CURETIS (ASX: CURE) - ADVANCING MOLECULAR MICROBIOLOGY - CORPORATE PRESENTATION OCTOBER 2018

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

CURETIS (ASX: CURE) - ADVANCING MOLECULAR MICROBIOLOGY

CORPORATE PRESENTATION

OCTOBER 2018

ARES

Technology

Platform

1

© 2018 Curetis N.V.DISCLAIMER & FORWARD LOOKING STATEMENTS

This document has been issued by Curetis N.V. (the “Company” and, together with its subsidiaries, the "Group") and does not constitute or form part of and should not be construed as any offer or

invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of the Company, nor shall any part of it nor the fact of its distribution form part of or be relied on in

connection with any contract or investment decision, nor does it constitute a recommendation regarding the securities of the Company or any present or future member of the Group.

In particular, this document is not an offer of securities for sale in the United States of America. Securities may not be offered or sold in the United States of America absent registration or an exemption

from registration under the U.S. Securities Act of 1933, as amended. Neither this document nor any copy of it may be taken or transmitted into the United States of America, its territories or possessions or

distributed, directly or indirectly, in the United States of America, its territories or possessions.

All information contained herein has been carefully prepared. However, no reliance may be placed for any purposes whatsoever on the information contained in this document or on its completeness. No

representation or warranty, express or implied, is given by or on behalf of the Company or any of its directors, officers or employees or any other person as to the accuracy or completeness of the

information or opinions contained in this document and no liability whatsoever is accepted by the Company or any of its directors, officers or employees nor any other person for any loss howsoever

arising, directly or indirectly, from any use of such information or opinions or otherwise arising in connection therewith.

Where third-party information has been used in this document, the source of this information has been identified. The information in this document that has been sourced from third parties has been

accurately reproduced and, as far as the Company is aware and able to ascertain from the information published by that third party, the reproduced information is correct. However, the Company has not

verified the reproduced information and does not guarantee nor bear or assume responsibility for the accuracy and completeness of the information from third-party sources presented in this document.

The information contained in this presentation is subject to amendment, revision and updating. Certain statements, beliefs and opinions in this document are forward-looking, which reflect the Company’s

or, as appropriate, senior management’s current expectations and projections about future events. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions

that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the

outcome and financial effects of the plans and events described herein. Statements contained in this document regarding past trends or activities should not be taken as a representation that such trends

or activities will continue in the future. The Company does not undertake any obligation to update or revise any information contained in this presentation (including forward-looking statements), whether

as a result of new information, future events or otherwise. You should not place undue reliance on forward-looking statements, which speak only as of the date of this document.

By attending, reviewing or consulting the presentation to which this document relates or by accepting this document you will be taken to have represented, warranted and undertaken that you have read

and agree to comply with the contents of this notice.

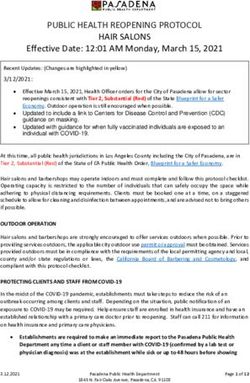

© 2018 Curetis N.V. 2KEY UPDATES CONTINUING TO EXECUTE De Novo request for Curetis‘ Unyvero System and Unyvero LRT Application Cartridge granted by U.S. FDA on 3 April 2018 Completed build-out of commercial team and initiated commercial roll-out of the Unyvero System and LRT Application in the U.S. Launched CE-IVD marked Unyvero UTI Urinary Tract Infection Cartridge and CE-IVD marked IAI Intra-Abdominal Infection Cartridge Raised additional financing of EUR 4.1 million in an equity offering (PIPE) and secured an additional USD 10 million equity facility1 Established U.S. Scientific Advisory Board (SAB) Unyvero HPN and BCU Application Cartridges received approval from Singapore Health Science Authority 1Accessible over a period of up to 36 months and subject to certain pre-agreed floor pricing © 2018 Curetis N.V. 3

