THE 2018 MOBILE REVIEW FOR SINGAPORE

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

MOBILE

MOBILE REVIEW

BENCHMARK

The XXXX

The

Mobile

2018

Network

Mobile

Test in REVIEW

the

FOR SINGAPORE

XXXXXXXX For the first time, the network bench-

marking expert P3 and connect

magazine have tested the mobile Thanks to strict regulatory require-

networks in the city-state of Singapore. ments, the network quality of all

We have conducted a drivetest as Singapore operators is very high.

well as a crowd based analysis over This makes it very intersting to compare

six months resulting in the following their performance with that of other

comprehensive Mobile Review. leading world capitals. Also, we have

taken a detailed look into the perfor-

mance of each Singapore operator.SINGAPORE

All three Singapore opera-

CROWD tors d eliver a high level of

data performance while

ranking very closely.

However, in the drivetest

DRIVETEST

results, Singtel is s lightly

ahead, The crowd results

are good o verall, but show

a slight lead of M1 in

some of the KPIs.

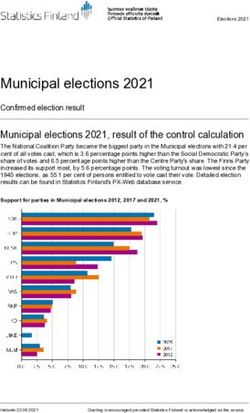

Q2 Q3 Q2 Q3 Q2 Q3

94,2 95,3 95,3 94,0 93,7 95,1 93,2 96,6 95,3

Operator Singtel Starhub M1

Shown scores in %

Results in a nutshell DRIVE- CROWD-

The Singapore market is known for its high network quality. Thus, it is TEST SOURCING

not surprising that the three operators considered in this review rank FACTS FACTS

closely. And still, our holistic network testing approach, comprised of

a data-centric drivetest and sophisticated crowdsourcing analyses,

reveals specific strenghts of each operator.

As this Mobile Review for the net- the fastest file downloads, while 99.5% 19,257

works in Singapore does not use StarHub scores best in the of population users

the full methodology of our regular YouTube measurements. covered

Network Benchmarks, we abstai- The extensive crowdsourcing

ned from ranking or g rading the analysis, based on 344 million

operators. However, the r esults samples collected in two con-

of our data-centric drivetest and secutive 3-month-periods from

crowdsourcing analysis provides April to June and July to Sep-

a good indication of their achieve tember 2018, overall validates

ments. The drivetest result shows these findings. The results show

the maximum performance of the

networks, whereas the crowd

the high performance level of all

three networks. The quality of 4G

31,003 344

evaluation reflects the actual user coverage was a little lower in the samples million samples

experience. first evaluation period. Singtel

The drivetest results confirm and StarHub improved regarding

that all three Singapore opera- this KPI in the s econd period,

tors deliver a high level of data only M1 fell a little behind. On

performance and rank closely. the other hand, the average data

However, in our drivetest, Singtel rates dropped in all networks in

shows a slight advantage over the second observation period.

its competitors. In the detailed

analysis, each operator demons-

In some of the KPIs, M1 showed a

slight advantage. The e xamination 2,100 97.8%

trates specific strenghts: M1 is of the Data Service Availability km drivetest of the built-up

ahead in the web browsing tests showed minor degradations in the area

and also takes a narrow lead in StarHub network in March and in

the file uploads. Singtel provides the M1 network in September.

MOBILE REVIEW

2operators in SingaPORE

According to the Singapore Info-Communications Media Development Authority’s (IMDA)

statistics, S ingapore’s mobile market has a penetration rate of almost 150 per cent.

A total of 5.6 million inhabitants hold about 8.5 million mobile subscriptions –

comprising of roughly 60 per cent postpaid and 40 per cent prepaid subscriptions.

