Transparency Register pursuant to the 4th European Money Laundering Directive - Status of Implementation in Selected EU Member States - June 2018 ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Transparency Register pursuant to the 4th European Money Laundering Directive – Status of Implementation in Selected EU Member States June 2018

Introduction | Content

Introduction Content

Among other measures designed to combat money laundering and terrorist financing, the Austria ......................................................................................................................... 3

4th Money Laundering Directive requires the EU member states to set up registers of the ultimate Belgium ......................................................................................................................4

beneficial owners of legal entities. It was left up to the individual member states how to implement Bulgaria ......................................................................................................................5

the directive, and in doing so, member states have taken different approaches. Croatia .........................................................................................................................6

Czech Republic ................................................................................................7

France ...........................................................................................................................8

In order to give an initial overview, CMS has summarized the regulations in selected member Germany ...................................................................................................................9

states. Of particular relevance to shareholders are those countries in which direct and indirect Hungary ................................................................................................................. 10

shareholders have an active obligation to make any necessary notification. Italy ............................................................................................................................... 11

Luxembourg .................................................................................................... 12

Netherlands ...................................................................................................... 13

Key Poland ...................................................................................................................... 14

Portugal ................................................................................................................. 15

Listed Companies: Companies listed on a regulated market Romania ................................................................................................................ 16

Slovakia .................................................................................................................. 17

UBO: Ultimate Beneficial Owner

Slovenia .................................................................................................................. 18

Transparency Register: A central transparency register in accordance

Spain .......................................................................................................................... 19

with the Directive (EU) 2015 / 849 Switzerland .......................................................................................................20

UK ................................................................................................................................ 21Overview of the implementation of a Transparency Register

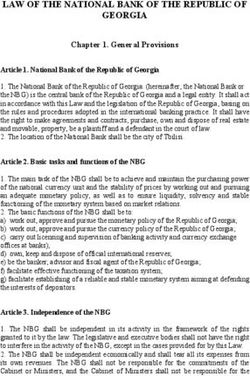

Austria What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Bundesgesetz über die Einrich Yes. Yes. The legal entity. No filings necessary in the 1 June 2018 Administrative fines. Yes.

tung eines Registers der wirt case of:

schaftlichen Eigentümer von Beneficial and legal owners Legal entities are obliged to Filings have to be made via the

Gesellschaften, anderen juris have to provide the legal enti- take appropriate measures to — Partnerships (Offene Ge- Unternehmensservicepor t al

tischen Personen und Trusts ty with all documents and in verify whether the information sellschaft, Kommanditge (www.usp.gv.at).

(Wirtschaftliche Eigentümer formation necessary. provided is correct and to ful- sellschaft), if all personally

Registergesetz). ly understand the ownership liable shareholders are na

and control structure. tural persons.

— Limited liability companies,

if all shareholders are nat-

ural persons.

— Cooperatives and Indus-

trial Societies (Erwerbs- u.

Wirtschaftsgenossenschaf

ten).

— Mutual insurance associ-

ations (Versicherungsver

eine auf Gegenseitigkeit).

— Associations pursuant to

the Austrian Associations

Act (Vereine gemäß Ver-

Your contact: einsgesetz).

— Listed Companies.

Peter Huber

Managing Partner

T +43 1 40443 1650

E peter.huber@cms-rrh.com

3Overview of the implementation of a Transparency Register

Belgium What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Act dated 18 September 2017 No. Yes. The legal entity (still subject to Yes, for listed companies. This n/a Where it is impossible for the Pending decree.

on the prevention of the use the implementing royal decree is still subject to the imple- legal entity to successfully go

of the financial system for the The Act does not indicate an Legal entities are bound to col- to be adopted). menting royal decree to be through the identification pro-

purposes of money laundering obligation of a UBO or a share- lect and keep relevant, up-to- adopted. cess, any business relationship

or terrorist financing and on holder to proactively provide date and correct information or operation run through the

the restriction for the use of information on the UBO to the on their UBO and their eco- entity will be precluded.

cash, effective from 16 Octo- legal entity but this is still sub- nomic interests. Such informa-

ber 2017. ject to the implementing royal tion should include at least the There are also administrative

decree to be adopted. name, date of birth, citizenship and criminal fines.

and address of the UBO as

well as the nature and extent

of its respective economic in-

terest (still subject to the im-

plementing royal decree to

be adopted).

