Ireland: Lockdown pushes recovery into H2 - Vaccine roll-out and Brexit deal give optimism from H2 onwards - NTMA

←

→

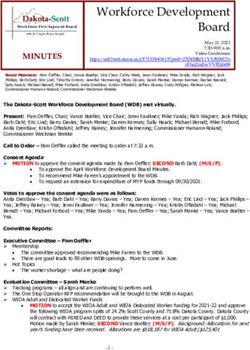

Page content transcription

If your browser does not render page correctly, please read the page content below

Ireland: Lockdown pushes recovery into H2 Vaccine roll-out and Brexit deal give optimism from H2 onwards February 2021

Index

Page 3: Summary

Page 8: Macro

Page 20: Fiscal

Page 28: NTMA Funding

Page 42: Structure of Irish Economy

Page 53: Brexit

Page 58: Property

Page 65: Other Data

2Economic performance uneven as strict lockdown in place

currently; H2 will see positive impact of vaccine rollout

GDP remained positive in 2020 Unemployment increase as Value added from ICT & pharma

but domestic sectors hit lockdown impacts Q1 has given Ireland resilience

35% 700 200.0

30% 180.0

600

25% 160.0

20% 500 140.0

15% 120.0

400

100.0

10%

300 80.0

5%

60.0

0% 200

40.0

-5%

100 20.0

-10%

0.0

-15% 0

1998

2005

2000

2003

2008

2010

2013

2015

2018

2020

-20%

2017

2005

2007

2009

2011

2013

2015

2019

GVA: Multinational dominated

Unemployment claimants sectors (€bns)

Domestic Demand GDP (Index, Jan 20 = 100)

GVA: Domestic sectors

Source: CSO

* Domestic demand series accounts for multinational activity and known as modified final domestic demand

(excludes inventories)

4

** Whether those on government income supports are unemployed is statistically debatable. Some will have

left the labour force, others are just temporarily furloughed.Ireland used 2014-19 growth to improve debt sustainability;

added fiscal room that will now be needed to fight Covid

Run of primary surpluses Debt position reversed in 2020 Debt fell from 166% to 95% of

ended; GG deficit c. €19bn national income pre-Covid

10 180%

160%

5 Debt-to-GNI*

(108% 2020f; 95% in 2019) 140%

0

120%

-5 Debt-to-GG Revenue 100%

(259% 2020f; 230% in 2019) 80%

-10

60%

-15

Average interest rate

40%

(1.9% 2020f, from 2.2% in 2019)

-20 20%

Debt-to-GDP 0%

-25 1995 2000 2005 2010 2015 2020f

1995 2000 2005 2010 2015 2020f

(63% 2020f, from 57% in 2019)

GG Balance Primary Balance Debt to GNI* Debt to GDP

Source: CSO, Department of Finance

^ due to GDP distortions, Debt to GDP is not representative for Ireland, we suggest using other 5

measures listed.Covid-19 and Ireland: significant hit to domestic economy

followed by powerful policy response

Recession Exposure Policy

Ireland (ex. Multinationals) is in Ireland’s domestic economy hit Significant stimulus announced

recession. hard like others but equivalent to 19% of GNI* over

internationally-traded sectors 2020 and 2021

Current lockdown will impact (Pharma/ICT) have thrived

on Q1 data but smaller than ECB and Fed actions should cap

initial lockdown. Vaccine gives The worst case scenarios for interest costs and allow

optimism from H2 onwards. Brexit avoided by UK-EU FTA necessary fiscal room

6NTMA has indicated a funding plan of €16 - €20bn for 2021;

€5.5bn already funded this year

Flexibility 10 years AA-

Ireland has large cash balances Weighted average maturity of Ireland has been affirmed in AA

and a year free of maturing debt one of longest in Europe space by S&P

bonds in 2021

The ECB’s first QE program On relative basis, hit to Ireland

In addition to bond funding, enabled NTMA to extend debt less than for other countries

Ireland will receive €2.5bn in maturities and reduce interest given multinationals, relatively

EU Sure funding in 2021. cost. Now ECB buying in large smaller domestic share of

amounts with few limitations economy and tourism

7Section 1: Macro Multinationals raced ahead in 2020; domestic sectors hit badly but aided by policy response

Current lockdown having intended effect – case numbers

trending better; lockdown in effect until at least Mar 5

14 day cumulative Covid-19 cases/deaths Ireland case numbers versus other countries

per 100k of population (per 100k of population)

1,400 25 1,600

2021 Q1

1,200 lockdown 1,400

20

1,200

1,000

2020Q4 1,000

lockdown 15

800 800

600

600

10

400

400

200

5

200 -

Aug-20

Apr-20

Nov-20

Mar-20

Jul-20

Sep-20

Jan-21

Feb-21

May-20

Dec-20

Jun-20

Oct-20

- -

Nov-20

Apr-20

Jul-20

Aug-20

Sep-20

Jan-21

Feb-21

Mar-20

Dec-20

Jun-20

Oct-20

May-20

Ireland France Germany

Italy Spain US

Cases Deaths (RHS)

UK

Source: DataStream 9Sector breakdown for 2020 Q1-Q3 – Multinationals racing

ahead, domestic side hit hard

30%

22% Domestic sectors hit badly – 26% of economy in

these four categories

20% 16%

12%

10%

3% 2% 2%

0%

-10%

Two sectors least

-20% impacted are -14% -15%

-18%

dominated by FDI

-30%

-40%

-50%

-51%

-60%

Industry ICT Agri, Fish Real Estate Public, Educ Fin & Construction Prof, Distribution, Arts & other

(incl. & Health Insurance science, Transport,

pharma) technical Hotels and

Restaurants

GVA Growth (Q1-Q3 2020, constant prices)

10

Source: CSOOn a relative basis Ireland performed well in 2020 – thanks

to ICT (tech) and pharmaceutical firms

Real GDP up 3.0% Y-o-Y in 2020 for Ireland: Real MFDD down 6.6% Y-o-Y in 2020: MFDD

GDP overstates impact of multinationals understates impact of multinationals

4% 0%

2% -2%

0%

-4%

-2%

-6%

-4%

-8%

-6%

-10%

-8%

-10% -12%

-12% -14%

NL

NL

EA

Italy

Italy

Norway

Sweden

Denmark

Belgium

France

Denmark

Sweden

Belgium

France

Australia

Finland

UK

Finland

UK

S Korea

US

Austria

S Korea

US

Austria

Germany

Germany

Ireland

Ireland

Canada

Japan

Japan

Portugal

Portugal

Switzerland

Switzerland

Y-o-Y impact to GDP (Q1-Q3, 2020 constant prices) Y-o-Y MFDD impact (Q1-Q3 2020, constant prices)

