The State of Competition in the Air Transport Industry: A Scoping Exercise - Gilberto M. Llanto and Ma. Cherry Lyn Rodolfo

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

PCC Issues Paper

No. 01, Series of 2020

PAPER

ISSUES

The State of Competition in

the Air Transport Industry: A

Scoping Exercise

Gilberto M. Llanto and Ma. Cherry Lyn RodolfoThe State of Competition in the Air Transport Industry: A Scoping Exercise

The State of Competition in the Air Transport Industry: A Scoping Exercise I. INTRODUCTION policies which relate to (i) the opening up

Gilberto M. Llanto and Ma. Cherry Lyn Rodolfo1 of regional airports to international flights,

This study reviews the state of competition (ii) reciprocity as to whether it hinders

in the domestic air transport industry, penetration of regional airports by foreign

Published by: specifically focusing on the airline carriers; and (iii) the overall air transport

passenger business. In reviewing the policy objective of the government, will

Philippine Competition Commission business and economic landscape of remain unaddressed. Despite this limitation,

25/F Vertis North Corporate Center 1 the industry, it considers factors such as the report tries to provide a substantial

North Avenue, Quezon City 1105 the market structure of the domestic air analysis of the present situation of the

transport industry, the economic incentives2 industry and the competition-related

that motivate the airline companies to issues faced by the industry, the public and

behave in a certain way, and the regulations3 government.

affecting the industry. The study turns to

Williamson’s (1975) idea that organizations After a brief introduction, Section 2 presents

review organizational costs and configures an overview of the air transport industry

a governance structure that minimizes costs and uses an aviation services market value

and maximizes revenues subject to the chain as a neat frame for understanding how

constraints of extant policy and regulatory several entities collaborate and coordinate

PCC Issues Papers aim to examine the structure, conduct, and performance of framework. Because the airline transport in producing the air transport services

select industries to better inform and guide PCC’s advocacy and enforcement industry is a complex mix of a competitive consumed by the buyer (passenger/cargo

initiatives. The opinions, findings, conclusions, and recommendations expressed and regulated industry, it is important to owner/shipper). A complete understanding

in these studies are those of the author(s) and do not necessarily reflect the views determine how government regulations of competition and competition-related

of the Commission. This work is protected by copyright and should be cited affect the level of competition in the industry issues in the air transport industry requires

accordingly. (Gowrisankaran, 2002). a study of the various components of

the value chain. In this study, two such

This study is a scoping exercise. It provides components, namely, airlines (main service

broad strokes of the current situation in provider) and the airports (a critical fixed

The views reflected in this paper shall not in any way restrict or confine the ability the industry, including an assessment of asset in the production process) are

of the PCC to carry out its duties and functions, as set out in the Philippine the role of airports, more specifically the considered. Section 3 summarizes the

Competition Act. PCC reserves the right, when examining any alleged anti- Ninoy Aquino International Airport (NAIA), performance of the air transport industry

competitive activity that may come to its attention, to carry out its own market in air transport service delivery; identifies after initial liberalization and deregulation

potential anticompetition issues; and efforts in the industry as gleaned from

definition exercise and/or competition assessment, in a manner which may deviate submits some recommendations for further available literature. Section 4 discusses

or differ from the views expressed in this paper. detailed study. policy and regulations in the air transport

industry and an initial review of air services

At the outset, it is important to note the agreement entered into by the country in

importance of getting cooperation from order to identify potential barriers to a more

concerned government agencies and the competitive air transport market. Section

industry players in the conduct of this study. 5 discusses the present situation in the

The report does not have any information on air transport industry. Section 6 discusses

the operations of Clark International Airport. the important role of airports in the air

At this point, it will be difficult to give a transport market with a focus on physical

meaningful answer to the question to what infrastructure and slot allocation. The

extent does Clark impose a competitive final section summarizes our findings and

constraint on NAIA? We were also unable to provides some recommendations.

meet with the Department of Transportation

and the Civil Aviation Authority of the

Philippines (CAAP) to discuss air transport

policy, regulation and planning. Thus, the

1 The authors gratefully acknowledge the inputs of Irish Almeida in the section on policy and regulatory framework, the assistance of Ma.

suggestion to include an assessment on the

Kristina Ortiz with data and preparation of charts/figures, and of Paolo Tejano and Cara Latinazo, both of the Philippine Competition

Commission in arranging and participating in meetings with various industry stakeholders. The authors would like to thank participants for 2 Defined as whatever motivates behavior in a certain way in contrast to preferences, that is ‘wants’, ‘needs’. https://study.com/academy/lesson/

their comments and suggestions on the initial draft of the paper during a presentation at the Philippine Competition Commission on August economic-incentives-definition-examples-quiz.html (accessed January 6, 2018).

1, 2018. Likewise, we acknowledge the invaluable inputs provided by individuals whom we interviewed in preparing this paper. 3 The Civil Aeronautics Board (CAB) is tasked with economic regulation while the Civil Aviation Authority of the Philippines (CAAP) is charged

queries@phcc.gov.ph | www.facebook.com/CompetitionPH | www.twitter.com/CompetitionPH | www.phcc.gov.ph with regulation of technical and safety aspects of the industry.

1The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise

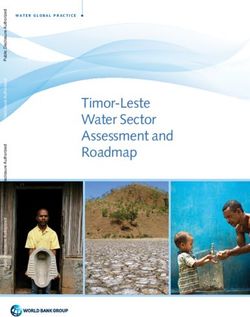

II. THE IMPORTANCE OF THE AIR Figure 2.1 Aviation services market value chain

TRANSPORT INDUSTRY Box 1. The economic impacts of the

Philippine air transport industry

The air transport industry provides the

In 2017, the Philippine air transport industry directly

country with vital connectivity within the generated Php 32.7 billion of gross value added

major islands of the archipelago and to (GVA) in real terms, equivalent to 12.4% of the GVA

the outside world. A well-functioning air of the transportation and storage sector, and 0.21%

of GDP. Among the transportation industries, air

transport industry correlates positively with transport ranked second to land transport in terms

a high level of growth (Perovic, 2013) and of GVA contribution. IATA (2016) reported that the

impacts the economy through growth in air transport’s share to Philippine GDP in 2014 was

roughly 3.5% due to its direct, indirect, induced and

tourism, trade, investments, employment, catalytic effects. The Philippine air transport industry

and productivity (Rodolfo, 2017). The supported 1.4 million jobs including 69,800 direct air

major purchasers of air transportation jobs and 1.2 million jobs from the wider economic

benefits- tourism, productivity and trade. By 2035, the

services are high value industries, indicating industry is expected to generate 3.4 million jobs and

the air transport industry’s important contribute US$ 23 billion to Philippine GDP.

linkage to other sectors of the economy.

