COMPANIES IN TRANSITION TOWARDS 100% RENEWABLES: FOCUS ON HEATING AND COOLING - IRENA ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

About the Coalition The IRENA Coalition for Action brings together leading renewable energy players from around the world with the common goal of advancing the uptake of renewable energy. The Coalition facilitates global dialogues between public and private sectors to develop actions to increase the share of renewables in the global energy mix and accelerate the global energy transition. About this paper This white paper has been developed jointly by members of the Coalition’s Working Group on Towards 100% Renewable Energy. Building on several case studies and first-hand interviews with companies, the paper showcases the opportunities and challenges experienced by companies in the industrial sector that have a target for 100% renewable electricity supply, and a meaningful and/or ambitious target or activities to increase the share of renewable energy in their heating and cooling operations. Acknowledgements Contributing authors: Rainer Hinrichs-Rahlwes (European Renewable Energies Federation), David Renné (International Solar Energy Society), Charlotte Hornung (former Energy Watch Group), Namiz Musafer (Integrated Development Association), Duncan Gibb and Chetna Hareesh Kumar (REN21), Aleksandra Mirowicz (The Climate Group), Stephanie Weckend, Emma Åberg, Kelly Tai and Anindya Bhagirath under the supervision of Rabia Ferroukhi (IRENA). Further acknowledgements: Valuable feedback and review were provided by Constantinos Peonides (Alectris), Britta Schaffmeister and Anton Schaap (Dutch Marine Energy Centre), Steven Vanholme (EKOenergy), Rohit Sen (ICLEI – Local Governments for Sustainability), Roque Pedace (INFORSE), Monica Oliphant (International Solar Energy Society), Tomas Kåberger (Renewable Energy Institute), Andrzej Ceglarz (Renewables Grid Initiative), Katerin Osorio Vera (SER Colombia), Jon Lezamiz Cortazar (Siemens Gamesa Renewable Energy), Maria Rojas and Tessa Lee (The Climate Group), Rina Bohle Zeller (Vestas), Bharadwaj Kummamuru (World Bioenergy Association), Anna Skowron (World Future Council), Jesse Fahnestock (former World Wide Fund for Nature), and Diala Hawila, Emanuele Bianco, Gayathri Prakash, Jinlei Feng and Nicholas Wagner (IRENA). The IRENA Coalition for Action would like to express special thanks and gratitude to senior representatives of companies interviewed for the case studies in this paper, including Flemming Lynge Nielsen, Rikke Skou Melsen and Martin Oredson Haugaard (Danfoss), Ishafir Izzadeen and Priyantha Dissanayake (Elpitiya Plantations PLC), Olaf Höhn (Florida Eis), Andreas Werner (Goess Brewery), Winston Chen and Paul Simons (Mars), and Kim Andre Lovas (TINE Group). Stefanie Durbin edited and Myrto Petrou designed this report. © IRENA 2021 Unless otherwise stated, material in this publication may be freely used, shared, copied, reproduced, printed and/or stored, provided that appropriate acknowledgement is given to IRENA as the source and copyright holder. Material in this publication that is attributed to third parties may be subject to separate terms of use and restrictions, and appropriate permissions from these third parties may need to be secured before any use of such material. ISBN: 978-92-9260-323-6 Citation: IRENA Coalition for Action (2021), Companies in transition towards 100% renewables: Focus on heating and cooling, International Renewable Energy Agency, Abu Dhabi. Disclaimer This publication and the material herein are provided “as is”. All reasonable precautions have been taken by IRENA and the IRENA Coalition for Action to verify the reliability of the material in this publication. However, neither IRENA, the IRENA Coalition for Action, nor any of its officials, agents, data or other third-party content providers provides a warranty of any kind, either expressed or implied, and they accept no responsibility or liability for any consequence of use of the publication or material herein. The information contained herein does not necessarily represent the views of all Members of IRENA or Members of the Coalition. Mentions of specific companies, projects or products do not imply any endorsement or recommendation. The designations employed and the presentation of material herein do not imply the expression of any opinion on the part of IRENA or the IRENA Coalition for Action concerning the legal status of any region, country, territory, city or area or of its authorities, or concerning the delimitation of frontiers or boundaries.

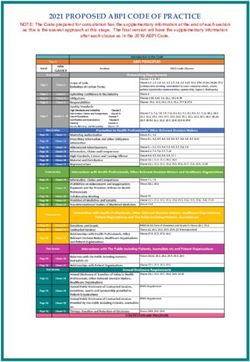

CONTENTS

FIGURES, TABLES AND BOXES..................................................................................................... 4

ABBREVIATIONS......................................................................................................................... 5

KEY FINDINGS............................................................................................................................ 6

1. INTRODUCTION...................................................................................................................... 7

2. DECARBONISING HEATING AND COOLING IN INDUSTRY.................................................... 10

2.1 Industry: The largest energy consumer....................................................................................................... 10

2.2 Renewable heating and cooling technologies and applications............................................................. 12

2.3 Sourcing models for renewable heating and cooling............................................................................... 14

3. ACCELERATING CORPORATE SOURCING OF RENEWABLE HEATING AND COOLING............ 16

3.1 Corporate target setting and drivers........................................................................................................... 16

3.2 The renewable heating and cooling challenge.......................................................................................... 19

4. KEY TAKEAWAYS AND LESSONS LEARNED............................................................................. 20

5. CASE STUDIES: COMPANIES IN TRANSITION ................................................................................ 23

Danfoss.................................................................................................................................................................... 24

Elpitiya Plantations.................................................................................................................................................27

Florida Eis................................................................................................................................................................ 31

Goess Brewery........................................................................................................................................................ 34

Mars ..........................................................................................................................................................................37

