2020 Professional Development Catalog - LOMA.org

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Key Dates

January 2020 November 17 Exam question challenges —

deadline for receipt at LOMA

January 1 LOMA closed for New Year’s Day;

LOMA’s Contact Center unavailable November LOMA closed for Thanksgiving;

26–27 LOMA’s Contact Center unavailable

January 2 Enrollment opens for May 2020 paper exams

December 2020

January 20 LOMA closed for Martin Luther King Jr. Day;

LOMA’s Contact Center unavailable December 5 November 2020 paper grades post

February 2020 December 25 LOMA closed for Christmas;

LOMA’s Contact Center unavailable

February 3 Ed Reps receive certificates and diplomas for

November 2019 paper exams January 2021

February 7 Deadline to submit paper enrollment forms January 1 LOMA closed for New Year’s Day;

for May 2020 paper exams LOMA’s Contact Center unavailable

February 21 Deadline to submit enrollments via January 4 Enrollment opens for May 2021 paper exams

learning.loma.org, and late paper enrollment forms January 18 LOMA Closed for Martin Luther King Jr. Day;

deadline for May 2020 paper exams LOMA’s Contact Center unavailable

April 2020

April 22 FLMI and FSRI Conferment Ceremony,

Salt Lake City, UT

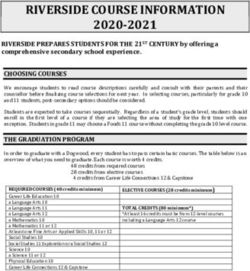

May 2020 About This Catalog

May 11–15 Paper exams administered

(see page 78 for dates and times) LL Global, Inc., made up of the LIMRA, LOMA, and Secure

Retirement Institute brands, is committed to a business partnership

May 25 LOMA closed for Memorial Day; with its worldwide members in the financial services industry to

LOMA’s Contact Center unavailable

improve their management and operations through quality

May 26 Exam question challenges — employee development, research, information sharing, and related

deadline for receipt at LOMA products and services.

June 2020 The mission of LL Global’s Professional Development Division is to

June 6 May 2020 paper grades post provide companies in the insurance and financial services industry with

July 2020 a quality education to meet their human resources development needs.

July 1 Enrollment opens for November 2020 LL Global does not discriminate on the basis of race, color, national

paper exams origin, sex, pregnancy, religion, age, disability, citizenship, ancestry,

July 3 LOMA closed for Independence Day; service in the uniformed services, sexual orientation, marital

LOMA’s Contact Center unavailable status, genetic information, or any other factors protected by

August 2020 federal, state and local law in education policies or eligibility

August 3 Ed Reps receive certificates and diplomas for May

requirements for its Programs.

2020 paper exams All statements in this Catalog are for informational purposes only

August 7 Deadline to submit paper enrollment forms and should not be construed as the basis of a contract between a

for November 2020 paper exams student, Educational Representative (Ed Rep), or participating

August 21 Deadline to submit enrollments via organization and LL Global. While the provisions of this Catalog will

learning.loma.org, and late paper enrollment forms ordinarily be applied as stated, LOMA and LL Global reserve the

deadline for November 2020 paper exams right to change any provision without any actual notice to students.

September 2020 Every effort will be made to keep students and company Ed Reps

advised of any changes. Ed Reps are not agents of LOMA or LL

September 7 LOMA closed for Labor Day;

LOMA’s Contact Center unavailable Global.

November 2020 Project Manager: Kathryn H. Brown, AIRC, ALMI, ASRI, PCS

November 2–6 Paper exams administered Graphic Designer: Allison Molette, Megan Swift

(see page 78 for dates and times)

Copyright © 2020 LL Global, Inc. All rights reserved.

This Catalog, or any part thereof, may be reproduced or transmitted for the purpose of informing current or potential LOMA students of available education

opportunities, on the condition that the reproduction or transmission includes the following notice: “Copyright © 2020 LL Global, Inc. All rights reserved.”

Reproductions or transmissions for any other purpose require the prior written permission of the publisher. LOMA®, FLMI®, FSRI TM, ASRI TM, ALMI®, ACS®, AIRC™,

ARA™, CPFS™, CSI®, LCIC™, PFSL™, and I*STAR® are service marks of LOMA, and use for purposes not authorized by LOMA is prohibited.Table of Contents

Advance Your Career 2 SRI 121 — Retirement Savings and Investments..................21

Guidelines for Use of LOMA Materials...........................................3 SRI 131 — Planning for a Secure Retirement.......................21

Who to Contact...........................................................................3 SRI 210 — Successful Retirement Outcomes.......................21

SRI 220 — Retirement Marketing and

Overview of Products and Services 4 Business Acquisition..........................................22

Professional Designation Programs...............................................4 SRI 230 — Retirement Administration..................................22

Designation Courses....................................................................4 SRI 500 — Transforming Retirement Security.......................22

Short Online Courses...................................................................4 UND 386 — Underwriting Life and Health Insurance..............22

Short Online Collections...............................................................4

Instructor-Led Training.................................................................5

LIMRA Leadership Institute 24

Custom Learning & Development Paths........................................6 About the LLIF....................................................................... 24

Customized Solutions...................................................................6 2020 LLIF Programs.............................................................. 25

Choose your Path to Industry Knowledge......................................6

Course Topic Categories..............................................................7

Short Online Courses and Course Collections 26

Languages..................................................................................7 Featured Short Online Courses............................................... 26

Certificates.................................................................................7 Short Online Course Collections.............................................. 26

Designation Programs..................................................................7

Course Types..............................................................................7

Course Enrollment, Access and

Course Providers.........................................................................7 Study Materials 28

Using your LOMA Learning Account............................................28

Professional Designation Programs 8 Enrolling for Courses................................................................. 29