Air transport is a vital support to the tourism industry.

Based on the Input-Output Tables of the In 2017, the Philippine Statistics Authority, drawing

Philippines, the wholesale and retail trade from the Philippine Tourism Satellite Accounts,

industry is the largest purchaser of air reported that the industry contributed Php 1.93 trillion

to the Philippine economy, equivalent to 12.2% of

transportation services with 21.5 percent of GDP. The employment in tourism accounted for 13.1%

all industry spending on aviation services. of national employment. Air transport moved 99%

Telecommunications spending for aviation of the 6.6 million international tourists who spent

Php 448.6 billion during their stay in the country.

services was at 8.3 percent of all industry Adding airline receipts amounting to an estimated Source: Tretheway and Markhvida (2014)

spending on aviation services (InterVistas, Php 68.6 billion, international tourism ranked as the

2015).4 In 2014, Oxford Economics (2016) 4th largest export revenue earner of the Philippines, This study reviews the performance and time constraints. An in-depth look

next to electronics and semi-conductors, overseas

estimated foreign tourists spending in the remittances, and information technology and business

of airlines and airport infrastructure in at the air transport market for cargo (i.e.,

Philippines at US$4.7 billion; in addition, the process management. While the share to total trade service delivery. It does not include other freight forwarders, cargo integrators, and

Philippines exported US$82.2 billion worth volume is a meager 0.5%, air transport moved at components of the value chain, such as consolidators) may be undertaken by the

least 52.5% of the dollar value of merchandise

of goods and services. Box 1 summarizes trade shipments in 2017. Air transport supported

providers of insurance, ground services, PCC in the future. Similarly, an assessment

an estimate of the economic impacts of the the mobility of overseas Filipino workers and their catering, aircraft maintenance services. The of the role of computer reservation systems

Philippine air transport industry. families, who contributed around US$ 28 billion to the airlines included in this study are Philippine (CRS), travel agents, integrators, and tour

economy in 2017.

Airlines, Cebu Pacific, and Air Asia. Minor operators in the domestic air transport

The aviation services value chain shown in In terms of multiplier effects, based on the 2006 airlines are mentioned in passing. The industry may be considered.

Figure 2.1 provides a neat starting point for Input-Output Tables of the Philippine Statistics study includes a discussion of operations

Authority, every peso increase in the final demand by

understanding the air transport industry. consumers, government or shippers for air transport

at the NAIA in Pasay City, Metro Manila. The There could be a need for a future study

The end-product is the service delivered as services translates to an additional Php 2.49 to the learning derived from the case study of the of the other components or units of the

transport of passengers and/or cargo from Philippine economy. operation of airlines in NAIA could be used air services market value chain to get a

designated points of origin to their points Source: Rodolfo (2017) as updated by the authors

as a take off point for future in-depth studies complete understanding of competition

of destination. The passengers or cargo of airline and airport operation in other parts issues in the air transport industry. Certain

shippers/forwarders/owners are the buyers intricate exploitation of connectedness of of the country, specifically Cebu and Davao practices in the air transport industry could

(customers) of the product. The airlines marketing and sales (e.g., computer/central international airports, or such airports to be give rise to competition issues. We only

are the major service delivery units in the reservations systems, travel agents), inbound identified by the Philippine Competition describe in passing some of these practices

value chain and to efficiently accomplish and outbound logistics (e.g., aircraft Commission (PCC). because they are outside the scope of this

the service delivery task various other units manufacturers, air carriers), supporting study but certainly they are important areas

in the chain such as airport infrastructure operations (e.g., ground handlers, airport Figure 2.1 also shows that airlines have to for future study.

and communications, should also efficiently infrastructure), and even financing in the collaborate with two types of distribution

perform their important roles in the chain. case of airlines entering into long-term systems, one for passengers and the other One of those practices is the code-sharing

leases of aircrafts, in order to deliver the for freight, in accomplishing their service arrangements among airlines that allow

The component units of the value chain product or service (air transport from points delivery task. Cargo services are important a flight operated by one carrier (known

have to coordinate and perform well of origin to points of destination).5 to the extent that they compete with as the “operating carrier” which will offer

to deliver the product. It involves an passenger flights for take-off and landing the flight for sale under its own code or

rights and gate use. Cargo services are designator and associated flight number) to

4 Source of basic data http://www.nscb.gov.ph/io/DataCharts.asp

5 Michael Porter’s value chain analysis considered inbound and outbound logistics, operations, marketing and sales, and service as primary

not included in the study for lack of data be marketed by another carrier (known as

activities of the value chain. See Porter (1985).

2 3The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise

the “marketing carrier”) under the operating airline within the same alliance may also a disinterested third party (namely, air several carriers reduced the number of

carrier’s code and flight number. Cleave constitute a considerable entry barrier. traffic control); (c) the presence of only two departures and seat capacity thus resulting

(2007) points out that these agreements Hanlon (1996) pointed out that more than major suppliers of the means of providing in cabin congestion. The liberalization

can lead to different outcomes depending half of respondents (travelers) in his survey the service; (d) the unique dominance of of international and regional routes also

on market conditions and the nature of the always or almost always considered building this form of transportation for long haul resulted in substantial reductions in airfare

code shares (i.e., parallel, unilateral, beyond FFP mileage in their choice of airlines. passenger traffic; (e) the interesting and as the number of competitors increased

or behind). While agreements among The FFPs build loyalty among customers complicated financial arrangements that are but with the side effect of reducing profits

partner airlines that have complementary in favor of incumbents who can also line used to provide the service; (f) the existence for most airlines. Citing various studies,

networks benefit consumers, they also those FFPs with additional perks. The FFPs of quasimonopolistic entities (airports) to Manuela (2011) reported that low-cost

have the potential to increase entry tend to affect competition by increasing jointly deliver the service; and (g) last, but carriers (LCCs) are the major beneficiaries

barriers in congested airports, resulting customer switching costs, thus, reducing by no means least, the international legal of deregulation and liberalization, and

to disadvantages to passengers. Thus, the chances of competitors to attract customers aspects of the industry. It is a complex by offering lower fares and keeping their

practice may favor collusive behaviors from airlines offering FFPs. Apart from and important transport industry and from costs at a minimum those LCCs flourished

among airlines by enabling the exchange strong loyalty effects, the loyalty programs the point of view of competition policy, at a time when their larger rivals have

of commercially sensitive information and may tend to reduce effective or potential its industrial organization gives rise to been in and out of Chapter 11 bankruptcy

engendering all the typical downsides competition if they have the so called tying competition issues. protection. He cited the findings of several

stemming from cooperation among effects,7 foreclosure effects,8 and strong studies indicating that: (i) competition

competitors (European Competition exclusivity effects9 (European Competition Studies on the performance of the air between full service airlines and LCCs

