CBUS Personal Accident & Sickness Insurance

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

CBUS Personal Accident &

Sickness Insurance

PRODUCT DISCLOSURE STATEMENT (PDS)

Preparation Date: 1 November 2014

The purpose of this PDS Cooling-off Period

This PDS has been prepared to help You decide: You are entitled to end this insurance cover prior

to the expiration of 14 days from the earlier of:

Whether this product will meet Your needs; the date You received confirmation of the

and

insurance transaction; or

Compare this product with any other the date the policy was issued to you

products You may be considering.

unless You have made a claim under this policy.

The unexpired portion of the premium less any

It sets out the significant features of the

non-refundable government taxes and duties will

insurance policy including its benefits, the risks

and information on how the insurance premium is then be repaid to you. You can also cancel the

calculated. You must still read the policy wording policy at other times in accordance with the terms

to ensure it meets Your needs. An index is shown in the policy.

provided to help You.

Your Duty of Disclosure

This statement and policy wording is only being

provided for comparison purposes. We have not You must tell Us anything that You know, or

considered Your personal needs or financial should know, that could affect Our decision to

situation in providing this statement and policy insure You and or the terms on which We insure

wording and/or quotation. If necessary You You. Full details are provided in the application

should seek separate professional advice. form and policy.

The Insurer The Purpose of the Cover

The insurer of this product is WFI Insurance This policy provides personal accident and illness

Limited ABN 24 000 036 279 AFS Licence No. cover for groups of individuals who are between

241461, trading as Lumley Insurance. You can the ages of 16 and 65 at the time of application.

contact Us by: Based on individual circumstances, these age

Telephone: (03) 86274333 limits may be varied by the company. It is an

Fax: (03) 86274312 annual renewable cover. The policy is not

In Writing: GPO Box 2764 Melbourne, Vic 3001. guaranteed renewable.

Freecall: 1300 651 654

Website: www.lumley.com.au How to Apply for Insurance

General Insurance Code of Practice Complete the application form and forward it to

Your Broker, representative or Us. If Your

We subscribe to the General Insurance Code of application is accepted, We will send You a

Practice that sets the standards of practice and schedule that sets out details of the insurance

service for the insurance industry. It is Our aim You have taken out. Please keep this policy

to provide a quality service to You, Our customer. wording and attach the Schedule to it.

In the event We do not achieve Our aim and

How to Make a Claim

cannot resolve the matter with You, We have a

dispute resolution process that You can access.

If You wish to make a claim, please contact Your

Full details appear in the policy under Code of

Practice. Broker, representative or Us. Details about

making a claim are shown in the policy wording.

ACHPDS50301114 1Taxation

The Total Cost

All government charges and taxes are shown

separately on the insurance schedule. Details Your premiums are calculated taking into account

about the Goods and Services Tax are shown in the many and varied risk factors. They are

the policy. payable annually or by instalments if so indicated

on the application form.

Excess Period

Your total premium includes all government

In the event of a claim, You may not receive any charges which are shown separately on the

payment until an Excess Period has expired. The schedule.

Excess Periods are described in the policy and

shown on Your Schedule. Premium rates may be changed but only on

renewal of the policy. You will be given at least

Significant Features and Benefits 14 days notice of the annual expiration of the

policy and of the renewal terms.

The policy provides for:

Weekly payments if you are temporarily

totally disabled through sickness or injury;

Weekly payments if you are temporarily

partially disabled through injury;

A capital sum payment if you lose your

hearing, an eye or limb.

An optional extra benefit of repayment of

certain business expenses.

The main benefits are:

You chose the amount of cover you

need;

The cover is world-wide;

There is cover for exposure to the elements

as a result of injury;

Death benefits are payable if your body is

not found following the sinking or wreckage

of the vehicle you are travelling in.

What is Not Covered

This policy will not provide cover in some

circumstances nor for some illnesses or injuries.

You should read the policy Exclusions for full

details. Some of the main exclusions are

sickness or injury caused by or resulting from:

Self-infliction

War and terrorism

Aerial activities

Professional sports

Pregnancy or childbirth

Criminal acts

Pre-existing conditions

Significant Risks

Your duty of disclosure is very important. If You

have not disclosed something We may be

entitled to refuse to pay a claim and it can have

consequences on Your future cover.

