Malaysia airlines vision and mission

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Malaysian Airline System Berhad Annual Report 04/05 11

(10601-W)

malaysia airlines

vision and mission

Vision

‘An airline uniquely renowned for its personal touch,

warmth and efficiency’

Mission

‘To provide air travel and transport service that rank

among the best in terms of safety, comfort and

punctuality’2 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

notice of annual general meeting

NOTICE IS HEREBY GIVEN THAT the Thirty-Fourth Annual General Meeting of

Malaysian Airline System Berhad will be held at Nirwana Ballroom 1, Lower Lobby,

Crowne Plaza Mutiara Kuala Lumpur, Jalan Sultan Ismail, 50250 Kuala Lumpur on

Monday, 19 September 2005 at 10.00 am for the following purposes:-

AGENDA

As Ordinary Business

1. To receive and adopt the Report of the Directors and the Audited Accounts for

the financial year ended 31 March 2005 together with the Report of the Auditors

thereon. Resolution 1

2. To approve the declaration of a final tax-exempt dividend of 2.5 sen per share in

respect of the year ended 31 March 2005. Resolution 2

3. To approve the Directors’ fees for the financial year ended 31 March 2005. Resolution 3

4. To re-elect the following Directors retiring under Article 139 of the Company’s

Articles of Association, and who, being eligible, offer themselves for re-election:-

(i) Dato’ Mohamed Azman bin Yahya Resolution 4

(ii) Dato’ N. Sadasivan a/l N. N. Pillay Resolution 5

(iii) Datuk Abdillah @ Abdullah bin Hassan @ S Hassan Resolution 6

5. To re-elect the following Directors retiring under Article 137 of the Company’s

Articles of Association, and who, being eligible, offer themselves for re-election:-

(i) Dato’ Izzuddin bin Dali Resolution 7

(ii) Dato’ Mohd. Annuar bin Zaini Resolution 8

(iii) Dato’ Zaharaah binti Shaari Resolution 9

Resolution 9

6. To re-appoint Messrs Ernst & Young as Auditors and to authorize the Directors to

fix their remuneration. Resolution 10

As Special Business

7. To consider and if thought fit to pass the following Ordinary Resolution:-

Authority to Allot and Issue Shares

“THAT subject to the Companies Act, 1965 (the Act), the Articles of Association

of the Company, approval from the Bursa Malaysia Securities Berhad and other

government or regulatory bodies, where such approval is necessary, full authority

be and is hereby given to the Board of Directors pursuant to Section 132D of the

Act, to issue shares in the capital of the Company at any time upon such terms

and conditions and for such purposes as the Directors may in their discretion

deem fit, provided always that the aggregate number of shares to be issued shall

not exceed 10 per cent of the issued share capital of the Company and that such

authority shall continue to be in force until the conclusion of the next Annual

General Meeting of the Company.” Resolution 11

Resolution 11

8. To transact any other ordinary business for which due notice has been given. Resolution 12Malaysian Airline System Berhad Annual Report 04/05 3

(10601-W)

NOTICE OF ANNUAL GENERAL MEETING

NOTICE OF BOOK CLOSURE FOR PAYMENT OF DIVIDENDS

Subject to the approval of shareholders at the Thirty-Fourth Annual General Meeting, a final tax-exempt dividend

of 2.5 sen per share in respect of the year ended 31 March 2005 will be paid on 18 October 2005 to shareholders

whose names appear on the Register of Members and the Record of Depositors at the close of business on 7

October 2005.

NOTICE IS HEREBY GIVEN that the Share Transfer Books, the Register of Members and the Record of Depositors

of the Company will be closed from 8 October 2005 to 11 October 2005 (both dates inclusive) to determine

shareholders’ entitlements to the dividend payment.

A Depositor shall qualify for entitlement only in respect of:-

a. shares deposited into the Depositor’s Securities Account before 12.30 pm on 5 October 2005 (in respect of

shares which are exempted from mandatory deposit);

b. shares transferred into the Depositor’s Securities Account before 4.00 pm on 7 October 2005 (in respect of

ordinary transfers);

c. shares bought on Bursa Malaysia Securities Berhad on a cum entitlement basis according to the Rules of Bursa

Malaysia Securities Berhad.

By Order of the Board

Rizani bin Hassan (LS 05125)

Company Secretary

26 August 2005

Kuala Lumpur4 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

NOTICE OF ANNUAL GENERAL MEETING

Explanatory Notes on Item 7 of the Agenda

Resolution pursuant to Section 132D, Companies Act, 1965.

The Ordinary Resolution proposed under item 7 of the Agenda, if passed, will empower the Directors to issue

shares in the Company up to an amount not exceeding in total 10% of the issued share capital of the Company,

subject to compliance with the relevant regulatory requirements. The approval is sought to avoid any delay and

cost in convening a general meeting for such issuance of shares. This authority, unless revoked or varied by the

Company at a general meeting, will expire at the next Annual General Meeting.

Notes:

1. A member of the Company entitled to attend and 5. The instrument appointing a proxy must be

vote at the Meeting is entitled to appoint a proxy/ deposited at Symphony Share Registrars Sdn

proxies to attend and vote in his stead. A proxy may Bhd, Level 26, Menara Multi Purpose, Capital

but need not be a member of the Company and a Square, No 8 Jalan Munshi Abdullah, 50100

member may appoint any person to be his proxy and Kuala Lumpur, not less than 48 hours before the

the provisions of Section 149(1)(b) of the Companies time for holding the Meeting or at any adjournment

Act, 1965 shall not apply to the Company. thereof.

2. In the case of a corporate member, the instrument 6. Shareholders’ attention is hereby drawn to the

appointing a proxy shall be under its Common Seal Listing Requirements of Bursa Malaysia Securities

or under the hand of its officers or attorney, duly Berhad, which allows a member of the Company who

authorised in that behalf. is an authorised nominee as defined under the

Securities Industry (Central Depositories) Act, 1991, 1

3. A holder may appoint more than two proxies to to appoint at least one (1) proxy in respect of each

attend the Meeting. Where a member appoints two securities account it holds with ordinary shares of

or more proxies, he shall specify the proportion of the Company standing to the credit of the said

his shareholding to be represented by each proxy. securities account.

