GLOBAL MOBILITY SERVICES: TAXATION OF INTERNATIONAL ASSIGNEES - NETHERLANDS - PWC

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

www.pwc.nl/

Global Mobility Services:

Taxation of International

Assignees – Netherlands

Netherlands

Taxation issues &

related matters for

employers &

employees 2019

Last Updated: April 2016

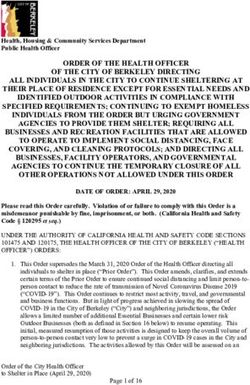

This document was not intended or written to be used, and it Menu

cannot be used for the purpose of avoiding tax penalties that

may be imposed on the taxpayer.Last Updated: February 2019 This document was not intended or written to be used, and it cannot be used for the purpose of avoiding tax penalties that may be imposed on the taxpayer.

Country:

Netherlands

Introduction: International assignees working in the 4

Netherlands

Step 1: Understanding basic principles 5

Step 2: Understanding the Dutch tax system 7

Step 3: What to do before you arrive in the 22

Netherlands

Step 4: What to do when you arrive in the 27

Netherlands

Step 5: What to do at the end of the tax year 30

Step 6: What to do when you leave the Netherlands 32

Step 7: Other matters requiring consideration 34

Appendix A: Rates of tax 36

Appendix B: Calculation of taxable income 37

Appendix C: Double-taxation agreements 39

Appendix D: Social security agreements 41

Appendix E: Netherlands contacts and offices 42

Additional Country Folios can be located at the following website:

Global Mobility Country Guides

Global Mobility Country Guide (Folio) 3Introduction: International assignees working in the Netherlands PwC is the world's leading provider of professional services. The People and Organisation network works together with its clients to find solutions for the challenges they encounter when transferring people from one country to another. This brochure is intended to inform foreign nationals and their employers about tax, social security and immigration issues in the Netherlands. This guide is not exhaustive and cannot be regarded as a substitute for professional advice addressing individual circumstances. Nevertheless, answers will be found to most of the questions raised by an expatriate or his/her employer. More detailed advice should be sought before any specific decisions are made about these issues. More information can be obtained from our Dutch offices specializing in People and Organisation’s Global Mobility Services (see Appendix E). 4 People and Organisation

Step 1:

Understanding basic principles

The scope of taxation in the The tax year Partners

Netherlands

2. The Dutch tax year runs from 3. Partners of expatriate

1. A foreign national working in January 1st to December 31st. employees are independently

the Netherlands will, in general, liable to Dutch tax on their

become liable to Dutch tax. The (employment) income. Under

main taxes are: conditions a partner may

qualify as a ‘fiscal partner’ for

Income tax; Dutch tax purposes. A 'fiscal

Wage tax; partner' is defined as a spouse

or a legally registered partner.

Dividend tax; Under certain conditions,

couples living together who are

Gift and inheritance tax; not married or registered are

also (automatically) regarded as

Real estate occupancy tax;

fiscal partners.

Real estate transfer tax;

Fiscal partners are (as

Social security mentioned) independently

contributions. liable to Dutch tax on their

income. However, for so-called

joint income and deductions,

fiscal partners may choose

which partner will take the joint

income/deductions into

account in his/her income tax

return.

Global Mobility Country Guide (Folio) 5Determination of residence The most important criteria in 5. In practice, an expatriate is

this respect are as follows: generally considered a resident

4. Under Dutch tax law, an of the Netherlands if:

individual’s place of residence Where a permanent home

for tax purposes depends upon is maintained; As a married person, his

all facts and circumstances family accompanies him to

applicable to the personal Where employment duties the Netherlands; or

situation. These facts and are performed;

circumstances are used to As a single person, he stays

Where the individual's in the Netherlands for more

determine where the center of

family resides; than one year.

an individual’s personal and

economic life is located. If the Where the individual is Expatriate status

center of the individual’s registered with the local (30% ruling)

personal and economic life is authorities;

located in the Netherlands, he 6. Under certain conditions, a

or she is considered to be a Where bank accounts and foreign employee assigned to

resident of the Netherlands for other assets are the Netherlands may be

tax purposes. maintained; and granted the right to be taxed

The intended length of stay in accordance with a special

Dutch tax regime, called the

in the Netherlands.

30% ruling. This ruling is

outlined in detail later on in

this brochure.

6 People and OrganisationStep 2:

Understanding the Dutch tax system

Taxation of resident individuals

Taxable income Box 1: Allowable expenses relating

to employment and home

7. Residents of the Netherlands 9. Box 1 includes an individual’s ownership.

are subject to Dutch tax on their taxable income from work and

world-wide income. This world- home ownership. This type of Box 2:

wide income is divided into income includes the following:

three different types of taxable 11. Box 2 includes an individual’s

income. Each type of income is Employment income; taxable income from a

taxed separately under its own substantial interest (defined

Home ownership of the further on in this brochure).

schedule, referred to as a 'Box'. principal residence (i.e.

Each Box has its own tax

deemed income lowered by Box 3:

rate(s). The individual's mortgage interest

combined taxable income is deduction); 12. Box 3 includes an individual’s

determined on the basis of the taxable income from savings

aggregate income in these three Gains from self- and investments (investment

boxes. employment and other yield tax).

professional activities;

8. For fiscal partners, some of the Employment income

income is taxed jointly (joint Periodic receipts and

income/deductions). With few payments; 13. Employment income includes

exceptions, income must be all direct or indirect cash

recognized at the time it is Benefits relating to income payments or benefits in kind.

received or offset, is put at the provisions (e.g. refund of Benefits in kind are generally

disposal of the individual, annuity premiums). taxed at market value.

begins bearing interest or is However, if the benefit in kind

10. This taxable income is subject is required for the proper

collectible and receivable.

to deductions for: performance of the employment

Appendix B contains an activities, the individual is taxed

Expenses relating to income

overview of how taxable income on what he saves (i.e. costs he

provisions, such as annuity

is calculated. avoids incurring by virtue of the

premiums provided that

provision of the benefit). There

certain conditions are met;

are fixed valuation rules

Personal deductions; regarding certain benefits in

kind (e.g. for company car,

(restricted) shares, housing

and meals).