CURETIS‘ VISION

MOLECULAR MICROBIOLOGY LEADERSHIP THROUGH PROPRIETARY PLATFORMS AND CONTENT

Striving for Molecular

Microbiology Leadership

MDx Platform MDx Content

*

ARESdb

Low- to High-Plex PCR Antibiotic Resistance

Broadest Sample Range Data Intelligence

* Unyvero A30 RQ Analyzer in development, latest design concept;

final product may differ; target CE-IVD-marking in late 2019 © 2018 Curetis N.V. 5CURETIS AT A GLANCE

A COMMERCIAL STAGE MOLECULAR DIAGNOSTICS COMPANY

Molecular Diagnostics Company with Focus on Severe Infections

Publicly Listed on Euronext Amsterdam and Brussels

Proprietary Unyvero Platform & Content

Commercial with CE-IVD and U.S. FDA-cleared Unyvero Products

Growing Global Presence & Installed Base

Strong R&D Pipeline

130 Employees

© 2018 Curetis N.V. 6IMPROVING CLINICAL PRACTICE IN MICROBIOLOGY

UNYVERO PROVIDES RAPID AND ACTIONABLE INFORMATION

Microbiology Culture Pathogen ID: 24-48h Antibiotic Susceptibility: 48-72h +

Informed

> Slow Therapy

Pathogen ID > Manual, laborious, complex

Unyvero & AMR Markers

4-5 h > Often misses hard-to-culture

Informed pathogens & multi-infections

> Fast Therapy

> Highly automated, Culture Unyvero

easy-to-use Time to informed therapy ▲ ▼

> PCR - no culture ▲ ▼

Potential

Unyvero

Length of stay

bias

Mortality ▲ ▼

> Find additional

pathogens and Total costs per case ▲ ▼

multi-infections Antibiotic Stewardship ▲ ▼

© 2018 Curetis N.V. 8UNYVERO IN A NUTSHELL

RAPID INFECTIOUS DISEASE TESTING FOR HOSPITALIZED PATIENTS

FAST

*

&

or COMPREHENSIVE PANELS

FLEXIBLE ON SAMPLE TYPES

*

* In development, latest design concept; final product may differ; EASY TO USE

target CE-IVD-marking in late 2019

IMPROVE CLINICAL OUTCOMES - SUPPORT ANTIBIOTIC STEWARDSHIP - CREATE HEALTHECONOMIC BENEFITS

© 2018 Curetis N.V. 9THE UNYVERO ADVANTAGE IN SYNDROMIC TESTING

FOCUS ON MULTIPLEXING AND SAMPLE FLEXIBILITY

* In development, latest design concept;

final product may differ;

target CE-IVD-marking in late 2019

© 2018 Curetis N.V. 10BROAD CARTRIDGE PORTFOLIO

SIX DISEASE-SPECIFIC CARTRIDGES WITH SYNDROMIC PANELS

Cartridge Indication area Number of targets* Sample types Clearance status

HPN** Severe cases of Pneumonia 48 targets****, Sputum, broncho-alveolar lavage, tracheal aspirate CE-IVD marked

pathogens (29) and

antibiotic resistance markers (19)

LRT Lower Respiratory Tract Infections 46 targets****, Tracheal aspirates U.S. FDA cleared

pathogens (36) and

antibiotic resistance markers (10)

ITI Severe cases of Implant and Tissue Infections 102 targets, Sonication fluid, swabs, striche, tissue, pus, aspirate/exudate, etc. CE-IVD marked

pathogens (85) and

antibiotic resistance markers (17)

BCU*** Bloodstream infections 103 targets, Positively flagged blood cultures CE-IVD marked

pathogens (86) and

antibiotic resistance markers (17)

IAI Severe Intra-Abdominal Infections Up to 130 targets, Paracentesis fluids, biliary fluids, peritoneal fluids, drainage fluids, retroperitoneal CE-IVD marked

pathogens (105), fluids, pus, swabs, samples from positively flagged blood culture bottles

toxins (3) and inoculated with other fluids than blood (IAI fluids such as ascites)

antibiotic resistance markers (22)