4. The right of foreigners to vote in respect of their

deposited securities is subject to Section 41 (1) (e)

and Section 41 (2) of the Securities Industry (Central

Depositories) Act, 1991 and the Securities Industry

(Central Depositories) (Foreign Ownership)

Regulations, 1996. The position of such Depositors

in this regard will be determined based on the

General Meeting Record of Depositors. Such

Depositors whose shares exceed the Company’s

foreign shareholding limit of 45% as at the date of

the General Meeting Record of Depositors may

attend the above Meeting but are not entitled to

vote. Consequently, a proxy appointed by such

Depositor who is not entitled to vote will also not

be entitled to vote at the above Meeting.Malaysian Airline System Berhad Annual Report 04/05 55

(10601-W)

statement accompanying the

notice of annual general meeting

Directors standing for re-election at the Thirty-Fourth Annual General Meeting of the Company to be held at

Nirwana Ballroom 1, Lower Lobby, Crowne Plaza Mutiara Kuala Lumpur, Jalan Sultan Ismail, 50250 Kuala Lumpur

on Monday, 19 September 2005 at 10.00 am are as follows:-

NAME OF DIRECTOR DETAILS OF ATTENDANCE DETAILS OF INDIVIDUAL DIRECTORS

OF BOARD MEETINGS AND OTHER DISCLOSURE

REQUIREMENTS

Dato’ Mohamed Azman bin Yahya

(Article 139 of the Company’s

Articles of Association) 9/11 Refer to page 88 of Annual Report

Dato’ N. Sadasivan a/l N.N. Pillay

(Article 139 of the Company’s

Articles of Association) 11/11 Refer to page 83 of Annual Report

Datuk Abdillah @ Abdullah Bin

Hassan @ S Hassan

(Article 139 of the Company’s

Articles of Association) 9/11 Refer to page 89 of Annual Report

Dato’ Izzuddin bin Dali

(Article 137 of the Company’s

Articles of Association) 4/5 Refer to page 85 of Annual Report

Dato’ Mohd. Annuar bin Zaini

(Article 137 of the Company’s

Articles of Association) 3/3 Refer to page 92 of Annual Report

Dato’ Zaharaah binti Shaari

(Article 137 of the Company’s

Articles of Association) 4/7 Refer to page 93 of Annual Report

General Meeting held during the financial year ended 31 March 2005

THIRTY-THIRD ANNUAL GENERAL MEETING

Date : 13 September 2004

Time : 10.00 am

Venue : Nirwana Ballroom 1

Lower Lobby

Mutiara Hotel Kuala Lumpur

Jalan Sultan Ismail

50250 Kuala Lumpur.Malaysian Airline System Berhad Annual Report 04/05 7

(10601-W)

corporate report

Ten-Year Statistical Review of the Group - 8

In A Class Among The World’s Best - 10

Chairman’s Statement - 12

Managing Director’s Report and Review - 26

Corporate Information - 80

Details of Board of Directors’ Meetings - 81

Board of Directors and Profile - 82

Board Audit Committee Report - 96

Statement on Internal Control - 100

Statement on Corporate Governance - 104

Group Structure - 116

Organisational Structure - 118

Management Committee and Profile - 120

Management Team - 128

Corporate Social Responsibility - 132

Corporate Calendar of Events - 138

Employee Calendar of Events - 140

Fleet Status - 142

Route Network - 14488 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

ten-year statistical review of the group

2004 2003 2002 2001

2005 2004 2003 2002

FINANCIAL*

Total Revenue (RM’000) 11,364,309 8,780,820 8,864,385 8,695,150

Total Expenditure (RM’000) 11,046,764 8,591,157 8,872,391 9,569,435

Taxation (RM’000) (35,707) (117,543) (5,017) (14,898)

Profit/(Loss) after Tax and Exceptional Item (RM’000) 326,079 461,143 336,531 (835,563)

Shareholders’ Funds (RM’000) 3,318,732 3,023,984 2,562,841 1,215,290

Profit/(Loss) as a % of Revenue (%) 2.9 5.3 3.8 (9.6)

Return on Shareholders’ Funds (%) 9.8 15.2 13.1 (68.8)

Earnings/(Loss) Per Share (Sen) 26.0 36.8 38.7 (108.5)

PRODUCTION

Network Size (KM) 504,051 445,263 439,547 453,720

Time Flown (Hours) 411,134 352,540 357,328 340,741

Distance Flown (000 KM) 265,050 227,865 228,762 201,189

Available Capacity (000 TKM) 10,299,867 8,413,110 7,977,845 7,823,943

Available Passenger Capacity (000 Seat KM) 64,115,190 55,692,377 54,265,627 52,594,942

TRAFFIC

Passengers Carried (000) 17,536 15,375 16,325 15,734

Passengers Carried (000 Pax KM) 44,226,090 37,658,910 37,652,955 34,708,514

Passenger Load Factor (%) 69.0 67.6 69.4 66.0

Cargo Carried (000 TKM) 2,686,783 2,184,226 2,071,271 1,759,209

Mail Carried (000 TKM) 3,004 2,840 2,054 2,014

Overall Load Carried (000 TKM) 6,728,547 5,628,573 5,496,735 5,149,942

Overall Load Factor (%) 65.3 66.9 68.9 65.8

STAFF

Employee Strength (As at 31 March) 22,513 20,789 21,916 21,438

Revenue Per Employee (RM’000) 505 422 429 406

Available Capacity Per Employee (TKM) 457,508 404,690 364,019 364,957

Load Carried Per Employee (TKM) 298,874 270,748 250,809 240,225

*As per Audited Financial Statements for the financial year under reviewMalaysian Airline System Berhad Annual Report 04/05 9

(10601-W)