Source: CSO, DataStream 11

Note: MFDD for Ireland is modified for multinational activity by Ireland’s Central Statistics Office (CSO). For

other countries MFDD = Domestic demand = Consumption + Government (current) spending + InvestmentLabour market data shows stark Covid-19 impact;

lockdowns has seen a reversal in unemployment rate

True unemployment rate is uncertain: At end-Q3, adjusted employment was

Covid-19 adjusted rate 25%* in January estimated just below 2.1m

35 2.4

millions

30 2.3

2.2

25

2.1

20

2.0

15

1.9

10

1.8

5 1.7 Actual hours worked down

5.4% y-o-y in Q3, an

0 1.6 improvement from -22% in Q2

2012

2005

2006

2007

2008

2009

2010

2011

2013

2014

2015

2016

2017

2018

2019

2020

2021

1.5

2004

1998

1999

2001

2002

2005

2007

2008

2010

2011

2013

2014

2016

2017

2019

2020

Unemployment

Covid-19 Adjusted Unemployment

Total Employment Covid Adjusted

Source: CSO

* The CSO have estimated the upper bound of the unemployment rate at 25% in January. The CSO

have urged caution around labour market data given the likelihood of revisions and the unique nature 12

of employment status for some people in the pandemic.800k on schemes in January as strict lockdown in place;

supports help maintain aggregate household income

January numbers increased by lockdown; Supports have meant aggregate household

numbers will fluctuate in H1 2021 income has been more than maintained

1.2 100

Millions

1 90

80

0.8

70

0.6

60

0.4 50

0.2 40

0 30

20

10

Temporary Wage Subsidy Scheme/Employment Wage 0

Subsidy Scheme 2019 Q1-Q3 2020 Q1-Q3

Pandemic Unemployment Payment Other Disposable Income Social Protection

Source: Revenue, DEASP, CSO 13Consumption fell sharply in Q2 despite incomes being

maintained

Consumption sharply hit in Q2 – down 22% Retail sales numbers in Q4 volatile on

y-o-y: Q3 saw rebound lockdown and re-opening

30 20% 40% 2020Q2 2020Q4

lockdown lockdown

15% 20%

25

10% 0%

20 5%

-20%

0%

15 -40%

-5%

-60%

10 -10%

-80%

-15%

5 -100%

-20%

2019M01

2019M03

2019M05

2019M07

2019M09

2019M11

2020M01

2020M03

2020M05

2020M07

2020M09

2020M11

0 -25%

1997 2000 2003 2006 2009 2012 2015 2018

Consumption Growth (Y-o-Y, RHS) All Retail Food Retail

Consumption (€bns, LHS) Bars Department Stores

Source: CSO

14Savings rate increased sharply in Q2 due to forced

savings; H2 saw spending return close to 2019 levels

Gross household saving rates jump in Q2 – January lockdown leads to a significant fall in

Ireland larger than most spending but still less than the trough in April

24 10%

5%

20

% of Disposable Income (4Q MA)

0%

-5%

16

-10%

-15%

12

-20% Spending in January decreased

-25% by 15% y-o-y

8

-30%

-35%

4

-40%

Jul-20

Apr-20

Feb-20

Mar-20

Sep-20

Nov-20

Jan-20

Aug-20

Jan-21

May-20

Dec-20

Jun-20

Oct-20

0

2002 2004 2006 2008 2010 2012 2014 2016 2018 2020

Spending on debit and credit cards (y-o-y change)

Ireland EA-19 UK

Source: Eurostat, ONS, CSO ; CBI, Eurostat; CBI

15

Note: Gross Savings as calculated by the CSO has tended to be a volatile series in the past, some

caution is warranted when interpreting this dataInvestment hit as construction sector has moved in & out

of lockdown; open in Q4 lockdown but closed in Q1

Building and construction investment by Another surge of IP into Ireland in 2019-2020

40% hit in Q2 2020 but rebounded in H2 – helps ICT but distorts investment picture

300 10 200

9 180

250 160 Four-quarter

8

sum (€bns)

7 140

200

6 120

100

150 5

80

4

100 60

3

40

2

50 20

1

0

2010

1996

1998

2000

2002

2004

2006

2008

2012

2014

2016

2018

2020

0 0

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

2020

Building Investment Other Domestic Investment

Construction Employment (000s) Distortions (mainly IP) Modified GFCF

Building GFCF (€bn RHS) Total GFCF

Source: CSO; NTMA calculations 16PMI – All three PMIs fell in January on the back of

lockdown

Ireland’s Composite PMI has tended to be a Manufacturing holding up better than

good guide for MDD – PMI averaged 50 in Q4 services

65 70 2020Q2 2021Q1

lockdown lockdown

60 R² = 0.61 60

55 50

Composite PMI

50 40

45 30

40

20

35

10

30

0

Jan-18

Jan-19

Jan-20

Jan-21

Apr-19

Apr-18

Apr-20

Jul-18

Jul-19

Jul-20

Oct-18

Oct-19

Oct-20

25

-20% -15% -10% -5% 0% 5% 10% 15%

Modified Domestic Demand y-o-y change Services Manufacturing Composite

17

Source: Markit, NTMA analysisExternal environment supportive – 2021 should see the

global economy rebound given large stimulus & vaccines

Oil price drop assisting Ireland’s economy –

2020 2021

Ireland is a pure price taker

Maximum Maximum 100 8

EA Monetary Policy

accommodative accommodative

90 7

EU Fiscal Policy Expansionary Expansionary 80

6

70

Maximum Maximum

US Monetary Policy 5

accommodative accommodative 60

50 4

US growth Covid-19 shock Rebound

40 3

Significantly down 30

Oil price Unclear 2

despite rebound 20 significant drop in import

cost in 2015/16 reversing 1

10

Covid-19 shock; Brexit resolved; in 2017/18

UK growth

Brexit unresolved Rebound 0 0

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Euro Growth Covid-19 shock Rebound

Brent Oil €/Barrel

Strengthening vs.

Euro currency Unclear Mineral Fuels Imports (RHS, 12m rolling, €bns)

Dollar

Source: NTMA analysis, DataStream, CSO 18Ireland has used 2014-19 recovery period to repair private

sector balance sheets – especially households

Household debt ratio has decreased due to Legacy of 2008-12 financial crisis is on the

deleveraging and increasing incomes Government balance sheet

40 400%

20 350% Economic growth has

allowed smooth private

- 300% sector deleveraging

-20

250%

-40

200%

-60

150%

-80

100%

-100

50%

-120

NL

Italy

Denmark

Greece

France

Sweden

Belgium

UK

Poland

Finland

Portugal

Germany

Slovenia

Austria

Czech Rep

Ireland

Romania

Spain

EA19

0%

Public and Private Private debt (% of Public debt (% of

debt (% of GNI*) GNI*) GNI*)

10 year pp change in HH Debt/Disposable Income ratio 2003 2008 2013 2020H1

Source: Eurostat (2019 versus 2009) Source: CBI data, CSO

Note: Private debt includes household and Irish-resident enterprises (ex. financial intermediation) 19

CBI quarterly financial accounts data used for household and CSO data for nominal government

liabilities.Section 2: Fiscal Ireland’s economic structure has meant revenues held up in 2020 despite Covid-19

Fiscal policy response was large and swift in 2020;

Conservatism in Budget 2021 allows for continued flexibility

Response Revenues Debt

Total fiscal response of €38bn Ireland’s economic structure has Debt ratios will reverse due to

over 2020 and 2021 (19% of meant revenues have held up Covid.