TINE Group - New Dairy Bergen........................................................................................................................... 41

REFERENCES............................................................................................................................. 454 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

FIGURES, TABLES

AND BOXES

Figure 1: Total final energy consumption in the industrial sector, 2017..........................................................................10

Figure 2: Working temperatures for various renewable heat technologies..................................................................12

Figure 3: Existing and potential corporate sourcing models for renewable heating and cooling..........................14

Figure 4: Corporate renewable energy targets......................................................................................................................16

Figure 5: Drivers for increasing renewable heating and cooling in industry.................................................................17

Figure 6: Number of countries with policies for renewable heating and cooling, 2009-2019................................18

Figure 7: Barriers to increasing renewable heating and cooling in industry.................................................................19

Table 1: Overview of featured company case studies......................................................................................................... 23

Table 2: Elpitiya Plantations energy generation and consumption by source, FY 2019/20.................................... 27

Box 1: Definition of 100% renewable energy............................................................................................................................ 7

Box 2: IRENA Coalition for Action Towards 100% Renewable Energy Working Group.............................................. 9

Box 3: Corporate sourcing of renewable electricity............................................................................................................... 11F O C US O N H E ATI N G A N D C O O LI NG 5 ABBREVIATIONS AEE INTEC AEE Institute for Sustainable Technologies °C Degree Celsius CHP Combined heat and power CO2 Carbon dioxide EPP Elpitiya Plantations PLC EUR Euro EV Electric vehicle GW Gigawatt GWh Gigawatt-hour hl Hectolitre HVO Hydrotreated vegetable oil IPCC Intergovernmental Panel on Climate Change kW Kilowatt kWh Kilowatt-hour kWhel Kilowatt-hour of electricity LPG Liquefied petroleum gas LUT Lappeenranta University of Technology (Finland) MW Megawatt MWh Megawatt-hour MWheq Megawatt-hour equivalent NGO Nongovernmental organisation PPA Power purchase agreement PV Photovoltaic SDG Sustainable development goal TFEC Total final energy consumption TWh Terawatt-hour USD United States dollar UTS University of Technology Sydney (Australia)

6 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

KEY FINDINGS

Driven by the cost-competitiveness of renewables With heating and cooling representing

and growing calls for sustainability amongst approximately 75% of energy used in industry,

investors and consumers, renewables have become which accounts for more than 25% of the global

an attractive source of energy for corporate users final energy consumption, the sector will play a

around the world. crucial role in the energy transformation towards

100% renewables. Currently, renewable energy

While companies are increasingly sourcing

only accounts for approximately 13% of total final

renewable electricity, the sourcing of renewable

energy consumption in industry.

heating and cooling is still in the early stages of

development due to, among other factors, its To further scale up corporate sourcing of renewable

context-specific and decentralised nature. heating and cooling in the industrial sector, the

following key takeaways may serve as guidance

and inspiration for governments and companies.

Setting national and subnational targets for 100% renewable

energy across all end-use sectors, including heating and

cooling, is key to driving the energy transformation in the

industrial sector.

Long-term government planning is particularly important for

decarbonising heating and cooling in industry.

Implementing ambitious regulatory, fiscal and financial policies

and incentives will help increase the share of renewables in

Key takeaways heating and cooling.

for governments Improving access to private capital for energy transition-related

technologies will encourage essential long-term investments.

Exploring innovative sourcing models for renewable heating

and cooling will further scale up progress.

Switching to renewable energy heating and cooling

brings important benefits beyond emission reduction.

Setting long-term corporate renewable heating and

cooling targets and implementation strategies accelerates

the decarbonisation of operations.

Considering the local context is key when choosing among

available pathways and technologies for renewable heating

and cooling.

Coupling renewable energy sourcing with measures to reduce

energy demand and improve energy efficiency is crucial.

Conducting further research and development across innovative

Key takeaways renewable energy technologies and infrastructure for heating

for companies and cooling is needed.

Improving data collection on companies’ renewable heating

and cooling operations can help monitor and adjust strategies

in support of established decarbonisation targets.

By working with local actors, such as governments, utilities,

communities and NGOs, companies can further accelerate the

energy transformation.F O C US O N H E ATI N G A N D C O O LI NG 7

INTRODUCTION 01

The objectives set out in the United Nations 2030 Renewable energy and related enabling

Agenda and the Paris Agreement can only be met technologies, as well as energy efficiency, have

through an urgent and complete decarbonisation proven to be resilient and increasingly cost-

of our entire energy system. This requires that all competitive solutions for supplying a growing

of our energy needs – power, heating and cooling, range of sectors and applications around the

and transportation – are reliably met by 100% world. Today, the costs of solar and wind projects

renewable energy, and are accessible to all people are competitive with coal- and gas-fired plants

(see Box 1). almost everywhere, and renewable power capacity

growth has been outpacing new installed capacity

in fossil fuels for the past decade (IRENA, 2020a).

Box 1 Definition of 100% renewable energy

The IRENA Coalition for Action has agreed on the following definition for 100% renewable energy:*

Renewable energy encompasses all renewable resources, including bioenergy, geothermal, hydropower,

ocean, solar and wind energy. One hundred percent renewable energy means that all sources of energy to

meet all end-use energy needs in a certain location, region or country are derived from renewable energy

resources 24 hours per day, every day of the year. Renewable energy can either be produced locally to meet

all local end-use energy needs (power, heating and cooling, and transport) or can be imported from outside

of the region using supportive technologies and infrastructure such as electrical or gas transmission systems,

hydrogen or heated water. Any storage facilities to help balance the energy supply must also use energy

derived only from renewable resources.

*Companies featured in the case studies may apply different definitions when referring to 100% renewable energy.

