CHEMICAL BUSINESS FOCUS - A MONTHLY ROUNDUP AND ANALYSIS OF THE KEY FACTORS SHAPING WORLD CHEMICAL MARKETS - TECNON ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS & SAN

ENGINEERING THERMOPLASTICS

ISSUE NUMBER 61

13TH AUGUST 2013

CHEMICAL BUSINESS FOCUS

A MONTHLY ROUNDUP AND ANALYSIS OF THE

KEY FACTORS SHAPING WORLD CHEMICAL MARKETS

CONTACT: MARY HEATHCOTE

Email: mary.heathcote@orbichem.com

Polyamide 6 & 66

In the US, polyamide polymer markets have come under no particular pressure in recent weeks

and buyers and sellers all describe their business in the past few months as flat in terms of both

volume and pricing. In Europe, August prices for virgin polyamide 6 engineering resin are mostly

the same as in July, even though lower feedstock costs are having a somewhat negative effect on

buying ideas. In Asia and China, poor demand and weaker caprolactam pricing has pulled down

polyamide 6 prices, while polyamide 66 markets are generally flat. The Japanese market is quiet

because of annual holidays but domestic demand in August is proving better than expected.

Polycarbonate

The outlook for the US economy, though patchy, continues to look encouraging. For the polycarbonate

resins business the continuing strength of the car industry underpins the strength of its demand.

Feedstock costs are finally stable and resin prices have been flat now for several months. The EU

economy remains weak but its prospects are not perhaps as gloomy as some have forecasted. After

some price weakness in Q2, Q3 polycarbonate resin prices have broadly rolled over. In China the

concerns are not so much about the past as the immediate future but the economy appears to be

becoming increasingly resilient. Low end GP prices eased in July; import prices were stable.

Polyacetal

The US polyacetal market has been clicking along at a decent pace in the third quarter as indicators

have continued to show the US economy growing steadily. Prices for homopolymer increased by

2 cents in June/July. The European polyacetal market reverted to normal seasonal activity during

late July/early August as many market participants were away for holidays. In China, domestic

polyacetal market prices continued to increase in July and were around Rmb300-400/ton higher

compared to the previous month. However, prices for material produced by joint-venture companies

decreased in July under pressure from lower priced imported material.

PBT

In North America, demand improved following the 4 July holiday period and by late July shipments

were equal or above early June levels. Producers have commented this July’s downturn was less

than in past years. In Europe, overall, automotive demand for PBT and its compounds is expected

to remain flat in the second half of 2013. Prices for PBT and related compounds were rolled over

in many cases for Q3. In Asia, markets remain depressed in the face of weak demand and new

capacity starting up in China. Competition for export markets is expected to intensify as new

Chinese producers seek to secure sales outlets.

ABS & SAN

ABS producers in North America have made no formal announcements about price changes for

August, but there will almost certainly be price decreases. The seasonal dip in demand that is typical

of the European ABS market in July and August is less noticeable this year. Sellers indicate that

demand is better than expected for the time of year, particularly in North and East Europe. Asian

ABS markets have languished for a further month as persistent weak demand has left producers

unable to raise prices despite record-high styrene prices. Exceptionally weak butadiene pricing has

helped ease pressure on margins, but has also put the lid on any hopes of higher polymer pricing.ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

PRICE MONITOR - POLYMERS

US PRICES

May-2013 Jun-2013 Jul-2013 09-Aug-2013 09-Aug-2013

¢/lb ¢/lb ¢/lb ¢/lb $/ton

Polyamide 6 Injection moulding, virgin 132.0 - 136.0 132.0 - 136.0 132.0 - 136.0 132.0 - 136.0 DDP 2910 - 2998

Polyamide 66 Injection moulding, virgin 140.0 - 145.0 140.0 - 145.0 140.0 - 145.0 140.0 - 145.0 DDP 3086 - 3197

Polycarbonate GP 145.0 - 170.0 146.0 - 170.0 147.0 - 170.0 147.0 - 170.0 DDP 3241 - 3748