TEN-YEAR STATISTICAL REVIEW OF THE GROUP

2000 1999 1998 1997 1996 1995

2001 2000 1999 1998 1997 1996

9,712,097 8,288,273 7,536,510 7,154,024 6,563,799 5,766,365

10,336,829 9,566,041 8,647,874 7,991,746 6,258,561 5,515,895

26,683 18,813 26,961 31,277 15,434 18,131

(417,428) (258,574) (700,051) (259,851) 333,018 247,666

1,252,148 3,222,276 3,496,250 4,211,701 4,486,952 3,685,372

(4.3) (3.1) (9.3) (3.6) 5.1 4.3

(33.3) (8.0) (20.0) (6.2) 7.4 6.7

(54.2) (33.6) (90.9) (33.7) 43.8 33.3

488,243 366,578 361,203 362,997 352,703 353,443

349,352 330,205 306,949 303,569 291,418 279,416

191,668 200,223 189,754 174,659 166,777 156,795

8,054,870 7,531,473 6,649,146 5,528,737 5,246,353 5,381,925

51,237,536 48,905,537 45,442,288 42,293,932 40,096,883 35,161,376

16,745 15,371 13,709 15,117 15,371 14,311

38,312,570 34,930,136 30,592,900 28,698,112 27,903,706 24,565,816

74.8 71.4 67.3 67.9 69.6 69.9

1,837,426 1,664,600 1,477,403 1,005,465 925,227 1,328,061

1,830 2,828 2,006 2,726 3,832 3,299

5,379,101 4,853,377 4,246,894 3,361,408 3,212,436 3,354,670

66.8 64.5 63.9 60.8 61.2 62.3

21,518 21,587 23,076 23,436 22,546 19,925

451 384 327 305 291 289

374,332 348,889 288,141 235,908 232,696 270,109

249,981 224,829 184,039 143,429 142,484 168,36510

10 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

in a class among the world’s best

“Malaysia Airlines has joined the most exclusive group

of world airlines, being ranked as a 5-Star airline by the

aviation rating organisation, Skytrax. There are just four

airlines in the world that merit this prestigious 5-Star

accolade, and we are delighted to be in this coterie that

represents the very best in air travel today.”

Dato’ Dr Mohd Munir bin Abdul Majid

Chairman

Malaysian Airline System BerhadMalaysian Airline System Berhad Annual Report 04/05 11

(10601-W)

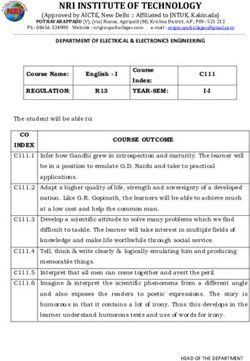

SUMMARY RANKING

Combined Quality of Product / Staff service in airport and onboard

environments

First Class

Business Class

Economy Class

AIRPORT SERVICES

Check-In service - First / Business

Check-In service - Economy Class

Transfer Services - First / Business

Transfer Services - Economy Class

Arrival Services

Business Class Lounge - product facilities

Business Class Lounge - staff service

First Class Lounge - product facilities

First Class Lounge - staff service

ONBOARD FEATURES

Inflight entertainment may vary according to aircraft type

Cabin Safety Procedures

Inflight Entertainment

Amenities, Blankets, Pillows, Towels etc

Airline Magazine, Newspapers & other mags

CABIN SEAT COMFORT

Seating may vary according to aircraft type

First Class - long haul

Business Class - long haul

Business Class - regional

Economy Class - long haul

Economy Class - regional

ONBOARD CATERING

First Class meals - long haul

Business Class - long haul

Business Class - regional

Economy Class meals - long haul

Economy Class meals - regional

STAR RANKING Certification CABIN STAFF SERVICE

Excellent First Class - service efficiency

Good First Class - staff attitude & friendliness

Fair Business Class - service efficiency

Poor Business Class - staff attitude & friendliness

Very Poor Economy Class - service efficiency

N/A not applicable Economy Class - staff attitude & friendliness

U not ranked Responding to Passenger requests

Cabin presence through flights

Assisting Parents with children

Staff Language Skills12

12 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

chairman’s statement

OUR PERFORMANCE IN 2004/2005

An Accolade

Malaysia Airlines has joined the most exclusive group of world

airlines, being ranked as a 5-Star airline by the aviation rating

organisation, Skytrax. There are just four airlines in the world

that merit this prestigious 5-Star accolade, and we are delighted

to be in this coterie that represents the very best in air travel

today.

It is a great honour because it is such a world-class award. The world airline star ranking

programme applies quality assessment for more than 375 airlines across the globe,

rating the standards of each airline’s front-line product and service. This is

predominantly based upon international flight operations. A 5-Star rating testifies

not only to the quality of product Malaysia Airlines provides to customers, but also to

the very high standards of staff service. Malaysia Airlines cabin staff service is renowned

as one of the world’s best - it has the required hallmarks of efficiency, but what sets it

apart is a most distinctive charm and character so reflective of the Malaysian culture.

According to Skytrax, our service philosophy of Going Beyond Expectations is well

portrayed by our front-line staff, and is a defining element of our elevation to 5-Star

airline status.Malaysian Airline System Berhad Annual Report 04/05 13

(10601-W)14 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

CHAIRMAN’S STATEMENT

I would like to congratulate the management and employees whose professionalism

and dedication to excellence made this great achievement possible. We must seek to

improve on those standards and have them spread more evenly across the network.

Being a 5-star airline reflects our commitment to consistently deliver high standards

of service wherever we are around the world. It also underscores our ongoing efforts

to make Malaysia more attractive to the world as a favourite tourist destination and

our determination to rank Malaysia Airlines top of the class.

Malaysian Economy

In 2004, the Malaysian economy experienced its most rapid growth in four years,

expanding as a result of robust growth in both global trade and domestic demand.

Real gross domestic product (GDP) increased by 7.1 per cent in 2004 against 5.3 per

cent in 2003, the fastest growth since 2000. Growth was led by the private sector

while the Government made further progress in fiscal consolidation. The services sector

recorded a stronger growth of 6.7 per cent in 2004. Expansion was driven mainly by

higher consumer spending as a result of rising disposable incomes, higher tourist arrivals

and increased trade-related activities that were spurred on by a buoyant export

performance.