Fellow, Life Management Institute™ (FLMI®)..............................10 Student Responsibilities............................................................ 29

Associate, Life Management Institute™ (ALMI®).........................10 Accessing Online Study Materials.............................................. 30

Fellow, Secure Retirement Institute™ (FSRI™)...........................11 Anticipating Curriculum Changes............................................... 30

Associate, Secure Retirement Institute™ (ASRI™).....................11 Extending Course Access.......................................................... 30

Associate, Customer Service™ (ACS®)......................................12 Students with Special Needs......................................................31

Associate, Insurance Regulatory Compliance® (AIRC™)..............14 Purchasing Printed Study Materials............................................31

Associate, Reinsurance Administration™ (ARA™)......................15 Shipping & Billing......................................................................31

Designation Course Descriptions Examinations 32

and Course Materials 16 Highly Interactive Online Courses and Short Online Courses........ 32

ACS 100 — Foundations of Customer Service.......................16 Course Portal Courses.............................................................. 32

ACS 101 — Customer Service for Insurance Professionals......16 Modularized Self-proctored Exams......................................... 32

AIRC 411 — The Regulatory Environment for Comprehensive Proctored Exams........................................... 32

Life Insurance....................................................16 Exam Procedures & Regulations................................................ 35

AIRC 421 — Regulation of Life Insurance Products, Sales,

& Operations.....................................................16 Grades, Credit, and Awards 36

ARA 440 — Reinsurance Administration................................17 Short Online Courses................................................................ 36

CX 50 — Impact Cx: The Quest........................................17 Highly Interactive Online Courses............................................... 36

LOMA 280 — Principles of Insurance.......................................17 Self-proctored Course Portal Exam............................................ 36

LOMA 281 — Meeting Customer Needs Proctored Course Portal Exams................................................. 36

with Insurance and Annuities.............................17 Retake Policy............................................................................ 36

LOMA 290 — Insurance Company Operations..........................17 Regrade Policy......................................................................... 36

LOMA 291 — Improving the Bottom Line: Credit from Other Programs.......................................................37

Insurance Company Operations..........................18 Awards.....................................................................................37

LOMA 301 — Insurance Administration....................................18

LOMA 302 — The Policy Lifecycle: Insurance Administration....18

International Programs 38

LOMA 307 — Business and Financial Concepts Arabic Programs....................................................................... 38

for Insurance Professionals ...............................18 Chinese Programs.................................................................... 40

LOMA 308 — The Business of Insurance: French Programs...................................................................... 48

Applying Financial Concepts..............................18 Korean Programs...................................................................... 54

LOMA 311 — Business Law for Insurance Professionals...........18 Spanish Programs.................................................................... 60

LOMA 320 — Insurance Marketing..........................................19 Thai Programs...........................................................................73

LOMA 321 — Marketing in Financial Services..........................19

LOMA 335 — Operational Excellence for Insurance

Fees and Schedules 74

Professionals.....................................................19 Enrollment Fees.......................................................................... 74

LOMA 357 — Institutional Investing: Principles and Practices....20 Prometric Fees........................................................................... 74

LOMA 361 — Accounting and Financial Reporting English-Language 2020 Course/Exam Enrollment Fees —

in Life Insurance Companies..............................20 North America............................................................................75

LOMA 371 — Risk Management and Product Design for Additional Fees...........................................................................75

Insurance Companies........................................21 2020 Paper Exam Schedule........................................................76

SRI 111 — Retirement Fundamentals..................................21 English Language Exams & Study Materials by Course.................77Advance Your

CAREER

Our Formula for Success

Start with the trusted source for industry knowledge, add Learners love our popular highly-interactive online

job-relevant course content and convenient course access, course format! Engaging content, multimedia delivery,

and you have a formula for success that industry modularized examinations built right into the course –

professionals around the globe rely on to advance their all features that help adult learners make the most of

careers! their study time and apply the learning to their everyday

lives! See page 32 for more information.

Our industry is changing…and we are keeping pace with

these changes in many ways! We continue to expand capabilities in response to

evolving learner preferences, with additional options

Best Interest? We’ve got you covered! LOMA and

for studying and testing.

LIMRA’s Understanding Best Interest courses are

designed to help financial professionals and home office FLMI fellowship level courses released in 2020 will offer

employees understand and comply with New York Reg delivery of study materials as an interactive e-book

187. See page 26 for more information. compatible with most mobile devices.

LOMA’s newest professional designation program, the Some courses will add a new modularized self-

Fellow, Secure Retirement Institute (FSRI), is a proctored exam option, similar to those embedded in

comprehensive program designed to educate employees our highly interactive online courses. See page 32 for

who develop, administer, and support retirement plans more information.

and products. See page 11 for more information.

So get started today! Let LOMA’s proven formula for success

help you advance your career today…for a better tomorrow!

LOMA’s diverse content helps you achieve your career goals!

Annuities Customer Service Legal and Ethics Reinsurance

Business Analysis Finance and Life and Health Retirement Planning

Business Insurance Accounting Insurance Sales Support

Communication Financial Services Management and Sales Training

and Financial Planning Leadership

Company Operations Securities and

and Administration Human Resources Product Development Suitability

Compliance Insurance Fraud Project Management Underwriting

Customer Insurance Onboarding Property/Casualty

Experience Insurance

2 1-800-ASK-LOMA (Option 1) n www.loma.orgAdvance your career

Disclaimer of Warranty Who to Contact

Examinations described in this Catalog are designed solely to measure

whether students have successfully completed the relevant assigned If you have questions about LOMA’s Professional

curriculum. The attainment of LOMA designations indicates only that all

examinations in the given curriculum have been successfully completed.

