MOVING TO DEVELOPMENT IN THE CARIBBEAN - TSX.V: UGD - Unigold ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

TSX.V: UGD OTCQX: UGDIF FSE: UGB1 CORPORATE PRESENTATION ⏐ CANADA

MOVING TO DEVELOPMENT

IN THE CARIBBEAN

September 2021 Precious Metals Summit Corporate Presentation

TSX.V: UGD unigoldinc.com 1Forward Looking Statements

Certain statements contained in this presentation, including statements regarding events and financial trends that may affect our future

operating results, financial position and cash flows, may constitute forward-looking statements within the meaning of the federal

securities laws. These statements are based on our assumptions and estimates and are subject to risk and uncertainties.

You can identify these forward-looking statements by the use of words like “strategy”, “expects”, “plans”, “believes”, “will”, “estimates”,

“intends”, “projects”, “goals”, “targets”, and other words of similar meaning. You can also identify them by the fact that they do not relate

strictly to historical or current facts. We wish to caution you that such statements contained are just predictions or opinions and that

actual events or results may differ materially.

The forward-looking statements contained in this document are made as of the date hereof and we assume no obligation to update the

forward-looking statements, or to update the reasons why actual results could differ materially from those projected in the forward-

looking statements. Where applicable, we claim the protection of the safe harbour for forward-looking statements provided by the

(United States) Private Securities Litigation Reform Act of 1995.

Core drilling is being done primarily with NQ. Samples are logged, split by wet diamond saw, and half sent for assaying with the other

half stored on site. Sample lengths typically average 1 m but vary by geological boundaries. QA/QC included inserting certified

standards and blanks into the sample stream at industry standard intervals. Samples are prepped by Bureau Veritas Labs in the

Dominican Republic, with assaying performed through Bureau Veritas’ laboratory in Vancouver, Canada. Analytical procedures include a

35-element ICP-ES analysis (MA-300) and a 50 g FA AA finish for gold (FA450). Wes Hanson, P.Geo., COO, and a Qualified Person under

National Instrument 43-101, has reviewed and approved the contents of this presentation.

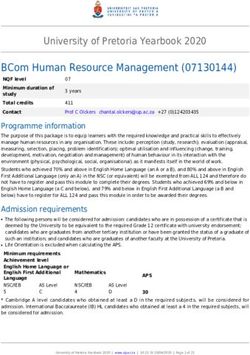

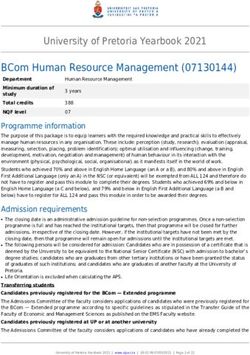

TSX.V: UGD unigoldinc.com 2WHY INVEST IN UNIGOLD

OXIDE PROJECT PROVEN, FIELD

Stand alone oxide TESTED HYPOTHESIS

project has 91,000 oz and understanding

of M&I resources in of the geology of ore

completed PEA body with over

showing 35% after tax 145,000 m drilled to

IRR date

CURRENT RESOURCES SULPHIDE PROJECT HIGHER GRADE

Measured and 2.2 million ounce MINERALIZATION

Indicated (“M&I”) resource has a Approximately

Resources containing number of treatment 700,000 oz of

1,158,000 ozs Au and options sulphide resources

an additional Inferred

average over 4 g/t

Resource containing

1,099,000 ozs Au

TSX.V: UGD unigoldinc.com 3CAPITAL STRUCTURE

TSX.V: UGD OTCQX: UGDIF

Market Capitalization CAD $16 million

Shares Outstanding 156 million

Warrants (Jun 2022, avg $0.29) 31 million

Options (avg. $0.30) 9.5 million

Fully Diluted 197 million

52 week Hi - Low $0.51 / $0.0

Shareholders

Eric Sprott (undiluted) 14%

Phoenix Gold Fund 8%

Officers and Directors 8%

TSX.V: UGD unigoldinc.com 4DOMINICAN REPUBLIC

Pueblo Viejo,

Falcondo,

Neita Concession Cerro de Maimon

• Diversified economy,

“upper middle income”

economy, largest economy

in Caribbean and Central

America

• Home to the largest gold

mine in Latin America:

Pueblo Viejo – a Tier 1

asset

• Established mining law,

taxation and regulations

• Good infrastructure,

0 20

km

power, workforce, roads,

telecommunications, etc.

