5G in the enterprise Developing a holistic approach to exploit the potential of next-generation mobile technology - UK5G

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

5G in the enterprise Developing a holistic approach to exploit the potential of next-generation mobile technology Enterprise survey report 5G represents a terrific opportunity for communications service providers (CSPs) to address the enterprise services market. Yet there are many unanswered questions ranging from the potential size of the market opportunity, to how providers can best deploy 5G for enterprises, to the need for partnering with other suppliers. To help answer such questions and provide some guidance for CSPs, Nokia and analyst firm ConnectivityX worked together to survey several enterprises from different sectors and investigate the business models 5G will bring to these industries. While the research reveals little awareness of 5G in enterprises, it does highlight substantial opportunities for CSPs, although exploiting them will require the development of new capabilities.

Contents

Introduction 3

Project scope and methodology 4

Voice of the enterprise 4

What is 5G? 5

Section 1: How and what telecoms operators sell to enterprises today 6

The building blocks of corporate networks 8

The evolution to ICT and cloud service providers 8

How enterprises view and use mobile communications today 9

CSP enterprise segmentation strategies; towards the vertical 10

Section 2: What are the opportunities for 5G in telecoms operators’ 13

enterprise services businesses?

In-building coverage 13

LTE and 5G fixed wireless access for remote, temporary and 14

mobile locations

“Applications 5G”: leveraging real-time and bandwidth hungry 15

capabilities in an automated world

Section 3: Enterprise 5G business models 16

Neutral host – sharing the cost burden 16

Network slicing – segmenting the enterprise market 19

Case study: Hamburg Port: first 5G network slicing trial in large industrial environment 20

Private LTE: an interesting concept which is set to gain momentum 21

Case study: 5G in the aviation sector 22

Conclusions 23

Recommendations for mobile operators (and 5G technology providers) 24

2 White paper

5G in the enterpriseIntroduction

For the first time, the telecoms industry is putting the B2B market front and centre of a next generation

mobile technology. Yes, 5G will deliver enhanced consumer services such as virtual reality and ultra-high

definition video. But it is also intended for specific use cases designed to address business challenges

in vertical markets such as industrial, transportation and healthcare. This new focus on the B2B market

– and of new monetization models and new sources of revenue, enabled by the increased connectivity

and digitization of the everyday living and working environment – is essential if operators are to maintain

revenues and profits. The ARPU revenue generation model alone will not be enough.

The precise role of the telecoms (5G) operator in each of the different use cases is still to emerge but it is

a fair assumption that the commercialisation of 5G in industry verticals will be the responsibility of existing

telecoms operator enterprise departments and divisions.

Telecoms operators’ enterprise service revenues are currently dominated by the provision of public and

private network connectivity. Enterprises also spend heavily on mobile communications. Operators are

expanding into the ICT services business but this still represents a relatively small proportion of total

enterprise revenues. With the emergence of low-powered wireless access ((LPWA) technologies such as

NB-IoT operators are stepping up their endeavours to expand into the Internet of Things (IoT) but these

currently represent just one per cent of mobile operator revenues globally.

Building a clear picture of the size – and the precise nature – of the enterprise services market opportunity

is absolutely crucial for any operator building its business case for 5G. Unlike previous generations of

mobile technology – and more specifically 3G and 4G – building a business case on smartphones and

assumptions around (mobile) ARPU uplift that can be generated may not be enough for 5G in the short- to

medium term. This is because LTE and the planned performance improvements to LTE, will support the

delivery of many of the services we see in today’s markets.

But how can a mobile operator factor the enterprise market opportunity into a regional and country-wide

deployment strategy? Is it realistic to expect mobile operators to deploy 5G for enterprises in places where

they have not already installed (or are not planning to soon install) a network for the wider consumer

market?

The role of the mobile operator in providing applications which, at some stage in the future, might embed

5G connectivity is also an issue. Many of the use cases that have been associated with 5G, for example

in healthcare, or in robotics or drones, are only likely to materialise if mobile operators can find a way of

inserting themselves in ecosystems where they have not traditionally had a role. And every sector has its

own ecosystem with dedicated providers of services, solutions and connected devices.

This report aims to answer a number of questions about 5G and telecoms operators’ current and future

strategies for selling into the enterprise market:

• Which market segments present the best 5G opportunities?

• Do they have the skills to put together complex propositions for new services that embed 5G and, if not,

do they need to partner with other companies that have such skills?

• Is 5G only really needed for new and emerging applications or is there also a market opportunity for 5G

to provide fibre-like connectivity to businesses with greenfield or temporary sites or premises?

• Will operators’ existing approaches to market segmentation be adequate for them to exploit the 5G

opportunity?

• Which other suppliers of technology and services to enterprises do telecoms operators need to partner

to advance the potential of 5G?

3 White paper

5G in the enterpriseProject scope and methodology

This project is designed to help join the dots between the promise of 5G and its applicability to different

use cases on the one hand and the status of mobile operators’ enterprise business and strategy on the

other.

For the project we spoke to more than 30 companies, principally in these three categories:

1. Telecoms operators – both the R&D and network functions that are working on 5G today and the

enterprise services divisions.

2. Enterprises from different vertical sectors – healthcare, aeronautical, shipping, logistics and financial

services. We chose those sectors where we believe that 5G capabilities may have specific applications.

3. Wireless enterprise network builders, operators and integrators.

Voice of the enterprise

For our research we spoke to a number of different enterprises from different sectors. They included:

• A logistics company that is developing robotics solutions

• An international pharmaceuticals group

• An international shipping company

• A mining company

• A global financial services company

• An airline company

We also had email exchanges with a number of enterprises that helped to flesh out some of our views. The

main conclusions from the interviews were as follows:

• There is little or no awareness about 5G capabilities (the exception being the logistics company).

