Sunstone Logistic Systems expansion potential of telemetry offering to the South African car rental industry

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Sunstone Logistic Systems expansion

potential of telemetry offering to the

South African car rental industry

A consulting report project submitted by

Elizabeth Sephton

Student number: 1557943

Cell: +27 72 439 1582

Email: sephton.elizabeth@gmail.com

Supervisor:

Surika Chaithram

Wits Business School

February 2019Table of Contents

Table of Contents ........................................................................................................ i

List of Figures ............................................................................................................. v

List of Tables ..............................................................................................................vi

1. Executive Summary ............................................................................................. 1

2. Introduction .......................................................................................................... 3

2.1. Opportunity.................................................................................................... 3

2.2. Purpose of report .......................................................................................... 3

2.3. Context of the report ..................................................................................... 3

2.4. Problem statement ........................................................................................ 3

2.5. Objectives of the report ................................................................................. 4

2.6. Assumptions of the report ............................................................................. 4

2.7. Limitations of the report ................................................................................. 5

2.8. Delimitations of the report ............................................................................. 6

2.9. Models and theories used for analysis .......................................................... 6

2.9.1. Customer Concentration ......................................................................... 6

2.9.2. Management theory: Porter’s Five Forces .............................................. 6

2.9.3. Implementation model: Ansoff Model ..................................................... 7

2.9.4. Implementation model: Business Model Canvas .................................... 7

2.10. Definition of terms ...................................................................................... 8

3. Organisation Background .................................................................................... 9

i3.1. Client Profile .................................................................................................. 9

3.2. Nature and history of the Organisation.......................................................... 9

3.3. The organisation today................................................................................ 10

3.4. Business and market environment .............................................................. 10

3.5. Organization Grow Requirements ............................................................... 11

4. Models and Theories ......................................................................................... 12

4.1. Literature Review of Models and Theories .................................................. 12

4.1.1. Customer Concentration ....................................................................... 12

4.1.2. Management theory: Porter’s Five Forces ............................................ 13

4.1.3. Implementation model: Ansoff Model ................................................... 14

4.1.4. Implementation model: Business Model Canvas .................................. 15

4.2. Application of Models to Organization Growth Strategy .............................. 16

4.2.1. Application of Porter’s Five Forces ....................................................... 17

4.2.2. Application of the Ansoff Model ............................................................ 25

5. Recommended Opportunity ............................................................................... 28

6. Literature Review of Identified Growth Opportunity ........................................... 30

6.1. Car Rental ................................................................................................... 30

6.1.1. Car rental company activities................................................................ 31

6.1.2. Car rental location ................................................................................ 32

6.1.3. Fleet rotation......................................................................................... 33

6.1.4. Car rental consumer programs ............................................................. 34

ii6.1.5. South African car rental environment ................................................... 34

6.1.6. African car rental environment .............................................................. 36

6.1.7. Competing industries ............................................................................ 37

6.2. Consumer programs ................................................................................... 37

6.2.1. Program classification........................................................................... 39

6.2.2. Timing of rewards ................................................................................. 39

6.3. Discussion ................................................................................................... 40

7. Business Plan .................................................................................................... 41

7.1. Target market requirements ........................................................................ 41

7.2. Business Model Canvas .............................................................................. 41

7.3. Marketing strategy....................................................................................... 44

7.3.1. Product description ............................................................................... 44

7.3.2. Target customer segment ..................................................................... 46

7.3.3. Marketing plan ...................................................................................... 46

7.4. Operations plan ........................................................................................... 48

7.4.1. Management......................................................................................... 48

7.4.2. Human resources ................................................................................. 48

7.4.3. Business locations ................................................................................ 48

7.4.4. Facilities................................................................................................ 49

7.4.5. Daily operations .................................................................................... 50

7.5. Financial plan .............................................................................................. 51

iii7.5.1. Revenue sources .................................................................................. 51

7.5.2. Projected financial statements .............................................................. 52

8. Recommendations ............................................................................................. 65

8.1. Recommendations for further research ....................................................... 66

9. References ........................................................................................................ 67

ivList of Figures

Figure 1: Projected additional revenue requirements to reduce customer concentration

................................................................................................................................. 11

Figure 2: Ansoff Matrix (Ansoff, 1957) ...................................................................... 15

Figure 3: Porter's Five Forces Representation of Sunstone Logistic Systems

Competition .............................................................................................................. 24

Figure 4: Customer Interaction in Short-term Car Rental (Dessie, 2015) ................. 32

Figure 5: Representation of the density of car rental branches in South Africa (Avis,

n.d.; Bidvest Car Rental, 2018; Budget, 2018; Drive South Africa, 2018; Europcar, n.d.;

First Car Rental, 2015; Hertz, 2018; Pace Car Rental, 2015; Tempest Car Hire, 2018;

Thrifty Care Rental, 2018; Woodford Car Hire, 2018; Xtreme Car Rental, 2017) ..... 36

Figure 6: Business Model Canvas of As-Is Sunstone Logistic Systems Business Model

................................................................................................................................. 42

Figure 7: Business Model Canvas of To-Be Sunstone Logistic Systems Business

Model ....................................................................................................................... 42

Figure 8: Estimated Marketing related costs (Sunstone Logistic Systems, 2018b) .. 47

