COMMERCIAL REAL ESTATE OUTLOOK: 2019.Q1 - National Association of REALTORS - National ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Commercial Real Estate Outlook: 2019.Q1 Download: www.nar.realtor/reports/commercial-real-estate-outlook ©2019 National Association of REALTORS® All Rights Reserved. May not be reprinted in whole or in part without permission of the National Association of REALTORS®. For reprint information, contact data@realtors.org.

COMMERCIAL REAL ESTATE

OUTLOOK

NATIONAL ASSOCIATION OF REALTORS®

2019 LEADERSHIP TEAM

JOHN SMABY, CRB, GRI

President

VINCE MALTA

President-Elect

CHARLIE OPPLER

First Vice President

JOHN FLOR, ABR, CRS, GRI, EPRO

Treasurer

ELIZABETH MENDENHALL, ABR, ABRM,

CIPS, CRB, GRI, PMN, EPRO

2018 President

BRIAN COPELAND, CIPS, CRS, GRI, EPRO

Vice President of Association Affairs

TRACY KASPER, CRS, GRI, SFR

Vice President of Advocacy

BOB GOLDBERG

Chief Executive OfficerCOMMERCIAL REAL ESTATE

OUTLOOK

CONTENTS

1 | Economic Overview………………………………………………………………………………… 5

2 | Commercial Real Estate Investments…………………………………………………….. 9

3 | Commercial Real Estate Fundamentals…………………………………………………… 13

4 | Market Highlight: Retail Trade Challenges and Opportunities…………………. 15

5 | Outlook……………………….………………………………………………………………………….. 18COMMERCIAL REAL ESTATE

OUTLOOK

GEORGE RATIU

Gross Domestic Product Director, Housing & Commercial Research

gratiu@realtors.org

The economy expanded at a stronger pace of 2.9

percent in 2018 from 2.2 percent in 2017 as GAY CORORATON

expenditures for private consumption, investment Research Economist

spending, net exports, and government spending all scororaton@realtors.org

rose at a faster pace. However, growth slowed to 2.6

percent in the fourth quarter on account of a slower Business investments increased for all categories.

expansion in personal consumption spending. Spending on structures rose at a 5.0 percent rate,

as spending increased equipment by 7.5 percent,

Exhibit 1.1: Real GDP (Percent Change and investments in intellectual property products

6 Annual Rate) advanced at 7.7 percent.

5

4 Exhibit 1.2: GDP - Real Consumer

3 Spending & Business Investments

2 (Percent Annual Rate)

1

Consumer Spending

0

Non-residential Private Fixed Investments

2014-Q1

2017

2012-Q1

2012-Q3

2013-Q1

2013-Q3

2014-Q3

2015-Q1

2015-Q3

2016-Q1

2016-Q3

2017-Q1

2017-Q3

2018-Q1

2018-Q3

-1 Residential Private Fixed Investments

20.0

-2

10.0

Source: Bureau of Economic Analysis

0.0

Consumer spending—which accounts for about two-

thirds of GDP—expanded at a slightly higher pace of -10.0

2.6 percent in 2018 (2.5 percent in 2017). Compared -20.0

to 2017 levels, private consumption spending rose

-30.0

across all items except for gasoline, fuel oil, and

2009

2000

2001

2002

2003

2004

2005

2006

2007

2008

2010

2011

2012

2013

2014

2015

2016

2017

2018

other energy goods. The Conference Board’s

Consumer Confidence Index continues to show Source: Bureau of Economic Analysis, SAAR, Bil.Chn.2009$

strong consumer confidence, with the index at 137.9

in October 2018, up from one year ago (126.2). The number of building starts—an indicator of

residential investment —declined to a seasonally

Private fixed investment spending rose at a stronger adjusted annual rate of 1.078 million units in

pace of 5.3 percent (4.8 percent in 2017) as non- December 2018 from 1.21 million in the same month

residential investment rose at a solid 7.0 percent last year. However, housing permits were up in

annual rate. On the other hand, residential December 2018 at a seasonally adjusted rate of

investment spending contracted 0.2 percent, as 1.326 million from 1.320 in the same month last

builders faced higher labor and construction year.

materials costs.

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 5COMMERCIAL REAL ESTATE

OUTLOOK

While construction is trending upwards, housing Government spending expanded 1.5 percent in 2018

permits remain below the 1.5 million new after contracting in 2017 (-0.1 percent). Federal

households being formed. The shortage of labor spending rose at a faster annual rate of 2.6 percent

and land due to zoning/regulatory issues were cited compared to state/local spending which rose more

by homebuilders as the main constraints to a ramp- modestly at 0.9 percent.

up in residential construction.