Global Mobility Country Guide (Folio) 714. In principle, all iii. The following expenses can o Extra-territorial costs

reimbursements made by the be reimbursed tax free in (which includes the tax

employer to the employee are addition to the 1.2% budget free allowance under

considered (taxable) wage. (below listed expenses are the 30% ruling);

However, 4 types of exceptions the so-named ‘specific

apply to this general rule. exemptions’): o Business related

moving expenses;

i. The employer has under the o Travel expenses at EUR

work-related cost scheme a 0.19 per kilometer; o Discounts on company

budget of 1.2% of the total products.

fiscal wages of its o PC’s and mobile phones

when necessary for an iv. So-named intermediary

employees to reimburse

employee’s costs (costs paid by the

incurred expenses tax free employee on behalf of the

amongst the employees. employment activities;

employer) can also be

ii. A limited number of o Business related reimbursed tax free in

workplace related facilities expenses for temporary addition to the 1.2% budget.

that fall within the scope of stay (e.g. hotel and Intermediary costs are for

the 1.2% budget (such as meal expenses); example costs of a business

working clothes, related meal or gasoline for

o Business related a company car paid by the

consumptions and meals at expenses regarding

the workplace) are valued employee who can

courses, seminars, afterwards claim the

at nil or are valued (very) symposia, business

low. expenses from his

literature, etc.; employer.

o Study expenses;

8 People and OrganisationTax credit tax-facilitated pension for Principle Residence

salary in excess of EUR 107,593.

15. A general tax credit will apply to It might therefore be advisable 20. The principal residence is taxed

all taxpayers. In addition, there for employees who participate in Box 1 based on the property’s

are a number of specific tax in a foreign (non-EU) pension fixed (deemed) rental value.

credits that are applied on a scheme and whose salary This rental value is based on the

case-by-case basis. The most exceeds EUR 107,593 to seek property's fair market value as

important specific tax credit is further guidance on the impact determined by the local

the labor rebate. Taxpayers who of these limitations. Making authorities. The deemed rental

receive business profits, income further arrangements might be value ranges from 0%-0.65% of

from employment or income recommended, to ensure that the fair market value. The

from independently performed their pension scheme still suits deemed rental value on

services are entitled to claim their whishes. property valued higher than

this credit. EUR 1,080,000 is EUR 7,020

Foreign pension schemes plus an additional 2.35% of the

Social security and value above EUR 1,080,000.

pensions 18. The Dutch Tax Authories can

assign a foreign pension 21. Interest paid on (mortgage)

16. Payments that employees make scheme as a recognized Dutch loans related to the principle

to foreign social security and pension scheme. As a result, residence is in principle

pension schemes may be tax the foreign pension scheme deductible in Box 1 for a

deductible if the schemes would does qualify under Dutch law, maximum period of 30 years.

qualify under Dutch law. Please which means that payments However, from January 1, 2013

note that employers to the pension scheme are tax the conditions under which an

contributions to foreign social deductible. For employees individual can benefit from the

security and pension schemes from the EU/EEA a (mortgage) interest deduction

can be taxable (and employees simplified procedure applies have become more strict. A

contributions non-deductible) if for recognition of the foreign distinction should therefore be

the schemes are non-qualifying. pension scheme. made between loans that

Upon emigration, the Dutch tax already qualified as a mortgage

authorities may issue a Home ownership loan for a principal residence

precautionary tax assessment (‘eigenwoningschuld’) on

on the capital sum of company 19. Individuals who own

property in the Netherlands December 31, 2012, and

pension accrued (or, depending mortgage loans that did not

the applicable tax treaty, on the will be liable to pay tax on

this (deemed) source of qualify as a mortgage loan for a

amount of contributions that principle residence at that

were subject to Dutch tax relief) income in the Netherlands. A

moment (e.g. mortgage loans

in order to retain their right to distinction should be made

between a property that is concluded for a principal

levy tax on that amount. residence from January 1, 2013

considered to be the

17. The tax beneficial build-up of individual's principal onwards).

pension entitlements is capped residence and a property

to a maximum income. For owned for other purposes.

2019, the maximum salary

amounts to EUR 107,593. It is

no longer possible to accrue

Global Mobility Country Guide (Folio) 922. For mortgage loans that did not occur to mortgage loans that 3 taxation is explained further

qualify as a mortgage loan for a were concluded prior to on in this brochure). The

principle residence on January 1, 2013, or situations mortgage interest paid for this

December 31, 2012 and where where the property for which type of real estate is not tax

transitional law is not the mortgage loan was deductible. However, under

applicable, the new conditions concluded qualified as a conditions, certain exceptions

can be summarized as follows: primary residence previously. may apply (under which Box 1

treatment and thus mortgage

The interest on (mortgage) 25. Furthermore, from January 1, interest deduction is still

loans will only be 2014, the maximum effective allowed), when the home is to

deductible if the mortgage tax rate against which the be sold or a new home is bought

is fully repaid within a mortgage interest is deducted or for a property under

maximum period of 30 has started to decrease construction.

years; annually. In 2019, the

maximum effective tax rate is Substantial interest (Box 2)

These loans must be repaid 49%.. As from 1 January 2020

periodically on the basis of the percentage at which the 28. In Box 2, income from a

a fixed pattern (e.g. linear/ interest is deducted per annum substantial interest is taxed,

annuity), which is included is to be decreased in four stages less the allowable losses and

in the loan of three percent to ultimately expenses from that substantial

agreement/contract as well. 37.05 percent in 2023. interest. Generally, a taxpayer

For foreign loans proof earns income from a substantial

needs to be provided (strict 26. If an individual has no interest if he/she owns at least

deadlines apply); (mortgage) loan, or the 5% of the shares in a company.

(mortgage) interest paid is The Box 2 tax rate is 25%.

