Export Processing Zones in Madagascar: a Success Story under Threat?

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

World Development Vol. 33, No. 5, pp. 785–803, 2005

Ó 2005 Elsevier Ltd. All rights reserved

Printed in Great Britain

www.elsevier.com/locate/worlddev 0305-750X/$ - see front matter

doi:10.1016/j.worlddev.2005.01.007

Export Processing Zones in Madagascar:

a Success Story under Threat?

JEAN-PIERRE CLING, MIREILLE RAZAFINDRAKOTO

and FRANÇOIS ROUBAUD *

DIAL and Institut de Recherche pour le Développement, Paris, France

Summary. — The success of export processing zones or the Zone Franche in Madagascar since 1990

is, with the exception of Mauritius, an isolated and unknown case in Africa. This paper, based on

first-hand data, explains that the Zone Franche has had a highly significant macroeconomic impact

in terms of exports and jobs. We show that average wages in the Zone Franche are equivalent to the

other formal activity sectors, other things being equal, and that labor standards there are higher

than average. The Zone Franche quickly recovered from the 2002 crisis and has benefited a great

deal from AGOA. The final phase-out of the Multi-Fibre Arrangement in 2005 is expected to have

a negative impact on the Zone Franche.

Ó 2005 Elsevier Ltd. All rights reserved.

Key words — export processing zones, employment, wages, AGOA, Africa, Madagascar

1. INTRODUCTION the introduction of another (a subsidy). This

implies that the impact of these systems on

There has been a significant increase in the well-being in the host country is, in principle,

number of export processing zones (EPZs) set undetermined. In his seminal study based on

up in developing countries in recent years. a Hecksher–Ohlin model with two factors of

The International Labour Organization (ILO) production and two goods, Hamada (1974)

reports that 116 countries had such systems in demonstrated that the establishment of an

2002 compared with just 25 in 1975. Total EPZ leads to specialization that runs contrary

employment in EPZs worldwide rose from less to the host country’s real comparative advanta-

than one million to 13 million employees over ges and tends to reduce national well-being.

the same period, excluding China (ILO, 2003). Conversely, other neoclassical economists con-

This increase can be explained by the fact that sider that the creation of EPZs improves a

nearly all the developing countries have now country’s well-being (Miyagiwa, 1986; Young

adopted export-led growth policies, which have & Miyagiwa, 1987). Despite this uncertainty,

encouraged them to actively promote foreign most empirical cost–benefit analyses underline

investment. These EPZs are generally special- the positive returns generated by EPZs, partic-

ized in the production of labor-intensive con- ularly in terms of foreign exchange earnings

sumer goods, mainly clothing, based on a and employment (Jayanthakumaran, 2003; Jen-

specialization strategy applied by most of the kins, Esquivel, & Larrain, 1998; Warr, 1989). In

countries in the initial stages of their industrial addition, the new growth theory stresses the ef-

development (Amsden, 2001). In particular, fects of the potential externalities of EPZs on

there is a strong correlation between growth the host economy, such as learning effects, hu-

in the EPZs and the Multi-Fibre Arrangement man capital development, and demonstration

(MFA), given that investment in these zones effects (Johansson, 1994; Johansson & Nilsson,

has served to circumvent textile quotas for over

30 years (Jayanthakumaran, 2003).

In the economic theory, EPZs are a second- * The authors wish to thank Peter Glick and four ano-

best optimum, consisting in offsetting the re- nymous referees for their comments on an earlier draft.

moval of one distortion (a customs duty) with Final revision accepted: January 5, 2005.

785786 WORLD DEVELOPMENT 1997). Whatever the case may be, spillover ef- was hard hit by the split in the government, the fects and externalities are probably limited due capital Antananarivo (where most Zone Fran- to the EPZs’ low level of integration into the che companies were established) being block- local economy (duty-free imports act as import aded and a general strike (Raison-Jourde & subsidies and prompt minimal local integra- Raison, 2002; Roubaud, 2002). 4 Although tion), the low skills of the labor employed, and the crisis came to a peaceful conclusion in July the potential volatility of foreign investment. 2002, a large number of companies had by then The findings of these studies are less clear-cut already left for good. Preliminary export and when it comes to wages paid by the EPZs com- employment figure estimates for 2004 suggest pared with the rest of the economy. They all that business has returned to its precrisis levels. agree that the situation varies enormously from The Zone Franche association reports that there one country and sector to the next. Limiting the were 180 firms in business with over 100,000 study to the textile and clothing sector, Romero employees at the end of 2004. Of these, 124 (1995) and Kusago and Tzannatos (1998) con- were textile companies, 12 were food compa- sider that there are no significant differences be- nies, and 12 were specialized in information tween the wages paid in Asian EPZs and those technology. paid by other companies in the same sector. In this article, we look at the Zone Franche’s The economic literature on the subject suggests macroeconomic and microeconomic impact to that, since most of the labor is female, the low determine whether the effects generally ob- average wages can be explained by low skills served in the rest of the world hold in Madagas- and the wage discrimination generally suffered car too. We also look at the zone’s prospects. by women, without EPZs appearing to practise Our study draws on international foreign trade a systematic policy of specific remuneration for databases to fill the gaps in national customs given jobs (Madani, 1999). However, it should statistics and some national statistical sources be noted that none of the abovementioned with no other equivalent in sub-Saharan Africa: studies is based on individual wage data, but Labor force surveys (LFSs) conducted annually on average sector wages. 1 in the Malagasy capital and industrial surveys Since the abovementioned studies agree that conducted at the authors’ initiative from 1995 EPZs do not practise specific wage discrimina- to 2003. These data together serve to make an tion, their poor image in terms of labor issues in-depth analysis and compare the results ob- stems mainly from the fact that working condi- tained for Madagascar with those for other tions are generally deemed harder than in the countries and regions of the world. To our other economic sectors. Labor legislation is knowledge, this is the first study to consider not applied as strictly as elsewhere, and some- the Zone Franche from the point of view of times not at all (ICFTU, 2003; ILO, 2003); all these aspects since the seminal paper by working hours are longer and the pace of work Razafindrakoto and Roubaud (1997). is faster; and trade unions are often forbidden In Section 2, we describe the Zone Franche’s (as was the case until recently in Bangladesh) booming growth in Madagascar in the 1990s or at least discouraged (hence the term sweat- and since the 2002 political crisis, and assess shops sometimes used in their regard). its contribution to export performances. Sec- Madagascar is the only example, alongside tion 3 analyzes its effect on employment, in- Mauritius, of significant EPZ success in sub- come, and taxes. Section 4 looks at the Zone Saharan Africa where all other free-zone initia- Franche’s impact on earned income using esti- tives have failed despite numerous attempts. 2 mated earnings equations to compare wages The example of Mauritius is well known, but paid in Zone Franche companies with other sec- not so the Malagasy EPZs otherwise known tors of the economy. Section 5 compares Zone as the Zone Franche. 3 Yet the Zone Franche Franche working conditions and other labor has developed quite remarkably in just one dec- standards with other companies. Section 6 pre- ade: It has gained considerable ground in terms sents the summary and conclusion. of exports and formal employment, making a significant contribution to the economic upturn observed in the second half of the 1990s. The 2. THE ZONE FRANCHE AND EXPORT open political conflict that followed the dis- PERFORMANCE puted presidential election in December 2001 had a drastic effect on the Zone Franche The introduction of a special scheme for free- (IMF, 2003). In the first half of 2002, the island zone companies in Madagascar in 1990 fol-