Exhibit 1.5: Real Government Spending

Exhibit 1.3 Housing Permits (Percent Annual Rate)

1-Family Multi-family Total 10.0 Federal State and local

2500

5.0

2000

0.0

1500

1000 -5.0

500 -10.0

2010

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2011

2012

2013

2014

2015

2016

2017

2018

0

Jan/2012

Jan/2017

Jan/2000

Jan/2001

Jan/2002

Jan/2003

Jan/2004

Jan/2005

Jan/2006

Jan/2007

Jan/2008

Jan/2009

Jan/2010

Jan/2011

Jan/2013

Jan/2014

Jan/2015

Jan/2016

Jan/2018

Source: Bureau of Economic Analysis, SAAR, Bil.Chn.2009$

Employment

Source: Bureau of Economic Analysis, SAAR, Bil.Chn.2009$

Employment conditions remained robust. During the

Exports rose in 2018 at a stronger pace of 3.9 12-month period of February 2018‒ January 2019,

percent (3.0 percent in 2017), as nearly all broad the economy created 2.8 million payroll jobs, more

categories of exports increased, led by minerals, than the 2.1 million jobs that were added in the

fuels, and related materials, which rose 42 percent same 12-month period one year ago. The economy

during the first three quarters of 2018 compared to has been steadily adding employment since October

year-ago levels. Oil prices (WTI) rose in 2018 to 2010, with 20.2 million jobs to date, which more than

$65/barrel from $50/barrel in 2017. offset the 9.1 million jobs lost during 2007 – 2010.

Exhibit 1.4: Real Exports & Imports Exhibit 1.6: 12-Month Payroll

(Percent Annual Rate) 4000 Employment Change ('000)

Exports Imports 2000

15.0

10.0 0

5.0

0.0 -2000

-5.0 -4000

-10.0

-15.0 -6000

2004

2009

2014

2000

2001

2002

2003

2005

2006

2007

2008

2010

2011

2012

2013

2015

2016

2017

2018

-8000

2018-Jan

2011-Aug

2018-Aug

2008-Feb

2008-Sep

2009-Apr

2011-Jan

2012-Mar

2013-May

2015-Feb

2015-Sep

2016-Apr

2009-Nov

2016-Nov

2007-Jul

2006-Dec

2010-Jun

2014-Jul

2013-Dec

2017-Jun

2012-Oct

Source: Bureau of Economic Analysis, SAAR, Bil.Chn.2009$

Source: Bureau of Labor Statistics

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 6COMMERCIAL REAL ESTATE

OUTLOOK

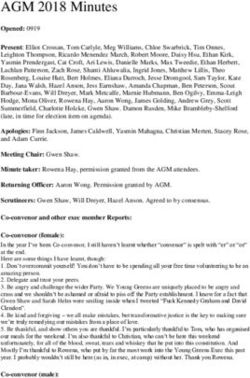

During the 12-month period of February 2018–

January 2019, payroll employment increased in all

sectors, except for information and utilities, with the

strongest gains in professional/business services

and education/health services. Employment in retail

trade increased by 37,000, notwithstanding the

many store closings in 2018. Manufacturing and

construction also generated strong job growth.

Exhibit 1.7: Payroll Employment: 12-

Month Change ('000)

Government 66

Leisure/Hospitality 254

Educ./Health 499

Prof./Bus. Services 516

The labor market continued to tighten. The

Financial Activities 115

unemployment rate stood at 4.0 percent in January

Information -15 2019, just slightly up from 3.7 percent in November

Utilities -2 2018, as more Americans entered the labor force.

Transp./Warehousing 184

Exhibit 1.9: Unemployment

Retail Trade 37 12

Wholesale Trade 94 10

Manufacturing 296 8

Construction 330 6

Mining/Logging 65 4

-100 0 100 200 300 400 500 600 2

Source: Bureau of Labor Statistics

0

2006-Jan

2006-Sep

2008-Sep

2016-Sep

2018-Sep

2007-May

2008-Jan

2009-May

2010-Jan

2010-Sep

2011-May

2012-Jan

2012-Sep

2013-May

2014-Jan

2014-Sep

2015-May

2016-Jan

2017-May

2018-Jan

In December 2018, employment increased at the

fastest pace from year-ago levels in Nevada,

Arizona, Washington, Texas, and Utah, with Source: Bureau of Labor Statistics

employment growing by at least three percent.

Nationally, non-farm employment rose 1.9 percent.

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 7COMMERCIAL REAL ESTATE

OUTLOOK

Inflation and Interest Rates

Exhibit 1.11: Interest Rates

With sustained growth, inflation has been trending

above the 2 percent target of the Federal Open Federal Open Market Committee: Fed Funds Target Rate:

Market Operations Committee (FOMC) since March Upper Limit (EOP, %)

2018. As of January 2019, prices for all items (CPI) FHLMC: 30-Year Fixed-Rate Mortgages: U.S. (%)

rose 2.2 percent from the levels one year ago. Core

9.0000

inflation, which measures the change in prices other

8.0000

than food and energy, rose at a slower pace of 1.6

percent. 7.0000

6.0000

To keep inflation in check, the FOMC raised the 5.0000

federal funds target range four times in 2018. 4.0000

However, the FOMC kept the federal funds rate 3.0000

target unchanged, in the 2.25 - 2.5 percent range at 2.0000

its January meeting, citing its reading of recent 1.0000

economic indicators and broader macroeconomic 0.0000

risks in the outlook (e.g. slower global growth).

