Corporate Presentation July 2020 New Discovery in the El Tigre Silver District

←

→

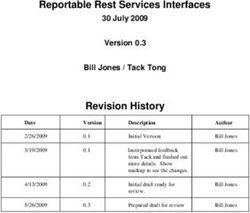

Page content transcription

If your browser does not render page correctly, please read the page content below

Forward Looking Statements This Silver Tiger Metals Inc. (“Silver Tiger” or the “Company”) presentation contains certain statements, which may constitute “forward-looking information” under Canadian securities law requirements and “forward looking statements” under applicable securities laws (“forward-looking information”). All statements other than statements of historical fact contained in this presentation, including, but not limited to, statements with respect to the future financial position and results of operations, strategy, plans, objectives, goals and targets, anticipated commencement dates of exploration and development programs and mining operations, projected quantities of future production, costs and expenditures and conversion of mineral resources to reserves of Silver Tiger, may constitute forward-looking information. Forward-looking information can be identified by the use of words such as “could”, “expect”, “believe”, “will”, “may”, “intend”, “plan”, “estimate”, “anticipate”, “predict”, “project” and similar expressions and statements relating to matters that are not historical facts. Forward-looking information involves known and unknown risks and uncertainties and other factors, including those described under the heading “Risk Factors” in the annual information form of Silver Tiger dated September 10, 2019 and in documents incorporated by reference therein, which may cause the actual results, performance or achievements of Silver Tiger to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. These factors include, among others, the ability of Silver Tiger to operate as a going concern; mineral exploration, development and operating risks; the Company’s limited operating history; the Company’s capital requirements for current and planned exploration and development; the trading price and volatility of the Company’s common shares; global financial volatility; volatility of commodity prices; risks related to operating in a foreign jurisdiction; and reliance on key members of management. Forward-looking information is based on assumptions that Silver Tiger believes to be reasonable. Key assumptions upon which the Company’s forward- looking information is based include, but are not limited to: that commodity prices will not decline significantly nor for a lengthy period of time; that the Company’s mineral resource and reserve estimates are accurate; that the Company will have sufficient working capital and be able to secure additional funding necessary for the continued exploration and development of the Company’s property interests; and that key personnel will continue their employment with the Company. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information in this presentation is made as at July 3, 2020 and the Company undertakes no obligation to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than where a duty to update such information or provide further disclosure is imposed by applicable law. The Technical Information contained in this presentation has been reviewed and approved by David R. Duncan, P. Geo., VP Exploration, Silver Tiger, who is a Qualified Person as defined in NI 43-101. www.silvertigermetals.com https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 2

El Tigre Project – Sonora, Mexico

• Silver Tiger owns 100% of the 28,414 ha El Tigre District (35

El Tigre Project

km long, which includes 25 km of trend of the prolific Sierra

Madre Au-Ag belt)

• Newly discovered northern vein extension of the El Tigre

deposit (maiden NI 43-101 compliant resource estimate

containing 661K oz AuEq (indicated) and 341K oz AuEq

(inferred))

• Past producing El Tigre mine historical records document

production of 67.4 million ounces of silver and 325,000

ounces of gold at an average grade of over 2 kg/tonne AgEq

• Silver Tiger’s maiden NI 43-101 compliant resource estimate

was based on only drilling of 2 of the 11 precious metals

bearing vein structures over a distance of 1.5 km

• Surface mapping and sampling at El Tigre indicate a

potential strike length of in excess of 20 km

• Step out drilling by Silver Tiger on the un-mined, high-grade

veins several kilometres north of the end of the historic El

Tigre Mine returned bonanza grades including 0.85 m of 37.2

g/t Au and 7,339 g/t Ag and 1.5 m of 1,107 g/t Ag (all within a

vertical depth of 180 m)

• These bonanza grades provide plenty of leverage to the drill

bit with potential multi-kilogram Ag intercepts

• In 2020, Silver Tiger will conduct a 10,000 m, 80-hole drill

program on the un-mined, multi-kilometres long vein

extensions to the north of the historic El Tigre Mine San Dimas Mine

Resource: 1.5M oz Au & 135M oz Ag

Produced >11M oz Au & >580M oz Ag

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 3El Tigre District

Unexplored property with Sizable existing resource Bonanza grade vein Proven exploration team

the historic, high-grade with district scale targets discovered 2 km and compelling value