Development Programs, contact your company’s LOMA

In no way should a student’s completion of a given LOMA course or Education Representative (Ed Rep) first. If you require

attainment of any LOMA designation be construed to mean that LOMA in additional assistance, or if you are an independent student,

any way certifies that student’s competence, training, or ability to

perform any given task. LOMA’s examinations are to be used solely for

please contact:

general educational purposes, and no other use of the examinations or LOMA’s Contact Center

programs is authorized or intended by LOMA. Furthermore, it is in no 6190 Powers Ferry Road, Suite 600

way the intention of the LOMA curriculum or examinations to describe

the standard of appropriate conduct in any field of the financial services

Atlanta, GA 30339 USA

industry, and LOMA expressly repudiates any attempt to so use the Tel: 1-800-ASK-LOMA (275-5662) (Option 1)

curriculum and examinations. Any such assessment of student 770-984-3761

competence or usual industry practices should instead be based on Fax: 770-984-6415

independent professional inquiry and the advice of competent

E-mail: education@loma.org

professional counsel.

Guidelines for Use of LOMA Materials Unless your company has specific written permission from

It is unlawful to make unauthorized copies of LOMA texts, LOMA in advance, any photocopying, inputting or recording

study aids, exams, software, this Catalog, or any other via computer or other storage medium or device, copying of

materials. When companies or students make unauthorized software, storing or accessing materials via company

copies of LOMA materials, they engage in illegal activity, intranets or networks, or incorporation of any LOMA materials

thereby depriving LOMA of revenues used for association into other works may subject you and your company to

activities such as new research, training, and development of substantial liability for damages under the Copyright Act. You

education programs. may reproduce or transmit this Catalog as permitted on the

inside front cover. You may apply to LOMA for permission to

use other LOMA materials on a case-by-case basis by

contacting LOMA at education@loma.org.

learning.loma.org n education@loma.org 3Overview of and Services

Overview of Products

PRODUCTS

AND SERVICES

As a leading provider of learning solutions for financial Some course portal courses are also available with a

services organizations around the globe, LOMA offers a wide modularized self-proctored testing option. Learners

range of products and services to meet your learning and who opt for self-proctored testing complete a self-proctored

development needs. exam at the end of each course module. Learners must

successfully complete each timed module exam within two

Professional Designation Programs exam attempts to pass the course. See page 32 for more

Since 1932, LOMA has awarded professional designations in information.

insurance and financial services industry education. Each Short Online Courses

LOMA designation program gives learners a broad

understanding of the industry as a whole, and an Whether you are new to the insurance and financial services

appreciation for how they can contribute to their companies’ industry or just want to build new skills, LOMA offers short

success. All LOMA professional designation programs are online courses that can help boost your productivity,

developed with guidance and support from industry subject performance and success!

matter experts, and are globally recognized as being relevant Our short online courses engage the learner with interactive

and engaging. See page 8 for more information. lessons and real-life scenarios that reinforce learning related

to the industry and, in many cases, are specific to individual

Designation Courses businesses or product lines. Online quizzes and knowledge

All courses in LOMA’s professional designation programs are checks provide instant feedback to keep you on track.

delivered online, either in a highly interactive format or in a

course portal format. Most of these courses can be completed in about an hour!

Learn at your own pace with 24/7 on-demand access to

Highly interactive format courses use an engaging,

LOMA’s short online courses.

multimedia approach that often includes integrated

audio, video, and scenario-based learning. Short Online Collections

Highly interactive format courses feature several We’ve combined several short online courses to form

self-proctored, end-of-module exams integrated into collections that focus on a specific aspect of the industry.

the course content as part of the learning experience. Short Online Collections range from 2 to 7 courses, all

No separate exam enrollment is required. available through one convenient enrollment.

Course portal format courses blend a traditional

textbook-based study experience (delivered as an See page 26 for more information about LOMA’s short online

e-book or as a PDF) with interactive practice questions, courses and short online course collections.

sample exam, and other review tools, all housed in a

dedicated mini website, or course portal. E-books are

delivered through an online course portal with links to

download files for each course by module or a PDF of

the entire book. The e-books feature videos, interactive

questions and interactive practice sections at the end of

each module or chapter.

Learners who opt for e-book delivery must have the

Kotobee™ Reader App or Apple Books® as these are

the only two readers LOMA supports. Other readers, or

reliance on the downloaded PDF, will not provide the

same robust interactive experience.

4 1-800-ASK-LOMA (Option 1) n www.loma.orgOverview of Products and Services

Instructor-Led Training

Insurance Immersion Leadership Development

LOMA offers instructor-led, activity-based programs The LIMRA Leadership InstituteTM invites you to become a

designed for employees who need a broad understanding of part of something special. For 30 years, our curriculum has

industry fundamentals. Led by skilled facilitators, the helped financial services leaders hone critical competencies,

programs include instruction from industry subject matter achieve heightened levels of success, and build invaluable

experts, participation in group activities, and interaction with relationships with their peers. Today, leadership development

peers. LOMA’s popular instructor-led training sessions are remains a top priority for companies throughout the industry,

delivered in a variety of formats: as they seek competitive advantage. Our faculty-led

Public Classroom Sessions are held several times workshops provide a fresh view on relevant, actionable topics

throughout the year in specified locations. These 2 ½ that can drive you and our industry forward. See page 24 for

day sessions are lively and fast paced, and move more information.

learners from introduction and understanding to

application and synthesis through focused discussion

about real-world challenges and solutions. Public

classroom sessions are limited to 25 participants.

Custom On-site Classroom Sessions are delivered

on-site at your location by LOMA’s trainers. Session

content can be tailored to fit your company’s unique

business needs.