Your contact:

Vincent Dirckx

Partner

T +32 2 743 6 985

E vincent.dirckx@

cms-db.com

4Overview of the implementation of a Transparency Register

Bulgaria What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Chapter II, Part VI of the Bul- Yes. No. The legal entity. Yes. 1 February 2019. Fines range between EUR 250 The Transparency Register is

garian Anti-Money Laundering and EUR 2,500 for responsible designed as part of two exist-

Measures Act (“AMLMA”) Currently, the process and The obligations of the legal en- There is an exemption if the The register will be operation- managers of a legal entity. ing public registers: the Com-

(Закон за мерките срещу forms by which such informa- tity are limited to collecting, requisite information is already al by 1 October 2018. Fines for legal entities range mercial Register and the BUL-

изпирането на пари) pub- tion is provided to the legal processing and providing in- available in the relevant re between EUR 500 and EUR STAT Register.

lished in State Gazette Issue entity are unclear. These will formation that was made gisters. 5,000.

No 27 / 2018 on 27 March be set out in secondary legis- available to it. The secondary

2018, effective from 31 March lation to the AMLMA and are legislation to the AMLMA,

2018. expected to be developed and which is not yet prepared, may

implemented by 27 August introduce such obligations on

2018. the legal entity.

Your contact:

Helen Rodwell

Managing Partner

T +420 296 798 818

E helen.rodwell@

cms-cmno.com

5Overview of the implementation of a Transparency Register

Croatia What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Act on Prevention of Money No. Yes. The legal entity. Yes. n/a Administrative fines (against From the wording of the Act,

Laundering and Terrorism Fi- legal entities / trust managers it seems that the Transparency

nancing (Zakon o sprječavan- The Act does not prescribe Although the Act is not ex- Exemptions are available for: Details of the procedure, in- and against board members Register will be established as

ju pranja novca i financiranja such obligation. plicit in this regard, the legal cluding deadlines for regis- or other responsible persons a separate register. This will be

terorizma); in force from 1 entity (or the trust manager) — Companies listed on a tration of information in the of legal entities). clear after the regulations have

January 2018. is obliged to have and keep stock exchange / regulated Transparency Register, are yet been adopted.

adequate, accurate and up- market of one or more to be prescribed by the regu-

The Transparency Register will to-date information on the EU member states; lations.

become operational only after UBO. Non-compliance can re- — Companies with a registe

the relevant regulations are ad sult in administrative fines. red seat in a foreign coun-

opted. The regulations should try, which are listed on a

be adopted by the end of June stock exchange / regulated

2018. market of (i) an EU mem-

ber state, or (ii) a relevant

third country (where the

company is seated), pro-

vided that the publishing

requirements in such for-

eign country are in com-

pliance with the EU regu-

lations ensuring transpar-

Your contact: ency of information on

UBOs.

Peter Huber

Managing Partner

T +43 1 40443 1650

E peter.huber@cms-rrh.com

6Overview of the implementation of a Transparency Register

Czech What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

Republic in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Act. No. 368 / 2016 Coll. im- No. Yes. The legal entity. No. 1 January 2019, for legal en- Under the applicable legisla- The Transparency Register was

plements the Directive and tities registered in the Czech tion, there is no provision established as a separate reg-

amends (i) Act No. 253/2008 There is no obligation of the Each legal entity is to maintain commercial register (e.g. all based on which a penalty may ister, known as the “record of

Coll., on selected measures UBO(s) to provide the legal and keep up-to-date records limited liability companies and be imposed on legal entities or data of ultimate beneficial

against legitimization of the entity with any information in about their respective UBO(s) joint-stock companies), or beneficial owners for breach- owners of legal entities and

proceeds of crime and financ- this respect. and the reasons why such per ing the obligation to disclose trust funds”. The Transparency

ing of terrorism, (ii) Act No. son(s) is / are considered the 1 January 2021 for entities reg- the beneficial ownership or Register is not a public register

304 / 2013 Coll. on public reg- legal entity’s UBO(s). istered in other public regis- any other information relating and is maintained in electronic

isters of legal entities and nat- ters. to the beneficial owner(s). form at the relevant court of

ural persons and (iii) some fur- registration administering the

ther Acts. A failure to disclose informa- file of the respective legal en-

tion on the beneficial owner(s) tity.

may have some indirect nega-

tive consequences, such as an

exclusion of the respective le-

gal entity from participation in

public tenders.

Your contact:

Helen Rodwell

Managing Partner

T +420 296 798 818

E helen.rodwell@

cms-cmno.com

7Overview of the implementation of a Transparency Register

France What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Ordinance no. 2016–1635 dat- No. Yes. The legal entity. Yes. For listed companies and Companies incorporated as Six-month imprisonment and Central register for beneficial

ed 1 December 2016, which state-owned industrial and from 1 August 2017 must a fine amounting to EUR 7,500 ownership information is at-

was itself authorized by a Legal entities should endeav- commercial establishments comply upon incorporation; as well as specific ancillary tached to the already existing

parent Act no. 2016–731 dat- our to find accurate informa- (EPIC). companies incorporated be- sanctions such as prohibition trade and companies register

ed 3 June 2016. Additional tion, in accordance with a fore that date must comply to manage a company (art. L. (R.C.S.).

measures have been given by “best efforts” standard. from 1 April 2018 on. 561–49).

a decree 2017–1094 dated Deposit formalities can be car-

12 June 2017. In case of unidentified UBO(s), Any change regarding the ried out electronically as long

it has to be noted that: UBO has to be filed within as the filing form bears an

A decree no. 2018–284 dated 30 days of the occurrence of electronic signature.

