Red-Hot High-Yield Bond Market Showing Signs of Restraint and Exuberance

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

ARTICLE Red-Hot High-Yield Bond Market Showing Signs of Restraint and Exuberance The U.S. high-yield (HY) bond market has come roaring back to life in 2020 after several years of playing second fiddle to the leveraged loan market. HY bond issuance exploded to more than $200 billion in 1H20, including $128 billion in 2Q20, on track for its best year ever. The same can’t be said for leveraged loans, where syndication ETF purchases through August. Nonetheless, its commitment volumes in 2Q20 were down significantly from a year ago as to support corporate credit markets should they seize up new deal flow dried up. The divergence between these two has been good enough for credit investors who continue to credit markets has been hard to miss. New HY bond issuance believe that the Fed has their back. In late July, the programs’ in 2020 has provided crucial financial lifelines to many large permitted investment period to make new purchases was businesses suddenly caught in the crosshairs of COVID-19. extended to year end from September 30, even with corporate Paving the way for this comeback, just as COVID-19 was credit markets functioning perfectly well on their own — a beginning to wreak havoc on credit markets, was the late reminder of how fragile investor confidence may still be. March announcement by the Federal Reserve Board of its Fed Chair Powell recently indicated that the Fed intends to Primary Market Corporate Credit Facility and Secondary keep base interest rates close to zero into 2023 via aggressive Market Corporate Credit Facility, two programs which purchases of Treasuries and mortgage securities. Corporate potentially represent up to $750 billion of purchases of new credit investors fully expect the Fed will backstop credit or existing bonds, including “fallen angel” corporate debt markets as a buyer of last resort when “free markets” go off and high-yield exchange-traded funds (ETFs).1 The mere the rails.2 The assumption of the Fed’s direct intervention in announcement of these programs restored confidence for private credit markets as needed is now embedded among sputtering corporate credit markets and ushered in a surge market participants. of new corporate debt issuance, including junk bonds, to Not only has new issuance soared since April, but market raise liquidity needed to withstand the pandemic’s impact. yields on high-yield bonds have nearly reverted to pre- Ironically (and surprisingly), the Fed has barely tapped these pandemic levels (Exhibit 1) from double-digit rates in two programs to date, with just $13 billion of HY bond and March — a remarkable turnaround considering how 1 https://www.federalreserve.gov/monetarypolicy/pmccf.htm 2 https://www.nytimes.com/2020/08/27/business/economy/federal-reserve-inflation-jerome-powell.html

RED-HOT HIGH-YIELD BOND MARKET SHOWING SIGNS OF RESTRAINT AND EXUBERANCE FTI Consulting, Inc. 02

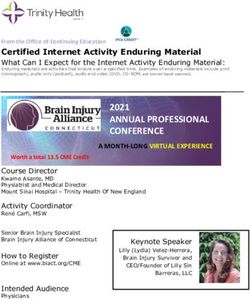

Exhibit 1 – U.S. Speculative-Grade Bond Yield-to-Worst

BB YTW B YTW CCC YTW

in %

25.00

20.00

15.00

10.00

5.00

0.00

Jan-18

Feb-18

Mar-18

Apr-18

May-18

Jun-18

Jul-18

Aug-18

Sep-18

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Source: Bloomberg

much uncertainty still pervades the corporate landscape. the opportunity to tap this market. Given the many

Embedded within this comeback story is the widely held uncertainties around the duration of the pandemic’s

expectation that 2021 will represent a return to normalcy financial effect, most impacted companies took the

for most issuers with respect to COVID-19 impacts. Financial money if it was available.

markets long ago gave most of the corporate sector a pass — However, net debt (total debt minus cash and

for 2020, but how realistic are its expectations for 2021 and equivalents) for these issuers increased by much smaller

beyond? Notable attributes of HY bond issuances to date help rates, indicating that many of these companies issued

inform that discussion. debt to raise liquidity amid the pandemic rather than

New High-Yield Bond Issuance Trends Tell a Story of for purposes of investment, acquisitions, refinancing or

Restraint and Exuberance shareholder returns. (Though for some recent issuances,

We evaluated speculative-grade bond issuances via Rule 144 it may be too soon to have deployed this capital.) In the

private placement offerings by U.S.-based public companies aggregate, net debt increased by 10% compared to the

in the recent six-month period from March through August. end of 2019, and by 7.5% on an equally weighted basis.

In all, there were 182 bond issues placed by 134 spec-grade Average net debt-to-EBITDA (again using EBITDA in

companies in this period, totaling $151 billion of issuance FY2019) for these issuers increased more moderately, to

proceeds. Some noteworthy takeaways from these issuances 3.8x from 3.5x at the end of 2019, with most companies

include the following: apparently sitting on newly raised cash. This is consistent

with the prevailing narrative that these issuers raised

— In the aggregate, new spec-grade bond issuance of $151

capital to ensure they had enough cash on hand to outlast

billion represented a 21% increase in total debt for these

the pandemic.

issuers compared to the end of 2019 — a huge uptake in

such a short period. On an equally weighted basis, total — The average S&P rating of these issuances was smack

debt increased by an average of 24% for these issuers in between a BB– and B+ rating, a reassuring indication