Custom Train-the-Trainer Classroom Sessions, in Learn More

which LOMA conducts a complete custom on-site

classroom session with your company’s facilitators For more information about LOMA’s Insurance Immersion

attending as participants, followed by a one-day training programs, visit us at www.loma.org, or contact us:

Facilitator Certification Workshop in which your

Phone: 770-984-3766

facilitators learn how to deliver the same program for

maximum impact. E-mail: insuranceimmersion@loma.org

Virtual Classroom Sessions use web-conferencing to Additional instructor-led training and development

deliver the same great training right to your desk. Virtual opportunities are available through LIMRA. To learn how

sessions include the expert instruction and small group these programs can have a positive impact on your

activities of the traditional classroom model, and are business, contact LIMRA at 888-785-4672 or online at

available in public sessions or custom sessions talentsolutions.limra.com.

tailored to your company’s needs. Virtual classroom

sessions are limited to 25 participants.

learning.loma.org n education@loma.org 5Overview of Products and Services

Custom Learning & Development Paths Choose your Path to Industry Knowledge

LOMA can tailor time-tested course content to meet your LOMA has education and training solutions to fit your needs.

company’s unique learning needs with custom learning and And thanks to LOMA’s enhanced learning system, navigating

development paths, based on criteria you specify. By your path to industry knowledge has never been easier!

integrating or adapting our courses and designation programs

When you log in to LOMA’s learning system, you can see all

into custom learning paths that appeal to a variety of learning

of your LOMA learning options in one place. Advanced online

styles, LOMA can design a development program unique to

learning catalog search features allow you to search for

each functional area within your organization. LOMA’s team

LOMA courses based on

of learning and development professionals matches learning

content and courses with job families and competencies Course topic

within jobs for an all-inclusive development solution. Designation program

Customized Solutions Course type

For companies that need more than a standard off-the-shelf Course provider

solution, LOMA offers customized solutions to maximize your

training investment. Some of these options include: Language

Certificate programs Keyword or phrase

Blended learning tools

This powerful filtering tool helps you see at a glance all of the

Learning management system (LMS) integrations LOMA learning opportunities that meet your criteria, and how it

Customized courses all fits together to deliver the solution that’s just right for you.

For more information about LOMA’s customized solutions, If you are working toward a Professional Designation, the

visit www.loma.org, or email membersolutions@loma.org. designation tracking features in LOMA’s learning system

will help you stay on target!

The system’s user interface is available in a variety of

languages to make your experience better than ever before.

6 1-800-ASK-LOMA (Option 1) n www.loma.orgOverview of Products and Services

Course Topic Categories Designation Programs

Annuities ACS® Associate, Customer Service™

Business Skills AIRC™ Associate, Insurance Regulatory

Compliance/Legal Compliance®

Customer Experience ALMI® Associate, Life Management Institute™

Customer Service ARA™ Associate, Reinsurance Administration™

Finance/Accounting ASRI™ Associate, Secure Retirement Institute™

Health Insurance FLMI® Fellow, Life Management Institute™

Life Insurance FSRI™ Fellow, Secure Retirement Institute™

Management/Leadership LCIC™ LOMA Certified Insurance Consultant™

Marketing

(Spanish)

Operations/Administration

LLIF LIMRA Leadership Institute™ Fellow

Property/Casualty Insurance

Reinsurance

Retirement

Course Types

Sales

Short Online Courses

Underwriting

Short Online Collections

Designation Courses

Instructor-Led Courses

Languages Instructor Materials/Discussion Guides

Arabic

Chinese (Simplified)

Chinese (Traditional)

Course Providers

English

LOMA

French

LIMRA

Korean

Convergent

Spanish

LOGiQ3

Thai

LRN

NATG

Certificates

Certificate in Insurance Fundamentals

Certificate in Customer Experience Essentials

Certificate in Retirement Essentials

Certificate in Regulatory Compliance Essentials

Certificate in Underwriting

learning.loma.org n education@loma.org 7Professional Designation Programs

Professional Designation

PROGRAMS

One of the most recognized and respected professional Enroll and Access Designation Courses

education institutions in the world, LOMA is perhaps best Once enrolled, learners access the study materials for

known for programs of study that lead to the internationally LOMA’s designation program courses through LOMA’s

recognized professional designations listed below: learning system.

ACS® Associate, Customer Service™

Whether you choose the highly interactive online format with

AIRC™ Associate, Insurance Regulatory Compliance® integrated end-of-module exams, the course portal format

ALMI® Associate, Life Management Institute™ with a comprehensive proctored exam, or the course portal

ARA™ Associate, Reinsurance Administration™ format with modularized self-proctored exams, LOMA is your

ASRI™ Associate, Secure Retirement Institute™ one-stop shop for everything you need to succeed.

FLMI® Fellow, Life Management Institute™ The charts on pages 77 and 78 show the format for each

FSRI™ Fellow, Secure Retirement Institute™ designation course.

LCIC™ LOMA Certified Insurance Consultant™ (Spanish) Credit for Retired Designation Courses

Track Designation Progress In some cases, learners may receive credit for courses that

are no longer offered by LOMA. Most of these situations are

LOMA’s learning system — learning.loma.org — provides explained in notes to the tables on the following pages.

quick access to the most current designation program However learners should check their Learning History in

information and materials. Although learners may enroll in LOMA’s learning system for the most up-to-date information

individual courses within any of LOMA’s programs without regarding program requirements and designation progress.

pursuing a professional designation, the Designation tab in

LOMA’s learning system makes earning a professional

designation easier by helping learners and administrators

stay on target.

When you enroll in a course that offers credit toward a

designation, this feature automatically displays the

LOMA professional designations that award credit for that

course and allows you to see the progress you’ve made

toward each designation, as well as the remaining courses

needed to achieve your designation goals. With this tab,

you’ll always know exactly what your next steps should be in

order to reach the finish line!