April 18th 2018 clarified the — The individual who is the such change.

identification of the UBO of a legal representative of the

legal person. legal entity has to be des-

ignated as UBO. If said le-

gal representative is a legal

entity, its own legal rep-

resentative, individual, is

deemed to be UBO, etc.

until an individual can be

identified.

— If a legal entity has several

legal representatives (indi-

viduals) all of them have to

Your contact: be filed as UBO.

— As regards foreign compa-

Jean-Robert Bousquet nies, the UBO is deemed

Partner to be the individual who is

T +33 1 47 38 42 60 the equivalent of the legal

E jean-robert.bousquet@ representative under for-

cms-fl.com eign law.

8Overview of the implementation of a Transparency Register

Germany What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Part 4 of the Gesetz über das Yes. No. The legal entity. Yes. If and to the extent that 1 October 2017 Administrative fines against As a separate register called

Aufspüren von Gewinnen aus the information on the UBO is shareholders, UBO and man- Transparenzregister

schweren Straftaten (Geldwä Any shareholder who is a The obligations of the man- available from certain public agement in breach of their

schegesetz – GwG) as amend- UBO or directly controlled by agement are limited to collect- records in Germany, no filings obligations. www.transparenzregister.de

ed on 23 June 2017. a UBO as well as any UBO has ing and processing informa- have to be made.

to provide the required infor- tion which was made available

mation (unless such informa- to it.

tion is available from certain

public records in Germany).

Your contact:

Dr Martin Kuhn

Partner

T T+49 89 23807 123

E martin.kuhn@cms-hs.com

9Overview of the implementation of a Transparency Register

Hungary What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Act LIII of 2017 on the Preven- Pursuant to the Act LIII of 2017, legal entities are not required to directly submit information to a central register regarding their UBO. However, in the event such entities Service providers must refuse n/a

tion and Combating of Money are to engage in a business relationship with certain service providers (eg. financial institutions, insurances, auditing firms etc.) they will be required in certain cases to provide to carry out transactions fol-

Laundering and Terrorist Fi- certain information to the service providers in accordance with the Act LIII of 2017 as part of the service providers’ customer due diligence. Such due diligence will lowing 26 June 2019 if no

nancing (2017. évi LIII. törvény include customer identification and verification procedures, including the identification and verification of the customer’s agent, proxy or other authorized representative. information is available.

a pénzmosás és a terrorizmus In the framework of the customer due diligence, customers are required to provide information regarding their UBOs as well. The collected and recorded data on the

finanszírozása megelőzéséről UBOs of customers (legal persons, unincorporated organizations and fiduciary managers) will then be forwarded to the central register by the service provider (details of

és megakadályozásáról). which are to be regulated in a separate Act that has yet to be adopted), provided such data is not already recorded in the central register.

Your contact:

Helen Rodwell

Managing Partner

T +420 296 798 818

E helen.rodwell@

cms-cmno.com

10Overview of the implementation of a Transparency Register

Italy What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Legislative Decree 90 /2017 Yes. Yes. The legal entity. Pursuant to article 21 of the No deadline yet for legal enti- Failure to provide the informa- The respective legal entity has

Italian decree, the following le- ties to provide the information tion pursuant to the Italian to communicate and register

Shareholders of a legal entity Pursuant to article 22 of the gal entities have an obligation regarding their beneficial own- decree is punished with a fine its beneficial owners with the

are requested to provide the Italian decree, each legal enti- to notify: ers to the respective database. between EUR 103.00 up to Italian Registry of Companies.

relevant information on the ty is responsible for identify- The specific national decree EUR 1,032.00. The information is registered in

beneficial owner proactively or ing its beneficial owners. 1) Undertakings having legal con cerning modalities and a specific section of the Regis-

upon specific request of any personality which are re- terms of communication to try of Companies and the filing

director of the company (un- quired to be recorded in the competent Registry of may only be made electroni-

less such information is availa- the Registry of Companies; Companies has still to be is- cally.

ble from certain public records 2) Private legal entities which sued by the Ministry of Econ-

or from company’s records). are required to be recorded omy and Finance and Ministry

in the Registry of Private of Economic Development.

UBOs only have to provide Legal Entities;

information upon request. 3) Trusts that produce legal

effects that are relevant

for tax purposes.

Entities other than the ones

listed above are not obliged

to file with the register.