TSX.V: UGD unigoldinc.com 5NEITA CONCESSION

EXPLORATION CONCESSIONS awarded

1

for 3 years - owner may apply for two

(2) extensions, each automatic

extension allows one year of additional

exploration;

2 EXPLOITATION CONCESSIONS awarded

for 25 years with two 25-year

extensions

3 Concession holder has advance period

to re-apply for existing concessions on

expiration;

Current exploration license granted

4

May 2018; Expiry is May 2023

Candelones Project – Inferred Mineral Resources Au and Cu

Au targets

Cu targets

TSX.V: UGD unigoldinc.com 62021 Mineral Resource Estimate (effective date May 10, 2021)

Au oz

Mining Method Mineralization Type Category Tonnes (x1,000) Au g/t Strip Ratio

(x1,000)

Measured 1,851 0.82 49

Oxide (Heap Leach)

Indicated 1,616 0.82 42

OXIDES Total Measured + Indicated 3,467 0.82 91 0.13

Open Pit

Oxide (Heap Leach) 1,154 0.6 22

Inferred

Transition (Heap Leach) 478 0.87 13

Total Inferred 1,632 0.68 36

NSR$ Cut- Tonnes AuEq AuEq oz Au oz Ag oz Cu lb Waste

Mining Method Category Au g/t Ag g/t Cu %

off (x1,000) g/t (x1,000) (x1,000) (x1,000) (x1,000) Ratio

SULPHIDES M+I 20 19,378 1.82 1.56 3.89 0.14 1,137 974 2,425 59,243

6.24

Open Pit Inferred 20 23,042 1.52 1.35 2.59 0.09 1,125 1,004 1,916 43,229

SULPHIDES M+I 77 1,107 3.02 2.56 2.02 0.27 107 91 72 6,488

Underground Inferred 77 755 2.67 2.38 2.31 0.16 65 58 56 2,649

Total Measured and Indicated 20,484 1.89 1.62 3.79 0.15 1,244 1,065 2,497 65,731

Total Inferred 23,797 1.55 1.39 2.58 0.09 1,190 1,063 1,972 45,878

See the Appendix of this presentation for the complete disclosure regarding this Resource Estimate with accompanying notes

TSX.V: UGD unigoldinc.com 7CANDELONES DEPOSIT

Significant Intersections from drilling 2016-2020

Target A Target B Target C

• 30.0 m @9.02 g/t Au, 0.6% Cu • 18.5 m @ 10.18 g/t Au, 1.52% Zn

• 34.9 m @ 6.19 g/t Au, 0.6% Cu • 7.0 @ 21.9 g/t Au, 2.7% Cu • 15.8 m @ 11.36 g/t Au, 0.4% Cu

• 34.0 m @ 4.15 g/t Au, 0.4% Cu • 15 m @ 16.36 g/t Au, 2.6% Cu • 12 m @ 9.7 g/t Au, 7 g/t Ag, and 1.6% Zn

• 22 m @ 6.93 g/t Au, 0.6% Cu • 2 m @ 19.62 g/t Au • 10.5 m @ 12.94 g/t Au, 15.6 g/t Ag,

• 21.2 m @ 6.0 g/t Au, 0.9% Cu • 24.4 m @ 3.2 g/t Au, 14 g/t Ag, • 10 m @ 6.71 g/t Au, 0.7% Cu

• 24 m @ 4.59 g/t Au, 0.54% Cu • 24 m @ 4.59 g/t Au, 0.54% Cu • 9.5 m @ 14.4 g/t Au, 46.6 g/t Ag, 1.5% Zn

• 23.7 m @ 6.03 g/t AU, 0.31% Cu • 22m @ 5.67 g/t Au • 9.0 m @ 16.48 g/t Au, 57.7 g/t Ag, 0.8% Zn

• 25 m @ 5.67 g/t Au, 0.4% Cu • 23.7 m @ 6.03 g/t Au, 0.31% Cu • 8 m @ 6.30 g/t Au,я17 g/t Ag

• 17 m @ 7.31 g/t Au, 1.22% Cu • 16.60 m @ 3.37 g/t Au, • 7 m @ 8.86 g/t Au, 37 g/t Ag