— again, a huge jump in just two quarters. Average that HY markets were discerning and mostly receptive to

total debt-to-EBITDA (using EBITDA in FY2019) for these better-quality junk issuances. About 55% of the issues we

issuers increased to 4.9x from 4.1x at the end of 2019. evaluated had credit ratings within the BB family, while

(The average leverage metric is likely even larger than only 15% of these spec-grade issuances were rated B– or

4.9x, as nearly 35% of issuers sold debt subsequent to below, ratings associated with “deep junk.” The high-yield

their most recent quarter end.) Credit investors are again market may have recovered impressively since March, but

in risk-on mode, and spec-grade issuers have seized its doors are not wide open to all borrowers.RED-HOT HIGH-YIELD BOND MARKET SHOWING SIGNS OF RESTRAINT AND EXUBERANCE FTI Consulting, Inc. 03

— Since the onset of COVID-19, HY investors have sought is another story entirely, with consensus EBITDA expectations

out new issues that place them higher up in the capital more than wiping out 2020’s declines and posting mid- to

structure. Historically, HY bonds issues have tended to high-single-digit gains compared to 2019; expectations

be senior unsecured or subordinated unsecured debt, for 2022 are much more bullish, with consensus EBITDA

but this year nearly 40% of the issues we evaluated were estimates expected to top those of 2019 by 26%-34% (Exhibit

senior secured debt — a notable departure from the past. 2). Such lofty expectations imply, in the aggregate, a near

— The average maturity of these 182 issues was nearly seven doubling of EBITDA by 2022 compared to 2020.

years, with 43% of new issues maturing in five years or If one were tempted to believe that these expectations aren’t

less, an indication that borrowers don’t anticipate a long- exceedingly aggressive, consider that many of these issuers

term need for this funding. The average yield at offering operate in industries hardest hit by COVID-19. In fact, 40%

date was 6.5%, while average current yield (YTM) has of the issuers we evaluated were operating in beleaguered

since fallen to 5.3% as credit markets continue to rally. industry sectors, including energy, retail & restaurants,

All in all, these findings are indicative of a HY bond market airlines & travel, and leisure & entertainment. It seems

that has been fairly disciplined even as deals are being unlikely that these industry sectors will be thriving again by

done with near abandon. However, markets are also very 2022. Moody’s and S&P expect the U.S. spec-grade corporate

optimistic regarding forward-looking operating performance, default rate to nearly double from current levels by early to

perhaps unrealistically so. It’s a given that 2020 is a washout; mid-2021, led by these very same industries. That doesn’t

consensus EBITDA estimates for the 134 issuers we evaluated exactly sound like the comeback story implied by earnings

will decrease within the range of 22%-30% vs. 2019, estimates for next year. Moreover, many recent HY borrowings

depending on whether issuers are weighted by size or equally are intended to fund operating shortfalls rather than

weighted. Moreover, 22 of these issuers are expected to investment, meaning that many of these risky issuers will be

report negative EBITDA in 2020 versus two in 2019. But 2021 considerably more leveraged by the time they arrive on the

Exhibit 2 – HY Issuers’ EBITDA % Change Compared to 2019

Total Equal Weighted

40.0% 34.8%

30.0% 26.6%

20.0%

8.6% 7.2%

10.0%

0.0%

-10.0%

-20.0%

-22.2%

-30.0%

-30.2%

-40.0%

FY2020 FY2021 FY2022

Source: S&P Capital IQ and FTI analysisRED-HOT HIGH-YIELD BOND MARKET SHOWING SIGNS OF RESTRAINT AND EXUBERANCE FTI Consulting, Inc. 04 other side of COVID. In short, there is no economic return on money borrowed to fund losses. Increasingly, the ongoing showdown between bulls and bears, optimists and pessimists, cheerleaders and realists won’t be resolved until we can glean what a post-pandemic world will really look like. Will folks again be piling into planes, hotels, casinos, malls and amusement parks by 2022? Will fossil fuels ever stage a comeback? Will a significant percentage of the workforce continue to work from home indefinitely or permanently? Will consumers be content to remain comfortably ensconced homebodies? Will the uneven recovery hobble consumer spending beyond 2020? In short, will COVID-19 alter the way most Americans choose to live after the virus is tamed? This is the fundamental debate taking place as markets wrestle with sharply conflicting views of a highly uncertain future. The HY market seems to be assuming that most of us eventually will go back to our old ways. Only time knows the answer to this one. MICHAEL C. EISENBAND Global Co-Leader of Corporate Finance & Restructuring +1 212.247.1010 michael.eisenband@fticonsulting.com The views expressed herein are those of the author(s) and not necessarily the views of FTI Consulting, Inc., its management, its subsidiaries, its affiliates, or its other professionals. FTI Consulting, Inc., including its subsidiaries and affiliates, is a consulting firm and is not a certified public accounting firm or law firm. FTI Consulting is an independent global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. FTI Consulting professionals, located in all major business centers throughout the world, work closely with clients to anticipate, illuminate and overcome complex business challenges and opportunities. ©2020 FTI Consulting, Inc. All rights reserved. www.fticonsulting.com

You can also read