23. For loans that do not meet the lower than the deemed rental

above-mentioned conditions value, the individual will be Investment yield tax

and where the transitional rules granted a deduction on the (Box 3)

are not applicable, the mortgage deemed rental value (i.e. the

interest deduction will no 29. In Box 3, income from savings

difference between the deemed and investments is taxed.

longer be allowed. rental value and the interest Rather than taxing the actual

24. For mortgage loans that paid). From 2019 onwards, this income received from saving

qualified as a mortgage loan for difference may only be partially accounts, bonds, shares and

a principle residence on deducted in box 1. This real estate, Dutch law assumes a

December 31, 2012 (and in deduction will be reduced fixed return on investment (see

specific other situations), annually. Appendix A) on net assets

transitional rules apply. If Real estate owned for other (assets less liabilities). The

transitional rules apply, the purposes value and fiscal qualification of

interest paid can be deducted the assets on January 1 is

for a maximum period of 30 27. In case real estate does not decisive. This fixed ROI is taxed

years, irrespective if the qualify (or no longer qualifies) at a fixed rate of 30%. However,

mortgage loan is being paid off as a principal residence, the real an amount of 30,360 euros is

or not during this period. A estate and the related exempted from this taxation.

careful assessment is required (mortgage) loan are taxed in For partners this is 60,720

in situations where changes Box 3 rather than in Box 1 (Box euros.

10 People and OrganisationDeductions called lucrative investment premiums towards (temporary)

(carried interest arrangements) old age annuities and a

30. Extraordinary expenditures, under taxation in Box 1. The survivor's annuity.

personal pledges and donations income from a lucrative

are tax deductible within limits. investment, both income and Personal deductions

A distinction is made between capital gains, will, in principle,

deductions relating solely to 37. Personal deductions are

be taxed in Box 1 rather than deductible from income (in

Box 1 income and those relating Box 3, and as such, be taxable

mainly to the taxpayer's chronological order) in Boxes 1,

at progressive tax rates (up to

personal circumstances. 3 and 2.

51,75%).

31. Insofar as these personal 38. The following expenses are

Commuting expenses considered personal

deductions exceed the (positive)

income in Box 1, they will be 34. With respect to costs of deductions:

deducted from Box 3 income traveling by public transport, a Alimony and other

and, thereafter, Box 2 income. fixed amount can be deducted

maintenance obligations;

Any remaining balance may be as commuting expenses. The

carried forward to the next fixed amount depends on the Specific medical and health

year(s). distance traveled and the expenses (under restriction

number of days traveled per of limited costs);

Incentive income and week. Costs of traveling

executive remuneration associated with traveling by car Weekend care expenses for

or motorbike cannot be handicapped close relatives

32. Income and benefits from

deducted. older than 21 years;

equity based remuneration is

generally taxable at the moment 35. Employers can reimburse actual Study costs and other

the benefit becomes costs of commuting tax free educational expenses (From

unconditional (shares) or at the 2020 onwards, this

regardless the way of travel with

moment the benefit is exercised deduction will be replaced

a maximum of EUR 0.19 per

(stock options). The income is by a subsidy for every

kilometer. Insofar as the person that has obtained a

pro-rated for the period it is reimbursement exceeds EUR minimum level of education

earned (e.g. the vesting period) 0.19 per kilometer, the excess is as determined by the

in case the individual worked considered taxable wage. If government);

and was taxable in more than communting takes place with

one country during this period. public transport, the actual Charitable donations;

The Dutch taxable income is costs can be reimbursed tax

determined based on the net free. Foreign tax relief

benefit (i.e. gross benefit minus

any exercise price paid). Life annuity premiums 39. According to Dutch tax law,

Furthermore, a discount applies resident individuals are taxed

on the taxable value in case of a 36. Life annuity premiums are on their worldwide income.

holding lock or forced deductible under certain However, tax treaties concluded

postponed exercise date. conditions, amongst those the by the Netherlands and other

existence of a pension gap. unilateral provisions of law may

33. The rules regarding ‘excessive’ Other tax deductible premiums result in the exemption of

remuneration have brought so- for life annuities include certain types of foreign-sourced

Global Mobility Country Guide (Folio) 11income from Dutch taxation. the credit method (i.e. actual Taxation of non-resident

According to most tax treaties foreign tax paid). Nonetheless, individuals

the Netherlands has concluded, exceptions may apply if certain

Taxable income

the following types of income conditions are met. Some

may be exempted from Dutch countries also levy withholding 43. An individual's residency status

taxation: taxes (source tax) on dividend is determined as described in

and interest payments to Dutch the section entitled

Income from a business or residents. In general, such "Determination of residence",

profession, provided that foreign withholding tax is above.

the income is generated by credited against Dutch income

a foreign permanent tax payable. 44. Similar to residents of the

establishment or fixed base; Netherlands, individuals who

Wage withholding tax qualify as non-residents for tax

Income from employment, purposes are taxable in the

provided that the Dutch 41. Employment income is Netherlands based on the Boxes

resident spends more than generally subject to wage tax system. They are liable to pay

183 days in a 12 month withholding. Wage tax is levied tax on their Dutch sourced

period (or in a tax or as a prepayment of income tax. taxable income in Boxes 1, 2

calendar year) in the The wage tax rates are based and 3. This comprises the

foreign country or the upon the income tax rates, following:

remuneration is (deemed to taking into account general and

be) paid by an employer labor levy rebates. If the Box 1:

resident in that foreign amount of wage tax withheld is

country or borne by a lower than the ultimate income Taxable income from

permanent establishment of tax liability, or if no tax is current or past employment

the employer in that withheld, tax will be due on the performed in the

country; receipt of a provisional or final Netherlands;

income tax assessment after Taxable income from

Directors' fees received in having filed a Dutch annual

respect of a directorship of lucrative investments in the

income tax return. Netherlands;

a foreign-resident

company; Other taxes Gains from self-employment

Income from foreign real 42. The most important other taxes and other activities in the

estate. levied by the Netherlands are: Netherlands attributable to a

Dutch permanent

40. Generally, the exemption is Inheritance and gift tax; establishment or

calculated as a pro-rata representative;

reduction of the amount of Real estate transfer tax;