• Many businesses are still using / relying on 3G (rather than LTE).

• The growth of BYOD – both among own staff and contractors – places a security burden on Wi-Fi

networks. Many companies would like a greater use of cellular to reduce the security requirement.

• In-building mobile coverage is a problem for many companies.

• Mobile communications is not seen as being sufficiently reliable for business-critical applications.

• IoT is still in the experimentation phase with a large number of localised “do-it-yourself” initiatives.

• Large businesses do not consider mobile solutions for their wide-area-network (WAN) architectures.

Our interviews were conducted with a number of different job titles including:

• Senior Director / Head of IT

• Chief Information and Technology Officer

• Director of Innovation

• Chief Digital Officer

• Chief IP Network Architect

4 White paper

5G in the enterpriseThe diversity of job titles is interesting. It demonstrates that within any large enterprise there are a

number of different senior executives that may have an interest in exploiting the capabilities of 5G – from

the network architects to the owners of transformation projects in the fields of robots and drones that

could be powered by 5G.

What is 5G?

Throughout our research we had to remind ourselves – and the companies that we were talking to –

precisely what we mean by 5G. Indeed, there is a wide range of views in the industry about what 5G may or

may not be.

In the briefings that we conducted for our research, the following “definitions” of 5G were all given to us

either by enterprises, telecoms operators or wireless enterprise builders or operators.

• A new air interface, using new spectrum from lower bands (600 MHz-3.5GHz) and high band (28GHz and

above), that benefits from technologies like massive MIMO.

• Using NFV and SDN technologies to increase flexibility in network deployment and operations.

• A cloud native core network, using ‘DevOps’ to improve automation for new services.

• 5G uses techniques such as edge computing to deliver millisecond end-to-end connectivity.

• 5G is a new wireless network that has the ability to deliver required levels of performance for specific

types of applications of services for market segments or enterprises.

• 5G is a technology that integrates other licensed and unlicensed technologies, particularly in an

enterprise environment.

• 5G will further drive the realization of fixed-mobile convergence. Convergence is both at the core /

infrastructure layer with, for example, SDN and NFV delivering capabilities over both fixed and mobile

networks, and the access network with 5G leveraging fibre in the access network.

• The ability to deliver required levels of performance for specific types of applications or services for

market segments or enterprises.

Many of these “definitions” of 5G do not, in their own right, provide unique capabilities. However, when

brought together they deliver network and service capabilities that are unique to wireless communications.

Interestingly, few of the industry executives we spoke to referenced 5G as one of the bearer network

technologies that will underpin the IoT.

5 White paper

5G in the enterpriseSection 1: How and what telecoms operators sell to

enterprises today

On a global basis the enterprise telecoms services business accounts for an estimated 25-30% of today’s

$1.6 trillion telecoms business. The vast majority of this revenue is from communications and connectivity

revenues from public and private, fixed and mobile networks. Industry research firm Ovum produces

forecasts for a full suite of telecoms operator enterprise services. For 2017, these services generated a

combined total of $484bn, split as per the chart below.

Figure 1. Telecoms operator large enterprise revenues in 2017 ($bn)

47 33 IP VPN

34 Enterprise fixed voice

75 Enterprise fixed broadand

9

Enterprise mobile

Applications

50 Compute & hosting

42

Managed mobility

10 Network services

15 Professional services

24 Unified communications

M2M

145

Source: Ovum

Revenues are for large enterprises only and not the B2B market as a whole

Data from telecoms research firm Ovum indicates that enterprise revenues fall into five major buckets:

1. Fixed voice and broadband (24%)

2. IP VPN (7%)

3. Mobile (29%)

4. Strategic ICT services (applications, compute & hosting, managed mobility, network services,

professional services and unified communications) (29%)

5. M2M (10%)

However, M2M is not always included in operators’ enterprise revenues as it largely comprises the sale of

cellular SIM cards (as opposed to strategic ICT revenues).

It would be misleading to apply these absolute revenues and market shares to all telecoms operators.

Clearly there is a split between fixed and mobile but within the fixed telecoms market there is a massive

concentration of revenues for strategic ICT services among large regional and global players such as AT&T,

Verizon, BT, Deutsche Telekom, Vodafone, Orange, Telefonica and SingTel.

6 White paper

5G in the enterpriseFigure 2 is an illustration of a forward-looking enterprise services portfolio of a telecoms operator that sits

between these large global players and smaller operators with little exposure to the enterprise market. KPN

is focussed on the Dutch market (it has largely curtailed its ambitions as a regional player) but has a very

clear strategy to become a major player in the Dutch ICT services market.

Figure 2. KPN’s enterprise services portfolio

Consulting

stry solutions

Indu

urity services

Applications and data Sec Digital workspace

• Data management and analytics data Digi • Workspace as a service

nd tal

• Hosted and cloud applications sa w • Unified communications

• App development (with partners) • Modular and hybrid

ion

or

ksp

cat

• Cloud contact center • Omni support

ace

Appli

Clo u d and

Cloud infrastructure and hosting Access and connectivity

ct a n d

ty

inf h

• (Mission) Critical hosting a • 2G/3G/4G, VDSL, Fiber

ivi

os s tr u es s

r

• CloudNL t c A cc n n e • Private connect, VPN, Network

B u i n g t u re co

• Storage and backup sin es • IoT, LoRa, M2M, Internet

ess vi c

• Colocation c o nti n u i t y s e r • Service operator

Source KPN

Prof

e s s i o n al s e r vi ce s

The vast majority of revenues today sit within the “Access & Connectivity” quadrant. As the dominant

provider of telecoms services to the largest Dutch businesses and public sector organisations, KPN has

built a full suite of public and private, fixed and mobile network solutions.