Singapore Telecommunica- In the course of the libera- M1 Limited (previously

tions Limited (Singtel) was lisation of the Singapore known as MobileOne) was

founded in 1992 and today telecommunications mar- formed in 1994, launched

employs more than 23,000 ket, StarHub was awarded its mobile service in 1997

staff worldwide. Headquar- the licence to provide fixed and became a p ublicly

tered in Singapore, Singtel network and mobile servi- listed company at the end

is also the parent company ces in 1998. The c ompany of 2002. M1 now employs

of the renowned Australian was officially launched in over 1,500 people. The

operator Optus. April 2000 and has been company prides itself to

Additionally, Singtel is listed on the Singapore have launched South East

invested in leading com- stock exchange since 2004. Asia’s first commercial LTE

panies in Asia and A frica, StarHub currently counts network in June 2011 and

including Bharti Airtel about 2,500 employees. to have become the first

(India, South Asia and For its fiscal year 2017, operator in South East Asia

Africa), Telkomsel (Indo- the Group published a to offer nationwide 4G ser-

nesia), Globe Telecom (the mobile revenue of 1.2 vices from September 2012.

Philippines) and Advanced billion Singapore Dollars For its fiscal year 2017,

Info Service (Thailand). (about 0.9 billion US Dol- M1 published an opera-

With an operating revenue lars). When also taking ting revenue of 1.1 billion

of 17.5 billion Singapore Pay TV, broadband, fixed Singapore Dollars (about

Dollars (about 12.5 billion line and other revenues 0.8 b illion US Dollars).

US Dollars) in the fiscal into a ccount, the company Additionally, the company

year 2018, Singtel is one of achieved a total revenue specified a fixed services

the largest telecommuni of 2.4 billion Singapore revenue of 130 million

cations companies in Asia. Dollars (about 1.7 billion Singapore Dollars (about

The group specifies over US Dollars) in 2017. 94 m illion US Dollars).

650 million customers in For Singapore, StarHub At the end of 2017, M1

21 countries. In Singapore, specifies 2.3 million mobile had a total of 2.2 m illion

Singtel has 4.1 million subscribers which equals mobile customers and

mobile subscribers, which a mobile market share of 189,000 fi bre subscribers.

equals a share in the about 27 per cent. Its mobile customer base

mobile market of about 48 equals a market share of

per cent. about 26 per cent.

MOBILE REVIEW

3This year, P3 and connect have conducted a Mobile Review in

Singapore for the first time. This review just marks the start

– further, even more complex investigations of the network

quality applying more KPIs are planned in the future.

A STUDY

INTO the

Singapore

mobile market

P3, headquartered in Aachen, Germany, is a world leader in mobile network

testing. The company has over 3,500 employees worldwide and a t urnover of

more than 350 million Euros. P3 is partnering with the international telecommu-

nications magazine connect, which has more than 20 years of e ditorial ex-

pertise and is one of the leading test authorities in Europe for telecommuni-

cations products and services. T ogether, P3 and connect h ave been con-

ducting the most important network b enchmark test in Germany for more

than 15 years, extending it to other E uropean countries since 2009. Above

that, P3 has been conducting its authoritative Mobile Benchmarking in A ustralia Singapore‘s mobile operators

since 2014 where it is well known and respected. P3 and connect also exa are among the best in a global

mined many other mobile networks all over the world including those the USA. comparison with very smart re-

In 2017 alone, P3 compiled more than 60,000 measurement hours sults. Our review confirms that

in more than 80 countries across five continents, with its test vehicles all three Singapore operators de-

covering almost one million kilometres. Recently, P3 has expanded its liver high quality while Singtel is

testing scope by amending the drivetests and walktests with a sophi- showing a slight advantage over

its competitors. Our crowd-based

sticated and statistically highly reliable crowdsourcing approach. As the

benchmarking also reveals that

de-facto industry standard, the P3 benchmarking methodology focuses particularly Sydney, Australia,

on customer-perceived network quality. P3‘s network benchmarks are achieves comparably high data

widely accepted as a completely objective authority. throughputs. Therefore, we are

looking forward to the certainly

very interesting results of our

drivetest and crowdsourcing reflect high upcoming Mobile Benchmark

in Australia.“

Performance of THE Singapore networks Hakan Ekmen,

In 2018, P3 and connect have extended the scope of their network CEO of P3 communications

assessments to the city-state of Singapore. This market is p articularly

interesting with its very large market penetration of almost 150 per cent

(see the previous page) as well as its very high standard of network

quality which is also e

nsured by strict regulatory requirements.

This year, P3 and connect have started their qualified look into the

Singapore mobile market by mainly concentrating on the data quality of

the networks – t aking into account the typical usage patterns of m obile

subscribers as well as the importance of mobile data availability and

performance for future applications such as IoT or automotive c onnectivity.