Optical grade 150.0 - 168.0 150.0 - 168.0 150.0 - 168.0 150.0 - 168.0 DDP 3307 - 3704

Polyacetal Contract Quarterly, homopolymer, natural 125.0 - 130.0 125.0 - 130.0 127.0 - 131.0 ‡ 127.0 - 131.0 DDP 2800 - 2888

Contract Quarterly, copolymer, natural 126.0 - 131.0 126.0 - 131.0 126.0 - 131.0 126.0 - 131.0 DDP 2778 - 2888

ABS GP injection, natural 154.0 - 158.0 154.0 - 158.0 154.0 - 158.0 150.0 - 155.0 † DDP 3307 - 3417

Extrusion pipe grade 160.0 - 165.0 160.0 - 165.0 160.0 - 165.0 158.0 - 162.0 DDP 3483 - 3571

SAN GP Grade 145.0 - 150.0 145.0 - 150.0 145.0 - 150.0 145.0 - 150.0 DDP 3197 - 3307

WEST EUROPE PRICES

€/ton €/ton €/ton €/ton $/ton

Polyamide 6 Engineering Resin, virgin 2000 - 2050 1900 - 2050 1950 - 2050 1950 - 2050 DDP 2603 - 2737

Polyamide 66 Engineering Resin, virgin 2300 - 2350 2300 - 2350 2300 - 2350 2300 - 2350 DDP 3071 - 3138

Polycarbonate GP 2300 - 2600 2300 - 2600 2300 - 2600 2300 - 2600 DDP 3071 - 3471

Optical grade 2300 - 2550 2300 - 2550 2300 - 2550 2300 - 2550 DDP 3071 - 3405

Polyacetal Contract Quarterly, homopolymer 2885 - 3035 2885 - 3035 2885 - 3035 2885 - 3035 DDP 3852 - 4052

Contract Quarterly, copolymer 2090 - 2290 2090 - 2290 2090 - 2290 2090 - 2290 DDP 2790 - 3057

PBT Contract, unreinforced modified resin 3050 - 3350 3050 - 3350 3050 - 3350 3050 - 3350 DDP 4072 - 4473

ABS GP injection, natural 2110 - 2150 2110 - 2150 2080 - 2110 2060 - 2100 † DDP 2750 - 2804

SAN Compounding grade 1950 - 2000 1950 - 2000 1950 - 2000 1980 - 2020 † DDP 2644 - 2697

ASIA PRICES (cfr Hong Kong/China)

$/ton $/ton $/ton $/ton

Polyamide 6 China import, virgin 2660 - 2670 2680 - 2700 2660 - 2680 ‡ 2650 - 2660 CFR

Polyamide 66 China import, virgin 2800 - 3000 2800 - 3000 2800 - 3000 2750 - 2900 CFR

Polycarbonate GP 2300 - 2500 2400 - 2650 2440 - 2610 2440 - 2610 CFR

Optical grade 2100 - 2250 2100 - 2360 2220 - 2310 2190 - 2330 CFR

Polyacetal GP natural, homopolymer 2780 - 3750 2850 - 3750 2950 - 3750 2930 - 3720 CFR

GP natural, copolymer 1390 - 1550 1300 - 1450 1420 - 1560 ‡ 1410 - 1550 CFR

PBT China import, virgin 1880 - 1900 1850 - 1900 1900 - 1920 1890 - 1900 CFR

ABS GP natural 1870 - 1920 1900 - 1940 1920 - 1950 1920 - 1960 CFR

SAN GP injection moulding grade N.A. N.A. N.A. N.A. CFR

CHINA DOMESTIC PRICES

Rmb/ton Rmb/ton Rmb/ton Rmb/ton $/ton

Polyamide 6 Virgin 19000 - 19500 19200 - 19700 19500 - 20000 18500 - 19500 DDP 3021 - 3185

Polyamide 66 Virgin 22000 - 23000 22000 - 23000 22000 - 23000 21800 - 22500 DDP 3560 - 3675