Want to see what other designations are available? Simply

search the Learning catalog and select the “Designation”

category to see all available designations and the courses

required for each.

8 1-800-ASK-LOMA (Option 1) n www.loma.orgProfessional Designation Programs

LOMA Certificates Certificate in Retirement Essentials

LOMA certificates provide both recognition of your efforts SRI 111—Retirement Fundamentals

and incentive to keep going! It signals your commitment to SRI 121—Retirement Savings and Investments

your professional development goals to colleagues and SRI 131—Planning for a Secure Retirement

superiors.

Certificate in Customer Experience Essentials

Learners earn certificates for completion of certain levels of

CX 50—Impact Cx: The Quest

LOMA designation courses. Other certificates may combine

courses from across multiple programs, or may be awarded LOMA 280—Principles of Life Insurance/

upon completion of a single course. LOMA 281—Meeting Customer Needs with Insurance

and Annuities

Current certificates and their course components include:

LOMA 290—Insurance Company Operations/

Level 1: Insurance Fundamentals LOMA 291—Improving the Bottom Line:

LOMA 280—Principles of Life Insurance/ Insurance Company Operations

LOMA 281—Meeting Customer Needs with Certificate in Underwriting

Insurance and Annuities

UND 386—Underwriting Life and Health Insurance

LOMA 290—Insurance Company Operations/

LOMA 291—Improving the Bottom Line: Insurance

Company Operations

Certificate in Regulatory Compliance Essentials

AIRC 411—The Regulatory Environment For

Life Insurance

AIRC 421—Regulation of Life Insurance Products,

Sales, and Operations

learning.loma.org n education@loma.org 9Professional Designation Programs

Fellow, Life Management Institute (FLMI)

and Associate, Life Management Institute

(ALMI)

The Fellow, Life Management Institute (FLMI) program is a LOMA recommends a course progression that begins with

10-course professional designation program that provides Level I followed by the ALMI level before enrolling in courses

an industry-specific business education in the context of in the FLMI level.

the life insurance and annuity industry. Established in 1932,

All courses leading to the ALMI are available in

the FLMI program is the world’s largest university-level

two formats – as a Highly Interactive Online course with

education program in insurance and financial services.

integrated modularized self-proctored exams, or as a Course

Level 1: Insurance Fundamentals: Provides need-to- Portal with a proctored end-of-course exam.

know information about insurance products and

operations so employees quickly gain confidence, serve Some upper level FLMI courses are only available in the

the customer effectively, and contribute to company Course Portal format with a proctored end-of-course exam.

success Select others, also available in Course Portal format, offer the

choice between a proctored end-of-course exam and

ALMI: Provides job-relevant knowledge about the core modularized self-proctored exams. See Page 32 for more

insurance functions and strengthens business and information.

financial acumen

FLMI: Teaches advanced insurance and financial

concepts to build a deeper understanding of the

insurance business

Associate, Life Management Institute (ALMI) and Fellow, Life Management Institute (FLMI)

Required courses

Level I ALMI FLMI

Insurance Insurance Insurance Business & Marketing Law2 Management 2 Investments2 Accounting Risk

Principles1 Operations1 Administration Financial Management

Concepts2 & Product

Design

LOMA 280 LOMA 290 LOMA 301 LOMA 307 LOMA 320 LOMA 311 LOMA 335 LOMA 357 LOMA 361 LOMA 371

or or or or or

LOMA 281 LOMA 291 LOMA 302 LOMA 308 LOMA 321

Level 1: LOMA awards a

personalized certificate to

learners upon successful

completion of LOMA 280/281 Level 1 plus the ALMI courses are required

and LOMA 290/291. to earn the ALMI designation.

1

Learners who complete CX 50 – Impact Cx: The Quest, as well as the FLMI Level 1 course requirements (LOMA 280/281 and LOMA 290/291) will earn the

Certificate in Customer Experience Essentials.

2

Learners who have credit for the discontinued courses shown below may receive FLMI credit for the applicable course category shown below. However, credit

for discontinued courses is subject to change without notice.

Discontinued Course Course Category

LOMA 351 Business & Financial Concepts

LOMA 310, 315, or 316 Law

LOMA 330 Management

LOMA 340 or 356 Investments

Learners may be eligible for credit for other discontinued

courses. Check your designation progess at learning.loma.org.

10 1-800-ASK-LOMA (Option 1) n www.loma.orgProfessional Designation Programs

Fellow, Secure Retirement Institute (FSRI) and

Associate, Secure Retirement Institute (ASRI)

The Fellow, Secure Retirement Institute (FSRI) is a self-study Level 3 (FSRI) delivers knowledge of broad challenges

designation program for industry professionals working in the facing society and the retirement industry, as well as

retirement industry. Designed specifically for employees in strategic approaches for meeting these challenges, to

insurance companies, asset management firms, distribution equip employees for problem solving, innovation, and

organizations, and recordkeeping companies, this advancement in their careers. Learners who complete

comprehensive professional development curriculum covers Levels 1, 2, and 3 will achieve the Fellow, Secure

the entire retirement planning and income marketplace. The Retirement Institute (FSRI) designation.