UTI Severe cases of Urinary Tract Infections 103 targets, Midstream urine, suprapubic aspiration, tissue CE-IVD marked

pathogens (88) and

antibiotic resistance markers (15)

*As of 31 July 2018 **HPN: Hospitalized Pneumonia ***BCU: Blood Culture Application

****Difference between HPN and LRT due to different reporting requirements between CE-IVD and © 2018 Curetis N.V. 11

U.S. FDA-cleared productsCURETIS‘ MARKET POTENTIAL

U.S. AND EUROPEAN MARKET WITH HIGH UNMET MEDICAL NEED ADDRESSABLE THROUGH

HOSPITAL-FOCUSED SALES CHANNELS

1,600,0006

2,329,0001

1,312,7005 > 9.73M

cases 1 CDC (2010); ECDC (2008); Chalmers et al. (2014)

2 Margolis et al. (2011); American Diabetes Association (2014); Diabetes Deutschland (2012); Richard et al. (2011); Livesly and Chow (2002);

2,128,2152 Dorner et al. (2009); Deutsche Gesellschaft für Verbrennungsmedizin (2014); Mayhall (2003); Klevens et al. (2007) in Jhung (2009); Geffers

(2001); Brun-Buisson (2011); Michelotti et al. (2012); Sunderlin (2006)

1,976,1304 3 Martin (2012); Statista (2015); Dellinger et al. (2013)

3 HCUP (2013); CDC (2010)

393,810

4

5 Martin (2012); Statista (2015)

6 ECDC (2013), Klevens et al. (2002)

The current Unyvero portfolio and pipeline of cartridges target over 9 million patients annually in EU and U.S.

with additional upside in Asia

© 2018 Curetis N.V. 12DUAL COMMERCIAL STRATEGY

COMBINATION OF DIRECT SALES & DISTRIBUTION PARTNERS

Towards Global

Commercial Reach

> Direct selling in Europe (DE,

UK, FR, BeNeLux) and U.S.

> 16 distribution partners

covering 29 countries in EU,

ME, and Asia

> Continuously expanding

partner network

Direct

Partner

© 2018 Curetis N.V. 13CURETIS‘ BUSINESS MODEL

INSTRUMENT PLACEMENTS AND CARTRIDGE UTILIZATION DRIVE SALES

TYPICAL SALES CYCLE 9-12 MONTHS IN EU / 6-9 MONTHS IN U.S.*

Microbiology Lab

“Razor / Razor-Blade“ - 24/7 day operation

Business Model - Minimal hands-on-time

> Systems placed under reagent-rental / rent-to-own in

direct sales markets

> ~ EUR 40,000 investment per installed system to be Hospital ICU & Clinicians

recouped by cartridge sales over time - Fast, actionable results

> Target customers using between 200-600 cartridges

Stakeholder - Point of need

per year Benefits - Antibiotic stewardship

> Customers utilizing growing menu of cartridges over

time

> 1-2 cartridges/day translate to approx. EUR 30,000-

75,000 recurring revenue potential per customer per

year Finance & Admin

- Improved health economics

- Increase margins on DRGs**

• Curetis management estimates based on sales experience in Europe and

experience of competitor firms in the U.S.

© 2018 Curetis N.V. 14

** Diagnosis-Related GroupsBALANCED MANUFACTURING SET-UP

CARTRIDGE MANUFACTURING IN HOUSE – INSTRUMENTS OUTSOURCED TO OEM

Cartridges

>Experienced manufacturing and QC teams (ex Abbott)

>ISO 13485 certified

>Dedicated 1,600 m² facility for cartridge manufacturing

§ Two ISO-8 and one ISO-7 clean-rooms

§ Three QC laboratories

§ Scalable capacity

Instruments

>Unyvero Systems manufactured by

Zollner Elektronik (Top-tier EMS Provider)

Logistics

>Logistics by Hegele and TNT

>Hundreds of shipments in last 12 months

>Over 100,000 cartridges manufactured to date

>Operational capacity estimated at up to 1 million cartridges (based on 24/7 processing) annually

>Seamless supply chain management

© 2018 Curetis N.V. 15OUTLOOK: GEOGRAPHIC EXPANSION

© 2018 Curetis N.V. 16UNYVERO LRT – CUTTING-EDGE MDX FOR THE U.S.