Authorities, 2006). Authorities, 2005). transport industry will invariably have resulted in price wars, driving weaker

as a useful reference the experience of airlines into bankruptcy, (ii) airlines used

Some code shares involve interlining The CRS also has the potential to direct the United States with deregulation and price discrimination to keep their market

arrangement,6 whereby an airline enters into passengers to the airline who owns or liberalization, which intensified competition share and increase revenues and profits;

an agreement with another airline to carry controls it. The CRS, which was a device in the industry. Manuela’s (2011) review of and (iii) price discrimination can increase the

passengers on behalf of another airline developed to save time and effort in literature described the US experience. His airlines’ profits by selling tickets at different

Austria (2001) made the point that this handling numerous flight reservations summary is as follows.10 The deregulation prices and restrictions, taking advantage of

type of arrangement becomes “particularly during the era of regulated airfares, has of the domestic airline industry in the the different price elasticities of demand of

important and strategic if an airline has been transformed into an instrument for US in 1978 was the forerunner of similar customers.

extensive domestic network or if one of the giving priority screen listing to incumbent policy shifts across the Atlantic and in other

points in the route is an international hub”. carriers’ flights or to whoever owns or developed economies. Deregulation, in In the US, Vasigh, Fleming, and Tacker

Typically, an incumbent airline, which has directs such CRS (Hanlon 1996, Warren et al, combination with competition, spurred (2008) observed some initial problems

first-mover advantage, would have had such 1999, Austria 2001). Hanlon (1996) observed growth in the airline industry and resulted with deregulation in 1979 but eventually

interlining arrangement done in the past. that 75 percent of flights made through a in lower fares, more efficient use of capital, the airline industry was able to recover and

Potential new entrants to the air transport CRS are made from the first screen page of higher productivity, more passengers, and posted profits in the late 1980s and again

market without such interlining or code- the CRS. It will be interesting to find out if more departures. One of the downsides of in the late 1990s. Airlines were forced to

sharing arrangement may face difficulty in the same phenomenon can be seen in the deregulation, however, is more crowded innovate and control costs in response to

attracting passengers who are ready to pay domestic air transport market. planes and congested airports because the competition. Some innovations were

for interline travel because of greater seat of the tremendous growth in passenger more effective revenue management,

availability and greater flight frequencies, III. COMPETITION AND REGULATORY traffic in the US between 1979 and 2002, FFPs, and recently e-ticketing, which

including greater amenities (e.g., travel ISSUES IDENTIFIED IN THE which outpaced the growth in capacity allows airlines to reduce ticket distribution

lounge available to business and first-class LITERATURE as new entrants and weaker airlines filed costs. Technological innovations that have

travelers) provided by airlines who have for bankruptcy or were acquired by their given rise to better and more fuel-efficient

a history of code-sharing or interlining The airline industry has many unique larger rivals. More crowded airplanes and jet engines helped with increasing the

arrangement. features. As listed by Vasigh, Fleming, congested airports tend to reduce the profitability of the airlines. The recovery

and Tacker (2008) they are as follows: airlines’ quality of service especially in high- of the global economy at that time also

Another feature of the air transport industry (a) perishable nature of the product and density markets. helped to put the industry in the black. Thus,

that may act as an entry barrier is the the consequent elasticity of demand and deregulation led to a lowering of airfares

frequent flyer programs (FFP) offered by pricing complications; (b) the control of Manuela (2011) referring to various studies with the consequent air traffic growth. The

incumbent carriers. The pooling of FFPs by the method of delivering the service by reported that the US deregulation benefited freedom of airlines to determine their routes

many passengers, but due to intense resulted in more flight frequencies and non-

6 Interlining agreements do not necessarily involve code-sharing.

7 If the tying is not objectively justified by the nature of the products or commercial usage, such practice may constitute an abuse of a competition a number of incumbents and stop flights.

dominant position. new entrants exited the air transport industry

8 A foreclosure effect arises from agreements, which are capable of affecting patterns of trade making it more difficult for undertakings to

penetrate a market. It may occur when suppliers impose exclusive purchasing obligation on buyers.

a few years after deregulation. The exit of

9 When most or all of the suppliers apply exclusive customer allocation, this may facilitate collusion, both at the suppliers’ and the distributors’ 10 Manuela’s review of literature cited various authors who did studies on the various aspects of the US experience with liberalization and

level. Hence, a competition risk of exclusive supply is the foreclosure of other buyers deregulation.

4 5The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise

Vasigh, Fleming, and Tacker (2008 of which was Cebu Pacific. Grand Air such restriction of passenger seats below years after liberalization. Austria (2001)

further noted that the recent air transport entered the domestic air transport industry competitive levels had resulted in efficiency also mentioned the short-lived operation

liberalization in Europe and India has led to in 1995 while Air Philippines, Asian Spirit, losses,16 which in turn had an adverse of Mindanao Express, an airline intended

a tremendous growth in air traffic in these and Cebu Pacific Air (Cebu Pac) entered impact on consumers. By 2009, Manuela to serve regional routes. Manuela (2011)

countries. On the other hand, in the US, the in 1996. Asian Spirit and Air Philippines (2011) indicated that PAL, CEB, Airphil, pointed out that in 1999 PAL pulled away

international routes have been deregulated changed their names to Zest Airways (Zest) Zest, and, SEAir competed for almost from low-density markets and concentrated

only gradually through negotiated bilateral in 2008 and Airphil Express (Airphil) in 2009, 14.7 million domestic passengers, up 198 on the most profitable routes to stay in

open-skies agreements. These agreements respectively. Grand Air exited the industry percent from its 1995 level, outpacing the competition. Both major airlines like PAL

enable airlines from two countries (bilateral in late 1998 while South East Asian Airlines growth in capacity or passenger seats, which and smaller airlines in the scheduled airline

partners) to fly between their respective (SEAir), a charter operator, entered the increased 176 percent in the same period. industry suffered substantial losses during

countries without restrictions. Nevertheless, scheduled airline industry in 2003, bringing The load factor then is higher in 2009 than in this period because of those external events

limited open-skies agreements do not the number of active airlines to five, namely 1995, a positive development in an industry (see Table 3.1). Thus, even major operators

necessarily create a fully competitive market PAL, Cebu Pac, Zest, Airphil, and SEAair. characterized by losses and bankruptcies. like PAL,which has a sizeable share of the

(Gowrisankaran, 2002) EO No. 219 relaxed market entry and Fare setting in markets with at least two market are not immune to downturns and

encouraged at least two airline operators in airline operators was deregulated under losses arising fromsuch external events.