While growth was positive in 2004, the business landscape was also increasingly being

reshaped and transformed by the rapid pace of globalisation, market liberalization

and advances in technology. On the global front, there were notable shocks to the

world economy in 2004, namely, high oil prices, revival in inflationary pressures,

tightening of the global monetary cycle, measures to reduce overheating in the People’s

Republic of China, sporadic outbreaks of avian flu and the effects of the tsunami in

December.

Although the Malaysian economy remained resilient, most businesses focused on

innovating and improving to compete in the rapidly changing global environment.

A Good Basis, But ...

Malaysian Airline System Berhad (Malaysia Airlines/the Company) had initiated a

strategic move three years ago with the implementation of the Widespread Asset

Unbundling (WAU) exercise in November 2002 which brought Malaysia Airlines back

to good and strong financial standing. This has to be followed through, as was the

plan, with high level operating performance to ensure and sustain earnings.

The strong balance sheet, in other words, has to be matched by operational efficiencies

that deliver excellent financial result. We have other strengths too, such as

acknowledged world-class air travel service quality, from which to leverage strong

operating performance, but there are many areas of doing business which we can

improve upon in the challenging airline industry.

Let me now present the highlights for the Company in the financial year ended 31

March 2005.Malaysian Airline System Berhad Annual Report 04/05 15

(10601-W)

CHAIRMAN’S STATEMENT

FINANCIAL PERFORMANCE

Revenue

Malaysia Airlines’ total revenue in 2004/2005 improved by RM2.6 billion to RM11.4

billion due primarily to the record 24 per cent increase in international passenger

traffic growth of 1.7 million passengers and a 21 per cent increase in cargo tonnage

flown. International passenger revenue grew by 29 per cent to RM7.9 billion while

cargo revenue increased by 44 per cent to RM2.4 billion.

Operating Expenditure

The Group’s total operating expenditure however increased by 29 per cent or RM2.4

billion to RM11.0 billion, primarily due to the RM1.5 billion increase in fuel cost which

rose sharply and became a major concern during and as the year ended, and to a

significant extent also to network expansion that covered new destinations. Total

passenger traffic which rose to 17.5 million compared to 15.4 million in the previous

year, reflecting a 14.1 per cent increase, further contributed to the increased operating

expenditure.

Profit

Profit before tax (PBT) for the financial year ended 31 March 2005 improved to RM364.5

million from the RM345.2 million registered in the previous year. Profit after tax (PAT)

registered RM326.1 million, a decrease from RM461.1 million recorded in the previous

year. The previous year’s PAT included a deferred tax asset of RM127.3 million.

Dividend

The Board has proposed for shareholder approval

at the Thirty-Fourth Annual General Meeting a final

dividend of 2.5 sen per share (tax-exempt). This

translates into a gross dividend payout ratio of 13.3

per cent for the year compared to 9.4 per cent in

the previous financial year. This is the second

consecutive year a dividend has been declared for

Malaysia Airlines shareholders. The dividend will

be paid on a date to be determined.16 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

CHAIRMAN’S STATEMENT

Earnings Per Share

For the year under review, Malaysia Airlines registered basic earnings per share of

26.02 sen compared to 36.80 sen in the previous year.

Financial Position

As at 31 March 2005, the cash balance at Malaysia Airlines improved to RM2.19 billion.

The primary use of cash during the year was to finance capital expenditure that included

investments to improve product and service standards, and improvements to various

operational and support service systems.

Shareholder Funds

During the year, shareholder funds at Malaysia Airlines increased by 10 per cent to

RM3.3 billion.

Assets

Total assets increased by 12 per cent to RM7.4 billion while net tangible assets per

share rose 10 per cent to RM2.66 per share.

Total assets increased by 12 per cent to

RM7.4 billion while net tangible assets per

share rose 10 per cent to RM2.66 per share.Malaysian Airline System Berhad Annual Report 04/05 17

(10601-W)18 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

CHAIRMAN’S STATEMENT

THE AIRLINE INDUSTRY

Big Business

The global airline industry is big business. Airlines the world over, employ 4 million

people and generate US$400 billion in economic output. While this is a colossal sum,

losses between 2001 and 2004 exceeded US$36 billion. According to an International

Air Transport Association (IATA) report, the industry is expected to lose another US$6

billion in 2005. The extraordinary price of fuel is affecting profitability. The latest rise

in oil prices in June 2005, taking the price of a benchmark barrel past the US$60 mark

for the first time, is having an impact on airline ticket prices as carriers slap on fresh

fuel surcharges. Many airlines are also increasing their freight charges. The increase in

fuel costs has indeed had a dramatic impact on the bottom line of airlines as fuel

represents an average of 20 per cent of their overall costs. Last year alone, the industry

lost US$4.8 billion.

However, regional differences are astonishing. For example, North American carriers

lost US$9 billion. Efficiency gains could not make up for structural problems. Labour

costs remained high and low cost competition at major hubs drove yields down.

European carriers posted a profit of US$1.4 billion. Yields were better and consolidation

helped capacity management. Middle Eastern carriers made US$100 million. Strong

traffic growth led to profitability but the economics of matching capacity to demand

is a challenge for this region. Latin American carriers were near break-even. The

situation is changing fast with some of the region’s airlines making money, but a large

number are technically bankrupt. African airlines were reported to have lost over

US$150 million. This region has major safety problems and is not investing in

infrastructure. Asian carriers on the other hand posted a hefty US$2.6 billion in profit.

Strong growth fuelled by China and low labour costs were the competitive advantage.

India may be the next great market for the industry.

Overall, during the year under review, the global airline industry saw positive

developments. Air transport has never been safer with over 1.8 billion passengers

flying safely. Indeed 2004 was the airline industry’s safest year. Airlines are

environmentally responsible with modern aircraft having a fuel efficiency of 3.5 litres

per 100 passenger kilometres, the same as a small compact car. More people than ever

are flying with new business models meeting consumer expectations for lower airfares.

And airlines are vital to the global economy. The airline industry makes global business

possible. Forty per cent of the value of goods traded in the world, are flown on aircraft.

Without air transportation, you would have a different world.