OFFERING UNIQUE ADVANTAGES FOR THE U.S. MDx MARKET

First approved molecular test to specifically address lower respiratory

tract infections

FIRST IN CLASS

PRODUCT

First FDA-cleared sample-to-answer molecular panel with broad coverage

of microorganisms and corresponding resistance markers

First FDA-cleared molecular diagnostics panel to include Legionella

pneumoniae

First molecular diagnostic panel for aspirate samples

© 2018 Curetis N.V. 17UNYVERO LAUNCH IN THE U.S.

Launched at ASM Microbe in June 2018 - Initial Focus on Hospitals and LTACs

LAUNCHED WITH FOCUS ON HOSPITAL AND LTAC*

MARKETS:

> Initially targeting about 1,000 Tier 1 and Tier 2 hospitals based on # of

ICU beds in each of the Territory Sales Manager territories

> Explore and qualify LTAC facilities associated with large hospital

networks

> Seek early adopters that embrace rapid results over current

methodology and that may not require extensive patient outcome study

support

> Target hospitals with strong antibiotic stewardship programs that may

gravitate to 2016 IDSA VAP/HAP guidelines

> Top-down and bottom-up approach with hospital “systems”, targeting

hospital network management and individual accounts in network,

Target influential KOLs per respectively *LTAC = Long term acute care

region for early adoption

© 2018 Curetis N.V. 18CURETIS USA – A STRONG & EXPERIENCED TEAM

DECADES OF COMBINED EXPERIENCE IN THE WORLD’S LARGEST MDx MARKET

CORE TEAM CURETIS USA INC.

Chris Emery Faranak Atrzadeh Rick Betts

President & CEO Curetis USA Director of Scientific Affairs, Curetis USA Director of Marketing, Curetis USA

> Location: San Diego > Location: San Diego

> 20+ years of experience in > Location: San Diego

healthcare and 10+ years in Dx and > 23 years in Dx space > 12 years in Dx space

pharma > Ex GenMark, Binding Site, Biosite > Ex Abaxis, Marketing agency owner,

> Ex Menarini Silicon Biosystems, (Alere), Ventana (Roche) Enterprise Software VP of Marketing