Polycarbonate GP injection 18300 - 21000 18100 - 21000 18600 - 21000 ‡ 17800 - 21000 DDP 2907 - 3430

Optical grade 19500 19000 19000 19000 DDP 3103

Polyacetal GP natural, homopolymer 22000 - 31000 22000 - 30500 22300 - 30500 22000 - 30200 DDP 3593 - 4932

GP natural, copolymer 8800 - 14000 9200 - 14500 9100 - 15000 9500 - 13000 DDP 1552 - 2123

PBT Virgin 13000 - 13400 12800 - 13200 12800 - 13300 12800 - 13300 DDP 2090 - 2172

ABS GP 14400 - 15200 14400 - 14900 14000 - 14700 14300 - 14700 DDP 2335 - 2401

SAN GP injection moulding grade 13500 13500 13500 13500 DDP 2205

For an explanation of DDP see text

N.A. = Not Available † = Provisional ‡ = Revised

Current one US dollar equivalent (09-Aug-2013)

€: 0.749 £: 0.644 (1/1.553) Yen: 96.3 NT$: 29.92 Won: 1112.28 Rmb: 6.12 Rs: 60.87

Current one € equivalent (09-Aug-2013)

US$: 1.335 £: 0.860 (1/1.163) Yen: 128.5

Information contained in this report is obtained from sources believed to be reliable, however no responsibility nor liability will be accepted by Tecnon

OrbiChem for commercial decisions claimed to have been based on the content of the report.

Reproduction of any part of this work by any process whatsoever without written permission of Tecnon OrbiChem is strictly forbidden.

Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

价格追踪 - 聚合物

㕢Ӌ

2013ᑈ5᳜ 2013ᑈ6᳜ 2013ᑈ7᳜ 2013ᑈ8᳜9᮹ 2013ᑈ8᳜9᮹

㕢ߚ/⺙ 㕢ߚ/⺙ 㕢ߚ/⺙ 㕢ߚ/⺙ 㕢ܗ/ৼ

ሐ啭6 ⊼ล,ॳ⫳ 132.0 - 136.0 132.0 - 136.0 132.0 - 136.0 132.0 - 136.0 ᅠৢѸ䋻 2910 - 2998

ሐ啭66 ⊼ล,ॳ⫳ 140.0 - 145.0 140.0 - 145.0 140.0 - 145.0 140.0 - 145.0 ᅠৢѸ䋻 3086 - 3197

㘮⺇䝌䝃 䗮⫼ 145.0 - 170.0 146.0 - 170.0 147.0 - 170.0 147.0 - 170.0 ᅠৢѸ䋻 3241 - 3748

ܝᄺ㑻 150.0 - 168.0 150.0 - 168.0 150.0 - 168.0 150.0 - 168.0 ᅠৢѸ䋻 3307 - 3704

㘮⬆䝯 ড়ৠ ᄷᑺ ॳ㉦,ഛ㘮 125.0 - 130.0 125.0 - 130.0 127.0 - 131.0 ‡ 127.0 - 131.0 ᅠৢѸ䋻 2800 - 2888

ড়ৠ ᄷᑺ ॳ㉦,݅㘮 126.0 - 131.0 126.0 - 131.0 126.0 - 131.0 126.0 - 131.0 ᅠৢѸ䋻 2778 - 2888

ϭ⛃㜜-ϕѠ⛃-㣃Э⛃݅㘮⠽ABS 䗮⫼ൟ ⊼ล,✊ 154.0 - 158.0 154.0 - 158.0 154.0 - 158.0 150.0 - 155.0 † ᅠৢѸ䋻 3307 - 3417

ߎ ㅵᴤ 160.0 - 165.0 160.0 - 165.0 160.0 - 165.0 158.0 - 162.0 ᅠৢѸ䋻 3483 - 3571

㣃Э⛃ϭ⛃㜜ᷥ㛖 䗮⫼ൟ 145.0 - 150.0 145.0 - 150.0 145.0 - 150.0 145.0 - 150.0 ᅠৢѸ䋻 3197 - 3307

