Policy summary BupaCare - Bu - Bupa UK

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

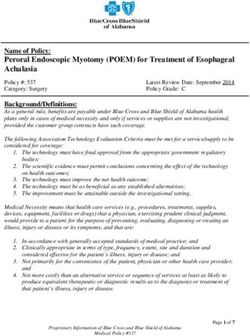

Policy summary

BupaCare

Effective from 1 June 2019

Bu~This policy summary contains key information about BupaCare. Please note that it does not contain the full terms and conditions or the exclusions of cover. These can be found in your membership guide and will be shown on your membership certificate. You should read this carefully and keep it in a safe place. About your cover The provider BupaCare is provided by Bupa Insurance Limited (Bupa, we, us, our), a subsidiary of The British United Provident Association Limited. Other services are provided by or via other subsidiary companies. The insurance and the cover that it provides BupaCare offers you private medical health insurance which aims to fund medical treatment. It will cover the costs of your eligible treatment in the UK up to the limits of your chosen cover by Bupa recognised consultants, therapists and practitioners. When you receive private medical treatment you have a contract with the providers of your treatment. You are responsible for the costs you incur in having private treatment. However, if your treatment is eligible treatment we pay the costs that are covered under your benefits. Any costs, including eligible treatment costs, that are not covered under your benefits are your sole responsibility. This policy is fully medically underwritten. This means that any symptoms or conditions you have prior to the start of your policy (before the ‘effective underwriting date’ shown on your membership certificate) may not be covered, and we may require further medical information to assess your claim, particularly where claims are made early in your policy. Following medical underwriting you may not have all the cover set out in your membership guide. It is your membership certificate that shows the cover that is specific to you. Page 2

Your membership guide and your membership certificate together set out full

details of your benefits. They should not be read as separate documents.

Alternatively, moratorium is an underwriting method where the member does

not need to declare their medical history to us at the start of their cover under

the policy. However, in the event of a claim we will ask the member questions

about their (or any relevant dependants’) health and medical history and may

ask their GP for a medical report (which we do not pay for).

For a full definition of Moratorium see section A1 and the glossary in your

membership guide.

Scale of cover

Some of the benefits shown in the summary of cover table have three benefit

limits for BupaCare – Scales A, B and C. There are additional benefits available

only on Scale A. The scale you choose affects the price of your cover and the

benefits you can receive. Scale A offers the highest ‘scale of cover’, while scale

C provides the lowest.

For further details please refer to the summary of cover table on page 5.

Choice of facility

There are three recognised facility networks that can apply to your cover:

JJ participating facility

JJ prime facility or

JJ prime with key London facility.

The list of hospitals within each recognised facility can change from time to

time, so please call us before you receive any treatment.

Where you choose either the prime facility or prime with key London facility

and you receive treatment from a Bupa recognised facility that is not in your

facility access, we will only pay a percentage of your facility charges.

For details visit our consultants and facilities website at finder.bupa.co.uk

The recognised facility you choose will affect the price of your cover and the

number of facilities you can access. Prime with key London facility offers the

largest selection of recognised facilities, while participating facility provides

the smallest.

A recognised facility is a hospital or a treatment facility, centre or unit in

accordance with the facility access that applies to your benefits.

Facility access is the network of recognised facilities for which you are covered

under your benefits which will be shown on your membership certificate.

Page 3Eligibility

To be eligible for this cover the main member and dependant(s) must:

JJ be resident in the UK

JJ at their cover start date have been registered continuously with a GP for

a period of at least six months, or have access to and be able to provide

their full medical records in English and;

JJ not receive payment for taking part in sports.

Summary of cover

The summary of cover overleaf contains key information about BupaCare.

The full list of benefits, conditions, exclusions, limitations and definitions which

apply to BupaCare can be found in your membership guide. The specific terms

of cover that apply to you will be shown on your membership certificate.