GNI*) is large despite Covid-19

Ireland has responded to Covid Strength of both Corporate and Gross Government debt 57% of

with first attempt at counter- Income tax revenues from GDP at end-2019 but close to

cyclical fiscal policy in its 100 Multinational sectors has helped 95% of GNI*. Ratios will revert to

year history sustain government coffers c.63% and 108% for end-2020

21Total fiscal response of €38bn over 2020/21 (19% of GNI*) is

large; contingency may not be needed but available

€bn 2020 2021 % GNI* Description

Taxation Measures 4.1 3.4 0.7 2.1

• Warehousing/Deferrals 2.0 2.0 0.0 1.0 Corporate Tax, VAT, Stamp duty tax deferrals

Temporary VAT decrease; hospitality VAT decrease,

• Other 2.1 1.4 0.7 1.1

CRSS

Expenditure Measures 28.7 16.8 11.9 14.1

• Social Protection PUP/TWSS extended into 2021; TWSS transforming

13.6 10.4 3.2 6.7

(income supports) into EWSS

• Health 4.4 2.5 1.9 2.2 Covid-19 capacity expenditure

Business supports, Grants, Education, Arts, Tourism

• Business Supports 1.0 0.9 0.1 0.5

and Transport

• Housing, Local Govt 1.2 1.1 0.1 0.6 Commercial Rates waivers

Help-to-Buy, other grants and aids, Recovery Fund,

• Other 8.5 1.9 6.6 4.2

Covid contingency response

Total Direct Supports 32.8 20.2 12.6 16.2

Credit Guarantee Scheme, Pandemic Stabilisation

Indirect supports 5.0 5.0 0.0 2.5

and Recovery Fund, other schemes

Total Supports 37.8 25.2 12.6 18.7

Source: Department of Finance 22Fiscal discipline in evidence in last decade – after Covid-19

stimulus ends Ireland plans to narrow its deficit again

Gen. Govt. Balance (€bn) will be in Revenues holding up despite pandemic;

significant deficit in 2020/21 expenditure is increasing (Central Govt.)

10 30%

25%

5

20%

0 15%

10%

-5

5%

-10 0%

-15 -5%

2020

GGB % of GDP -5.5% -10%

-20 GGB % of GNI* -9%

-15%

-25 -20%

2020 vs 2019

Income tax VAT Excise duties

GG Balance Primary Balance Corporation tax Total Revenue Total Expenditure

Source: CSO; Department of Finance 23Gross Government debt c. 62% of GDP at end-2020 but

close to 108% of GNI*

Debt-to-GNI* had dropped since last crisis; Primary balance main contributor to debt

could increase 20pp in coming years ratio deterioration

180% 15.0%

160% 10.0%

5.0%

140%

0.0%

120%

-5.0%

100%

-10.0%

80% -15.0%

60% -20.0%

40% -25.0%

~

-30.0%

20% -40%

0%

1995 1999 2003 2007 2011 2015 2019 Primary Balance (% of GNI*)

Debt to GNI* Debt to GDP Debt Stabilising PB (% of GNI*)

Source: CSO; Department of Finance, NTMA analysis 24CT revenue cushioned by 2019 payments and defensive

nature of Pharma and ICT; income tax protected also

Corporation tax (CT) receipts continue to Progressiveness of income tax system and

rise – have nearly tripled in 6 years sector mix limits hit to overall receipts

24% 14.0 40%

20% 12.0 35%

10.0 30%

16%

8.0 25%

12%

6.0 20%

8% 15%

4.0

4% In 2019, 40% of CT paid 2.0 10%

by 10 companies

0% - 5%

2021f

1997

1995

1999

2001

2003

2005

2007

2009

2011

2013

2015

2017

2019

0%

Corporation Tax (€bns, RHS)

Corporation Tax (% of tax revenue)

Corporation Tax (% of GG Revenue) % of taxable income cases % of income tax collected

Source: Department of Finance, Revenue, NTMA analysis

Note: Most affected sectors include construction, wholesale and retail trade, transport, accommodation 25

and food service activities, real estate activities, professional, scientific and technical activities;

administrative and support service activities, arts, entertainment and recreationNTMA’s job is to finance the cash deficit (EBR) but it’s best

to use accruals-based GGB for comparison to peers

Methodological

EBR and GGB (€bns) usually minor – gap is EBR GGB

Differences

larger currently

Accounting basis Cash (exchequer) Accrual

10 Financial

Included Excluded

transactions

0

Subset of Central Includes all of

Scope

Govt. Central & Local

-10

Intra-Government

No Yes

Consolidation

-20

2020 2021 Comments

This is the deficit in cash terms that the

-30 EBR -12.3 -17.6 NTMA must finance each year

Prom. Note capital Accruals can relate to interest, taxes, other

transfer to recap Adjust for Accruals 3.1 0.4 expenditures

-40

banks hit GGB in Transactions between the Exchequer and

Exclude Equity &

2010 but not EBR -4.6 -1.5 NAMA, CBI and other govt. entities: this

Loan Transactions benefits funding req.

-50 (non-cash Archaic funding structure of social insurance

expenditure) Social Insurance

-2.2 -0.6 in Ireland is outside Exchequer. Consolidated

Fund in GGB

-60

Semi State, ISIF, Dividends and profits from government

-0.2 -0.2 entities

other funds

Local Govt. -1.0 -0.9 Local governments fund themselves

GG Balance EBR Outturn different than forecast for EBR walk.

Unspecified -1.8 This category is a placeholder until further

information is available

Most complete metric for fiscal position.

GGB -19.0 -20.5 Use this for deficit comparison with other

Source: CSO, nations 26

Department of Finance,

NTMA analysisNeed to assess other metrics apart from debt to GDP when

analysing debt sustainability

2020 F GG debt to GG revenue % GG interest to GG rev % GG debt to GDP %

Greece 411.7% 6.1% 207.1%

Italy 332.7% 7.5% 159.6%

Portugal 316.1% 6.9% 135.1%

Spain 292.8% 5.8% 120.3%

Cyprus 272.7% 5.7% 112.6%

Ireland 264.0% 4.6% 63.1%

Belgium 234.5% 4.1% 117.7%

France 220.1% 2.6% 115.9%

EA19 218.8% 3.4% 101.7%

Slovenia 182.2% 3.8% 82.2%

EU28 177.2% 3.5% 79.4%

Austria 175.8% 2.9% 84.2%

Germany 154.1% 1.5% 71.2%

Slovakia 149.2% 3.0% 63.4%

Netherlands 142.2% 1.4% 60.0%

Finland 134.3% 1.4% 69.8%

Source: EU Commission forecasts

Ireland 107.8% Debt to GNI* ratio in 2020 expected (Budget 2021) 27Section 3: NTMA Funding Flexibility in funding strategy due to smooth maturity profile and no 2021 bond redemptions

NTMA has indicated a funding plan of €16 - €20bn for 2021;