While renewables account for approximately The industrial sector has a particularly important

25% of global electricity consumption, the share role to play, representing a considerable share of

of modern renewables1 in global demand for global heating and cooling use. In total, around

heating and cooling is just 10% (IRENA, IEA 75% of final energy use in the industrial sector is

and REN21, 2020). Decarbonising heating and for heating and cooling, which accounts for more

cooling remains critical as these end-uses than 25% of the global final energy consumption.

account for approximately 50% of total final

energy consumption globally (IRENA, IEA and

REN21, 2020).

1 Modern renewables include all renewables with the exception of traditional uses of biomass for cooking and heating with negative

environmental and socio-economic impacts.8 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

More and more companies in the industrial sector The Coalition for Action Working Group on

are now seeing the need to decarbonise their “Towards 100% Renewable Energy” has produced a

operations in all end-uses by switching from series of white papers and analyses that document

fossil fuels to renewables, not only as a way to case studies and best practices for achieving 100%

demonstrate corporate social responsibility but renewable energy, including recommendations to

also to improve their financial performance and policy makers on how to support an accelerated

carbon footprint. energy transformation (see Box 2).

To accelerate the decarbonisation of heating This white paper examines the technical,

and cooling, significantly scaled-up efforts are economic and policy opportunities available

however required from both the public and to, and challenges faced by, companies in the

private sectors. At the end of 2019, only 49 industrial sector trying to integrate high shares

countries had national targets for renewable of renewables into their heating and cooling

heating and cooling, compared to the 166 countries operations. Companies featured as case studies in

that had national targets for renewable electricity. this paper have already set, or achieved, a 100%

As governments move forward with green renewable energy target for the power sector and

recovery packages in response to the COVID-19 are engaged in ambitious activities to increase

pandemic, they have a unique opportunity to the share of renewables used in their heating and

accelerate and enable the transformation to cooling operations.

100% renewable energy in all end-uses, including

heating and cooling. Stimulus packages targeting Following this introduction, this white paper

the industrial sector can increase the uptake is organised as follows: Chapter 2 elaborates

of renewables. Besides making local industries on the role of industrial players in the energy

resilient in the long-term, investing in renewables transformation, focusing on heating and cooling;

and related infrastructure will also bring much Chapter 3 examines companies’ drivers, barriers

needed socio-economic, health, climate and and target setting for renewable heating and

environmental benefits. Although many companies cooling; Chapter 4 summarises key takeaways on

are increasingly sourcing renewable electricity, how to scale up the share of renewables in heating

setting targets in other end-uses, including and cooling operations; and finally, Chapter 5

heating and cooling, will be crucial to accelerate presents company case studies based on first-

the energy transformation. hand interviews with representatives of the

industrial sector.

Photo: Flemming Lynge Nielsen/Danfoss

CO 2 neutral district energy plant suppling Danfoss headquarters, DenmarkF O C US O N H E ATI N G A N D C O O LI NG 9

Box 2 IRENA Coalition for Action Towards 100% Renewable Energy Working Group

Established in 2018, the IRENA Coalition for Action Towards 100% Renewable Energy Working Group has

produced a series of white papers and analyses that document case studies and best practices for achieving

100% renewable energy. These analytical outputs include a comprehensive mapping of 100% renewable

energy targets at national and subnational levels, as well as key messages to policy makers on how to support

an accelerated energy transformation.

The Working Group’s first white paper analysed the transformation to a 100% renewable energy system from

the point of view of national and subnational governments (IRENA Coalition for Action, 2019). A second white

paper followed, focusing on utilities in transition towards 100% renewable energy and addressing energy

generation, transmission and distribution in the electricity sector (IRENA Coalition for Action, 2020).

This third white paper offers a logical follow-up to the previous two by exploring the barriers and necessary

incentives for companies who have already set ambitions for 100% renewable electricity to specifically increase

the share of renewables in their heating and cooling operations.

Coalition for Action white paper series – Towards 100% renewable energy

TOWARDS 100%

RENEWABLE ENERGY:

TOWARDS 100%

RENEWABLE ENERGY: UTILITIES IN TRANSITION

STATUS, TRENDS AND LESSONS LEARNED

COMPANIES IN TRANSITION

TOWARDS 100% RENEWABLES:

FOCUS ON HEATING AND COOLING

2019 2020 202110 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

DECARBONISING

02 HEATING AND COOLING

IN INDUSTRY

This chapter provides an overview of how applications for industrial operations, as well

renewable energy is or can be used for heating and as options available to companies for sourcing

cooling2 in the industrial sector. Particular focus renewable heating and cooling.

is placed on renewable energy technologies and

2.1 Industry: The largest energy consumer

The past two decades have seen increasing As illustrated in Figure 1, of the industry’s TFEC in

growth in the overall energy consumption of 2017, 36% came from coal, 24% from electricity,

industry. In 2017, the sector was responsible for 18% from natural (fossil) gas and 10% from oil,

approximately one-third of the world’s total final with the rest coming from biomass, district heat,

energy consumption (TFEC), largely driven by solar thermal and geothermal (IRENA, 2020b).

rising demand for, and manufacturing of industrial To accelerate the decarbonisation of our energy

products in a broad variety of subsectors. The system, the 13% share of renewables in TFEC has

industrial sector, including industrial processes, to significantly increase. Most of the renewables

also accounts for approximately one third of global in the industrial sector are supplied by bioenergy

energy-related carbon dioxide (CO2) emissions in subsectors such as pulp and paper and other

(IRENA, 2020b). industries that produce on-site biomass waste and

residues.