El Tigre Mine potential north of the historic mine

• 28,414 ha property located in • Delivered maiden NI 43-101 • Exceptionally high-grade veins • Led by David Duncan (P.Geo),

Sonora, Mexico in the prolific resource estimate of 661K oz 2 km north of the El Tigre Mine with >40 years of exploration

Sierra Madre Au-Ag Belt AuEq (indicated) and 341K oz ‒ Productora vein: 3.15 m of 36.6 g/t experience and has led teams

• Access to key infrastructure AuEq (inferred)1 AuEq, including 0.85 m of 37.2 g/t that have discovered >3.6M oz

Au and 7,338.9 g/t Ag and 1.5 m of of gold resources in Mexico

(roads/highways, grid power, • Resource based on only 2 of 11 1,107.36 g/t Ag and 0.024 g/t Au

water and skilled labour) known vein structures along a ‒ Ramon Luna (Project Manager)

‒ Caleigh vein: 0.75 m of 10.91 g/t has 20 years of experience as a

5.3 km long system

• El Tigre Mine produced 67.4M Au and 2,830.4 g/t Ag and 0.50 m geologist in Mexico and has led

oz of silver and 325,000 oz of • Intersected high-grade veins of 10.0 g/t Au and 2,247.1 g/t Ag teams responsible for the

gold at 1,308 g/t Ag, and 7.54 400 m south and 2,000 m north discovery of 12M oz Au

• Many high-grade targets

g/t Au (1903-1938), which following 2019 channel • Trades at an EV/resource

• Mapping and sampling

equates to >100M oz AgEq at sampling program multiple of only C$38/oz AuEq

indicates over 20 km of

>2 kg/tonne AgEq mineralization • Targeting an 80-hole, 10,000 m ‒ 42% discount to weighted

• 6 km of the 35 km long El Tigre drill program for 2020 average of companies advancing

property has been explored primarily epithermal precious

metals projects in the Americas

with 1.5 km resource drilled

Unlocking the exploration potential of the historic El Tigre high-grade district in Sonora, Mexico

1. See slide 22 for footnotes regarding the NI 43-101 resource estimate

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 4Capital Structure

Tickers TSXV:SLVR, OTCQB:SLVTF

Share Price (July 3, 2020) C$0.21

52-Week Range C$0.04 – C$0.23

Basic shares outstanding 178.9M

Options 17.1M1

Warrants 7.7M2

FD shares outstanding 206.2M

Market capitalization C$36.7M (basic)

Cash ~C$800K

Shares held by 28.8M (16.1%)

management/directors/consultants

1. 17,065,000 options outstanding with a weighted average exercise price of C$0.20/share and a weighted average life of 5.4 years

2. Includes 2,884,612 warrants with an exercise price of C$0.17 expiring on September 17, 2020 and 4,821,429 warrants with an exercise price of C$0.10/share expiring on

May 22, 2022

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 5Experienced Management and Board

Glenn Jessome (JD, MBA), President, CEO and Director Keith Abriel (CPA, CA, CFA), Chairman

• Founding shareholder of Silver Tiger and oversaw the listing of the • Previously the CFO of DHX Media Ltd., Linear Gold Corp., Stockport

Company on the TSXV Exploration Inc. and Ucore Uranium Inc. and Director of Rhino Resources

• Extensive capital markets experience primarily in the resource sector as a • Past President of the Atlantic Canada CFA Society

securities lawyer

Wade Anderson (CPA, CA), Director

• Corporate Secretary of GoGold Resources Inc.

• Principal with Dylke and Company, a firm specializing in professional

• Member of TSXV National Advisory Committee accounting and advisory services to privately held business interests in

Western Canada

Glenn Holmes (CPA, CA), CFO, Corporate Secretary and Director

• Director of El Tigre Silver Corporation from 2007 to 2015

• 30 years of experience in the financial management of exploration and

mining companies • Also served as a director of numerous private companies in the agriculture

and mining sectors

• Previously the CFO of Etruscan Resources and the VP Finance and

Secretary Treasurer of NovaGold Resources Richard Gordon, Director

David Duncan (P.Geo), Vice President of Exploration • Mining executive with over 25 years of experience working on exploration

and development stage projects

• 40 years of experience across Canada, West Africa and Mexico

• Former Director of Investor Relations for Etruscan Resources Inc.