㽓Ӌ

ܗ/ৼ ܗ/ৼ ܗ/ৼ ܗ/ৼ 㕢ܗ/ৼ

ሐ啭6 Ꮉล᭭ᷥ㛖,ॳ⫳ 2000 - 2050 1900 - 2050 1950 - 2050 1950 - 2050 ᅠৢѸ䋻 2603 - 2737

ሐ啭66 Ꮉล᭭ᷥ㛖,ॳ⫳ 2300 - 2350 2300 - 2350 2300 - 2350 2300 - 2350 ᅠৢѸ䋻 3071 - 3138

㘮⺇䝌䝃 䗮⫼ 2300 - 2600 2300 - 2600 2300 - 2600 2300 - 2600 ᅠৢѸ䋻 3071 - 3471

ܝᄺ㑻 2300 - 2550 2300 - 2550 2300 - 2550 2300 - 2550 ᅠৢѸ䋻 3071 - 3405

㘮⬆䝯 ড়ৠ ᄷᑺ,ഛ㘮 2885 - 3035 2885 - 3035 2885 - 3035 2885 - 3035 ᅠৢѸ䋻 3852 - 4052

ড়ৠ ᄷᑺ ,݅㘮 2090 - 2290 2090 - 2290 2090 - 2290 2090 - 2290 ᅠৢѸ䋻 2790 - 3057

㘮ᇍ㣃Ѡ⬆䝌Ѡϕ䝃 ড়ৠ,ᔎᬍᗻⱘᷥ㛖 3050 - 3350 3050 - 3350 3050 - 3350 3050 - 3350 ᅠৢѸ䋻 4072 - 4473

ϭ⛃㜜-ϕѠ⛃-㣃Э⛃݅㘮⠽ABS 䗮⫼ൟ ⊼ล,✊ 2110 - 2150 2110 - 2150 2080 - 2110 2060 - 2100 † ᅠৢѸ䋻 2750 - 2804

㣃Э⛃ϭ⛃㜜ᷥ㛖 ড়㑻 1950 - 2000 1950 - 2000 1950 - 2000 1980 - 2020 † ᅠৢѸ䋻 2644 - 2697

Ѯ⌆Ӌ (CFR佭␃/Ё)