Figure 1: Total final energy consumption in the industrial sector, 2017

1% Solar thermal & geothermal

4% District heat 7% Biomass

10% Oil

18% Natural (fossil) gas

36% Coal

24% Electricity

Source: IRENA (2020b)

2 Heating and cooling in this white paper refers to “applications of thermal energy, including space and water heating, space cooling,

refrigeration, drying, and heat produced in the industrial process. It includes the use of electricity for heating and cooling” (IRENA,

IEA and REN21, 2020).F O C US O N H E ATI N G A N D C O O LI NG 11

The Paris Climate Agreement, as well as the Finland, working in collaboration with the Energy

Intergovernmental Panel on Climate Change Watch Group, and the University of Technology

(IPCC), emphasise that countries should Sydney (UTS) in Australia show pathways to a fully

undertake urgent action to prevent global renewables-based energy supply across all sectors

warming from exceeding 1.5°C (degrees Celsius) by 2050 to remain within the 1.5°C target (Ram et

above preindustrial levels (IPCC, 2018). This al., 2019) (Teske, 2019).

will require the reduction of all greenhouse gas

emissions to net zero by mid-century (IPCC, While industry has traditionally relied on centralised

2018). According to IRENA’s Transforming systems to procure its mostly fossil-fuel based

Energy Scenario, outlining an energy pathway to electricity supply, more and more companies in

“well-below 2°C”, the share of renewables in the the industrial sector and beyond have started to

industrial sector must increase to 29% by 2030 increase the share of renewables in their operations.

and 62% by 2050 (IRENA, 2020b). However, the This is especially the case for electricity supply,

Transforming Energy Scenario still forecasts some for which a range of renewables sourcing options

energy-related greenhouse gas emissions at mid- are available in the market (IRENA, 2018) (see

century, including for the industrial sector. Under more in Box 3 on corporate sourcing of renewable

IRENA’s Deeper Decarbonisation Scenario, in electricity). However, the corporate sourcing of

which emissions are projected to decrease to zero renewable heating and cooling is still in the early

and limit temperature rise to 1.5°C, a significant stages of development given its context-specific

additional increase in renewables’ share will be and decentralised nature. With heating and

needed (IRENA, forthcoming). cooling making up approximately 75% of energy

used in industry, (90 exajoules), there is significant

Other scenarios suggest even higher shares of up potential to accelerate the decarbonisation of

to 100% renewable energy use in industry. Both industry through renewables (REN21, 2020).

Lappeenranta University of Technology (LUT) in

Box 3 Corporate sourcing of renewable electricity

Companies in the commercial and industrial sector account for roughly two-thirds of the world’s end-use

of electricity. With increased electrification of the sector’s heating, cooling and transport processes, the

commercial and industrial sector is expected to continue consuming a large share of electricity going forward.

As early as 2017, corporates had sourced over 465 terawatt-hours (TWh) of renewable electricity and more than

70 countries had put specific enabling frameworks for corporate sourcing in place (IRENA, 2018). According to

BloombergNEF, corporations are increasingly signing corporate power purchase agreements (PPAs) and have

cumulatively purchased almost 80 gigawatts (GW) of renewable electricity globally since 2011 (BNEF, 2021).

In 2020 alone, companies purchased 23.7 GW of renewable electricity through corporate PPAs, exhibiting

momentum despite the impacts of COVID-19 (BNEF, 2021).

Several company-led initiatives have emerged to further facilitate corporate sourcing of renewable power.

The global RE100 initiative, led by the Climate Group and the Carbon Disclosure Project, brings together over

280 of the largest companies in the world that have pledged to power their operations using 100% renewable

electricity by 2050 at the latest. RE100 companies have a combined electricity consumption of over 315 TWh

per year. BloombergNEF estimates suggest that these companies will need to purchase an additional 269

TWh of renewables by 2030 to meet their 2030 targets, which is equivalent to over USD 98 billion (US dollars)

of investment in renewable electricity (The Climate Group, 2020; BNEF, 2021). In recent years, several other

local initiatives have emerged, such as the US Renewable Energy Buyers Alliance (REBA, 2020) and the Indian

Green Power Market Development Group (GPMDG, 2020).12 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

2.2 Renewable heating and cooling technologies

and applications

Alongside energy efficiency, renewable energy will When identifying viable renewable heating and

play a key role in decarbonising heating and cooling cooling solutions for a given industrial application,

operations. A broad range of renewable energy it is important to consider the variation in the

technologies and applications to meet industry’s energy intensity of industrial processes across

heating and cooling needs already exist, such as subsectors. Iron and steel, cement, and chemicals

renewables-based electrification, renewable gases, production are among the most energy-

the direct use of renewables through solar thermal intensive subsectors and the most challenging to

or geothermal, and the sustainable use of biomass. decarbonise because they require high processing

Further, new technologies are being explored such temperatures, whereas pulp and paper, wood

as sea water air conditioning. products, and the food and beverage sectors use

medium and low process temperatures (IRENA,

IEA and REN21, 2020). Figure 2 provides an

overview of the working temperatures for various

renewable energy technologies.

Figure 2: Working temperatures for various renewable heat technologies

Total final energy consumption in the industrial sector

Heat pumps

Geothermal

Solar thermal

Bioenergy

C

Electricity

Green Hydrogen

0 200 400 600 800 1 000 ...