Figure 9: Projected vehicle purchasing behaviour for fleet rotation and fleet increases

................................................................................................................................. 52

Figure 10: Projected vehicle sales behaviour for fleet rotation ................................. 53

Figure 11: Forecast of required telemetry devices installed and active in customer fleet

................................................................................................................................. 61

vList of Tables

Table 1: Definitions and explanation of the terms used .............................................. 8

Table 2: Ansoff Matrix Possible Growth Strategies for Sunstone Logistic Systems . 25

Table 3: Growth Opportunity Alternative Comparison .............................................. 29

Table 4: Summary of Business Model Canvas concepts effected by the introduction of

the proposed customer segment .............................................................................. 43

Table 5: Pricing of rental telemetry device in 2018 (Sunstone Logistic Systems, 2018b)

................................................................................................................................. 45

Table 6: Projected pricing......................................................................................... 46

Table 7: Projected vehicle months per 100 vehicles in fleet at January ................... 53

Table 8: Projected vehicles to be tracked at January to meet revenue requirement of

organisation.............................................................................................................. 54

Table 9: Forecasted Monthly Cashflow 2019 ........................................................... 56

Table 10: Forecasted Monthly Cashflow 2020 ......................................................... 57

Table 11: Forecasted Monthly Cashflow 2021 ......................................................... 58

Table 12: Forecasted Monthly Cashflow 2022 ......................................................... 59

Table 13: Forecasted Monthly Cashflow 2023 ......................................................... 60

Table 14: Forecasted Income Statement ................................................................. 62

Table 15: Forecasted Balance Sheet ....................................................................... 64

vi1. Executive Summary

Sunstone Logistic Systems, headquartered in South Africa, providing routing and

scheduling, and telemetry software solutions to two primary customers in over 13

African countries was investigating a growth strategy for the organisation. The aim of

this report was to identify a suitable growth opportunity for the organisation aligned to

the organisation’s strategic objectives.

The organisation has grown significantly since its beginnings in 2009 but was at risk

due to its high customer concentration. This report therefore sought to explore the

opportunities available to Sunstone Logistic Systems in expanding to provide services

to a new customer segment to reduce the risks associated with high customer

concentration.

Appropriate models and theories were used to determine that high customer

bargaining power was a significant threat to the organisation and that market

development would be the most appropriate strategy to employ to address this threat.

The financial requirements reducing the organisation’s customer concentration in the

medium-term was given due consideration. Furthermore, the organisation’s objective

of retaining its focus on the African continent was an important factor in the selection

of a suitable opportunity. Alternatives for market development opportunities were

investigated and it was determined that the short-term car rental industry in South

Africa provided the most reasonable opportunity for Sunstone Logistic Systems to

meet its growth requirements in the period required. The value offering that the

organisation would provide to the target customer would be advanced telemetry

solutions to inform a consumer program to incentivise improved driver behaviour of

their vehicles by their clientele.

In depth investigation into the short-term car rental industry was conducted to provide

a better understanding of the environmental requirements of the target customer and

the challenges that the industry faces from e-hailing applications.

Financial projections were generated for the project for 2019 through to 2023. The

projections used several assumptions based on information provided by the

1organisation and the cycle of fleet sizes. The projected financials used a 3-year loan

to finance the project, with installations commencing in March of 2019 to coincide with

de-fleeting cycles of the target customer segment. The projected financials show

positive growth potential whilst meeting the loan repayment requirements and meeting

the revenue generating requirements of the organisation.

The report concludes by providing recommendations to Sunstone Logistic Systems

with the size of the new market segment essential to meeting its revenue growth

requirements and the intention of the new market segment to differentiate itself in the

South African car rental industry through consumer programs.

22. Introduction

2.1. Opportunity

Sunstone Logistic Systems is a small company that provides routing and scheduling,

and telemetry services. The organization has a high customer concentration which

poses a risk; the opportunity is therefore to identify the appropriate growth strategy for

the organization based on the strategic objectives of the organization and identify

suitable grow opportunities to reduce customer concentration.

2.2. Purpose of report

The proposal will attempt to provide an analysis of Sunstone Logistic Systems and the

environment in which it operates; to identify suitable growth opportunities with the aim

of reducing the organization’s customer concentration; to select the most appropriate

growth opportunity from the identified alternatives and analyze the opportunity

identified for growth.

2.3. Context of the report

Sunstone Logistic Systems operates from its Johannesburg offices offering services

to two principal customers in over 13 African countries. The organization operates in

competitive markets where multiple alternatives are available but has expanded as a

result of its ability to provide an integrated suite of products to its customers, who

prefer to engage with one service provider rather than multiple vendors.

2.4. Problem statement

This report seeks to identify a suitable growth opportunity for Sunstone Logistic

Systems to reduce its customer concentration from 65% to 50% (i.e. a 15% reduction)

in the medium term on the African continent.

32.5. Objectives of the report

The objectives of this report are to:

• Investigate the financial growth requirements of the organization to meet its

customer concentration targets based on the organization’s forecasted revenue

for the medium-term.

• Identify the external factors that the organization needs to address to improve

its competitiveness in the market using the Porter’s Five Forces model.

• Identify a suitable growth strategy based on the strategic objectives of the

organization using the Ansoff model.

• Identify, select and analyze an appropriate growth opportunity which is aligned

to the internal and external strategies identified.