KPN has more than 50% market share for enterprise access and connectivity services. However, in newer

ICT markets, KPN is a relative newcomer. It puts its own market share for IT services at less than 5%.

KPN’s ambition is to obtain a “leading market position” in cloud, security and unified communications

(workspace). It aims to strengthen its position in services virtualisation, IoT and Housing and Hosting

through partnership models. It is interesting that IoT and M2M sit within the Access & Connectivity

quadrant and that there appears to be little ambition to develop new IoT services or solutions.

It is interesting to contrast the enterprise positioning of operators such as KPN with mobile-only operators

– companies which have been founded in the last 30 years to operate mobile networks. These have a much

smaller share of the enterprise market. In many cases their B2B strategy has largely comprised the sale

(and management) of SIM cards and devices to large corporate accounts. Some mobile operators have also

moved into the enterprise mobility space, offering services such as mobile device management.

When assessing the networks and services offered by operators to enterprises, it is clear that the range

of (private) network services and capabilities is much less developed for mobile communications than for

fixed communications.

When it comes to private networks, interconnecting enterprise premises scattered across cities, countries

and regions, providing high speed access to the Internet – and more recently, connecting sites to their

own, or third party data centres - a whole range of network technology options are available.

7 White paper

5G in the enterpriseThe building blocks of corporate networks

Until now mobile networks and technologies have played a minor role in the building and operation of

private networks. A private network today is made up of the following building blocks:

• Local area networks (LANs) which link computers and peripherals to servers within a distinct geographic

area such as an office or a commercial establishment.

• Wide area networks (WANs) which interconnect multiple local area networks. In an enterprise this is likely

to consist of connections to a company’s headquarters, branch offices, colocation facilities and cloud

services. This allows users to share access to applications, services and other centrally located resources.

This eliminates the need to install the same application server, firewall or other resource in multiple

locations, for example.

• Virtual private networks (VPNs) which facilitate connectivity between WAN sites. VPNs create safe and

encrypted connections over less secure networks, such as the Internet.

Fixed networks and technologies dominate the corporate enterprise landscape. At the same time,

businesses recognise that their own internal customers are, increasingly, doing their jobs using mobile

phones and tablets. Laptops are replacing – and for a large proportion of businesses – have replaced

desktop PCs. As such, companies are assessing WLANs as a primary means of connectivity.

Yet mobile technologies such as LTE are generally not seen as being ingredients of a corporate network. For

mobile technologies to become part of the corporate network landscape they need to demonstrate that

they are:

• Secure

• Reliable

• Capable of providing high bandwidth

• Responsive (and flexible) to (meeting) corporate requirements

The continued improvements to LTE – and the advent of gigabit LTE delivering speeds of up 1.2Gbps –

means that mobile operators will soon be able to deliver on bandwidth. However, while most use cases can

be accommodated using LTE, operators will need 5G to provide scalability and applications which genuinely

require millisecond latency for “real-time” connectivity.

The evolution to ICT and cloud service providers

While telecoms operators dominate the market for access and connectivity services they face stiff

competition for ICT services. The key players in the ICT services market are:

• Systems integrators

• IT service providers

• Cloud service providers

• Telecoms operators

8 White paper

5G in the enterpriseHowever, despite the competition, some large telecoms operator groups – particularly converged

operators with legacy fixed line businesses and a long history of servicing the large enterprise and public

sector market - are carving out a niche for themselves in strategic ICT services. These include business IT

and IP applications, compute and hosting, enterprise mobility, managed networks, professional services

and unified communications.

Many of these services are moving from premises and into the cloud. The ICT services market is going

through a radical transformation as a result of the advent of private, public and hybrid cloud services.

Indeed, the explosion of cloud services has brought telecoms closer to the IT services business because of

the need to use telecoms networks to access cloud services.

Many telecoms operators started off thinking they could become public cloud service providers like AWS,

Microsoft, Google and Alibaba, but they could not keep up. They did not have the business models or scale

to sustain the capital expenditure needed to be a global CSP. Some operators moved out of delivering

cloud platforms altogether - others have adopted a partnering strategy.

A number now partner with original equipment manufacturers (OEMs) to deliver public and/or private

clouds at a national level primarily to SMEs, public sector organisations and national corporations. A few

telecoms operators also see opportunities in managing their customers’ application stacks on their own-

brand clouds.

While many telecoms operators will be looking for their traditional network equipment providers (NEPs) to

support them as they transition into ICT service providers, they may well find themselves competing with

them. The slowdown in the network infrastructure market means that all the NEPs are looking to diversify

and serve the enterprise market directly.

How enterprises view and use mobile communications today

Some of the key societal and economic changes taking place today point to a far more central, strategic

and integrated role for mobile communication in corporations’ network, communications and applications

strategies.

However, our primary and secondary research indicated that this is taking far longer to achieve than might

be expected.

There are a number of reasons for this:

• Mobile / cellular has not, until now, tended to be viewed as part of, or integrated into, the fabric of the

corporate network. That is to say, it cannot be configured / designed / deployed to meet companies’

requirements in terms of performance, security etc.

• Mobile performance is seen as being unreliable, particularly inside large buildings and in remote

locations. When it comes to improving mobile coverage, enterprises can either seek to leverage their

relationship with an operator to persuade them to invest in a particular building or location or they can

invest in a costly Distributed Antenna System (DAS) network.

• Wi-Fi is the de facto technology for providing mobility on site both for company staff and for contractors

/ visitors.

• The growth of BYOD has slowed the adoption and deployment of mobile devices which provide access to

corporate applications in workforces.

9 White paper

5G in the enterprise• Many enterprises have been slow to adopt large sets of apps because of the challenges around

configurations and security.

• Telecoms operators have made little effort to offer services beyond pure connectivity. As a result, it

has been left to individual enterprises to create and address their own specific mobile needs. Given the

inherent integration cost, this tends to be only possible in very large enterprises.