EXPORT PROCESSING ZONES IN MADAGASCAR 787 lowed the decision to opt for an export-led India. Although labor productivity is appar- growth strategy under the structural adjust- ently much lower in Madagascar than in Mau- ment policies adopted in the late 1980s in ritius or China (and equal to that in India), unit compliance with Bretton Woods Institution production costs are among the lowest in the recommendations. The law passed in 1991 de- world and lower than in the other three coun- fined the scheme’s scope and the tax incentives tries. granted Zone Franche companies (GEFP, As many Asian countries had already satu- 2002), which are under no obligation to set up rated their quotas, the choice of Madagascar in specific zones. Companies wishing to be part also helped circumvent the textile quotas im- of the free-zone scheme must intend to export posed by the developed countries under the at least 95% of their production. Companies MFA. Hence, the Central Bank of Madagascar providing services to the Zone Franche can also (2002) reported that clothing accounted for benefit from the free-zone scheme. 90% of the Zone Franche’s production in 2001. Zone Franche companies are exempt from all Madagascar enjoys duty-free and quota-free duties and taxes on exports and imports alike. access to the European and American markets: As regards domestic tax, they are exempt from — Madagascar has been AGOA (African excise taxes, but have been liable for Value Growth and Opportunity Act) eligible since Added Tax (VAT) on imported inputs since 2001. Starting in 1997–98, investments were 1997, although this can be refunded at a later made in the Zone Franche in anticipation date against proof of export. This measure of AGOA (Gibbon, 2003). Yet although was introduced to curb tax evasion and prevent AGOA authorizes duty-free access to the companies supplying the local market from set- American market for the products it covers, ting up as Zone Franche companies. The Zone it imposes restrictive conditions in terms of Franche scheme grants total exemption from inputs (‘‘third-party fabric provision’’), profit tax for a grace period of two years for which must come either from the United labor-intensive farming and fishing companies States or other countries benefiting from and four years for industrial and service com- the agreement. However, Madagascar was panies. These companies are liable for a fixed granted a dispensation for its clothing sector rate of 10% thereafter, which is far lower than to use inputs from other countries. In 2004, the general rate of 35%. They are also eligible this was extended through to the end of for profit tax breaks equal to 75% of the cost 2007. of new investments. Last but not the least, Zone — Madagascar also benefits from tax-free Franche companies are granted special access to access to the European market under the foreign currency and total freedom for capital terms of the Cotonou Agreement signed transfers. between the EU and the ACP (Africa– The success of the Zone Franche was initially Caribbean–Pacific) States and, since 2001, due to French investors, attracted by a French- under the ‘‘Everything But Arms’’ (EBA) speaking environment where a large number of initiative covering all LDCs (least developed their compatriots had already set up business countries). The rules of origin are particu- (Madagascar has the largest French community larly strict under these agreements too, espe- in Africa). Yet investors gradually became cially as regards the EBA. more diverse. By 1997, the last year for which Clothing exports are concentrated on the official data are available, French investors American and European markets, which are (companies in which France has a majority the top two markets worldwide for these prod- holding) accounted for 46% of jobs in the Zone ucts. Sales to the European market grew Franche, Mauritians (Madagascar’s next door through to 1998 before stagnating thereafter. neighbors) for 28%, Madagascans for 11%, Sales to the American market, which were mar- and Asian investors for 7% (with the remaining ginal until 2000, then took over due to AGOA 8% from various other countries) (MADIO, and drove growth in the Zone Franche. Mala- 1999). 5 Investors sought primarily to take gasy clothing exports to the United States advantage of low labor costs in Madagascar. nearly tripled from 1999 to 2001, reaching al- Cadot and Nasir (2001) report that the monthly most the same level as those to the European wage for an unskilled textile industry machine Union. Yet although trade preferences played operator is less than one-third of the equivalent an important role in this trend, they would wage in Mauritius, around half that in China, not have been taken up had it not been for and only about 60% of the average wage in the tax breaks granted under the EPZ scheme.

788 WORLD DEVELOPMENT

EPZ managers interviewed by several surveys growth in total goods exports and Zone Fran-

clearly state that they would not have invested che exports. Both sources confirm that exports

in Madagascar had it not been for these advan- from Madagascar nearly tripled in current dol-

tages (Cadot & Nasir, 2001; Razafindrakoto & lars from 1991 to 2001. They show that these

Roubaud, 2002). 6 exports reached a historic peak in 2001, plum-

Two types of data are available to measure meted due to the crisis in 2002 and then re-

growth in the value of Malagasy goods exports: sumed growth thereafter. Starting from

— First, a direct estimate based on national negligible amounts at the beginning of the per-

customs statistics for the 1991–2003 period. iod, growth in Zone Franche exports was even

The customs statistics also provide a direct more remarkable, albeit temporarily thrown

estimate of total Zone Franche exports, for off stride by the crisis before posting a swift

which special declarations are required, for recovery. The share of the Zone Franche in to-

the same period. tal exports hence rose steadily to reach 42–43%

— Second, an indirect estimate based on by the end of the period, a proportion un-

total world imports from Madagascar, using equalled in any other LDC.

the ‘‘mirror-data’’ method. The historical The mirror-data evaluations are systemati-

series of mirror-data for the 1991–2002 per- cally higher than the national customs data

iod is drawn from the International Trade evaluations for the entire period (excepting

Centre (ITC) database. 7 We use US and Zone Franche exports in 1996 and 2002). The

EU import data as mirror-data for 2003– national customs data evaluations for total ex-

04 since ITC data are not available for this ports come to some 70–90% of the mirror-data

period. The mirror-data do not explicitly evaluations depending on the year (with consid-

identify exports from the Zone Franche. erable customs data under-recording for 2002,

Given that nearly all apparel exports come presumably due to the crisis). This ratio is more

from the Zone Franche and that most of its erratic for Zone Franche exports. The deviation

firms are specialized in clothing, it can be is due partly to different methods since customs

assumed that total garment exports are statistics use FOB (free on board) measure-

roughly equivalent to total Zone Franche ments, whereas the mirror-data, based on im-

exports. ports, use CIF (costs, insurance and freight)

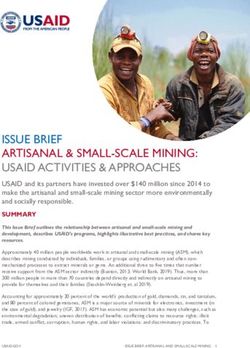

Table 1 shows that both types of data present measurements, which include additional trans-

the same trends over the past decade, which port and insurance costs. Exceptionally large

leads to the robust conclusion of remarkable differences are found in certain years, doubtless