• Conduct a financial projection to determine the operational and financial

implications for the organization in perusing the identified growth opportunity.

• Provide recommendations to the organization in implementing the identified

opportunity.

2.6. Assumptions of the report

• The financial requirements to reduce customer concentration from 65% to 50%

will be based on the latest set of financials provided by the organization.

• It is assumed that there will be no change to the relative proportions of revenue

contribution for the organization (i.e. customer concentration ratio would remain

constant if a new customer segment was not targeted.)

• The implementation of the growth strategy would be short to medium term.

• The implementation and management models selected are appropriate for the

organization’s requirements.

42.7. Limitations of the report

• The report will be limited by the depth of information that is provided by the

client on its customers and operations.

o Customer concentration ratio will be determined based on the latest

financial results of the organization.

o The required revenue stream to reduce the customer concentration ratio

to the desired level will be based on the latest financial results and the

projected revenue growth of the organization.

• Porter’s Five Forces model has a number of limitations due to its attempts to

simplify the systems it is used to describe. These limitations include:

o The model assumes a relatively static market structure.

o The model assumes competitive advantage is against other market

players, suppliers and customers.

o The model does not allow for the representation of the interdependence

of the forces.

• Similarly, the Ansoff model has limitations as a result of the simplification of

systems it is used to describe. These include:

o External market forces are not considered by the model.

The Porter’s Five Forces model and the Ansoff model will be used in combination to

identify the market and internal factors which will influence the strategy of the

organization.

52.8. Delimitations of the report

• This report will focus on the financial and market position of Sunstone Logistic

Systems and its operations on the African continent; markets on other

continents will not be considered.

• This report will focus on short-term commercial car rental industry; long-term

rentals and industrial vehicles will not be included in this report.

• Consumer programs will be looked at broadly to incorporate both loyalty and

rewards. Consumer satisfaction will not be included in this report.

• This report will provide a description of high-level system requirements; detailed

system requirements would need to be determined in consultation with the

customer.

2.9. Models and theories used for analysis

2.9.1. Customer Concentration

The concept of customer concentration has its origins in the manufacturing industry,

where it was recognized that the improvements in margin gained by firms supplying

major customers were accrued by the customer, rather than the firm (Irvine, Park, &

Yıldızhan, 2015). Customer concentration was selected as a theory for this report as

the client has identified customer concentration as a risk to the organization.

2.9.2. Management theory: Porter’s Five Forces

The Porter’s Five Forces model is a framework that is used for analyzing competition

in industries that influence corporate strategy. Porter simplified complex micro-

economic literature into five causal variables to explain performance: the threat of new

entrants (or entry barriers); the threat of substitution; the bargaining power of suppliers;

the bargaining power of customers; and industry rivalry (or competitive rivalry)

(Grundy, 2006). As the organization operates in a competitive environment the

external industry forces need to be analyzed and opportunities for improved

competitiveness to be identified. This model will be used in combination with an

organization focused model to identify possible management action to address the

opportunities identified.

62.9.3. Implementation model: Ansoff Model

The Ansoff model is a marketing tool that aims to provide the organization with a

two-dimensional planning tool that focuses on product and market growth. There are

four growth strategies available to organizations: market penetration; market

development; product development; and diversification (Ansoff, 1957). The

organization’s stated requirements were used to determine which of the growth

strategies were most appropriate for the organization and used to direct the

investigations for growth opportunities for the organization.

2.9.4. Implementation model: Business Model Canvas

The Business Model Canvas is a tool to describe and manipulate business models to

create new strategic alternatives (Osterwalder & Pigneur, 2010).

72.10. Definition of terms

Table 1: Definitions and explanation of the terms used

Term Definition Authors

Car rental The classification of a group of companies SASB (2014)

industry providing short-term vehicle rentals to

consumers. This excludes vehicles that are

leased to purchase and does not include

drivers as a part of the service offered to

consumers.

Consumer A series of planned activities, events and items

program executed by company functions with the

purpose of attracting and retaining customers.

Driver The operator of a vehicle. Merriam-Webster

Online (2017a)

Driver The quantification of the observable actions of

behaviour the driver of a vehicle, including but not limited

to speed, distance travelled, time of action,

position, acceleration, deceleration, turning

and heading.

Loyalty Faithful to a cause, ideal, custom, institution, or Merriam-Webster

product. Online (2017b)

Off-airport Not on airport property. Travel Industry

Dictionary (2013)

On-airport Located on airport property in or close to the

terminal buildings

Repurchase A contract giving the seller of asset the right to

agreement repurchase the asset after a stated period.

Reward A gift in recognition of effort, behaviour or Oxford

achievement. Dictionaries

(2018)

Telemetry The science and technology of remote Merriam-Webster

measurement and transfer of data via means Online (2017c)

such as radio, wire, satellite, or other such

devices, to an observer.

83. Organisation Background

3.1. Client Profile

The managing director of Sunstone Logistic Systems is Mark Jaffe. Mr Jaffe resides

in and has largely built his career from Johannesburg, South Africa. Prior to being the

managing director of Sunstone Logistic Systems, Mr Jaffe managed a large account

for a software development and consulting organisation that specialises in vehicle

logistics. Mr Jaffe identified a gap in the African market to implement the vehicle

logistics software which had previously been focused on the South African market. Mr

Jaffe’s philosophy has been to identify and adapt his organisation to the needs of the

customer to provide an integrated suite of solutions to the vehicle logistics market.