Dutch tax computed on the Certain periodic benefits and

Real estate tax; and payments;

individual's world-wide income

(exemption with progression Road tax. Income received in the

method). However, the employee's capacity as a

avoidance for double taxation Further details can be found later

managing or supervisory

for director’s fees is under most on in this brochure.

director of a Dutch

tax treaties concluded, based on company;

12 People and Organisation Home ownership of the the aggregate 183 days in a from employment abroad if the

principal residence (deemed calendar year, tax year or income was subject to taxation

income); any twelve months period in the other country and if the

commencing or ending in taxation rights on this income

Box 2: the fiscal year concerned are allocated to the foreign

Dividend and (capital) gains (depending on the tax country in question.

from a company in the treaty); and

Definition employer in tax

Netherlands in which the The individual’s salary is treaties

taxpayer has a substantial paid or borne by an

interest; employer who is not a 47. The policy guidelines on the

resident of the Netherlands; definition of “employer” in the

Box 3: employment article of tax

and

Income from real estate treaties have been set out in a

located in the Netherlands The individual's salary costs specific Decree published by the

are not borne by a Dutch Ministry of Finance. The

(other than the principal

permanent establishment or Decree solely applies in case of

residence);

fixed base in the assignments to a separate legal

Entitlements relating to real Netherlands. entity in the country of

estate in the Netherlands; employment (it does not apply

Deemed country of to assignments to permanent

Profit-sharing entitlements employment establishments). Furthermore,

relating to companies whose the assignment must be in the

46. A non-resident employee

management is based in the context of an exchange

Netherlands (except if the (employed with an employer

programme or career

shareholding qualifies as a who is a Dutch wage tax

withholding agent), who development, or in situations

lucrative investment which where the employee in question

performs part of his

is taxed in Box 1). has a specific expertise. Based

employment duties in the

on the Decree, in some cases it

Employment income Netherlands and part outside

the Netherlands, is deemed to can be assumed that –

45. Under Dutch tax law, all income have carried out 100% of his irrespective of who is actually

derived by non-residents from employment duties in the bearing the employment costs –

employment duties physically Netherlands. Consequently, the the host country employer is

performed in the Netherlands, non-resident is in principle not considered as the tax treaty

is in principle subject to Dutch liable to pay Dutch income tax employer when an assignment

income tax. However, according on his total employment income does not exceed 60 days over a

to most tax treaties concluded twelve-month period. This relief

(not only on the part of the

by the Netherlands, the employment income that is intended for group entities as

employment income is relates to Dutch workdays). defined in the Dutch Wage Tax

exempted from Dutch taxation Act (which means that a 1/3

Subject to double taxation

if the following three treaties between the equity stake is required).

cumulative conditions are met: Netherlands and other Groups that do not satisfy this

requirement, but do present

countries, the deemed country

The individual is present in themselves as a group, can file

of employment provisions do

the Netherlands for a period an application with the Dutch

not apply to income earned

or periods not exceeding in

Global Mobility Country Guide (Folio) 13tax authorities to request any exercise price paid). lucrative investment and if the

corresponding application of Furthermore, a discount applies substantial interest route is

the Decree. on the taxable value in case of a chosen.

holding lock or forced

48. When an employee is subject to postponed exercise date. 54. The Dutch taxation on

Dutch wage tax, the foreign severance payments that relate

(formal) employer is in 50. Specific rules regarding to activities performed in

principle liable to remit wage ‘excessive’ renumeration apply different countries, is based on

tax. In other words, the home to income from lucrative the OESD guidelines. This

country employer will have to investments (i.e. both income means for example that the

register in the Netherlands and and capital gains). These gains (actual) severance payment is

process a Dutch (shadow) will, in principle, be taxed in allocated for tax purposes

payroll. However, there is a Box 1 rather than Box 3, and, as according to the taxation on the

general facility to transfer the such, be taxable at progressive regular employment income

wage tax withholding obligation tax rates (up to 51,75%). during the twelve months

from the home country (formal) preceeding the termination of

employer to a Dutch entity 51. For non-residents, where and to employment.

within the same concern. As the extent (taxable) activities

such, the Dutch entity can take are performed in the Director's fees

over the withholding obligation Netherlands, (part of) the

lucrative investment is subject 55. Generally, based on most

from the home country

to taxation in the Netherlands Dutch tax treaties,

employer. A request should be incomeearned as a managing

filed with the Dutch tax based on Dutch domestic tax

legislation. However, it should or supervisory director of a

authorities in this respect. company that is domiciled in

be determined on a case-by-

Incentive income, case basis whether the the Netherlands is fully

executive remuneration Netherlands also have the right taxable in the Netherlands. It

is irrelevant in this respect

and severance payment to levy tax on the income from

lucrative investments based on whether the director’s duties

49. Similar to resident taxpayers, the applicable tax treaties. are actually carried out in the

non-resident taxpayers are Netherlands.

generally taxed in the 52. Furthermore, for individuals

who arrive in the Netherlands Personal deductions

Netherlands on income and

benefits from equity based after January 1, 2009, whilst 56. A non-resident taxpayer is

remuneration at the moment holding a lucrative investment granted with the following

the benefit becomes and who did not qualify as non- personal deductions:

unconditional (shares) or is residents for Dutch tax

exercised (stock options). The purposes prior to the date of Foreign social security

income is pro-rated for the arrival for this (lucrative) contributions paid in

period it is earned (e.g. the investment, a step up to the fair relation to Dutch sourced

vesting period) in case the market value of the lucrative employment income,

individual worked in more than investment on the date of provided that certain

one country during this period. arrival will be applied. conditions are met;

The Dutch taxable income is

53. Finally, different rules may Contributions made to a so-

determined based on the net

apply in case of an indirect called qualifying pension

benefit (i.e. gross benefit minus

14 People and Organisationscheme (limitations may applies, in principle, to non- can qualify as qualifying non-

apply); resident taxpayers who operate resident taxpayers of the

a company via a permanent Netherlands (this rules out

Expenses for income establishment in the third country residents).

provisions, such as annuity Netherlands. The amount of the Furthermore, the Netherlands

premiums and premiums tax portion of the employed will only grant the benefits to

for disability or accident person’s tax credit will be based the extent that the non-resident

insurance provided that on the worldwide employment taxpayer is not able to

certain conditions are met; income. Furthermore, on basis effectuate these deductions in

Interest and costs on of tax treaties, Ministerial the home country.