Table 1. Comparative customs and ITC figures on total exports of goods and exports from the Zone Franche

(1991–2003) (in millions of dollars)

Total exports Exports from the Zone Franche Zone Franche/total

ratio

Customs ITC Ratio Customs ITCa Ratio Customs ITC

1991 333.4 373.3 89.3% 7.8 17.8 43.8% 2.3% 4.8%

1992 324.0 395.3 81.9% 18.2 24.9 72.9% 5.6% 6.3%

1993 334.9 418.0 80.1% 49.3 54.8 90.0% 14.7% 13.1%

1994 447.4 545.6 82.0% 48.2 98.8 48.8% 10.7% 18.1%

1995 522.9 620.5 84.3% 105.8 115.4 91.7% 20.2% 18.5%

1996 512.3 682.8 75.0% 175.5 169.4 103.6% 34.3% 24.8%

1997 506.8 695.1 72.9% 186.8 206.6 90.4% 32.9% 29.7%

1998 522.4 761.2 68.6% 194.6 248.4 78.3% 37.2% 32.6%

1999 583.5 795.0 73.4% 223.8 294.4 76.0% 38.4% 37.0%

2000 830.3 945.1 87.9% 327.8 369.7 88.7% 39.4% 39.1%

2001 962.5 1111.7 83.0% 372.1 467.3 79.6% 43.3% 42.0%

2002 481.6 838.1 57.5% 245.2 237.3 103.3% 36.4% 28.3%

2003 788.9 n/a n/a 361.1 n/a n/a 42.7% n/a

Source: Central Bank and Ministry of the Economy and Finance; International Trade Centre PC-TAS database.

Customs data: FOB; ITC data: CIF.

a

Clothing exports (SITC product code 84) are used as a proxy for all the Zone Franche’s exports.EXPORT PROCESSING ZONES IN MADAGASCAR 789

due to data-recording problems encountered by exclusively agricultural products (mainly coffee,

the Malagasy customs authorities. This lack of vanilla, cloves, and shrimps). Yet the share of

customs data reliability is not specific to Mad- these products subsequently fell by more than

agascar. It explains why most studies on Afri- 30 points to less than half of total exports.

can foreign trade use mirror-data of this sort, The share of manufactured products, on the

since they provide the only way of making other hand, was negligible in 1991, but grew

international comparisons using a consistent steadily to nearly half of total exports in 2001.

nomenclature. We therefore refer solely to mir- This growth mainly concerned exports of cloth-

ror-data in the rest of this article, given, as we ing products, that is, exports from the Zone

have seen, that the customs data produce the Franche.

same results in terms of general trends. The Malagasy economy was hard hit by the

Madagascar’s export growth rate was excep- 2002 political crisis, which took a heavy toll

tional by African standards in the last decade, on Zone Franche companies. Missed contract

given that exports virtually stagnated in most deadlines due to the crisis prompted interna-

countries on the continent and sub-Saharan tional buyers to cancel their orders and, given

Africa’s market share continued to slide (UNC- the political instability, turn to more reliable

TAD, 2002). This performance even shapes up suppliers. The foreign trade figures show the

as excellent compared with world trade, since Zone Franche’s extreme vulnerability to the cri-

the share of Malagasy exports in world trade sis and its remarkable responsiveness once the

more than doubled in the last decade. The Zone crisis was over. Total clothing exports were

Franche accounted for nearly three-quarters of practically halved in 2002. Yet exports to the

the boom in Madagascar’s goods exports from United States (Figure 1) shot back up in 2003

1991 to 2001. In 2001, Madagascar became the to just over their precrisis level, making the

number two clothing exporter in sub-Saharan United States the Zone Franche’s main cus-

Africa, behind Mauritius. tomer, ahead of the European Union. Exports

The Zone Franche made Madagascar the to the European Union, however, have not

only successful African new exporter of manu- recovered. Among other things, the Mauritian

factured goods, excepting Lesotho, in the last companies that had shifted their textile produc-

decade. The breakdown of exports conse- tion facilities to Madagascar for export to the

quently changed considerably. At the beginning European Union did not all return after the

of the 1990s, Madagascar exported almost crisis. 8 For example, the leading Mauritian

550

Political crisis

500

450

400

350

300

250

200

150

100

50

0

1998 1999 2000 2001 2002 2003 2004

USA EU Total

In millions of dollars

Figure 1. Malagasy exports of clothing products to the United States of America and the European Union (1998–

2004). Source: Otexa and Eurostat. USA and EU data are available for the first nine months of 2004 only. They are

both extrapolated for the entire year by applying the variation between the first nine months of 2004 and the same period

of 2003 to the total amount for 2003.790 WORLD DEVELOPMENT

investor, the Ciel group, halved its staff in as defined by the official nomenclature, were

the Malagasy factories and invested in India. asked about their labor market participa-

Yet the fact that total clothing exports tion. The definitions used (employment, unem-

(USA + EU) for 2004 have already topped ployment, etc.) respected the international

their precrisis level is very promising. Despite standards recommended by the ILO. Further-

some companies having left, the immediate rise more, in addition to the general LFS purpose

in the number of approvals for free-zone com- of analyzing the labor market dynamic, one

panies as soon as the crisis was over confirms of the strong points of the Malagasy survey is

this continuing dynamic. A total of 30 authori- that the questionnaire included a specific ques-

zations were issued in 2003 (especially for Asian tion to single out employment in the Zone

companies), compared with 20 in 2002 and 43 Franche (Razafindrakoto & Roubaud, 1997).

in 2001. The LFSs confirm the Zone Franche’s excep-

tional buoyancy in recent years. From 1995 to

2001, the rate of job creation in the Zone Fran-

3. MACROECONOMIC IMPACT ON che was six times higher than in Antananarivo’s

EMPLOYMENT AND SPILLOVER labor market as a whole. The average annual

EFFECTS employment growth rate stood at 27% com-

pared with 4.5% for the market as a whole. This

Against an economic backdrop of massive is by far the best performance, all sectors con-

underemployment 9 and widespread poverty, sidered (Table 2). Even though the informal

the analysis of the Zone Franche’s contribution sector is the main job provider, it is way behind

to the local economy takes on vital importance, in this respect. Over the period, the Zone Fran-

particularly as regards jobs created and the in- che’s contribution to job creation was as strong

come redistributed. 10 as that of the informal sector. Of a total

The LFSs used in this study correspond to 125,000 new jobs, 38% could be attributed to

the first phase of the 1–2–3 survey of the labor the informal sector, whereas the Zone Franche

market, the informal sector and consumption generated 34%, tripling its share of total

conducted in a number of developing countries employment from an initial 3% to 10% in

in Africa and Latin America (Razafindrakoto 2001. In the formal private sector, nearly one-

& Roubaud, 2003). This system of household third of all employees worked in the Zone Fran-

surveys was introduced in Madagascar for the che in 2001 compared with barely one in 10 in

first time in 1995 (Rakotomanana, Ramilison, 1995. In the same year, there were more women