3.2. Nature and history of the Organisation

Sunstone Logistic Systems is owned and managed by Mr Jaffe. The head office is

situated in Johannesburg, with satellite operations and partners in East and West

Africa.

Sunstone Logistic Systems began its operations by providing vehicle logistics

software, but soon extended to telemetry and execution management solutions and

consulting services. The organisation has grown having two principal customers that

are beverage companies in over 13 African countries. The organisation has expanded

since its beginnings in 2009 to incorporate software development and telemetry

experts in addition to its software implementation and support team. The organisation

has grown organically to meet the needs of its customers. The organisation seeks to

select the best of breed hardware and software to provide custom solutions to its

customer requirements and use cutting edge technologies and systems to solve

operational needs (Sunstone Logistic Systems, 2018a). The management has actively

sort young ambitious technical experts to extend the capabilities of the organisation.

The organisation’s services are cloud-based and supported remotely from the

Johannesburg office, although software training and telemetry device maintenance

and fitments are conducted locally at their customer premises (Sunstone Logistic

Systems, 2018a).

9Each product individually has a high number of competitors in the market, but the

integrated suite of products has provided the organisation with the competitive

advantage to retain the business of its two principal customers.

The organisation has performed well in the ailing South African economy as a result

of its significant focus on other African markets, and its intense efforts on providing its

customers with an integrated product suite to meet their vehicle logistics needs.

3.3. The organisation today

The organisation has a relatively flat architecture, as a result of its relatively fast

expansion to approximately 30 employees (Sunstone Logistic Systems, 2018a). There

is significant overlap between the implementation and support teams. The software

development team requires the customer knowledge of the implementation team to

effectively address the needs of its customers. The organisation has identified further

opportunities to extend its existing product suite and is investing significant R&D

resources to fulfilling these.

Whilst the organisation aims to retain its two principal customers, management has

identified the significant risk of high customer concentration and is actively trying to

reduce this risk by attracting new customers. The customers that it has focused on are

small to medium size vehicle distribution operations. This customer expansion

initiative aims to leverage on the current resources, expertise and geographical

footprint of the organisation without endangering the survival of the organisation.

The organisation has not previously sought consultancy on its growth strategy.

3.4. Business and market environment

The organisation operates in a market that has several international competitors and

multiple local competitors in each of the 13 African markets in which it currently

conducts business. Vehicle logistics in these markets is the primary means of transport

due to poor rail infrastructure and large geographical areas needing to be serviced.

The local currencies in these countries are vulnerable to fluctuations in the US Dollar

and the price of fuel. This vulnerability has resulted in an ever-increasing focus on

10improving vehicle logistics efficiencies. Customers in these environments therefore

require consistent consideration and engagement to actively meet their changing

needs and promote efficient use of resources in doing so.

The two primary customers of the organisation are large corporate companies.

Although other corporate companies of similar size and geographic situation certainly

exist, it is unlikely that the organisation would attract the business of such corporates

based on its current size and its limited physical presence in local markets.

3.5. Organization Grow Requirements

The problem statement of the organization is to reduce its customer concentration

from 65% to 50% in the short to medium term on the African continent (Sunstone

Logistic Systems, 2018b) to reduce the organization’s risk exposure of having two

major customers.

To achieve a reduction in customer concentration 15%, the organization would require

additional annual revenue of approximately R9 146 832.24 in 2019, growing at an

annual rate of 12% for the next 3 to 5 years. Figure 1 provides a graphical

representation of the revenue requirements for each of the next 5 years to attain the

desired customer concentration ratio.

Projected additional revenue requirements to reduce

customer concentration of Sunstone Logistic Systems to

desired level

R15 000 000,00

R10 000 000,00

Rands (R)

R5 000 000,00

R0,00

2019 2020 2021 2022 2023

Year

Figure 1: Projected additional revenue requirements to reduce customer concentration

114. Models and Theories

4.1. Literature Review of Models and Theories

The literature review was conducted to gain understanding of the research that has

been conducted into elements of this report. Customer concentration was selected as

a model as it was explicitly stated in the organisation’s problem statements and was

therefore of significance. The Porter’s Five Forces management theory was selected

to analyse and evaluate the external factors influencing the organisation. The Ansoff

model was selected to analyse and evaluate the internal strategic growth opportunities

available to the organisation. The external and internal elements were used in

combination to develop potential growth strategies for the organisation, from which

one was selected based on its ability to meet the organisation’s growth requirements

and its feasibility to implement.

4.1.1. Customer Concentration

The concept of customer concentration has its origins in the manufacturing industry,

where it was recognized that the improvements in margin gained by firms supplying

major customers were accrued by the customer, rather than the firm. The customer

made use of their bargaining power to renegotiate contract terms to receive discounted

pricing, increased credit and other advantages. High customer concentration is

inversely related to price elasticity and directly related to demand unpredictability

(Irvine et al., 2015). Relationships between the firm and customer, where there is a

high customer concentration, are more prominent. By having high customer

concentration the firm is exposed to higher cost of capital and higher risk customer

defection (Dhaliwal, Judd, Serfling, & Shaikh, 2016).