• Managed the exploration of many projects (San Diego, La Lajita, Parral and

Esmeralda Tailings, Santa Gerturdis, Los Ricos and El Tigre) with a Michael Anaka (ICD.D), Director

combined resource of >3.6M oz Au

• 40-year career at PricewaterhouseCoopers LLP, where he acted as the

• Managed exploration/development programs culminating with 7 gold Atlantic Region Managing Partner and member of the Canadian

mines (Pine Cove, Rambler, Dufferin, Samira Hill, Youga and Agbou) Leadership Group

• Formerly with Algoma Ore, Kidd Creek Mines, Falconbridge, WMC and • CEO and Director of Vivre Communities Inc. (TSXV)

Etruscan

Kevin Lindsey (FCPA, FCMA, ICD.D), Director

Ramon Luna, Project Manager

• 34-year career with the federal government

• 20 years of experience as a geologist in Mexico

• Former CFO at the Department of National Defence and Industry Canada

• Led or was part of teams responsible for the discovery of 12M oz Au and

• Former senior executive of the Treasury Board

the development of Magistral, Ocampo, El Cubo, Orion, Guadalupe, Calvo,

Santa Gertrudis, Los Ricos and El Tigre deposits • Director of a large credit union and export finance/insurance company

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 6Underexplored Region of the Sierra Madre Belt

• Located in the northern portion of the El Tigre Project

Sierra Madre Au-Ag Belt Resource: 1M oz AuEq

• 28,414 ha property located in the state of

Santa Gertrudis Project

Sonora, Mexico Resource: 1.3M oz Au & 62M oz Ag Las Caridad Mine

Reserves: 24.1B lbs Cu

• 236 km northeast of the capital of Sonora Las Chispas Project

Resource: 613K oz Au & 62M oz Ag

Produced >9.6B lbs Cu

(Hermosillo) and 230 km southeast of

Tucson, Arizona

Delores Mine

• 40 km northeast of the La Caridad mine Resource: 1.4M oz Au & 45M oz Ag

Produced >100K oz Au & >38M oz Ag

(35K tpy copper operation) Mulatos Mine

Resource: 4.4M oz Au & 12M oz Ag

• 95 km northeast of SilverCrest’s Las Produced >2.2M oz Au

Chispas Ocampo Mine

Pinos Altos Mine

Resource: 2.5M oz Au & 61M oz Ag

Resource: 2.5M oz Au & 118M oz Ag

• 125 km east of AEM’s Santa Gertrudis

Produced >2.2M oz Au & >23M oz Ag

Produced >700K oz Au & >30M oz Ag

Palmarejo Mine

Resource: 1.5M oz Au & 111M oz Ag

Produced >1.1M oz Au & >71M oz Ag

Bolivar Mine

Resource: 19.3M oz Ag & >700M lbs Cu

Produced >4M oz Au & >144M lbs Cu

El Gallo Mine

Produced >300K oz Au

Cienega Mine

Resource: 1.5M oz Au & 129M oz Ag

Produced >2.6M oz Au & >66M oz Ag

San Dimas Mine

Resource: 1.5M oz Au & 135M oz Ag

Produced >11M oz Au & >580M oz Ag

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 7Large Property with Access to Key Infrastructure

Federal Highway 17

• Access through Federal

Highway 17 and 45 km road

• 15 km from a large water

reservoir

• 18 km from the electrical

power grid

• Skilled labour available from

nearby mining towns

(Esqueda, Nacozari and Agua

Prieta)

• Only 6 km of the 35 km long El

Tigre property has been

explored

100% ownership of 28,414 ha of mining claims that are royalty-free with no Ejido.