Page 4Summary of cover

Type of cover Membership Available benefit

guide section

Being treated as an out-patient

Out-patient 1.1 Paid in full – when referred by GP, consultant

consultations or (where available under your cover) our

Direct Access service

Out-patient 1.2 and 1.3, Scale A – £800♦

therapies, and 5.1 Scale B – £650♦

related charges,

Scale C – £500♦

complementary

medicine Up to £250 from your out-patient

♦

treatment, mental therapies benefit limit can be used towards

health treatment complementary medicine

When referred by GP, consultant or (where

available under your cover) our Direct

Access service

Diagnostic tests 1.4 and 1.5 Paid in full in a Bupa recognised facility

and out-patient Facility that is not a recognised facility: up to

MRI, CT and £100 towards the total facility charges and not

PET scans each service or charge individually

Recognised 3.1 Paid in full in a recognised facility

facility charges: For out-patient non-recognised facilities we pay

JJ out-patient for up to £100 towards the total facility charges

eligible surgical and not for each service or charge individually

operations

Page 5Type of cover Membership Available benefit

guide section

Being treated in hospital

Consultants’ fees 2 Scale A – paid in full for all consultants that are

for surgical and recognised practitioners

medical hospital Scale B and C – paid in full only for fee-assured

treatment consultants. Paid to benefit limits for

non fee-assured consultants

For details visit our consultants and facilities

website at finder.bupa.co.uk

A Bupa fee-assured consultant is a consultant

who, at the time you receive treatment, is

recognised by us as a fee-assured consultant

A Recognised Practitioner is a healthcare

practitioner who at the time of your treatment:

JJ is recognised by us for the purpose of our

private medical insurance schemes for treating

the medical condition you have and for

providing the type of treatment you need, and

JJ is in our list of recognised practitioners that

applies to your benefits

Diagnostic tests 3.2.5 Paid in full in a Bupa recognised facility

and MRI, CT and Not paid in a non-recognised facility

PET scans

Recognised 3.2 Paid in full in a recognised facility:

facility charges: up to £200 each day for day-patient

JJ day-patient and treatment or each night for in-patient

in-patient treatment for all the facility charges, and

treatment not for each service or charge individually

including for non-recognised facilities

eligible surgical

operations

Page 6Type of cover Membership Available benefit

guide section

Cancer treatment

Cancer cover 4.1 Paid in full with a fee assured consultant in

a recognised facility

Except for:

JJ MRI, CT and PET scans are not paid under

this benefit – see benefit 1.5.

We do not pay for any complementary,

homeopathic or alternative products,

preparations or remedies for treatment

of cancer

Mental health treatment

Day-patient and 5.2 JJ Up to a maximum of 45 days each year

in-patient mental for mental health day-patient treatment

health treatment and mental health in-patient treatment

combined and not individually

JJ Recognised facility:

−− paid in full

JJ Non-recognised facility payments included

within the total facility charges and not for

each service or charge individually:

−− up to £50 each day for mental health

day-patient treatment or

−− up to £80 each night for mental health

in-patient treatment

Additional benefit

Free Bupa health 13 For Scale A members only

assessment One free Bupa health assessment is available

every other year, for either you or any one of

your dependants who is aged 18 or over on

the date of the assessment

The Bupa health assessment you or your

dependant is entitled to is either:

JJ the Bupa Health Enhance assessment

(for those aged under 65); or

JJ the Bupa Mature health assessment

(for those aged over 65)

Page 7Type of cover Membership Available benefit

guide section

Cash benefits

NHS cash benefit CB1 We pay NHS cash benefit for each night you

for NHS in-patient receive in-patient treatment provided to you

treatment free under the NHS. We only pay NHS cash

benefit if your treatment would otherwise have

been covered for private in-patient treatment

under your benefits

Scale A – £30 per night

Scale B – £25 per night

Scale C – £20 per night

(up to a maximum of 35 nights a year for

eligible in-patient treatment)

JJ Any costs you incur for choosing to occupy an

amenity bed while receiving your in-patient

treatment are not covered under your benefits.