Your contact:

Pietro Cavasola

Managing Partner

T +39 06 478151

E pietro.cavasola@

cms-aacs.com

11Overview of the implementation of a Transparency Register

Luxembourg What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

There is a bill of law number At this stage, and according to At this stage and according to At this stage and according to According to the Bill of Law, At this stage, and according to Criminal fines of between At this stage, and according to

7217 (the Bill of Law) which the Bill of Law, no. the Bill of Law, legal entities the Bill of Law, the legal entity no filing is required for com- the Bill of Law, legal entities EUR 1,250 and EUR 1,250,000 the Bill of Law, it is proposed

will implement article 30 of have to obtain and keep re- has to request the filing of the panies whose shares are ad- will have a six-month period as (art. 23 et seq.). to establish a register of bene-

the Directive into the Luxem- cord of the information regar information in the register con mitted to trading on a regu- from the entry into force of ficial owners called “REBECO”

bourg legal framework. ding their beneficial owner(s), cerning their beneficial owners lated market in the Grand the law to comply with the which will be managed by the

to be accurate and kept duly together with their related Duchy of Luxembourg or in provisions of the law (art. 27). economic interest group RCSL

The Bill of Law will put in place up-to-date (art. 20 of the Bill amendments (art. 4 of the Bill another State party to the and established under the au-

in Luxembourg a register to of Law). of Law). Agreement on the European thority of the Ministry of Jus-

hold and provide information Economic Area or in another tice.

on beneficial owners of Lux- foreign country imposing ob-

embourg entities. ligations recognized as equiv-

alent by the European Com-

mission within the meaning of

Directive 2004 / 109 / EC of the

European Parliament and of

the Council of 15 December

2004 on the harmonization of

transparency requirements

concerning information on

issuers whose securities are

admitted to trading on a reg-

Your contact: ulated market and amending

Directive 2001 / 34 / EC (art.

Rémi Czauderna 1.4).

Business Developer

T +352 26 27 53 40

E remi.czauderna@

cms-dblux.com

12Overview of the implementation of a Transparency Register

Netherlands What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

At present, there is only a draft According to the draft law, According to the draft law, The legal entity. According to the draft law, Unknown at this stage. Pursuant to the Trade Register According to the draft law:

law to implement the Direc- yes. yes. exemptions are available for: Act 2007 (Handelsregisterwet

tive by amending: 2007), acting in violation of or — information on UBOs is to

— foreign legal entities with not complying with the obli- be registered with the tra

— the Trade Register Act headquarters or a branch gation pursuant to this law to de register of the Dutch

2007 (Handelsregisterwet in the Netherlands; make a registration in the Chamber of Commerce;

2007); — associations for owners of Dutch Trade Register is pro- — filing can be done either

— the Money Laundering and apartments; hibited. This prohibition also electronically on the web-

Terrorist Financing Preven — legal entities governed by relates to the registration of site of the Dutch Chamber

tion Act (Wet ter voorkom- public law, i.e. governmen- UBO information. Acting in of Commerce or in paper

ing van witwassen en fi- tal organizations; violation of this prohibition is form.

nanciering van terrorisme); — church organisations. an economic offence within

— the Economic Offences Act the meaning of the Economic

(Wet op de econmische Offences Act (Wet op de

delicten). econmische delicten), punish-

able by detention of up to six

months, community service or

a fine of the fourth category

(in 2018 being EUR 20,500).

Your contact:

Martijn van der Bie

Partner

T +31 20 3016 453

E martijn.vanderbie@

cms-dsb.com

13Overview of the implementation of a Transparency Register

Poland What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

On 1 March 2018 the lower No. Yes. The legal entity Yes. Legal entities registered in the Sanctions include: The draft law proposes the

house of the Polish Parliament National Court Register (“Kra- establishment of a Central

passed the Act on Counter- UBOs have to provide informa- The legal entity will have to Public joint stock companies jowy Rejestr Sądowy”) before — publication of information Register of Beneficial Owners

acting Money Laundering and tion only upon request. take all available and legitimate („spółka publiczna“) will not the entrance into force of the about the obligated insti- (Centralny Rejestr Beneficjen-

Terrorism Financing (the “Pol- activities within its scope of be obliged to file with the Act will be required to file to tution and the scope of tów Rzeczywistych).

ish Act”) which was signed activity in order to identify the Register. the register the information violation;

by the Polish President on 28 UBO and verify its identity. regarding their UBOs within — ordering cessation of spe-

March 2018. 6 months. cific activities;

— removal of regulated ac-

The Polish Act will come into tivity from the register;

force within three months — ban on performance of

from the date of its publication managerial functions for

in the Official Gazette (a date the person responsible for

yet to be determined). How- the violation of the provi-

ever, the provisions regarding sions of the Polish Act;

the establishment of a Central and

Registry of Beneficial Owners — fines of up to EUR

(Centralny Rejestr Beneficjen- 4,970,000 for a natural

tów Rzeczywistych) will enter person or, in the case of an

into force within 18 months entity / organisational unit,

from the date of its publication fines of up to EUR

Your contact: in the Official Gazette. 5,000,000 or 10% of

turnover of the preceding

Helen Rodwell financial year.