As a result of the above challenges, mobile communications remains somewhat independent of many

companies’ IT systems, capabilities and applications. However, this does not mean that mobile is not an

invaluable business tool. Rather, the mobile phone is essential for voice and email but less so for specific

company-centric tasks and applications.

CSP enterprise segmentation strategies; towards the vertical

Traditional telecoms segmentation approaches have typically been based on the size of the enterprise

or organisation. Much of the focus of telecoms operators’ enterprise divisions is on large enterprises.

Operators use a combination of direct and indirect channels to serve mid-market and medium-sized

businesses. The SoHo market is often neglected by telecoms operators and small businesses often go

through consumer channels. However, with a growing focus on cloud services and the availability of a whole

range of new cloud-based services, many operators are stepping up their efforts to serve small businesses

by bundling together a whole range of fixed, mobile and cloud services.

Figure 3. Traditional telecoms operator segmentation strategies

Employees Market segment

1000+ Global MNC/

Public sector

1000+

Large

500

Medium

250

Small

50

SoHo

10

1 Self-employed

Source: ConnectivityX

10 White paper

5G in the enterpriseHowever, over time, and with the increasing breadth and complexity of the enterprise services business,

operators have required a more sophisticated approach towards market segmentation.

Systems integrators and professional services firms have tended to take more of a vertical approach

towards market segmentation. This is because the products and services they sell do not tend to serve a

generic requirement – communications and connectivity – rather, they are designed to address challenges

and opportunities that are specific to a vertical market segment.

Within the last five years, telecoms operators have started to embrace market verticalisation. This has

been most pronounced in the IoT sector, although some operators take a vertical market focus for a

broader set of ICT services. The verticalisation is not driven by the wireless part of the business – rather, it

comes out of the enterprise line of business, particularly when the operator has a wholly-owned IT services

business (for example Deutsche Telekom which owns T-Systems and Singapore Telecom whose subsidiary,

NCS, is a regional ICT services provider).

However, the “depth” of the verticalisation varies hugely. It tends to be the larger operators which have

relatively mature ICT services businesses and capabilities that have gone furthest into verticalisation. And

in many cases they have acquired vertical market specialist businesses either to propel them into a vertical

or strengthen an existing position.

Table 1. Examples of “vertical market” divisions and subsidiaries owned by telecoms operators

Sector/vertical Telecoms operator Solution

Automotive and Verizon Verizon Telematics is a subsidiary of Verizon that provides a range of services to the

Fleet commercial vehicles sector. It has grown through the acquisition of a number of companies

including Hughes Telematics, Fleetmatics and Telogis

Events Solutions Swisscom Swisscom Event and Media Solutions AG is a subsidiary of Swisscom offering E2E solutions in

event infrastructure and video communication

Digital service Belgacom BICS, the wholesale arm of Belgian telecoms operator Belgacom, has built mobile

providers (International authenication services for digital service providers following its acquisition of cloud

Carrier Services) communications platform TeleSign

Industrial/ BT BT Industrial Wireless provides mining and oil companies with connectivity to the coalface or

manufacturing wellhead for safer and more cost-efficient operations

Healthcare Orange Healthcare Orange Healthcare is the healthcare subsidiary of Orange Business Services. It provides

secure data transmission and storage services for the French healthcare sector

Media Telstra In 2014, Telstra acquired Ooyala, one of the world’s largest premium video platforms.

Ooyala also offers a media logistics solution for video production workflows, and an

advertising platform for direct and programmatic trading

Media SingTel SingTel subsidiary Group Digital Life offers digital marketing, advanced data analytics and

intelligence, and premium over-the-top (OTT) video services to the media and other sectors

Retail BT BT’s Digital Consumer portfolio enables retailers to provide an online experience to

shoppers in their physical stores

Source: ConnectivityX

In some cases, these are businesses that operate independently or semi-independently of the operator.

Others are simply divisions that sit within the enterprise division. Swisscom’s Event & Media solutions

business is an example of an enterprise services division which has, within the last two years, been

separated into a standalone business unit. It is now free to source communications and connectivity

services from telecoms operators other than Swisscom. It is also free to expand outside of Switzerland.

When assessing the merits of verticalisation, a distinction needs to be made between, on the one hand,

application verticals and, on the other, industry verticals. The application vertical relates to the product

and the industry vertical relates to the market.

11 White paper

5G in the enterpriseAs a general rule, telecoms operators are more likely to structure themselves around an application

vertical – a product – than an industry vertical. Even though operators market their capabilities for different

industry verticals on their websites, most of their alignment tends to be around the sales and marketing

function rather than the creation of products specifically for these verticals. We are starting to see this

change where telecoms operators are investing in strategies to help to digitally transform companies and

organisations in specific sectors.

Deutsche Telekom, for example, has been working with oil giant Shell to modernise its data centre

infrastructure since 2014. Earlier this year it signed a new contract with Shell for global hosting and

storage and with a specific remit to drive greater automation and agility. Orange Business Services,

meanwhile, is partnering car rental giant Hertz with the delivery of an IoT solution for Hertz 24/7, its new

keyless car-sharing service.

The application verticals listed below are applicable to the M2M / IoT market. It includes a combination of

relatively mature products such as smart meters and point of sale / ATMs and new and emerging product

areas such as asset tracking and medical and healthcare.