㕢ܗ/ৼ 㕢ܗ/ৼ 㕢ܗ/ৼ 㕢ܗ/ৼ

ሐ啭6 Ё 䖯ষ, ॳ⫳ 2660 - 2670 2680 - 2700 2660 - 2680 ‡ 2650 - 2660 ࠄኌӋ

ሐ啭66 Ё 䖯ষ, ॳ⫳ 2800 - 3000 2800 - 3000 2800 - 3000 2750 - 2900 ࠄኌӋ

㘮⺇䝌䝃 䗮⫼ 2300 - 2500 2400 - 2650 2440 - 2610 2440 - 2610 ࠄኌӋ

ܝᄺ㑻 2100 - 2250 2100 - 2360 2220 - 2310 2190 - 2330 ࠄኌӋ

㘮⬆䝯 䗮⫼ ॳ㉦ ,ഛ㘮 2780 - 3750 2850 - 3750 2950 - 3750 2930 - 3720 ࠄኌӋ

䗮⫼ ॳ㉦ ,݅㘮 1390 - 1550 1300 - 1450 1420 - 1560 ‡ 1410 - 1550 ࠄኌӋ

㘮ᇍ㣃Ѡ⬆䝌Ѡϕ䝃 Ё 䖯ষ, ॳ⫳ 1880 - 1900 1850 - 1900 1900 - 1920 1890 - 1900 ࠄኌӋ

ϭ⛃㜜-ϕѠ⛃-㣃Э⛃݅㘮⠽ABS 䗮⫼ൟ ॳ㉦ 1870 - 1920 1900 - 1940 1920 - 1950 1920 - 1960 ࠄኌӋ

㣃Э⛃ϭ⛃㜜ᷥ㛖 䗮⫼ ⊼ล㑻 ϡ䆺 ϡ䆺 ϡ䆺 ϡ䆺 ࠄኌӋ

Ё ݙӋ

ܗ/ৼ ܗ/ৼ ܗ/ৼ ܗ/ৼ 㕢ܗ/ৼ

ሐ啭6 ॳ⫳ 19000 - 19500 19200 - 19700 19500 - 20000 18500 - 19500 ᅠৢѸ䋻 3021 - 3185

ሐ啭66 ॳ⫳ 22000 - 23000 22000 - 23000 22000 - 23000 21800 - 22500 ᅠৢѸ䋻 3560 - 3675

㘮⺇䝌䝃 䗮⫼ൟ ⊼ล 18300 - 21000 18100 - 21000 18600 - 21000 ‡ 17800 - 21000 ᅠৢѸ䋻 2907 - 3430

ܝᄺ㑻 19500 19000 19000 19000 ᅠৢѸ䋻 3103

㘮⬆䝯 䗮⫼ൟ ॳ㉦,ഛ㘮 22000 - 31000 22000 - 30500 22300 - 30500 22000 - 30200 ᅠৢѸ䋻 3593 - 4932

䗮⫼ൟ ॳ㉦,݅㘮 8800 - 14000 9200 - 14500 9100 - 15000 9500 - 13000 ᅠৢѸ䋻 1552 - 2123

㘮ᇍ㣃Ѡ⬆䝌Ѡϕ䝃 ॳ⫳ 13000 - 13400 12800 - 13200 12800 - 13300 12800 - 13300 ᅠৢѸ䋻 2090 - 2172

ϭ⛃㜜-ϕѠ⛃-㣃Э⛃݅㘮⠽ABS 䗮⫼ൟ 14400 - 15200 14400 - 14900 14000 - 14700 14300 - 14700 ᅠৢѸ䋻 2335 - 2401

㣃Э⛃ϭ⛃㜜ᷥ㛖 䗮⫼ൟ ⊼ล㑻 13500 13500 13500 13500 ᅠৢѸ䋻 2205

݇ѢᅠৢѸ䋻ⱘ䆺㒚㾷䞞䇋ⳟ⊼㾷

† = ᱖ᅮ ‡ = ᷵ℷ

ᔧ㕢ܥܗᤶ⥛ (2013ᑈ8᳜9᮹)

ܗ: 0.749 㣅䬥: 0.644 (1/1.55 ᮹ܗ: 96.3 ᮄৄᏕ: 29.92 䶽ܗ: 1112.28 Ҏ⇥Ꮥ: 6.12 श↨: 60.87

ᔧܥܗᤶ⥛ (2013ᑈ8᳜9᮹)