€5.5bn already funded this year

Flexibility 10 years AA-

Ireland has large cash balances Weighted average maturity of Ireland has been affirmed in AA

and a year free of maturing debt one of longest in Europe space by S&P

bonds in 2021

The ECB’s first QE program On relative basis, hit to Ireland

In addition to bond funding, enabled NTMA to extend debt less than for other countries

Ireland will receive €2.5bn in maturities and reduce interest given multinationals, relatively

EU Sure funding in 2021. cost. Now ECB buying in large smaller domestic share of

amounts with few limitations economy and tourism

29Flexibility helped by smoother maturity profile and no bond

redemptions in 2021

20

18

16

14

12

10

Billions €

8

6

4

2

0

Bond (Fixed) EFSM EFSF Bond (Floating Rate) Green Other (incl. Bilateral)

Source: NTMA

Note: EFSM loans are subject to a 7-year extensions. It is not expected that Ireland will refinance any of

its EFSM loans before 2027. As such we have placed the pre-2027 EFSM loan maturity dates in the

30

2027-33 range although these may be subject to change.Near-term redemptions much lower than last four years;

lower borrowing costs also provides NTMA with flexibility

NTMA issued €92.5bn MLT debt since 2015; Even with extra Covid-19 borrowings, NTMA

13.2 yr. weighted maturity; avg. rate 0.83% might not match supply in 2017-2020 period

7.0 27 80

€ Billions

6.0 24

5.5 70

5.0 21

3.9 18 60

4.0

2.8 15

3.0 7Y 50

10Y 12

2.0 1.5 15Y

9 40

0.8 0.9 1.1 0.9

1.0 6

0.2

10Y 10Y -0.3 30

0.0 5Y 5Y 10Y 7Y 5Y 12Y 3

12Y

8Y 10Y 16Y 30Y 10Y 20Y 15Y 10Y

-1.0 30Y 0 20

2012201320142015201620172018201920202021

10

Auction

Syndication 0

Weighted Average Yield % (LHS) Issuance (2017-2020) Redemptions (2021-2024)

Source: NTMA 31

Only showing marketable MLT debt (auctions and syndications). Other issuance such as inflation

linked bonds, private placement and amortising bonds occurred but not shown.The NTMA has taken advantage of QE to extend debt

profile since 2015

Various operations have extended the …Ireland (in years) now compares

maturity of Government debt … favourably to other EU countries

20 12

18

16 10

14

8

12

10 6

10.9 10.9 10.4

8

6 4 7.9 7.8 7.3 7.3 7.0 6.8 6.5 6.5

4

2

2

0 0

2015 2016 2017 2018 2019 2020 IR AT BG ES FR NL DK IT BD FN PT

Weighted Average Maturity Issued (Years) Govt Debt Securities - Weighted Maturity

EA Govt Debt Securities - Avg. Weighted Maturity

Source: NTMA; ECB Note: Data excludes programme loans. 32Various sources of funding will be used to meet Covid-19

borrowing requirements: cash balance and flexibility key

€24

• No bonds mature in 2021. The last of the UK

Run-down of cash: 1

bilateral loan matures in 2021. Other: 4

Other: 1

€20

Sure: 2.5

• The Exchequer Borrowing Requirement (EBR) for UK Bilateral: 0.5

2020 was lower than expected at €12.3bn. €16

• Thus, NTMA entered 2021 with a larger cash

€12

balance of €17.4bn.

Bond

EBR: 18 issuance:

• NTMA expects to utilise the EU SURE scheme for a €8 18

diversified source of funding in 2021 (c. €2.5bn).

• End year cash balances are currently forecasted at €4

€16bn.

€-

Funding Requirements Sources of Funding (€bn)

Source: NTMA

(€bn)

Notes:

Rounding may affect totals as some figures have been rounded up to the nearest €bn.

1. In its 2021 Funding Statement of December 2020, the NTMA outlined its plan to issue €16-€20bn in

long term government bonds. €18bn is reflected as an indicative estimate in the chart.

2. Other funding needs includes provision for the potential bond/FRN purchases and general

contingencies.

3. Other funding sources includes retail (State Savings), private placements and EIB loan drawdowns.

4. SURE refers to the European instrument for temporary Support to mitigate Unemployment Risks in

33

an Emergency.

5. EBR is the Department of Finance’s estimate of the Exchequer Borrowing Requirement for 2021.In addition to PSPP, ECB’s PEPP with its flexibility (no

limits) & size (€1.85trn) will underpin Irish bond market

6 70

€ Billions

5 PEPP monthly IGB purchases running 60

at roughly €1.2bn a month

50

4

40

3

30

2

20

1 10

0 0

Q1 2021f

Q2 2021f

Q3 2021f

Q4 2021f

Q1 2015

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2019

PSPP Net IGB purchases (LHS) PEPP/PSPP net purchases (LHS)

Cumulative Net ECB Purchases (RHS)

Source: ECB, NTMA Calculations

Notes:

Forecasts sees Ireland’s capital key of 1.69% and assumes 90% of new purchases will be for public sector 34

assets with 7% of public sectors assets being supranational issuers.Diverse holders of Irish debt – sticky sources account for

over 50%; will increase further with Eurosystem’s PEPP

Ireland roughly split 80/20 on non-resident “Sticky” sources - official loans, Eurosystem,

versus resident holdings (Q3 2020) retail - make up over 50% of Irish debt

250

200

Other Debt

(incl. IGBs - 150

Official) Private Non

27% Resident

100

33%

Retail, 50

Resident

IGBs -

11%

Private 0

2010

2017

2007

2008

2009

2011

2012

2013

2014

2015

2016

2018

2019

2020

Resident

Eurosystem

23% Short term 5%

2%

IGBs - Private Non Resident IGBs - Private Resident

IGBs - Private Non Resident IGBs - Private Resident Short term Eurosystem

Short term Eurosystem Retail Other Debt (incl. Official)

Retail Other Debt (incl. Official) Total Debt (€bns)

Source: CSO, Eurostat, CBI, ECB, NTMA Analysis

IGBs excludes those held by Eurosystem. Eurosystem holdings include SMP, PSPP and CBI holdings of

FRNs. Figures do not include ANFA. Other debt Includes IMF, EFSF, EFSM, Bilateral as well as IBRC- 35

related liabilities. Retail includes State Savings and other currency and deposits. The CSO series has

been altered to exclude the impact of IBRC on the data.Investor base for Government bonds is wide and varied

Investor breakdown: Country breakdown:

Average over last five syndications Average over last five syndications

7.6%

10.0%

15.2%

10.6% 34.2%

24.8%

42.0% 9.2%

45.0%

Ireland UK

Fund/Asset Manager Banks/Central Banks*

US and Canada Continental Europe

Pensions/Insurance Other Nordics Asia & Other

Source: NTMA 36

* Does not include ECB. ECB does not participate on primary market under its various asset purchasing

programmesIrish Sovereign Green Bonds (ISGB) - €6.1bn issued with

€3.9bn allocated to green projects

• Launched 2018 February 2021 Update

• Based on ICMA Green Bond Principles – Use of proceeds • €6.1bn nominal outstanding (€6.5bn cash

model

• Governed by a Working Group of government equivalent)

departments and managed by the NTMA • €3.9bn allocated to eligible green projects