Decrees and EU law, non-

(mortgage) loans for real Income tax rates

estate, provided that the residents may also be entitled to

real estate qualifies as a the income tax part of various 61. For non-resident employees,

levy rebates normally only the income tax rates are the

principal residence for

Dutch tax purposes. This available to residents. same as for resident taxpayers.

includes, for example, the However, in the Netherlands,

59. If non-residents are covered by the social security tax rates are

scenario in which the the Dutch social security levied together with the tax

former Dutch principle scheme, they are entitled to the rates. As such, for employees

residence is for sale or is social security part of all not covered by the Dutch social

being sold, provided certain applicable evy rebates security system, taxation on box

limitations in time are met. 1 income (e.g. employment

Kindly note that as of Qualifying non-resident income) is effectively levied at

January 1, 2015, it may be status “lower” tax rates due to the

necessary for non-residents exclusion of the social security

to be considered as 60. As of January 1, 2015 the option tax rates. (see Appendix A).

qualifying non-resident in regime (‘keuzeregeling’) has

order to be eligible for been revoked and replaced by Other taxes

Dutch mortgage interest the ‘qualifying non-residents’

regime. As a consequence, only 62. Non-resident taxpayers may

deduction.

non-residents who meet the also be subject to other taxes.

Levy rebates conditions to be considered as The most important of these

qualifying non-resident taxes are:

57. The Dutch levy rebates consist taxpayers of the Netherlands

of both an income tax and a Inheritance and gift tax;

(i.e. individuals who earn 90%

social security part. of their worldwide income in Real estate transfer tax; and

58. As of 1 January 2019, non- the Netherlands and meet

certain other conditions) are Real estate tax.

qualifying non-resident

taxpayers who are resident in eligible for personal/familial

Information about these taxes is

an EU member state, the EEA, deductions, tax credits, etc.

normally only available to summarized further on in this

Switzerland or the Carribean brochure.

Netherlands will be given the Dutch tax residents. Please note

statutory right to the tax that only residents of EU

countries, Liechtenstein,

portion of the employed

person’s tax credit. The same Norway, Iceland, Switzerland,

Bonaire, Sint Eusatius or Saba

Global Mobility Country Guide (Folio) 15tax". The term "partial" The employee should have

indicates that, even if the lived outside a 150 km

Special regime for

employee qualifies as a radius from the Dutch

expatriates (30% ruling) resident of the Netherlands, borders for more than 2/3rd

General he is treated as a non- out of 24 months before

resident taxpayer for Box 2 being recruited to work in

63. The 30% ruling is a special tax and Box 3 income, but as a the Netherlands, in order to

regime available for inbound resident taxpayer for Box 1 be considered as incoming

employees who meet certain income. Hence, he is employee.

conditions. Before explaining eligible for all general and

these conditions in more detail, personal allowances in Specialist test

please find below the main connection with Box 1, as

features of the 30% ruling: 65. The 30% ruling only applies to

well as for tax credits; employees with special skills or

Upon granting of the 30% The employee involved, and knowledge not readily available

ruling, a maximum of 30% his/her spouse, can on the Dutch labor market

of an employee’s gross exchange their foreign (specific expertise). The specific

income from current drivers’ license for a Dutch expertise is assessed on the

employment is considered driver’s license without basis of a (taxable) salary norm.

to be a reimbursement for taking a Dutch driving test. When an employee meets this

extraterritorial costs and salary requirement, he is in

can therefore be Conditions principle deemed to meet the

reimbursed tax free (i.e. condition of specific expertise.

regardless of the actual 64. Please find below the most The following three salary

extraterritorial costs recent conditions under which requirements can be applicable:

incurred). This means that the 30% ruling can be applied:

if the conditions of the 30% General (taxable) salary

The employee should be norm: EUR 37,743 (or EUR

ruling are met, the assigned to the

employee will only be taxed 53,919 including full 30%

Netherlands, or recruited allowance);

on 70% of his employment from abroad for the

income. This will result in a purpose of employment in Masters (Msc) younger

substantially reduced the Netherlands (i.e. than 30 years of age: EUR

effective tax due (i.e. the inbound employee criteria); 28,690 (or EUR 40,986

effective maximum rate is including full 30%

reduced to 36.2% (70% x The employee must be allowance);

51,75%)). employed by a Dutch

resident employer or a Scientific personnel,

The employer is allowed to foreign employer who is a researchers and (specialist)

reimburse school fees wage tax withholding agent physicians under training of

relating to the education of in the Netherlands; designated educational

the employee's child(ren) at institutes: no salary norm.

an international school free The employee must have

of Dutch tax; specific skills or knowledge 66. In addition, the specific

not readily available on the expertise should still not or

The employee can opt to be Dutch labor market ('the hardly be available on the

"partially liable to Dutch specialist test'); Dutch labor market. The

16 People and Organisationscarcity of the expertise may be company. However, the Dutch the 30% ruling in 2019 or 2020

checked for certain specific Supreme Court ruled on due to this new legislation,

groups of employees where the October 12, 2007 that, provided transitional law will be

salary level is not a sufficiently that all conditions are met, a applicable. In case of employees

distinctive criterion for specific supervisory board member who have used the 30% ruling

expertise. could be allowed to benefit from for five years or longer in 2019

the 30% ruling, as supervisory or 2020, transitional law of two

PhD Graduates board members are in most years maximum will be

67. If university doctorates move to cases treated as employees for applicable. The ruling will end

the Netherlands (or a country Dutch wage tax purposes. as of 1 January 2021 at the

However, as of 1 January 2017 latest (i.e. unless the original

within the 150 km radius from

the Dutch country borders) to opting-in is recuired for end date would be reached

obtain their PhD and start to supervisory board members to earlier). In case of employees

still benefit from the 30% who have not yet used the 30%

work in the Netherlands

afterwards, they can in ruling, as supervisory board ruling for five years in 2019 or

principle not benefit from the members are as of January 1, 2020, the end date of their

2017 no longer treated as eiligibility for the 30% ruling is

30% ruling, as they cannot be

considered as inbound employees. As of 1 January reduced with three years. For

employees for the 30% ruling 2018 non executive directors of some expats this means that

a one tier board of a listed their 30% also ends as of 2021.