Managing Partner

T +420 296 798 818

E helen.rodwell@

cms-cmno.com

14Overview of the implementation of a Transparency Register

Portugal What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to

make filings with

Are there exemptions to the fil-

ing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- the Transparency Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- Register, the legal existing register?

gal entity? ty of the UBO(s)? entity or the UBO?

Law no. 89/2017, of 21 August Yes. No. The legal entity. The following entities are not covered The initial filing by already ex- In addition to administrative As a separate register / data-

2017, implements Chapter III – by the scope of the filing obligation: isting entities will have to be fines, a legal entity that does base named Registo Central

Beneficial Ownership Informa- Shareholders of a legal entity Legal entities must file and made within the deadline to not comply with its transpar- de Beneficiário Efetivo (RCBE),

tion of Directive 2015/849 EU are bound to provide the rel- keep up-to-date the relevant — diplomatic and consular missions, be established by regulation of ency obligations is not allowed which will be managed by the

into Portuguese Law and arti- evant information on the ben- information on the UBO with as well as international entities of the Ministry of Finance and to: (i) distribute dividends; (ii) Public Institute of Registries

cle 34 of the Law 83/2017, of eficial owner, and, if applica- the RCBE, to confirm the in- a public nature recognized by the Ministry of Justice, still to be enter into certain agreements and Notarial Services (Instituto

18 August 2017 on anti-mon- ble, on its respective Portu- formation on the UBO in the international agreement of which approved. with the Portuguese State and dos Registos e do Notariado).

ey laundering and anti-terror- guese tax representative to the annual declaration, to keep an the Portuguese State is a party, other public entities and any

ist financing measures, appro entities and communicate any internal register of the UBO set or with host agreement in In case of a legal entity incor- of such agreements that have

ving the Beneficial Ownership change occurred to the rele- and shareholders of the legal Portugal; porated after the entry into already been entered into shall

Central Registry (Registo Cen vant information provided. If entities are obliged to provide — services and entities part of the force of the Law, the incorpo- not be renewed; (iii) bid for

tral de Beneficiário Efetivo) shareholders fail to provide the the UBO information to the State administration’s local, re- ration deed must already pro- the tender of public services;

(“RCBE” and the regulation information on the UBO to entity. Notwithstanding legal gional and central subsectors; vide information on the ben- (iv) trade financial instruments

“RCBE Regime”). the legal entity, the legal entity entities not being expressly — independent administrative en- eficial owner and the initial in a regulated market; (v)

is allowed to require the share- obliged to actively inquire on tities; filing shall occur with the filing launch public offers of distri-

Some aspects of the RCBE Re- holder to provide the relevant the identity of the UBO, legal — the Bank of Portugal and the Reg- for registration of the incor- bution of any financial instru-

gime are still subject to further information. If the sharehold- entities that fail to comply with ulatory Authority for the Media; poration deed with the Com- ment issued by such entity; (vi)

regulation, to be adopted in er fails, without justification, their obligations regarding the — companies with shares admitted mercial Registry Office or with enter into any transaction re-

the form of joint regulations of to provide the information re- UBO subject themselves to to trading in a regulated market, the first register with the Cen- garding the transfer of the

the Ministry of Finance and quired by the legal entity, the sanctions. subject to the information disclo- tral File of Legal Entities (Fichei- ownership of, incorporation,

Ministry of Justice. same is allowed to amortize sure requirements in accordance ro Central de Pessoas Coleti- acquisition or disposal of any

the shareholding(s) held by These rules apply to commer- with the European Union law or vas) in case of entities not usufruct rights or any security

the non-compliant sharehold- cial companies as well as to equivalent international rules; subject to registration with the interests over any real estate

er. the remaining entities subject — consortiums and complementary Commercial Registry Office. assets.

to the RCBE Regime with the group of companies;

These rules apply to commer- “required adjustments”. — condominiums, with regard to As mentioned, a shareholder

Your contact: cial companies as well as to buildings or group of buildings, that fails, without justification,

the remaining entities subject It is still pending further regu- constituted under horizontal to provide the information on

Francisco Xavier de Almeida to the RCBE Regime with the lation on the form of declara- property, provided that certain the UBO required by the legal

Partner “required adjustments”. tion regarding the beneficial requirements are met. entity, may face a procedure

T +351 210 958 100 owner, to be adopted by joint for amortization of its share

E francisco.almeida@ regulation of the Ministry of holding(s).

cms-rpa.com Finance and Ministry of Jus-

tice.