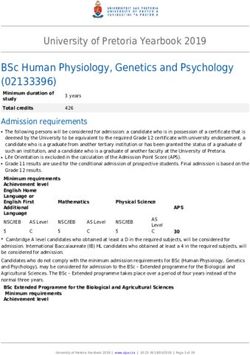

ACHPDS50301114 2INDEX PAGE 1. When You ask for cover, You must tell Us all

that You know about the risk that You want

Product Disclosure Statement .. .. .. 1 covered that may affect Our decision:

(a) To offer You cover, and

Introduction .. .. .. .. .. 3 (b) The terms and the cost of such cover.

Important Notices .. .. .. 3 2. If You ask for the cover to be renewed,

altered or reinstated You must tell Us:

Code of Practice .. .. .. 3 (a) If there have been any changes in what

Privacy .. .. .. . .. 4 is covered, and

(b) Of all things that may increase the

Definitions .. .. .. .. 5 chances of a claim.

Agreement to Cover .. .. .. 7

NON DISCLOSURE

Additional Benefits .. .. .. 7 If You don’t tell Us something that You know that

Optional Extras “ 7 may affect Our decision to offer You cover or the

terms of that cover We may be allowed to:

Conditions .. .. .. .. 8 1. Reduce the amount that We have to pay for a

Exclusions .. .. .. .. 9 claim. This may mean that We would pay

You nothing.

Making a Claim .. .. .. .. 9 2. Cancel this policy. We may even be allowed

Table of Benefits .. .. .. 10 to cancel this policy from the date that the

cover started if You lie to Us or deliberately

keep information from Us or mislead Us.

INTRODUCTION

WHAT YOU DON’T HAVE TO TELL US

This Policy and the attaching Schedule are You do not have to tell Us of anything:

important documents and provide proof of the 1. That reduces the chances of a claim;

contract between You and Us, WFI Insurance 2. That is common knowledge;

Limited ABN 24 000 036 279. Please keep them 3. That We should know as a normal part of Our

in a safe place. business;

4. If We waive Your Duty of Disclosure.

Please read the Policy and Schedule carefully and

together to ensure that You fully understand them IF YOU REDUCE OUR RIGHTS

and that they provide You with the protection that We will not pay that part of a claim where You or

You need and that the interests and amounts an Insured Person have agreed to limit or exclude

insured are those that You selected. A copy of this their rights to recover their loss from another

policy document and the attaching Schedule must party.

be made available to all those employees covered

under it. PROVING YOUR LOSS

If You make a claim We will ask You or the

If it is not completely in accordance with Your Insured Person to justify the amount claimed. We

intentions or You are in doubt as to the meaning suggest that records be kept to make this task

or effect of the wording, please contact Your easy.

Broker, Agent or representative immediately for

clarification. GOODS AND SERVICE TAX (GST)

This policy is subject to a Goods and Services

The Policy Schedule that accompanies this Tax by You in relation to premium.

document shows those Sections of the Policy

which are in force, the people or organizations CODE OF PRACTICE

covered, the amounts of cover You have, any

excess applicable and any special terms that may We subscribe to the General Insurance Code of

change the cover provided under the standard Practice that sets the standards of practice and

Policy. service for the insurance industry.

IMPORTANT NOTICES It is Our aim to provide a quality service to You,

Our customer. However We recognize that

YOUR DUTY OF DISCLOSURE occasionally there may be some aspect of Our

This policy is subject to The Insurance Contracts service or a decision We have made that You

Act 1984. Under that Act You have a Duty of wish to query or draw to Our attention.

Disclosure.

This means:

ACHPDS50301114 3If after talking to Us, You wish to take the matter At the time of collection or as soon as practicable

further, We have a complaints and dispute thereafter We will notify You or make sure You

resolution procedure that undertakes to provide are aware of Our identity, contact details, the

an answer to Your matter within 15 working days. purposes for which We collect the information,

If Your dispute is about a claim and You are not the consequences of not providing the

happy with Our answer or We have taken more information, how You can access and correct the

than 15 days to respond, You may refer the information, that We will disclose the information

matter to the Insurance Ombudsman Services overseas and the countries We will so disclose to.

(IOS) which is an external disputes resolution

body that is free to consumers.