To achieve this, P3 have conducted a data-centric drivetest in May 2018.

In order to validate and supplement its results and analyse trends in the

development of the networks‘ performance, we have also p erformed an

extensive crowdsourcing analysis covering two periods of three months

each in order to be able to also. The results of both approaches clearly

reflected the high performance level of the mobile networks in Singapore.

MOBILE REVIEW

4SINGTEL IS

Data drivetests CLOSELY

AHEAD OF A

FOR THIS MOBILE REVIEW, WE HAVE CONDUCTED A DATA-CENTRIC

VERY STRONG

DRIVETEST, taking into account the typical usage patterns

of mobile subscribers as well as the importance of mobile COMPETITION

data availability and performance for future applications

such as IoT or automotive connectivity.

In order to assess the performance and reliability of data con-

nections in the Singapore networks, two d rivetest cars drove a

total of 2,100 k ilometres, c

overing 99.5 per cent of Singapore‘s

population.

Each of P3‘s drivetest cars was equipped with arrays of

Galaxy S8 Smartphones capable of supporting 300 Mbit/s

download and 50 Mbit/s upload speeds. All data measure-

ments were done in 4G p referred mode. Each car carried one

smartphone per operator.

P3‘s drivetesting considers fast throughputs as well as the

networks‘ availability and stability. Web page and file down

loads or file uploads reward fast speeds, while recording

success ratios and assessing YouTube playouts concentrate

on reliability a spects. As YouTube streams videos at adaptive

bitrates, the average value of the received video resolution is

another important performance indicator.

Overall high data performance Data in Cies - Drivetest Singtel Starhub M1

The drivetests show the high Web-Page Download (Live/Sta c)

performance level of all three mobile

Success Ra o (%) 99,6 99,8 99,9

operators in Singapore. Determining

Time to First Byte (ms) 506 425 419

their overall scores for the data drive-

tests, all competitors are close KBytes First Second (kB) 566 561 538

together: Singtel achieves 94.2 per HTTP Sta c Page DL Qualifier (%) 99,8 97,7 98,8

cent of the total possible points, HTTP Sta c Page DL Overall Session Time (s) 1,2 1,1 1,0

StarHub follows with 94.0 per cent File Download (3 MB)

and M1 with 93.2 per cent. Although Success Ra o/Avg. Session Time (%/s) 99,8/1,0 99,8/1,2 100,0/2,2

we see some differences in their 90%/10% faster than (kbit/s) 15938/72948 15669/45810 9073/46083

detailed performances, this is a very

File Upload (1 MB)

good result for all three of them.

Success Ra o/Avg. Session Time (%/s) 99,5/0,7 99,7/0,6 99,7/0,7

90%/10% faster than (kbit/s) 10012/ 28369 11512/ 27397 10599/ 31873

File Download (7 Seconds)

Success Ra o (%) 99,7 99,8 100,0

Avg. Throughput (kbit/s) 66526 60963 39350

90%/10% faster than (kbit/s) 19927/128676 20433/113872 14370/70779

File Upload (7 Seconds)

Success Ra o (%) 100,0 100,0 99,5

Avg. Throughput (kbit/s) 25708 27293 36076

90%/10% faster than (kbit/s) 13432/47602 15931/36323 13923/57709

Youtube Video

Success Ra o/Start Time (%/s) 99,0/1,8 99,4/1,8 98,9/1,9

Playouts without Interrup ons (%) 99,8% 100,0% 99,7%

Average Video Resolu on (p) 1080 1080 1058

MOBILE REVIEW

5M1 ahead in Web BROWSING IN A CLOSE

When it comes to accessing

live web pages from the widely RACE, EACH

acknowledged Alexa ranking and

Web the static Kepler test page, M1 OPERATOR

BrowsinG is closely ahead of the other two

operators. M1‘s success rates

SHOWS

are slightly higher and the downlo-

ad times slightly shorter. This

SPECIFIC

results in a fulfillment rate of

96 per cent in this category.