Source: IRENA, IEA and REN21 (2020)

Renewables-based electrification for energy-efficient heat pumps, radiators, electric

or hybrid hot boilers, refrigerators, and other

An increasing number of industrial players are

equipment. To achieve further efficiency gains

looking at renewables-based electrification of

and cost reductions, many companies combine

various end-uses, including higher-temperature

efficient heat pumps and waste recovery. Under

processes where direct utilisation of renewables

IRENA’s Transforming Energy Scenario, renewable

faces technical limitations (REN21, 2019). electricity is expected to account for a growing

Renewable electricity is now employed to meet percentage of energy utilised in industry, reaching

thermal demands of industrial processes such as approximately 35% of overall energy consumed by

drying, refrigeration, and packaging and hardening the industrial sector by 2050 – an increase from

for metal production. This involves electricity use just 7% today (IRENA, 2020b).F O C US O N H E ATI N G A N D C O O LI NG 13

Renewable gases Biomass

Renewable gases have the potential to replace As of today, 90% of the renewable energy

natural (fossil) gas (IRENA, 2020b) commonly supplied for heat in the industrial sector comes

used in high-temperature applications in the iron, from bioenergy, primarily derived from biomass.

steel, chemical and petrochemical industries, Biomass is predominantly used in the pulp

among others (IRENA, 2020c). Renewable gases – and paper, forestry, wood products, and food

including biogas, biomethane and green hydrogen industries. In these industries, biomass waste and

produced from 100% renewable electricity or residues are typically produced on-site and then

biogas – can replace natural (fossil) gas in many re-used as fuels. Potential remains to extend the

of its uses by leveraging relevant parts of existing use of biomass and the efficiency with which it

gas networks. One solution that has gained much is used in industry. With some adaptations to

attention lately is green hydrogen. Green hydrogen ensure compatibility across production processes,

offers an alternative route to harness the potential biomass can be used not only for low-temperature

of renewable electricity where direct electrification heat, but also in high-temperature applications

can be challenging (IRENA, IEA and REN21, 2020). such as in the cement industry, where companies

Green hydrogen can produce high-temperature are turning to solid biomass to replace coal.

(>400°C) industrial heat (e.g., for melting, In some countries, biomass is even used to

gasifying, drying) for which renewable alternatives produce cement and iron, processes that require

to fossil fuels are currently limited. Green hydrogen, temperatures ranging up to 600°C (IRENA, IEA

moreover, has an important role as substitute of and REN21, 2020). The extent to which bioenergy

“grey” and “blue” hydrogen (traditional hydrogen contributes to greenhouse gas emission reduction

produced from fossil fuels) as a feedstock in the targets, and whether its widespread development

chemical industry (IRENA, IEA and REN21, 2020). would have positive or negative environmental,

social or economic impacts – for instance related

Direct use of renewables for heating to biodiversity or landscape preservation –

remains controversial for some forms of bioenergy.

The electrification of industrial heating and

Sustainability of bioenergy sourcing and use is

cooling can be complemented by the direct

an important requirement for its widespread

use of renewable energy for heating (IRENA,

development (IRENA, IEA and REN21, 2020).

2020c). This includes the use of solar thermal

and geothermal technologies. Solar thermal

While electrification and the direct use of

technologies have the potential to supply energy

renewable energy technologies can cover a

for temperatures between 20°C and 400°C and

wide range of industrial heating and cooling

are used mainly for preheating water, drying and

processes and temperatures, the additional use of

generating low-temperature steam in industries

energy-efficient technologies further accelerates

such as food and beverage production, textiles

the deployment of renewables in heating and

and agriculture (IRENA, IEA and REN21, 2020). Hot

cooling by reducing the required process heat

water from geothermal energy can supply process

temperatures (IRENA, IEA and REN21, 2020).

heat for pulp and paper processing, greenhouse

heating, dairy processing, and wood curing for

temperatures above 300°C (IRENA, IEA and

REN21, 2020). In general, direct use of renewables

for industrial process heat occurs mainly in lower-

temperature applications (REN21, 2020).14 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

2.3 Sourcing models for renewable heating and cooling

In an effort to decarbonise operations, many While the availability of sourcing models for

companies in the industrial sector are looking to renewable electricity has advanced significantly

increase the share of renewables in their energy over the years, sourcing options for renewable

supplies. heating and cooling are still in their infancy.

They remain highly dependent on available

For companies that have started to shift industrial infrastructure and renewable resources on-site

processes towards increased electrification, or in close proximity. New sourcing mechanisms

a growing range of options are available for that facilitate easy access to renewable heating

sourcing renewables. In addition to self-generating and cooling will be critical to scale up corporate

renewable electricity or sourcing renewable sourcing of renewables and accelerate the rapid

electricity through unbundled energy attribute decarbonisation of industry.

certificates, many companies are signing long-

term corporate PPAs or purchasing renewable Figure 3 illustrates existing and potential corporate

energy through utility green procurement sourcing models for renewable heating and

green procurement programmes (see Box 3) cooling.

(IRENA, 2018).

Figure 3: Existing and potential corporate sourcing models for renewable

heating and cooling

Self-generation Renewable heating and cooling Energy attribute certificates for

offerings from utilities renewable heating and cooling

A company invests in its own renewable A company has options of purchasing A company purchases attribute certificates

energy systems, on-site or off-site, to produce renewable heating or cooling from local of renewable heating and cooling through

renewable heating and cooling primarily for utilities, including from the district heating a certificate market system.

self-consumption. or gas network.

Source: IRENA (2021)

Self-generation Austria use on-site biomass, which meet 23%

Some companies produce renewable energy on- and 42% of their heat demand respectively (see

site for their heating and cooling operations. Chapter 5 and case studies). Another option for

This model is particularly used in industries self-generation includes the installation of heat

that generate biomass waste and residues on- pumps or converting self-generated electricity into

site, which are subsequently re-used as fuels heating or cooling. For example, Danish industrial

for production processes requiring heating and Danfoss has installed heat pumps in order to

cooling operations. Companies like Elpitiya recover heat from its water cooling processes (see

Plantations in Sri Lanka and Goess Brewery in Chapter 5 and case studies).F O C US O N H E ATI N G A N D C O O LI NG 15

Renewable heating and cooling offerings from certificates as well as a market mechanism for

utilities trading these. Being able to claim environmental

sustainability effectively and efficiently is critical

In some locations, options may be available for

to companies, and therefore raises a need for

companies to purchase renewable heating or

a certificate market for renewable heating and

cooling from local utilities, including from the

cooling to promote certainty, prevent double-

district heating or gas network. Several local

counting and enable regulators to oversee claims

environmental and renewable energy consumer

and activities related to the corporate sourcing of

labels have emerged for district heating, including

renewable heating and cooling.