㕢ܗ: 1.335 㣅䬥: 0.860 (1/1.16 ᮹ܗ: 128.5

ᴀਞ᠔ࣙⱘֵᙃⱚᴹ㞾ৃֵⱘ䌘᭭ᴹ⑤ˈ

Ԛᰃᇍӏԩໄ⿄䎳ᴀਞݙᆍ᠔ⱘخଚϮއㄪˈ㣅⋄ৃ㤷ܼ⧗࣪ᄺ᳝䰤݀ৌὖϡ䋳䋷DŽ

㒣㣅⋄ৃ㤷ܼ⧗࣪ᄺ᳝䰤݀ৌк䴶䆌ৃˈϹ⽕ҹӏԩᮍᓣᇍᴀਞⱘӏԩݙᆍࡴҹᡘ㺁DŽ

Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

POLYMER PRICE MONITOR

US PRICES 2003-2013

KEY DATA AND STATISTICS Dollars per Ton delivered

Regional Price Graphs 4,600

4,400 PA6 virgin chip

4,200

Key Trade Data 4,000 PA66 virgin

3,800 chip

3,600

POLYAMIDE 6 & 66 3,400 Polycarbonate

3,200 GP

North America 3,000

2,800 ABS GP natural

2,600

West Europe 2,400

2,200

Asia 2,000

1,800

China 1,600

03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 13 13

b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g-

Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u

POLYCARBONATE 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A

North America Source: Tecnon OrbiChem

West Europe

Asia

China

WEST EUROPE PRICES 2003-2013

POLYACETAL

North America Euro per Ton delivered

West Europe 3,300

PA6 virgin chip

China 3,100

2,900 PA66 virgin

chip

2,700

PBT 2,500 Polycarbonate

2,300 GP

North America 2,100

ABS GP natural

1,900

West Europe 1,700

Asia 1,500

1,300

China 1,100

03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 13 13

b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g-

Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u

ABS & SAN 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A

North America Source: Tecnon OrbiChem

West Europe

Asia

China

ASIA PRICES 2003-2013

MATERIALS and

Processing FOCUS Dollars per Ton cfr

Materials News 4,200

PA6

4,000 PA6 virgin

virgin chip,

chip

3,800 NEA export*

3,600

STRATEGY FOCUS 3,400 Polycarbonate

PA6 virgin

3,200 GP chip,

China import

Company News 3,000

2,800 ABS GP natural

2,600 Polycarbonate

Project News 2,400 GP

2,200

2,000 ABS GP natural

ECONOMIC NEWS 1,800

1,600

1,400

STUDIES 1,200

1,000

800

FEEDSTOCKS *Series ends

03 03 04 04 05 05 06 06 07 07 08 08 09 09 10 10 11 11 12 12 13 13 June 2012

b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g- b- g-

Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u Fe u

Market Trends 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A 1- 1-A

Price Monitor Source: Tecnon OrbiChem

Access Tecnon

orbichem online

Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

TRADE DATA FOR KEY MARKETS JANUARY-MAY 20131

(1,000 Metric Tons)

Polyamide1,2 Polycarbonate1 Polyacetal1 PBT1 ABS1 SAN1

Imports

China 367.5 (0%) 534.1 (-4%) 90.4 (+4%) 56.6 (-6%) 648.9 (-5%) 67.7 (-19%)

EU 27 70.7 (-13%) 36.3 (-9%) 25.1 (-2%) N.A. 68.0 (-1%) 14.0 (+25%)

4

Japan 40.5 (0%) 30.2 (-4%) 6.2 (-15%) N.A. 16.1 (-2%) 2.1 (+38%)

South Korea 53.7 (+11%) 43.6 (+7%) 3.4 (+1%) 28.6 (+16%) 1.8 (-37%) 5.4 (+46%)

Taiwan 33.6 (-6%) 71.1 (-19%) 5.5 (+29%) 1.8 (-50%) 3.8 (-24%) 0.7 (0%)

USA 40.0 (+9%) 25.2 (+15%) 9.4 (-2%) N.A. 58.4 (-5%) 6.9 (-1%)

Exports

China 38.9 (-26%) 78.2 (-19%) 24.3 (+5%) 36.3 (-4%) 12.7 (-11%) 2.3 (-15%)

EU 274 167.7 (-6%) 133.9 (+17%) 18.1 (-2%) N.A. 53.0 (-3%) 3.6 (+49%)

Japan 33.0 (-6%) 66.7 (-22%) 22.5 (-2%) N.A. 39.8 (-23%) 15.8 (-14%)

South Korea 64.0 (+13%) 190.7 (+14%) 48.4 (+8%) 9.3 (+20%) 512.6 (+9%) 55.3 (-4%)

Taiwan 152.7 (+1%) 94.6 (+6%) 25.1 (+2%) 76.1 (+3%) 437.0 (-4%) 33.1 (-6%)

USA 290.8 (+8%) 167.7 (-14%) 38.2 (-2%) N.A. 40.6 (-1%) 9.3 (-31%)

CHINA IMPORTS BY LEADING SOURCE COUNTRIES JANUARY-MAY 20131

(1,000 Metric Tons)