Closer To Home

Our financial year saw the travel industry rebounding strongly with the return of

traffic into the region following the scare of SARS in 2003. Economically, China

continued to dominate, providing much of the optimism in Asia. Forecasts from leading

sources agreed that Asia, particularly China and India will fuel much of the economic

expansion in the region with traffic growth projected to be at 2 percentage points

above the world’s average of 5 per cent. The promise of good profitability was, however,

dampened by the unprecedented high fuel prices which have been soaring.Malaysian Airline System Berhad Annual Report 04/05 19

(10601-W)20 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

CHAIRMAN’S STATEMENT

CORPORATE DEVELOPMENTS

On 4 October 2004, Malaysia Airlines and Asset Global Network Sdn Bhd (AGN) agreed

to end the conditional reimbursement agreement dated 26 March 2003 for the

reimbursement of Subang Complex A buildings. The deposit of RM1.0 million was

refunded by the Company and AGN was also reimbursed RM580,000 for the cost

incurred.

The Board of Directors approved on 2 February 2005 that the financial year end of

Malaysia Airlines after 31 March 2005, be changed to 31 December effective 2005, to

be co-terminous with that of the ultimate holding company, Khazanah Nasional Berhad,

and to comply with Section 168(1) of the Companies Act, 1965.

HUMAN CAPITAL AND PRODUCTIVITY

During the year under review, productivity at Malaysia Airlines saw a 19.5 per cent

increase to RM504,789 per employee compared with RM422,378 per employee recorded

in the previous year. This is a result in the right direction, even if there is room for

improvement.

The Company continues to develop its human capital through investments in relevant

training programmes and has also implemented a career development and succession

planning system. In addition, Malaysia Airlines also intends to increase the supply of

its pilots and ground engineers to ensure a continuous and sufficient availability for

the current and future requirements of the business, bearing in mind the problems

faced in this area in the past year.

Your Company will continue to implement measures to develop its human capital and

to ensure organisational readiness in realising business objectives.

CORPORATE GOVERNANCE

To protect and enhance shareholder value, the Board of Directors remains committed

to ensuring that the highest standards of corporate governance are observed

throughout the Company and Group as an imperative part of discharging its

responsibilities. In a separate chapter of this Annual Report, a comprehensive disclosure

on corporate governance by Malaysia Airlines is presented.Malaysian Airline System Berhad Annual Report 04/05 21

(10601-W)

CHAIRMAN’S STATEMENT

CORPORATE SOCIAL RESPONSIBILITY

At Malaysia Airlines, we recognise the need to strike a harmonious balance between

private sector pursuits and community pursuits – both of which provide the combined

force that wins not only customer loyalty and support, but also the support of the

world community at large.

A full and dedicated report on our corporate social responsibility pursuits is outlined

in a separate section of this Annual Report.

COLLABORATION

During the year under review, Malaysia Airlines entered into partnerships with two

leading international Maintenance, Repair and Overhaul (MRO) operators, Leading

Edge and Aviation Partner Boeing. The collaboration with Leading Edge will offer

specialised boutique external aircraft painting services. The tie-up with Aviation Partner

Boeing will offer installation of fuel-saving wing extension (winglets) services on Boeing

737 aircraft.

The development of the MRO activities are synergistic to current operations and will

support the government initiative to transform Subang into a regional hub for MRO

activities.22 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

CHAIRMAN’S STATEMENT

AWARDS

During the year under review, Malaysia Airlines was honoured with the World’s Best

Cabin Staff Award for 2004 for the fourth consecutive year by Skytrax of London. The

award recognizes Malaysia Airlines as an airline that fulfils the sincerity, warmth,

friendliness, attentiveness, efficiency and overall best services criteria that passengers

seek in an in-flight experience. Skytrax also awarded Malaysia Airlines with a third

placing for best on-board catering in the economy class category for 2005.

In a web-based poll by Smart Travel Asia in 2005, Malaysia Airlines emerged number

one in the category for Favourite Airline Food.

In March 2005, our freighter division MASkargo received two international standards

certification from SIRIM QAS International (SIRIM). The two certificates are the OHSAS

18001:1999 for MASkargo’s Advanced Cargo Centre (ACC) in KLIA, and the ISO

9001:2000 certification for the Penang Cargo Centre (PCC) facility. MASkargo was the

first airline to receive the OHSAS 18001:1999 certification.

During the year, MASkargo was also recognised as ‘Asia’s Top 3 Air Cargo Carrier’ for

a third consecutive year during the Asian Freight & Supply Chain Awards ceremony

organized by Cargonews Asia.

In the Asia Money-Malaysia “Best Managed Company” polls for 2004, Malaysia Airlines

emerged as Most Improved Investor Relations Company, a joint first for Most Improved

Annual Report, a joint second for Best Annual Reports, a joint second for Best Chief

Financial Officer conferred on Mr Low Chee Teng and a joint second for Best Investor

Relations Officer conferred on Mr Senthil Balan Danapalan.

Malaysia Airlines was also listed within the top 5 in the Best Investor Relations category

in the FinanceAsia Best Companies Poll 2005 for Malaysia.

Malaysia Airlines front-line crew showed remarkable product skills and effort in raising

the profile of in-flight merchandise selling and marketing by winning the Best In Product

Knowledge Award in the In-flight Sales Person of the Year (ISPY) 2004 competition

held in London. This effort had contributed to a 38 per cent increase in the overall in-

flight sales for the Company in the last financial year.Malaysian Airline System Berhad Annual Report 04/05 23

(10601-W)

CHAIRMAN’S STATEMENT

PROSPECTS

China, India and ASEAN will be the focused markets of our capacity growth in 2005 as

up to five additional long range narrow-bodied aircraft are planned to be leased in

the last quarter of 2005.

Competition, however, will remain strong as airlines continue to inject additional

capacity with delivery of new aircraft and more low cost carriers poised to be launched

this year in this region. New traffic rights granted by China and India to the United

Kingdom, Europe, Canada and the United States will result in greater capacity and

frequencies being redirected by European and North American carriers to Asia.