“Bra Milijöval” in Sweden and “NatureMade” in

Switzerland. These third-party labels not only While the procurement of certificates for renewable

impose criteria on the source of the heat itself, but heating and cooling is still limited, it may become

also other aspects of heat production including an important driver for companies to invest in the

transportation and process energy at the plant near future. For corporate sourcing of renewable

(IRENA, 2018). Based on these criteria, district electricity, many companies started off by

heating providers can certify/label all or part of purchasing renewable energy certificates, before

their heat production and offer this labelled district progressing towards more complex additional

heating to their customers at premium rates – sourcing models after gaining some experience and

so called “green premium products” or “green as markets had further evolved to accommodate

tariffs”. While such options are broadly available for increasing corporate demand. Similarly, energy

electricity already, they could be further scaled-up attribute certificates for renewable heating and

for renewable heating, to provide utility customers cooling may increase demand for corporate

with additional procurement options. For example, sourcing.

Mölndal Energi in Sweden offers its customers

For example, the Guarantees of Origin certificate

(both households and businesses) both

system for the European renewable electricity

environmentally labelled electricity and district

market is being revised jointly in mid-2021 by the

heating (IRENA Coalition for Action, 2020). The

European Committee for Standardization (CEN)

utility also recently announced a new collaboration

and the European Committee for Electrotechnical

that will supply the cities’ life-science industry

Standardization (CENELEC) to include renewable

cluster with renewable heating and cooling

heating and cooling, in an effort to support

(Energinyheter, 2020).

the objectives listed in the Renewable Energy

Directive II – which falls under the European

Energy attribute certificates for renewable

Green Deal actions (CEN CENELEC, 2020).3 In

heating and cooling

North America, initiatives such as the Renewable

As companies move towards supplying their Thermal Collaborative and Green-e are working

heating and cooling operations with renewables, with industry and policy makers to assess the

it is important to create a recognised accounting feasibility of energy attribute certificates for

framework for renewable heating and cooling renewable heating and cooling.

3 CEN and CENELEC are two private international nongovernmental organisations (NGOs) that convene the national standards

agencies of 34 countries and provide a platform for the development of European Standards and other technical specifications

across a variety of sectors.16 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

ACCELERATING

CORPORATE SOURCING

03 OF RENEWABLE HEATING

AND COOLING

This chapter provides an overview of how The purpose of the survey was to better understand

companies source renewables for their heating corporate strategies, including target setting

and cooling operations based on an analysis and ambitions, as well as drivers and barriers for

of companies that participated in a survey.4,5 renewable heating and cooling.

3.1 Corporate target setting and drivers

Corporate renewable energy targets play an IRENA’s findings indicate that while only one-fifth of

important role in forecasting companies’ medium- corporations in the commercial and industrial

and long-term expectations and commitments to sector that source renewable electricity have

transitioning their operations towards sustainable committed to a renewable electricity target, it is

processes in line with global and national climate even less common for companies to set specific

objectives. renewable energy targets for other end-uses, such

as heating and cooling (IRENA, 2018).

Even as an increasing number of companies

commit to ambitious renewable energy targets

The companies surveyed reported having a

for their electricity supply, target setting is not yet

combination of multiple targets that impacted their

commonplace for heating and cooling.

energy use for heating and cooling operations, as

highlighted in Figure 4.

Figure 4: Corporate renewable energy targets

Renewable heating and/or cooling targets

Direct targets

Renewable electricity targets

Renewable energy targets

Decarbonisation targets

Indirect targets

Emissions targets

Energy efficiency standards and targets

Source: IRENA (2021)

4 The company survey jointly undertaken by IRENA and the Climate Group was launched in November 2020 and circulated to EP100

and RE100 member companies, as well as the companies featured as case studies in Chapter 5 of this white paper. EP100 brings

together a group of 123 energy-smart companies committed to using energy more productively, to lower greenhouse gas emissions

and accelerate a clean economy. RE100 is a global initiative bringing together over 280 of the world’s most influential businesses

driving the transition to 100% renewable electricity.

5 The reporting companies are private sector companies from a variety of countries around the world, with a range of 25 to 100 000

employees. The survey had 17 respondents. All survey responses have been used only in aggregated form to maintain the privacy of

reporting companies’ disclosed information. The survey was divided into three sections – target setting, drivers and barriers.

Reporting companies’ disclosed information uses data from 2019 and 2020.F O C US O N H E ATI N G A N D C O O LI NG 17

Trends show companies adopt multiple This is in stark contrast to companies increasingly

targets simultaneously that cover a variety of setting direct renewable electricity targets (IRENA,

sustainability and decarbonisation ambitions. In 2018).

terms of direct targets impacting companies’

heating and cooling operations, only one-third had From the companies surveyed, the main drivers for

set specific renewable heating and cooling targets. increasing the share of renewables in companies’

Almost 80% of companies surveyed had adopted heating and cooling operations can be grouped

at least one indirect target, including emissions into five categories, as illustrated in Figure 5.

targets, energy efficiency targets or standards, Key drivers considered to be of importance

or decarbonisation targets. Overall, survey results to companies include, in descending order:

indicate that companies wanting to decarbonise environment and sustainability; corporate social

heating and cooling are more likely to set indirect responsibility and company reputation; customer,

targets with broader climate and sustainability shareholder and staff demand; economical savings

objectives as opposed to direct renewable heating and price stability; policy incentives; and fiscal and

and cooling targets. financial incentives.