Jul/2005

Jul/2016

Jun/2006

Jun/2017

Nov/2001

May/2007

Apr/2008

Nov/2012

May/2018

Jan/2000

Dec/2000

Sep/2003

Mar/2009

Aug/2004

Feb/2010

Jan/2011

Dec/2011

Sep/2014

Aug/2015

Oct/2002

Oct/2013

Given the FOMC’s indication of fewer rate hikes

ahead, the 30-year fixed rate has trended down, to

3.8 percent in February 2019 after trending above

Source: Federal Reserve Board, Freddie Mac

four percent monthly during May–December 2018.

Exhibit 1.10: Inflation

All Items All Items -Less Food and Energy

6.0

5.0

4.0

3.0

2.0

1.0

0.0

-1.0

-2.0

-3.0

Jul/2005

Jul/2016

Dec/2000

Jun/2006

May/2007

Jun/2017

Nov/2001

Apr/2008

Nov/2012

May/2018

Jan/2000

Sep/2003

Mar/2009

Aug/2004

Feb/2010

Jan/2011

Dec/2011

Sep/2014

Aug/2015

Oct/2002

Oct/2013

Source: Bureau of Labor Statistics

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 8COMMERCIAL REAL ESTATE

OUTLOOK

Commercial space is concentrated in large Accounting for the last quarter’s activity, investment

buildings, yet large buildings are a relatively small sales in LCRE markets accounted for $562.1 billion

number of the overall stock of commercial buildings. during 2018, a noticeable 15.0 percent increase on

Based on Energy Information Administration data a yearly basis. Deal volume for the year was at the

approximately 72 percent of commercial buildings third-highest level on record, and only about $8

are less than 10,000 square feet in size.1 An billion kept investments from claiming the historical

additional eight percent of commercial buildings are top spot, according to RCA. While portfolio and

less than 17,000 square feet in size. The entity-level sales accounted for a good share of the

commercial real estate market is bifurcated, with the sales, individual property investments provided the

majority of buildings (81 percent) relatively small bulk of the gains, and reached a new record during

(SCRE), but with the bulk of commercial space (71 2018, at $387.5 billion.

percent) in larger buildings (LCRE).

Apartment sales maintained the lead in terms of

Likewise, commercial sales transactions are transaction volume, with $50.9 billion in closed

measured and reported based on deal value. Deals transactions in the fourth quarter of 2018, a nine

at the higher end—$2.5 million and above— percent gain year-over-year, based on RCA data.

comprise a large share of investment sales, and Office properties captured the second largest share

generally receive most of the press coverage. of investor dollars, with $41.3 billion in sales. Office

Smaller commercial transactions tend to be investment volume rose 11.0 percent from a year

obscured given their values. However, these smaller ago. The retail sector closed $17.4 billion in sales

properties comprise the backbone of daily economic during the fourth quarter. Industrial transactions

activity—e.g. neighborhood shopping centers, increased a significant 44.0 percent from the prior

warehouses, small offices, supermarkets, etc. Given year, with sales totaling $27.2 billion in the fourth

the importance of these buildings to local quarter.

communities, and REALTORS®’ active roles in Exhibit 2.1: CRE Sales Volume ($2.5M+)

serving these markets, this report focuses on

illuminating trends in both large and small markets. $200 Individual Portfolio Entity

Billions

$180

Large Cap Commercial Real Estate Markets

$160

The last quarter of 2018 registered a solid increase $140

in the volume of sales transactions in LCRE $120

markets, closing the book on the year on a high $100

note. Investment volume in the large cap space $80

totaled $160.0 billion during the fourth quarter, a 20

$60

percent jump from the same period in 2017,

according to Real Capital Analytics (RCA). Deal $40

volume advanced for all property types, except $20

development sites. $-

13Q4

07Q1

07Q4

08Q3

09Q2

10Q1

10Q4

11Q3

12Q2

13Q1

14Q3

15Q2

16Q1

16Q4

17Q3

18Q2

1Smith and Ratiu, (2015), "Small Commercial Real Estate Market,"

National Association of REALTORS® Source: Real Capital Analytics

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 9COMMERCIAL REAL ESTATE

OUTLOOK

Sales in the six major metros tracked by RCA Exhibit 2.2: Commercial Property Price

experienced renewed interest from investors, Indices

posting a 35.0 percent advance from a year ago, to

$65.9 billion. Large-cap transactions in secondary NCREIF Green Street Advisors

and tertiary markets comprised a combined $92.4 Real Capital Analytics

billion in sales volume, notching about 10.0 percent 400.0

gains each on a yearly basis. 300.0

200.0

Investments mirrored trends in the broader economy

across the property sectors. During 2018, apartment 100.0

properties captured the largest share of 0.0

2007-Q1

2010-Q1

2001-Q1

2002-Q1

2003-Q1

2004-Q1

2005-Q1

2006-Q1

2008-Q1

2009-Q1

2011-Q1

2012-Q1

2013-Q1

2014-Q1

2015-Q1

2016-Q1

2017-Q1

2018-Q1

transactions, accounting for 31.0 percent of total,

according to RCA. Apartment deals in major

markets were particularly active, even as investors

maintained a keen interest in non-major markets as at a value of 132.0. For 2018 overall, GSA’s price

well. Office sales were the second-largest in terms index rose 1.6 percent. The National Council of Real

of volume, netting 24.0 percent of 2018 total. Estate Investment Fiduciaries (NCREIF) Price Index