15Overview of the implementation of a Transparency Register

Romania What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

At present, there is a draft law Based on the provisions of the draft law, the obligation to provide the information on UBO rests on Yes. Within 12 months as of the With respect to legal entities For non-governmental organ-

to implement the Directive by the legal entity, whose legal representative submits to the relevant authority a statement incorporating date of entry into force of the required to be registered with isations and foundations, the

the Act on the prevention and identification information regarding the UBO. This statement must be filed at the incorporation, State-owned companies are draft law. the Trade Registry, in case of registry will be kept by the

combating money laundering annually, or any time there is a change in the respective statement. exempt from submitting in- breach of transparency obliga- Ministry of Justice.

and terrorism financing. formation on UBO. All legal entities incorporated tions, the director of the legal

For legal entities that are required to be registered with the Trade Registry, the annual statement must after the date of entry into entity is subject to a fine rang- For legal entities required to

be filed within 15 days after the annual financial statements are approved, and any changes must be force of the draft law will pro- ing from EUR 1,100 to EUR be registered with the Trade

filed within 15 days after the date such change has occurred. vide this statement along with 2,200. Registry, the registry will be

the incorporation documen- kept by the National Trade Re

For non-governmental organizations and foundations, the annual statement must be submitted with tation. Subsequently, if the statement gistry Office.

the Ministry of Justice by January 15 of each year, and any changes must be filed within 15 days after incorporating information re-

such change has occurred. garding the UBO is not sub- For trusts (fiducie), the registry

mitted within 30 days of the will kept by the National Fiscal

For trusts (fiducie), the information on the UBO must be provided when such trust is created. director being fined, the Na- Administration Agency (which

tional Trade Registry Office will become operational within

may seek in court the disso- 120 days of the effective date

lution of the legal entity. of the draft law).

Your contact:

Helen Rodwell

Managing Partner

T +420 296 798 818

E helen.rodwell@

cms-cmno.com

16Overview of the implementation of a Transparency Register

Slovakia What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Act No. 52/2018 Coll. imple- No. Yes. The legal entity Yes. This obligation will be manda- The department of financial The Transparency Register will

ments the Directive and tory for companies as of 1 police of the police force may be a part of the already exist-

amends the Act No. 297 / There is no obligation of the Each legal entity (except public If the information on the UBO As of 1 November 2018, when November 2018. Companies impose a penalty of up to ing Commercial Register. How-

2008 Coll. on protection UBO(s) to proactively provide administration bodies) is obli has not already been filed the second part of the Act No. established before 31 October EUR 200,000. A further pen- ever, all relevant data provided

against the legalization of the legal entity with any infor- ged to verify the identity of with the Slovak Register of 52 / 2018 enters into force, 2018 are obliged to make ini- alty of up to EUR 3,310 can be to the Commercial Register will

criminal proceeds and protec- mation. UBO(s) and keep this informa Public Sector Partners, then it there will be exemptions for: tial filings by 31 December imposed for breaching the be transferred (copied) to the

tion against terrorist financ- tion up-to-date, unless such shall be filed with the appro- public entities (i.e. governmen- 2019. statutory deadline or including Register of Legal Persons main-

ing. This, together with the information is already available priate “source registers” (Com tal organisations); and issuers false information about the tained by the Statistical Office

Act No. 315/2006 Coll. on in the Slovak Register of Public mercial Register, Register of of securities admitted to trad- UBO. of the Slovak Republic.

Register of Public Sector Part- Sector Partners. non-profit organizations etc.) ing on a regulated market.

ners, Act No. 272 / 2015 Coll. for which the Ministry of Inte-

on Register of legal entities, rior of the Slovak Republic and

entrepreneurs and public au- Ministry of Justice of the Slo-

thorities and Act No. 530 / vak Republic are responsible.

2003 Coll. on Commercial re Information from these reg-

gister, creates the legal basis isters will be shared with the

for the Transparency Register. Register of legal entities, entre-

preneurs and public authori-

ties (“RPO”). The administrator

of the RPO is the Statistical

Office of the Slovak Republic.

Your contact:

Helen Rodwell

Managing Partner

T +420 296 798 818

E helen.rodwell@

cms-cmno.com

17Overview of the implementation of a Transparency Register

Slovenia What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

The “Prevention of Money No. Yes. The legal entity. According to Article 44 of the 19 January 2018 A fine of between EUR 6,000 The Slovenian Act provides

Laundering and Terrorist Fi- Slovenian Act, independent in- and EUR 60,000 may be im- that the register will be main-

nancing Act” (Zakon o pre- There are no such obligations dividual entrepreneurs, indivi posed on a legal entity if it, tained and managed by the

prečevanju pranja denarja in of beneficial owners. duals who independently con inter alia, fails to acquire or if it Agency of the Republic of Slo-

financiranja terorizma) imple duct an activity, limited liability acquires false information re- venia for Public Legal Records

ments the Directive into Slo- companies with a sole share- garding its beneficial owner or and Related Services (AJPES)

venian law. holder and direct and indirect owners or if it fails to establish and the filing will be done

users of the state budget and and manage a detailed record through a web portal of the

This Act entered into force on legal entities who are compa of the information regarding registry administrator.