According to IATA, traffic demand is expected to remain buoyant in Asia Pacific. The

forecast growth is above 6 per cent for 2005 despite slightly lower economic growth

and capacity expansion. The Pacific Association of Travel Agents (PATA) has forecast

even higher visitor arrivals in Asia Pacific averaging 10.6 per cent per annum until

2007.

The Company will continue to broaden regional cooperation through collaboration

with other full service carriers within the region. During the year, Malaysia Airlines

forged collaborations with Singapore Airlines, Silk Air and Korean Air.

The Malaysia Airlines Travel Fair (MASTF) generated RM115 million in February 2005

and will continue to be an annual event for distribution. The Company will also

continue to diversify its distribution channels to increase its market reach and enhance

its customer loyalty and ownership. The Internet booking facility (IBF) will continue to

be enhanced with global partnerships, such as the recent tie-up with GRS Networks in

May 2005.

The ongoing upgrading of the First and Business Class cabins of the B747-400 and

B777 fleet, the re-branding of the front-end experience coupled with the new

advertising campaign will help strengthen Malaysia Airlines’ competitive position this

highly competitive year.

The uncertainties surrounding the US currency, instability in the Middle East, higher

interest rates, slower economic growth in Asia Pacific, high fuel prices and strong

demand for technical crew and engineers are the key concerns of the airline industry

presently. Slower demand for cargo space and increase in available capacity in the

market will result in pressure on yields. Make no mistake, 2005 will be a challenging,

potentially difficult year.24 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

CHAIRMAN’S STATEMENT

On a brighter note, the Malaysian government has revised upward its projected tourist

arrivals for this year from 16.6 million to 20 million. Malaysia Airlines is tapping this

growth forecast.

The Company hopes to exploit the various opportunities in China and India. In 2005,

Malaysia Airlines intends to reinforce its presence and expand further into China and

India, to include Shengyang, Chongqing, Fuchou, Haikou, Amritsar, Cochin, Trivandrum

and Trichi. In the same period, Malaysia Airlines proposes to increase its capacity into

Guangzhou, Hyderabad, New York and Stockholm, and its frequency into Singapore.

Within China and India, our expansion strategy is designed to ensure we reach the

various lucrative points there. Malaysia Airlines currently operates into all key metro

points in China and India. We will continue to expand into key secondary points in

China and India to further tap these growing markets.

In spite of high fuel prices, heightened competition from full service carriers and

increasing proliferation of low cost regional carriers, the Company continues to remain

committed to improving and growing from our current position. Our network

expansion strategy is focused on strengthening our regional connectivity to grow and

feed our international network, without taking our eye off cost and return. Malaysia

Airlines is focused on ensuring that the upgrade of its product and service standards

translate into further improvements in yield, seat factor, customer loyalty and overall

revenue performance.

Malaysia Airlines will also continue to look at its operations as a whole and increase

efficiencies and productivity of our existing resources to drive cost savings. During the

year, fuel cost as a percentage of total cost increased from 27 per cent to 34 per cent.

The fuel surcharge and hedging of fuel requirements will continue to provide a cushion

to the Group’s performance, although they cannot fully meet the punishing cost

imposition.

The Company will take all measures to adapt to the high fuel price environment to

protect our financial position and performance while maintaining our competitive

position. We have a commitment to manage our responsibility to both shareholders

and customers alike.Malaysian Airline System Berhad Annual Report 04/05 25

(10601-W)

CHAIRMAN’S STATEMENT

APPRECIATION

As always, I am extremely grateful to the many loyal and valued customers for their

support in flying Malaysia Airlines. Your allegiance and the valuable feedback offered

have helped the Group to better serve customers. Malaysia Airlines’ performance for

the year ended 31 March 2005 would not have been what it was if not for the continued

confidence in our brand. For this, I wish to thank you very much.

To our shareholders, travel agents, service subscribers, suppliers and contractors, the

Government and all stakeholders involved in the performance of Malaysia Airlines, I

would also like to express my appreciation and gratitude for your contribution and

support in making it another good year for Malaysia Airlines.

I would like to thank Dato’ Gumuri bin Hussain and Dato’ Zaharaah binti Shaari who

resigned as directors with effect from 16 August 2004 and 2 November 2004 respectively

for their invaluable contributions.

I would like to welcome Dato’ Izzuddin bin Dali, Tengku Azmil Zahruddin bin Raja

Abdul Aziz and Dato’ Mohd Annuar bin Zaini who have been appointed to the Board

with effect from 13 September 2004, 23 August 2004 and 2 February 2005 respectively,

and look forward to their contributions. I am also pleased to welcome back Dato’

Zaharaah binti Shaari who rejoins Malaysia Airlines as a director effective 18 July 2005.

In closing, the performance of Malaysia Airlines has again been driven by the dedication

and commitment of the management and employees. I wish to record my gratitude to

them, and look forward to their full support in the coming challenging year.

Dato’ Dr Mohd Munir bin Abdul Majid

Chairman

18 July 200526

26

Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

managing director’s report

and review

OVERVIEW

The year ended 31 March 2005 was another great year

for Malaysian Airline System Berhad when the Company

reported a profit after tax (PAT) of RM326.1 million

achieved on the back of a RM11.4 billion turnover, a

29.4 per cent increase over the RM8.8 billion turnover

reported in the previous year.

It was also a period when we were measured for our very high staff service standards

as well as enhanced product levels being offered by the airline. As a result, Malaysia

Airlines was elevated to a 5-star status by Skytrax in June 2005. This prestigious

conferment confirms that our formula for excellence works. Indeed everybody at

Malaysia Airlines is proud of this elevation as we are among only four in the world to

be in this class. A detailed profile of our ranking is outlined in this report.

Great effort continues to be made towards our ultimate goal of positioning Malaysia

Airlines as a truly global brand. The airline is uniquely renowned for its personal touch,

warmth and efficiency. Indeed, our customers bear testimony that Malaysia Airlines is

going the extra mile to provide air travel and a transport service that rank among the

best in terms of safety, comfort and punctuality.