FSRI will help companies ensure that their employees have

LOMA recommends a course progression that begins with

the knowledge and skills to support retirement plans and

Level 1 followed by the ASRI level courses before enrolling in

products, deliver effective service and solutions to clients and

the FSRI course.

advisors, and address the challenges and opportunities

presented by the evolving retirement marketplace. All courses leading to the ASRI are highly interactive online

Level 1 (Certificate Level) consists of three courses that courses with integrated modularized exams. The final FSRI

provide an overview of the retirement marketplace and a course features a blended learning approach that includes an

strong foundation in retirement principles, products, and interactive online component and a PDF text in a course

planning. A Certificate in Retirement Essentials is portal with a proctored exam, as well as an application

awarded upon completion of these three courses. assignment segment that challenges learners to demonstrate

understanding and application of advanced retirement

Level 2 (ASRI) consists of three courses that teach concepts.

advanced concepts in generating successful retirement

outcomes and the application of retirement industry

knowledge to marketing, business acquisition,

administration/operations, service, and other functions

that support the business. Learners who complete Level 1

and Level 2 will earn the Associate, Secure Retirement

Institute (ASRI) designation.

Associate, Secure Retirement Institute (ASRI) and Fellow, Secure Retirement Institute (FSRI)

Required courses

Level 1 Level 2 Level 3

Certificate in Retirement Essentials ASRI FSRI

SRI 111 SRI 121 SRI 131 SRI 210 SRI 220 SRI 230 SRI 500

Retirement Retirement Planning for Successful Retirement Retirement Transforming

Fundamentals Savings and a Secure Retirement Marketing Administration Retirement

Investments Retirement Outcomes and Business Security

Acquisition

learning.loma.org n education@loma.org 11Professional Designation Programs

Associate, Customer Service (ACS) The ACS program provides a course on the foundations of

customer service, and the program’s elective tracks allow

Employees at all levels can benefit from the Associate, you to focus your studies within a particular product area.

Customer Service (ACS) program. It is appropriate for Those pursuing the ACS may choose one of the following

anyone who interacts with internal or external customers on a tracks to complete the designation:

regular basis.

ACS — Life Insurance

The ACS program is designed to help you: ACS — Property & Casualty (P&C)

Increase your knowledge of product lines

Successfully manage customer relationships

Exceed customers’ expectations

Improve your company’s bottom line

ACS — Life Insurance

Required courses Elective courses — select two

Customer Service Insurance Insurance Operations/ Insurance Business & Marketing

Principles Reinsurance Administration Administration Financial Concepts

ACS 100 LOMA 280 LOMA 290 LOMA 301 LOMA 307 LOMA 320

or or or or or or

ACS 101 LOMA 281 LOMA 291 LOMA 302 LOMA 308 LOMA 321

or

ARA 440

Learners must complete THREE required courses and TWO electives to earn the ACS designation.

ACS — Property & Casualty (U.S.) ACS — Property & Casualty (Canada)

Jointly sponsored by LOMA and The Institutes, the U.S. Jointly sponsored by LOMA and The Insurance Institute

Property & Casualty track of the ACS program provides a solid of Canada (IIC), the Canadian Property & Casualty track

understanding of customer service and how it affects property/ of the ACS program provides a solid understanding of

liability, personal and commercial insurance, regulation, claims customer service and how it affects property/liability

and more. Policies and procedures for LOMA-administered insurance, loss adjusting, underwriting, and agent/broker

ACS courses are described in this Catalog. For information on activities. Policies and procedures for LOMA-administered

enrolling for The Institutes courses, see the contact information ACS courses are described in this Catalog. For information

below. To send proof of credit to LOMA, complete the form at on enrolling for IIC courses, see the contact information

www.loma.org. below. To send proof of credit to LOMA, complete the

form at www.loma.org.

The Institutes

Customer Service Department

720 Providence Road The Insurance Institute of Canada

Suite 100 18 King Street East, 6th Floor

Malvern, PA 19355-3433 Toronto, ON M5C 1C4

Tel: 800-644-2101 / 610-644-2100 Tel: 866-362-8585 / 416-362-8586

Fax: 610-640-9576 Fax: 416-362-1126

E-mail: customerservice@theinstitutes.org E-mail: iicmail@insuranceinstitute.ca

Web site: http://www.theinstitutes.org Web site: http://www.insuranceinstitute.ca

12 1-800-ASK-LOMA (Option 1) n www.loma.orgProfessional Designation Programs

ACS — Property & Casualty (U.S.)

Required courses Elective courses — select two

Customer Property/ Personal/ Personal/ Insurance Information Claims Insurance Reinsurance2

Service Liability Commercial Commercial Regulation Technology Services

Principles1 Insurance1 Insurance1

ACS 100 AINS 21 AINS 22 AINS 22 IR 201 CYBER 301 AIC 30 AIS 25 ARe 144

or or or

ACS 101 AINS 23 AINS 23

(whichever was

not taken as a

required course)

For details on the required and elective courses offered by The Institutes, visit http://www.theinstitutes.org.

Learners must complete THREE required courses and TWO electives to earn the ACS designation.

ACS — Property & Casualty (Canada)

Required courses Elective courses — select two

Customer Insurance Property/ Property/ Loss Advanced Loss Underwriting Agent/

Service Principles/ Liability Liability Adjusting3 Adjusting Broker

Practices Insurance Insurance

ACS 100 C11 C12 C12 C110 C111 C120 C130

or or or or or or

ACS 101 C81 and C82 C13 C13 C121 C131

(whichever was not taken

as a required course)

For details on the required and elective courses offered by the IIC, visit http://www.insuranceinstitute.ca.

Learners must complete THREE required courses and TWO electives to earn the ACS designation.