• Compliance reviews by Sustainalytics since inception

• €2.6bn remaining to be allocated to eligible

expenditure in 2020

• Issuance through two syndicated sales and

one auction

• Pipeline for eligible green expenditure

remains strong

• ISGB 2019 Allocation Report

• ISGB 2017/2018 Impact Report

Irish Rail train at Avoca on the Dublin to Rosslare route. Heavy rail was allocated some €400m from

ISGBs in 2019

37Allocation of ISGB funding has focused on Water/Waste

management and transportation

€2,300

Allocation per eligible green category 2019

€2,200

€2,100 Built Environment/

€2,000 energy efficiency

11%

€1,900

Clean transportation

€1,800 35%

Allocation €million

2017/8 2019 2020frcst

Climate change

adaptation

Management of living

natural resources and

42% land use

1%

Renewable energy

8%

3%

Sustainable water and

Construction of the new water treatment plant at Vartry (March 2020) wastewater

management

38Irish Sovereign Green Bond Impact Report 2018: Some 50 Impact

measures reported

Some highlights from Report*

• Built Environment/ Energy Efficiency

– Energy saving (GigaWattHours) : 621.06

– GHG emissions reduced/ avoided in tonnes

of CO2 : 150.5

– Number of homes renovated : 27,549

• Clean Transportation

– Number of public transport passenger

journeys : 268.66 million

– Additional km of cycling infrastructure works

(feasibility/ design/ screening phase) : 85km

– Take-up of Grant Schemes/ Tax foregone

provided (number of vehicles) : 15,712

• Climate Change Adaptation (2017 and 2018)

– Number of properties protecting from

flooding on completion : 7,403

– Amount of damages/ losses avoided on

completion : €658 million

Waterford Greenway

*For a more detailed break-down please see the ISGB 2017/ 2018 Impact

39

Report hereIrish Sovereign Green Bond Impact Report 2018: Some 50 Impact

measures reported

Some highlights from Report

• Environmentally Sustainable Management of Living

Natural Resources and Land Use

– Number of hectares of forest planted : 4,025

– Number of hectares of peatlands restored :

203

• Renewable Energy

– Number of companies (including public sector

organisations) benefitting from SEAI Research

& Innovation programmes as lead, partner or

active collaborators : 68

– Number of SEAI Research & Innovation awards

benefitting research institutions : 52

• Sustainable water and wastewater management

– Water savings (litres of water per day) : 79.1

million

– New and upgraded water treatment plants :

10

– New and upgraded wastewater treatment

plants: 11

– Length of water main laid (total) : 416km

– Length of sewer laid (total) : 74km

Irish peatlands

40Ireland rated in “AA” category by Standard & Poor's

Date of last

Rating Agency Long-term Short-term Outlook/Trend

change

Standard & Poor's AA- A-1+ Stable Nov 2019

Fitch Ratings A+ F1+ Stable Dec 2017

Moody's A2 P-1 Stable Sept 2017

DBRS Morningstar A(high) R-1 (middle) Stable May 2020

R&I A+ a-1 Stable Jan. 2021

41

Source: NTMASection 4: Structure of Irish economy Multinationals distort Irish economy picture but have added resilience during Covid-19

Multinational activity has distorted Ireland’s data;

notwithstanding those issues, MNCs have real impact

Multinationals dominate GVA: profits are booked Domestic side of economy adds jobs; MNCs

here but overstate Irish wealth generation add GVA/high wages

Arts & Other

1% Share of Share of Gross Weekly

Share of

Wage Bill GVA Earnings € (Q4

Employment

(2019) (2019) 2019)

Public sector

10% Agriculture 4.5% 1% 1% N/A

Industry (incl.

Professional

Industry (incl.

12.2% 14% 35% 916

services Pharma.)

Pharma)

11%

35%

Construction 6.2% 4% 3% 821

Real estate

7% Dist., Tran,

25.4% 20% 11% 571

Hotel & Rest

ICT (Tech) 5.4% 8% 15% 1,241

Financial &

insurance

Financial 4.5% 8% 6% 1,235

Dist, tran,

6% hotel & rest ICT (Tech)

Real Estate 0.4% 1% 7% 730

11% 15% Professional 10.8% 13% 11% 810

Agri, forest & Public Sector 25.6% 28% 10% 836

Construction fish

3% 1%

Arts & Other 5% 2% 1% 514

Source: CSO 43Sizeable inflows of intellectual property into Ireland by

tech. & pharma. in recent years: exports & jobs created

Ireland is a leader in Computer Services; Enormous inflows of IP assets into Ireland

Exports have trebled since 2014 since 2015 on the back of BEPS reforms

140 18.0% 300

120 16.0%

14.0% 250 c.€500bn in

100 IP assets

€billions, Constant prices

12.0% transferred

80 10.0% 200 to IE since

8.0% 2015

60

6.0% 150

40

4.0%

20 2.0% 100

0 0.0%

2006

2014

2005

2007

2008

2009

2010

2011

2012

2013

2015

2016

2017

2018

2019

50

Computer Services Exports (€bn) 0

Chemical Products (€bn) 1995-2014 2015 2016-19

% of World Computer Services Exports (RHS) 2015 once-off IP assets increase estimate

% of World Chemical Products Exports (RHS) Fixed Capital Investment - IP assets

Source: IMF, UN Comtrade, CSO, NTMA Economics Calculations 44Ireland has deftly navigated the changing global economy

landscape this century (adjusted GVA for Ireland)

Euro Area manufacturing base hollowed out The digitalisation of the economy: Ireland

over time: Ireland less impacted than most able to grow its tech sector in recent years

2 3

0 2.5

Ireland: 3% of EA19

-2 2 tech sector wages

but only 1.4% of

-4 1.5

EA19 population

-6 1

-8 0.5

-10 0

-12 -0.5

-14 -1

Italy

Estonia

Italy

Estonia

Cyprus

Cyprus

Belgium

France

Latvia

Belgium

Ireland*

Greece

Greece

Austria

France

Finland

Latvia

Ireland*

Malta

Finland

Austria

EA 19

Malta

Slovenia

Slovenia

EA 19

Germany

Slovakia

Lithuania

Lithuania

Germany

Slovakia

Netherlands

Netherlands

Spain

Portugal

Spain

Portugal

Luxembourg

Luxembourg

Manufacturing GVA: pp change in share of economy since Tech Sector GVA: pp change in share of economy since

1999 1999

Source: Eurostat, NTMA calculations

* Ireland’s GVA data has been adjusted to strip out the distortionary effects of some of the

multinational activity that occurs in Ireland. Specifically a profit proxy is removed from the GVA

data for the sectors in which MNCs dominate (parts of Manufacturing, ICT, and renting and leasing

services). Unadjusted Ireland’s figures are +7.1pp (manufacturing) and +6.5pp (tech sector).Adjusting for MNC profits, underlying economy was robust

pre-Covid: MNCs add real substance to IE economy

Ireland’s income = wages (all sectors) + Pre-Covid, Ireland had a robust underlying

domestic sectors profits + tax on MNC profits economy; compared favourably to EA

MNC sectors 250

contributed

€17bn CoE in ‘19 200 Index, Constant

prices, 100 = 2008

150

Comp of

Employee,

100

€100bn ,

MNC Sector

30%

Profits, 50

€142bn ,

43% 0

Three MNC sectors

contributed €5bn

in CT in 2019 Domestic MNC Sector Profits

Sector

Profits, Domestic Sector Profits

€90bn , 27% Compensation of Employee

Real GVA ex. MNC Sector Profits

Real GVA - EA19

Source: CSO, NTMA calculations (Nominal 2019 data used in left chart)