• 15.7 m @ 7.45 g/t Au, 1.1% Cu 12.96 g/t Ag, 0.30% Cu, • 4.6 m @ 3.4 g/t Au, 56 g/t Ag, and 0.9% Zn

• 15.3 m @ 5.75 g/t Au, 0.52% Cu 2.13% Zn • 4 m @ 9.67 g/t Au, 0.1% Cu

• 12 m @ 6.95 g/t Au, 0.86% Cu • 4 m @ 10.1 g/t Au, 21 g/t Ag, and 2.4% Zn

• 9.0 m @ 4.81 g/t Au, 0.7% Cu • 3.3 m @ 5.06 g/t Au, 90 g/t Ag

• 9.0 m @ 11.9 g/t Au, 2.0% Cu • 3 m @ 10.7 g/t Au, 2.1% Cu

• 6 m @ 6.05 g/t Au, 0.8% Cu

• 5.7 m @ 5.07 g/t Au, 2.5% Cu

• 5.7 m @ 12.1 g/t Au, 1.2% Cu

TOGETHER TARGET A, B, C DEFINE OVER 1.5 KM OF STRIKE EXTENT

TSX.V: UGD unigoldinc.com 8CANDELONES DEPOSIT

There are

16 m @ 10.78 g/t Au

two distinct

projects at

Candelones:

• Oxides at

surface

Candelones Main: Oxides and

• Sulphides underlying sulphides

to the

east Ap

pr

ox

.3

Km

Candelones Extension:

Sulphides, possible

oxides further to the east

TSX.V: UGD unigoldinc.com 9OXIDE TARGET

Capital and Operating Cost Estimates

Production Summary

Total mineralized material mined (000 t) 5,275

Total Waste (000 t) 963

Average grade (Au g/t) 0.75

Total gold contained (oz) 126,989

Total gold produced (oz) 95,587

Total gold payable after royalty (oz) 90,116

Average Gold recovery (%) 75%

Average annual gold produced (oz) 31,040

Capital Cost Estimate (US$M) Pre-Production Sustaining Total

Mining 1.84 0.43 2.27

ADR Processing Plant 11.84 11.84

Infrastructure 12.86 12.86

EPCM, Indirects, Owners Costs 5.18 5.18

Subtotal 31.72 0.43 32.15

Contingency 4.76 4.76

Total Capital Costs 36.48 0.43 36.91

Unit Operating Cost (per tonne) US$/t

Mining $3.22

Processing $5.97

General & Administration $1.93

Refining, delivery, royalty $1.64

Total operating cost per tonne $12.76

All-in Sustaining Cost (US$/oz)** $744

** All-in Sustaining Costs are presented as defined by the World Gold Council less Corporate G&A

TSX.V: UGD unigoldinc.com 10OXIDE TARGET

PEA Economic Summary and Sensitivities

60.0

PEA Summary Financial Results @ $1650/oz gold US$M 50.0

LOM Net Smelter Return Revenue $150

Total LOM Pre-Tax Cash Flow $90

40.0

Average Annual Pre-Tax Cash Flow $29

NPV (US$ millions)

LOM Income Taxes $16

Total LOM After-Tax Free Cash Flow after Capital $34 30.0

Average Annual After-Tax Free Cash Flow from Operations $23

Discount Rate (%) 5% 20.0

Pre-Tax 5% NPV $41

Pre-Tax IRR 50.3 %

10.0

After-Tax 5% NPV $26

After-Tax IRR 34.9 %

After-Tax Payback after start of production (Months) 22 .0

Cautionary Statement - The reader is advised that the PEA summarized in here is intended to

provide only an initial, high-level review of the project potential and design options. The PEA mine

plan and economic model include numerous assumptions and the use of inferred mineral (10.0)

resources (27% of production). Inferred mineral resources are considered to be too speculative to 75% 80% 85% 90% 95% 100% 105% 110% 115% 120% 125%

be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. There is no

guarantee that inferred mineral resources can be converted to indicated or measured mineral Revenue drivers (.1) 5.2 10.5 15.7 21.0 26.3 31.6 36.9 42.2 47.4 52.7

resources, and as such, there is no guarantee the project economics described above will be

achieved. Operating costs 36.0 34.1 32.1 30.2 28.3 26.3 24.4 22.4 20.5 18.5 16.6

Capital costs 35.5 33.7 31.8 30.0 28.2 26.3 24.5 22.6 20.8 18.9 17.1

TSX.V: UGD unigoldinc.com 11OXIDE TARGET

Candelones Hill Looking South

Open Pit Area Heap Leach

Area

TSX.V: UGD unigoldinc.com 12SULPHIDE TARGET

1.07 million ounces oz Measured and Indicated Resource, plus an additional 1.06 million oz Inferred