Purchased 6,238 ha of land around the old El Tigre Mine

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 8El Tigre Property

Historical Production and Exploration History

1896 • Gold discovered in the Gold Hill area by James Taylor Overhead picture of the historic El Tigre Mine

1911 Today

1903-1938 • El Tigre Mining Company commences mining in the Brown Shaft

area

• Milling operation established at 75 tons/day, and was expanded

over time to 175 tons/day

‒ Overall silver recovery of 93%-95%

• 3 main veins were mined (El Tigre, Sooy and Seitz-Kelly)

‒ 14 mine levels developed (~450 m of dip) along 1.6 km of strike

‒ Mine cutoff grade was 15 oz/ton Ag and mined widths were 1-5 m

• From 1903-1927, mined 1.2M tonnes averaging 1,308 g/t Ag, 7.54 g/t

Au and produced 50.4M oz Ag and 290,500 oz Au

• Estimated to have produced 70-75M oz of silver and 325K-350K oz

Au by the time the mine closed in 1938 due to low silver prices

1981-1984 • Anaconda Minerals completes first modern exploration program

• Surface geological mapping, underground surveying, 22 drill holes

(7,812 m) and 352 m of exploration drifting of the Fundadora Vein

1995 • Minera de Cordillaras drills 4 holes (890 m) of deeper vein system

2011-2013 • El Tigre Silver Corp. completes 59 drill holes totaling 9,411 m

• Confirms extension of El Tigre, Sooy and Seitz Kelly veins

• Intersected bulk-tonnage Au-Ag mineralization across Gold Hill

stockwork zone

2016-2019 • 2016-2017: drilled 62 holes totaling 11,923 m

(Silver • Oct 2017: maiden NI 43-101 compliant resource estimate

Tiger) • Fall 2017: 600 m drill program on the Caleigh and Protectora veins

• 2018: prospecting and mapping confirms ~20 km long system

• 2019: sampling and mapping of the Caleigh, Combination,

Protectora and Aguila veins

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 9Veins at Surface – 5.3 km

• Gold-silver primarily contained in

fissure veins and surrounding lower-

grade stockwork halos within a narrow,

5.3 km long north-trending belt

• 11 known veins across the district

‒ Northern section: Aguila, Caleigh,

Fundadora, Protectora and Las Aguilas

‒ Southern section: El Tigre, Sooy, Seitz-

Kelly and Combination

‒ Other veins: La Chula and Santa Maria

• Similarities to other large-scale low

sulphidation epithermal system across

the Sierra Madre Belt

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 10El Tigre Project

NI 43-101 Compliant Resource Estimate1

Indicated resource

Inferred resource

Zone Class Cut-Off Tonnes Grade Contained Metal

g/t AuEq 000s g/t Au g/t Ag g/t AuEq 000 oz Au 000 oz Ag 000 oz AuEq

El Tigre pit constrained Indicated 0.20 25,170 0.51 15 0.69 416 11,906 559

Inferred 0.20 2,791 0.38 12 0.52 34 1,093 47

El Tigre underground Indicated 1.50 207 0.46 156 2.33 3 1,041 16

Inferred 1.50 11 1.27 82 2.26 0 29 1

Fundadora pit constrained Indicated 0.20 451 0.93 167 2.94 14 2,428 43

Inferred 0.20 1,774 0.69 150 2.49 39 8,554 142

Fundadora underground Indicated 1.50 80 1.03 118 2.45 3 306 6

Inferred 1.50 2,003 0.60 140 2.28 38 9,044 147

El Tigre tailings Indicated 0.37 939 0.27 78 1.21 8 2,345 37

Inferred 0.37 101 0.27 79 1.22 1 254 4

Total Indicated 0.20,0.37,1.50 26,847 0.51 21 0.77 444 18,026 661

Inferred 0.20,0.37,1.50 6,680 0.52 88 1.59 112 18,974 341

• Prepared by P&E Mining Consultants with an effective date of September 7, 2017

• Based on drill database of 147 drill holes (30,037 m) and 752 underground chip samples