Polyamide2 PA663 Polycarbonate Polyacetal PBT ABS SAN

EU27 32.5 (-8%) N.A. 46.5 (+76%) 1.7 (+4%) N.A. 4.5 (-19%) 0.2 (1447%)

4,5

Japan 14.1 (-10%) 8.9 (-11%) 34.5 (-33%) 9.9 (-10%) 7.5 (-7%) 25.3 (-18%) 8.8 (-7%)

Malaysia 8.5 (+56%) 0.9 (+5%) 0.3 (-46%) 2.2 (+14%) 9.0 (-28%) 26.9 (-32%) 0.7 (-24%)

Singapore 9.8 (-5%) 9.6 (-5%) 23.9 (-9%) 0.1 (+38%)ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

SUBSCRIBER NOTE: INCOTERM CHANGES IN PRICE MONITOR

POLYMER PRICE MONITOR

DDP - Delivered Duty Paid

KEY DATA AND STATISTICS Please note that, in order to bring consistency with Incoterms 2010, price series previously described

using the non-incoterms DEL, FD, Fr.Pd and Fr.Eq will, from now on, be described by the incoterm DDP.

Regional Price Graphs

Key Trade Data

完税后交货

POLYAMIDE 6 & 66 请注意,为了保持与2010年国际贸易术语解释通则的一致性,从现在开始,之前使用非国际贸易术

语送到价, 送到价, 运费已付 和 平均运费 描述的价格系列将会被代替描述为完税后交货.

North America

West Europe

Asia

POLYAMIDE 6 & 66

China

POLYCARBONATE North America

North America

Polyamide polymer markets have come under no particular pressure in recent weeks and buyers and sellers

West Europe all describe their business in the past few months as flat in terms of both volume and pricing.

Asia

China BASF has not persisted in its effort to raise prices since abandoning the 5 c/lb price increase that it

proposed in June for polyamide 6 base resin. Although no other producer has attempted a similar price

POLYACETAL rise since then, there is much dissatisfaction with current margins. With prices in the benzene market again

North America pointed upwards in August, there is some speculation that autumn increases will be considered.

West Europe

August increases appear to have been ruled out because of typically weak trading conditions in the summer

China holiday period. One seller has observed a significant slowdown since the beginning of the month, but the

decline in business is mostly in line with seasonal expectations. Another has found volume demand from

PBT

the automotive industry for polyamide resins to be steady despite the holiday period. September is typically

North America a peak period for polyamide 6 resin consumption.

West Europe

Asia Polyamide 66 polymer prices are similarly flat in August and demand is described as lukewarm. The

buoyant automotive industry remains the end-use sector where demand is growing fastest. There has been

China

no change in the usual gap between prices for polyamide 6 and polyamide 66 polymers and substitution

ABS & SAN of one for the other is not a feature of the current market.

North America

West Europe

West Europe

Asia August prices for virgin polyamide 6 engineering resin in Europe are mostly the same as in July, even

China though lower feedstock costs are having a somewhat negative effect on buying ideas. Benzene prices

decreased in July and are lower again in August. Although the July benzene decrease was partially passed

MATERIALS and through to the caprolactam market, prices for polyamide 6 polymer have not been affected.

Processing FOCUS

There has been no further trace of polyamide 6 base resin being sold at prices lower than €1.95/kg ddp,

Materials News

as was the case in June. There are many sellers who refused to sell at prices lower than €2.00/kg ddp

STRATEGY FOCUS in July, and some are maintaining this level as a floor price for August. One seller has been trying to hold

base resin prices above €2.05/kg ddp, but this appears to be an exception.

Company News

Project News Polyamide 6 polymer buyers are generally satisfied with stable pricing, and most would like to avoid

ECONOMIC NEWS transferring the volatility of benzene pricing to their downstream businesses. They are not pressing for price

decreases now, but they can be expected to resist price increases should the benzene market suddenly

STUDIES spike upwards later in the year.