1

Resource (pit-optimized)

2 66% conversion of 2013 pit optimized inferred resource into Measured and Indicated material

3 Sulphide Flotation in all types of mineralization shows recoveries between 92% and 97%

Phase 1 metallurgy shows that high-grade (+3 g/t) sulphide material is amenable to gravity-float-leach

4 recovery process with 85% to 90% leach recovery; low grade material can be leached but with 30% to 45%

recoveries; agitated leach shows better recoveries

Phase 2 metallurgical program underway to test possible improvements in leaching and to develop a

5

process flowsheet

PRELIMINARY METALLURGICAL TESTING – Basis for Resource Estimates

Agitation Leaching Flotation Concentrate for Sale Autoclave Treatment

Average Estimated Average Estimated Average Estimated

Total Total Total

Recovery Payable Recovery Payable Recovery Payable

Gold 63.0% 99.5% 63% 93% 90% 84% 93% 99% 92%

Silver 42.0% 95.0% 40% 92% 60% 55% 92% 81% 75%

Copper 0.0% 0.0% 0% 97% 90% 87% 97% 88% 85%

80% passing 75 μm Basis for Resource Estimate

Produces doré on site Produces 2 concs for sale On-site autoclave

TSX.V: UGD unigoldinc.com 13REGIONAL EXPLORATION

• Airborne Geophysical surveys completed in 2007

• Soil Geochemical Surveys completed and infilled between 2002 and 2010

• Mapping, grab sampling and trenching between 2002 and 2014

• 15 Gold +/- Copper targets have been identified to date

• 5 Copper targets identified to date

TSX.V: UGD unigoldinc.com 14HISTORIC REGIONAL EXPLORATION - DRILLING

Target # DH meters 35000

Candelones Extension 178 71,724

Candelones Main 184 29,544 Vall e Simon

30000 Rancho Pedro

Candelones Connector 65 8,449

Pan de Azucar

Rancho Pedro 23 6,091

Palo Quemado

Montazo 19 4,750

Gold +/- Copper targets

25000 Other

Juan del Bosque 22 4,404 Noisy

Guano 14 2,682 Naranja

Montazo

Loma de Montazo 7 1,974 20000

Mariano Cestero

Noisy 10 1,690

Loma de Montazo

Kilometro 6 5 1,229 Kilometro 6

Pan de Azucar 2 388 15000 Juan del Bosque

Gina Mocha 1 298 Jimenez

Guano

Naranja 2 210

10000 Gina Mocha

Valle Simon 1 185

Cruz de Cabrera

Cruz de Cabrera 1 112 Corozo

Corozo 10 1,880 Candelones Main

5000

Copper

Targets

Mariano Cestero 4 1,061 Candelones Extension

Jimenez 4 1,045 Candelones Connector

Palo Quemado 1 176 0

1990 1998 2003 2004 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2019 2020

Grand Total 553 137,890

TSX.V: UGD unigoldinc.com 15REGIONAL EXPLORATION TARGETS

14 other Regional gold targets include

high amplitude gold-in-soil anomalies,

gold pathfinder element anomalies and

coincident large IP conductivity/resistivity

anomalies

MGN area

• Rock and Grab samples returned up to

10 g/t

• Rhyolites and Quartz-feldspar porphyry

intrusives outcrop

• Trenching returned up to 10 m @ 4.1 g/t

gold

• Short drillholes in 2010/2013 returned

disseminated mineralization with

barite/anhydrite enrichment

TSX.V: UGD unigoldinc.com 16Surface Geochemistry Compilations

Neita Fase II Concession • Dominican Republic

Volcanic center

marked by:

• Zone of magnetite CALCIUM

destruction (low

magnetic response)

due to reworking

and explosive

Airborne Magnetics Copper in Soil

activity

• Coincident Copper,

Moly and Al:Ti highs

are consistent with

the location of a

volcanic intrusive

halo

Molybdenum in Soil Aluminum:Titanium in Soil

TSX.V: UGD unigoldinc.com 17Surface Geochemistry Compilations

Neita Fase II Concession • Dominican Republic • 2007 to 2012

GOLD

1

Six cohesive gold-in-soil

anomalies have been identified

GOLD in Soils 10 Km

around the perimeter of an GOLD

interpreted volcanic center MGN area

2 Only Candelones has seen any

QFP AND RHYOLITE

significant drilling PLUG

Rancho Pedro and Juan De

3 Interpeted

Bosques are at least partially JUAN DE BOSQUES

Volcanic

covered by limestone to the south Km6

Center area

area

and have chargeability highs

4

MGN has coincident mag high,

arsenic and copper anomalies LOMA DE

MONTAZO area

RANCHO PEDRO

5 Loma de Montazo is the largest, area

highest amplitude IP anomaly on CANDELONES

1.15 MM oz M&I

the property 1.1 MM oz Inferred

TSX.V: UGD unigoldinc.com 18Surface Geochemistry Compilations

Neita Fase II Concession • Dominican Republic • 2007 to 2012

ARSENIC

GOLD PATHFINDERS:

ARSENIC IN SOIL ARSENIC

Arsenic is generally very

low in the Candelones

deposits but can build up

QFP AND

in residual soils on top of RHYOLITE PLUG

gold deposits through

redeposition in the

weathering profile

TSX.V: UGD unigoldinc.com 19Surface Geochemistry Compilations

Neita Fase II Concession • Dominican Republic • 2007 to 2012

GOLD PATHFINDERS:

BARIUM IN SOIL

Barite (BaSO4) can form

large halos above gold

deposits. Sulphate

complexes are some of

the best solutions for

transporting gold in

hydrothermal systems.

Large barium anomalies

may mark hydrothermal

centers.

TSX.V: UGD unigoldinc.com 20Surface Geochemistry Compilations

Neita Fase II Concession • Dominican Republic • 2007 to 2012

GOLD PATHFINDERS:

ZINC+LEAD IN SOIL

Zinc and Lead are

commonly found as

sphalerite (ZnS) and

galena (PbS) minerals in

gold deposits. Both

elements are relatively

immobile in surface

environments and can be

used as effective

pathfinders for gold

deposits.

TSX.V: UGD unigoldinc.com 21REGIONAL EXPLORATION TARGETS

14 other Regional gold targets include

high amplitude gold-in-soil anomalies,

gold pathfinder element anomalies and

coincident large IP conductivity/resistivity

anomalies

Jimènez - Neita area

• Mitsubishi Metals conducted mapping

and short scout drilling (7 DDHJimènez - Neita area

Neita Fase II Concession • Dominican Republic

The Jimenez-Neita area is

approximately 3 km long

and contains multiple CALCIUM

showings of copper veins,

up to 1 metre wide, in

basaltic rocks on the edge

of an intermediate

intrusion.

The last period of

exploration in this area

was in the 1970s, when

Mitsubishi placed 7 short

drill holes into the area.

No modern exploration

has been conducted in the

area. A north-south tending copper vein from the Neita showing with intense copper oxide staining.

TSX.V: UGD unigoldinc.com 23Jimènez - Neita area

Neita Fase II Concession • Dominican Republic

Grab sample (sawn surface) from Neita showing:

secondary quartzCALCIUM

with chalcocite and malachite

Grab sample (sawn surface) from Neita showing:

malachite, chalcopyrite, bornite, azurite

TSX.V: UGD unigoldinc.com 242021 Potential Price Catalysts

Q1 2021 Q2 2021 Q3 2021 Q4 2021

• Complete PEA

• Commence application process for exploitation license

Oxide • Commence BFS/ESIA

Resource

• Continue Oxide exploration programs

• Assemble final permits

• Update Resource estimate

Sulphide • Complete phase 2 metallurgical studies to finalize a process design

Resource • Complete trade-off studies for OP vs UG

• Continue exploration drilling to depth and along strike

Explore • Prioritize regional targets, complete compilations

Regional • Exploration drilling and Assessment

Targets

• Continue with local community engagement programs

CSR • Finalize sustainability framework

Programs

• Initiate national engagement program

TSX.V: UGD unigoldinc.com 25APPENDIX: SUPPLEMENTAL INFORMATION

Conceptual Geologic Model

Resource Statements

Management and Board Biographies

Unigold Website

Unigold SEDAR filings

TSX.V: UGD unigoldinc.com 26Stage 1

Silica rich tuffite SEA WATER Bedded sulphides

Candelones Deposit Brecciated and Massive

Conceptual Model Sulphides

Large massive sulphide mounds are Paleoseafloor

generally formed on the seafloor under high

confining pressures, sometimes venting

DACITE VOLCANICS /

directly to seawater (black smokers), and VOLCANOCLASTICS

sometimes diffusing through sediments to

form replacement deposits

Sericite Alteration

Stockwork

Chlorite Alteration

TSX.V: UGD unigoldinc.com 27Stage 2

Synchronous dacite layer

Candelones Deposit Diffuse VMS Zn, Pb,

Ag, Cu, Au

up to 150m thick deposited

as VMS enrichment is

mineralization ongoing

Conceptual Model SEAWATER

At Candelones, disseminated mineralization

seems to have diffused through dacitic

composition sediments in shallow water with DACITES

low confining pressures.

Continuing volcanism deposited less porous

volcanoclastic andesites above the dacites, VMS vents poorly

sealed the dacites and increased confining altered due to lack

of confining

pressures and temperatures pressure ANDESITES

DACITES

TSX.V: UGD unigoldinc.com 28Stage 3

ANDESITES

Candelones Deposit

Conceptual Model

A prolonged period of volcanism, earthquakes,

thrusting, cross faulting and island arc tectonics

tilted the strata….

DACITES

ANDESITES

….and opened up new pathways for the

mineralizing events to overprint existing deposits.

DACITES

TSX.V: UGD unigoldinc.com 29Candelones

Stage 4 Main Candelones Candelones

Connector Extension

Candelones Deposit

Conceptual Model ANDESITES

A late stage of intermediate epithermal

mineralization, driven by continuing

volcanism utilized new pathways and Target A

created new mineral assemblages and Au-Cu MS

zoning which overprints all previous DACITES

mineralization and fills permeable Target

C

structures with a mixed sulphide matrix Target

B

TSX.V: UGD unigoldinc.com 302021 Mineral Resource Estimate (effective date May 10, 2021)

Au oz

Mining Method Mineralization Type Category Tonnes (x1,000) Au g/t Strip Ratio

(x1,000)

Measured 1,851 0.82 49

Oxide (Heap Leach)

Indicated 1,616 0.82 42

OXIDES Total Measured + Indicated 3,467 0.82 91 0.13

Open Pit

Oxide (Heap Leach) 1,154 0.6 22

Inferred

Transition (Heap Leach) 478 0.87 13

Total Inferred 1,632 0.68 36

NSR$ Cut- Tonnes AuEq AuEq oz Au oz Ag oz Cu lb Strip

Mining Method Category Au g/t Ag g/t Cu %

off (x1,000) g/t (x1,000) (x1,000) (x1,000) (x1,000) Ratio

Measured 20 6,280 2.22 1.90 3.28 0.18 449 383 662 25,042

SULPHIDES Indicated 20 13,098 1.63 1.40 4.18 0.12 688 591 1,762 34,201

6.24

Open Pit M+I 20 19,378 1.82 1.56 3.89 0.14 1,137 974 2,425 59,243

Inferred 20 23,042 1.52 1.35 2.59 0.09 1,125 1,004 1,916 43,229

Measured 77 759 3.15 2.65 1.88 0.29 77 65 46 4,836

SULPHIDES Indicated 77 348 2.73 2.35 2.32 0.22 31 26 26 1,652

Underground M+I 77 1,107 3.02 2.56 2.02 0.27 107 91 72 6,488

Inferred 77 755 2.67 2.38 2.31 0.16 65 58 56 2,649

Total Measured and Indicated 20,484 1.89 1.62 3.79 0.15 1,244 1,065 2,497 65,731

Total Inferred 23,797 1.55 1.39 2.58 0.09 1,190 1,063 1,972 45,878

See Accompanying Notes on the following page

TSX.V: UGD unigoldinc.com 31Notes relating to Mineral Resource Estimate

1. Mineral resources were estimated by Mr. W. Lewis, P.Geo. and Mr. A. San Martin, MAusIMM(CP) of Micon International Limited. (“Micon”), a Toronto based consulting

company, independent of Unigold. Both Mr. Lewis and Mr. San Martin meet the requirements of a “Qualified Person” as established by the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (“the CIM Standards”). The mineral resource estimate has an

effective date of May 10, 2021.