Industrial properties remained in high demand, with recorded a 9.8 percent advance during the fourth

sales comprising 16.0 percent of the yearly total, quarter, compared with the same quarter a year

placing the property in third place overall. While the ago, and posted a 9.2 percent gain for the year,

doom-and-gloom about the fundamentals in the compared with 2017.

retail sector stole the headlines, investors discerned

opportunities in the market. Sales volume for retail The financial markets’ volatility of the fourth quarter

properties increased 32.0 percent in 2018 compared of 2018 saw the 10-year Treasury moving past the

with the prior year, the second-highest gain among 3.0 percent threshold. For investors, there was

all property types. strong expectations that cap rates in LCRE markets

would begin trending up. However, cap rates

With investment activity on an uptrend in LCRE remained flat during the quarter, hinting that owners

markets, prices advanced 6.2 percent year-over- and investors maintained a steady approach to

year during 2018, according to RCA’s Commercial valuations.

Property Price Index. All property types recorded Exhibit 2.3: NCREIF Property Index

higher prices during the year, with the apartment Returns—2018.Q4

sector showing double-digit gains from a year ago.

Prices in non-major markets outpaced those in the NATIONAL 1.37%

six major markets.

OFFICE 1.65%

The gains in commercial pricing were mirrored in INDUSTRIAL 3.40%

other commercial real estate price indices. The

RETAIL -0.43%

Green Street Advisors Commercial Property Price

Index—focused on large cap properties—rose 2.0 APARTMENT 1.35%

percent on a yearly basis during the fourth quarter,

Source: National Council of Real Estate Investment Fiduciaries

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 10COMMERCIAL REAL ESTATE

OUTLOOK

Small Cap Commercial Real Estate Markets

In tandem with the broader investment trends in indicated that the pricing gap between buyers and

LCRE markets, small cap markets experienced a sellers was a main issue. Prices in SCRE markets

solid fourth quarter of 2018, with investors focused rose 1.8 percent during the fourth quarter of 2018.

on growing local economies and markets. Sales in Capitalization rates in SCRE markets experienced a

SCRE markets increased by 2.3 percent from the decline of eight basis points.

same quarter in 2017.

Exhibit 2.5: Sales Prices

Exhibit 2.4: Sales Volume (YoY Percent Change)

(YoY Percent Change) Real Capital Analytics CRE Markets

Real Capital Analytics CRE Markets REALTOR® CRE Markets

REALTOR® CRE Markets 15.0%

200% 10.0%

5.0%

150%

0.0%

2008.Q4

2009.Q3

2010.Q2

2011.Q1

2011.Q4

2012.Q3

2013.Q2

2014.Q1

2014.Q4

2015.Q3

2016.Q2

2017.Q1

2017.Q4

2018.Q3

100% -5.0%

-10.0%

50%

-15.0%

0% -20.0%

2013.Q2

2008.Q4

2009.Q3

2010.Q2

2011.Q1

2011.Q4

2012.Q3

2014.Q1

2014.Q4

2015.Q3

2016.Q2

2017.Q1

2017.Q4

2018.Q3

-25.0% Sources: National Association of REALTORS®, Real Capital Analytics

-50%

-100% Sources: National Association of REALTORS®, Real Capital Analytics

The SCRE investment markets were characterized

by a significant shortage of available inventory,

which remained ranked as the top concern for

REALTORS®. Anecdotally, members in many

markets reported investors actively seeking off-

market properties, fueling continued increases in

transaction prices. Close to 40.0 percent of

respondents to a market survey ranked tight

inventory as the number one issue affecting their

markets, followed by a quarter of respondents who

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 11COMMERCIAL REAL ESTATE

OUTLOOK

International transactions remained a fixture in Treasury 10-year note averaged 3.0 percent during

REALTORS®’ CRE markets in the final quarter of the quarter, reaching 3.1 percent by the end of the

the year, accounting for 11.0 percent of responses year. The rising 10-year Note rate narrowed the

to a survey. The average international sale price spread with SCRE cap rates below 400 bps, as

was $1.4 million in the fourth quarter of the year. forward expectations project further spread

compression.