(i.e. they are not posted or

recruited from abroad). company are also no longer

treated as employees and also 71. The period for which

However, a specific exemption individuals qualify as employee

applies in their case, allowing need opting-in to benefit from

the 30%-ruling. in the meaning of the Dutch

them to obtain the 30% ruling if Wage Tax Act is considered a

they take up a Dutch Period of validity deemed period of work for the

employment within one year purpose of reduction rules.

after obtaining their PhD. For 69. As of 1 January 2019, the With this rule, it is avoided that

completeness’ sake it is noted maximum term of the 30% (statutory) directors and

that university doctorates still ruling is reduced from eight to members of the supervisory

need to meet the salary norm, five years. The ruling will be board of Dutch companies, who

which depends on their age applicable as long as the in the past have benefitted from

(younger than 30 or not) conditions are met. Periods of the 30% ruling, can obtain the

and/or where they will be previous stay and employment ruling in the future again whilst

working (educational and in the Netherlands during the only a reduction is applied on

research institutes or other). last 25 years are deducted from days physically spent in the

the maximum duration period Netherlands.

Supervisory board of the 30% ruling. This rules out

members almost all Dutch national 72. Please note the tax free 30%

employees who return to the allowance can only be paid

68. Until October 12, 2007

members of the supervisory Netherlands at some stage in during the period the 30%

board of a Dutch entity were their international career. ruling is applicable. Based on

the current legislation, for

not able to benefit from the 70. The five years term will also

30% ruling, as they were not inbound assignees the

apply to existing cases. For applicability of the 30% ruling

considered employees of the existing expats that would lose

Global Mobility Country Guide (Folio) 17ceases on the last day of the employees pay themselves are Tax and social security

wage period following the not tax deductible. equalization payments; and

period in which the employee’s

Dutch employment ends (i.e. Reimbursements for losses

for most employees on the last on the sale of assets due to

Other reimbursements and the transfer.

day of the month following the allowances

month in which the Dutch 76. In addition, an employer may

employment ends). Please note 74. As mentioned, under the 30% reimburse certain expenses tax

that a lower Dutch court in 2015 ruling, the employer is allowed free if they are incurred wholly

has made the judgement that to reimburse a maximum of because of the expatriate's

the applicability of the 30% 30% of the employee's salary employment outside the

ruling also ceases when the from current employment country of origin. The actual

employer suspends the (excluding 30% allowance) tax moving expenses and, in

employee from active duty, free as a reimbursement for addition, an amount of EUR

predecing the formal end of the extraterritorial expenses 7,750 can be reimbursed tax

employment.This has effect on incurred. Any other free. Examples of other tax free

the application of the 30% reimbursement of actual expenses are:

ruling on the remuneration extraterritorial expenses by the

during this period and employer to the employee in Professional expenses

potentially also for the potential addition to the 30% allowance incurred on business trips;

(future) continuation of the will be considered as taxable

ruling with a new employer. income (or should be deducted Limited business mileage at

from the 30% tax free EUR 0.19 per kilometer;

School fees allowance). If the actual and

73. When the 30% ruling is extraterritorial expenses

Professional education

granted, the actual cost of incurred are higher than 30% of expenses otherwise

attendance at an international the employee's total salary, it incurred in connection with

primary or secondary school, might therefore be more

employment.

reimbursed by the employer, beneficial not to apply the 30%

will not be considered as ruling and to reimburse the

taxable wage to the employee, actual expatriate expenses

instead. Wage withholding tax

provided that the costs are

limited to tuition fees and if 75. Allowable business expenses 77. The 30% ruling is granted on a

arranged by the school, (not being extraterritorial case-by-case basis. The

transport. A Dutch school with expenses) can be reimbursed application must be filed with

an "international stream" also the Dutch tax authorities within

tax free in addition to the 30%

qualifies as an international allowance. The following four months after the start of

school if the school is in payments do not qualify as the Dutch employment in order

principle only available for for the ruling to be applicable as

allowable business expenses

children of employees working and are considered as taxable of the start date. If the

outside their home country. reimbursements and benefits: application is filed after the four

The maximum tax-free term of months period, the ruling (if

reimbursement is also set at five Foreign-service premiums; granted) will be applicable as of

years. School fees that the month following the month

18 People and Organisationin which the application was advice should be sought on a

filed. If the foreign employee is case by case basis in this

assigned to the Netherlands to respect. The 30% ruling may

work for a foreign employer also have an impact on the

that does not have sufficient amount of Dutch social security

substance in the Netherlands contributions due (if applicable)

(for tax purposes), then the and the build-up of Dutch social

foreign employer should apply security entitlements of the

be appointed as a wage tax expatriate.

withholding agent by the Dutch

tax authorities before filing the Similar to resident and non-

application for the 30% ruling. resident individuals, expatriates

who qualify for the 30% ruling

Foreign tax relief may also be subject to other

taxes. The most important of

Expatriates covered by the 30% these taxes are:

ruling who reside in the

Netherlands are liable to tax on Inheritance and gift tax;

their worldwide employment

income. Consequently, if they Real estate transfer tax;

receive employment income which, Real estate tax; and

under a tax treaty, is liable to tax in

another country, foreign tax relief Road tax.

can be claimed. Expatriates covered

by the 30% ruling who do not reside Information about these taxes is

in the Netherlands are only liable to summarized further on in this

Dutch tax on the portion of their brochure.

employment income that relates to

activities actually carried out in the

Netherlands. Kindly note that

applying the 30% ruling may have

an impact on the relief for double

taxation that the non-resident

employee is eligible for in the home

country. Also note that special rules

apply to US nationals, residing in

the Netherlands who are covered by

the 30% ruling.