Abbott, CombiMatrix

REGIONAL SALES DIRECTORS

Scott Weiss

Michael Petrunich Sean Toddy

Director of Sales – West, Curetis USA

Director of Sales – East, Curetis USA Director of Sales – Central, Curetis USA

> Location: San Diego

> Location: Boston > Location: Cleveland

> 30 years in Dx space

> 34 years in Dx space > 20 years in Dx space

> Ex Trinity Biotech, Mikrogen, Cellestis

> Ex Abaxis, Oxford Immunotech, Cytyc > Ex Epic Sciences, Metabolon, ARUP

Corporation Laboratories, Cytyc Corporation

© 2018 Curetis N.V. 19U.S. DIRECT SALES TEAM & OUTLOOK

SET-UP TO BROADLY ROLL-OUT UNYVERO TO THE U.S. MARKET

Curetis U.S. Sales Team U.S. Outlook

> Executive Team > Launched at ASM Microbe in

June with first placements

> Territory Sales Managers expected in Q4 / 2018

> Clinical Application Specialists > Expect to place 40-50

> Field Service Specialists Analyzers within the first 6-9

> Warehouse management months, and 60-80 Analyzers

within in the first full year of

> Scientific Affairs commercial launch

> Marketing

> HR, Accounting, Admin

© 2018 Curetis N.V. 20U.S. Commercial Execution Update

STRONG PIPELINE - 10 NEAR-TERM OPPORTUNITIES WITH ESTIMATED AVERAGE OF 700 – 800*

(RANGE 250 to >1,600) LRT CARTRIDGES PER YEAR

Accounts qualified Potential near-

as potential buyers term

as of September 2018 commercial

opportunities

~1,000 140+ 60+ ca. 10

Potential Commercial Average annual

opportunities LRT cartridge

within 3-6 months volume

U.S. Hospitals initially based on in-depth est. at ca 700-800*

targeted for Unyvero LRT qualification per account

* Based on Curetis management estimates

© 2018 Curetis N.V. 21PLANNED U.S. UNYVERO PORTFOLIO EXPANSION

LRT LABEL CLAIM EXTENSION & NOVEL IJI INVASIVE JOINT INFECTION CARTRIDGE FOR THE U.S.

MARKET

UNYVERO LR UNYVERO IJI

T– IN

EXTENDED V DEVELOPME

ERSION NT

LRT Label Claim Extension IJI Invasive Joint Infection Cartridge

Expand LRT intended use to bronchoalveolar

lavage (BAL) samples > Next Application Cartridge for the U.S. market

> Use LRT for aspirates as predicate device in a > Synovial fluid sample collection has been

510(k) submission initiated in Q4 2017 and is ongoing at multiple

sites in the U.S.

> Working closely with FDA reviewers to identify

most appropriate path to suitable BAL data > Initiation of first sites for prospective arm of

package trial expected to start in H2-2018

> Aiming to initiate further data collection

(if required) in 2018

© 2018 Curetis N.V. 22GEOGRAPHIC EXPANSION: CURETIS IN CHINA

CHINA REPRESENTS A STRONG POTENTIAL MARKET FOR CURETIS

Distribution Agreement with Beijing Clear Biotech (BCB)

> Covers China, Taiwan, and Hong Kong (via Technomed)

> BCB will conduct and fully fund all clinical trials for CFDA approval

> BCB commited to minimum purchase of Unyvero Systems and

Application Cartridges post CFDA approval

UPDATE ON CHINA

> Successfully completed analytical testing in China – Expect to leverage US FDA data for clinical part of submission

> CFDA trial to be carried out by our partner BCB with completion expected in 2019 and commercial impact expected from

2020 onwards

© 2018 Curetis N.V. 23MEDIUM TERM UPSIDE POTENTIAL THROUGH

PRODUCT PORTFOLIO DEVELOPMENT

© 2018 Curetis N.V. 24UNYVERO A30 RQ: SMALL, FAST, QUANTITATIVE

EXPANSION TO LOW- AND MID-PLEX APPLICATIONS

A30 RQ A30 RQ: Expected Key Features

A new mid-plex > Low- to Mid-plex with 5-30 targets

analyzer module for

Unyvero integration > Sensitive and quantitative real-time PCR technology

or standalone > Processes any native samples

operation. leveraging Unyvero Lysator when required

A30 RQ*

> Rapid 45-90 min time-to-result

> Easy to use with 2-5 min hands-on time

> Small footprint

> Point-of-care capable

> Low COGS Target: >66% reduction vs. current high-plex

Unyvero (Instrument & Consumables) at scale

Unyvero Modular Concept* > Modular concept for full integration with other Unyvero

modules or stand-alone operation

* in development, latest design concept; final product may differ; target

CE-IVD-marking in late 2019 © 2018 Curetis N.V. 25UNYVERO A30 RQ: R&D PROGRESSING AS PLANNED

TARGET LAUNCH LATE 2019

Current Development

Status

> Industrial designs

available; working with

external development

partners and design

ca. 16 inch

firm

> Expect to progress

development in 2018 ca. 10 inch

for CE-IVD marking in

A30 RQ*

late 2019

* latest design concept; final product may differ

© 2018 Curetis N.V. 26ARES TECHNOLOGY PLATFORM

DATA INTELLIGENCE FOR MOLECULAR MICROBIOLOGY

Content for Unyvero

ARESdb & ARES Technology Platform

> Believed to be the world’s most comprehensive database on the genetics of AMR

covering > 30 years of emerging antibiotic resistance

> Advanced bioinformatics and artificial intelligence solutions to inform infectious

diagnostics and therapeutics

> Broad IP coverage of biomarkers expected to fuel Curetis’ Unyvero Platform with