2. The mineral resource estimate is based on a long-term gold price of US$ 1,700 per ounce and economic cut-off grades of 0.28 g/t Au (OXIDE PIT), 0.49 g/t Au (TRANSITION),

0.66 g/t Au (SULPHIDE – OPEN PIT) and 1.90 g/t Au (SULPHIDE – UNDERGROUND). Pit constrained resources are reported within an optimized pit shell; underground

resources are reported within continuous and contiguous shapes which lie adjacent to and below the ultimate open pit shell and interpreted to be recoverable utilizing

standard underground mining methods. NSR cut-offs are based on silver prices of $20.00 per ounce and copper prices of $4.00 per pound. The estimate assumes the

following metallurgical recoveries that are based on completed test work to date: Oxide 80%, Transition 50%, and Sulphide 84%.

3. The estimate assumes the following costs: Mining (Pit) US$ 2.35/tonne, Mining (Underground) US$ 60.00 Oxide Processing (Heap Leach) US$7.40 / t, Transition Processing

(Heap Leach) US$ 7.40/t, Sulphide Processing US$ 25.00/t ((Leach) and G&A US$ 2.39/t.

4. The pit constrained resource is reported within an optimized pit shell that assumed a maximum slope angle of 45 degrees.

5. Open pit mining recovery was assumed to be 100%. Open pit dilution was assumed to be 0%. Underground mining recovery was assumed to be 100%. Underground dilution

was assumed to be 0%.

6. Micon has not identified any legal, political, environmental or other risks that could materially affect the potential development of the mineral resource estimate.

7. The mineral resource estimates are classified according to the CIM Standards which define a Mineral Resource as “a concentration or occurrence of solid material of

economic interest in or on the earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location,

quantity, grade or quality, continuity and other characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge

including sampling. Mineral resources are sub-divided, in order of increasing geological confidence, into inferred, indicated and measured categories. An inferred mineral

resource has a lower level of confidence than an indicated mineral resource. An indicated mineral resource has a higher level of confidence than an inferred mineral

resource but has a lower level of confidence than a measured mineral resource.“

8. The CIM Standards define a Measured and Indicated Mineral Resource as: “that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical

characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the

economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume

geological and grade or quality continuity between points of observation.”

9. The CIM Standards define an Inferred Mineral Resource as: "that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited

geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a

lower level of confidence than that applying to an indicated mineral resource. It is reasonably expected that the majority of inferred mineral resources could be upgraded to

indicated mineral resources with continued exploration.“

10. All procedures, methodology and key assumptions supporting this mineral resource estimate shall be fully disclosed in a Technical Report that will be available on SEDAR and

the Company’s website on or about May 31, 2021

The reader is reminded that mineral resources are not mineral reserves and therefore do not have demonstrated economic viability.

TSX.V: UGD unigoldinc.com 32MANAGEMENT

Joseph Hamilton, P. Geo, CFA Wesley C. Hanson, P. Geo. Donna McLean

Chairman of the Board of Directors Chief Operating Officer Chief Financial Officer and

and Chief Executive Officer Secretary

Joe is a Professional Geologist with over 30 years of Wes joined Unigold's team in March 2013. Wes brings Donna has over 30 years’ experience

experience in mineral exploration, capital markets over 32 years of industry experience , including working with numerous publicly traded

and mine development. Joe has been involved in all exploration, mine development, mine operations, and private companies, specializing in

facets of the mineral development cycle from early project evaluation and financing. Wes was President the areas of financial reporting, controls

stage generative exploration to resource definition, and CEO of Noront Resources (2009 -- 2012), VP Mine and administration. She has served as

feasibility studies, environmental permitting, Development, Western Goldfields / Silver Bear CFO for several junior mineral

community consultations, project financing, and Resources (2006 through 2009), Director Technical exploration companies.

construction management. Joe has managed base Services, Kinross Gold (2002-2006) and Project

metal and gold projects in North America, Latin Geologist, SNC-Lavalin Engineers and Constructors

America and Africa. In addition to being a

Professional Geologist in Ontario, Joe is a

(1999-2002). Wes has also served on the Board of

Directors for Noront, Cobriza Metals and St. Eugene

Helga Fairhurst

Chartered Financial Analyst, a member of the CFA Mining. Earlier in his career, Wes supervised Corporate Secretary