In the Philippines, the year 1995 marked any route while exit from unprofitable routes EO No. 219 although fares in markets with a It can be recalled that European airlines

a critical turning point in the domestic air was given free course. single operator continued to be regulated. and the global travel industry suffered

transport industry (used interchangeably Manuela (2006) estimated that airfare per substantial losses during the height of the

here with “civil aviation industry”) with the At present, PAL, Cebu Pac, Airphil, and to kilometer is 10 percent lower, on average, Severe Acute Respiratory Syndrome (SARS)

issuance of Executive Order (EO) No. 219 some extent Air Asia (a new operator), serve after liberalization while more than 90 crisis.18

liberalizing the industry.11 This included the the major high-density markets while minor percent of domestic airline passengers

privatization of Philippine Airlines (PAL).12 routes were left to the small operators like in 2003 benefited from lower fares due Despite the erosion of PAL’s share of the

For more than 20 years before the issuance Zest, SEAir, and Skyjet. It is noted that PAL to discounts and promos that stimulated market in terms of passenger and cargo

of EO No. 219, the air transport industry Holdings own Airphil, which has a code- demand for air transport services.17 traffic, number of passenger seats, and

was a monopoly of PAL, a corporation fully share agreement with PAL. revenues, it has managed to retain a

owned and controlled by the government.13 The immediate results of liberalization, substantial share of the market. Austria’s

Letters of Instructions Nos. 151 and 151-A In 2014, SEAir, Inc. was acquired by Cebu therefore, were the entry of several (2001) computation of the Herfindahl-

issued in 1973 granted PAL a monopoly Pacific and was rebranded as “CebGo.” operators as well as the huge increase in Hirschman Index (HHI) for the industry, a

of the civil aviation industry. Although CebGo now operates an all ATR-fleet serving domestic passenger traffic in traditional measure of industry concentration, shows

Presidential Decree 1590 (issued in 1987) inter-island short routes. Cebu Pacific and major markets and the opening of new it is only the major routes that are fiercely

provided PAL with a franchise, which was its wholly-owned subsidiary CebGo now markets for airline services. An example of contested. She noted that the secondary

not considered as an exclusive privilege to comprise the Cebu Pacific Group (CEB), a relatively new market is Caticlan, which and tertiary or the minor routes were niche

PAL, it nevertheless operated as a virtual which is today the largest Philippine carrier has become an important gateway to the markets,which faced competition from the

monopoly from 1973 till the issuance of EO in terms of routes and frequencies operated world-famous Boracay island, a major tourist nascent high speed ferries that started to

No. 219 in 1995. Before liberalization and within the Philippines.15 destination. operate following the deregulation of the

deregulation under EO No. 219, the Civil inter-island shipping industry. The HHI is

Aeronautics Board determined which routes There was an increase in the number of It has been observed that the airline industry a measure of industry concentration; a

the PAL, a monopoly, will service, and at the passenger seats offered in major markets is vulnerable to economic fluctuations and value of 1 corresponds to a monopoly; 0.5

same time regulated air ticket prices.14 such as Manila-Iloilo, Manila-Cagayan de is inherently unstable (Gowrisankaran, 2002; corresponds to an industry with two equal-

Oro, and Manila-Bacolod. The expansion Manuela, 2011) with volatility in prices of sized firms, 0.33 to an industry with three

Liberalization and deregulation stimulated of passenger seats in the major markets, fuel and labor contributing to fluctuations equal-sized firms, etc. (Gowrisankaran,

the growth of the domestic civil aviation e.g., Manila-Bacolod market expanding in profitability. The Asian financial crisis and 2002).

industry. After the removal of restrictions on by as much as 42 percent between 1994 lately the global economic crisis, threats

routes, flight frequencies, and fare setting, and 1995 even without the presence of a of terrorism, and a general slowdown of Manuela’s (2011) computations

domestic airline passenger traffic grew with competitor, was interpreted as an indication economies have had adverse impacts on corroborated Austria’s earlier findings.

the entry of several competitor airlines in that PAL had been restricting output regional and global airline operations. Austria (2001) and Manuela (2007, 2011)

the civil aviation industry, the most notable prior to liberalization (in 1995) and that All these may have triggered the exit of indicated potential anti-competitive issues in

11 This section of the study draws from Austria (2001) and Manuela (2011). less capable operators. As earlier noted, the civil aviation market dominated by two

12 The first domestic airline was PAL, a government owned-and-controlled corporation, which served as the flagcarrier of the country. This was Grand Air exited the industry in 1998 three large domestic operators and a motley small

before the issuance of EO No. 219.

13 Inefficient management and financial woes eventually led to the privatization of PAL. It was dependent on government subsidies for its 16 Manuela, Wilfred “The evolution of the Philippine airline industry” https://aerlinesmagazine.files.wordpress.com/2013/01/36_manuela_

operations. Austria (2001) described the mismanagement of PAL and its inefficient air services as a clear waste of resources. evolution_philippine_airline_industry1.pdf (accessed January 25, 2018).

14 This was the same situation in the US before deregulation in 1979 when the US Civil Aeronautics Board controlled airline routes and pricing 17 Manuela, Wilfred (2006) “The Impact of Airline Liberalization on Fare: The Case of the Philippines” Journal of Business Research,

(Gowrisankaran, 2002). doi:10.1016/j.jbusres.2006.10.019 http://cba.upd.edu.ph/phd/docs/manuela_paper.pdf

15 Source: Cebu Pacific position paper on House Bill Nos. 5815 and 5817 submitted to the Committee on Legislative Franchises, House of 18 A BBC news report on June 13, 2003 states that “the SARS virus has had more effect on the global airline industry than the war with Iraq,

Representatives, August 10, 2017. according to a report from the flight schedule provider OAG”. http://news.bbc.co.uk/2/hi/business/2986612.stm (accessed June 23, 2018).