Research by Irvine, Park and Yildizhan (2015) supported Patatoukas’s (2011) position

that high customer concentration results in lower profitability of the firm, showing that

customer concentration had varying advantages and disadvantages during the life-

cycle of the relationship between the firm and the customer. More specifically Irvine,

et al. (2015) found that the benefits of early customer specific selling, general and

administrative investments are reaped as the relationship matures and the firm is able

to achieve higher operating profits.

124.1.2. Management theory: Porter’s Five Forces

The Porter’s Five Forces model is a framework that is used for analyzing competition

in industries that influence corporate strategy. Porter simplified complex micro-

economic literature into five causal variables to explain performance: the threat of new

entrants (or entry barriers); the threat of substitution; the bargaining power of suppliers;

the bargaining power of customers; and industry rivalry (or competitive rivalry)

(Grundy, 2006).

The five forces identified by Porter in the microenvironment drive competition and

influence the firm’s ability to be profitable. The attractiveness of the market and its

profitability largely define the market structure. It is this market structure that influences

the strategic behavior of the firm; thus the firm’s success is indirectly dependent upon

the market structure (Dälken, 2014). In the words of Porter, “Whatever their collective

strength, the corporate strategist’s goal is to find a position in the industry where his

or her company can best defend itself against these forces or can influence them in

its favor” (Porter, 1979, p. 137).

The organization operates in a competitive environment, shaped largely by external

factors such as transport infrastructure and market demands. The Porter’s Five Forces

model will provide context to the competitive African environment and illuminate the

competitive forces that the organization should address to meet or improve upon the

industry standards, and thereby become more competitive in the market. This model

will be used in combination with organization focused models to identify possible

management action to address the opportunities identified.

4.1.2.1. Limitations of the Porter’s Five Forces Model

The model assumes a relatively static market structure (Dälken, 2014) which does not

adequately describe the fluidity of the industry barriers. The model has its foundation

in competition and assumes that competitive advantage is gained over other market

players, suppliers and customers, but fails to link directly to possible management

action (Grundy, 2006). The model does not allow for the representation of the

interdependence of the forces (Grundy, 2006). Further criticisms of the model are that

Porter did not provide justification for the selection of the five forces (Dälken, 2014).

134.1.2.2. Opportunities for Extension or Improvement of Porter’s Five

Forces

As stated by Dälken (2014), the degree of impact of each of the five forces on the

market structure is variable depending on the industry. There is therefore potential for

the Porter’s Five Forces to be extended to include evaluation of the degree of impact

each of the five forces has on the industry under analysis. A critical literature review

would be required to determine how to evaluate the degree of influence

Furthermore Dälken (2014), raised the criticism of Porter’s Five Forces that its basis

did not include the more recent drivers of technology and their effects on each of the

five forces. A critical literature review would be needed to expand on the work of

Dälken and analyze the interdependencies of the original five forces and the drivers

of technology.

4.1.3. Implementation model: Ansoff Model

The Ansoff model is a marketing tool that aims to provide the organization with a

two-dimensional planning tool that focuses on product and market growth. The

model is defined by whether the products and markets are existing or new. See

Figure 2.

There are four growth strategies available to organizations: market penetration; market

development; product development; and diversification (Ansoff, 1957). These growth

strategies may be used in combination to meet the long-term growth objectives of the

organization. According to Ansoff (1957) diversification stands apart from the other

three growth strategies at it requires new skills, techniques and facilities to depart from

the present product line and market structure through vertical, horizontal or lateral

diversification.

Ansoff (1957) suggested that trend forecasts should be used in combination with

planning for contingencies and unforeseeable events to make informed decisions

relating to strategic growth for the organization.

14……………..

Figure 2: Ansoff Matrix (Ansoff, 1957)

4.1.3.1. Limitations of the Ansoff Model

The limitations of the Ansoff model include that it does not represent the change of

strategic interventions to daily operational activities for the organization, which is

apparent for Sunstone Logistic Systems. This model is internally focused and does

not account for the activity of external competitor activities (Munro, 2018). External

competitor activity is important for the organization as it operates in an environment

with both local and international competitors and significant external forces. Hence the

Ansoff model should be used in combination with other models that take external

competitive factors into account.

4.1.3.2. Opportunities for Extension or Improvement of Ansoff Model

A critical literature review would need to be conducted to determine if the development

in industry’s external has given rise to a third dimension to the Ansoff Model, for

example the stimulus for internal strategic growth.

4.1.4. Implementation model: Business Model Canvas

The Business Model Canvas is a tool to describe and manipulate business models to

create new strategic alternatives. The model is built on nine concepts that describe

how the organization intends to be profitable. These concepts cover the four main

areas of business: customers, offering, infrastructure and financial feasibility

(Osterwalder & Pigneur, 2010).

154.1.4.1. Limitations of the Business Model Canvas

The Business Model Canvas is market focused but does not include the concepts of

competition. Although strategic alternatives may be derived through the use of this

model.

4.1.4.2. Opportunities for Extension or Improvement of the Business

Model Canvas

As stated in section 4.1.4.1 the Business Model Canvas, does not include concepts of

competition, a critical literature review would therefore be required to identify how

competition could be adequately incorporated to the implementation model.