Ireland’s GVA data has been adjusted to strip out the distortionary effects of some of the

46

multinational activity that occurs in Ireland. Specifically a profit proxy is estimated for the sectors

in which MNCs dominate (MNC sectors = part of Manufacturing, ICT, and renting and leasing

services).The result of such high value MNC activity in Ireland:

Ireland less impacted by Covid - in particular the tax base

GDP overstates Ireland’s progress but is still a good Multinational sectors critical for Income tax

barometer for Revenue, in particular CT and IT

and Corporation tax: proven true in 2020

Income Revenue

Elasticity GG Revenue Tax Corporate Tax Ex. CT 100%

MDD 0.96 0.93 2.26 0.86 90%

GDP 1.08 1.03 1.33 1.05 80%

70%

40% 60%

30%

20% 50%

10% 40%

0% 30%

-10%

-20% 50% of CT, PAYE, VAT 20%

-30% comes from five least 10%

-40% impacted sectors* 0%

-50%

-60% VAT PAYE CT Three taxes

Industry (excl.

Information and

Agriculture, Forestry and

Real Estate Activities

Public Admin, Education

Financial and Insurance

Construction

Professional, Admin and

Distribution, Transport,

Arts, Entertainment and

Hotels and Restaurants

Communication

Construction)

combined

Support Services

Other Services

Other Sectors

and Health

Activities

Fishing

Financial and Insurance

Admin + support (incl. Aircraft Leasing)

ICT (tech sector)

% of CT, PAYE, VAT y-o-y change in GVA, Q1-Q3 2020 Manufacturing (incl. Pharma)

Source: CSO, Revenue, NTMA Calculations

* Agriculture sector pays minimal tax 47

Elasticity based on 1995-2019 data.

E = (annual % change in tax)/(annual % change in growth variable)On a relative basis Ireland performing better than most EU

peers during Covid - thanks to ICT and pharma firms

The Irish wage bill is not going to be as ICT sector has acted as a bulwark in

impacted as other countries protecting incomes in Ireland

Latvia Ireland

Lithuania UK

France Latvia

Spain Sweden

Netherlands Finland

UK Luxembourg

Malta France

Cyprus Malta

Sweden Netherlands

Portugal

Luxembourg Germany

Denmark Denmark

Austria EU 27

EA 19 Cyprus

Finland EA 19

EU 27 Slovakia

Slovenia 40% of Lithuania

Belgium wage bill in Spain

Greece most Austria

Italy Belgium

Ireland affected Slovenia

Slovakia sectors Italy

Germany Portugal

Greece

30 35 40 45 50

0.0 2.0 4.0 6.0 8.0 10.0

Compensation of Employee in most affected sectors (% of

total) % of Compensation of Employee % of Employment

Source: Eurostat (2019)

Note: Most affected sectors include construction, wholesale and retail trade, transport, 48

accommodation and food service activities, real estate activities, professional, scientific and technical

activities; administrative and support service activities, arts, entertainment and recreationOECD’s BEPS 2.0 process could impact the business tax

landscape globally – agreement may come in mid-2021

Pillar One : proposal to re-allocate taxing Pillar Two: proposal for minimum global tax

rights on non-routine profits

• The OECD has proposed further corporate tax • Pillar Two - the basic idea is to introduce a

reform - a BEPS 2.0. minimum tax rate with the aim of reducing

incentives to shift profits.

• BEPS 2.0 looks at two pillars. The first pillar

focuses on proposals that would re-allocate taxing • Where income is not taxed to the minimum level,

rights between jurisdictions where assets are held there would an “income inclusion rule” which

and the markets where user/consumers are operates as a ‘top-up’ to achieve the minimum

based. Non-routine profits could - to some - rate of tax.

degree be taxed where customers reside.

• The obvious questions arise:

• Under such a proposal, a proportion of profits what is the appropriate minimum tax rate?

would be re- allocated from small countries to who will get the ‘top-up’ payment?

large countries. Such a proposal would probably Is the minimum rate taxed at a global (firm)

reduce Ireland’s corporation tax base but it is level or on a country-by-country basis?

impossible to predict the size of the impact.

• These questions are as yet unanswered. If the

• Nothing has been decided yet. There are minimum rate agreed is greater than the 12.5%

disagreements across countries. OECD has revised rate that Ireland levies, it might erode this

the deadline to mid-2021. country’s comparative advantage.

49Outside of sector makeup, Ireland’s population helps

growth potential: Age profile younger than the EU average

Ireland’s population estimated at 4.98m in Ireland’s population will remain younger

2020: younger population than EU than most of its EA counterparts

70% Japan

Greece

60% Portugal

Italy

Spain

50%

Germany

Finland

40% France

Denmark

30% Ireland

UK

Belgium

20% China

Canada

10% Sweden

USA

World

0%Migration has improved Ireland’s human capital; post-

Covid migration to be closer to zero given travel bans

Latest Census data show net migration Migration inflow particularly strong in highly

positive since 2015 – mirroring economy educated cohort – work in MNCs attractive

150 3.0% 120

100 2.0% 90

60

50 1.0%

30

0 0.0%

0

-50 -1.0%

-30

-100 -2.0%

-60

2003

1987

1989

1991

1993

1995

1997

1999

2001

2005

2007

2009

2011

2013

2015

2017

2019

-90

Emigration (000s)

Immigration (000s) -120

Net Migration (000s) Third level Other Education Net Migration

Net Migration (% of Pop, RHS) 2009-2013 2015-2019

51

Source: CSOIncome equality has improved: Ireland’s progressive

system the main driver and cushioned the economy in 2020

Lower inequality (1985-2015): economic rise Progressive system means Ireland is around

reduced GINI coefficient unlike others the OECD average for GINI after tax

0.06 0.8

Lower GINI score means more

0.7

0.04 equal society

0.6

0.02 0.5

0.4

-

0.3

(0.02) 0.2

(0.04) 0.1

0

Denmark

Belgium

France

Italy

Latvia

Greece

Norway

Sweden

Austria

Poland

USA

Chile

South Africa

Slovenia

Iceland

Estonia

Finland

Germany

Australia

Russia

Israel

UK

Mexico

Costa Rica

Canada

Ireland

Slovakia

Czech Rep

Lithuania

Hungary

Netherlands

Portugal

Japan

Luxembourg

Spain

Korea

Turkey

Switzerland

(0.06)

(0.08)

Italy

France

Denmark

Belgium

Norway

Sweden

Greece

USA

Finland

Austria

Germany

Ireland

UK

Japan

Portugal

Netherlands

Canada

Spain

Switzerland

Luxembourg

Pre Taxes and Transfers

GINI Coefficient (Post Taxes and Transfers)

Source: IMF, OECD 52Section 5: Brexit “Hard Brexit” risk eliminated by free trade agreement leaving smaller long term impact

Following intense negotiations, a Free Trade Agreement

was agreed in December 2020 allowing for tariff free trade

Main points of FTA

• From January 1, the UK becomes a “third country” outside the EU’s single market and customs union. As

such without a free trade agreement, trade would be subject to tariffs and quotas.