6 7The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise

Table 3.1 Philippine Scheduled Airline Industry Profits (In million PhP) Table 3.2 Philippine air transport industry post liberalization and deregulation

Year Industry PAL Grand Air CEB Airphil Zest SEAir Positive developments Negative developments

• Overall, growth of the air transport industry • Crowded planes

1995 -1,634.13 -1,716.91 82.78 • More air carriers, LCCs lower air fares opening of • Reduction in quality of service

1996 -2,105.60 -2,182.28 234.50 27.19 -185.40 0.39 new routes (e.g., Caticlan) • Congested airports

• More passengers • Bankruptcy of smaller airlines and their acquisition

1997 -2,035.71 -2,502.00 209.69 130.45 119.78 6.37 • More departures, boost to tourism by larger rivals

• Higher productivity and increased mobility of • Few operators reduction of service quality in high-

1998 -8,264.41 -8,581.00 -21.50 301.71 40.01 -3.63 economic agents density markets

1999 -10,648.39 -10,188.00 63.72 -562.85 38.74 • More efficient use of capital • Monopoly in low-density markets

• Investment in new fuel efficient aircraft

2000 -1,102.97 46.00 24.90 -1,234.27 60.40 Source: Authors’ review of literature

2001 -420.39 419.00 80.77 -941.70 21.54 and liberalized the industry. However, there Liberalization and deregulation of air

2002 -1,562.15 -1,008.00 25.17 -650.63 71.32 are also results unique to the Philippines. transport industry

2003 -193.08 372.00 12.40 -573.41 -6.47 2.40 There is a great deal of competition

among air carriers resulting in opening of EO No. 219 under President Fidel Ramos

2004 -489.62 -643.00 130.32 9.90 9.43 3.73

new routes and lower air fares but there removed barriers to entry by new players

2005 1,350.19 1,162.85 82.00 55.07 48.68 1.58 is also scope for anti-competitive issues in the Philippine domestic air transport

2006 1,127.20 1,245.93 196.79 -153.42 -165.62 3.53 in a market dominated by two dominant industry. In the domestic front, this enabled

2007 10,531.75 7,139.65 3,614.02 -164.09 -63.67 5.85 domestic operators. Curiously, government the entry of Grand Air in 1995 and later

policy or regulatory stance, for example, a Cebu Pacific, Air Philippines, and Asian

2008 -2,828.05 1,302.73 -3,259.89 -580.77 -200.92 -89.20

protectionist stance in ASA negotiations, Spirit. In the international air transport

2009 -11,513.75 -13,434.62 3257.85 -687.16 -619.67 -30.14

can result in an unintended consequence of market, the government has pursued

Source: Airlines’ annual reports as submitted to the Civil Aeronautics Board. strengthening potentially anti-competitive a policy of progressive liberalization of

group of minor operators. This study will necessarily coincide with that of the larger practice. the ASAs between the Philippines and

examine these findings and review whether public, that is, passengers, cargo shippers/ its bilateral partners. The EO removed

the current situation in the domestic civil forwarders/operators, tourism operators IV. POLICY AND REGULATORY the restrictions on domestic routes and

aviation industry still reflects these earlier and their ancillary enterprises, exporters FRAMEWORK frequencies together with government

findings. and others who would obviously prefer control of rates and charges. At present,

low cost transport and logistics. Austria Republic Act No. 776 (also known as the airlines employ a yield management

In 1999, the government started with a (2001) hypothesized that the absence of 1952 Civil Aeronautics Act of the Philippines, approach, which takes into consideration the

policy on progressive liberalization of the competition results to poor performance as amended by Presidential Decree No. cost structure of the company, routes, and

bilateral air services agreement entered and growth. She used as indicator the 1462) and Executive Order No. 217 govern traffic forecast, among others.19 According

into by the country with other countries. inability of PAL to use the entitlements, e.g., the technical and economic regulation of to CAB, there is total freedom to start or end

There is a need to examine the bilateral air capacity under the country’s air service the air transport industry. Two government a domestic route and there are also no seat

services agreement because of a disturbing agreements (ASAs) signed at that time. bodies regulate aviation, namely, the Civil limitations. The only limiting factor is the

finding made by Austria (2001) that during In 1996, PAL used only 61 percent of the Aeronautics Board (CAB) by virtue of RA airport infrastructure.20

negotiations of these agreements, the country’s traffic rights per week compared No. 776 and the Civil Aviation Authority of

government’s tendency was to keep to its to 81 percent by the foreign airlines flying the Philippines (CAAP) by virtue of Republic Fare setting is deregulated but CAB

old restrictive policies and practices while in the country. This represents missed Act No. 9497, also known as the CAAP Law. approval is still needed. The CAB conducts

other countries went for the elimination of opportunities for Philippine-based operators The CAB regulates the economic aspects of hearings to ask airlines to explain

constraints in flight frequency and capacity to take advantage of those entitlements air transport and has general supervision, applications for fare increases or other fees.

to meet the rising demand for international without immediate need for the government control, and jurisdiction over air carriers, At present, there is a move in Congress to

travel. to ask for greater capacity under those general sales agents, cargo sales agents, make CAB regulate fares once again by

ASAs. and air-freight forwarders. Meanwhile, setting ceiling prices and to set uniform

This protectionist stance taken by CAAP acts as the public registry for aircrafts fares for all passengers based on average

bureaucrats in trade negotiations is due to In sum, the literature showed a mixed and generally regulates the technical, fares charged by airlines. The proposed

a mistaken notion that it will serve national experience of the Philippines with operational, safety, and security aspects of bills in Congress seek to return to a regime

interest. In the particular case of the air liberalization and deregulation, which have aviation. of regulated air fares.21 These market

transport industry, a negotiation stance such transformed the market structure of the interventions will be very detrimental to

as this only serves to protect the interest domestic airline industry and the incentives the efficiency of the air transport market

of the incumbent operators, mainly the faced by airlines/carriers (Table 3.2). The and ultimately to end-consumers. The

big one, which is not necessarily aligned developments in the domestic air industry

19 Interview with IATA resident representative, April 26, 2018.

with public interest. In other words, the mirror more or less the experience of other 20 Interview with CAB, April 4, 2018.

interest of incumbent operator/s do not countries, which had earlier deregulated 21 Ibid.