4.2. Application of Models to Organization Growth Strategy

A combination of the Porter’s Five Forces model and the Ansoff model will be used to

identify the external and internal forces which affect Sunstone Logistic Systems and

will used to determine an appropriate direction of the growth strategy.

The Porter’s Five Forces model provides the framework to analyze the external

competitive forces affecting the environment in which the organization operates. The

performance of the organization in each dimension affects its competitiveness and

profitability. The identification of initiatives to improve performance in one or more

competitive dimensions, is important in shaping the strategic efforts of the

organization.

The Ansoff model provides strategic growth alternatives that are internally focused.

The organization exists and operates in a competitive environment therefore the

internal strategic growth initiatives need to be informed by and aligned to the initiatives

of the organization to improve its competitiveness in the external environment.

164.2.1. Application of Porter’s Five Forces

In accordance with the management model of Porter (1979), the competitive forces

affecting Sunstone Logistic Systems were analyzed to determine the attractiveness of

the industry in which it operates and identify potential growth areas. The model was

used to determine the strategic position of the organization relative to the industry in

which it operates and identify potential growth areas based on the competitive forces

affecting the organization.

4.2.1.1. Threat of new entrants

The barriers to entry for the products within the Sunstone Logistic Systems suite are

low.

4.2.1.1.1. Routing and scheduling services

Multiple local and international software solutions exist as standalone or managed

services from a variety of vendors and software providers for routing and scheduling

vehicle logistics (Open Door Logistics Ltd, 2018; OPSI Systems, 2018; PTV Route

Optimiser, n.d.; Resolve, 2018; Staedtler-Logistik, 2018). New entrants may choose

to be resellers of existing products, thereby surpassing the capital requirements of

R&D.

Routing and scheduling software and services generally require integration to an ERP

(Gayialis & Tatsiopoulos, 2004) or order capturing system, which increases the cost

of switching (Barki & Pinsonneault, 2002), but middleware can be developed at

relatively low cost to counter these switching costs.

Routing and scheduling software vary in feature capability. The changing operating

environment of customers has put a greater focus on dynamic route planning

(Speranza, 2018).

174.2.1.1.2. Telemetry services

Similarly telemetry hardware and software providers exist locally and internationally

with varying cost, feature and service options (Aplicom, n.d.; Driver Check, 2104; MiX

Telematics Africa, 2018; Tracker, 2016; Trilogical, 2016; VBox AutoMotive, n.d.). New

entrants may choose to be resellers of existing products and platforms, thereby

surpassing the capital requirements of R&D.

Switching costs for the customer are associated to hardware replacement and

integration to other systems (if any) (Farrell & Klemperer, 2007). Hardware has a life

expectancy after which it requires replacement; this therefore presents an opportunity

to new entrants to time their entry to minimize total cost to the customer on hardware

loss. Customers do however tend to be locked in for the duration of the hardware life

expectancy.

4.2.1.1.3. Threat to new entrants summary

In summary there is a high threat of new entrants into the market sectors that Sunstone

Logistic Systems participates in due to the relatively low barriers to entry in securing

existing products and reselling these in the market without having significant capital

outlays for R&D rights.

4.2.1.1.4. Sunstone Logistic Systems in the context of new entrants

Sunstone Logistic Systems entered and expanded into routing and scheduling, and

telemetry services in part due to the low barriers to entry. Sunstone Logistic System

has developed it software suite to be strategically integrated, however this does not

prevent new entrants from doing the same.

4.2.1.2. Threat of substitutes

The products that Sunstone Logistic Systems has chosen to include in its suite are

likely to be required in the future and have a low probability of being substituted.

184.2.1.2.1. Routing and scheduling services

Routing and scheduling software will be required in the future for companies to retain

and improve distribution efficiencies and promote efficient use of economic and

environmental resources (Lin, Choy, Ho, Chung, & Lam, 2014). If transportation were

to be outsourced, the third-party logistics providers would require software to optimize

the utilization of their resources.

4.2.1.2.2. Telemetry services

Although there is potential for vehicle telemetry devices to be substituted by mobile

positioning data, however there would be an associated a loss of vehicle specific

events (e.g. ignition on/off events, accelerometer events, etc.). Commercial fleets

would be unlikely to use a substitute of mobile positional data if driver behavior

monitoring or vehicle recovery were of importance.

4.2.1.2.3. Threat of substitutes summary

There is a low threat of substitutes taking market share due to the continual need for

transportation for movement of product and the need to improve efficiencies

(Cattaruzza, Absi, Feillet, & González-Feliu, 2017) to drive competitiveness and

profitability of the customer.

4.2.1.2.4. Sunstone Logistic Systems in the context of threat of

substitutes

Sunstone Logistic Systems provides solutions that are focused on vehicle logistics.

The efficiency of vehicle logistics is continually under pressure in a global economic

climate of rising fuel costs and local infrastructure environments that do not offer

feasible alternatives means of transportation or localized production.

194.2.1.3. Bargaining power of customers

4.2.1.3.1. Routing and scheduling services

As previously discussed in section 4.2.1.1.1 multiple competing products exist in the

market, thus giving the customer a level of bargaining power because several

alternatives are available. Price sensitivity in this market is noteworthy for software

systems of similar capability.

There are however factors that weigh in organization’s favor, such as the cost of

switching to another routing and scheduling software; integration to ERP systems,

implementation, training and contract and SLA negotiations with new potential

software providers.