19 November 2016. nies on a regulated market, its beneficial owners or if it

where in accordance with the fails to update it with every Based on the draft Rules on

EU law or comparable interna change or if it does not retain establishing, maintenance and

tional standards, and have to the information regarding its keeping the Register of bene-

comply with disclosure require- beneficial owners for five years ficial owners, the filing will be

ments that ensure pro per from the date of termination done electronically and will not

transparency of information of the status of beneficial include any charges.

on ownership are not obliged owner.

to file with the register.

Your contact:

Peter Huber

Managing Partner

T +43 1 40443 1650

E peter.huber@cms-rrh.com

18Overview of the implementation of a Transparency Register

Spain What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

According to the Spanish government, the Directive has already been implemented into national law. In December 2017, the European Commission opened an infringement procedure against the Spanish government for failing to fully implement the Directive into national

law. Accordingly, the implementation of the Directive is currently in progress and only a preliminary draft law (“Ante Proyecto de Ley”) with regard to such implementation exists. Such draft law shall be approved shortly in accordance with the Spanish legislation proceedings.

Your contact:

Carlos Peña

Partner

T +34 91 451 92 90

E carlos.pena@cms-asl.com

19Overview of the implementation of a Transparency Register

Switzerland What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the identi- tity or the UBO? existing register?

gal entity? ty of the UBO(s)?

Switzerland is not a member There is a notification obliga- The legal entity itself or its There is no Transparency Re There is no Transparency Re There is no Transparency Re If a shareholder fails to comply There is no Transparency Regis

of the EU. Therefore the Direc- tion applicable to sharehold- directors, respectively, are re- gister and, accordingly, no fil- gister and, accordingly, no fil- gister and, accordingly, there with the obligation to notify ter. The register of UBO’s has

tive is not (directly) applicable. ers upon acquisition of shares sponsible for (i) maintaining a ing obligations with such re ing obligations with such re are no filing obligations with the legal entity of the UBO, to be maintained by each legal

in stock corporations or lim- register of UBOs and (ii) ensur- gister. gister. such register. such shareholder’s (i) partici- entity either as part of the

The following legislation deals ited liability companies, sub- ing that no shareholder exer- pation rights (in particular vo (existing) shareholder register

with the subject matter of the ject to certain thresholds and cises its shareholder’s rights However, each legal entity is The shareholder’s notification However, the notification by ting rights) are suspended and or as a separate register.

Directive: (i) The Federal Act on exceptions. while violating such notifica- required to maintain a register obligation (based on which the the shareholders must be sub (ii) only such monetary rights

Combating Money Launder- tion obligations. of UBOs based on respective register of UBOs is maintained) mitted to the legal entity with- (in particular the right to div-

ing and Terrorist Financing notifications by the sharehol is not applicable concerning an in one month from the respec- idends) originating after fulfil-

(AMLA) and (ii) certain amend- ders. acquisition of shares: tive acquisition. ment of the obligation may be

ments of various federal acts, asserted.

including the Swiss Code of — by virtue of which the

Obligations, with a view to the threshold of 25% of the On 17 January 2018, the Swiss

revised FATF Recommenda- legal entity’s capital or vot- Federal Council launched the

tions 2012. ing rights is not reached consultation (Vernehmlassung)

by the acquirer; on, inter alia, a tightening of

— in a legal entity which is the transparency obligations

(partially) listed on a stock under Swiss corporate law by

exchange or, pursuant to introducing, in addition to the

part of the doctrine, if the above-mentioned sanctions,

acquirer or any of the ac- criminal sanctions for breaches

quirer’s beneficial owners of both (i) the shareholders’

is listed on a stock exchan notification obligation and (ii)

ge; or the legal entities’ obligation to

— which are organised as maintain a register of UBOs. It

intermediated securities in is expected that the proposed

accordance with the Inter- legislation will be deliberated

Your contact: mediated Securities Act of in the Swiss Parliament in win-

3 October 2008; the legal ter 2018 / 2019.

Dr Daniel Jenny, LL. M. entity designates the cus-

Partner todian where the shares

T +41 44 285 11 11 are held or recorded in the

E daniel.jenny@cms-vep.com main register (custodian

must be in Switzerland).

20Overview of the implementation of a Transparency Register

UK What is the legal basis of

the Transparency Register

Is there an obligation of a

UBO or shareholder to pro-

Is there an obligation of a

legal entity to actively in-

Who is required to make

filings with the Transpar-

Are there exemptions to

the filing obligation?

