC. ONLY YOUR INVESTMENT ADVISOR WHO KNOWS YOUR

UNIQUE CIRCUMSTANCES CAN MAKE A PROPER RECOMMENDATION AS TO THE MERIT OF ANY PARTICULAR

SECURITY FOR INCLUSION IN YOUR PORTFOLIO. This REPORT is solely for informative purposes and is not a solicitation or an

offer to buy or sell any security. It is not intended as being a complete description of the company, industry, securities or

developments referred to in the material. Any forecasts contained in this report were independently prepared unless otherwise

stated, and HAVE NOT BEEN endorsed by the Management of the company which is the subject of this report. Additional

information is available upon request. THIS REPORT IS COPYRIGHT. YOU MAY NOT REDISTRIBUTE THIS REPORT WITHOUT

OUR PERMISSION. Please give proper credit, including citing Fundamental Research Corp and/or the analyst, when quoting

information from this report. The information contained in this report is intended to be viewed only in jurisdictions where it may be

legally viewed and is not intended for use by any person or entity in any jurisdiction where such use would be contrary to local

regulations or which would require any registration requirement within such jurisdiction.

©2020 Fundamental Research Corp. “17+ Years of Bringing Undiscovered Investment Opportunities to the Forefront”

Click here to view FRC’s complete list of top picks

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORTYou can also read