• Under the deal, goods trade between the two blocs will remain free of tariffs.

However, goods moving between the UK and the EU will be subject to customs and other controls, and

extra paperwork is expected to cause disruptions.

Due to these non-tariff barriers, Brexit will likely result in less trade.

• Under the deal, services trade between the two blocs will continue but again could be hampered.

The Agreement provides for a significant level of openness for trade in services and investment.

But providing services could be hampered. For example, UK service suppliers no longer have a

“passporting” right, something crucial for financial services. They may need to establish themselves in

the EU to continue operating.

• The deal means less cooperation in certain areas compared to before Brexit. Financial and business services

are only included to a small extent. Cooperation on foreign policy, security and defence will be lower also.

• Brexit is likely to result in less trade in the long run between the EU and the UK but the deal does avoid the

worst case scenarios: Hard Brexit has been averted and the economic impact to Ireland will be modest.Impact of Brexit on Ireland will be net negative but deal

means the shock is smaller and spread over long horizon

Modelled impact on output versus No Brexit IE trading partners: UK important for good

baseline: FTA reduces impact significantly imports (land bridge) & services exports

0 % of Goods Services Total

total (2019) (2019) (2019)

-1 Exp. Imp. Exp. Imp. Exp. Imp.

-2 US 30.8 15.5 15.8 18.6 21.9 17.9

-3 UK

8.9 20.6 15.8 6.9 13.5 10.6

(ex NI)

-4

NI 1.4 1.9 n/a n/a n/a n/a

-5

EU-27 37.1 36.7 29.8 19.8 32.8 23.8

-6

China 5.9 5.8 2.8 1.3 4.0 2.3

-7

2020 2021 2022 2023 2024 2025

Other 15.9 19.4 35.9 53.4 27.8 45.5

FTA WTO Disorderly No-Deal

55

Source: CBI, NTMA analysisOne possible offset to Brexit impact is FDI inflows into IE;

service suppliers in UK may need to re-establish in EU

FDI: Ireland benefitting already Companies that have indicated jobs have or

will be moved to Ireland

Ireland could be a beneficiary from displaced FDI.

The chief areas of interest are

Financial services

Business services

IT/ new media.

Dublin is primarily competing with Frankfurt,

Paris, Luxembourg and Amsterdam for financial

services.

The UK (City of London) has lost significant

degree of access to EU market so there may be

more opportunities in time.

2019 figures from the IDA have shown that at

least 70 investments into Ireland have been

approved since the announcement of Brexit.

56Withdrawal Agreement in 2019 solves Northern Ireland

border issues

Main points of Withdrawal Agreement

• The withdrawal agreement is a legally binding international treaty which works in tandem with the free

trade agreement.

• Northern Ireland will remain within the UK Customs Union but will abide by EU Customs Union rules –

dual membership for NI.

• No hard border on the island of Ireland: the customs border will be in the Irish sea. Goods crossing

from Republic of Ireland to Northern Ireland will not require checks, but goods that are continuing on

to the UK mainland will.

• Complex arrangements will be necessary to differentiate between goods going to NI and those

travelling through NI to UK or vice versa. Customs checks at ports, VAT and tariff rebates and alignment

of regulations will be needed.

• All of this is backed by a layered consent mechanism, which allows Stormont to opt-out under simple

majority at certain times.

57Section 6: Property Property market in 2020 showed fewer transactions, completions; prices less affected

House prices had plateaued before the virus arrived; Covid

price impact was minimal with December seeing price jump

House prices have stabilised 20% Covid-19 impact: transactions, approvals

below their peak (100 in 2007) down sharply initially; prices stable

120 Level

Jul Aug Sep Oct Nov

(y-o-y % change)

100

3,327 2,927 4,227 5,463 4,007

# of transactions

80

(-39.7%) (-42.1%) (-17.2%) (-1.8%) (-38%)

60 3,397 3,875 4,621 5,207 4,336

# of mortgage

approvals

(-33.8%) (-11.0%) (20.8%) (15.4%) (29%)

40

134.4 134.5 134.7 135.5 136.0

Residential Property

20 Price Index

(-0.7%) (-0.9%) (-0.9%) (-0.4%) (1%)

0 114.0 114.2 114.6 114.0 114.0

2006

2005

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Private Rent Index

(-1.4%) (-1.8%) (-2.6%) (-3.2%) (-3%)

National Excl. Dublin Dublin

Source: CSO; BPFI, PPR, Department of Housing 59Housing supply still below demand; supply was catching

up before Covid-19 slowed market

12.0

Average annual New Dwelling

10.0 housing demand Completions (last four

(2020-2030) quarters)

8.0

State 33.6 19.7

6.0 GDA 17.2 10.5

Ex-GDA 16.5 9.2

4.0

• Greater Dublin Area (Dublin + Mid East)

2.0

requires the majority of needed dwellings.

-

• On average, 9,200 housing units are

demanded a year in the regions that are

not currently funded by markets.

Average annual housing demand (2020-2030)

New Dwelling Completions (last four quarters)

Source: CSO; NTMA analysis 60Covid-19 has impacted supply for 2020 and 2021

Housing supply picked up pre-Covid:

Housing Completions* close to 25,000 in

coronavirus to hamper supply for 2020/21

2020; 20,000+ in new dwelling completions

30000 30000

25000 25000

20000

20000

15000

15000

10000

10000

5000

5000

0

2015 2016 2017 2018 2019 2020 0

New dwelling completion Unfinished 2017 2017 2018 2018 2019 2019 2020 2020 2021 2021

Reconnection Non-Domestic Starts (advanced 12 months)

All connections Completions (new dwellings)

Source: DoHPCLG, CSO, NTMA Calculations

* Housing completions derived from electrical grid connection data for a property. Reconnections of 61

old houses or connections from “ghost estates” overstate the annual run rate of new building.