By an amenity bed we mean a bed which the

hospital makes a charge but where your

treatment is still provided free under the NHS

NHS cash CB6.1 We pay NHS cash benefit for each night of

benefit for NHS in-patient stay that you receive radiotherapy,

in-patient stays chemotherapy or a surgical operation that is for

that you receive cancer treatment including in-patient treatment

radiotherapy, related to blood and marrow transplants when

chemotherapy those are carried out in the NHS. The in-patient

or a surgical treatment must be provided to you free under

operation that the NHS and we only pay if your treatment

is for cancer would otherwise have been covered for private

treatment in-patient treatment under your benefits

JJ £100 each night for NHS in-patient treatment

that would otherwise have been covered

for private in-patient treatment under

your scheme

JJ Any costs you incur for choosing to occupy an

amenity bed while receiving your in-patient

treatment are not covered under your benefits.

By an amenity bed we mean a bed which the

hospital makes a charge for but where your

treatment is still provided free under the NHS

Page 8Type of cover Membership Available benefit

guide section

Cash benefits

NHS cash benefit CB6.2 We pay NHS cash benefit as follows:

for NHS JJ radiotherapy – for each day radiotherapy is

out-patient or received in a hospital setting

day-patient

treatment or NHS JJ chemotherapy – for each day you receive

home treatment treatment for IV-chemotherapy and for each

for cancer three-weekly interval of oral chemotherapy,

or part thereof

JJ a surgical operation – on the day of your

operation which is treatment for cancer carried

out as out-patient treatment, day-patient

treatment or in your home, when it is provided

to you free under the NHS

£100 per day

Except for eligible treatment for oral

chemotherapy, this benefit is not payable at the

same time as any other NHS cash benefit and

we only pay NHS cash benefit if your treatment

would otherwise have been covered for private

out-patient or day-patient treatment under

your benefits

We only pay this benefit once even if you

have more than one eligible treatment on

the same day

For eligible treatment for oral chemotherapy

we pay this benefit at the same time as another

NHS cash benefit you may be eligible for on

the same day

Page 9What your policy does not cover Exclusion 12

Exclusions Dental/oral treatment (exceptions

apply for accidents, jaw bone cysts

The following are significant general and impacted teeth).

exclusions for certain conditions,

treatments and services on this policy, Exclusion 14

full details of which can be found by Drugs and dressings for out-patient

referring to the relevant exclusion or take-home use and complementary

number in the section ‘What is not and alternative products (except for

covered’ of your membership guide. cancer treatment).

The section ‘What is not covered’ also Exclusion 16

details the other general exclusions on Experimental drugs and treatment

the policy. (exceptions apply for certain drug

Exclusion 1 treatment for cancer).

Ageing, menopause and puberty. Exclusion 18

Exclusion 3 Pandemic.

Allergies or allergic disorders Exclusion 19

and conditions. Intensive care (except following an

Exclusion 5 eligible procedure in a recognised

Birth control, conception, sexual facility, as defined in benefit 3 of

problems and gender reassignment. your membership guide).

Exclusion 6 Exclusion 20

Chronic conditions (except for acute Learning difficulties, behavioural and

symptoms of a chronic condition developmental problems (except

that flares up). diagnostic tests to rule out ADHD or

Note – we do not consider cancer ASD when a mental health condition

as a chronic condition. is suspected and you have cover for

mental health treatment).

Exclusion 8

Contamination, wars, riots and some Exclusion 21

terrorist acts. Overseas treatment or repatriation.

Exclusion 9 Exclusion 23

Convalescence, rehabilitation and Pre-existing conditions (except for

general nursing care (exceptions a condition that neither you nor the

apply for rehabilitation). person with the pre-existing condition

knew about).

Exclusion 10

Cosmetic, reconstructive or weight Exclusion 24

loss treatment (except for excision Pregnancy and childbirth (various

of some lesions or surgery to restore exceptions apply).

appearance after an accident or after

surgery for cancer).