Use and disclosure

We may disclose Your personal information to

We are bound by their decision but You are not

and if You disagree, can still pursue the matter companies in the Insurance Australia Group (IAG),

further through other channels. Please telephone Our agents, overseas service providers, other

Us or the Insurance Council of Australia for the insurers, mailing houses and document service

IOS’s contact number. providers, financial institutions, insurance and

claim reference agencies, credit agencies, loss

PRIVACY assessor and adjusters, financial or investigative

service providers, internal dispute resolution

We are committed to meeting Our privacy officers and dispute resolution providers such as

obligations to You under the Privacy Act 1988 the Financial Ombudsman Service.

(Cth) (‘the Act’). The Act provides for information

to be collected, used, disclosed and held in We use and disclose Your personal information for

accordance with the Australian Privacy Principles the purposes of providing insurance,

(APPs). administration of Your policy, claims handling and

dispute resolution.

You agree that We may collect, use, disclose and

hold Your personal information as set out below. We may also use or disclose Your personal

information for a secondary purpose and You

Collection agree that We may so use it.

We collect information which is reasonably

necessary to provide Our services for underwriting Indirect collection

and administering Your insurance, claims When You provide information about other

handling, market and customer satisfaction individuals You must make them aware of the

research and to develop and identify products and disclosure and the use to which their personal

services that may interest You. Collection will only information will be put.

take place by lawful and fair means.

We will only collect personal information about an

We collect information regarding You, other individual from that individual, unless it is

people, any risk to be insured, previous claims or unreasonable or impractical to do so.

losses, details of previous insurances and insurers,

credit status and any matters relevant to the Overseas recipients

insurance to be provided. If Your personal information is collected by or

We collect personal information directly or supplied to an organisation outside of Australia

indirectly by telephone, email, facsimile, online, We will ensure it will be held, used or disclosed

post, external agencies and in person from You or only in accordance with the Act. We collect and

another person or persons. provide Your personal information to a call centre

in South Africa, information technology centres in

If We collect information pursuant to a law, India and a customer survey service in New

regulation, or court order then We will advise You Zealand. The countries to which information may

of the law or the court order applicable. be disclosed may vary from time to time. We

provide You with notification of these changes by

If You fail to provide Us with personal information means of Our online privacy policy which You can

then this insurance may not meet Your needs. If access at www.lumley.com.au.

You fail to provide information further to Your

duty of disclosure to Us, then there may be no Marketing

cover or a reduced cover for any claim made and We also collect Your information so that We and

in some cases the policy may also be avoided. Our related companies and business alliance

partners can offer You services and products that

ACHPDS50301114 4We believe may be of interest to You. You agree any kind to Your complaint within 30 days, then

that We may so use Your personal information. You have the right to take the matter to the

However, You can opt out of receiving such OAIC.

communications by contacting Us.

The OAIC is the statutory body given the

Access and correction responsibility of complaint handling under the Act.

You can seek access to Your personal information The OAIC is independent and will be impartial

by contacting Us. You can require Us to correct when dealing with Your complaint. The OAIC will

the personal information if it is inaccurate, investigate Your complaint, and where necessary,

incomplete or out of date. We will respond to any make a determination about Your complaint,

such request within a reasonable time. We will provided Your complaint is covered by the Act.

provide You with access within a reasonable time You have 12 months from the date You became

in the manner requested, unless We are entitled aware of Your privacy issue to lodge Your

to refuse to provide access. If We decline to complaint with the OAIC. The contact details of

provide You with access We will provide You with the OAIC are:

the reasons for Our refusal and how You may

access Our internal dispute resolution (IDR) Office of the Australian Information Commissioner

process. GPO Box 2999

Canberra

If We correct information We will inform You. If ACT 2601

We refuse to amend information We will provide Telephone: 1300 363 992

You with Our reasons for the refusal and details of Website: www.oaic.gov.au

how to access Our IDR process. Email: enquiries@oaic.gov.au

Data quality and security You also have a right in limited circumstances to

We will take such steps as are reasonable in the have Your privacy complaint determined by the

circumstances to ensure the personal information Financial Ombudsman Service (FOS). The FOS can