What is the due date for

the initial filing with the

What are the sanctions in

case of a breach of the

Is the Transparency Regis-

ter established as a sepa-

in the respective Member actively provide informa- quire with its sharehold- ency Register, the legal en- Transparency Register? transparency obligation? rate register or part of an

State? tion on the UBO to the le- ers / partners on the iden- tity or the UBO? existing register?

gal entity? tity of the UBO(s)?

The relevant provisions are im- Yes. Yes. The legal entity, which must UK companies whose shares Legal entities must enter the There is a range of sanctions The legal entity keeps the re-

plemented in the UK through keep its register up to date and are listed on a regulated mar- details of each UBO or other for non-compliance with the gister and must make regular

the Persons with Significant Upon the receipt of an investi- Each legal entity itself must make various filings at Com- ket in an EEA state (including registrable person in its inter- Act, including restrictions on filings reflecting the contents

Control (“PSC”) regime. The gation notice, the recipient has take reasonable steps to iden- panies House. the UK Main Market (the Of- nal register within 14 days of the relevant shares / partner- of the register with Companies

PSC regime is set out in Part one month to provide the UK tify any UBOs or others that ficial List) of the London Stock the details being confirmed or ship interests, so that all vot- House.

21A and Schedule 1A and 1B legal entity with the informa- are registrable. In particular, it Exchange, but not including ascertained. Within 14 days of ing, dividend and other share /

of the Companies Act 2006, tion requested. must send out an investigation the AIM Market) or on certain doing so, the legal entities partnership interest rights

which were inserted by the notice to anyone whom it markets in Israel, Japan, Swit- must also provide the details would be suspended and no

Small Business, Enterprise and Even if not served with an in- knows or has reasonable cause zerland and the USA that are to Companies House. transfers would be permissi-

Employment Act 2015 and vestigation notice, a person to believe to be registrable, re- specified in Schedule 1 to The ble without a court order.

were subsequently amended who thinks they should be re- quiring them to state whether Register of People with Signifi-

by the Information about Peo- corded in a UK legal entity’s they are registrable and to cant Control Regulations 2016

ple with Significant Control register has an obligation to supply or confirm particulars. are not required to maintain a

(Amendment) Regulations 2017 proactively notify the UK legal The legal entity must also keep register, but they are still

and the Scottish Partnerships entity. Among others, this in the register up to date, send- obliged to notify a UK legal

(Register of People with Sig- cludes individuals or corpora- ing out investigation notices if entity if they think that they

nificant Control) Regulations tions that are registered hol it has reasonable cause to be- should be recorded in the

2017. ders of more than 25% of the lieve that a change has oc- entity’s register.

shares in the legal entity, but curred.

in some circumstances the re

gistrable persons will instead

be individuals or corporations

that directly or indirectly con-

Your contact: trol such registered holders.

The person recorded on the

Martin Mendelssohn register must also notify the le-

Partner gal entity of any changes in

T +44 20 7367 2872 the person’s details or if the

E martin.mendelssohn@ person ceases to be registra-

cms-cmck.com ble.

21Your free online legal information service. Your expert legal publications online.

A subscription service for legal articles In-depth international legal research

on a variety of topics delivered by email. and insights that can be personalised.

cms-lawnow.com eguides.cmslegal.com

CMS Legal Services EEIG (CMS EEIG) is a European Economic Interest Grouping that coordinates an

organisation of independent law firms. CMS EEIG provides no client services. Such services are solely

provided by CMS EEIG’s member firms in their respective jurisdictions. CMS EEIG and each of its

member firms are separate and legally distinct entities, and no such entity has any authority to bind

any other. CMS EEIG and each member firm are liable only for their own acts or omissions and not

those of each other. The brand name “CMS” and the term “firm” are used to refer to some or all

of the member firms or their offices.

CMS locations:

Aberdeen, Algiers, Amsterdam, Antwerp, Barcelona, Beijing, Belgrade, Berlin, Bogotá, Bratislava,

Bristol, Brussels, Bucharest, Budapest, Casablanca, Cologne, Dubai, Duesseldorf, Edinburgh, Frankfurt,

© CMS Legal Services EEIG

Funchal, Geneva, Glasgow, Hamburg, Hong Kong, Istanbul, Kyiv, Leipzig, Lima, Lisbon, Ljublijana,

London, Luanda, Luxembourg, Lyon, Madrid, Manchester, Mexico City, Milan, Monaco, Moscow,

Munich, Muscat, Paris, Podgorica, Poznan, Prague, Reading, Rio de Janeiro, Riyadh, Rome, Santiago

de Chile, Sarajevo, Seville, Shanghai, Sheffield, Singapore, Skopje, Sofia, Strasbourg, Stuttgart,

Tehran, Tirana, Utrecht, Vienna, Warsaw, Zagreb and Zurich.

cms.lawYou can also read