Other matters

78. The 30% ruling may have an

impact on the amount of

pension rights which can be

built-up tax free while working

in the Netherlands. Expert

Global Mobility Country Guide (Folio) 19The Dutch Social 81. The national insurance Dutch health insurance. This

Security System contributions paid by an means that the individual

employee are not deductible should conclude a health

General

from his taxable income. insurance with a Dutch health

79. The Netherlands has an National insurance insurance company. The

extensive compulsory social contributions and income taxes employer's contribution to the

security system, including are included as a single tax in Health Insurance Act

national health insurance and the first and second income tax (amounting to 6.95 %) is paid

employee’s insurances. brackets (see Appendix A). on a maximum amount of EUR

Employees only pay 55,927 on an annual basis

Dutch employee’s (maximum amount is EUR

contributions with respect to

insurance schemes 3,886.93).This contribution

the national insurance and the

Dutch health insurance. 82. Dutch employee’s insurance should be processed via the

payroll. This amount does not

schemes are provided for in the

Dutch national insurance need to be processed via the

following legislation:

individuals’ pay slips and does

80. Under Dutch law, the national not constitute taxable income

Unemployment Insurance

insurance schemes cover all for the employee anymore. In

Act ("WW");

residents of the Netherlands, addition, the employee should

regardless of their employment Occupational Disability pay a fixed contribution per

status. In general, non- Insurance Act ("WIA"); year (the so-called "nominale

residents are covered if they are premie") per adult to the health

employed in the Netherlands Sickness Benefits Act

insurance company. This

and if their employment income ("ZW");

amount varies per health

is subject to Dutch wage insurance company (average for

83. Generally speaking, no

withholding tax. The national 2019: EUR 1,420 and an own

employee’s insurance

insurance schemes are provided contribution of EUR 385).

contributions are due if

by the following legislation:

activities are performed in the

General Old Age Pensions Netherlands for a period not

Act ("AOW"); exceeding six months, provided

that they are performed by a

Dependants Benefits Act non-resident employee under

("ANW"); an employment contract with a

non-resident employer. This

General Act for Long Term

exemption is not applicable if

Care (“WLZ”);

the EU Regulation or a social

General Child Benefit Act security treaty is applicable.

("AKW").

Dutch Health Insurance Act

84. According to the Health

Insurance Act, an individual,

who is mandatory covered by

the Dutch social security

system, should conclude a

20 People and OrganisationEU/EEA nationals continue to apply the old EU Some social security treaties also

Regulation 1408/71 for third apply to third-country nationals and

85. EU rules apply to the temporary country nationals. Please note to family members. We recommend

assignment of an employee that Denmark has not adopted that you check the treaty provisions

from one EU* country to the old Regulation for third in each individual case.

another (under EU Regulation country nationals and will not

883/04). The rules direct that, adopt the new Regulation In Appendix D you can find an

under certain conditions, the either. overview of countries with which

employee remains subject to the the Netherlands has concluded

social security system of his Other nationals social security treaties.

home country, provided that

the duration of the transfer 88. Non-EU/EEA or Swiss *EU = Austria, Belgium, Bulgaria,

does not exceed 24 months. nationals** employed in the Croatia, Cyprus, Czech Republic,

This is an exception to the main Netherlands are covered by the Denmark, Estonia, Finland,

rule that employees are Dutch social security system. France, Germany, Greece,

compulsorily covered under the However, social security Hungary, Ireland, Italy, Latvia,

social security system of the agreements between the Lithuania, Luxembourg, Malta,

country in which they work. It Netherlands and some other Poland, Portugal, Romania,

is possible to extend this countries may entitle the Slovakia, Slovenia, Spain, Sweden,

coverage for a period of up to employee to an exemption from The Netherlands and the United

five years (in general, depends paying Dutch social security Kingdom.

per country). Special rules contributions. This relief is

similar to the provisions for an **EEA = European Union plus

apply to employees who work in Norway, Liechtenstein, and

more than one EU Member EU/EEA or Swiss national.

Iceland.

State.

86. The EU Regulation 883/04 has

entered into force on May 1,

2010. This Regulation is

applicable to all EU countries.

Under certain conditions the

previous EU Regulation

1408/71 remains applicable for

situations which started before

May 1, 2010.

87. The scope of EU Regulation

883/04 is applicable to third

country nationals from

January 1, 2011. This relates

only to moves between EU

countries.

The UK does not participate in

this new Regulation for third

country nationals. They

Global Mobility Country Guide (Folio) 21Step 3:

What to do before you arrive in the

Netherlands

Immigration formalities in Application for a (MVV) South Korea;

the Netherlands visa

United States of America;

89. A Dutch immigration procedure 90. In order to enter the

must be started for foreign Netherlands third country Vatican City.

nationals who want to reside nationals may be subject to 91. Foreigners who have the

and/or work in the entry visa requirements, nationality of these countries

Netherlands. In general, a depending on nationality and may come to the Netherlands

Dutch employer needs to obtain duration of intended stay. In

without an MVV. Their

a work permit to arrange legal case a foreigner comes to the residence permit application

employment in the Netherlands for a stay shorter can be started while they are

Netherlands. Depending on the than three months a short term

still residing abroad or shortly

nationality and duration of (Schengen) visa may be after their arrival in the

intended stay, an entry visa required. When coming to the Netherlands in case their

and/or residence permit are/is Netherlands for a period longer

intended stay exceeds three

required. For a stay of more than three months a long term

months.

than four months in a entry visa (in Dutch so-called

timeframe of six months, MVV) may be required prior to 92. In case the company of the

registration at the town hall of arrival in the Netherlands. A foreign national is registered as

the municipality of residence is visa is an annotation, placed in an recognized sponsor and the

required. EU/EEA and Swiss the foreigner's passport, foreign national is in possession

nationals are exempted from enabling the foreigner to enter of a valid residence permit

the entry visa, work and the Netherlands. The nationals issued by another Schengen

residence permit requirement. of the following countries are country no long term entry visa

exempted from the MVV (MVV) is required.