Figure 4. Application verticals applicable to the M2M / IoT market

• Asset tracking • Agriculture

• Connected car • Business services

• Consumer electronics • Energy & utilities

• Environmental • Finance & insurance

• Fleet and logistics • Government

Application • Industrial Industry • Healthcare

vertical • Medical and healthcare vertical • Manufacturing

• Point of sale & ATMs • Mining and oil

• Transportation • Public sector

• Security & surveillance • Retail & wholesale

• Digital signage • Transportation

• Smart meter / grid

Source: ConnectivityX

Four of the application verticals in this list - Fleet and logistics, Connected car, Smart metering and Grid

and industrial – accounted for more than half of all M2M/IoT contracts in 2016 and 2017, according to TMT

research firm Ovum.

Figure 5. M2M and IoT contracts 2016-2017

2%

2% 1%

2%

4%

18%

5%

Fleet and logistics Agricultural

6% Connected car Asset tracking

Smart metering and grid Point-of-sale and ATMs

14% Industrial Consumer electronics

7%

Smart cities Environmental

Medical and helthcare Security and surveillance

8%

Other Public transport

13%

8% Source: Ovum

10%

12 White paper

5G in the enterpriseSection 2: What are the opportunities for 5G in telecoms

operators’ enterprise services businesses?

On the one hand, 5G can be considered as simply another access network technology, albeit one which

combines the benefits of mobility with fibre-like speeds. On the other, 5G can be viewed as an enabler

for specific applications that the mobile operator can take to the market either on its own or as part of a

partner ecosystem. The difference between these two use cases for 5G is that while the first considers the

merits of 5G compared with access technologies, the second involves the adoption of 5G for a brand new

and in many cases experimental, technology or application.

When considering the opportunities for 5G across the enterprise market, we believe it is important that

both “Access 5G” and “Applications 5G” are given due consideration.

In-building coverage

In-building coverage has always been a challenge for the mobile industry. This is partly for technical

reasons – it is not easy to deliver signals deep inside a building from a base station in the street outside.

The challenges to delivering good in-building coverage are mounting. Modern buildings are filled with

materials that act as radio signal barriers, such as metalized insulation, steel frames and treated glass.

Yet commercial issues are also a factor. If a mobile operator wants to install network hardware inside a

building it needs to secure permission from the building owner. And in most countries, building owners

have adopted the same approach to negotiations with mobile operators for the right to install a base

station in a building as they would to negotiations to install a base station on a building i.e. you should pay

a fee. As a result, mobile operators take a selective approach to when and where they install base station

in-building coverage.

A whole industry has grown up dedicated to the provision of better in-building coverage. A distributed

antenna system (DAS) is a network of antenna nodes, replacing a single antenna and which is connected

back to the mobile network operator’s base station via a controller and cabling.

Because distributed antenna systems operate on spectrum licensed to the mobile operator, an enterprise

cannot undertake a DAS deployment on its own without involving at least one operator. DAS can be passive

or active. A passive DAS takes the mobile signal from antennas on the roof and runs them through leaky

feeder cables throughout the building. In this approach, the signal leakage distributes the signal. In an

active system, the signal is passed from roof antennas through fibre cables. Along the way, systems boost

and amplify signals as needed.

Small cells tend to be installed on an operator-by-operator basis and can be either a complement or

an alternative to DAS systems. However, given the expense of DAS, smaller cells are the only option

for improving indoor coverage for many companies and organisations. Small-cell solutions, sometimes

referred to as picocells or femtocells, have been most popular in the US where all the main operators offer

products connecting up to 64 users.

13 White paper

5G in the enterpriseLTE and 5G fixed wireless access for remote, temporary

and mobile locations

Both enterprises and operators’ enterprise lines of business tend to think of network access technologies

such as HSPA and LTE as “mobile” devices where the end user device is a mobile phone rather than, for

example, a PC.

Yet, such is the performance of LTE and, in the future, 5G, that mobile networks are now becoming viable

alternatives to DSL and, potentially, fibre. Making the business case for replacing fibre with, for example,

5G, is extremely challenging. But where there is no fibre – typically in mobile, temporary, remote or

greenfield sites – there is a business case to be made.

Table 2. LTE and 5G use cases for mobile, temporary, remote and greenfield businesses

Use case Mobile requirement Vertical

Mobile This comprises organisations which are based around transportation and •

Aviation

organisations cargo. Both planes and ships need to upload and download massive amounts •

Shipping

of operational and customer data when they are arriving / departing at or from •

Freight

a port or at a gate in an airport. Broadband connectivity may also be needed •

Public transportation

for staff and customers. In public transport systems broadband connectivity (trains, buses)

will become an operational requirement.

Temporary There are a number of events and businesses which can last anything from one •

Kiosks (bars, cafes, tourist

businesses day to several months but which cannot justify (or wait for) the investment in a information, shops)

fixed broadband line. In many cases they rely on 3G or LTE connectivity. Events •

Sports, music, religious

and festivals often rely on costly satellite connectivity for TV broadcasting. events & festivals

•

Construction sites

Remote Remote businesses today must either use satellite connectivity or dedicated •

Oil refineries & mines

businesses fixed connectivity (plus mobile). The growing requirement for cloud services •

Solar & wind power

in oil rigs and mines and strong demand for high-speed consumer broadband •

Tourist developments

connectivity will drive demand for higher speed connectivity and “elastic” •

Mobile offices

bandwidth.

Greenfield & When new business premises are constructed it may take some time for fibre •

Factories

back-up connections to be installed. And even after fibre is installed, 5G may represent • Warehouses

the best option for redundancy / back-up. • Retail

• CCTV

Source: ConnectivityX

In most of the examples listed in the above chart there are multiple use cases. Many of these fall into

either of two categories - a) operational requirements where the broadband connection is required for

business critical, cloud-based applications and b) the provision of broadband access to staff and / or

customers.

14 White paper

5G in the enterprise“Applications 5G”: leveraging real-time and bandwidth

hungry capabilities in an automated world

Most of our analysis so far has involved considerations of 5G as an alternative to other telecoms networks

and technologies either as a replacement or a greenfield installation or deployment. However, another

category of use cases for 5G involves connecting “things” rather than “people”. We generally call this the

Internet of Things (IoT).