Pharma Services unique & proprietary content mid- to long-term

> Collaboration-based business model to fast-track digital AMR solutions; ongoing

partnering discussions with global industry leaders

ARESdb

AMR Interpretation Solutions

NGS Tools &Services

© 2018 Curetis N.V. 27ARES GENETICS MILESTONES

LEADING MOLECULAR MICROBIOLOGY WITH GLOBAL PARTNERS

2.0

*

* Total project volume funded with an average funding rate of about 40%

© 2018 Curetis N.V. 28WHY CURETIS?

LEADER IN MOLECULAR MICROBIOLOGY WITH MULTIPLE PLATFORMS, PRODUCTS, AND

DIFFERENTIATED CONTENT

Versatile Unyvero MDx Platform: Sample-to-Answer MDx allowing broad range of applications: from 5+ target triage-screen, via 10 to 30

target rapid tests to 100+ target syndromic panels

Validated Products in an Attractive Market: Unique Unyvero System and Applications address high unmet needs in some of the most

prevalent infectious disease indications in hospitalized patients

Unique U.S. Application: Unyvero LRT, recently cleared by U.S. FDA, is a first-in-class product, currently with no direct MDx competition in

the U.S. market

Seasoned U.S. Team: Curetis has a seasoned U.S. team in place to capture this market opportunity and drive growth after the recent FDA

clearance and Unyvero LRT launch in the U.S.

Strong Technology Base: Broad patent portfolio covering key aspects of sample preparation, nucleic acid amplification and detection, and

molecular microbiology content

Partnering Opportunities: Further near-, mid- and long-term partnering opportunities beyond the core business in the rapidly growing market

for PCR and NGS-based Molecular Microbiology (Unyvero Application Cartridge Pipeline, Unyvero A30 RQ Platform Expansion, ARESdb &

ARES Technology Platform)

© 2018 Curetis N.V. 29APPENDIX

© 2018 Curetis N.V. 30STRONG MANAGEMENT BOARD

COMBINES DECADES OF OPERATIONAL AND COMMERCIAL EXPERIENCE

Oliver Schacht, Ph.D., CEO Dr. Achim Plum, CBO Johannes Bacher, COO &

~20 years in MDx and biotech ~20 years in commercial roles in Co-Founder Curetis

(ex CFO Epigenomics AG and IVD/MDx, Biotech & Pharma ~20 years R&D and

CEO Epigenomics, Inc.) (ex Siemens, Epigenomics, management experience

Schering) (ex Hewlett Packard, Agilent

Technologies, Philips)

© 2018 Curetis N.V. 31MANAGEMENT TEAM WITH DEEP DOMAIN EXPERTISE

COMBINES DECADES OF OPERATIONAL AND COMMERCIAL EXPERIENCE

Christopher Emery Dr. Sabine Müller Dr. Michael Schleichert

President & CEO Curetis USA Inc. Head of Marketing EMEA Director IVD Development

Riwat Lim Heiko Schorr Dr. Gerd Luedke*

Director Commercial Operations Director Finance Director Innovation,

EMEA Technology and IP*

Dr. Helmut Hilbert Bernd Bleile

Head of Business Development General Counsel

Dr. Andreas Posch

Andreas Boos*

Managing Director

CTO and Managing Director

Ares Genetics GmbH

Curetis GmbH

© 2018 Curetis N.V. • Co-Founder Curetis 32SUPERVISORY BOARD

EXPERIENCED AND DIVERSE NON-EXECUTIVE SUPERVISORY BOARD

William E. Rhodes, III Mario Crovetto Dr. Rudy Dekeyser

Chairman of the Board; Chairman of the Audit Committee; Member of the Board;

Chairman of Remuneration ex CFO Eurand / Recordati, LSP,

Committee; Italy Belgium

ex Becton Dickinson,

USA

Dr. Werner Schäfer Prabhavathi Fernandes, Ph.D. Dr. Nils Clausnitzer

Vice chairman; Member of the Board; Member of the Board;

