Private sector credit; Credit cards - CommSec

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economics | November 29 2019

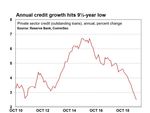

Annual credit growth hits 9½-year low

Credit card debt at 9½-year lows

Private sector credit; Credit cards

Lending: Private sector credit (effectively outstanding loans) rose by 0.1 per cent in October after lifting

0.2 per cent in September. Annual credit growth fell from 2.7 per cent to a 9½-year low of 2.5 per cent.

Credit cards: According to APRA, loans by deposit taking institutions to households via credit cards fell

from $37.7 billion in September to a 9½-year low of $37.5 billion in October. Credit card lending is down by

a record 6.6 per cent over the year (biggest fall in over 14 years).

Credit card data is important for the retail and financial sectors.

What does it all mean?

Aussie retailers are increasingly embracing Black Friday and Cyber Monday sales. The likes of JB Hi-Fi,

Woolworths, David Jones and even Myer have joined established e-commerce giants’ Amazon and eBay offering

online discounts across a range of goods. And the battle for our ‘hard earned coin’ has intensified with consumers

reluctant to spend on ‘big ticket’ items given modest wage growth. Retailers will be hoping that Aussies will be

encouraged to spend ahead of the festive season using their debit cards or ‘buy now, pay later’ payment methods

with credit cards out of favour.

According to CoreLogic data, home prices in Sydney and Melbourne are up by 8.5 per cent since the Federal

Election. And increased buyer demand - with borrowing costs at 60-year lows - is reflected in the 17 per cent lift in

new owner-occupier home lending since the May lows. The pass-through from the Reserve Bank’s three quarter

per cent rate cuts since June has been modest with repayments slow to adjust. But the Reserve Bank has

recently stated in its November Board meeting minutes that, “the increase in new loans over recent months had

been accompanied by faster repayment of existing loans, as usually occurs in the months immediately following

an interest rate reduction.” Either way, annual housing credit growth is the slowest on record, pulled down by

falling investor credit.

Perhaps even more troubling for Reserve Bank policymakers is the ongoing weakness in business credit growth.

In fact, business credit fell by 0.1 per cent in October – the first decline since January 2017. And the annual

growth rate fell from 3.3 per cent to a 5½-year low of 2.7 per cent.

Aussie businesses are fixated on their balance sheets, concerned about consumer demand, profit margin

pressures and rising labour costs. Demand for funding by large businesses has receded. And small businesses,

in particular, are still contending with challenging business conditions (and greater compliance) amid the

economic slowdown. The Reserve Bank has received reports that credit conditions for SMEs remain tight. It is

hoped that lower borrowing costs and signs of a stabilisation in the economy will eventually encourage ‘Corporate

Australia’ to once again increase investment in capital and equipment, but the outlook for the services and non-

Ryan Felsman, Senior Economist (Author)

Twitter: @CommSec

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399 a wholly owned but non guaranteed subsidiary of Commonwealth Bank of Australia

ABN 48 123 123 124. Important disclosures are included in the Important Information and Disclaimer for Retail Clients on the final page of this report.Economic Insights: Annual credit growth hits 9½-year low

mining sectors - more broadly – appear more challenging if

yesterday’s business investment intentions survey are an

guide.

What do the figures show?

Private sector credit - October

Private sector credit (effectively outstanding loans) rose by 0.1

per cent in October after lifting by 0.2 per cent growth in

September and August. Annual credit growth fell from 2.7 per

cent to a 9½-year low of 2.5 per cent.

Housing credit grew by 0.3 per cent in October. And the annual

growth rate fell from 3.1 per cent to 3.0 per cent – the slowest

growth rate on record.

Owner occupier housing credit rose by 0.4 per cent in October

to stand 4.8 per cent higher over the year – equalling the

weakest annual growth rate in the past 5½ years.

Investor housing finance was flat in October with the annual decline the biggest on record at -0.2 per cent.

Personal credit fell by 0.6 per cent in October after falling by 0.7 per cent in September. Lending fell by 4.7 per

cent over the year – the biggest annual decline in a decade.