& Roubaud, 2003). The National Statistical Of- employed in the Zone Franche than in the rest

fice has repeated the operation every year since of the formal private sector.

then. The sample, drawn from a stratified two- A job in the Zone Franche increases the earn-

stage area-based survey plan, is representative ings of the household to which the worker be-

of all ordinary households in the Malagasy cap- longs. Nicita and Razzaz (2003) estimate that

ital. In each household, all individuals aged 10 a 20% annual growth rate in Madagascar’s tex-

and over, that is, all individuals of working age tile sector for five years (close to actual growth

Table 2. Change in the employment breakdown by institutional sector in Antananarivo (1995–2002) (%)

Institutional sector Growth period: 1995–2001 Crisis period: 2001–02

Average annual Contribution Structure Growth rate Structure

growth rate

1995–2001 1995–2001 1995 2001 2001–02 2002

Public administrations 1.4 3 11.6 8.2 2.3 8.3

Public companies 4.1 2 2.7 2.6 7.1 2.8

Formal private companies 8.9 63 28.1 36.1 20.0 33.0

of which Zone Franche 27.2 34 3.1 10.2 60.0 4.1

Informal private companies 3.1 38 57.6 53.1 12.2 59.9

Total 4.5 100 100 100 0.4 100

Source: 1–2–3 surveys, Phase 1 (employment) 1995–2002, INSTAT/MADIO, authors’ calculations. The contribution

of the institutional sectors has not been calculated for 2001–02 as total employment fell due to the crisis.EXPORT PROCESSING ZONES IN MADAGASCAR 791 in the second half of the 1990s) would take 7% and creates an additional 5% in tax reve- approximately 158,000 people above the pov- nues. erty line. This is somewhat low given the high As with the foreign trade statistics, the rate of poverty in the country. Yet in addition employment data highlight that the Zone Fran- to these direct jobs with Zone Franche compa- che was extremely vulnerable to the crisis. The nies, jobs are generated by demand from these LFS specially conducted in Antananarivo in firms and satisfied by local companies through December 2002 and January 2003 to assess the backward linkages. Granted, their integration impact of the crisis provides the wherewithal into the country’s economy is modest since to make a diagnosis of the state of the labor three-quarters of their raw materials and sup- market six months after the end of this crisis. plies are of foreign origin, whereas the average Although the capital’s economy started to re- rate in the industrial sector is 50% (MADIO, cover after the height of the crisis, the negative 1999). However, the services they use should impacts were still very apparent. Zone Franche also be added to local inputs as should the employment fell 60% between mid-2001 (date share of their investment in the domestic mar- of the previous survey) and the end of 2002, ket. If we assume constant average productivity wiping out in one fell swoop the huge progress for local companies used by Zone Franche com- made in previous years. The Zone Franche panies, the number of jobs generated by the lat- clearly adjusted to the downturn in demand in ters’ demand can be calculated using an input– terms of quantity (jobs and working hours) output matrix for the Malagasy economy. rather than price. Nominal wages, hard to re- Razafindrakoto and Roubaud (2002) use this duce, more or less followed inflation, which method and find that the ratio between indirect meant that those who kept their jobs virtually and direct jobs created by the Zone Franche is maintained their purchasing power. The other approximately 0.7. institutional sectors reacted differently. There The Zone Franche’s impact on tax revenues is were no layoffs in the public sector, where wages obviously vital in a country where most of the were partially deindexed. The informal sector State’s revenue comes from external tax. An acted as a safety net for employees who had accurate assessment of the impact of the Zone been made redundant and for new arrivals. Franche on taxes entails knowing whether The number of jobs in this sector grew 12%. investment decisions are linked to the tax incen- We fine-tune the diagnosis using the May tives offered (if not, the Zone Franche makes a 2003 Impact of the Crisis survey conducted in net loss for the State, excluding indirect effects). the Malagasy capital almost one year after the As already mentioned, this appears to be the end of the crisis (Ramilison, 2003). 11 Although case for most investors. Zone Franche imports practically all the households stated that the are duty- and tax-free, meaning a loss of reve- crisis had had a negative effect on them and nue for the State. However, Zone Franche firms had resulted in a loss of income, the form and are not fully exempt from tax. They pay all intensity of the shock varied significantly taxes on employees hired and other special depending on the type of household. In general, employment-based levies such as employees’ households with some members working in the and employers’ social contributions, which are Zone Franche were hard hit by temporary far from negligible. In 1997, for instance, 20% unemployment, especially when the individuals of employers’ social contributions came from kept their jobs. Zone Franche employees, both Zone Franche companies (MADIO, 1999). In those who kept and those who lost their jobs, addition, the Zone Franche injects income into appear to have suffered a larger drop in income. the economy that, given the Keynesian multi- Whereas the last quarter of 2001 was the high- plier, contributes to increased demand and est point in the economic cycle before the crisis, thereby to State revenues (customs duties, there was a drastic drop in the first quarter of property tax, VAT, etc.). A macroeconomic 2002. The drop in income can be estimated at model serves to assess the multiplier effect of nearly 30% for households in the Zone Franche, demand generated by the revenue distributed compared with less than 20% for the others. locally by the Zone Franche in the form of work The Zone Franche companies laid off large remuneration and spending on intermediate numbers of employees during the second quar- consumption and investment. Razafindrakoto ter, and those made redundant clearly had and Roubaud (2002) posit that, if the spillover more trouble finding alternative sources of in- effects are taken into account, the Zone Fran- come equivalent to the earnings they had previ- che’s contribution to GDP rises from 2% to ously enjoyed.

792 WORLD DEVELOPMENT

Yet crisis aside, the study in this section long working hours, which tended to raise

shows the positive impact of the Zone Franche monthly earnings compared with other sectors:

on Madagascar’s economy. It has not only been In 2001, Zone Franche employees worked nine

a buoyant sector since it was set up in the early hours longer on average per week than their

1990s, but it has also remained the main driving counterparts in the non-Zone Franche private

force behind growth for a decade. However, we industrial companies (53 hours and 44 hours

need to delve deeper than this general diagnosis per week, respectively). Hence, the diagnosis

to see whether the Zone Franche’s positive mac- is reversed when comparing hourly earnings.

roeconomic impact has the disadvantage of Although growth in real median hourly earn-

overexploiting the labor force and lowering ings per Zone Franche worker is appreciable

labor standards, as claimed by the race to the (5.3% per year), it is among the lowest when

bottom theory, due to the fact that the main compared with the labor market as a whole,

motivation for investing in the Zone Franche where it comes to 7.5% per year.

is to minimize the costs of producing labor- However, these differences in average and

intensive consumer goods by unskilled workers. median earnings are misleading for two rea-

We will endeavor to answer this question in the sons: Firstly, the remuneration taken into

next two sections of the paper, addressing account does not include benefits, in money

firstly wage levels in the Zone Franche and then or in kind (bonuses, paid holidays, and miscel-

the quality of jobs, working conditions, and la- laneous benefits). These benefits are added to

bor standards. The analysis is based on the basic earnings to form total earnings. Secondly,