1. See Appendix for footnotes relating to the mineral resource estimate

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 11El Tigre Project

Historic Underground Development and Drilling

Mined out stope

Underground workings

Drill intercept >0.2 g/t AuEq

• Historic El Tigre underground mine (1903-1938) was • Historical drill programs focused on the El Tigre deposit

developed 1,600 m along strike over 14 mine levels to a

depth of 450 m Company Period Drill Holes Meters Drilled

• From 1903-1927, mined 1.2M tonnes averaging 1,308 g/t Anaconda 1982-1983 22 7,813

Ag, 7.54 g/t Au and produced 50.4M oz Ag and 290,500 oz Minera de Cordillaras 1995 4 (RC) 890

Au El Tigre Silver 2011-2013 59 9,411

Silver Tiger Metals 2016-2017 69 12,523

Total 154 30,637

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 12El Tigre Project

Step-Out Drill Results

• 2016-17 drill program intersected many near-surface, wide zones of high-grade gold-silver mineralization

• Several step out holes completed at the end of 2017 had encouraging results 400 m to the south and 800 m to the north (in

the Protectora vein) of the old El Tigre Mine

‒ South step-outs: 67.6 m of 1.49 g/t AuEq from 78.5 m down-dip (ET-17-133) and 9.0 m of 1.86 g/t AuEq from 35.0 m down-dip (ET-17-140)

‒ North step out (ET-17-144): 3.15 m of 36.6 g/t AuEq from 88.25 m down-dip, including 0.85 m of 135.1 g/t AuEq and 1.5 m of 1,107.36 g/t Ag

from 188.65 m ET-83-015

1.5 m @ 21.5 g/t AuEq

ET-17-133 ET-17-144

67.6 m @ 1.49 g/t AuEq 3.15 m @ 36.6 g/t AuEq

(1.24 g/t Au and 19.1 g/t Ag) Including 0.85 m of 135.1 g/t AuEq (37.2

ET-17-135 g/t Au and 7,338.9 g/t Ag) and 1.5 m of

37.7 m @ 0.78 g/t AuEq 1,107.36 g/t Ag and 0.024 g/t Au

ET-17-140 (0.62 g/t Au and 12.4 g/t Ag)

9.0 m @ 1.86 g/t AuEq (125.5 g/t

Ag and 0.18 g/t Au)

ET-82-001

Including 1.5 m @ 9.54 g/t AuEq

1.2 m @ 4.09 g/t AuEq

(683 g/t Ag and 0.43 g/t Au)

• Historic El Tigre underground mine (1903-1938) was • Numerous historical drill programs focused on the El

developed 1,600 m along strike over 14 mine levels to a Tigre deposit

depth ofstep

• Several 450 out

m holes completed at the end of 2017 had encouraging results

Company400 m to the south and

Period 2,000

Drill m toMeters

Holes the north

Drilled

• (in the1903-1927,

From Caleigh and Protectora

mined veins)averaging

1.2M tonnes of the old El Tigre

1,308 g/tMine Anaconda 1982-1983 22 7,813

‒Ag, 7.54by

South g/tAnaconda

Au and

step-outs: 67.6produced 50.4M

m of 1.49 g/t AuEq oz Ag1.2

from and

78.5 m 290,500

down-dipoz(ET-17-133)Minera

and 9.0demCordillaras 1995 35.0 m down-dip

of 1.86 g/t AuEq from 4 (RC) (ET-17-140)890

• Drilling in 1983 intersected m of 4.09 g/t AuEq at a 600 m depth (down-dip), demonstrating the excellent

‒AuNorth step

potential out (ET-17-144):

to define 3.15 mresources

high-grade of 36.6 g/t AuEq El Tigre0.85

from 88.25 m down-dip, including

at depth

Silver

m of 135.12011-2013

g/t AuEq (37.2 g/t59

Au and 7,338.99,411

g/t Ag)

and 1.5 m of 1,107.36 g/t Ag from 188.65 m Silver Tiger Metals 2016-2017 69 12,523

• Drilling by Anaconda in 1983 intersected 1.2 m of 4.09 g/t AuEq at a 600 mTotal 154 the excellent

depth (down-dip), demonstrating 30,637

potential to define high-grade resources at depth

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 13El Tigre Project

Caleigh Vein

Hole ID From To Length Au Ag AuEq

• Located 2 km north of the old El Tigre Mine (m) (m) (m) (g/t) (g/t) (g/t)1

• Numerous exceptionally high-grade intercepts from the Q4 T-17-145 3.50 29.25 25.75 0.65 91.9 1.88