During the year under review, Malaysia Airlines delivered on its brand promise in

Going Beyond Expectations. And I am pleased to report on our many initiatives and

endeavours that helped build a great airline to be among the top four in the world.Malaysian Airline System Berhad Annual Report 04/05 27

(10601-W)28 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

MANAGING DIRECTOR’S REPORT AND REVIEW

GOING BEYOND EXPECTATIONS

As at 31 March 2005, the total fleet size at Malaysia Airlines was 111 comprising 50

wide–bodied and 54 narrow-bodied passenger aircraft, and seven wide-bodied B747-

200 freighters. It was this magnificent fleet that afforded Malaysia Airlines the golden

opportunity to report a profitable year. This fleet size represented a net increase of

two wide-bodied aircraft over the previous financial year. The Company took delivery

of two B777-200 aircraft from Boeing on 22 November and 13 December 2004. One

A330-300 was leased from ILFC on 17 May 2004.

To ensure the highest standards of customer satisfaction, emphasis on maintaining

on-time departures, minimal delays and the reduction in mishandled passengers were

undertaken at our main hub at the Kuala Lumpur International Airport (KLIA). In all

three aspects, satisfactory performance was achieved despite the substantial increase

in flights out of KLIA.

As our customer service operations expanded to cope with the higher passenger load

and additional flights, our operational budget also increased. The total operating

expenditure expanded by RM28.5 million to RM249.5 million during the financial year

under review. This 12.9 per cent increase was attributed to higher staff costs, hire and

maintenance of equipment, passenger layover and delay costs, other passenger sales

expenses, and other expenses. These costs were necessary to enable Malaysia Airlines

to uplift 17,535,823 passengers, an increase of 14.1 per cent from the previous year.

Revenue from cargo and traffic handling increased by 30.5 per cent to RM42.4 million

during the year under review. The higher traffic handling was due to the increased

frequency by customer airlines, and the addition of new airlines. As the KLIA operator

Malaysia Airports Berhad and the government continue to woo more airlines to

subscribe to KLIA as its hub, Malaysia Airlines expects a further boost to our revenue

from customer airlines in the next financial year.

The Company’s strategy to pamper our customers with new offerings in our products

and services continued with the introduction of new menus. Even new menus designed

for the children that fly Malaysia Airlines, were introduced. Advanced in-flight

entertainment (IFE) systems to complement the installation of new sleeper beds on

our wide-bodied fleet were also introduced. Additional enhancements for our in-flight

services will be the introduction of new dinnerware, cutlery, glassware, linen and seat

comfort items. Our enhanced products and services will enable Malaysia Airlines

passengers to enjoy facilities and amenities that are on par or above that of our

competitors.

In our efforts to enhance service quality, Malaysia Airlines is now participating in the

IATA Global Airline Performance (GAP) survey. For the period from July to September

2004, in terms of “overall rating on airline performance” on the Europe-Asia routes,

Malaysia Airlines achieved third position amongst the airlines. In terms of the airline

lounge, Malaysia Airlines emerged top in the first and business class lounge category

on the Europe-Asia routes.

A commitment to excelMalaysian Airline System Berhad Annual Report 04/05 29

(10601-W)30 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

MANAGING DIRECTOR’S REPORT AND REVIEW

THE FULL REVIEW OF OPERATIONS OF MALAYSIA AIRLINES

Flights Handled

During the year, Malaysia Airlines managed a total of 179,715 flight

departures system-wide compared to the previous year of 166,025 flight

departures system-wide. Malaysia Airlines at KLIA handled a total of 46,732

flight departures, an increase of 10.8 per cent as compared to the previous

year, and also an increase of 4.9 per cent from the estimated flights handled

for the year 2004/2005.

Malaysia Airlines has also managed to handle the increasing frequency of

customer airlines, both existing and new, such as First Cambodia Airlines,

Lufthansa, China Eastern Airlines, PT Riau and Shenzen Airlines.

On Time Performance

On time performance for Malaysia Airlines flights recorded an average of

86.8 per cent for international flights and 90.5 per cent for domestic flights.

Malaysia Airlines managed a total of 179,715 flight

departures system-wide compared to the previous

year of 166,025 flight departures system-wide.Malaysian Airline System Berhad Annual Report 04/05 31

(10601-W)

A statement of pride32 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

In the year 2004/2005, the system-wide passenger uplifted

increased by 14.1 per cent to 17,535,823 passengers as

compared to the previous year.Malaysian Airline System Berhad Annual Report 04/05 33

(10601-W)

MANAGING DIRECTOR’S REPORT AND REVIEW

Passengers Handled By Malaysia Airlines

In the year 2004/2005, the system-wide passenger uplifted increased by

14.1 per cent to 17,535,823 passengers as compared to the previous year.

The increase in the number of passengers was partly due to the higher

number of flights handled as a result of an expansion of current routes

and the launching of new destinations. Malaysia Airlines at KLIA recorded

6,621,300 passengers uplifted, an increase of 14.6 per cent compared to

the previous year.

Integrated System For Regulatory Compliance

Passenger clearance through the immigration at their arrival destination

was also part of Malaysia Airlines’ concern. In view of the strict border

controls, Malaysia Airlines as with other airlines, was also being subjected

to the stringent regulatory ‘Advance Passenger Processing’ (APP)

requirement.

The Company is in compliance with the Australian APP and New Zealand

‘Advance Passenger Screening’ (APS) through the integrated functions

implemented within the Departure Control System applications in early

2004. For the Australian APP, Malaysia Airlines achieved the highest

compliance level of 98 per cent. Indirectly, passengers can be processed

speedily at the immigration checkpoints as their data have been pre-

verified and captured by the authorities.34 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

MANAGING DIRECTOR’S REPORT AND REVIEW

Malaysia Airlines Travel Fair

The Company scored yet another success with its second Malaysia Airlines Travel Fair

held in February 2005 that attracted an overwhelming 180,000 visitors and generated

a turnover of RM115 million in ticket sales, excluding our packages. The Company

intends to use this event as a platform to raise the Malaysia Airlines brand awareness.

