Can the Dutch Gas Bubble defy King Hubbert's Peak?

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

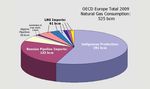

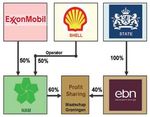

first break volume 29, April 2011 news feature Can the Dutch Gas Bubble defy King Hubbert’s Peak? The Peak Oil theory may be on its way to being confirmed by the depletion of Europe’s largest natural gas field, which can only be rescued by a new era of gas exploration. This would also delay Europe’s growing dependency on foreign gas imports. Ruud Weijermars1* and Elaine Madsen2 examine whether past success can be equaled by future exploration initiatives. King Hubbert was already a revered Fortunately, practical improve- in conventional gas production. If cor- Shell research scientist in its Houston ments in E&P technologies have rect, Holland’s gas production may research lab when he presented his shifted the global peaking of oil and have peaked for a last time in 2010 Peak Oil ideas to the 1956 Spring gas production a couple of decades and is now entering a final decline Meeting of the Southern District, into the future. In Holland too, the phase. American Petroleum Institute, in San advent of new technology has delayed Antonio, Texas. Science magazine the final peaking of domestic gas pro- NAM oil stumbled into had published an earlier scholarly duction several times, as can be seen giant gas find account of his theory in 1949. ‘The from the extended production plateau The current profit-sharing agreement end of the oil age is in sight,’ Hubbert during 50 years of gas production (Fig. between Exxon and Shell and the stated. He repeated this assertion in 1b). Hubbert’s theory – if not deferred Dutch State (Fig. 2) goes back a long a 1974 contribution to the National by further production innovations - way. Standard Oil (Exxon’s parent Geographic, claiming that the global heralds an imminent end for the Dutch company) had entered the Dutch production of oil and gas would peak gas bubble. The Netherlands still plays petroleum play after World War II in 1995 (Hubbert, 1949, 1974). His a lead role in European gas supply to form in 1947 the Nederlandse Peak Oil theory was plausible under after Norway: in 2009 it was still the Aardolie Maatschappij (NAM), a the assumptions made (Fig. 1a) and world’s 6th ranked producer and 7th 50/50 joint venture between Shell and provided a provisional deadline for ranked gas exporter. However, recent Standard’s Dutch subsidiary Esso. alternative forms of energy that must inventories of all past gas production The NAM partnership was originally replace petroleum in the sharp drop- and remaining field pressures (EBN/ formed to develop a giant oilfield off that would follow. TNO reports) foresee a steep decline at Schoonebeek. Nearly 250 million Figure 1 (a) King Hubbert poses in front of a poster - mockingly headed ’What on Earth can we do about Hubbert’s pimple?’ Exactly this question is what keeps the Dutch busy. (b) Stacked on top of one another the production profiles of the Groningen Field, offshore small fields, and onshore small fields (after EBN, 2010; Scheffers, 2010) resemble a real life example of Hubbert’s pimple peaking. Shaded areas are EOR and anticipated new discoveries, all in conventional small field prospects. 1 Department of Geotechnology, Delft University of Technology, Stevinweg 1, Delft 2628CN, The Netherlands. 2 US-based oil industry writer on Dutch gas and ExxonMobil operations. * Corresponding author, E-mail: R.Weijermars@TUDelft.nl © 2011 EAGE www.firstbreak.org 35

news feature first break volume 29, April 2011

a young engineer, Douglass Stewart, to the new gas money flowing in – how

the Netherlands. The story is told in could one manage the new gas money

two recent books (Stewart and Mad- flow and avoid a negative impact on the

sen, 2007; Madsen and Stewart, 2008) economy from the future gas produc-

which fill in an important part of the tion? How do we manage the (limited)

Dutch gas legacy from the perspective of life-cycle of the resource?

the Exxon stakeholder, something that As long as the pipeline and the

was completely missing in the Dutch market did not exist, there was no

historical records. Stewart’s first task reference price for the Dutch gas. In

was to check the rumour that a major essence, the Dutch gas remained worth-

gas field had been found. less unless many practical above-ground

Figure 2 Profits from NAM are shared between His first visit to Shell’s headquarters issues could be solved. A large field

Exxon, Shell, and Dutch State at 30-30-40% accord-

ing to the profit sharing agreement in Maatschap in The Hague in October 1960 led to a required a major field development plan

Groningen (adapted from Schenk, 2010). remarkable rebuff. Only after overnight and enormous investments to build the

transatlantic cable exchanges between pipelines to the customers. This required

barrels of crude have been recovered the leaders of both companies did Shell the setting of an acceptable gas price

from that single field between 1947 and accede to the Exxon man access to their with the help of the several governments