1995–2001 series of LFSs. We have excluded as shown in Table 3, job characteristics and

the 2002 survey, which is the last available sur- wages are not identical across sectors. Some

vey, to avoid introducing potential biases asso- characteristics weigh negatively on Zone Fran-

ciated with the disruptive effects of the political che earnings, such as the low percentages of

crisis. managerial staff, the lack of seniority and pro-

fessional experience, and the preponderance of

female staff. All of these characteristics are

4. REMUNERATION IN THE common to most EPZs worldwide (Madani,

ZONE FRANCHE 1999). In 2001, women represented nearly

70% of the labor employed by the Zone Franche

The LFS data clearly show the structural as opposed to 40% in formal industrial jobs

weakness of wages in the Zone Franche. Not outside the Zone Franche. 13 Yet other charac-

only was the average monthly wage 37% lower teristics work in favor of earnings in the Zone

than that paid by other types of industrial com- Franche. For example, there is the rate of

panies in 2001, but it was also one of the lowest trade union presence, which is almost as high

on the market. Despite a slight improvement as in the public sector and double the rate

over the period, it remained lower than the observed for the rest of the industrial sector

average earnings for gainfully employed work- (this characteristic can be linked, in particular,

ers in all sectors of the economy (the gap nar- to the large average size of Zone Franche com-

rowed from 23% in 1995 to 16% in 2001). panies compared with other industrial com-

Only the informal sector paid its workers less. panies).

These findings are somewhat tempered if we Fine-tuning our calculations entails checking

compare median monthly wages (which have all these ‘‘structural effects’’ to measure earn-

the advantage of being less sensitive to extreme ings levels, all other things being equal, that

values): The median monthly wage in the Zone is, for comparable jobs and human capital as-

Franche was equivalent to that for all gain- sets. These estimates are made first for basic

fully employed workers together, but was still earnings and then for total job earnings. In

lower than that found in other industrial both cases, we compare the positive or negative

firms. 12 premium earned by Zone Franche employees

Zone Franche companies appear to have with the labor force as a whole and with

granted more generous wage raises than others employees in the non-Zone Franche formal pri-

from 1995 to 2001. Whereas the purchasing vate industrial sector. Maskus (1997) and Ro-

power of monthly earnings grew an average mero (1995) consider a number of reasons

7.3% per year for all gainfully employed work- why EPZ firms could tend to pay higher wages:

ers, the rate was 9.1% in the Zone Franche. Yet EPZ firms pay productivity incentives and

this positive finding is partly due to increasingly overtime bonuses (the latter obviously haveEXPORT PROCESSING ZONES IN MADAGASCAR 793

Table 3. Labor force characteristics in the Zone Franche compared with the other sectors (Antananarivo), 2001

Public Formal private Of which: industrial Of which: Informal Total

sector sector (excl. Zone Franche) Zone Franche sector

Monthly earnings (USD) 87 51 57 38 33 45

Hours worked per week 40.9 47.4 43.8 52.8 40.9 43.3

% Female 36.4 44.3 39.7 69.4 52.0 47.3

% Managerial staff 35.8 12.0 12.7 9.7 0.3 8.3

% Trade union presence 47.6 20.3 22.9 41.7 0.6 12.7

Years of schooling 11.8 8.9 8.6 7.8 6.3 7.8

Potential experience 26.2 17.8 19.9 13.6 22.4 21.2

Seniority 13.2 5.2 7.0 2.4 7.0 7.0

Size of company 85.9 36.2 31.0 93.0 0 23.2

(% P100 employees)

Source: 1–2–3 survey, Phase 1, 2001, MADIO, authors’ calculations. Number of observations: 5,499. Exchange rate

(June 2001): 1 USD = 6,859 FMG.

no effect on hourly wages); they are generally Lastly, we introduce a dummy Zone Franche

larger than firms outside the EPZs, and wages variable (DUMMY EPZ) to estimate the earn-

tend to rise with firm size due to economies of ings premium associated with this sector. Each

scale; foreign firms, especially those from devel- of these estimations is made first for all gain-

oped countries, generally have higher labor fully employed workers and then for wage

standards; EPZ firms may pay a wage premium earners (excluding nonwage earners such as

to entice workers to move into the area or to the self-employed) in the formal industrial sec-

dissuade them from moving to other firms; tor with apparently comparable working condi-

and the fact that EPZ firms produce for export tions. We carry out both OLS estimates and

means that they face pressure to maintain high Heckman estimates selection-corrected for par-

quality standards, which prompts them to pay ticipation and sector choice (Zone Franche vs.

better wages (according to efficiency wage the- non-Zone Franche). Yet as the results are very

ory, better wages induce more effort from similar and the database does not provide any

workers). It could also be argued that the eco- credible instruments for correcting potential

nomic performance of export-oriented Zone selection biases, we only present the OLS esti-

Franche companies places them in a better posi- mates here.

tion to make wage policy concessions than At the same time, we estimate a global model

other sectors that depend entirely on the using stacked data for the seven years from

domestic market. 1995 to 2001. The dependent variable is real

We estimate extended Mincerian earnings hourly earnings at 1995 prices 16 and dummies

functions for each year from 1995 to 2001 to are introduced for each year (DATE):

explain the level of hourly earnings (both basic

earnings and total earnings). 14 Log Writ ¼ a þ bGEN þ cSCOit þ dEXP it þ eS it

X X

Log W it ¼ at þ bt GEN þ ct SCOit þ d t EXP it þ fS 2it þ g SEC it þ ht DATEt

þ et S it þ ft S 2it þ gt SEC it þ DUMMY EPZ þ eit : ð2Þ

þ DUMMY EPZ þ eit : ð1Þ Table 4 presents the results of estimates of

the real hourly wage in the formal industrial

Dependent variables are the usual explanatory sector using stacked data, excluding bonuses

factors: gender (GEN), number of years of (models 1 and 2) and including bonuses (mod-

schooling (SCO) and potential professional els 3 and 4), and excluding socioeconomic

experience (EXP). We also include seniority group (models 1 and 3) and including socioeco-

(S) and seniority squared (S2) in the explana- nomic group (models 2 and 4). The quality of

tory variables. 15 Socioeconomic group (SEC) the regressions is good and in keeping with

broken down into nine groups (including six the international literature on the subject (R2

categories of wage earners) is alternatively in- from 0.36 to 0.44), and the coefficients for the

cluded and excluded from the regressions to four chosen models are close to and comply

take account of its potential endogeneity. with the theory. Remuneration, regardless of794 WORLD DEVELOPMENT

Table 4. Equation of Zone Franche hourly wages/rest of the formal industrial sector (1995–2001)

Wages (excluding bonuses) Wages (including bonuses)

Model 1 Model 2 Model 3 Model 4

Intercept 1.604 (42.48) 1.522 (39.29) 1.557 (39.01) 1.483 (36.22)

Sex (male = 1) 0.139 (8.35) 0.122 (70.89) 0.147 (8.40) 0.130 (7.92)

Years of schooling 0.097 (40.19) 0.065 (25.67) 0.100 (39.27) 0.066 (24.71)