8 9The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise

proposed bills need thorough analysis International Airport, the gateway to and SBIA. However, some political and secondary gateways of the Philippines and

and enlightened debate in Congress. The Boracay. Both PAL and Cebu Pacific operate business leaders in the region have claimed China were already included in the 2010

International Air Transport Association (IATA) charter flights. The charter flights cater that EO No. 500-A impedes the flow of bilateral air agreement before EO No. 29

resident representative argues that the primarily to leisure travelers although new investments and the generation of was signed. In the case of Turkey, the 2015

fare capping contemplated by legislators some flights also accommodate non- employment and tourism receipts in the agreement still imposed limitations on

will have dire implications, especially if it is leisure travelers like returning Philippine region. Local elective officials claim that secondary gateways.

made to cover international air fares. The residents, but these are relatively few the issuance of EO No. 500-A was for the

setting of international air fares is governed compared to tourist arrivals. A 2017 study purpose of extending protection to PAL. The policy reduced the entry barriers

by specific provisions of the ASA entered by the Asia Foundation revealed that of international airlines to secondary

into by any country, which are supposed the number of tourists who used direct Executive Order No. 29 (s. 2011) expanded airports. The ratification by the Philippines

to be binding on the parties to the flights to Kalibo reached 648,948 in 2016, the coverage of the so-called “pocket open of the ASEAN agreement on open skies

agreement.22 51.3 times the volume in 2008, the year skies” to all secondary airport gateways for secondary airports of ASEAN further

international charter flights started in outside of Manila. It opened secondary reduced the barriers to entry to the

From 2001 to 2010, liberalization continued Kalibo. The relative shares of international airport gateways to competition by Philippines for the ASEAN-based airlines. In

as a principal policy and the government tourists who flew directly to Kalibo Airport removing restrictions in third and fourth 2016, the government ratified the ASEAN

began developing secondary gateways. to the total international tourist arrivals freedom traffic rights and by granting Protocols 5 and 6 with Manila as capital

In 2001, during negotiation on ASAs, to the Philippines increased from 0.4 limited fifth freedom traffic right. Table gateway under the ASEAN Multilateral

the government started to aggressively percent in 2008 to 10.9 percent in 2016. 4.1 provides brief descriptions of those Agreement for the Full Liberalization of

negotiate for new entitlements and create Before the issuance of CAB Resolution 23, freedoms of the air. Passenger Services. However, congestion

provisions for separate entitlements for charter applications were approved on a and poor infrastructure in NAIA have

secondary airports outside of Manila. per-flight basis. The new policy allows for EO No. 29 (s. 2011) provided the continued to limit competition in Manila.23

charter flights over a six-month period. government air negotiating panel with a

Executive Order No. 253 (s. 2003) aimed Nevertheless, this falls short of the practice policy framework for bilateral ASAs as seen International ASAs and the ASEAN Single

to strengthen EO No. 219 by expanding air of other countries like Malaysia that allow in those that were negotiated as new or Aviation Market

services at the Clark International Airport long-term charter flights where charter amended ASA from the time of the policy

in the Clark Freeport Zone and the SBIA operators can operate for one year or more issuance, that is, with Australia, Japan, Hong The Philippines is a party to the ASEAN

at the Subic Bay Freeport Zone. This EO and with incentives. Kong, Malaysia, Myanmar, Ethiopia, South Single Aviation Market (ASAM). The ASAM

opened these airports to international air Korea, Macau, New Zealand, Singapore, aims to provide the competitive space

cargo operators that later on resulted in an Executive Order No. 500 (s. 2006) Taiwan, Thailand, and Oman. In the case of in terms of more destinations, increased

upsurge in commercial air cargo. designated the Clark International Airport China, the unlimited frequencies between capacities, and lower fares through the

as an international gateway, allowing

Table 4.1 Freedoms of the air

By virtue of CAB Resolution 23 (s. 2005), the unlimited flights by foreign airlines to Clark.

government liberalized the international It lifted the restrictions on airlines to fly to First freedom

The right of an airline of one country to fly over the territory of another country without

landing

charter market to support the thrust to the Clark International Airport with regard

promote tourism. A grantee of a permit to traffic rights, capacity, and air freedom The right of an airline of one country to land in another country for purposes of refueling

Second

and maintenance while en route to another country, but not to pick up or disembark traffic

to operate under the liberalized charter rights, with the exception of cabotage, that freedom

(passenger, cargo or both)

program can now operate pre-approved is, transport between two points within the

The right of an airline of one country to carry traffic from its country of registration to another

charter flight schedules renewable for six country. It promotes the utilization of Clark Third freedom

country

(6) month periods or less with authority International Airport by foreign air carriers The right of an airline of one country to carry traffic from another country to its country of

to issue individual tickets. The program without counting their flights or entitlements Fourth freedom

registration

covered the following gateway airports: to fly to Clark against their total entitlements The right of an airline of one country to carry traffic between two countries outside of its

Diosdado Macapagal International Airport to fly to the Philippines, particularly Manila. Fifth freedom own country of registration as long as the flight originates or terminates in its own country of

(DMIA), SBIA, Davao International Airport This opened Clark International Airport to registration

(DIA), Mactan-Cebu International Airport unlimited point to point air seat entitlements Sixth freedom

The right of an airline of one country to carry traffic between two countries via its own

(MCIA), Laoag International Airport (LIA), and with limited fifth freedom (intermediate country of registration (i.e., combination of third and fourth freedoms)

Zamboanga International Airport (ZIA), and and beyond points) traffic rights. Seventh The right of an airline of one country to operate flights between two other countries without

other developmental gateways. freedom the flight originating or terminating in its own country of registration

Executive Order No. 500-A (s. 2006) The right of an airline of one country to carry traffic between two points within the territory of

Eight freedom another country, on a service originating and terminating in the home country of the airline

CAB Resolution 23 served as catalyst in amended EO No. 500 because of the (i.e., consecutive cabotage rights)

stimulating direct flights to Kalibo and lobby of certain interest groups. It restricts

The right of transporting cabotage traffic of the granting country on a service performed

Clark. It has enabled the development the entry of non-designated low budget Ninth freedom

entirely within the territory of the granting country (stand alone cabotage)

of long-term charter operations in Kalibo airlines into Clark International Airport Source: World Trade Organization (2001)

22 Interview with IATA resident representative, April 26, 2018. 23 This will be discussed in detail in Section 5.

10 11The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise

provision of international air services with 2008: Transport ministers of the ASEAN traffic purposes (the “second freedom”). finite capacity that has to be negotiated

full third, fourth, and fifth freedom traffic signed three agreements that seek to The MAAS and MAFLPAS Implementing bilaterally. This has an effect on the level of

rights within the ASEAN region. liberalize freight and other air services in the Protocols that spell out the “freedoms” are competition and the availability of lower air

region, namely Multilateral Agreement on legal instruments that stand separately fares to domestic travelers. There is a good

2006: The Philippines’ long-standing the Full Liberalization of Air Freight Services from their “parent” MAAS and MAFLPAS case for ratifying Protocols 5 and 6 of MAAS.