2017 drill program (600 m) including 27.70 29.25 1.55 5.35 1380.1 23.75

‒ 0.85 m of 37.2 g/t Au and 7,338.9 g/t Ag (135.1 g/t AuEq) including 28.50 29.25 0.75 10.91 2830.4 48.65

‒ 0.75 m of 10.91 g/t Au and 2,830.4 g/t Ag (48.7 g/t AuEq) from 28.5 m ET-17-146 68.85 71.80 2.95 0.94 138.7 2.79

‒ 0.50 m of 10.0 g/t Au and 2,247.1 g/t Ag (40.0 g/t AuEq) from 90.1 m and 81.20 90.80 9.60 0.34 23.8 0.66

• Reminiscent of bonanza silver and gold grades mined in the including 81.20 82.60 1.40 0.40 113.9 1.92

1920/30s at the old El Tigre Mine ET-17-147 98.70 102.00 3.30 0.19 62.3 1.02

Including 101.20 102.00 0.80 0.20 150.1 2.20

ET-17-148 90.10 95.35 5.25 1.08 218.0 3.98

including 90.10 94.00 3.90 1.40 292.4 5.30

including 90.10 90.60 0.50 10.00 2247.1 39.96

ET-17-149 15.50 17.05 1.55 0.14 27.6 0.51

and 32.10 35.60 3.50 0.16 25.7 0.51

including 32.70 33.20 0.50 0.42 85.6 1.56

and 55.50 56.50 1.00 0.29 32.7 0.72

ET-17-150 21.40 24.15 2.75 0.23 23.1 0.54

including 21.40 22.00 0.60 0.54 81.3 1.63

ET-17-151 60.70 61.90 1.20 0.15 24.7 0.48

1. AuEq based on a 75:1 gold:silver ratio

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 14El Tigre Project 2018 Exploration Adit Channel Samples – Along Strike of Veins www.silvertigermetals.com https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 15

El Tigre Project

2019 Exploration Adit Channel Sampling Program

• Exceptionally high-grades from underground

exploration adit channel samples across the Caleigh,

Canon Combination and Protectora veins

‒ Caleigh: 0.50 m of 1,970.7 g/t Ag and 4.64 g/t Au and 0.50 m

of 1,896.3 g/t Ag and 6.40 g/t Au

‒ Canon Combination: 0.50 m of 1,793.7 g/t Ag and 0.25 g/t Au

‒ Protectora: 0.50 m of 378.0 g/t Ag and 2.01 g/t Au

• Provides many high-priority targets for the upcoming

2020 drill program

Vein Sample # Length Au Ag AgEq

(m) (g/t) (g/t) (g/t)1

Caleigh ETU-1005 0.5 10.13 966.6 1,726.31

Caleigh ETU-1006 0.5 4.64 1,970.7 2,318.35

Caleigh ETU-1007 0.5 6.40 1,896.3 2,375.97

Canon Combination ETU-1012 0.5 0.25 1,793.7 1,812.78

Canon Combination ETU-1013 0.5 0.26 364.9 384.40

Protectora ETU-1008 0.5 2.01 378.0 528.57

Protectora ETU-1004 0.5 1.12 340.4 424.66

Aguila ETU-1009 0.6 0.94 73.3 144.10

Aguila ETU-1010 0.5 0.90 212.6 280.08

Level 4 ETU-1011 0.5 0.08 41.4 47.63

Protectora ETS-2922 0.7 3.32 374.4 623.67

Protectora ETS-2923 0.5 0.57 192.3 234.72

Protectora ETS-2924 1.0 0.66 30.8 80.60

Protectora ETS-2925 0.5 1.00 168.9 243.67

1. AuEq based on a 75:1 gold:silver ratio

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 16El Tigre Project

Regional Exploration Potential

• Completed an extensive prospecting and

regional mapping program in 2018

• El Tigre Formation continues for an additional

5 km (southeast) towards the Lluvia de Oro

prospect

‒ El Tigre Formation was also identified a further 3

km to the south at La Mancha (site of old

workings)