Seniority 0.020 (6.17) 0.019 (6.08) 0.029 (8.34) 0.027 (8.32)

Seniority squared 0.0003 (3.06) 0.0003 (3.18) 0.0005 (4.58) 0.0005 (4.78)

Experience 0.013 (12.91) 0.008 (19.30) 0.013 (12.46) 0.010 (9.82)

Year

1995 0.480 (16.40) 0.404 (14.59) 0.499 (16.11) 0.412 (14.06)

1996 0.294 (10.32) 0.201 (7.40) 0.295 (9.79) 0.190 (6.62)

1997 0.194 (6.90) 0.135 (5.13) 0.159 (5.36) 0.094 (3.39)

1998 0.135 (4.88) 0.063 (2.38) 0.129 (4.42) 0.045 (1.63)

1999 0.075 (2.76) 0.018 (0.73) 0.055 (1.93) 0.008 (0.29)

2000 0.018 (0.72) 0.001 (0.05) 0.021 (0.76) 0.001 (0.04)

2001 – – – –

Socioeconomic group

Senior managers 1.444 (24.09) 1.500 (23.67)

Middle manager 0.611 (16.77) 0.669 (17.37)

Empl., skilled workers 0.222 (9.83) 0.259 (10.89)

Empl., unskilled workers 0.111 (4.85) 0.123 (5.10)

Laborers – –

Dummy EPZ (=1) 0.002 (0.11) 0.008 (0.47) 0.019 (1.01) 0.022 (1.24)

Number of observations 4,651 4,651 4,651 4,651

R2 0.36 0.44 0.36 0.44

Source: 1–2–3 surveys, Phase 1, 1995–2001, MADIO, authors’ calculations.

In brackets, the absolute value of the t-statistics.

Reading: in model 1, a man’s average hourly wage exceeds that of a woman by 14.9% (coefficient 0.139) all other

things being equal.

whether the different types of bonuses are taken is beneficial to employees: Firstly, by giving

into account, is a growing function of the level them access to more highly skilled jobs and sec-

of education, seniority, and professional experi- ondly, by giving them additional income in a

ence. For example, each additional year of given job. Hence, the return on education is

schooling is equivalent to a net wage increase reduced by approximately one-third (from

of nearly 7% in 2001, whereas benefits from 10.2% to 6.7%) when the socioeconomic group

seniority and professional experience are less is included in the equation. Finally, women ap-

marked (under 2% and approximately 0.5%, pear to be subject to a form of wage discrimina-

respectively). tion, earning approximately 15% less in the

Growth in average hourly wages is not due industry. Nicita and Razzaz (2003) observed

solely to improved skills over the period, as is an even higher level of discrimination in the

shown by the significant positive trend of the Malagasy textile industry (whose coverage is

year dummies. 17 Madagascar also experienced similar to, but not exactly the same as the Zone

unprecedented dynamic endogenous urban Franche) using the same kind of wage equa-

growth (Razafindrakoto & Roubaud, 2000). tions.

The hourly wage is also closely correlated with As regards our variable of interest, the Zone

position in the company, in keeping with a Franche dummy is not significant in any of the

strict wage scale ranging from senior manage- models estimated. Although Zone Franche

ment to unskilled workers. When the socioeco- employees were paid 25% lower hourly wages

nomic group is taken into account, it partially on average than their counterparts in the non-

absorbs the return to human capital, highlight- Zone Franche private formal industrial sector

ing the two-stage mechanism whereby the latter over the 1995–2001 period, this gap can beEXPORT PROCESSING ZONES IN MADAGASCAR 795

Table 5. Equation of hourly earnings in Zone Franche/rest of labor market (1995–2001)

Earnings (excluding bonuses) Earnings (including bonuses)

Model 1 Model 2 Model 3 Model 4

Intercept 2.145 (116.4) 2.088 (48.89) 2.075 (112.6) 2.039 (47.54)

Sex (man = 1) 0.276 (31.14) 0.247 (28.87) 0.276 (31.05) 0.238 (27.66)

Years of schooling 0.140 (129.55) 0.106 (84.39) 0.141 (130.79) 0.105 (82.77)

Seniority 0.028 (22.95) 0.021 (17.41) 0.030 (24.69) 0.022 (18.91)

Seniority squared 0.0005 (16.71) 0.0004 (13.61) 0.0006 (17.50) 0.0004 (14.23)

Experience 0.015 (35.74) 0.011 (26.50) 0.014 (32.93) 0.010 (24.60)

Year

1995 0.386 (23.22) 0.332 (20.79) 0.351 (21.10) 0.303 (18.89)

1996 0.371 (22.66) 0.332 (21.12) 0.369 (22.50) 0.330 (20.90)

1997 0.273 (16.87) 0.256 (16.51) 0.251 (15.51) 0.235 (15.13)

1998 0.182 (11.26) 0.150 (9.70) 0.173 (10.66) 0.144 (9.23)

1999 0.114 (6.97) 0.078 (4.95) 0.055 (1.93) 0.077 (4.89)

2000 0.052 (3.19) 0.043 (2.75) 0.021 (0.76) 0.032 (2.06)

2001 – – – –

Socioeconomic group

Senior managers – –

Middle managers 0.256 (8.44) 0.258 (8.57)

Empl., skilled workers 0.521 (18.94) 0.573 (20.75)

Empl., unskilled workers 0.721 (24.55) 0.803 (27.24)

Laborers 1.120 (37.13) 1.155 (38.14)

Employers 0.096 (3.07) 0.262 (8.27)

Self-employed 0.641 (22.77) 0.817 (28.91)

Fam. help & apprent. 0.974 (22.95) 1.113 (26.11)

Dummy EPZ (=1) 0.121 (6.70) 0.065 (3.59) 0.161 (8.91) 0.063 (3.51)

Number of observations 35,718 35,718 35,718 35,718

R2 0.40 0.45 0.40 0.45

Source: 1–2–3 survey, Phase 1, 1995–2001, MADIO, authors’ calculations. Note: idem Table 4.

attributed entirely to labor force composition wage groups being inserted into the scale. 18

differences between the two sectors. Hence, employers’ earnings appear to be lower

Table 5 presents the results of the same esti- than senior managers’ earnings, but higher than

mates for all gainfully employed (wage and middle managers’ earnings, whereas self-em-

nonwage) workers. In this case, we refer to ployed workers earn the same as unskilled

earnings rather than wages since some workers employees, with apprentices and family work-

are nonwage workers. The quality of the ers coming last.

adjustments is slightly better than for the esti- However, contrary to the estimates for the

mates commented on above, for relatively sim- formal industrial sector alone, employees in

ilar results. Gender discrimination is the most the Zone Franche always have a significant pre-

notable exception: It is approximately twice as mium varying from 6% to 17% depending on

high in the economy as a whole as those esti- the model. Introducing the socioeconomic

mated for formal industry. This result can be group into the regression sharply reduces the

attributed mainly to the presence of the infor- earnings premium secured by Zone Franche

mal sector, where highly significant differences employees, by nearly half in the model exclud-

between men and women are found. The return ing bonuses and by nearly two-thirds in the

on human capital is higher than that observed model including all remuneration elements.