Longer-dated bond yields kept on an upward path in

the fourth quarter of 2018, fueled by the rise in

financial market volatility. The interest rate on the

Exhibit 2.6: Cap Rates - 2018.Q4 Exhibit 2.7: CRE Spreads: Cap Rates to 10-

Yr. T-Notes (basis points)

RCA Markets REALTOR® Markets

8.0% RCA Cap Rates REALTORS® Cap Rates

1200

7.0%

1000

6.0%

800

5.0%

4.0% 600

3.0% 400

2.0%

200

1.0%

0 15Q3

10Q1

10Q3

11Q1

11Q3

12Q1

12Q3

13Q1

13Q3

14Q1

14Q3

15Q1

16Q1

16Q3

17Q1

17Q3

18Q1

18Q3

0.0%

Office Industrial Retail Apartment

Sources: National Association of REALTORS®, Real Capital Analytics Sources: National Association of REALTORS®, Real Capital Analytics

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 12COMMERCIAL REAL ESTATE

OUTLOOK

Large Cap Commercial Real Estate Markets

The commercial fundamentals in LCRE markets Industrial net absorption totaled 62.9 million square

maintained an upward trend, displaying strong feet during the fourth quarter, according to CBRE

performance during the last quarter of 2018, and data. The solid demand outpaced new deliveries,

closing the year on a bright note. Macroeconomic even as completions picked up, with a total of 56.6

trends proved beneficial to space demand across million square feet of new space coming to market.

the core property types, leading to declines in In addition, the pipeline of industrial space under

vacancy rates and continued advances in rental construction rose three percent during the fourth

income. These factors maintained the attractiveness quarter. Strong demand kept the vacancy rate at 4.3

of investments in LCRE markets during the year. percent for the quarter. Asking rents advanced to

$7.37 per square foot, the highest level in 30 years,

The solid economic currents and employment gains and marking a 2.2 percent year-over-year increase.

translated into strong demand for office space in the

fourth quarter of 2018. Net absorption of office The traditional holiday season of the fourth quarter

spaces totaled 16.9 million square feet during the provided wind in the sail of retail stores. Department

quarter, according to CBRE. For 2018 overall, net store closures continued to impact the landscape.

absorption summed to 58.3 million square feet, the However, lifestyle malls, neighborhood shopping

highest annual figure since 2015. According to centers and outlets experienced increased foot

CBRE data, over 90.0 percent of office markets traffic. Net absorption of retail space totaled 14.8

experienced positive absorption during the year. On million square feet. As the supply of new stores

the supply side, the quarter notched 11.8 million came in at a modest 7.2 million square feet, the

square feet of new space delivered, tallying up 49.0 retail availability rate declined to 6.3 percent, based

million square feet of completions for 2018. In on CBRE data. Asking rent rose to $17.57 per

addition, about 70 percent of newly-finished space square foot during the last quarter.

was preleased, as tenants continue to seek quality

work accommodations. Reflecting the demand- The improvement in household formation figures

supply balance, the office vacancy rate declined 10 remained favorable to the multifamily sector during

basis points in the fourth quarter, to 12.6 percent. the fourth quarter of 2018. Net absorption of

The asking rent for office space nationally averaged apartments totaled 286,600 units during 2018, the

$33.2 per square foot at the end of 2018, a 2.7 highest level since 2000, according to CBRE.

percent increase from 2017. Construction of multifamily properties was apace

during the year, with 267,900 units delivered. As

Despite continuing tensions about international demand outstripped supply, the national vacancy

trade negotiations, import and export activity rate declined 20 basis points from 2017, to an

remained brisk in the fourth quarter. In addition, average of 4.5 percent by the end of the year.

consumer spending was solid, especially in the e- Apartment effective rents rose 2.8 percent year-

commerce arena. These factors contributed to over-year, to a monthly average of $1,655 per unit

strong demand for industrial properties—logistics during the fourth quarter.

centers, distribution warehouses, manufacturing

facilities.

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 13COMMERCIAL REAL ESTATE

OUTLOOK

Small Cap Commercial Real Estate Markets

Commercial fundamentals in REALTORS®’ markets Lease terms reflected a preference for slightly

stood in contrast with those in LCRE ones. shorter terms during the fourth quarter. The share of

Following in the wake of a moderate increase in the 60-month leases declined from 27.0 percent of total

third quarter of 2018, fourth quarter leasing activity in the third quarter to 16.0 percent during the fourth

declined 3.1 percent, as a smaller share of quarter of 2018. In tandem, the share of 36-month

members reported closing a leasing deal. The and 48-month lease terms recorded increases,

slowdown was mirrored in construction activity, accounting for 40.0 percent and 11.0 percent of

which notched a mere 0.9 percent uptick. Leasing total, respectively. In addition 12-month leases also

rates remained positive, advancing 2.1 percent showed increased interest from tenants.

during the quarter, and concessions declined 1.3

percent. As leasing activity declined, vacancy rates provided

a mixed picture during the quarter, reflecting mixed

Exhibit 3.1: REALTORS® Fundamentals

conditions across the core property types. The office

New Construction Leasing Volume and industrial vacancy rates in SCRE markets

declined compared to a year ago, by 10 basis points

15% and 40 basis points, respectively. The apartment

10% vacancy remained on par with the fourth quarter of

2017. The vacancy rate for retail properties rose in

% Change, Quarter-over-quarter

5%

small cap markets to 12.5 percent in the last quarter

0% of 2018, reflecting the wave of store closures,

2009.Q2

2010.Q1

2010.Q4

2011.Q3

2012.Q2

2013.Q1

2013.Q4

2014.Q3

2015.Q2

2016.Q1

2016.Q4

2017.Q3

2018.Q2

-5% particularly in smaller, more rural markets.