**2020 completions forecasted down 20% on 2019Demand could fall off given lower migration and rising

unemployment – demand may drop below 30,000 in ST

Mortgage drawdowns (000s) rose from Non-mortgage transactions still important;

deep trough before Covid-19 impact transactions hit in Q2/Q3 but rebound in Q4

120 20 80.0%

Thousands

18 70.0%

100 16

60.0%

14

80

12 50.0%

60 10 40.0%

8 30.0%

40

6

20.0%

20 4

2 10.0%

0

0 0.0%

2006 2008 2010 2012 2014 2016 2018 2020

Q2 2011

Q2 2018

Q4 2010

Q4 2011

Q2 2012

Q4 2012

Q2 2013

Q4 2013

Q2 2014

Q4 2014

Q2 2015

Q4 2015

Q2 2016

Q4 2016

Q2 2017

Q4 2017

Q4 2018

Q2 2019

Q4 2019

Q2 2020

Q4 2020

Residential Investment Letting

Mover purchaser Non-mortgage transactions

Mortgage drawdowns for house purchase

First Time Buyers Non-mortgage transactions % of total (RHS)

Source: BPFI (4 quarter sum used) Source: BPFI; Residential Property Price Register

62Covid-19 impact on prices muted as both supply and

demand impacted, but rents have come off highs

Dublin house prices unmoved in 2020 Rents are well above previous peak but have

fallen in recent months

30% 180

160 Rents now well

20% above prices

140

10% 120

100

0%

80

-10% Prices were

60 above rents

-20% 40

20

-30%

0

2005 2007 2009 2011 2013 2015 2017 2019

2009

2010

2005

2006

2007

2008

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

National (Y-o-Y %) Ex Dublin (Y-o-Y %)

Dublin (Y-o-Y %) Rents (100 = 2005) Price

Source: CSO; RTB 63Irish house price valuation metrics remained well below

2008 levels throughout last cycle

Deviation from average price-to-income ratio (Q2 2020, red dot represent Q1 2008)

60%

40%

20%

0%

-20%

BG SD OE NL LX NW DN FR ES IE PT EA UK BD GR FN IT

Deviation from average price-to-rent ratio (Q2 2020, red dot represent Q1 2008)

100%

80%

60%

40%

20%

0%

-20%

SD NW BG UK LX FR DN ES NL IE OE FN EA BD PT GR IT

Source: OECD, NTMA Workings 64

Note: Measured as % over or under valuation relative to long term averages since 1980.Section 7: Banks & other Ireland’s banks among best capitalised in Europe – complete reverse of late 2000s

Ireland’s pillar banks in relative good shape to weather

Covid-19 storm

• Banks profitable before Covid-19: income, cost and balance sheet metrics much improved.

• Interest rates on mortgages and to SMEs are still high compared to EU thanks to legacy issues and the

slow judicial process in accessing collateral.

• An IPO of AIB stock (28.8%) occurred in June 2017. This returned c. €3.4bn to the Irish Exchequer: used

for debt reduction. Further disposal of banking assets unlikely in the short term given low valuations

• Irish banks had paid dividends in recent years.

All three pillar banks were profitable in recent years, Covid impact in H1

Net Interest Margin Profit before Tax

3.0% 1.5

2.5% 1

2.0% 0.5

1.5%

0

1.0% AIB BOI PTSB

-0.5

0.5%

-1

0.0%

AIB BOI PTSB -1.5

2017 2018 2019 2020 H1 2017 2018 2019 2020 H1

66

Source: Annual reports of banks - BOI, AIB, PTSBIreland’s banks are among the best capitalised in Europe

12

Estonia

Leverage Ratio (fully phased-in definition )

11

10

IE

9

Greece

Cyprus

8

Lithuania

7 MT

LX

Italy

6 Spain

FR

5

Germany

4

10 12 14 16 18 20 22 24 26 28 30

Common equity Tier 1 ratio [%]

Source: ECB consolidated banking data (Q3 2020)

Note: Leverage Ratio = Tier 1 capital/Total leverage exposure; CET1 = Common tier 1 capital/total risk 67

exposures. “Fully loaded” refers to the actual Basel III basis for CET1 ratios.Capital ratios strengthened as banks shrunk and

consolidated in last ten years

CET 1 capital ratios allow for amble Loan-to-deposit ratios have fallen

forbearance in 2020 significantly as loan books were slashed

20% 200

18% 180

160

16%

140

14%

120

12% 100

10% 80

17.3% 16.4% 60

8%

13.8% 14.6% 13.6% 13.9% 40

6%

20

4%

-

2% Loan-to- Loans (€bn) Loan-to- Loans (€bn)

Deposit % Deposit %

0%

CET1 % (Dec 2019) CET1 % (June 2020) AIB BOI

AIB BOI PTSB Dec-10 Dec-19

Source: Published bank accounts Source: Published bank accounts

Note: “Transitional” refers to the transitional Basel III required for CET1 ratios

68

“Fully loaded” refers to the actual Basel III basis for CET1 ratios.Domestic bank cost base has risen due to Covid

Cost income ratios increased … … IE banks* below EU average pre-Covid

90%

150% 80%

144%

70%

123% 60%

125%

50%

40%

100%

88% 30%

79% 20%

75% 66% 10%

63%

0%

NO

DK

DE

MT

PL

PT

NL

SK

SI

FI

EU

FR

SE

EE

GR

ES

GB

AT

LT

CZ

RO

LV

IS

HU

IE

IT

LU

BG

HR

CY

BE

50%

Staffing (000s) halved post crisis

25% 30

20 26

0%

AIB BOI PTSB 16

10

10 10

2012 2013 2014 2015 2016 5 2

0

2017 2018 2019 2020 H1 AIB BOI PTSB

2008 2019

Source: Annual reports of Irish domestic banks, EBA 69

* EBA data includes three domestic banks as well as Ulster Bank, DEPFA & Citibank.Irish residential mortgage arrears may reverse course in

2020/2021

Mortgage arrears (90+ days) Repossessions*

20% 12.0 3500 6.0%

18% 10.0

3000 5.0%

16% 8.0

PDH Arrears

14% 6.0 (by thousands) 2500

4.0%

12% 4.0

2000

10% 2.0

3.0%

8% 0.0 1500

6% -2.0 2.0%

4% -4.0 1000

2% -6.0 1.0%

500

0% -8.0

10 11 12 13 14 15 16 17 18 19 20 10 11 12 13 14 15 16 17 18 19 20 0 0.0%

Over 90 days 90-180 days 13 14 15 16 17 18 19 20

PDH + BTL (by balance)

181-360 days 361-720 days

PDH + BTL (by number) PDH BTL % of MA90+ (RHS)

>720 days Total change

Source: CBI

* Four quarter sum of repossessions. Includes voluntary/abandoned dwellings as well as court ordered 70

repossessionsThe European Commission’s ruling on Apple annulled in

court; further appeal by EC means case continues

• Back in 2016, the EC had ruled that Ireland illegally provided State aid of up to €13bn, plus interest to

Apple. This figure is based on the tax foregone as a result of a historic provision in Ireland’s tax code.

The Irish Government closed this provision on December 31st 2014.

• Apple appealed the ruling, as did the Irish Government. The General Court granted the appeal in July,

annulling the EC’s ruling.

• This case had nothing to do with Ireland’s corporate tax rate. It related to whether Ireland gave unfair

advantage to Apple with its tax dealings. The General Court has judged no such advantage occurred.

• The Commission has decided to appeal to a higher court: the European Court of Justice. This process

could still be lengthy. Pending the outcome of the second appeal, the €13bn plus EU interest will

remain in an escrow fund.

• The NTMA has made no allowance for these funds in any of its planning throughout the whole

process. There is no need to adjust funding plans given the decision by the General Court in July or by

the Commission’s decision to appeal.

71You can also read