bilateral ASAs with South Korea, Japan, (MAFLAS), the Multilateral Agreement on agreements. Hence, these Protocols must The ratification of Protocols 5 and 6 of the

Taiwan, Singapore, Hong Kong, Malaysia, Air Services, and the ASEAN Framework be individually accepted by member states MAAS are measures that will help improve

Thailand, United Arab Emirates, the Agreement on the Facilitation of Inter-State before they can take effect for those states. the competitive condition in the air transport

Netherlands, and Germany had already Transport.24 Otherwise stated, the instruments sector. Allowing ASEAN carriers’ operations

reached a level of full or high utilization of only have binding effect for and among into the Philippines will increase competition

entitlements. This means that the parties 2009: The ASEAN Multilateral Agreement on those states that have expressly accepted and provide travelers with lower fares and

to the ASAs were close to reaching the Air Services (MAAS) and its Protocols are in them. connectivity to the ASEAN region.

maximum seat and flight capacities set forth force and effective among all member states

in their respective agreements. except the Philippines with Protocols 5 and MAAS Protocol 1 provides that designated The Philippines has agreed to the MAFLPAS

6 still to be ratified. The ASEAN MAFLAS airlines from each contracting party shall to open up access to its secondary cities

2007: The Philippine air panel held air talks and its Protocols are in force and effective be allowed to operate unlimited third while keeping Manila (NAIA) restricted. This

with key markets. The successful conclusion among all member states.25 and fourth freedom passenger services explains its staying out of MAAS Protocols

of new air agreements with South Korea, from any designated point in its territory 5 and 6 while embracing MAFLPAS. The

Canada, New Zealand, Macau, Hong Kong, 2010: The ASEAN Multilateral Agreement to any designated point in the sub-region Philippines has justified its decision by

and Thailand has significantly expanded on the Full Liberalisation of Passenger Air to which it belongs. The Protocol lists the reference to the shortage of landing

air access to and from the Philippines, Services (MAFLPAS), and its Protocols (12 designated cities by country — for the BIMP- and take-off slots, and overall runway

particularly through the Clark International November 2010) are in force and effective EAGA sub-region, for instance, Bandar congestion at NAIA. While the Philippine

Airport. In less than two years, from a among all member states except Indonesia Sri Begawan is designated by Brunei; government’s concern over the implications

combined 23,850 airplane seats per week, and Lao PDR.26 Balikpapan, Manado, Tarakan and Pontianak of congestion on air safety and passenger

the Philippines increased its entitlements by Indonesia; Kota Kinabalu, Labuan, Miri comfort at NAIA is understandable, we

to at least 58,100 seats per week to Korea, The MAAS and MAFLPAS have now both and Kuching by Malaysia; and Davao, Puerto argue that traffic rights and airport slots

Macau, New Zealand, and Hong Kong. The entered into force after receiving the Princesa, Zamboanga and, General Santos are separate matters. The lack of slots at an

Clark International Airport alone gained acceptance of the minimum number of by the Philippines. What is obvious is that airport should not prevent member states

12,600 seats per week in new entitlements three member states for each agreement. the designated points in the subregions from ratifying the ASEAN agreements to

as a result of proactive stance and visibility The MAAS and MAFLPAS both refer to the covered by Protocols 1 to 4 are mainly liberalize market access rights and signal

during the conduct of air talks. The recent liberalization of passenger air services. secondary cities. This is due to the desire support for ASEAN’s market integration

air talks also led to new and increased The main difference between the two is of these ASEAN states to protect their commitments. Linking slots to access

entitlements to other secondary gateways, that the MAAS provides for freedom rights respective carriers’ operations and to be rights is also a negative precedent in that it

such as Davao, Cebu, and Laoag. only between sub-regions (e. g., from more cautious in granting greater access to encourages governments to use congestion

BIMP-EAGA, that is, Brunei, Indonesia, other states’ carriers. and lack of slots as excuses to delay their

2007: In the south, the Philippines signed Malaysia, Philippines to Indonesia, Malaysia, adherence to regional commitments to

a Memorandum of Agreement (MOA) Singapore) and between capital cities, while Notably, the Philippines has accepted liberalize the industry. Rather, the right thing

to enhance economic growth in the the MAFLPAS provides for freedom rights Protocols 1 to 4 but has not ratified Protocols to do is to pursue with great urgency the

East ASEAN Growth Area, which covers in international destinations within the 5 and 6. Consequently, Protocols 5 and 6 do rehabilitation of NAIA and the development

Mindanao and Palawan in the case of the entire ASEAN. Essentially, MAAS is the more not have binding effect on the Philippines. of other international airport/s near Metro

Philippines. The MOA effectively put in conservative initial step while the MAFLPAS Protocol 5 provides for unlimited third and Manila to ensure greater connectivity and

place an open skies policy by granting fifth provides for full liberalization of passenger fourth freedom traffic rights between ASEAN competition.

freedom traffic rights to selected airports air services within ASEAN. capital cities while Protocol 6 provides

in the BIMP (Brunei, Indonesia, Malaysia, unlimited fifth freedom traffic rights between Despite efforts at multilateral air services

Philippines) region. It also encouraged the Under the MAAS and MAFLPAS, each ASEAN capital cities. agreement, it is noted that bilateral

development of international gateways in contracting state party will provide the agreements seem to be the norm among

Davao, Zamboanga, General Santos, and designated airlines of the other contracting The reason behind the Philippines' non- countries to date. On this, the WTO (2001)

Puerto Princesa, which are covered by the parties the right to fly across its territory ratification of Protocols 5 and 6 is to protect states that “Air Services Agreements have

agreement. without landing (the “first freedom”) and the local carriers like the Philippine Airlines and started from a very restrictive approach with

right to make stops in its territory for non- Cebu Pacific from foreign competition. Non- severe market access limitations, toward

ratification has resulted to the restriction gradually embracing more liberal provisions

24 Sosa, A. (2007) “Philippine Civil Aviation Policy Paper: ASEAN Single Aviation Market” Available at pdf.usaid.gov/pdf_docs/PNADJ694.pdf;

accessed 18 October 2009. of other ASEAN carriers’ operations within the bilateral framework. These

25 ASEAN Transport Strategic Plan 2016-2025 in the Philippines, subjecting them to include increased freedom for designated