We collect is accurate, up to date, complete and determine a complaint about privacy where the

protected from unauthorised access, misuse, complaint forms part of a wider dispute between

modification, interference or loss. You and Us or when the privacy complaint relates

to or arises from the collection of a debt. The FOS

Privacy policy is an independent dispute resolution body

If You would like more details about Our privacy approved by the Australian Securities and

policy, would like to seek access to or correct Investments Commission. We are bound by FOS’

Your personal information, or opt out of receiving determinations, provided the dispute falls within

materials We send, please contact Us. You can the FOS’ Terms of Reference, but You are not so

also view a copy of Our privacy policy on Our bound. You have two years from the date of Our

website at www.lumley.com.au. letter of decision to make an application to the

FOS for a determination. You can access the FOS

Complaints dispute resolution service by contacting them at:

If You have a complaint regarding Our

management of Your privacy You may access Our The Financial Ombudsman Service,

internal dispute resolution (IDR) process by GPO Box 3,

contacting Us. In the first instance You should Melbourne,

contact Us requesting a resolution. The person Victoria 3001.

contacted has one business day to resolve Your Telephone: 1300 780 808

complaint and if he or she cannot do so must Website: www.fos.org.au

refer the complaint to a manager. The manager Email: info@fos.org.au

has a further five business days to resolve the

matter. If the manager cannot resolve the matter

You may ask him or her to refer it to the Lumley DEFINITIONS

IDR Committee which then has 15 business days

to make a decision. When We make Our decision We, Us, Our means WFI Insurance Limited

We will also inform You of Your right to take this ABN 24 000 036 279 AFS Licence No. 241461,

matter to the Office of the Australian Information trading as Lumley Insurance.

Commissioner (OAIC) together with contact

details and the time limit for applying to the OAIC.

In addition if You have not received a response of

ACHPDS50301114 5You, Your means the person or organization Earnings means:

shown in the Schedule as the Insured.

If the Insured Person is self-employed:

Insured Person means such persons that are The Insured Person’s gross weekly income

shown in the Schedule as the Insured Person. derived from personal exertion after deducting

any expenses necessarily incurred in deriving

Schedule means the Schedule We have that income, averaged over the period of twelve

issued. The Schedule is part of the policy and months prior to the date of disablement

will show the cover You have chosen plus any commenced or over such shorter period that the

Excess or special terms that We may have Insured Person has been continuously self-

imposed. employed.

Injury shall mean bodily Injury resulting from an If the Insured Person is an employee:

accident occurring during the Period of The Insured Person’s gross weekly rate of pay

Insurance and caused by violent, external and inclusive of overtime payments, bonuses,

visible means, but does not include any commissions and allowances averaged over the

condition that is also a Sickness. period of twelve months prior to the date of

disablement commenced or over such shorter

Sickness means illness or disease first period that the Insured Person has been

manifesting itself during the Period of Insurance continuously employed.

and which must continue for a period of not less

than seven days from the date the Insured Business Expenses means the fixed expenses

Person first sought treatment from a legally that You reasonably incur in running Your

qualified medical practitioner in respect of that business being:

Sickness.

1. employees wages and on-costs (for example;

Permanent Total Disablement means superannuation, premiums for accident or

disablement resulting from an Injury and which workers’ compensation, pay-roll tax, amounts

has lasted for at least twelve calendar months payable under awards and regulations)

from the date of such Injury and which 2. rent, property rates

thereafter is beyond hope of improvement and 3. electricity, water, gas or telephone charges

which entirely prevents the Insured Person from 4. laundry and cleaning expenses

engaging in their usual occupation, profession 5. leasing payments on equipment or motor

or business, or any other for which the Insured vehicles

Person is qualified by education, training or 6. other expenses that are usual for the Insured

experience. Person’s type of business and that would be

considered business expenses for income

Temporary Total Disablement means tax purposes.

disablement that either entirely prevents the

Insured Person from engaging in their usual Business Expenses does not mean:

occupation, profession or business or prevents

the Insured Person from performing at least one 1. Payment of Your personal accounts or

of the duties of their occupation that they must withdrawals from Your accounts for

be able to perform to earn their income, while personal use

under the regular care of and acting in 2. Your wages, salary or fees

accordance with the advice of any legally 3. Wages, salary or fees for any person as Your

qualified medical practitioner. replacement.