1996. Notably, 750 million barrels of geological records. During a surprise involved in an emergent NW European

thick viscous oil remained underground visit to NAM’s exploration office near gas market. It took an agonizing four

at Schoonebeek’s abandonment in 1996. the Groningen Field, he quickly realized years of negotiations between the three

Field redevelopment was approved some that a major find was on its hands. principal partners (Exxon, Shell, and

years ago and was finalized in 2011. Early estimates of the gas field’s size the Dutch State) before the gas from

Some 100 million barrels of oil will now were impressive: some 300 bcm, perhaps the Groningen Field came into produc-

be lifted above ground by liquefying the more. Years later it became apparent tion in 1963. What no one considered

residual oil by steam injection over the that the ultimate recoverable reserves of then was what happens when the gas

next two decades. the Groningen Field were 10 times the is depleted. Now in 2011 the question

The early development of Dutch original estimated volume, some 3000 has suddenly become very relevant and

gas was much more complicated than bcm. answers are sought as to how to deal

Schoonebeek’s early oil success. Separate Exxon, Shell and the Dutch State with the impending gas deficit.

gas finds in wells drilled along the con- began an intriguing period of negotia-

tours of its giant footprint, back in 1959, tions and inventories to settle numerous Gas income for the State

were at first not recognized as being part questions: Who pays for the start up Substantial income from the national

of a single reservoir. Reportedly, Royal cost? How do you secure an agreement gas endowment has been part of the

Dutch Shell was rather disappointed that benefits all stakeholders? Who has Dutch government’s operational budget

to find gas and no oil in any of these the know-how to develop such a big since 1963. The discoveries of oil at

wells. Without a natural gas market in gas field? The local economy could be Schoonebeek (1943) and gas at Gro-

Europe back in the late 1950s, the gas severely disrupted by inflation due to ningen (1959) have had a tremendous

was commonly considered a nuisance as

it remained worthless.

Exxon’s gas expertise

The casual announcement by a Belgian

politician in 1960 that the Dutch gas

discovery could be big enough to serve

an entire NW European market revived

Exxon’s interest in the Netherlands.

With so much gas in the ground proven

by geological research, the remaining

problem could be solved: gas could be

produced and sold at a profit if a market

was physically tied to the wellhead by a

pipeline distribution system. However, Figure 3 Gas money has been important for the Dutch economy and provides innovation incentives.

Gert-Jan Lankhorst, director of the Dutch gas-trading company GasTerra (right) awards the annual sus-

no natural gas infrastructure existed

tainable energy prize. In 2010, €50,000 went to Coos Wallinga (centre) and four more students of the

in Europe back in 1960. To build the Hanzehogeschool in Groningen received €10,000 each for their carbon neutral village concept. (Photo:

market and the pipelines, Exxon sent GasTerra).

36 www.firstbreak.org © 2011 EAGEfirst break volume 29, April 2011 news feature

impact on the postwar economic recov- to unlock gas trapped in tight sand, shale gas drilling has slowed consider-

ery of the Netherlands. In addition to shale, and coal seams. The development ably for economic reasons (Weijer-

the 40% profit sharing in NAM (Fig. 2), of these so-called unconventional gas mars, 2011), and majors like Shell and

the State receives 50% of the gas trading resources requires horizontal drilling Exxon have their own exploration

profits from GasTerra; the remainder and high pressure hydraulic fracturing going on elsewhere in Europe (Shell

is shared equally between Exxon and of the rock, as well as a pioneering spirit in Sweden’s Alum shales; Exxon in

Shell. GasTerra trades the NAM gas and to turn these risky geological plays into German shales).

buys additional supplies from abroad an economic business (Holditch and Cuadrilla is entrepreneurial enough

for re-export through the gas pipelines HusamAdDeen, 2010). As a result of to have acquired an exploration licence

and roundabout of Gasunie. GasTerra’s early successes, production of US domes- to drill a 4 km deep vertical well into

annual turnover averaged some €20 tic gas from unconventional reserves Jurassic Posidonia shales at Boxtel in

billion in recent years (Fig. 3). has now surpassed domestic output of 2011. The operation is run by Cuadrilla

The Dutch golden age of convention- conventional gas. Is there a formula for subsidiary Brabant Resources, with a

al oil and gas production has brought success here for the Netherlands? negative cash flow in the 2009 annual

the State a windfall income of hundreds The Dutch have begun to assess their report. Nonetheless, EBN has taken

of billions of Euros. Handsome net unconventional gas resource potential in a 40% share in the company’s Dutch

earnings of €230 billion accumulated earnest in attempts to replace the falling operations as stated in a 2010 presenta-

between 1963 and 2010, mainly from gas production from conventional fields. tion by Brabant Resources in Boxtel.