26 Ibid.

12 13The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise

carriers to choose the entry point and the transfers of funds from ticket sales from in the ASAs are amended or removed. or charter services. It amounts to full

destination country, freedom to choose the abroad, and so on. The hard provisions One restriction is the number of airlines deregulation because it will allow airlines

gauge of aircraft, and an increased ability cover pricing and capacity limits. Gillen permitted or designated by each state to to set their routes, capacities, flight

to utilise behind and beyond destination (2009) further notes that the international operate frequencies or mount seats on frequencies, and fare pricing free from

points. Nevertheless, bilateral air transport experience in the past 60 years revealed that certain routes. The designation could be government restriction. Initial estimates

traffic rights remain the modus operandi the property rights for market access were, single, dual or multiple for each state. indicate that ASEAN Open Skies significantly

throughout most of the world”. by default, given to nations. They, in turn, increased intra-ASEAN air passenger flows

transferred those rights to their national The multiple designation policy is limited as and bilateral flows by an estimated 70.5

According to North (1993), institutions airline, thus leading to highly protectionist in the case of the Philippines-South Korea percent (Mandri-Perrott, 2015).

form the incentive structure of a society; or “predetermined” agreements and ASA where not more than four airlines

the political and economic institutions, unproductive activities that consequently were permitted to operate for each state. The liberal open skies policy was deemed

in consequence, are the underlying increase transaction costs. The ASAs have, Another restriction is in the capacity (seating too radical by government and instead, a

determinants of economic performance. thus, constrained the ability of airlines to of aircraft) or frequency of flights that may “pocket (or limited) open skies” policy was

As humanly devised formal (rules, laws, operate on a fully commercial basis on be operated. Airlines of each state are allowed. The government’s preference

constitutions) and informal (reputations, international routes. restricted to specific numbers of seats per is to liberalize access through secondary

conventions) constraints, these institutions flight or per route or the number of weekly airports like Clark and SBIA under the so-

serve to structure interactions and define The ASAs provided for the framework for frequencies that may be operated. The type called “pocket open skies” policy. Despite

the incentive structure of societies, and fares and tariffs that may be charged on of aircraft may also be restricted for one its limitations, the “pocket open skies” policy

specifically, economies. These constraints routes. One modality is for the airline to state in the bilateral ASA, as in the case of has produced salutary effects as indicated in

can influence the returns on economic seek prior approval from both states that the Philippines-Japan ASA that provided Box 2.

activities by restricting agents’ behaviors are parties to the agreement. Another is for conversion factors for certain types of

and incentivizing them in different where each state decides on the tariffs aircraft.

directions. Institutions can also be viewed within its own jurisdiction. Airlines may also Box 2. Effects of pocket open skies policy

as “political settlements” between various be free to decide on tariffs and fares and are Even if a particular ASA provides for Between 2005 and 2006, tourist arrivals at the Clark

groups in society, which can be changed required only to file them with the regulating multiple designation policy of airlines for International Airport increased by over 70 percent

according to the changing relative strengths bodies. The last form is the so-called double each state, the entry of a new airline may from 55,000 to 93,000 or equivalent to at least

Php200 million in direct and indirect earnings by the

of these groups (Rodolfo, 2012). disapproval regimes under which airlines still be restricted under conditions where tourism industry. The number of hotel rooms likewise

have freedom until a fare is disapproved by frequencies or seats per week would already increased by over 50 percent in the same period. In

In the case of international aviation, Gillen both states. be fully allocated by the government to Clark alone, there are over 1,337 rooms to date. In

the Greater Clark area, including Angeles and the

(2009) explains that the bilateral ASAs and the incumbents. 27 The air entitlements, neighboring areas, occupancy rates of hotel rooms

market liberalization policies are examples The EO No. 219 provided the direction whether in the form of frequencies or seats are at an all-time high. The effects on employment

of these formal institutions. They shape for the Philippine air negotiating panel to per week, may also be allocated for use for rate have been noteworthy. Thousands of jobs are

being created with an average of 1.2 to 1.4 employees

the strategic behavior of airlines and the “exchange traffic rights and routes with other all points of entry in each state. Thus, if an for every room. The success of these hubs in making

users of air services, which in this case, countries based on (a) the national interest incumbent officially designated airline is travel affordable to markets beyond the affluent and

are enterprises like airports, hotels, tour taking into consideration the larger interest already utilizing all its allocated entitlements bringing in tourists from foreign countries whose

carriers are allowed to fly into the country makes the

operators, and shippers. The bilateral ASA, of the country, which shall include value in Manila, it had to reduce its capacity prospect of open skies all the more promising.

an international framework that emerged for the Philippines in terms of promoting utilization in Manila for it to explore new

from the 1944 Chicago Convention international trade, foreign investments routes out of Cebu, or any other Philippine There is pressure created from the provincial

governments, tourism authorities, and business

established the rules that govern the entry and tourism, among others; and on (b) point. Some ASAs in the 1990s provided for community to allow greater direct access into regional

of airlines into markets. This framework the reciprocity between the Philippines separate but limited entitlements for other cities.

became the basis for the exchange of and other countries. Reciprocity shall be points outside of Manila, as in the case of Source: Serrano and Salandanan (2010) and https://asiafoundation.

traffic rights and the ASAs as matters for interpreted to mean the exchange of rights, the Philippine-Hong Kong ASA.28 org/2009/02/25/in-the-philippines-to-fly-friendlier-skies/

negotiation between states, not carriers. freedoms, and opportunities of equal or

The ASAs are trade agreements between equivalent value, thereby attempting to Pocket “Open Skies” Restrictions on foreign ownership and

governments and contain administrative move away from the traditional zero-sum control

(soft) and economic (hard) provisions. They game in bilateral air service negotiations. In the past, there was a great deal of

define the number of airlines that can only discussions on adopting an "open skies" Air transport service is governed by

be allowed to service the markets, route While EO No. 219 allowed the official policy that will allow foreign airlines to Commonwealth Act No. 146, also known

structures, flight frequencies, seats, the type designation of at least two Philippine provide unlimited services in the country, as the Public Service Act. This is in relation

of aircraft, costs of doing business, and tax carriers to serve international routes, it whether for passenger, cargo, scheduled to Section 11, Article XII of the 1987

policies, among others. The soft provisions would not be able to promote effective

27 For example, prior to the amendments of the Philippine-South Korea ASA, the agreement provided for a maximum of 13 frequencies per

cover taxation, exemption from duties on competition in the international air transport week only for each state (total of 26 frequencies for both) and with only Manila and Seoul as points of origin and/or destination.

imported aircraft parts, airport charges, and market unless the restrictions embodied 28 Prior to the amendments of the Philippine-Hong Kong ASA, the air entitlements for points outside of Manila (i.e., Clark, Cebu, Subic, Davao

and Laoag) provided for a maximum of 2,300 seats per week.

14 15You can also read