Fund Domiciles and Regulation - hot spots Destination - Alter Domus

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Fund Domiciles and Regulation

July/August 2021 • perenews.com

Destination

hot spots

What factors

are influencing

managers’

choices?Analysis

K E Y N O T E I N T E R V I E W

Ireland opens the door for

funds growth

A new funds regime will enable the domicile to compete for business in post-Brexit

Europe, suggest Alter Domus’s Anita Lyse and Ronan O’Donoghue

Managers of international capital in the Irish Limited Partnership (ILP)

SPONSOR

Europe with fund vehicles in the UK regime and some associated regula-

ALTER DOMUS

were forced by Brexit to search for an tory changes for private funds have

EU domicile for their funds in order to now made Ireland a real contender in

maintain their ability to market to the

continent’s investors. Ireland was per-

haps an obvious choice but did not see

Q How has Ireland fared so

far in winning post-Brexit

business from private real

Europe as a fund domicile when com-

pared with the Luxembourg SCSp, and

with the partnership structures availa-

the momentum expected with many estate funds? ble in the UK and Cayman.

going to Luxembourg. Anita Lyse: Ireland, as an Eng-

Alter Domus’s Anita Lyse, head of lish-speaking country with many cul- Ronan O’Donoghue: Those changes

real estate, and Ronan O’Donoghue, tural and legal similarities to the UK, is came into force in February this year,

head of AIFM Ireland and real estate well positioned at a high level. But in so the tools they provide were not

leader for Ireland, explain how regu- the wake of Brexit, we didn’t see sig- available to managers while they were

latory changes are forcing a reassess- nificant volume in private real estate planning their post-Brexit arrange-

ment of the domicile’s appeal, and why funds outside of those investing in Irish ments over the past four years.

alternative investment industry service real estate. This was principally owing Before Brexit, many managers had

provision businesses such as theirs are to the local funds regime lacking align- established fund structures in Luxem-

now expanding their operations in ment with typical strategies and me- bourg, so it was natural to move their

Ireland. chanics seen in private funds. However, Alternative Investment Fund Managers

28 PERE • July/August 2021Analysis

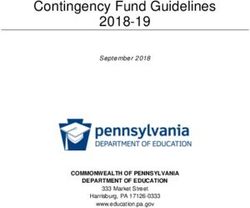

Growth of Irish-registered Qualifying Investor Alternative Investment Funds

Net assets (€bn) No of funds (inc sub-funds)

Directive (AIFMD)-regulated manage- 800 3,000

ment companies from the UK to Lux-

embourg, too. Meanwhile, Ireland’s 700 2,750

Partnership Act was quite restrictive.

600 2,500

Managers were unable to set up part-

nerships of the kind commonly used

500 2,250

in private real estate investment, and

regulatory rules didn’t allow for funds 400 2,000

with features like multiple closings, al-

lowing investors to come in at values 300 1,750

different to NAV, and the normal in-

200 1,500

centive structures. That made Ireland

uncompetitive as a domicile in a Euro-

100 1,250

pean context.

0 1,000

AL: When the UK left the EU, it 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Mar

2021

became a third-party country, so

managers could no longer use their Source: Irish Funds

UK-domiciled AIFM to manage an

EU fund. And those AIFMs are no created a tax-transparent Irish part- necessarily the biggest factor. And

longer able to use the AIFMD passport nership, which can exist as an um- some may point to cultural fit. But

to market their fund to EU investors. brella with segregated sub-funds. It’s one of the biggest attributes Ireland

That’s problematic because there a regulated product which can receive has is its good availability of well-ed-

are a lot of very large insurance compa- 24-hour regulatory approval from ucated labor. We set up a central op-

nies and pension funds based in the EU the Central Bank of Ireland, subject erations center in Cork, Ireland’s

that many UK-based managers rely on to some exceptions depending on the second-biggest city, partly because it

as sources of capital. During the period strategy. has two large universities and a good

following the 2016 referendum on EU The ILP is very comparable with community of financial services firms.

membership, managers increasingly set the limited partnerships available in the Availability of talent will also in-

up their own AIFM in the EU to en- UK, Cayman and Delaware, or Luxem- fluence managers’ decisions on where

sure their EU operations could contin- bourg. In addition, the Central Bank they will set up their own offices. Those

ue uninterrupted post-Brexit. of Ireland issued updated guidance on that already have well-established op-

At the same time, there’s been a sig- closed-ended AIFs in late 2020. The erations in Luxembourg will probably

nificant initiative under ESMA to en- new regulations are a game-changer remain there because to change that is

sure AIFMs have sufficient substance, because they provide a toolkit for pri- like turning a supertanker. However,

so we see it’s become quite costly and vate equity partnerships domiciled in for those starting with a blank sheet

time-consuming for managers to set up Ireland in real estate, debt, infrastruc- of paper, it will be possible to compare

their own AIFM. Consequently, lots of ture and other alternative asset classes. Ireland and Luxembourg in the future

them chose to use third-party AIFMs The changes to Irish partnership to see which works best for them. Then

managed by specialist administrators law will be more relevant to real es- factors start to come into play like hav-

like Alter Domus, and we’ve likewise tate investors and managers making ing existing connections with Ireland,

just established our second third-party domiciliation decisions in the future, closer cultural fit or being part of a

AIFM outside of Luxembourg in Ire- because now they have more options. larger company that already has em-

land to support this. Over the coming months and years, ployees working here in other sectors.

it will be proven to what extent Ireland

Q What difference will

those changes to Irish

partnership law make to its

will work for them in terms of tax ef-

ficiency, access to professional support

and relationships with the regulator.