The Company will explore opportunities of replicating the travel fair initiative in

selected international markets.Malaysian Airline System Berhad Annual Report 04/05 35

(10601-W)

MANAGING DIRECTOR’S REPORT AND REVIEW

A challenge to embrace

The Company scored yet another success with

its second Malaysia Airlines Travel Fair held in

February 2005 that attracted an overwhelming

180,000 visitors and generated a turnover of

RM115 million in ticket sales, excluding our

packages.36 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

MANAGING DIRECTOR’S REPORT AND REVIEW

INNOVATING FOR COMPETITIVE ADVANTAGE

New Service Delivery

In line with the cabin upgrade for First Class/Business Class on B747/B777 aircraft, total

change of equipment of dinnerware, cutlery, glassware, linen and seat comfort items

were introduced on two B747 aircraft and on five B777 aircraft under phase one.

From 29 March 2005 the new service delivery was introduced on the Kuala Lumpur/

London/Kuala Lumpur and Kuala Lumpur/Sydney/Kuala Lumpur sectors using the

retrofitted B747 aircraft. At the same time, the new service delivery was also introduced

on the Kuala Lumpur/Zurich/Kuala Lumpur sector using the retrofitted B777 aircraft.

This new service delivery was also extended to the Kuala Lumpur/Sydney/Kuala Lumpur

non-stop B777 flights from 1 May 2005 and to the Kuala Lumpur/Tokyo/Kuala Lumpur

non-stop flights effective 18 May 2005.

Under phase two, the new service delivery will be further extended to the Kuala

Lumpur/Manchester/Kuala Lumpur and the Kuala Lumpur/Amsterdam/Kuala Lumpur

B747 flights effective July/August 2005.

In-flight Entertainment (IFE) Upgrade on B747 and B777 with Matsushita

System 3000i

Malaysia Airlines is expected to lead in its delivery of top of the line high quality in-

flight entertainment system with the Matsushita System 3000i. Our valued customers

will now have digitized on-demand audio and video media on all classes. The other

features of the system include new games, SMS, interactive flight information and pc

laptop power.Malaysian Airline System Berhad Annual Report 04/05 37

(10601-W)

MANAGING DIRECTOR’S REPORT AND REVIEW

IFE Re-Branding

To ensure a consistent look and feel, Malaysia Airlines revamped its interactive screen

designs, navigation and entertainment guide for all IFE systems. This exercise was

implemented in December 2004.

Better Reading Pleasure

Our in-flight magazine Going Places was revamped with a trendier look and feel, with

more feature articles and better pictures. The first issue with the new design layout

and concept was distributed on board our aircraft in August 2004. There has also been

a review of the current in-flight reading materials to accommodate the demand for

more variety.

Kerb Side Drop Off Facility

At KLIA, a new Kerb Side Drop-off and Front-end Check-in services have been

introduced. The Kerb Side Drop-off provides our premium class passengers with a

designated drop off point at the departure lane in KLIA with porter service to assist in

the baggage handling.

A statement of pride38 Malaysian Airline System Berhad Annual Report 04/05

(10601-W)

A promise to be better

EXTENDING HORIZONS FOR MARKET REACH

Destinations

As at 31 March 2005, the Malaysia Airlines global network comprised 32 domestic and

86 international destinations. Of the 86 international destinations, 17 were operated

in collaboration with our airline partners.

The Network Strategy

The strategic focus during the year under review was to build a viable and sustainable

network while focusing on capturing our share of the Asian market. Efforts were

aimed at increasing our market span into India and China and improving market

penetration through frequency increases in ASEAN, North Asia and the Middle East.

Highlights of Network Changes

North America

The 3x weekly services to Newark via Dubai were rerouted via Stockholm effective 1

November 2004 to improve the viability of the Newark service and to cater to the

growing outbound Scandinavian market.

United Kingdom

The 4x weekly Kuala Lumpur-Manchester return B747 services were retimed to depart

Kuala Lumpur in the morning instead of evening in order to provide connectivity for

the Brisbane, Sydney and Melbourne morning arrival services. Manchester Airport

Authorities offered reduced charges on landing, parking, and passenger handling for

these arrivals, giving Malaysia Airlines also the benefit of such incentives.Malaysian Airline System Berhad Annual Report 04/05 39

(10601-W)

Continental Europe

For Europe, the services to Paris were increased from 3x to 5x weekly effective 1 May

2004 while the 7x weekly services to Frankfurt were rescheduled as 4x weekly Kuala

Lumpur-Frankfurt return and 3x weekly Kuching-Kuala Lumpur-Frankfurt return from

Northern Summer 2004.

The 3x weekly Kuala Lumpur-Vienna return services that were suspended in 2003 were

reinstated in Northern Summer 2004. Stockholm was introduced as a new destination

replacing Dubai in the rerouting of the Newark flight.

The total weekly frequencies to Continental Europe were increased from 24x weekly

to 28x weekly in Northern Summer 2004 and to 31x weekly in Northern Winter 2004

with the operation of the 3x weekly Kuala Lumpur-Stockholm-Newark return on B777.

Australia/New Zealand

To strengthen our position in Australia, the services to Sydney and Melbourne were

increased and rescheduled to operate 14x weekly to each destination. In addition, the

3x weekly A330-200 Kuala Lumpur-Brisbane return and 3x weekly B747 Kuala Lumpur-

Brisbane-Auckland return services were rerouted as 5x weekly B777 Kuala Lumpur-

Brisbane return in Northern Summer 2004 and a sixth Brisbane service on day 7 was

introduced in Northern Winter 2004. For Kuala Lumpur-Auckland return, the services

were increased to daily from 1 May 2004 with 3x weekly operated on B747 and 4x

weekly on B777.

Japan

The 3x weekly Kuala Lumpur-Nagoya services were increased to 5x weekly effective

18 February 2005 and the 5x weekly Kuala Lumpur-Osaka services were increased to

7x weekly with the introduction of 2x weekly Kuala Lumpur-Kota Kinabalu-Osaka

return services in Northen Summer 2004. Meanwhile, the Kuala Lumpur-Fukuoka return

services which were suspended from 15 May 2003, were reinstated on 9 November

2004 with 3x weekly services.You can also read