requirement:

93. Foreigners must obtain an entry

Australia; visa prior to enter the

Netherlands from the Dutch

Canada; embassy/consulate in the home

Japan; country or from the country

where the foreigner has legal

Monaco; residence (e.g. be in the

possession of a residence

New Zealand; permit and passport valid for at

22 People and Organisationleast six months at the moment migrant residence permit have found a job after this

of collection of the entry visa). procedure, the employer is not search year in the Netherlands,

required to arrange for a their employer can apply for a

94. The regular procedure for the separate work permit for the residence permit as a Highly

application of a MVV has to be employee. Instead, the Skilled Migrant, if the gross

started simultaneously with the employer applies for a wage of EUR 2,364 per month

application of a work permit residence permit that will (EUR 2,553.12 including 8%

and residence permit. In entitle the employee to work holiday pay) (figure 2019) is

general a MVV will be issued and reside in the Netherlands. met.

after a work permit has been For the highly skilled migrant

granted. procedure, it is not relevant 101. The spouse/partner can also

whether the employee is already work in the Netherlands if the

95. MVV applications in employee holds a highly skilled

combination with a work permit employed by the Dutch

company or not or hired from migrant permit. The

will in principle be granted partner/spouse can obtain a

within six to eight weeks of the abroad as a new recruit by a

Dutch company. The highly dependent highly skilled

date that documents have been migrant permit which allows

skilled migrant procedure can

received by the authorities. employment without a

only be used if the employer has

In cases other than work, obtaining the status of an acknowledged separate work permit.

a MVV can take up to three months. sponsor issued by the Dutch

II. Highly Skilled Migrant

Immigration Authorities.

Application for a work work permit procedure

permit 99. For immigration purposes, a 102. If the employee will have to

person qualifies for this

96. Dutch employers who hire a work in the Netherland for less

procedure if the intended stay than 90 days, a work permit as

foreign employee must obtain a in the Netherlands exceeds

work permit for him/her from a highly skilled migrant can be

three months and the salary applied for, provided that all

the first day he/she will work in threshold is met. In 2019 the conditions are met. The

the Netherlands (see 'Penalties gross monthly threshold is EUR

for non-compliance' under processing time of the

4,500 (EUR 4,860..00 application is approximately 2

102). No work permit is including 8% holiday pay) or to 3 weeks. In order to be able

required for employees who are EUR 3,299 (EUR 3,562.92

nationals of the EEA and to make use of this possibility,

including 8% holiday pay) for

Switzerland excluding Croatian the employer has to be an

applicants under 30 years of acknowledged sponsor and the

nationals. age. The processing time of the employee must fulfil a key

application is approximately 2

97. There are several work permit position or must have at least a

to 3 weeks. Bachelors degree.

procedures, under paragraphs I

– V the most common The gross monthly salary

procedures are outlined. 100. For recently graduated threshold for this work permit

students, who studied in the is EUR 4,500 (EUR 4,860.00

I. Highly skilled migrant including 8% holiday pay) or

Netherlands, possibilities exist

residence permit EUR 3,299 (EUR 3,562.92

to obtain a residence permit to

procedure including 8% holiday pay) for

look for a job as a highly

skilled migrant for a period of applicants under 30 years of

98. This is the most commonly used

one year (starting after their age (figures 2019).

procedure in the Netherlands.

Under the highly skilled graduation). As soon as they

Global Mobility Country Guide (Folio) 23III. Intra company transfer Dutch education. Before the IV. Exceptions and special

start of the apprenticeship, the rules on work permits

103. The conditions for the intra student should have a valid

company transfer procedure Dutch residence permit for 108. Exception 1: EEA and Swiss

include the following: study and the employer should nationals do not require a

have a contract governing the work permit.

The foreign employee

must be assigned from a apprenticeship signed by the 109. Exception 2: spouses and

university, the student and the

company abroad to the partners - actually living

Dutch company within the employer. together - of a Dutch or

same global group; V. Regular procedure European employee in the

Netherlands can obtain a

The international group of 105. In case no exceptional residence permit for the

companies need to have an application procedures are purpose "stay with

annual turnover of at least applicable, the procedure for partner/husband". The

EUR 50 million; new recruited employees most residence permit should

The foreign employee is in likely needs to be followed. include the notification that no

the possession of at least a This is a more time-consuming work permit is required.

procedure because of the

bachelor degree, has a 110. Exception 3: if the foreign

management or key prerequisites of prior

notification of the vacancy and employee is in the possession

position and has a monthly of a residence permit under

gross wage of at least EUR fulfilling recruitment efforts.

the heading 'Arbeid vrij

4,500 (EUR 4,860.00 106. The employer should actively toegestaan', no work permit is

including 8% holiday pay) investigate whether personnel required. This type of

(figure 2019); is available on the EEA labor residence permit is open for

In addition, trainees can market. First of all, the employees that have:

under certain conditions employer should therefore

advertise the vacancy in An uninterrupted

also be assigned on an residence permit and work

intra company base. A several newspapers

throughout the EEA and permit for at least five

traineeship program years, directly preceeding

professional journals, during a

outlining the tasks and the application for this

objectives must then be period of five weeks, and fulfill

sufficient additional new residence permit; or

available and a gross

monthly wage must be recruitment activities. A permanent residence

paid of EUR 3,299 (EUR 107. Secondly, the employer has to permit.

3,562.92 including 8% report the job vacancy with the

holiday pay, figure 2019). 111. Other exceptions: the

Dutch employment authorities following individuals do not

IV. Students (“UWV Werkbedrijf”) for at need a work permit (list is not

least five weeks, or for three exhaustive):

104. Employers are no longer months when the labor market

required to obtain a work for this kind of positions is Foreigners that reside

permit for students who, as very tight. We also recommend abroad and who are

being a part of their study at a the employer to report the job incidentally in the

Dutch institution, must follow vacancy with EURES Netherlands for business

a mandatory apprenticeship in (European Employment purposes provided that the

the Netherlands during their Services). employee stays in the

24 People and OrganisationYou can also read