1 Learners who have earned the CPCU designation can get credit for AINS 21, 22, and 23

2 Learners who have credit for ARe 141 may receive ACS credit for the Reinsurance course.

3 Learners who have credit for C17 by July 2004 may receive ACS credit for the Loss Adjusting course.

learning.loma.org n education@loma.org 13Professional Designation Programs

Associate, Insurance Regulatory Certificate in Regulatory Compliance

Compliance (AIRC) Essentials

Compliance is one of the most critical issues facing insurers LOMA recognizes that everyone in your organization – not

today. LOMA’s Associate, Insurance Regulatory Compliance just those working towards an AIRC designation – needs a

(AIRC) program provides a comprehensive knowledge base solid foundation in Compliance. That’s why learners who

of the complex issues surrounding state and federal successfully complete AIRC 411 and AIRC 421 will be

regulation of the life insurance industry and products in the awarded the Certificate in Regulatory Compliance

United States. Courses in this designation program are Essentials.

frequently updated to reflect evolving regulations. NOTE: Learners may not apply existing credit for AIRC 410 or AIRC

The AIRC program helps you understand: 420 toward earning the Certificate. Our Contact Center representatives

are available to help explain your options. Call us at 1-800-ASK-LOMA

Compliance concepts, terms, processes, and regulatory (Option 1).

requirements

How states and the U.S. federal government regulate

insurance companies

What to expect during financial examinations and market

conduct examinations

What kinds of filings states need on life insurance

products and annuities

When, how, and why U.S. federal securities laws apply

to the sale of financial products

What specific regulations govern insurance, including

life, pensions, annuities, credit insurance, and group

products

Associate, Insurance Regulatory Compliance (AIRC)

Required courses

Insurance Insurance Operations Law 1

Marketing2 Compliance 1 Compliance 2

Principles

LOMA 280 LOMA 290 LOMA 311 LOMA 320 AIRC 4113 AIRC 4214

or or or

LOMA 281 LOMA 291 LOMA 321

LOMA awards a Certificate in Regulatory

Compliance Essentials to learners

upon successful completion of

AIRC 411 and AIRC 421.

Learners must complete ONE course from each subject category to earn the AIRC designation.

1 Learners who have credit for LOMA 310 or LOMA 315 may receive AIRC credit for the Law course.

2 Learners who have credit for LOMA 326 may receive AIRC credit for the Marketing course.

3 Learners who have credit for AIRC 410 may receive credit for AIRC 411.

4 Learners who have credit for AIRC 420 may receive credit for AIRC 421.

Note: Credit for discontinued courses is subject to change without notice.

14 1-800-ASK-LOMA (Option 1) n www.loma.orgProfessional Designation Programs

Associate, Reinsurance Administration The ARA program describes:

(ARA) Key players and the reasons for using reinsurance

Laws and regulations affecting reinsurance transactions

Reinsurance plays a vital role in the financial services

industry. LOMA’s Associate, Reinsurance Administration Provisions of a reinsurance agreement and how they

(ARA) program will help you grasp reinsurance principles, affect the administration of reinsurance transactions

the importance of the written reinsurance agreement, and Processes involved in the administration of new

the administration and auditing of reinsurance business. business, in-force business, and terminations of

reinsurance

Associate, Reinsurance Administration (ARA)

Required courses

Insurance Insurance Insurance Law/Compliance1 Accounting Reinsurance

Principles Operations Administration Administration

LOMA 280 LOMA 290 LOMA 301 LOMA 311 LOMA 361 ARA 440

or or or or

LOMA 281 LOMA 291 LOMA 302 AIRC 411

or

AIRC 421

Learners must complete ONE course from each category to earn the ARA designation.

1 Learners who have credit for LOMA 310, LOMA 315, AIRC 410, or AIRC 420 may receive ARA credit for the Law/Compliance course. However,

credit for discontinued courses is subject to change without notice.

learning.loma.org n education@loma.org 15Designation

Designation Course and Course Materials

Course Descriptions

DESCRIPTIONS &

COURSE MATERIALS

Your date of enrollment in a course dictates which materials you should study. Please check your materials carefully, particularly

if you plan to purchase an optional printed textbook.

ACS 101

How to Use This Section Customer Service for

Insurance Professionals

This section provides brief course descriptions for all LOMA

Designation courses. Courses are listed alphabetically by ACS 101 uses a variety of media to provide a comprehensive

designation, and then numerically by course numbers. overview of the role of customer service in insurance and

financial services organizations and the skills service providers

See page 28 for Course Enrollment and Access

need to deliver exceptional customer service. The course

information.

describes important customer service functions, processes,

See page 75 for Course Fees. and technologies and offers opportunities for students to

Now you can also take your search for designation learn and improve their listening, speaking and writing skills

courses online! Detailed course descriptions, assigned so that they can interact effectively with customers.

study materials, and learning outcomes are also available in This course is delivered as a highly interactive online course,

LOMA’s learning system. and self-proctored, end-of-module exams are integrated

within the course.

Visit www.loma.org/LearningCatalog to browse all LOMA

course offerings. AIRC 411

The Regulatory Environment

for Life Insurance

ACS 100 AIRC 411 discusses the compliance function in a life

Foundations of Customer Service insurance company and how the state and federal

ACS 100 provides a comprehensive introduction to customer governments regulate life insurance companies operating in

service in a financial services environment. The course the United States.

explores the knowledge and skills employees need to

This course is delivered as a highly interactive online course,

understand and deliver exceptional customer service.

and self-proctored, end-of-module exams are integrated

This course includes access to the Course Portal for all study within the course.

materials, as well as enrollment in a proctored examination.

AIRC 421

Important Testing Note: The proctored examination is

Regulation of Life Insurance

available in I*STAR and Prometric formats only.

Products, Sales, & Operations

Optional printed textbook available (not included in

AIRC 421 explains state and federal regulation of life

enrollment fee)

insurance and annuity product design in the United States.

See Order Form.

The course also describes the regulation of life company

operations, including underwriting, claims, reinsurance,

market analysis and examinations.

This course is delivered as a highly interactive online course,

and self-proctored, end-of-module exams are integrated

within the course.