STRENgTHS

However, Singtel with 94 per cent in THE DATA

and StarHub with 93 per cent

follow at close distance. CATEGORY

SINGTEL PROVIDES THE FASTEST

DOWNLOADS, ALL THREE almost

FILE ON PAR REGARDING UPLOADS

DOWNLOADS In the download tests, Singtel

& UPLOADS is one step ahead due to faster

average data rates and a higher

top speed (P90). StarHub ranks

second and M1 third in the down-

load evaluation. Examining their

upload performance, all three

operators are almost on par with

a slight advantage for M1 due to

slightly higher average upload

data rates.

Data Results

STARHUB SCORES BEST IN At a Glance

THE YOUTUBE MEASUREMENTS

In our tests of YouTube play- Although all three Singapore ope-

backs, StarHub showed a slight rators deliver a high level of data

youtube advantage over its competitors. performance and rank closely

This operator achieves a 100 per together, in the overall assess

cent playout without interruptions ment, Singtel shows a slight

(Singtel: 99.8 per cent, M1: advantage over its competitors.

99.7 per cent). Also, the overall In the detailed analysis, each

success ratio is slightly higher operator shows specific strenghts:

in the StarHub network. Still, M1 is ahead in the web browsing

the mobile reception of YouTube tests and is closely ahead of the

videos provides a very good competition when it comes to

user experience in all three file uploads. Singtel provides

Singapore mobile networks. the fastest file downloads, and

StarHub scores best in the

YouTube measurements.

MOBILE REVIEW

6THE CROWD

Crowd SOURCED

RESULTS

CONFIRM

19,257 users have contributed 344 million samples to our crowd- THE HIGH

sourcing analysis of the Singapore networks over two consecutive PERFORMANCE

periods spanning three months each. The evaluation area of our crowd- OF THE

sourcing represents 97.8 per cent of the built-up area of Singapore. SINGAPORE

NETWORKS

In order to validate and supplement the results of the

drivetest, we have also performed an extensive crowd-

sourcing analysis of the mobile market in S ingapore.

This analysis is based on crowd data that has been

gathered in two periods of three months each. P3 decided

to follow this approach because our crowdsourcing metrics

are based on three-month periods. As the drivetests Overview Score (April - June)

were conducted in May 2018, we wanted to factor in Coverage

crowdsourcing data from this period as well — resulting User DL

in including the measurement period April to June 2018. Speed

On the other hand, we also wanted to present data that Data Service

Availability

is as current as possible. This is why we also included

a second period ranging from July to September 2018.

Considering two consecutive three-month crowdsour

cing periods allows us to also have a look at trends and

developments between the two c ompared periods.

The results are based on usage data that have been

collected from smartphone users who are utilising one

or more of 800+ apps in which P3 has integrated back

ground diagnosis processes determining relevant usa-

ge data 24/7, 365 days a year. Quarterhourly reports are

93,7 92,0 100,0 91,1 94,7 97,6 95,2 95,0 100,0

generated daily and sent to P3‘s s ervers for a thorough

analysis (see detailed description of the methodology Operator Singtel Starhub M1

on p ages 9 and 10). This way, more 19,257 users Shown scores in %

have contributed a total of 344 million samples in the

described six-month period. Based on the total popu-

lation count of 4.6 million people, one of 308 inhabi-

tants of Singapore has contributed to our crowd data. Overview Score (July - September)

The evaluation area of our crowdsourcing represents Coverage

97.8 per cent of the built-up area of Singapore. User DL

Speed

Data Service

ALL OPERATORS SHOW HIGH PERFORMANCE, BUT THERE Availability

ARE STILL SOME VARIATIONS IN THEIR CROWD RESULTS

The overall results of our crowd tests confirm the drive-

test results in so far as all three Singapore operators

show respectable performance. In an o verall assess

ment, M1 leads the field with a narrow margin in the

April to June period. In the July to S eptember period,

Singtel and M1 are on par. StarHub follows at close

distance in both cases. A direct comparison of both

periods shows that Singtel‘s performance stayed the

same, StarHub was able to improve by some percen- 94,8 89,3 100,0 94,5 91,0 98,7 94,8 91,7 98,2

tage points, w hereas M1 lost a couple of percentage

Operator Singtel Starhub M1

points. However, these variances are minor all in all.