• Identified historic underground workings at

the Santa Maria Target

‒ Identified quartz veins that are similar to El Tigre

• Surface mapping shows that the Protectora,

Caleigh and Fundadora veins extend at least

3 km to the north of the old El Tigre mine

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 17Proposed 2020 Exploration Program

• Follow-up drilling on the Protectora,

Caleigh and Fundadora veins north of

the old El Tigre mine

‒ These areas have not been mined or

extensively drilled

‒ Many drill targets were identified

following the mapping/sampling

programs in 2018-19

• Targeting exceptionally high-grades

(often >1,000 g/t Ag) at economically

mineable widths (1-5 m)

‒ We expect to replicate similar success

from late 2017 step-out drill holes at

Caleigh (0.75 m of 10.91 g/t Au and

2,830.4 g/t Ag) and Protectora (0.85 m of

37.2 g/t Au and 7,338.9 g/t Ag), except on

a larger scale drill program

• Targeting an 80-hole, 10,000 m drill

program for 2020

‒ Subject to completion of an equity

financing

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 18Silver Tiger is on VRIFY • El Tigre VRIFY slide deck and 3D presentation • VRIFY is a platform being used by companies to communicate with is on investors using 360° virtual tours of remote mining assets, 3D models and interactive presentations. VRIFY can be accessed by website and with the VRIFY iO3 and Android apps • Access the Silver Tiger Metals Inc. company profile on VRIFY at http://vrify.com • The VRIFY slide deck and 3D presentation for Silver Tiger Metals Inc. can be viewed at https:vrify.com/explore/decks/492 and on the Company’s website at www.silvertigermetals.com www.silvertigermetals.com https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 19

Contact Information

Corporate Office

• 1969 Upper Water Street, Purdy’s Tower, Suite 2108

https://www.facebook.com/SilverTigerMetals • Halifax, Nova Scotia, B3J 3R7

https://twitter.com/SilverTigerMtls Glenn Jessome, President, CEO and Director

https://www.linkedin.com/company/silver-tiger-metals-inc

• jessome@silvertigermetals.com

• (902) 492-0298

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 20Footnotes for the El Tigre Mineral Resource Estimate

1. El Tigre Deposit Mineral Resources are comprised of the El Tigre and Seitz Kelly Veins.

2. Fundadora Deposit Mineral Resources are comprised of the Aquila, Fundadora, Protectora and Caleigh Veins.

3. El Tigre Tailings Deposit Mineral Resources are comprised of the tailings from the former El Tigre operation.

4. Mineral Resources are reported within a constraining pit shell.

5. The Mineral Resource Estimate is reported in accordance with the Canadian Securities Administrators National

Instrument 43-101 and has been estimated using the CIM “Estimation of Mineral Resources and Mineral Reserves Best

Practice Guidelines and CIM “Definition Standards for Mineral Resources and Mineral Reserves.

6. Au:Ag ratio = ($1250/$17)/(70% Ag Rec/80% Au Rec)= 84:1 Therefore, AuEq=(Ag/84) + Au

7. Mineral Resources in this estimate are based on approx. two year trailing average metal prices of US$1,250 oz Au and

US$17 /oz Ag, estimated process recoveries 80% Au and 70% Ag, US$5.70/t process cost and US$0.80/t G&A cost.

Mining costs of US$1.55/t for open pit and $45/t for underground and tailings mining costs of US$5.50/t were used to

derive the respective Mineral Resource Estimate AuEq cut-offs of 0.20 g/t and 1.5 g/t and 0.37g/t. Pit optimization slopes

were 50 degrees

8. The Mineral Resource Estimate uses drill hole data available as of September 1, 2017.

9. Totals may not add correctly due to rounding.

10. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and

must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources

could be upgraded to Indicated Mineral Resources with continued exploration.

11. Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of

Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical,

marketing or other relevant issues.

www.silvertigermetals.com

https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 21Main Deposit 4150N – Geology and Geophysics www.silvertigermetals.com https://vrify.com/explore/decks/492 TSXV:SLVR │ OTCQB: SLVTF 22

You can also read