-10% Exhibit 3.2: REALTORS® Commercial

-15%

Vacancy Rates

-20% Office Industrial Retail

-25% Multifamily Hotel

30.0%

-30%

Source: National Association of Realtors® 25.0%

Tenants seeking space in REALTORS®’ markets

20.0%

remained focused on smaller footprints. In the fourth

quarter, the ‘5,000 square feet and below’ segment 15.0%

accounted for 75.0 percent of activity. Demand for

the ‘5,000 – 7,499 square feet’ segment was on par 10.0%

with the prior quarter, and accounted for 11.0

5.0%

percent of activity. The ‘7,500 – 9,999 square feet’

segment experienced a bump in demand, as it 0.0%

comprised 5.0 percent of reported transactions. The

2010.Q1

2010.Q3

2011.Q1

2011.Q3

2012.Q1

2012.Q3

2013.Q1

2013.Q3

2014.Q1

2014.Q3

2015.Q1

2015.Q3

2016.Q1

2016.Q3

2017.Q1

2017.Q3

2018.Q1

2018.Q3

‘50,000 square feet and above’ segment accounted

for 3.0 percent of total activity, the same share as

the preceding quarter. Source: National Association of Realtors®

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 14COMMERCIAL REAL ESTATE

OUTLOOK

Retail trade faces headwinds from e-commerce, yet Quarterly E-Commerce Sales (in $Bn)

expands in growing metropolitan areas 12.0% 140.00

9.8%

10.0% 120.00

E-Commerce: a $500 Billion Industry 100.00

8.0%

80.00

E-commerce retail sales continues to account for a 6.0%

60.00

larger share of retail trade, with sales estimated at 4.0%

40.00

$507 billion in 2018, or 9.6 percent of the estimated 2.0% 20.00

$5.2 trillion in total retail sales. In 1999, e-commerce

0.0% 0.00

sales made up less than one percent of retail sales.

Q4/2010

Q4/1999

Q4/2000

Q4/2001

Q4/2002

Q4/2003

Q4/2004

Q4/2005

Q4/2006

Q4/2007

Q4/2008

Q4/2009

Q4/2011

Q4/2012

Q4/2013

Q4/2014

Q4/2015

Q4/2016

Q4/2017

The retail trade sector lost 14,900 payroll jobs in 2018

E-Commerce Sales (in $Bn)- right axis

compared to 2017. Meanwhile, there were 225,000

more payroll employment in warehousing and As a Percent of Retail Sales- left axis

transportation services—which are services related

to e-commerce. Change in Non-farm Employment in 2018

from 2017 (in thousands)

Largest Declines in Women’s Clothing/Shoes, Dept.

Stores, Sporting Goods/Hobby/Music Retail Trade -14.9

Utilities -0.7

Looking at 2017 US Census Bureau retail sales data,

Information 13.0

e-commerce has dealt the biggest blow to women’s

Wholesale Trade 39.3

clothing (-2.5% y/y), shoe stores (-1.4% y/y),

Mining & Logging 55.9

department store sales (-1.5% y/y), and sporting

goods, hobby, book, and music stores sales (-2.9% Other services 75.3

y/y). However, with income increasing at a modest Government 98.3

pace, sales were still up in warehouse clubs and Government 98.3

super stores (3.1% y/y), miscellaneous store retailers Financial Activities 118.8

(3.4%) and other general merchandise stores (3.7%). Transportation 225.0

Clothing and accessories (which includes women’s Trade, transportation & utilities 248.7

clothing and women’s shoes) is still growing overall Manufacturing 248.9

(1.4%), on account of the growth in men’s clothing Leisure & hospitality 298.9

stores (4.4%) and jewelry sales (6.1%). Meanwhile, Construction 324.2

electronic shopping and mail order house retail sales Education & health services 479.7

rose 12.1 percent in 2017 from 2016. Professional & business services 491.5

Source: Bureau of Labor Statistics, Seasonally adjusted data

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 15COMMERCIAL REAL ESTATE

OUTLOOK

Annual Percent Change in Sales in 2017

Sporting Goods, Hobby, Book & Music Stores

Women's Clothing Stores

Department Stores excl Leased Departments

Shoe Stores

Clothing & Accessory Stores

Furniture & Home Furn & Electronics/Appliance Stores

Health & Personal Care Stores

General Merchandise Stores

Warehouse Clubs & Super Stores

Miscellaneous Stores Retailers

Other General Merchandise Stores

Men's Clothing Stores

Retail Sales 4.9

Motor Vehicle & Parts Dealers

Jewelry Stores

Fuel Dealers

All Other Gen Merchandise Stores

Building Materials, Garden Equipment & Supply Dealers

Gasoline Stations

Nonstore Retailers

Electronic Shopping & Mail Order Houses

-4.0 -2.0 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0

Source: US Census Bureau, seasonally adjusted retail sales

Metro Areas with the Largest Decrease in Retail Trade Payroll Employment in 2018 from 2016