Shown scores in %

MOBILE REVIEW

7Singtel

CROWD Starhub

User Download Speed M1

April - June

ALMOST PERFECT VOICE AND DATA COVERAGE FOR

ALL OPERATORS AND ALSO HIGH 4G COVERAGE

160,7

For all Singapore operators, we observed 100 per cent

coverage within our test area for both voice and data

Mbit/s

134,4

services during both observation periods. Even the de- 10% EA

manding 4G coverage is very high with values between 126,2 faster than

97 and 99 per cent. Also, the results for the so called

Quality of Coverage (the percentage of actual availability

of the mobile network services) were high for voice 30,2

and data. An examination of the Quality of 4G C overage

Mbit/s

shows that these values were a little lower in the first 32,3

10% Users

evaluation period with Singtel and StarHub improving in faster than

33,0

the second period, while M1 received a slightly better

result in the first period than in the second one.

When it comes to data rates, M1 shows a slight ad 10,6

vantage in the average as well as the top values (P90)

Mbit/s

of each Users‘ Best Throughput within the observation 11,1

time. These averages were 11.2 Mbit/s in the first Avg. Users

Best Throughput

evaluation period and 10.5 Mbit/s in the second one. 11,2

StarHub and SingTel each follow at close distance

with StarHub achieving 11.1 Mbit/s in the first and Singtel

10.3 Mbit/s in the second period, SingTel‘s results are CROWD Starhub

10.6 Mbit/s in the first and 10.1 Mbit/s in the second User Download Speed M1

observation period. A possible explanation for the July - September

overall drop in these values between the April to June

and the July to September period could be a higher 156,9

number of users in the networks leading to a higher

Mbit/s

utilisation of the network cells and their capacities. 132,5

10% EA

Stil, SingTel delivers the highest values for the top faster than

126,6

speeds (P90) observed per evaluation area (“EA“). This

applies to both observation periods. The difference to

the User‘s Best Throughput is that these top speeds 28,7

have been achieved by varying users.

Mbit/s

Occasional drops especially in some coverage KPIs 29,9

between the first and the second three-month period 10% Users

faster than

can be explained by user fluctuations – the number of 30,9

users within a particular observation area is typically

not constant between evaluation periods. 10,1

SINGTEL SHOWED NO DEGRADATIONs IN 10,3 Mbit/s

BOTH CONSIDERED PERIODS Avg. Users

In the evaluation for Data Service Availability, also all 10,5 Best Throughput

three competitors shows generally pleasing results.

Our analysis identified one hour with limited service

availabilty in the StarHub network in March and also a

two hour degradation in the M1 network in S eptember. CROWD RESULTS

Both incidents only had a very limited impact on the AT A GLANCE

users‘ experience of network availability and stability. The crowdsourced results for the

coverage of voice and data ser-

vices is exceptionally high in the

Singapore networks. The Quality

DATA SERVICE AVAILABILITY

of 4G Coverage was a little lower in

Affected hours (h) and days (d) (2018) the first evaluation period, SingTel

and Starhub improved regarding

this KPI in the second one. On the

Singtel

other hand, the average data rates

Starhub 1h over 1d

dropped in all netwoks in the se-

cond observation period. In some

M1 2h over 1d

of the KPIs, M1 showed a slight

advantage. The examination of

March April May June July August September Data Service Availability showed

only minor degradations in

the StarHub and M1

networks.

MOBILE REVIEW

8How does Singapore

compare to other

world capitals?

As a successful business capital, Singapore is competing with

metropolitan areas on a global scale. Therefore we have compared

our crowdsourced throughput results gathered in Singapore with

those achieved in Berlin, Cape Town, Jakarta, London and Sydney.

A look at the average values of In London, only EE achieves with buildings, whereas cities like

the best throughputs a chieved by similar results, while the other Berlin or London contain a higher

each individual user participating British operators as well as the share of open spaces such as

in our crowdsourcing (see chart mobile networks in Berlin, Cape parks or fringe areas, which are

below) shows that the Singapore Town and Jakarta overall deliver provided with less mobile co

operators deliver considerably slower data rates. When looking verage and also comprise of

high performance also when com- at the P90 value (the threshold less mobile users.

pared to their global competitors. below which 90 per cent of the Furthermore, in order to e nsure

gathered values are ranging statistical relevance, we had

HIGHEST OBSERVED DATA RATES – see also the description of to exclude Jakarta‘s smallest

IN SINGAPORE AND SYDNEY our methodology on pages 10 operator Smartfren from this

and 11), S ydney even shows comparison.