4. The cost of stock or merchandise

Temporary Partial Disablement shall mean

disablement that entirely prevents the Insured Period of Insurance means the period the

Person from carrying out a substantial part of insurance policy is in force for which a premium

the duties normally undertaken in connection has been paid as shown in the Schedule. This

with their usual occupation, profession or period may be restricted to certain times of the

business. day or week as shown under Scope of Cover.

Loss of Use means loss of, by physical Endorsement Period means the period

severance or permanent loss of the full effective between the date of a requested change in the

use of the part of the body referred to in the policy cover and the expiry date of the policy as

Table of Benefits. shown in the Schedule.

ACHPDS50301114 6Excess Period means the period stated in the such condition will be treated as though it were

Schedule during which no benefits are payable an Injury for the purpose of this policy.

for Temporary, Total or Partial Disablement.

2. Disappearance

Benefit Period means the maximum time for If, during the Period of Insurance, a conveyance

which benefits are payable for Temporary, Total on which the Insured Person is travelling, sinks

or Partial Disablement. or is wrecked and the Insured Person’s body

has not been found within one year of the date of

Act of Terrorism means an act, including but the disappearance, sinking or wrecking, We will

not limited to the use of force or violence and or presume that the Insured Person has died as a

threat thereof, of any person or group of result of Injury at that time and the benefits will be

persons, whether acting alone or on behalf of or payable accordingly.

in connection with any organization or

government which from its nature or context is 3. Rehabilitation Expenses

done for, or in connection with, political, If We have paid for a claim under a condition

religious, ideological, ethnic or similar purposes listed under the Weekly Benefits section in the

or reasons, including the intention to influence Table of Benefits, We will also pay expenses

any government and or to put the public, or any incurred for tuition or advice from a licensed

section of the public, in fear. vocational school, provided such tuition or advice

is undertaken with Our prior written agreement

Scope of Cover means a period of time within and the agreement of the Insured Person’s

a Period of Insurance that the cover under this attending physician.

policy is restricted to as shown in the Schedule.

Payments under this provision will be limited to

Aggregate Limit of Liability means the the actual costs incurred not exceeding $500 per

maximum amount shown in the Schedule that month and will be payable for a maximum of six

We will pay for any one event giving rise to months.

claims involving more than one Insured Person

in any one Period of Insurance. 4. Home Renovations

If an Insured Person is entitled to claim

AGREEMENT TO COVER compensation under The Table of Benefits,

Capital Sum Benefits Conditions 5 to 9, and is

Provided You have paid Us the premium, if, as also as a direct result of such Injury required to

a result solely and directly of: renovate their residence (including but not limited

1. Sickness, an Insured Person suffers from to the installation of ramps for external or internal

Temporary Total Disablement; wheel chair access, internal guide rails,

2. Injury, an Insured Person suffers from emergency alert system and similar disability aids)

Temporary Total Disablement or any of the in order to perform daily lifestyle activities such as

other conditions set out in the Table of washing, cooking, bathing, dressing and

Benefits movement around their existing residence, We will

occurring anywhere in the world, We will pay pay 80% of the cost incurred for such renovations

the benefits set out in the Table of Benefits to to a maximum of $10,000.

You or to the Insured Person shown in the

Schedule if so directed by You. This additional benefit is only payable:

a) where such renovations are undertaken with

The Sickness or Injury must occur within the Our prior written agreement and the

Scope of Cover shown in the Schedule. agreement of the Insured Person’s attending

physician; and

All conditions in the Table of Benefits must b) in respect of one residence only.

occur within twelve months of the Sickness or

Injury as the case may be.