16 1-800-ASK-LOMA (Option 1) n www.loma.orgDesignation Course Descriptions and Course Materials

Browse our online Learning Catalog to view currently assigned study materials:

www.LOMA.org/LearningCatalog

ARA 440 LOMA 280

Reinsurance Administration Principles of Insurance

ARA 440 shows how reinsurance strengthens the insurance LOMA 280 introduces the principles of insurance, the

industry and increases the likelihood that insurance process of becoming insured, and the policyowner’s

companies will have sufficient funds to pay anticipated contractual rights. The course includes information on the

claims. This course also discusses reinsurance principles, features of individual and group life insurance, health

regulation of reinsurance, typical provisions in a reinsurance insurance, and annuity products.

agreement, the administration of reinsurance business, and This course includes access to the Course Portal for all study

the importance of quality control for reinsurance. materials, as well as enrollment in a proctored examination.

This course includes access to the Course Portal for all study Optional printed textbook available (not included in

materials, as well as enrollment in a proctored examination. enrollment fee)

See Order Form.

Important Testing Note: The proctored examination is

available in I*STAR and Prometric formats only. LOMA 281

Meeting Customer Needs

CX 50 with Insurance and Annuities

Impact Cx: The Quest

Part of the Need 2 Know series, LOMA 281 uses a variety of

Creating a positive customer experience is an increasingly media to teach principles of insurance, insurance products,

important differentiator for your company — it can set you and the policyowner’s contractual rights. The course

apart from the competition, sustain customer loyalty, and describes the features of individual and group life insurance

help achieve profitable growth. CX 50 is an interactive, and annuity products, and emphasizes how insurance

decision-based, gamified course that helps organizations companies serve customers and meet customer needs

create a unified customer-first mindset among all employees, through the products they provide.

not just those in customer-facing roles. It transforms

employees into customer advocates who demonstrate This course is delivered as a highly interactive online course,

empathy and sound judgment in meeting customer needs and self-proctored, end-of-module exams are integrated

— and improving the overall customer experience — at key within the course.

touchpoints in the customer journey.

LOMA 290

CX 50–Impact Cx: The Quest is available for volume purchase Insurance Company Operations

for companies that want to build an enterprise-wide customer LOMA 290 describes how life insurance companies operate in

experience mindset. Individual learners can also enroll in the today’s global environment: how they are organized, how they

course directly through LOMA’s learning system. are managed, and the roles of functional and support units in

Learners who complete CX 50, as well as LOMA 280/281 developing, distributing, issuing, and administering life

and LOMA 290/291 will earn the Certificate in Customer insurance and annuity products. Learners who take this course

Experience Essentials. will better understand how an individual job fits into the entire

scope of the company, as well as the importance of each

employee’s contribution to overall organizational success.

This course includes access to the Course Portal for all study

materials, as well as enrollment in a proctored examination.

Optional printed textbook available (not included in

enrollment fee)

See Order Form.

learning.loma.org n education@loma.org 17Designation Course Descriptions and Course Materials

Browse our online Learning Catalog to view currently assigned study materials:

www.LOMA.org/LearningCatalog

LOMA 291 LOMA 307

Improving the Bottom Line: Business and Financial Concepts

Insurance Company Operations for Insurance Professionals

Part of the Need 2 Know series, LOMA 291 uses a variety of LOMA 307 introduces industry employees to basic financial

media to teach operations, functions, and product development concepts and terminology and relates these concepts to the

basics unique to the insurance organization. In addition, the business of insurance and company operations and profitability.

course will teach that (1) a company’s success depends on its

operational efficiency and effectiveness, and (2) every employee This course includes access to the Course Portal for all study

has a role in ensuring the company’s financial success. materials, as well as enrollment in a proctored examination.

This course is delivered as a highly interactive online course, Optional printed textbook available (not included in

and self-proctored, end-of-module exams are integrated within enrollment fee)

the course. See Order Form.

LOMA 301 LOMA 308

Insurance Administration The Business of Insurance:

LOMA 301 provides a detailed discussion of the activities of Applying Financial Concepts

insurance administration for individual and group life LOMA 308 uses a variety of media to present basic

coverages, focusing on underwriting, reinsurance, claims, economic, financial, and business concepts and practices

and customer service.

related to insurance company management, operations,

This course includes access to the Course Portal for all study solvency, and profitability. The course utilizes extensive

materials, as well as enrollment in a proctored examination. examples and exercises that enable learners to understand

Optional printed textbook available (not included in and apply important financial concepts and principles in their

enrollment fee) own work environments.

See Order Form. This course is delivered as a highly interactive online course,

and self-proctored, end-of-module exams are integrated

LOMA 302

within the course.

The Policy Lifecycle:

Insurance Administration LOMA 311

LOMA 302 uses a variety of media to trace the lifecycle of a life Business Law

insurance policy and explore insurance administration functions for Financial Services Professionals

through real-world examples. Learners will closely examine the

underwriting processes, customer service practices, reinsurance LOMA 311 presents the basic features and principles of the

protocols, and claims evaluation procedures to gain an legal environment in which financial services companies

understanding of how insurers carry out a broad range of around the world operate.

administrative activities. Case studies provide opportunities for Enrollments purchased before February 2020 include

learners to apply what they’ve learned to real-life scenarios. access to the Course Portal for all study materials, as well as

This course is delivered as a highly interactive online course, enrollment in a proctored examination.

and self-proctored, end-of-module exams are integrated within Important Testing Note: May 2020 is the final paper

the course. exam for LOMA 311 in English. After that, the proctored

examination will be available in I*STAR and Prometric

formats only.

Optional printed textbook available (not included in

enrollment fee)

See Order Form.

18 1-800-ASK-LOMA (Option 1) n www.loma.orgYou can also read