Metro areas with Largest Increase /Decrease in Largest Decline % Change

Chicago-Naperville-Elgin IL-IN-WI (12,642) -3%

Retail Trade Employment in 2018 from 2016 Pittsburgh PA (4,317) -3%

Montgomery Cnty-Bucks Cnty-Chester Cnty PA MetDiv (2,875) -2%

Of 412 metros with retail trade employment data from Wichita KS

Philadelphia-Camden-Wilmington PA-NJ-DE-MD

(2,625)

(2,550)

-8%

-1%

the U.S. Census Bureau, nearly half suffered a New Orleans-Metairie LA (2,258) -4%

decline in retail trade payroll employment in 2018 Buffalo-Cheektowaga-Niagara Falls NY (2,008) -3%

Boston-Cambridge-Newton MA NECTA Division (1,858) -1%

compared to 2016, led by Chicago-Naperville-Elgin Oklahoma City OK (1,842) -3%

(12,642), Pittsburgh (4,317), Montgomery (2,875) Miami-Miami Beach-Kendall FL MetDiv (1,758) -1%

Wichita, KS (2,625), and Philadelphia-Camden- Los Angeles-Long Beach-Anaheim CA (1,742) 0%

Cleveland-Elyria OH (1,692) -2%

Wilmington (2,550). Detroit-Dearborn-Livonia MI MetDiv (1,625) -2%

Allentown-Bethlehem-Easton PA-NJ (1,600) -4%

However, retail trade employment continues to grow Bridgeport-Stamford-Norwalk CT Metro NECTA

Anchorage AK

(1,467)

(1,467)

-3%

-7%

strongly in about half of metro areas, led by Seattle- McAllen-Edinburg-Mission TX (1,358) -4%

Tacoma-Bellevue (27,542), Dallas-Fort Worth- Springfield IL (1,350) -11%

Shreveport-Bossier City LA (1,258) -5%

Arlington (10,717), Houston-The Woodlands-Sugar St. Louis MO-IL (1,183) -1%

Land (9,392), Dallas-Plano-Irving (9,183), and Baltimore-Columbia-Towson MD (1,133) -1%

Atlanta-Sandy Springs-Roswell (7.633). These Lancaster PA (1,108) -4%

Toledo OH (1,100) -3%

metros have had large gains in population and job Sioux Falls SD (1,075) -6%

growth over the past years. Naples-Immokalee-Marco Island FL (1,067) -5%

Miami-Fort Lauderdale-West Palm Beach FL (1,050) 0%

Columbus GA-AL (1,033) -7%

Los Angeles-Long Beach-Glendale CA MetDiv (1,033) 0%

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 16COMMERCIAL REAL ESTATE

OUTLOOK

Metro Areas with the Largest Increase in Retail Trade Payroll Employment in 2018 from 2016

Nearly 5,000 Announced Store Closings in 2019

Largest Increase % Change

Seattle-Tacoma-Bellevue WA 27,542 13% As e-commerce purchases continue to eat into the

Seattle-Bellevue-Everett WA MetDiv 24,625 14% brick-and-mortar retail space, another major

Dallas-Fort Worth-Arlington TX 10,717 3%

retailer, Payless Shoe Source, announced last

Houston-The Woodlands-Sugar Land TX 9,392 3%

Dallas-Plano-Irving TX MetDiv 9,183 4%

February 15 it was closing its 2,100 stores in the

Atlanta-Sandy Springs-Roswell GA 7,633 3% United States and Puerto Rico after it had filed for

Riverside-San Bernardino-Ontario CA 7,050 4% bankruptcy in 2017. This brings to 4,287 announced

Phoenix-Mesa-Scottsdale AZ 6,475 3% store closings in 2019, following on the heels of 8,139

Orlando-Kissimmee-Sanford FL 6,117 4% announced store closures in 2017 and 5,524 in 2018,

Columbus OH 5,900 6%

according to CoreSight, a website that tracks the

Denver-Aurora-Lakewood CO 5,650 4%

New York City NY (Thous) 5,450 2%

retail market. Announced closures in 2019 includes

Jacksonville FL 5,250 7% Gymboree, Shopko, Chico’s, Gap, Starbuck’s, The

Louisville/Jefferson County KY-IN 4,842 7% Children’s Place, Performance Bicycle, Charlotte

Minneapolis-St. Paul-Bloomington MN-WI 4,767 3% Russe, Sears, Destination Maternity, Lowe’s, Kmart,

Charlotte-Concord-Gastonia NC-SC 4,225 3% Christopher and Banks, Beauty Brands, Henri Bedel ,

Provo-Orem UT 3,800 13%

Lord & Taylor, Target, Macy’s, J. Crew, Kohl’s, and JC

Nashville-Davidson-Murfreesboro-Franklin TN 3,667 4%

New York-Newark-Jersey City NY-NJ-PA 3,550 0%

Penny.