Page 10Exclusion 25 To identify which applies to you please

Screening, monitoring and preventive see your membership certificate or

treatment (except for specific eligibility information leaflet. If you

circumstances where you are being are subject to a common renewal,

treated for cancer). depending on the month in which

you join the scheme, your initial

Exclusion 33

period of cover may not be a full year

Moratorium conditions.

and your subscription and benefits

In certain circumstances other and those of your dependants may

exclusions may apply, these will be change at the common renewal date.

detailed in the section ‘Further details’ This date may be different from the

on your membership certificate. cover start date shown on your

membership certificate.

In addition, based upon your medical

history, we may add exclusions and Cover is automatically renewed each

conditions specific to you and your year and will continue until:

dependants; these will be in the JJ you stop paying subscriptions to it

section ‘Special conditions’ on your

membership certificate. JJ you stop being resident in the UK

Policy excesses JJ you die

(See ‘Claiming’ section of your JJ your policy is cancelled or

membership guide for full details.) ends in accordance with the

You can choose to pay a policy excess, terms and conditions in the

where you pay up to the first £100, membership guide.

£150, £200, £250, £500, £1,000 or Where cover extends to dependants’

£2,000 of your eligible treatment costs cover, it may end at an earlier date

in any policy year and your BupaCare to the main member’s. Cover for

policy will then pay the rest. The higher dependants will always end when

your policy excess, the lower your the main member’s cover ends.

subscription costs will be. The excess

is payable per person on the cover. You should review and update

Details of the excess option that you your cover periodically to ensure it

have chosen are shown in your remains adequate for you and your

membership certificate. dependants’ needs.

How long your cover will last

Cover under your policy will last for an

initial period of 12 months from your

cover start date, unless your policy is

subject to a common renewal date.

Page 11Changing your mind Getting in touch

Your right to cancel The Bupa helpline is always the

You may cancel your membership first number to call if you need

for any reason by calling us on help or support. Please call us on

0800 010 383* or writing to us within 0345 609 0111*, alternatively you

the later of 21 days of receipt of your can write to us at:

policy documents (including your Bupa, Bupa Place, 102 The Quays,

membership certificate) we send you Salford M50 3SP

each year confirming your cover, or

the cover start date of your policy. For hearing and speech impaired

If you have not made any claims we members who have a textphone,

will refund all of your subscriptions. please call on: 0345 606 6863.

After this period of time you can If you require correspondence and

cancel your cover at anytime, we will marketing literature in an alternative

refund any subscriptions you have format, we offer a choice of Braille,

paid relating to the period after your large print or audio. Please get in

cover ends. touch to let us know which you

You may cancel any of your would prefer.

dependants’ membership for any How to make a claim

reason by calling us on 0800 010 383* For certain medical conditions you

or writing to us within the later of can call us directly for a referral to a

21 days of receipt of your policy consultant or therapist usually without

documents (including your seeing your GP and we call this our

membership certificate) we send Direct Access service. For details

you each year confirming cover, or about cover for Direct Access and

the cover start date of your policy. how it works please see the Benefits

As long as no claims have been made section of your membership guide

in respect of their cover we will refund under the heading ‘Direct Access

all of your subscriptions paid in service’. If Direct Access is not

respect of that dependant’s cover for available (or if you prefer) – visit

that year and any sums paid in respect your GP.

of that dependant for future years

(if any). After this period of time you You will also need to have your Bupa

can cancel their cover at anytime, we membership number handy when you

will refund any subscriptions you have call. (See ‘Claiming’ section of your

paid relating to the period after their membership guide for full details.)

cover ends. (See ‘How your If your membership lapses for any

membership works’ section of your reason before the completion of

membership guide for full details.) your eligible treatment, your claim

for treatment that takes place after

your effective lapse date may not be

paid by Bupa.

*We may record or monitor our calls.

Page 12Making a complaint For more information and to sign

We are committed to providing you up for a free Egress account, go to

with a first class service at all times https://switch.egress.com. You will

and will make every effort to meet the not be charged for sending secure

high standards we have set. If you feel emails to a Bupa email address using

that we have not achieved the the Egress service.

standard of service you would expect Via our website: bupa.co.uk/

or if you are unhappy in any other way, members/member-feedback

then please get in touch.