in the model limited to the industrial sector, For an equivalent level of human capital, Zone

whereas the time trend is flatter. In the models Franche employees have lower level jobs. This

including socioeconomic group, we find the phenomenon can be partly explained by the

same wage scale as observed earlier, with non- specific labor organization (low percentage of796 WORLD DEVELOPMENT

managerial staff and little job differentiation). It an even greater loss of ground for hourly earn-

could also be due to a deliberate policy by ings, as the increase in hours worked essentially

employers to hire overqualified workers. Esti- concerned the Zone Franche. Although the pre-

mates broken down by the different institu- mium was still positive in 1999 and 2000 for the

tional sectors 19 show that the premium for model excluding socioeconomic group, this was

Zone Franche workers is always significantly no longer the case in 2001. As regards the

lower than for workers in the public sector model including socioeconomic group, the pre-

(administration and public enterprises) and mium was no longer significant after 1998 and

higher than in the informal sector, and is not even became negative in 2001.

significantly different from that secured by This trend can doubtless be explained to a

other employees in the formal private sector. large extent by the fact that the exceptional

By studying the time curve for the premium activity seen on the domestic market did not

for Zone Franche workers, we can go beyond benefit Zone Franche companies, which export

the average effects for the period as a whole to highly competitive international markets.

(Figures 2 and 3). The comparison of wages Moreover, the rise in the exchange rate from

in the formal industrial sector shows that the the second half of 2000 reduced the Zone Fran-

average income gap widens, particularly as re- che companies’ room for maneuver. The pre-

gards hourly wages, to the detriment of Zone mium’s downward trend highlights a gradual

Franche employees. Hourly wages (excluding aligning of wages in the Zone Franche with con-

bonuses) were similar in both sectors in 1996, ditions on the labor market. Despite the up-

but posted a 45% difference in 2001. The pre- surge in Zone Franche employment, there was

mium curve also fell from significant and posi- no shortage of salaried labor, which could have

tive in the first two years (1995 and 1996) to put downward pressure on wages. The esti-

negative (albeit not significant) as of 1998. mates for 2002 show that, in spite of the crisis

Compared with all gainfully employed workers and the sharp drop in Zone Franche employ-

on the labor market, we also note a drop in rel- ment, the wage premium remained in line with

ative earnings for Zone Franche workers, with its previous trend.

40%

Political

crisis

20%

0%

-20%

-40%

-60%

1995 1996 1997 1998 1999 2000 2001 2002

Monthly wage Hourly wage

Premium (ex. socio-eco group) Premium (inc.socio-eco group)

Figure 2. Change in relative wages and wage premium in the Zone Franche from 1995 to 2002: Zone Franche vs. non-

Zone Franche formal industrial private sector. Sources: 1–2–3 survey, Phase 1, 1995–2002, MADIO, authors’

calculations. Note: remuneration excludes bonuses. The monthly and hourly wage curves correspond to the ratio of wages

in the Zone Franche compared with the other sectors. The premium corresponds to the coefficients of models 1 and 2,

estimated for each year. For each curve, the significant coefficients (5%) are shown in black.EXPORT PROCESSING ZONES IN MADAGASCAR 797

40%

Political

crisis

20%

0%

-20%

-40%

1995 1996 1997 1998 1999 2000 2001 2002

Monthly earnings Hourly earnings

Premium (ex. socio-eco group) Premium (inc. socio-eco group)

Figure 3. Change in relative earnings and earnings premium in the Zone Franche from 1995 to 2002: Zone Franche vs.

Rest of the economy. Sources: 1–2–3 survey, Phase 1, 1995–2002, MADIO, authors’ calculations. Note: idem Figure 2.

5. OTHER LABOR STANDARDS ments contribute to secure, formal working

relations. Although there is less in-house pro-

Job quality is gauged by more than just motion of Zone Franche employees, this can

money. It is also measured by the nonmonetary be explained by the fact that they have less

elements attached to the job such as the social seniority. Once the differences in jobs and skills

security cover it provides, job security, and pro- have been taken into account, the disparities

motion possibilities. Table 6 shows that, across are no longer significant. Lastly, Zone Franche

all these benefits, Zone Franche companies per- companies have adopted a highly active policy

form better than all the other formal industrial to promote labor skills: In 2001, nearly one in

companies in the private sector. This is particu- three employees took a vocational training

larly true of the three main types of benefits course paid for by the company, compared with

that are systematically more common in the one in five in the formal private sector outside

Zone Franche: registration with an official so- the Zone Franche. The logit models we have

cial security body, paid holidays, and the possi- tested—where the dependent variable corre-

bility of consulting a company medical service. sponds to a form of cover or protection and

Yet Zone Franche employees are at the greatest the independent variables are the same as for

advantage when it comes to job security. A the earnings equations—show that Zone Fran-

higher percentage of them have permanent jobs che employees enjoy significantly better cover-

and receive pay slips. They are also more often age across all these benefits. 20 In many

covered by a written employment contract and respects, Zone Franche employees are in as

are paid on a monthly basis. All of these ele- favorable a situation as public sector employees,

Table 6. Share of employees with job benefits in the Zone Franche compared with the other sectors (Antananarivo),

2001

Public Formal private Of which: industrial Of which: Informal Total

sector sector (non-Zone Franche) Zone Franche sector

Social security registration 85.1 61.8 65.0 88.2*** 1.9 52.9

Company medical service 68.1 57.5 60.1 83.7*** 11.7 49.3

Paid holidays 85.7 60.2 64.0 79.0*** 7.7 53.4

Pay slip 95.8 76.0 79.0 96.1*** 6.2 64.2

Written contract 96.3 65.1 73.6 93.3*** 9.8 64.6

Company-paid training 37.2 20.6 17.9 32.6*** 2.6 19.8

Do not want to change job 85.3 72.5 69.3 73.1 59.4 72.2

Source: 1–2–3 survey, Phase 1, 2001, MADIO, authors’ calculations.