Mobile operators today are deploying low-powered-wireless-access (LPWA) technologies such as LoRA,

Sigfox and NB-IoT for IoT applications that have modest requirements in terms of speed, bandwidth

and latency. These are expected to represent the vast majority of IoT applications. 5G will, ultimately,

have a key role to play, as these applications require the volume and scale that cannot be met by today’s

technologies. Yet, 5G is not needed to prime this market. As such, we are not factoring this market into our

analysis.

Where 5G will have a role to play in IoT is for applications and use cases requiring high-bandwidth and low-

latency connectivity. The mobile industry is committed to building a technology that delivers 1 ms latency

and 10 Gbps throughput.

We have identified a number of “application verticals” that specifically require low-latency connectivity for

mobile, temporary, greenfield or remote applications that can be delivered by 5G. We have then assessed

their relevance / applicability to a number of different industry verticals.

While some application verticals are closely associated with certain industry verticals, others may be

relevant to a number of different sectors. For example, autonomous vehicles are likely to generate interest

in a number of sectors.

Table 3. The relevance of applications requiring low latency connectivity to a variety of industry verticals

Application vertical

Drones Robots Virtual Augmented Autonomous HD video “Tactile”

reality reality vehicles apps

Healthcare

Manufacturing

Utilities

Media

Industry vertical

Hospitality

Retail

Transportation and automotive

Financial services

Insurance

Police and armed forces

Ports and freight

Source: ConnectivityX Relevant May be relevant Not relevant

15 White paper

5G in the enterpriseThe executives at the enterprises that we spoke to for this research had little to say in terms of the

relevance and potential applicability of the various low-latency applications for their businesses. A common

theme coming back from them was that they have no overarching, agreed strategy for IoT and their

endeavours to date largely comprise local-market trial and experimentation. The one exception to this was

the logistics company which has been actively involved in 5G demos and trials.

Mobile operators are unlikely to be viewed as viable providers of IoT solutions for these applications

except in those cases where enterprises are building their own products and need to engage with a mobile

operator for connectivity and, potentially, a connectivity platform. The more likely service and solution

providers are:

• Dedicated (vertical specific) IoT or ICT service providers

• OEMs (drones, robots, vehicles)

• Device vendors / suppliers (e.g. providers of medical equipment).

• Systems integrators

• Platform service providers

• “Vertical” equipment and technology vendors

• Data management organisations

If mobile operators want to accelerate the adoption of 5G technology by these players, they will need to

build relationships and ecosystems. Another approach, already pursued by many operators, is to acquire

companies that are already established as vertical market IT service providers.

Section 3: Enterprise 5G business models

While the capabilities of mobile networks have fundamentally changed through the transition from 2G to

3G to 4G, business models have remained the same. Each mobile operator builds out its own independent

mobile network to blanket cities, towns, villages, roads and ultimately, rural areas. Most operators

undertake a degree of passive or active network sharing and many sell off some, or all, of their “towers”

to dedicated tower companies. Enterprises get the same services as consumers with pricing based around

SIM cards and usage.

5G gives operators the opportunity to rethink their business models for the enterprise and to start

introducing the same sophistication in terms of private networking, network colocation and SLAs as is the

case for fixed network services.

Neutral host – sharing the cost burden

“Neutral host” is a term that has come out of the US mobile market. It refers specifically to the creation

of a new business model to provide cellular and Wi-Fi communications (and in some cases shared fibre)

to a specific building or campus area such as a shopping mall, a large office development or a university

campus.

Under the neutral host model, a third party company invests its own money in the project to deploy and

maintain all or part of the system. It then leases space, or access to the system, to the mobile operators.

Companies active in this space include Boingo Wireless, SpiderCloud Wireless and, in the UK, Arqiva.

16 White paper

5G in the enterpriseThe neutral host business model offers benefits to both the enterprise and mobile operators. Installing a

DAS system is a costly endeavour for any enterprise – unless it can persuade the mobile operator to share

some of the costs. If the mobile operator has a large ongoing contract (or new contract) with the company

(or companies) inside the building to deliver mobile phones and services to its employees, it may be

prepared to contribute to some (or all) of the cost.

However, for the enterprise, or the building owner, it may not be in their interest to tie themselves to

one particular operator. Even though a company may have a corporate account with a particular service

provider, it will want the flexibility to switch providers. Furthermore, contractors, temporary workers and

visitors are as likely to be subscribing to another network as the one the company has chosen.

As such, it is far more attractive for an enterprise to have an in-building coverage solution for all mobile

operators, and not just one.

A “neutral host” approach is one that takes the DAS or a small cell model and applies it to multiple

operators.

Figure 6. Neutral host roles and responsibilities The mobile operator either a)

builds out the system and sells

to the neutral host provider or

Mobile b) it leases access from the host

operator(s) operator or c) a combination of

a) and b)

For indoor models the neutral host The venue wants a solution

provider typically deploys and owns the that delivers both WiFi and

DAS and provides maintenance and multi-operator cellular

upgrade services to the mobile operator. Neutral host Venue connectivity for both its

For outdoor venues the neutral host own internal operations

may only provide the cabling and the and staff and for its

operators installs its own DAS. visitors and customers.

Source: ConnectivityX

There are many types of businesses that are suited to the neutral host business model. They include:

• Sports stadiums

• University campus

• Holiday complex

• Theme parks

• Business parks

• Train, underground stations

• Airports

• Ports

• Railways

• Shopping malls

• Smart cities

17 White paper

5G in the enterpriseNeutral host business models do not need 5G. Today’s deployments rely on both 3G and LTE. However, 5G

provides an opportunity for mobile operators to expand their neutral host capabilities as part of a broader

initiative to extend the reach and role of mobile communications in the enterprise.