4.2.1.3.2. Telemetry services

As previously discussed in section 4.2.1.1.2 multiple competing products exist in the

market, thus giving the customer a level of bargaining power because several

alternatives are available. Price sensitivity is high in the telemetry services market.

Factors such as integration costs of telemetry to execution management systems,

deters customers from switching.

4.2.1.3.3. Bargaining power of customers summary

Customer bargaining power is high considering the number of alternatives available

for each product in the local and international markets, however switching costs could

be a significant deterrent to customers with high levels of integration between systems.

4.2.1.3.4. Sunstone Logistic Systems in the context of customer

bargaining power

The customer concentration of the Sunstone Logistic Systems customers is high as a

result of the organization having two principal customers, which intensifies the

bargaining power of its principal customers.

204.2.1.4. Bargaining power of suppliers

Due to the high number of providers described in section 4.2.1.1, suppliers have low

bargaining power. Suppliers compete in an international market on cost, quality and

features of their hardware and/or software.

4.2.1.4.1. Routing and scheduling services

Industry participants may develop their own software or have reselling agreements

with one or more software providers. The availability of multiple similar software

solutions means that suppliers have relatively low bargaining power unless their

resellers are contractually limited to using only their software/services or have used

their software as the platform for related products and services.

Once a software solution has been implemented for a customer switching to another

supplier becomes prohibitive as contractual agreement to the customer generally

requires that the software be provided for a specified period. This raises the bargaining

power of the supplier in supplementary work such as new development to meet

additional needs of the customer.

4.2.1.4.2. Telemetry services

Industry participants make use of both open and closed telemetry platforms. Those

which make use of open telemetry platforms have greater scope for the use of multiple

hardware vendors, thereby reducing reliance on their suppliers. Whilst those that make

use of closed telemetry platforms are limited to their suppliers, giving their suppliers

greater bargaining power.

The significant investment in the telemetry hardware makes it prohibitive for the firm

to replace hardware before the end of its useful life. However, should the firm make

use of an open telemetry platform this does not limit the firm from switching to a

different supplier for new installations of telemetry hardware.

214.2.1.4.3. Bargaining power of suppliers summary

Depending on the firm’s strategic choices in the type suppliers it uses, the supplier(s)

has a greater or lesser degree of power. The industry is characterized low bargaining

power of the supplier at the outset of the contract, as a result of the number of

alternative suppliers in the market, but increased bargaining power once the supplier

is selected and the solution implemented for the customer.

4.2.1.4.4. Sunstone Logistic Systems in the context of supplier

bargaining power

Sunstone Logistic Systems has long-standing relationships with software and

hardware providers but has not contractually limited itself to any one vendor. The

organization has also sought to reduce its reliance on vendors by developing skills

and software solutions in-house to meet the needs of its customers. The strategic

decision of the organization to build in-house competencies and intellectual property

whilst remaining vendor neutral has significantly reduced the potential bargaining

power of Sunstone Logistic Systems’ suppliers.

4.2.1.5. Industry rivalry

As previously mentioned, there are a high number of providers of similar hardware

and software solutions as those provided by Sunstone Logistic Systems, which

translates into intense competition between organizations to service these markets.

Firm concentration for the African and South African markets is low.

4.2.1.5.1. Routing and scheduling services

Organizations differentiate their product offerings product feature differentiation, price

differentiation, extended product range provision, consulting and support services.

Software solutions are developed locally and internationally, with resellers and

partners extending the reach of software solutions to numerous markets using local

and cloud hosted services.

224.2.1.5.2. Telemetry services

Telemetry service providers differentiate their product on cost, add-on products and

services (e.g. panic buttons, vehicle recovery, fuel monitoring, etc.) depending on the

market sector.

Telemetry service providers may choose to partner with complementary industries,

such as vehicle insurance providers, to structure packaged offerings to customers that

are competitively priced and ensure security in fixed term contracts for the firm.

4.2.1.5.3. Industry rivalry summary

Industry rivalry is characterized as high, with firms attempting to differentiate their

products and services to gain competitive advantage.

4.2.1.5.4. Sunstone Logistic Systems in the context of industry rivalry

Sunstone Logistic Systems has differentiated itself in the market by providing

customized integration, reporting and event detection to fully meet the needs of its

customers, which would require significant time investment from competitors to

replicate. The two principal customers serviced by Sunstone Logistic Systems in the

African market, gives the organization credibility within the market.

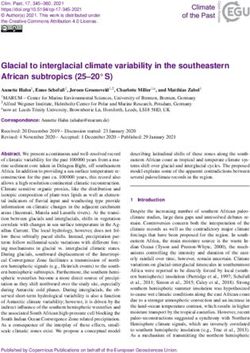

4.2.1.6. Discussion of Porter’s Five Forces

Figure 3 is a graphical representation of the qualitative interpretation of the competitive

environment in which Sunstone Logistic Systems currently operates and the forces

that affect the organization itself. (The scale is 0: low, 5: high).

The organization is subject to the same forces of threat of new entrants, threat of

substitution and industry rivalry as other firms in the industry. However, the

organization has reduced the power of its suppliers relative to the industry norm by

developing in-house capabilities and remaining supplier neutral. Due to the

organization’s reliance on its two principal customers (and therefore its high customer

concentration) the organization is subject to higher customer bargaining power than

the industry norm.