***

Significant positive coefficient at 1% threshold (logit models in private formal industrial sector).798 WORLD DEVELOPMENT who are the most highly protected on the labor ers by acting as an incentive to other companies market. to align their labor policies with the usually In addition to this relative advantage for more advantageous conditions found in the Zone Franche employees, the zone’s companies Zone Franche. stepped up their formalization of work rela- However, employment in the Zone Franche is tions over the past decade. For example, not the be all and end all for wage earners, as whereas only 21% of Zone Franche employees shown by the employee satisfaction rates, were covered by the social security system in which, albeit high, are no higher than the aver- 1995, this percentage gradually rose to reach age (Table 6). 21 Further proof of this is the high 88% by 2001. The same phenomenon can be staff turnover, calculated by the ratio of the observed for all work-related benefits (paid hol- number of employees who left their companies idays, bonuses, medical cover, etc.) to the ex- in the year preceding the survey to this same to- tent that the contractualization of wage tal plus those still employed in the Zone Franche relations is now widespread in the Zone Fran- at the time of the survey. Every year, about one che, which was far from the case just a few in five Zone Franche employees leave their job, years ago. This fundamental change, which compared with a little over one in 10 in the for- has occurred in record time, is all the more mal private sector. This rate is far higher than in exceptional in that it took several decades for Mauritius, where it is around only one in 20 the industrialized countries to achieve the same (Cadot & Nasir, 2001). result. The 1980s and 1990s even saw an inverse The abovementioned advantages of working trend toward increased insecurity in wage rela- in the Zone Franche are actually offset by a ser- tions in most of the emerging countries (see ies of negative factors. These include the work- Saavedra, 2003, for a study of Latin America). load and work pace, both far higher than This positive trend for the Malagasy workforce elsewhere. Integration into the world market is gradually spreading to the formal sector as a and its demands in terms of competitiveness whole. The model introduced by the Zone Fran- (costs, delivery times, and quality) force the che was probably a driving force behind this. companies to tighten their labor management, Overall, Zone Franche companies treat their with stricter controls as regards rates, output, employees somewhat better than their counter- and productivity. The problems caused by stea- parts in the private formal sector and much bet- dily increasing working hours, standing at 53 ter than workers in the informal sector, hours in 2001, are all the more acute since the although, as we have seen, the wage premium Zone Franche employs a large number of wo- is tending to disappear. Doubtless, this favor- men who suffer, as elsewhere, from the ‘‘double able treatment of Zone Franche employees, day’’ phenomenon since they also have to cope albeit relative, should not be attributed to with domestic tasks and bringing up their chil- the company heads’ philanthropic tendencies, dren (Rambeloma, Rabeson, & Andrianarison, given that their main reason for setting up in 2002). Madagascar was the low cost of labor. Some of the abovementioned factors that could push wages up in EPZs (larger size, foreign-owned 6. SUMMARY AND CONCLUSIONS firms’ ‘‘best practices’’, etc.) could also explain the more favorable conditions. Some factors Three main factors have been behind the suc- might be more specific. For example, as these cess of the Malagasy EPZs or the Zone Franche companies are sometimes working in a hostile since the early 1990s: Low labor costs accompa- local environment, they are more mindful of nied by relatively high productivity, an attrac- the legislation, especially labor standards, and tive policy for foreign investment with the this observance is further stimulated by active introduction of a highly advantageous tax and trade unions. It is important to belie the com- customs scheme, and the granting of trade pref- mon assumption that EPZs undermine working erences by the European Union and the United conditions on the national labor market. In States of America, which has increased Mada- Madagascar’s case, it is not the Zone Franche gascar’s competitiveness over its competitors. companies that reduce the quality of wage A number of particularities provide additional employment, but the poor conditions provided reasons for the Malagasy success. These are, employees on the local labor market that at- in particular, historical (presence of a large tract them to the country in the first place. In French community, which has contributed to fact, their presence is likely to benefit the work- the magnitude of French investments), cultural

EXPORT PROCESSING ZONES IN MADAGASCAR 799 (national textile tradition), and geographic other things being equal, to that paid by the (close to Mauritius, one of the leading inves- other industrial firms in the formal private sec- tors). Given these circumstances, the Zone tor. This fact had been hitherto accepted for Franche has been the main driving force behind EPZs in general, but had remained unproved employment and export growth over the last 10 until now. Moreover, the Zone Franche compa- years and has made a major contribution to the nies pay their employees more on average than economic upturn observed since 1995 after a the informal sector, which is the main alterna- long recession period. tive for the low-skilled female workforce. Being Although the Malagasy Zone Franche is a hired in the Zone Franche therefore improves a highly specific case in that it is the only success- worker’s situation compared with previous ful EPZ in an African LDC, our analysis shows employment, as concluded also by Nicita and that its characteristics are similar to those usu- Razzaz (2003). We also show that the Malagasy ally observed on other continents. Specializa- Zone Franche boasts a major particularity com- tion in virtually one single product (apparel) pared with EPZs in other countries as regards goes hand in hand with the Zone Franche’s the other labor standards. Employees’ working growing and currently decisive weight in the conditions (with the exception of working country’s exports. The Zone Franche has hence hours) are generally more generous in the zone set the economy on the road to industrializa- than elsewhere in the private sector and are in tion. This success may eventually meet its limits line with those enjoyed by public sector work- in the absence of clear prospects for the diversi- ers. This inversion of the relative situation of fication of exports outside of the Zone Franche, Zone Franche employees compared with the consistent with a scenario often observed in the generally agreed view that nonwage benefits small countries (Schrank, 2001). The Zone are inferior in EPZs could be explained by the Franche, whose effect is geographically highly fact that Madagascar is an LDC, unlike middle targeted (concentrated essentially in the capi- income countries (MICs), where most of the tal), is also a factor for rising inequalities. Yet EPZs are established. Low average labor costs despite not-inconsiderable spillover effects, it give the Zone Franche firms leeway to improve represents too small a weight to have a signifi- their employees’ working conditions, an advan- cant impact on poverty reduction. The work- tage that their counterparts in the MICs do not force is made up mainly of young low-skilled have. Consequently, the EPZs can play a posi- women who, on average, do not stay in the tive role in job quality and constitute a factor company very long. However, there is no sug- for social progress in the LDCs, whereas com- gestion that the strong demographic dynamic petitive pressure drives EPZs in the MICs more and the youth of the firms are the result of a in the other direction. This hypothesis appears deliberate high staff turnover policy. Moreover, to be confirmed in the case of Madagascar: despite particularly long working hours a priori not only has Zone Franche employee cover sub- rather incompatible with family life, married stantially improved over the period studied, but women with or without children do not appear the zone has also been a driving force behind to be excluded from the Malagasy EPZ compa- the observed improvement in working condi- nies (Glick & Roubaud, 2004), contrary to tions in the other sectors of the economy. observations in other countries. The 2002 crisis The success of the Zone Franche has enabled highlighted the vulnerability of the Zone Fran- Madagascar to join the select club of countries che system. Given that investment in this sector receiving direct investment in the clothing sec- is relatively light and hence conducive to quick tor. Generally speaking, the Zone Franche’s profits, companies can easily pull out whenever continued growth in Madagascar will depend there is the slightest political, economic, or so- in the long run on whether its costs remain cial problem. For this reason, Winters, McCul- competitive and whether it continues to benefit loch, and McKay (2004) consider that the EPZs from the current preferential conditions of ac- constitute an example of liberalization that in- cess to the leading markets. There is probably creases household vulnerability. Yet although no call for concern as regards the first point, gi- the EPZ firms were the hardest hit by the crisis, ven the tax advantages granted Zone Franche the latest information available shows that they companies and the current low labor costs, have also been the most buoyant since. which guarantee a substantial competitive mar- Our econometric estimates on individual data gin even though the business environment re- show that the remuneration paid by the Zone mains difficult (Cadot & Nasir, 2001). The Franche companies is not significantly different, main threat facing the Zone Franche comes in

You can also read