Figure 5: Drivers for increasing renewable heating and cooling in industry

Environment and sustainability

Corporate social responsibility and company reputation

Corporate Customer, shareholder and staff demand

drivers Economical savings and price stability

Policy incentives

Fiscal and financial incentives

Source: IRENA (2021)

Environment and sustainability was ranked as well as demonstrating concrete actions addressing

one of the most important drivers by companies. shareholder, customer and staff concerns with

With the industrial sector being the largest energy regard to companies’ sustainable operations and

consumer with a significant climate impact, processes. To this end, renewable energy target

reducing greenhouse gas emissions has become setting is a useful tool for companies to signal

a priority for companies (IRENA, 2020b) (IRENA, their sustainability performance as well as future

IEA and REN21, 2020). Furthermore, fossil fuel use investment and growth opportunities to investors,

and the inefficient burning of biomass for heating customers and governments (IRENA, 2015).

and cooling contribute significantly to air pollution,

resulting in concerns over poor air quality and Economical savings and price stability also

threats to public health. Transitioning to higher motivate companies to switch to renewables.

shares of renewable energy in companies’ heating More specifically, they include improved financial

and cooling processes will become increasingly savings through reduced energy costs, energy

critical as companies act to address climate change efficiency savings, as well as less exposure to

and sustainability concerns. volatility in energy prices due to the price stability

of renewable energy options. For instance, carbon

Companies also highlighted corporate social pricing policies and emissions trading schemes

responsibility and company reputation along with have rendered biomass heating to be more cost-

customer, shareholder and staff demand as critical effective compared to fossil fuels (IRENA, IEA and

drivers. These include maintaining a public image REN21, 2020).

as an active agent in the energy transformation as18 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

Furthermore, by setting new or more ambitious With companies facing high upfront investment

renewable heating and cooling targets and costs, fiscal and financial incentives in the form of

implementing supporting policies, governments tax credits, and grants for renewable heating and

can provide companies with clear and long-term cooling technologies and sustainability schemes

policy signals that encourage them to set their – as well as widely-adopted renewable energy

own corporate targets. standards, certifications and regulations – further

incentivise companies to invest in renewables.

Figure 6 illustrates existing renewable heating and

cooling regulatory and financial policies across

countries.

Figure 6: Number of countries with policies for renewable heating and cooling,

2009-2019

Number of countries

70

60

50

40

30

20

10

0

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Countries with only financial policies Total countries with financial or regulatory

Countries with both financial and regulatory policies policies for renewable heating and cooling

Countries with only regulatory policies

Source: IRENA, IEA and REN21 (2020)F O C US O N H E ATI N G A N D C O O LI NG 19

3.2 The renewable heating and cooling challenge

While companies are increasingly driven to set and in their heating and cooling operations. Figure 7

achieve ambitious renewable energy targets, they illustrates some of the key barriers considered by

also experience various barriers that hinder their companies to be of importance in this context.

progress towards scaling up renewable energy use

Figure 7: Barriers to increasing renewable heating and cooling in industry

Fossil fuel lock-in

Cost competitiveness of conventional energy solutions

Lack of access to finance

Competing internal priorities for capital expenditure

Lack of available technologies

Corporate

New investments in cost-intensive advanced technologies

barriers

Sparse information and data on renewable energy

solutions for industrial processes

Regulatory and policy uncertainty and complexity

Lack of government support measures

Structural and behavioural barriers

Source: IRENA (2021)

Survey respondents indicated that modifying these factors limit their abilities to effectively set

industrial processes designed around fossil fuel- renewable heating and cooling targets and make

based energy sources was one of the main barriers progress towards decarbonising their operations.

to scaling up renewable heating and cooling.

Historical investments in industrial processes Companies’ survey responses also highlighted

create a fossil fuel lock-in effect, making the the importance of effective policies. Policy

transition away from fossil fuels and investing in uncertainty and complexity coupled with a lack

new enabling infrastructure for renewable heating of government support measures have made it

and cooling more challenging. Furthermore, the difficult for companies to invest. Without clear,

cost competitiveness of conventional energy long-term renewable heating and cooling targets

solutions, coupled with the lack of access to from national governments backed by concrete

finance for renewable energy investment, increases energy transition roadmaps, companies are

the likelihood that companies need to make a not incentivised or able to construct long-term

choice between competing internal priorities for renewable energy and sustainability strategies

capital expenditure. (see Figure 6). In the industrial sector, incentive

schemes often also target heavy industry and fail

Given the context-specific nature of heating to address small and medium-sized enterprises.6

and cooling, renewable energy solutions often

have to be customised to meet the unique Delivering the energy transformation will require

needs of various industry subsectors. The lack fundamental shifts in companies’ investments,

of available technologies for renewable heating planning processes, attitudes and behaviours.

and cooling processes in industry is especially By overcoming structural and behavioural

relevant for industrial heat processes requiring barriers, companies can help unleash additional

high temperatures and new investments in renewable energy deployment and its associated

cost-intensive advanced technologies. Further, socioeconomic benefits such as gross domestic

sparse information and data on renewable product growth, job creation and welfare gains.

energy solutions for industrial processes make it This calls for closer collaboration between policy

challenging for companies to fully evaluate their makers and companies to align sustainability and

energy needs and invest in the appropriate heating climate objectives.

and cooling solutions. Companies indicated that

6 Small and medium-sized enterprises are non-subsidiary, independent firms which employ fewer than a given number of employees.