Extending the neutral host model in 5G is an attractive proposition for mobile operators, for enterprises

themselves and for regulators and potential new market entrants if they can work together to develop a

lower cost model for building out 5G mobile network connectivity.

With early 5G deployments most likely to be in the ranges 3300–4200 MHz and 4400–4990 MHz, it will be

extremely difficult for mobile operators to meet the cost of building out nationwide networks over a three-

to-five-year period – the time it normally takes a mobile operator to deploy a next-generation network.

Instead, 5G roll-out will be slower, there will likely be more shared elements and there is no guarantee

that it will be adopted by all of today’s 3G/4G operators. As such, any opportunities to share elements of

network roll-out will be welcomed by many operators.

There are a number of potential models and approaches for enterprises to host network elements that

perform the combined role of fulfilling part of their own corporate network and a wider area network. They

include:

• Securing their own spectrum – or using unlicensed spectrum – building out their own network to use

both for their own internal requirements and wholesaling access to licensed mobile operators.

• Hosting different mobile network elements. This could include the radio network – for example a

small cell infrastructure or other new network elements that make up part of a 5G network, more

specifically computing, storage, control or networking power that make up part of an edge networking

infrastructure.

• The enterprise could be a neutral host itself or it could work with one of the existing (or future)

dedicated neutral host providers. Given the required expertise and complexity of building and operating

a mobile network, we would not expect to see many enterprises taking a proactive approach to

developing a neutral host business – particularly given that the economics of 5G are so unclear.

There is good reason to believe that enterprises and mobile operators may be more amenable to working

together to extend connectivity than might have been the case in the past. Corporations, and owners of

venues, need to offer their staff and customers good mobile connectivity. If the venues do not have this,

it will adversely affect the experience they can deliver to their customers. As such, they are becoming

less concerned about being paid by operators and more concerned about the quality of service that is

provided.

For governments and regulators, a neutral host or a wholesale model may also be attractive if it helps

to improve mobile coverage. The UK’s National Infrastructure Commission is a public body that provides

expert advice on major long-term infrastructure challenges for the UK. In December 2016 it produced a

report on the future of communications networks in the UK entitled Connected Future. The report was

critical of the slow roll-out of LTE networks. One of the ideas put forward in the report was for a neutral

host 5G network built and operated by the Strategic Road Network, the public body responsible for the

UK’s motorways and networks.

Analysis for the NIC indicated that it would cost £380m ($292 million) to build a fibre network supporting

4G and 5G networks (i.e. fronthaul and backhaul) and connecting the 18,000 wireless sites currently

located alongside the UK’s network of motorways.

18 White paper

5G in the enterpriseFor neutral host models to be successful they need to have access to significant assets to allow them to

pass on cost savings to mobile operators. These assets should include some (or ideally, all) of the following:

• Existing ducts and, ideally fibre (or dark fibre)

• Other customers beyond the mobile operators

• Locations to house radio equipment

• Access to spectrum

The Strategic Road Network ticks all these boxes. It already owns a network of poles, ducts and, in some

places, fibre. Its existing customer is its own internal customer. Telecoms links are needed to connect

CCTV cameras and road signage. Furthermore, the SRN has undertaken a “smart motorway” initiative

to better manage capacity on the motorways. There is also plenty of space along motorways to house

radio equipment. Access to spectrum has been a problem until now but UK telecoms regulator Ofcom is

exploring the possibility of opening the licensing process for 5G to new regional players.

Network slicing – segmenting the enterprise market

The mobile industry sees massive potential in the concept of network slicing and its ability to deliver sets

of capabilities that match specific requirements of different businesses and sectors. These capabilities

relate to the different characteristics and capabilities of 5G including:

• Latency

• Bandwidth

• Speed

• The volume of connections and the number of events

The vision for network slicing is that specific “slices” will be created for different use cases, applications and

businesses. For example, a slice could be created for a utility company, for a TV company, or for a factory.

As such, the concept of network slicing could help to solve enterprise requirements for their connectivity

providers to be responsive (for example, to connect different company sites with little or no lead times)

and flexible (for example, the ability to tune bandwidth and speeds up and down based on factors such as

business volumes or regional variances).

Network slicing is different, for example, to Quality of Service because it provides a holistic end-to-end

virtual network for a given tenant. This includes compute and storage functions as well as networking.

No existing QoS-based solution can offer anything like this. This ability to isolate traffic is crucial for

applications which have strict privacy and security requirements including where the data can be stored

and who can access it. Although network slicing is possible with LTE – indeed NB-IoT is a network slice

dedicated to low-bandwidth IoT applications – the new core network that is being designed for 5G will offer

much greater flexibility and functionality.

19 White paper

5G in the enterpriseCase study: Hamburg Port: first 5G network slicing trial in

large industrial environment

Nokia, Deutsche Telekom and Hamburg Port Authority are conducting a live trial of network slicing at

the harbour of Hamburg covering 8,000 hectares. The logistics and connected infrastructure is business

critical within a sea port of that size, with 18 million containers that need to be handled per year, tens of

thousands of truck per day and more than 100,000 sensors that need to be connected.

Main requirements of any use case in the port include resilience (guaranteed availability, even in the case of

failures), security and support for service diversity. In its initial phase the trial focuses on three use cases:

• Better traffic flow: intelligent transport system - Traffic light control: Traffic lights (mobile and fixed

installations) are connected via 5G (network slicing) to the traffic light management in the port´s

operations centre. 5G connection enables the monitoring of traffic status and the optimization of traffic

flow.

• Enhanced experience & security: Mobile broadband for augmented reality and cruise ship passengers:

Video cameras and AR provide live expert assistance at watergates (Schleusentore) and construction

sites. This will make operations in such areas more secure.