OPTIONAL EXTRAS – Business Expenses

ADDITIONAL BENEFITS

If:

1. Exposure 1. Your Schedule shows that You are covered

If by reason of an Injury occurring during the for this Optional Extra and

Period of Insurance the Insured Person is 2. We have agreed to pay You a weekly benefit

exposed to the elements and as a result of such for total disablement,

exposure suffers a condition for which benefits We will also pay You the lessor of:

are payable as set out in the Table of Conditions, 1. Your Weekly Business expenses that You

actually incur each week, or

ACHPDS50301114 72. Your Weekly Business Expenses that You benefit entitlement. If the Insured Person

incur periodically for that week. For example is receiving a weekly benefit at the time the

if You have to pay a Business Expense every Insured Person becomes entitled to a

four weeks, then We will pay You one quarter capital sum benefit for the same Injury and

of that amount for each week You are totally the capital benefit is the higher, then the

disabled. weekly benefit will cease and any weekly

benefit payments already made will not be

We will pay Your weekly Business Expenses for deducted from the capital sum benefit.

each week that You are totally disabled by the

Sickness or Injury up to the Benefit Period shown 4. Not more than one capital sum benefit shall

in the Schedule for each claim You make under be payable for any condition resulting from

this Optional Extra in each Period Of Insurance. the one Injury. In the event that more than

one benefit is payable, We shall pay the

The weekly amount We will pay is shown in the highest benefit.

Schedule less any amount for the Excess Period.

5. Weekly benefits shall not be payable for

All General Conditions, Exclusions and Definitions more than one condition during the same

apply to Business Expenses. period.

6. No benefits are payable unless as soon as

CONDITIONS possible after the happening of any Injury

or Sickness the Insured Person procures

1. The cover under this policy for an Insured and follows medical advice from a qualified

Person shall become effective on the latest of medical practitioner.

the following dates:

a) the commencing date of the first Period of 7. If an Insured Person suffers an Injury

Insurance set out in The Schedule; resulting in any one of the conditions under

b) the date such Insured Person becomes the Table of Benefits, Capital Sum Benefits

eligible for cover under this policy. Section 5 to 9, We will not be liable under

c) where a proposal is required by Us, on this policy for any subsequent Injury to that

the date of Our acceptance of Your Insured Person.

written proposal

8. If an Insured Person received compensation

Provided always that, if as a result of under the Weekly Benefits section of the

medical advice, an Insured Person is not Table of Benefits and while this policy is in

regularly performing all the usual duties of force suffers a recurrence of Temporary Total

their occupation on the date of their or Temporary Partial Disablement from the

inclusion under this policy, then this same or related causes within 6 consecutive

Insurance shall only take effect on the date months of their return to their occupation on a

of return to the regular performance of all full time basis, We will consider such

their usual duties after being medically Disablement to be continuation of the prior

certified fit to do so. claim period.

2. The weekly benefit payable for Temporary The period of recurring Disablement will be

Total Disablement shall be reduced by: aggregated with the prior claim period.

(a) the amount of any worker's

compensation entitlement or any other 9. You must give Us immediate written notice if

form of statutory compensation You take out any other insurance with

(b) income earned from any other another insurer providing for weekly benefits

occupation of a similar kind which together with this

(c) weekly benefits from any other accident insurance, will exceed the Insured

and or sickness policy of insurance Person’s Earnings.

in order to limit the total payments to the

Insured Person under this policy and items 10. You must give Us written notice containing

(a), (b) and (c) above, to their weekly income full particulars of any Injury or Sickness in

or the limit stated in the policy Schedule, respect of which a claim is to be made as

whichever is the lesser. soon as possible and the Insured Person

must, at their own expense, furnish Us with

3. If the Insured Person becomes entitled to all such documentation and evidence as

a weekly benefit and a capital benefit for the We may require.

same Injury We will pay You the highest

ACHPDS50301114 811. In the event of a claim, the Insured condition for which a duly qualified medical

Person must submit to any medical or practitioner was consulted or for which

other examination or examinations as We medication or treatment was prescribed

may, at Our expense, require. within six months immediately prior to

becoming insured under this policy. This time

12. In the case of the Insured Person’s death, frame includes a condition, the symptoms of

We shall be entitled to conduct a post which would have caused a reasonable

mortem examination. person to seek medical advice or treatment.

13. All Weekly benefits will be paid fortnightly 4. In respect of any Injury or Sickness directly

in arrears. The underwriter will pay one- or indirectly caused by or contributed to by

seventh (1/7th) of the Weekly Benefit for an Act of Terrorism

each day of Disablement.

5. For any Injury or Sickness that results from

14. This policy may be cancelled at any time at the illegal or criminal acts of the Insured

Your request. We may cancel the Policy only Person.

in accordance with the provisions contained

in the Insurance Contracts Act 1984.