The upper-limit for employees in these enterprises varies across countries, but is often 250 employees.20 COMPAN IES IN T R A NSIT IO N TOWA R D S 100% RE N E WA BLE S :

KEY TAKEAWAYS AND

04 LESSONS LEARNED

Renewable energy investments in all sectors and commitments and implement strategies and

end-uses must grow significantly and jointly as an policy frameworks that effectively encourage and

integrated energy transformation to meet the Paris incentivise the use of renewable energy beyond

Agreement objectives. As companies around the the power sector and into the heating and cooling

world increasingly prioritise sustainability within sector.

their operations, many have set and even achieved

100% renewable electricity targets and are scaling Based on case studies as well as a survey of

up the share of renewable energy in their heating companies’ renewable energy use for heating and

and cooling operations. This growing momentum cooling operations, the following key findings may

within industry presents an important opportunity serve as guidance and inspiration for governments

for policy makers to affirm their renewable energy and companies.

Key takeaways for governments

Setting national and subnational targets for 100% governments can help companies make informed

renewable energy across all end-use sectors, decisions that are competitive and cost-effective

including heating and cooling, is key to driving in the long term.

the energy transformation in the industrial sector.

As a growing number of companies prioritise Long-term government planning is particularly

sustainability and strive to reduce greenhouse gas important for decarbonising heating and cooling

emissions, they look to national and subnational in industry. In addition to national target setting,

governments to provide clear policy signals integrated long-term planning is crucial when

through long-term renewable energy targets. it comes to heating and cooling. Companies

However, as of today, less than a third of national seeking to decarbonise their heating and cooling

governments have adopted renewable energy operations are faced with complex decisions given

targets for heating and cooling in comparison the context-specific and infrastructure-dependent

to 166 countries that have targets for renewable nature of heating and cooling solutions. Whether

electricity. This trend can also be observed in a company chooses to electrify a portion of its

corporate target setting, with companies setting heating operations, switch fuels or rely on direct

renewables targets for electricity to a larger extent thermal heat depends heavily on national and

than for heating and cooling. Companies tend local government plans. Such plans may include

to have broader targets (i.e., energy efficiency, developing or expanding central solutions – such

emissions, decarbonisation) that only indirectly as district heating networks or gas grids utilising

impact the uptake of renewables for heating renewable gases – as well as resource availability

and cooling. Policy and regulatory clarity by and costs. For example, access to cost-competitiveF O C US O N H E ATI N G A N D C O O LI NG 21

renewable electricity can be a strong driver for heating and cooling projects remains difficult in

electrifying processes, whereas the availability many parts of the world due to limited access to

of sustainable biomass can be a incentive for capital, elevated by underlying market barriers and

switching fuel from coal, oil or natural (fossil) gas real or perceived risk. This is particularly relevant

to biogas or biomass combustion. in developing markets. Through the strategic use

of public funds such as incentive programmes,

Implementing ambitious regulatory, fiscal and governments can help mobilise private capital and

financial policies and incentives will help increase reduce investment risks by sending clear signals

the share of renewables in heating and cooling. to the financial sector that they support the shift

Regulatory policies – including renewable heat away from fossil fuel-dependent processes, as well

obligations, feed-in tariffs, and bans on the use as providing de-risking loan guarantees and grants

of fossil fuels/price on carbon and other negative and risk insurance funds. Regulatory environments

externalities of conventional energy production – that encourage green lending practices – both

can help further stimulate renewables uptake for public and private – can further lower financing

heating and cooling. Given the high upfront capital costs for renewable heating and cooling.

costs of renewable heating and cooling solutions,

appropriate policy frameworks fostering research, Exploring innovative sourcing models for

development, quality standards, certifications and renewable heating and cooling will further scale

deployment programmes (private and public- up progress. New and innovative sourcing models

private partnerships) are needed to lower their cost (i.e., corporate PPAs and utility green procurement

and to increase acceptance of new technologies. programmes) have been put forward in the

Long-term fiscal and financial support programmes market for renewable electricity, underpinned by

also remain key to accelerating the transition to the availability and effective tracking of energy

renewables. Companies that have successfully attribute certificates. Lessons learned from the

installed decentralised heating and cooling development of renewable electricity sourcing

technologies such as solar thermal or heat pumps models can be leveraged to develop sourcing

have typically received some sort of financial or models for other end-uses. In addition to creating

fiscal support in the form of a subsidy, grant or tax a recognised accounting framework for renewable

credit. heating and cooling certificates that will help

create transparency and efficiently track attributes,

Improving access to private capital for energy governments should explore new mechanisms that

transition-related technologies will encourage facilitate easy access to renewable heating and

essential long-term investments. Although falling cooling sources, such as green utility programmes.

renewable energy costs have significantly lowered

up-front capital costs, financing renewable energy

Key takeaways for companies

Switching to renewable energy heating and Setting long-term corporate renewable

cooling brings important benefits beyond emission heating and cooling targets and implementation

reduction. In the transition to a climate-safe future, strategies accelerates the decarbonisation of

decarbonising heating and cooling operations operations. Committing to a renewable energy

plays a major role. Alongside significant emission target is an important tool to measure company

performance and progress. Setting a target also

reductions, shifting companies’ energy supply

communicates a clear signal to shareholders,

towards renewables provides a competitive edge

investors and customers of a company’s dedication

by reducing their risk exposure to volatile fossil

and ambition towards sustainability and the energy

fuel supply and costs. The importance of corporate transformation. Any target should be supported

social responsibility and reduced reputational risks by a strategy outlining how the company will meet

is also becoming more prominent as shareholders its energy demand through renewables, including

and clients increasingly demand sustainability as a milestones towards the target, sourcing models

core practice. and planned projects.You can also read