Institute and a member of the Institute of numerous gold exploration projects throughout

Helga has over 12 years of experience

Corporate Directors. northern Canada and the US, many of which

successfully advanced from exploration projects with providing corporate secretarial and

through mine development and construction into administrative services to public

commercial operation. Wes graduated from Mount companies listed on the TSX, TSXV, and

Allison University in 1982 with a Bachelor of Science CSE within the mining industry. She has

worked for several mineral exploration

degree in Geology.

companies including U.S. Silver

Corporation (now U.S. Silver and Gold

Inc.), Carlisle Goldfields Limited and

Idaho Champion Gold Mines Canada

Inc.

TSX.V: UGD unigoldinc.com 33BOARD OF DIRECTORS

Joseph Hamilton, Charles Page, Joseph Del Campo, CPA, CMA Steven Haggarty, P.Eng. Normand Tremblay

P. Geo, CFA M.Sc., P.Geo. Director Director Director

Chairman of the Board of Lead Director Audit Committee Chairman Mr. Haggarty is the Managing Mr. Tremblay is the former

Directors and Chief Executive In addition to being a Mr. Del Campo holds Chartered Director of Haggarty Technical CEO of United Bottles &

Officer Professional Accountant (CPA) Services Corp., a consulting Packaging of Laval, Quebec.

Professional Geologist, Mr.

Mr. Hamilton is a Professional Page has acted as senior and Certified Management engineering company providing

Geologist with over 35 years of officer, director and CEO for Accountant (CMA) designations. project, process and risk

experience in mineral several publicly traded junior He began his career with management services to the

exploration, capital markets and resources companies. Over Falconbridge Limited and spent mining industry. Prior to forming

mine development. Mr. the past 30 years, Mr. Page over 19 years working within the Haggarty Technical Services, Mr. Jose Acero

Hamilton has been involved in has developed, organized and Falconbridge group of companies Haggarty had a lengthy 40 year

Director

all facets of the mineral implemented major at progressive financial positions, career with companies including

development cycle from early including Controller and Barrick Gold, Homestake Mining, Mr. Acero is a residient of the

exploration projects in several

stage generative exploration to Treasurer of Falconbridge International Corona and Teck Dominican Republic. He has

mining camps in Canada and

resource definition, feasibility Dominicana, a ferronickel Corporation. His metallurgical 20 years of experience as

in the Republic of Cuba. He is

studies, environmental operation in the Dominican background and operational metal trader. He holds a

familiar with all aspects of

permitting, community Republic; and Falconbridge Gold experience includes copper, business degree from the

exploration from grass-roots

consultations, project financing, Corporation, a gold mining molybdenum, gold, silver and PGM Universidad Nacional Pedro

projects to feasibility studies,

and construction management. company with operating mines in group metals at mining operations Henriquez Ureña in Santo

production and mine closure.

Mr. Hamilton has managed base Africa and Timmins, Ontario. involving copper SX-EW, flotation, Domingo, DR. Mr. Acero sits

His primary geological

metal and gold projects in North Over the past 20 years, Joseph heap leaching, pressure oxidation, on the Management Board of

expertise is in Precambrian

America, Latin America and has been a Director and Vice roasting and CIL recovery plants. the Dominican Electric

gold and base metal,

Africa. In addition to being a President, Finance and Chief Mr. Haggarty is a member of the Transmission Company

epithermal gold, porphyry

Professional Geologist in Financial Officer (CFO) of a Professional Engineers of Ontario (ETED)

copper-gold and

Ontario, Mr. Hamilton is a disseminated gold deposits. number of junior exploration and the Canadian Institute of

Chartered Financial Analyst, a He is also a director of Osisko companies listed on the TSX and Mining and Metallurgy. He is a

member of the CFA Institute Gold Royalties Ltd. TSX Venture Exchange. graduate of McGill University with

and a member of the Institute of a degree in Metallurgical

Corporate Directors. Engineering.

TSX.V: UGD unigoldinc.com 34TSX.V: UGD unigoldinc.com

CONTACT

INFORMATION

Ste. 2100 – 401 Bay St.

Joseph Hamilton P.O. 55

Chairman & CEO Toronto, Canada M5H 2Y4

jhamilton@unigoldinc.com

unigold@unigoldinc.comYou can also read