MAKING A CLAIM

If You cancel the policy, We shall retain or be

entitled to the proportional premium for the If You become aware of an event that may lead to

period during which the Policy has been in a claim You must:

force plus Our cancellation charge. 1. Tell Us about it as soon as You can;

2. Within 30 days, assist Us in obtaining full

15. The insurance cover on any Insured Person details in writing including any proofs for

shall be immediately cancelled at the earliest which We may ask;

of the following times: 3. Tell the Police if the claim was due to a

(a) The date the policy is cancelled by You; crime.

(b) The date the Insured Person leaves or is

dismissed from Your employment;

(c) The date You request the Insured Person

is to be deleted from cover;

(d) The date the Insured Person reaches an

age that is outside the age limits

specified in the Schedule.

EXCLUSIONS

No benefits are payable:

1. For any condition resulting from Injury or

Sickness which:

(e) is deliberately caused by the Insured

Person or which is self –inflicted;

(f) occurs as a result of war, invasion or

civil war;

(c) results from being engaged in any aerial

activity other than as a passenger in a

licensed aircraft;

(d) results from taking part in or training for

any professional sporting activity.

2. For any condition attributable to pregnancy

or childbirth or complications of these unless

the Insured Person is continuously

confined to bed on advice from a duly

qualified medical practitioner and the term of

the pregnancy has not exceeded 26 weeks.

3. For any Injury or Sickness that is directly or

indirectly caused by any pre-existing

ACHPDS50301114 9Table of Benefits

The Conditions The Benefits

Weekly Benefits - Sickness

1. Temporary Total Disablement caused For each week of Disablement, the weekly sum insured

directly and solely by Sickness. stated in the Schedule or the percentage of the Insured

Person’s Earnings stated in the Schedule (whichever is

the lesser) payable for the period shown in the Schedule

and commencing from the first treatment by a duly

qualified medical practitioner.

Weekly Benefits - Injury

2. Temporary Total Disablement caused For each week of Disablement, the weekly sum insured

by Injury stated in the Schedule or the percentage of the Insured

Person’s Earnings stated in the Schedule (whichever is

the lesser) payable for the period shown in the Schedule

and commencing from the first treatment by a duly

qualified medical practitioner.

3. Temporary Partial Disablement caused Is calculated by reducing the Temporary Total

by Sickness or Injury Disablement benefit by the same proportion that the

Insured Person’s Earnings are reduced as a direct result

of being unable to perform their normal hours of duties.

Capital Sum Benefits (payable as a result of Injury only) The Benefits

The percentage of the capital sum insured stated in the Schedule as

shown hereunder

4. Death 100%

5. Permanent Total Disablement 100%

6. Permanent and incurable paralysis of all limbs 100%

7. Permanent total loss of one or two limbs 100%

8. Permanent total loss of sight in one or both eyes 100%

9. Permanent and incurable insanity 100%

10. Permanent total loss of hearing

10.1 In one ear 20%

10.2 In both ears 75%

11. Permanent total loss of lens of one eye 50%

12. Permanent total loss of use of fingers:

12.1 Three joints per finger 10%

12.2 Two joints per finger 8%

12.3 One joint per finger 5%

13. Permanent total loss of use of one thumb of either hand

13.1 in both joints 30%

13.2 in one joint 15%

14. Permanent total loss of use of toes in either foot

14.1 All in one foot 15%

14.2 Great both joints 5%

14.3 Great one joint 3%

14.4 Other than great each toe 1%

15. Fractured leg or patella with established non-union 10%

16. Permanent disability not otherwise An amount that We shall in Our absolute discretion

provided for under conditions 5 to 15 determine and being in Our opinion not inconsistent with

inclusive the benefits provided under Conditions 5 to 15 inclusive but

in no case more than 75% of the Capital Sum Insured

shown in the Schedule.

17. Burns or disfigurement extending to more than 50% of the entire body 50%

18. Loss of at 50% of all sound and natural teeth, including capped or 1% per tooth

crowned teeth per tooth. Maximum $10,000 per event.

19. Shortening of leg by at least 5 cm 7.5%

20. Permanent Total Loss of four fingers and thumb of either hand 70%

21. Permanent Total Loss of four fingers of either hand 40%

ACHPDS50301114 10You can also read