Chairman of Nomination & ex CEO of Cempra Pharmaceuticals VWR International LLC / VWR

Appointment Committee; Inc., Bristol-Myers Squibb GmbH

ex COO Roche Diagnostics, Pharmaceutical Research Institute, ex QIAGEN, Olympus, Abbott

Abbott Laboratories, Germany

Germany

USA

© 2018 Curetis N.V. 33CURETIS OVERVIEW

KEY FACTS AT A GLANCE

Curetis N.V. Shareholders**

LSP

C Partners (ex aeris Capital)

• Listed on Euronext Amsterdam and Brussels 17%

Forbion

27%

• Ticker symbol: CURE HBM

Aviva

• IPO: 11th Nov 2015 14%

Mila ya Invest

• No. shares outstanding: 16,392,577 6%

Roche

6% 8%

• Current market capitalisation: €53 M* KfW (Federal Republic of Germany)

7% 8% Fre e Float

7%

Research Analyst Coverage

Analyst Institution Location

Kevin DeGeeter Ladenburg Thalmann New York, NY, U.S.

Chris Redhead goetzpartners London, U.K.

Stéphanie Put Degroof Petercam Brussels, Belgium

* Source: Euronext as of 26 September 2018

© 2018 Curetis N.V. 34

** As of 05 June 2018FINANCIAL REPORTING

KEY FIGURES FIRST HALF-YEAR 2018 & FINANCIAL CALENDAR 2018

Key Figures H1-2018 2018 Financial Calendar

For the six months ended 2017 2018* Report Release Date

30 June

Global Installed Base as of 30 June (Analyzers) 175 162

FY 2017 30 Apr 2018

Revenue (in thousand EUR) 595 807

Q1 2018 18 May 2018

Net cash and cash equivalent at the end of the 25,401 11,646**

period (in thousand EUR) AGM 21 Jun 2018

- Net cash & cash equivalents at the beginning of 22,832 16,311**

the year H1 2018 14 Aug 2018

- Net decrease in cash & cash equivalents 2,786 -4,912

- Effects of exchange rate changes of cash & cash

equivalents -217 247 Q3 2018 16 Nov 2018

* Unaudited first half-year 2018 financials, published on 14 August 2018

** Includes total of EUR 13 M tranches (10 Mio in 2017 and 3 M in 2018) of a debt financing facility provided by the European Investment

Bank (EIB), a EUR 4.1 M in a private equity placement and issued 854,166 new shares and secured access to an additional USD 10 M

equity facility offered by Global Corporate Finance.

© 2018 Curetis N.V. 35OUTLOOK 2018 & BEYOND

COMMERCIAL EXECUTION, DEAL FLOW, PORTFOLIO DEVELOPMENT

Curetis expects to…

… convert U.S. and EMEA commercial opportunities for Unyvero into near-term deal closures and revenue contribution.

… expand its distribution network and commercial reach through further partnerships with suitably positioned distributors worldwide.

… continue to work with BCB to finalize the CFDA study and regulatory submission to gain market access in China.

… execute on and expand its partnership with MGI / BGI to develop and commercialize solutions for NGS-based Molecular Microbiology.

…execute on all R&D programs including a Unyvero LRT Cartridge label claim extension for BAL, IJI clinical studies in the U.S., Unyvero A30 RQ

development expected for CE-IVD launch in late 2019, and further development of ARESdb and the ARES Technology Platform.

…enter into further value-adding R&D and commercial partnerships with well-known industry players around ARESdb and the ARES Technology Platform

as well as the Unyvero Platform.

… continue to assess all tactical and strategic financing options in the debt and equity capital markets globally to raise additional growth capital as either

equity or debt in 2018 in order to fund continued operations for at least the next 12 months.

© 2018 Curetis N.V. 36Curetis N.V.

Max-Eyth-Str. 42

71088 Holzgerlingen | Germany

Tel.:+49 (0)7031/49195-10

E-Mail: ir@curetis.com

www.curetis.com

© 2018 Curetis N.V. 37You can also read