M1, StarHub and Singtel provide slightly better overall results than The analysis at hand concen-

high data rates to their customers, Singapore. trates on data throughputs. But

which in this comparison are only However, when evaluating the an additional look at the Areas

matched by the performances of actual values, it must be taken and Quality of Coverage with 4G

the Australian operators Telstra, into account that areas such as services, 3G/2G data services as

Optus and Vodafone in Sydney. Singapore are densely c overed well as voice services in the consi-

dered cities also

shows favour

Singapore Berlin Cape Town Jakarta London Sydney

able results for

12M Singapore and

Sydney – how

ever, some com

petitors such

as London or

Jakarta come

close in one or

the other of the

analysed metrics.

Deeper insights

can be made

MobileOne

Telefónica

Telefónica

Telkomsel

Vodafone

Vodafone

Vodafone

Vodacom

INDOSAT

Telekom

CROWD

Starhub

Telkom

Telstra

Singtel

available to

Optus

Three

Three

Cell C

MTN

Users‘ Best Throughput

EE

XL

(AVG)

interested parties

Mbit/s 10,1 10,5 10,3 5,4 6,1 5,6 3,8 4,7 4,7 4,4 4,6 6,7 4,3 5,5 8,0 4,9 5,5 6,8 9,4 10,3 9,3

on request.

Shown values are rounded.

MOBILE REVIEW

9Methodology

The methodology of the P3 connect Mobile Review is the result

of more than 15 years of testing mobile networks. Today, network tests

are conducted in more than 80 countries. They were carefully designed

to evaluate and objectively compare the performance and service quality

of mobile networks from the users’ perspective.

The P3 connect Mobile Review for Alexa ranking. In addition, the

Singapore includes the r esults of static Kepler test web p age as Boxes were mounted into the rear and

an extensive data drivetest as well specified by ETSI (European side windows of each measurement car

as a sophisticated crowdsourcing Telecommunications Standards supporting the smartphones used

for the drivetests.

approach. Institute) was used.

In order to test the data s ervice

drivetests performance, files of 3 MB and 1 MB

The drivetest was conducted on for download and upload w ere based on crowd data that had

12 measurement days from May transferred from or to a test server been gathered in two periods of

2nd to May 16th, 2018. All sam- located on the Internet. In addition, three months each. P3 decided

ples were collected between 8am the peak data performance was to follow this approach because

and 10pm. Two d rivetest cars tested in uplink and downlink di- our crowdsourcing metrics are

drove a total of 2,100 kilometres, rections by assessing the amount based on three-month periods.

covering 99.5 per cent of Singa of data that was transferred within As the drivetests were conducted

pore‘s total population. a seven seconds time period. in May 2018, we wanted to factor

Each of P3‘s drivetest cars was Another discipline was the in crowdsourcing data from this

equipped with arrays of Samsung playback of YouTube videos. It period as well — thus, we have

Galaxy S8 Smartphones. These took into account that Y ouTube included the months from April to

„Cat 9“ phones are capable of dynamically adapts the video June 2018. On the other hand, we

supporting 300 Mbit/s download resolution to the available band wanted to present as current data

and 50 Mbit/s upload speeds. All width. So, in addition to success as possible, which is why we also

data measurements were done in ratios, start times and playouts included the period from July to

4G preferred mode. Each car car- without interruptions, YouTube September 2018. The considera-

ried one smartphone per operator. measurements also determined tion of two crowdsourcing periods

average video resolution. All tests of a duration of three months each

DATA TESTING were conducted with the best allows us to also have a look at

For the web tests, the test smart- performing mobile plan available trends and developments between

phones accessed web pages ac- from each operator. the two compared periods.

cording to the widely recognised For the collection of crowd data,

RANKING AND GRADING P3 has integrated a background

As this Mobile Review is intended diagnosis processes into 800+

just as an indication of network diverse Android apps. If one of

performance and q uality, we ab- these applications is installed on

stained from ranking or grading the end-user’s phone, data collec

the operators considered based tion takes place 24/7, 365 days a

on the number of total achieved year on this device. Reports are

points. However, the p ublished generated for every 15 minutes and

percentages give a good indica daily sent to P3‘s cloud servers.

tion of their achievements. Such reports generate just a small

number of bytes per message

CROWDSOURCING and do not include any personal

As an addition to the drivetests, user data. Interested parties can

P3 conducted thorough crowd- deliberately take part in the data

All test phones used in the drivetests

were operated and supervised by based analyses of the Singapore gathering with the specific ”U get“

P3‘s unique control system. networks. These analyses are app (see box on next page).