Q What impact will the

imminent changes to

funds marketing in the EU have

attractiveness as a domicile? But Ireland has many ingredients to on domiciliation choices?

RoD: There’s a lot of excitement about make it attractive. People talk about RoD: Until now, many non-AIFMD

the impact going forward. They’ve the language advantage, but it’s not authorized managers have relied on

July/August 2021 • Fund Domiciles and Regulation 29Analysis

“The new Irish

reverse solicitation to market their managers and investors is essential. But

funds. It’s a subtle arrangement where Limited Partnership a domicile also needs skilled people to

manager and investor have conversa- run these structures day to day.

tions about ideas for potential funds, regime has now There are clear differences in the

and then the manager relies on the way a real estate fund operates com-

investor making a proactive request made Ireland a real pared to a debt fund, a private equity

for information about their new fund, fund, a hedge fund or a mutual fund,

so the manager is not marketing. It’s contender in Europe as and one should not neglect the impor-

the reverse. It’s an approach that has tance of asset-specific knowledge and

been well used by US and UK-based

a fund domicile” expertise. Ireland has a vibrant domes-

managers. tic real estate investment market, so

But the new cross-European mar- ANITA LYSE combining this with its more than 30

keting rules, being introduced this years of funds experience means we

summer, will restrict it. If a manager should seriously consider its growth

accepts a subscription from an investor prospects.

within 18 months of having a conver-

sation with them, marketing will be RoD: Alter Domus has just launched

deemed to have taken place. Going depositary and third-party AIFM ser-

forward, that will mean more managers vices in Ireland to provide our clients

setting up European AIFs and appoint- with fully integrated services, so we’re

ing EU-authorized AIFMs, which can bullish about the potential for Ireland

avail themselves of the AIFMD mar- to grow as a domicile. We’re very much

keting passport to raise capital. It will focused on alternatives, including real

now be possible to set up Irish part- estate, and Ireland has the tools to par-

nerships and Irish AIFMs. In addition, ticipate in that space going forward.

providers like Alter Domus will offer a Europe, there are still some that don’t. Real estate is one of the most popu-

third-party service, so a manager from For them, it might be worth consid- lar asset classes in Ireland, so there are

the US, for instance, would be able to ering setting up in Ireland instead of plenty of experienced professionals in

set up an Irish or Luxembourg partner- Luxembourg. On paper, there’s no the market who can expand their offer-

ship, appointing us as their AIFM. reason why Ireland should not work ing to work with pan-European asset

That would allow them to submit well for these types of managers, if they managers.

their fund to the local regulator in Ire- can get their fund structures right and The number of Irish domestic alter-

land to be issued with a passport to mar- make good connections with service native AIFs has already doubled in the

ket that fund around Europe, instead of professionals. last five years, so the industry is grow-

having to go through the awkward and In Luxembourg, there’s a certain ing rapidly. It will certainly get the at-

time-consuming process of using the level of resource scarcity in several are- tention of US-based managers, and

national placement regime in each in- as of the financial services sector, which potentially UK-based managers too.

dividual country. They would not nec- can sometimes lead to constraints on That the future is bright is borne out

essarily have to base the whole fund in capacity. This is among the reasons if you look at the corporate activity in

Europe, just set up a parallel sleeve or why we’ve set up alternative centers our industry. Many of our competitors

fund for raising capital in the EU. Alter of operation outside Luxembourg, in- are making sure they have an operation

Domus already has a significant man- cluding in Cork. in Ireland as well as in Luxembourg,

agement company business in Luxem- because they see the growth in both

bourg, and now we have an AIFM in

Ireland authorized by the Central Bank

of Ireland, as well as authorization to

Q How would you gauge

Ireland’s future potential

as a fund domicile?

markets.

Ireland has a history of competing

successfully for foreign direct invest-

set up a real asset depositary here. AL: The recent enhancements of the ment in other sectors, such as IT and

Irish funds regime were needed to al- pharmaceuticals. There’s no reason

AL: We can see from our own client low Ireland to compete in private funds why it can’t win a share of the growth

base that while many large US inves- generally. Having a fund product, and we’re seeing in the fund services

tors and managers already operate in a legal and tax regime that works for industry. n

30 PERE • July/August 2021You can also read