taxes and participations in indigenous Some small successes can be reported Meanwhile, the Netherlands has

gas production. A year with high natural from the application of unconventional pragmatically secured future gas supplies

gas prices like 2008 brought the State and new technologies. Recovery has – a new LNG landing terminal is already

over €14 billion net income in that year already been demonstrated from a tight under construction on a remote stretch

alone. sand formation near Ameland, north- of Rotterdam’s reclaimed seafloor board

Unlike Norway, which created a west of the Groningen Field, using mul- (Fig. 4a). Giant storage tanks can hold

Sovereign Wealth Fund (SWF) from ti-stage fracking and horizontal drilling landed LNG from Nigeria, Qatar, Trini-

excess oil and gas earnings to protect its technology (Crouch et al., 1996). But dad, and other overseas LNG provid-

national economy against inflation, the much more is needed to replace the ers. Additionally, giant ships equipped

Netherlands chose not to institute such a deflation of its huge conventional gas with stingers for laying submarine gas

fund. Instead, gas income has been spent production. pipelines are now preparing to build the

by the government over five decades, Accelerating the unlocking of uncon- 1224 km Nordstream pipeline. Gas sup-

mostly as sunk cost into durable infra- ventional resources is now in the hands plies may come in via the Nordstream

structure, with the argument that such of Cuadrilla Resources Holdings, a junior pipeline, a joint venture of Gazprom and

spending would cushion inflation, and company with a market capitalization of Dutch Gasunie, from the Urengoy Field

future wealth would be generated by the some $100 million. The company is 41% in the Russian tundra (Fig. 4b). Russian

improved infrastructure. owned by AJ Lucas Group, an Austral- gas fields connect via Nordstream with

While the debate to install a belated ian diversified mining services group. northwest European consumers and can

Netherlands SWF continues until today, Riverstone/Carlyle Global Energy and be dispatched to the Dutch gas grid. The

much of that easy, past gas income will Power Funds, for which former BP chief new LNG terminal and the Nordstream

evaporate for the Dutch State (Weijer- executive Lord Browne is UK managing gas pipeline will both be operational in

mars and Luthi, 2011). The drop in gas director, invested $58 million in Cuad- 2012.

production income implies the Dutch rilla in February 2010. The company As more foreign gas will be landed

GDP will decline by as much as 3% drilled the Bowland shale formation in the Netherlands to close the emerg-

over the next few decades. But can the near Blackpool (UK) in 2010, and will ing gas supply gap, all seems fine and

accumulation of lost gas income perhaps frac the well in 2011. solved. But some worries remain. There

be avoided? For example, could shale Cuadrilla is not into shale gas for are geopolitical concerns: What hap-

gas bring a halt to the steep gas produc- long-term development. Chris Cor- pens if the Russians block the gas flow

tion decline in Holland, the country nelius, director and co-founder, stated in Nordstream as has happened on a

which launched Europe’s conventional in a UK Channel 4 interview last year: number of occasions with the Ukraine?

gas markets? ‘If those (Bowland shale) explorations

prove successful, then Cuadrilla will Europe’s dash for gas

Can unconventional gas defeat look to sell the entire operation to a The question remains whether the

the King’s prophecy? large exploration company, like Shell, Netherlands will be a play opener or

The US has averted an imminent decline to carry out the expensive and time- a follower in European unconven-

of its domestically produced natural consuming production process’. This tional gas development. Following the

gas by developing new technologies assumption may be optimistic as US US example is particularly attractive

© 2011 EAGE www.firstbreak.org 37news feature first break volume 29, April 2011

Figure 4b The Urengoy Field is Russia's largest gas

field and also one of the largest onshore deposits

in the world. By completing a pipeline link from

the world's biggest gas reserves in Russia to the

Figure 4a LNG Gate terminal construction in Rotterdam port started in 2009 with three huge storage tanks. European gas network, Nord Stream will meet

They will be ready to land LNG imports from 2012 onward. The LNG terminal will have an initial through- about 25% of the additional gas import needs of

put capacity of 12 bcm per year, which requires about 150 shipments a year (Photo: GATE). the European Union. (Photo: Nord Stream).

Figure 6 Students from the Department of

Geotechnology, TU Delft, have fanned out to study

oil and gas formations in all corners of the world, as

well as participated in domestic oil and gas opera-

Figure 5 Gas supply origin for OECD Europe. LNG imports account for 12% of total consumption and come tions. This readies them for the world’s energy

from Algeria (21 bcm), Qatar (15 bcm), Nigeria (8 bcm), Trinidad (6 bcm), Egypt (5 bcm), and other sources realities after completion of their degree studies.