How will we deal with your complaint

If Bupa, or any representative of and how long is this likely to take?

Bupa, did not sell you this policy and

If we can resolve your complaint

your complaint is about the sale of

within three working days after the

your policy, please contact the party

day you made your complaint, we will

who sold the policy. Their details can

write to you to confirm this. Where we

be found on the status disclosure

are unable to resolve your complaint

document or the terms of business

within this time, we will promptly write

document they provided to you.

to you to acknowledge receipt.

If you are a member of a company

We will then continue to investigate

or corporate scheme please call

your complaint and aim to send you

your dedicated Bupa helpline,

our final written decision within four

this will be detailed on your

weeks from the day of receipt. If we

membership certificate.

are unable to resolve your complaint

For any other complaint our member within four weeks following receipt,

services department is always the first we will write to you to confirm that

number to call if you need help or we are still investigating it.

support or if you have any comments

Within eight weeks of receiving your

or complaints. You can contact us in

complaint we will either send you a

several ways:

final written decision explaining the

By phone: 0345 609 0111* results of our investigation or we will

send you a letter advising that we

In writing: Customer Relations,

have been unable to reach a decision

Bupa, Bupa Place, 102 The Quays,

at this time.

Salford M50 3SP

By email:

customerrelations@bupa.com

Please be aware that the information

you send to this email address may

not be secure unless you send your

email through Egress.

*We may record or monitor our calls.

Page 13If you remain unhappy with our Resolution (ADR) scheme. For Bupa,

response, or after eight weeks you do complaints will be forwarded to the

not wish to wait for us to complete Financial Ombudsman Service and you

our review, you may refer your can refer complaints directly to them

complaint to the Financial using the details above. For more

Ombudsman Service. You can write information about ODR please visit

to them at: Exchange Tower, London http://ec.europa.eu/consumers/odr/

E14 9SR or contact them via email at

The Financial Services Compensation

complaint.info@financial-

Scheme (FSCS)

ombudsman.org.uk or call them on

0800 023 4567 calls to this number In the unlikely event that we cannot

are now free on mobile phones and meet our financial obligations, you

landlines or 0300 123 9123 (free for may be entitled to compensation from

mobile phone users who pay a the Financial Services Compensation

monthly charge for calls to numbers Scheme. This will depend on the type

starting 01 or 02). of business and the circumstances of

your claim.

For more information you can visit

www.financial-ombudsman.org.uk The FSCS may arrange to transfer

your policy to another insurer,

If you refer your complaint to the provide a new policy or, where

Financial Ombudsman Service, they appropriate, provide compensation.

will ask for your permission to access Further information about

information about you and your compensation scheme arrangements

complaint. We will only give them is available from the FSCS on

what’s necessary to investigate 0800 678 1100 or 020 7741 4100

your complaint and this may include or on its website at: www.fscs.org.uk

medical information. If you are

concerned about this, please Privacy notice

contact us. Our privacy notice explains how we

take care of your personal information

Your complaint will be dealt with

and how we use it to provide your

confidentially and will not affect how

cover. A brief version of the notice

we treat you in the future.

can be found in your membership

Whilst we are bound by the decision guide or the full version is online at

of the Financial Ombudsman Service, bupa.co.uk/privacy

you are not.

The European Commission also

provides an online dispute resolution

(ODR) platform which allows

consumers who purchase online to

submit complaints through a central

site which forwards the complaint to

the relevant Alternative Dispute

Page 14Notes

Page 15Bupa health insurance is provided by:

Bupa Insurance Limited. Registered in England

and Wales No. 3956433. Bupa Insurance Limited is

authorised by the Prudential Regulation Authority

and regulated by the Financial Conduct Authority

and the Prudential Regulation Authority.

Arranged and administered by:

Bupa Insurance Services Limited, which is authorised

and regulated by the Financial Conduct Authority.

Registered in England and Wales No. 3829851.

Registered office: 1 Angel Court, London EC2R 7HJ

© Bupa 2019

0 bupa.co.uk

BC/4681/JUN19 BINS 00741You can also read