MOBILE REVIEW

10Other crowdsourcing solutions relevant statements, P3 requires which 10 per cent of the values

have a very technical user base. a certain number of users and are situated. These values depict

Thus, their results are typically measurement values per opera- how fast the network is under

skewed towards high-end, heavy tor for each tile and each evalua- favourable conditions.

data users. With the integration tion area. If these thresholds are

into more than 800 diverse apps not met by one of the considered Data service availability

covering different market seg- operators, this part of the map is Another performance indicator

ments, P3 has generated data not considered in the assessment considered in the crowd results is

which is a fair and equal repre to ensure fair terms. the Data Service Availability. This

sentation as o pposed to that of Even more relevant results are parameter indicates the availability

classical speed test apps. The accomplished by not only de- of a network and the number of

unique crowdsourcing t echnology termining the mere network outages or service d egradations

allows P3 to collect data about coverage but also considering its respectively.

real-world customer experience quality. The parameter Q uality of In order to differentiate net-

in a truly passive way – wherever Coverage reveals whether voice work glitches from normal varia-

and whenever customers use and data services actually work tions in network coverage, we

their smartphones. in the respective evaluation area. apply a precise definition of ser-

P3‘s crowdsourcing data set P3 does this because not in each vice degradation: A degradation

is the most realistic, s ince it is area that allegedly provides net- is an event where d ata connec-

the most diverse that is c urrently work reception, the mobile servi- tivity is impacted by a number of

available in the market in terms ces can actually be used. For this cases which significantly exceeds

of locations, geography, times, reason, the percentage for Quality the expectation level. To judge

devices, subscriptions, n etworks, of Coverage is always a little lower whether an hour of interest is an

technologies and

s martphone than the corresponding coverage hour with degraded service, the

usage patterns. P3 applies value. We specify these values algorithm looks at a sliding win-

advanced big data analytics to each for the coverage of voice dow of 168 hours before the hour

distill the essence of informa- services (2G, 3G and 4G combi- of interest. This ensures that we

tion from the bulk data. By ana ned), Data (3G and 4G combined) only consider actual network ser-

lysing data according to prede- and 4G only. vice degradations differentiating

fined m etrics, P3 can provide them from a simple loss of net-

information for the optimisation of ASSESSMENT of data throughputs work coverage of the respective

networks and also show whether Additionally, P3 investigates the smartphone due to prolonged

networks live up to the expecta data rates that were a ctually indoor stays or similar reasons.

tions of their customers. available to each user. For this In order to ensure the statisti-

purpose, we have determined the cal relevance of this approach, a

rating of network Coverage best obtained data rate for each valid assessment month must fulfil

For the assessment of network user during the e valuation period clearly designated prerequisites:

coverage, P3 lays a grid of 2 by and then calculated the a verage A valid assessment hour con-

2 kilometers over the whole test of these values. In addition, we sists of a predefined number of

area. The so-called evaluation have determined the so-called samples per hour and per opera-

areas generated this way are then P90 values for the top throughput tor. The exact number depends on

sub-divided into 16 smaller tiles. of each evaluation area as well as factors like market size and num-

In order to ensure statistically of each user‘s best throughput. ber of operators. A valid assess

P90 values specify the threshold ment month must include at least

in a statistical distribution, below 90 per cent of valid assessment

which 90 per cent of the gathe- hours (again per month and per

red values are ranging – or above operator).

Participate in our crowdsourcing

Everybody interested in becoming a part of our global crowdsourcing panel

and obtaining insights into the r eliability of the mobile network that her or his

smartphone is logged into, can most easily participate by installing and using

the “U get“ app. This app exclusively concentrates on network analysis and

is available under uget-app.com or via the adjoint QR code.

“U get“ checks and visualises the current mobile net-

work performance and contributes the results to our crowd-

sourcing platform. Join the global community of users who

understand their personal wireless performance, while con-

tributing to the world’s most comprehensive picture of the

mobile customer experience.

MOBILE REVIEW

11You can also read