(6 bcm). (Plotted from data in OECD/IEA, 2010). (Photo: TU Delft).

for many European nations. Europe’s for a staggering 12% of Europe’s gas by the US State Department in 2010.

indigenous gas production is declining consumption. These LNG imports come Shale gas strategy drivers vary somewhat

rapidly since 2005. The statistics of into European ports via overseas LNG across Europe.

the International Energy Agency show carriers from Algeria, Qatar, Nigeria, For example, Poland is 50% depend-

that of the 16 countries in the OECD Trinidad, and Egypt. ent on Russian gas imports and wants to

Europe, only Norway and the Neth- Europe could break out of its depend- reduce its dependency on these imports

erlands harness sufficiently large gas ent position by vigorous exploration for while also replacing a portion of power

reserves to cover domestic demand. All unconventional gas resources. Shale gas supply from polluting coal generators by

other European countries are now net has become somewhat of a global hype, gas generators to meet EU GHG emis-

importers of natural gas. and is still in an early stage as production sion reduction targets. Germany too is

A hefty 45% of Europe’s total gas of unconventional gas outside the US keen on unlocking its own gas potential

supply comes from imports outside remains insignificant. Most EU countries as domestic gas consumption is now

the European Zone (Fig. 5): 33% of are now inventorying their unconven- for 80% dependent on pipeline imports

Europe’s gas is brought in via pipeline tional gas resources, with Poland in the from Russia (31%), Norway (29%)

imports from Russia, Algeria, and Azer- lead, partly aided by experts from the and Netherlands (20%). On August

baijan. LNG landing terminals account USGS Survey and workshops organized 8th, 2010, the German Research Center

38 www.firstbreak.org © 2011 EAGEfirst break volume 29, April 2011 news feature

The Solitaire in Rotterdam harbour can lay pipes for oil and gas in oceans to depths over 2700 m using the

S-lay method over its stinger. This floating factory ship with a length of 300 m (excluding stinger) accom-

modates 420 men. (Photo: Dirkjan Ambtman).

for Geosciences (GFZ) started a scien- multiple fracced horizontal well. In: Rondeel,

tific drilling project in the Danish Alum H.E., Batjes, D.A.J. and Nieuwenhuijs, W.M.

shale, a dense Cambrian deposit of some (Eds) Geology of Gas and Oil under the

500 million years old – a prospective Netherlands. Kluwer, Dordrecht, 93–102.

resource for shale gas in both Germany EBN [2010] Focus on Dutch Gas. Energie Beheer

and Denmark. Clearly, hopes are high in Nederland.

Europe to improve its security of energy Holditch, S.A. and HusamAdDeen, M. [2010]

supply by upgrading prospective uncon- Global Unconventional Gas – It is there,

ventional gas resources into securely but is it Profitable? Journal of Petroleum

proved reserves. Technology, December, 42–49.

Hubbert, M.K. [1949] Energy from Fossil Fuels.

New gas research focus Science, 109, 2823, 103–109.

To help unlock Europe’s unconven- Hubbert, K.M. [1974] Oil, the Dwindling Treas-

tional gas potential, Delft University ure. National Geographic, June.

of Technology has launched a new Madsen, E. and Stewart, D. [2008] Gaswinst.

see below.

unconventional gas research initiative Nieuw Amsterdam Uitgevers, 192 pp.

(UGRI). Delft University’s confidence is OECD/IEA [2010] Natural Gas Information

growing about future solutions for clos- 2010. International Energy Agency, 594 pp.

ing the emergent Dutch gas gap. Hopes Scheffers, B., Godderij, R., De Haan, H. and Van

are high that a next generation of Hulten, F. [2010] Unconventional gas in the

geoscience and petroleum engineering Netherlands. Including results from TNO

students from Delft (Fig. 6) will help to study ‘Inventory non-conventional gas’

unlock unconventional gas reservoirs (2009). SPE NL Presentation, 8 February

large enough to delay the unfolding of Schenk, J. [2009] Groningen gasveld vijftig jaar.

a Peak scenario for Dutch gas. Whether Boom, 220 pp.

King Hubbert can really be defeated in Stewart, D. and Madsen, E. [2007] The Texan

the small Dutch nation remains to be and Dutch Gas. Kicking off the European

seen. Nonetheless, by putting academic Energy Revolution. Trafford Publishing,

ingenuity into practice, TU Delft wants Bloomington, 212 pp.

to contribute to the postponement of Weijermars, R. [2011] Price scenarios may alter

King’s Peak for another generation or gas-to-oil strategy for US unconventionals.

more. Oil & Gas Journal, 109(1) 3 January,

74–81.

References Weijermars, R. and Luthi, S.M. [2011] Dutch

Crouch, S.V., Baumgardtner, W.E.L., Houlle- Natural Gas Strategy: Historic Perspec- magnetics • gravity

breghs, E.J.M. and Walzebuck, J.P. [1996] tive and Challenges Ahead. Netherlands

Development of a tight gas reservoir by a Journal of Geosciences, in review.

© 2011 EAGE www.firstbreak.org 39You can also read