San Francisco-Oakland-Hayward CA 3,400 2%

Portland-Vancouver-Hillsboro OR-WA 3,325 3% How the Brick-and-Mortars Can Reinvent

New York-Jersey City-White Plains NY-NJ MetDiv 3,175 0% Themselves

Austin-Round Rock TX 3,100 3%

Indianapolis-Carmel-Anderson IN 3,083 3%

How the brick-and-mortar retail stores will survive

Tacoma-Lakewood WA MetDiv 2,917 7%

Salt Lake City UT 2,708 4% the increasing shift of consumers to e-commerce

Raleigh NC 2,550 4% will depend on how they re-invent themselves. Many

Sacramento-Roseville-Arden-Arcade CA 2,525 3% stores have invested in technology to engage

Las Vegas-Henderson-Paradise NV 2,458 2% consumers through an omni-channel marketing

Oakland-Hayward-Berkeley CA MetDiv 2,233 2% platform (online and offline). Meanwhile, retailers

have focused on turning stores into a brand-

enhancing space, in addition to the locations’ primary

focus on generating sales. Stores who will cater to

customers’ increasing use of technology for product

search (using visual search rather than just tech

search), and find ways to cut down costs are most

likely to meet the challenge of e-commerce.

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 17COMMERCIAL REAL ESTATE

OUTLOOK

Reflecting changes in economic indicators and

monetary policy, NAR expects the Federal

Operations Market Committee to take a cautious

approach with interest rate adjustments. The federal

funds rate is projected to increase to 2.4 percent in

2019. The move will exert upward pressure on

longer-termed interest rates, which are likely to

affect investment spending, including residential

construction.

As interest rates increase, NAR forecasts inflation

to fall to 1.3 percent. Economic output is expected

to expand at a slower pace of 1.8 percent in 2019.

With monetary tightening and considering that a

strong employment market has been attracting

workers back into the labor force, the

unemployment rate is expected to rise slightly to 4.0

percent in 2019, and non-farm payroll jobs to

increase at a slower pace of 1.3 percent.

As economic activity remains positive, commercial

leasing fundamentals are expected to maintain their

trajectory this year. Vacancy rates will likely provide

mixed results, while cash flows should continue

rising.

Exhibit 4.2: Commercial Real Estate Vacancy Forecast (%)

2017.Q4 2018.Q1 2018.Q2 2018.Q3 2018.Q4 2019.Q1 2019.Q2 2019.Q3 2019.Q4 2020.Q1 2020.Q2 2021.Q3 2018 2019 2020

Office 12.0 12.7 12.4 12.9 13.7 12.8 12.6 12.4 12.3 12.8 12.7 12.5 12.9 12.5 12.6

Industrial 7.8 7.4 7.7 6.8 7.3 7.6 7.3 7.1 6.9 6.8 6.6 6.5 7.3 7.2 6.6

Retail 11.4 12.0 12.0 12.6 12.7 13.0 12.9 13.2 13.4 13.6 13.7 13.9 12.3 13.1 13.8

Multifamily 5.0 5.5 6.1 6.2 6.4 6.2 6.0 5.8 5.7 6.3 6.1 5.8 6.0 5.9 6.0

Source: National Association of REALTORS®

NATIONAL ASSOCIATION of REALTORS® | RESEARCH GROUP | www.nar.realtor/research-and-statistics 18COMMERCIAL REAL ESTATE

OUTLOOK

The National Association of REALTORS® is America’s largest trade association, representing

more than 1.3 million members, including NAR’s institutes, societies and councils, involved in all

aspects of the real estate industry. NAR membership includes brokers, salespeople, property

managers, appraisers, counselors and others engaged in both residential and commercial real

estate. The term REALTOR® is a registered collective membership mark that identifies a real

estate professional who is a member of the National Association of REALTORS® and subscribes

to its strict Code of Ethics. Working for America's property owners, the National Association

provides a facility for professional development, research and exchange of information among

its members and to the public and government for the purpose of preserving the free

enterprise system and the right to own real property.

NATIONAL ASSOCIATION OF REALTORS®

RESEARCH GROUP

The Mission of the NATIONAL ASSOCIATION OF REALTORS® Research Group is to produce

timely, data-driven market analysis and authoritative business intelligence to serve members,

and inform consumers, policymakers and the media in a professional and accessible manner.

To find out about other products from NAR’s Research Group, visit

www.nar.realtor/research-and-statistics

500 New Jersey Avenue, NW

Washington, DC 20001

202.383.1000COMMERCIAL REAL ESTATE OUTLOOK | 2019.Q1

You can also read