Business credit fell by 0.1 per cent in October – the first decline in 33 months. And the annual growth rate fell from

3.3 per cent to a 5½-year low of 2.7 per cent.

The M3 money aggregate rose by 0.5 per cent in October and Broad Money also lifted by 0.5 per cent. Annual

growth of the M3 money aggregate rose from 3.8 per cent to 4.0 per cent with the Broad Money annual growth

rate up from 3.9 per cent to 4.2 per cent.

Loans and advances by banks grew by 3.3 per cent in the year to October, down from 3.6 per cent in the year to

October.

According to APRA, loans by deposit taking institutions to households via credit cards fell from $37.7 billion in

September to a 9½-year low of $37.5 billion in October. Credit card lending is down by a record 6.6 per cent over

the year (biggest fall in over 14 years).

What is the importance of the economic data?

Private sector credit figures are released by the Reserve Bank on the last working day of the month. Credit is

separated into three categories – housing, other personal and business. Private sector credit is effectively the

amount of loans outstanding in the economy. If growth in lending is strong then it suggests that credit from

financial institutions is freely available, underlying demand for assets such as cars and houses is firm and that the

price of credit (interest rates) is attractive.

What are the implications for interest rates and investors?

The lack of a credit pulse across the Australian economy reflects both consumer and business caution. Stimulus

is expected to eventually lead to a pickup in credit growth, but the missing ingredient in all of this is confidence.

Consumer sentiment is at 4-year lows and business confidence remains stuck below its long-run average,

according to the most recent NAB survey.

Much hinges on the global backdrop around trade, but clearly Aussie consumers are more worried about their

own pay packets, ability to pay their bills, mortgage debt and job

security. The consumer ‘straightjacket’ is spilling over into the

business sector. Most consumers are also small business owners

and weak consumer demand and still-difficult access to loans are

the biggest hurdle to business confidence and spending.

Commonwealth Bank Group economists have pencilled in a rate

cut in February 2020. But with limited conventional monetary

policy ammunition at its disposal, the Reserve Bank would prefer

to see additional fiscal initiatives – such as infrastructure spending

and tax cuts - potentially be announced by the Federal

Government to prop up economic activity.

Ryan Felsman, Senior Economist, CommSec

Twitter: @CommSec

November 29 2019 2Economic Insights: Annual credit growth hits 9½-year low

IMPORTANT INFORMATION AND DISCLAIMER FOR RETAIL CLIENTS

The Economic Insights Series provides general market-related commentary on Australian macroeconomic themes that have been selected for coverage by the

Commonwealth Securities Limited (CommSec) Chief Economist. Economic Insights are not intended to be investment research reports.

This report has been prepared without taking into account your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell

any securities or financial instruments, or as a recommendation and/or investment advice. Before acting on the information in this report, you should consider the

appropriateness and suitability of the information, having regard to your own objectives, financial situation and needs and, if necessary, seek appropriate professional of

financial advice.

CommSec believes that the information in this report is correct and any opinions, conclusions or recommendations are reasonably held or made based on information

available at the time of its compilation, but no representation or warranty is made as to the accuracy, reliability or completeness of any statements made in this report.

Any opinions, conclusions or recommendations set forth in this report are subject to change without notice and may differ or be contrary to the opinions, conclusions or

recommendations expressed by any other member of the Commonwealth Bank of Australia group of companies.

CommSec is under no obligation to, and does not, update or keep current the information contained in this report. Neither Commonwealth Bank of Australia nor any of

its affiliates or subsidiaries accepts liability for loss or damage arising out of the use of all or any part of this report. All material presented in this report, unless

specifically indicated otherwise, is under copyright of CommSec.

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399, a wholly owned but not guaranteed subsidiary of

Commonwealth Bank of Australia ABN 48 123 123 124. This report is not directed to, nor intended for distribution to or use by, any person or entity who is a citizen or

resident of, or located in, any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or

that would subject any entity within the Commonwealth Bank group of companies to any registration or licensing requirement within such jurisdiction.

November 29 2019 3You can also read