23This high customer bargaining power may pose a risk to the organization’s ability to

compete effectively in the market in the future. It is therefore recommended that the

organization act to strategically reduce the customer bargaining power forces that it is

subject to.

Porter’s Five Forces –

Sunstone Logistic Systems

Threat of new

entrants

5

4

3

Industry rivalry 2 Threat of substitutes

1

0

Bargaining power of Bargaining power of

suppliers customers

Industry Sunstone Logistic Systems

Figure 3: Porter's Five Forces Representation of Sunstone Logistic Systems Competition

244.2.2. Application of the Ansoff Model

See Table 2 for the identified growth strategies available to Sunstone Logistic Systems

according to Ansoff’s matrix.

Table 2: Ansoff Matrix Possible Growth Strategies for Sunstone Logistic Systems

Existing Products New Products

Existing Market Penetration Strategies: Product Development Strategies:

Markets • Increase market share • Product improvement

• Increase quality • Product line extensions

• Increase marketing • New products for same

• New application market

New Market Development Strategies: Diversification Strategies:

market • Expand markets for existing • Vertical diversification

products • Horizontal diversification

• Geographical • Lateral diversification

• New segments

• Resellers

4.2.2.1. Sunstone Logistic Systems Growth Strategy Requirements

As discussed in section 4.2.1.6 the objective of the growth strategy is to reduce the

customer concentration of Sunstone Logistic Systems. This would exclude the market

penetration and product development growth strategies described by Ansoff, as these

are concentrated on existing markets, whereas the objective clearly requires new

markets.

This therefore narrowed the possible growth strategies to market development and

diversification. According to the research conducted by Robson, Gallagher and Daly

(1993), following a diversification strategy is likely to endanger a small firm’s survival

prospects, unless the firm has first built a strong foundation in its primary business

operations. This sentiment was echoed by the client, who highlighted that the risk of

diversification was deemed too high for Sunstone Logistic Systems by its management

at the current time (Sunstone Logistic Systems, 2018b).

25Market development strategies is therefore the only growth strategy which will meet

the organisation’s need to reduce its customer concentration without exposing the

organisation to risk levels that may endanger the survival of the organisation.

4.2.2.2. Market development strategies

4.2.2.2.1. Geographical expansion

When comparing the existing Sunstone Logistic Systems geographical foot print to the

Doing Business Economy Rankings by the World Bank (2018), it was noted that the

organisation already operates in 11 of 16 top ranked countries to do business in in

Africa. 3 of the countries that are not included in the Sunstone Logistic Systems foot

print are small island nations (Mauritius, Seychelles and Cabo Verde).

To expand geographically Sunstone Logistic Systems would need to consider

targeting African countries that have greater barriers to entry and operation than those

in which it already operates. Alternatively, Sunstone Logistic Systems may consider

expanding to geographical regions beyond Africa that have a high dependency on

vehicle logistics and have similar operating environments to the geographies in which

already operates (i.e. developing countries), however this is outside of the scope of

this report. Entering new geographies would likely require significant investment in

marketing and potentially a partnership with a local complimentary organisation.

4.2.2.2.2. New segments

4.2.2.2.2.1. Consumables

Sunstone Logistic Systems has focused on beverage company vehicle distribution,

which is only one segment of vehicle logistics. Routing and scheduling and telemetry

services for vehicle logistics of other consumables offer alternative potential segments

for Sunstone Logistic Systems to target.

The South African market is at an advanced stage of consolidation with few franchised

supermarket chains dominating the industry. These supermarket chains have

consolidated and centralised procurement and distribution functions (Chikazunga,

Joordan, Bienabe, & Louw, 2007). According to Kiiru (2015) South Africa’s retail

26industry has the highest levels of formalisation on the continent (60%), followed by

Kenya (30%).

According to a report by AT Kearney (2015), developing retail markets such as Nigeria,

Ghana, Mozambique and Tanzania are good entry points for retailers seeking to enter

the African market due to their growth potential and improving infrastructure. Ghana

for example has a fast-growing retail segment of open-market stands and

neighbourhood kiosks. Smaller kiosk serviced daily by distributor’s motorised tricycles

whilst larger kiosks are serviced three times a week by distributor’s delivery vans

(Agyenim-Boateng, Benson-Armer, & Russo, 2015). There is potential to align with the

distribution logistics functions to support these developing markets that are not yet

consolidated and centralised as is the case in the South African market.

4.2.2.2.2.2. Sales representatives

Sales representative activity routing and scheduling is more static than the dynamic

needs of distribution which reduces the need for routing and scheduling for this market

segment, however telemetry and execution management services may be required to

verify sales representative activity.

The sales representative functions have developed substantially to incorporate the

use of mobile and tablet technologies for inventory and price checks, order placement

and invoice processing activities (Agyenim-Boateng et al., 2015). As such, this market

segment does not offer significant potential growth for Sunstone Logistic System’s

routing and scheduling or telemetry product offerings.

4.2.2.2.2.3. Service sector

Scheduling and execution management of on-location service activities was identified

as a potential sector in vehicle logistics that Sunstone Logistic Systems, however this

sector is set for the same trajectory as sales representatives in the use of mobile and

tablet technologies which makes this sector unsuitable.

27You can also read