• Improved pollution control: Mobile sensors on barges for emissions measurement. Sensor data are being

transmitted in a rapid, stable and secure manner to an IoT-Cloud. There, data are analysed and put

into a relationship to events. Moving vehicles (barges) are a good stress test for the resilience of the 5G

network.

The enterprises that we spoke to found the concept of network slicing extremely attractive. It uses the

same technology concepts to build and manage the network as SD-WAN. This is a way of managing a wide

area network that enables the enterprise to dynamically allocate resources across its network, managed

via a single interface. Even though less than 5% of businesses today deploy SD-WANs, most large service

providers are in the process of launching SD-WAN services, usually in competition with a range of new and

established IT service providers.

At the same time, however, it is not at all obvious to enterprises how they might use network slicing

capabilities, because they do not currently operate a cellular WAN. The idea of managing a cellular network,

whose capabilities are specific to their own users, is alien to them.

Network slicing is possible using LTE. Indeed, NB-IoT is a network slice dedicated to low-bandwidth IoT

applications. However, for mission-critical, low-latency applications, 5G slicing is needed because it

incorporates differentiation in the RAN.

20 White paper

5G in the enterprisePrivate LTE: an interesting concept which is set to

gain momentum

There are already plenty of examples of Private LTE out there in the market, such as:

• Shanghai Pearl, China – Smart City: Private LTE network using 700MHz LTE for all city workers and

services

• Beach Energy, Australia – Oil & Gas: Private LTE network for remote on-shore drilling site operations

• Rio Tinto, Australia – Mining: Private LTE network for autonomous equipment in open pit mine operation

There are companies today that have their own, private cellular network. However, until now private

networks have been largely the domain of specialist service providers.

One such private network service provider is Athonet. Its customers / network deployments include:

• The “world’s first LTE commercial smart grid,” delivered to Italian electricity group Enel in 2011.

• The “world’s first commercial LTE MVNO for public safety” for the Finnish government.

• The “world’s first commercial deployment for disaster relief” following a major earthquake in Italy in

2012.

The Enel deployment is particularly interesting as it points the way towards 5G. Enel needed a network

that delivered sub-10 millisecond latency. It used LTE because of the high cost and difficulties of installing

a fibre network. Furthermore, the network needed to be cellular because Wi-Fi would not provide the

required connectivity.

Another company that has specialised in private LTE – albeit on a much smaller scale – is Blue Wireless, an

MVNO in Singapore which provides LTE networks as an alternative to DSL or fibre and largely to temporary,

remote or mobile locations.

Last but not least is Ukkoverkot in Finland, which operates a nationwide private LTE network supporting

industrial and public safety services. Among Ukkoverkot’s micro-operator customers is Finnish airport

operator Finavia, building a private LTE network for Helsinki airport.

However, mobile operators are starting to show an interest in private LTE, particularly for emergency

services. In the US, AT&T won a £46bn contract in March 2017 to modernise the country’s emergency

services infrastructure. UK mobile operator EE has a similar contract for the country’s 300,000 critical

emergency workers.

The Citizens Broadband Radio Service developed in the United States – a shared spectrum licensing

approach which will allow enterprises to use spectrum in the 3.5GHz band – is set to give new momentum

to private LTE. Spectrum is allocated on a building-by-building basis and the expectation is that existing

mobile operators, other service providers, building management companies or the enterprises themselves

will be potential candidates.

21 White paper

5G in the enterpriseCase study: 5G in the aviation sector

By 2026, the world’s fleet of airlines will be generating 98 million terabytes of data, according to

management consulting firm Oliver Wyman. The newest generation aircraft by then will be spewing out

between five and eight terabytes per flight, as much as 80 times what older planes today generate, it

calculates.

Yet, airlines and airports have only limited capacity to process this information and to use advanced

analytics and artificial intelligence to help inform operations and maintenance.

Oliver Wyman estimates that the operational efficiencies that could be generated through the effective

use of data, for example from remote diagnostics, making provision for adverse weather conditions and

deploying crew more effectively, could result in a 2.5% reduction in global operating costs, which translates

to $5-6 billion annually.

Clearly, the availability of broadband connectivity is only one of the requirements for airlines (and airports)

to exploit the potential of data analytics. Arguably the bigger challenge is piecing together and executing a

strategy for collecting the data and extracting meaningful, actionable insights from it.

However, even in the shorter term there is a huge potential for delivering improved mobile connectivity

to aeroplanes at airports. Airline companies today lease LTE capacity from mobile operators to download

operational data from their flights. They also need to use the mobile connectivity to upload videos for

passenger entertainment systems. If, in the future the planes were connected with a 5G antenna, the

time that it takes to download and upload content would be massively reduced, generating significant

operational savings.

Both airlines and airports are becoming aware of the potential for digital transformation to deliver

significant benefits to both their operations and their customer experience. A late 2016 survey of aviation

industry executives conducted by SITA, a multinational information technology company providing IT

and telecommunication services to the air transport industry, revealed that the proportion of IT spend

dedicated to transforming their business was set to increase from 13.9% in 2019 to 17.0% in 2017.

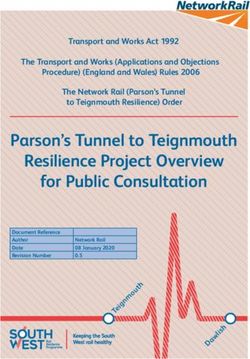

Figure 7. Share of IT spend on business transformation to grow

2016 Actual 2017 Planned

13.9%

17.0%

56.6%

26.1% 26.4%

60.0%

Run the business

Grow the business

Source: SITA % split of IT spend in 2016 and expectations for 2017 Transform the business

22 White paper

5G in the enterpriseYou can also read