FEEDSTOCKS

Market Trends

Price Monitor

Access Tecnon

orbichem online

Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

Polyamide 66 polymer prices are also unchanged in August, and have remained at the same level since

POLYMER PRICE MONITOR January. Sellers have been unable to implement proposed price increases for polyamide 66 polymer after

the dramatic fall in butadiene prices from €1250/ton in June to €750/ton in August. Buyers claim to have

KEY DATA AND STATISTICS been offered discounts on purchases of polyamide 66 in August, but no seller has acknowledged anything

but a rollover of polymer prices so far this month.

Regional Price Graphs

Key Trade Data Sales volumes are traditionally lower during the July and August holiday period, but the seasonal downturn

in activity is less pronounced this year in both polyamide 6 and polyamide 66 markets. Some sellers have

POLYAMIDE 6 & 66

commented that they sold more material in July than in June, but this is not a universal assessment of recent

North America demand.

West Europe

Asia Asia

China

In Japan, August has brought little change to the domestic polyamide engineering plastics market. As in

POLYCARBONATE western countries, August is a peak holiday season in Japan and some downtime is expected at automotive

assembly lines, automotive parts factories and plastics moulding operations.

North America

West Europe Vehicle production in Japan has been increasing since the second quarter as the industry benefits from the

Asia sharp depreciation of the yen. Japanese car makers have also been able to increase their production and

China sales in China since the beginning of the year, another factor in rising demand for polyamide base polymer

and compounds.

POLYACETAL

North America Vehicle Production In Japan

(1,000 Units)

West Europe

China Passenger Car Truck Bus Total

June 2013 684.2 112.8 11.5 808.6

PBT

% Change (yoy) -11.1 -0.7 11.8 -9.5

North America Jan-Jun 2013 3973.3 634.6 67.0 4675.0

West Europe % Change (yoy) -12.3 -3.6 12.7 -10.9

Asia Source: JAMA

China

Electric and electronic appliance production remains depressed, especially the manufacture of liquid-crystal

ABS & SAN televisions, but there has been a marginal recovery since the end of the second quarter. This trend, along

with steady demand for packaging film and fishing line, means that domestic polyamide polymer demand

North America

in Japan is somewhat better than expected in August.

West Europe

Asia July prices for polyamide polymer exports from Japan essentially rolled over from June, despite efforts to

China raise July prices by around $30/ton. Typical export prices for the two months were in the ranges $3200-

3400/ton cfr Northeast Asia for injection grades and $3700-3900/ton for polyamide copolymers.

MATERIALS and

Processing FOCUS In August, several Japanese producers have been offering material at a further rollover, even though

Japanese caprolactam sellers have been seeking $40/ton increases for their July business. Buyers have

Materials News

been quick to reject any idea of a rollover, and some have proposed decreases of $50-100/ton for August

STRATEGY FOCUS polymer purchases. The likely outcome is very unclear.

Company News

Polyamide polymer demand in Asia is understood to be relatively weak, especially in China, and demand

Project News for injection moulding material is exceptionally poor. Polymer demand for fishing line and packaging

ECONOMIC NEWS applications is much stronger.

STUDIES

FEEDSTOCKS

Market Trends

Price Monitor

Access Tecnon

orbichem online

Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

Polyamide Polymer Production For Moulding Materials

POLYMER PRICE MONITOR (1,000 Metric Tons)

KEY DATA AND STATISTICS 2010 2011 2012 2013

Jan 22.6 21.1 19.9 19.8

Regional Price Graphs

Feb 19.4 18.0 15.7 16.7

Key Trade Data Mar 18.9 19.9 15.0 15.4

Apr 19.4 17.8 17.3 18.2

POLYAMIDE 6 & 66

May 19.6 17.6 18.2 18.4

North America Jun 20.1 18.2 17.0 16.8

West Europe Jul 19.7 19.9 21.3

Asia Aug 21.4 21.1 22.3

Sep 19.2 19.7 19.2

China

Oct 18.1 19.7 18.5

POLYCARBONATE Nov 20.7 19.6 18.0

Dec 21.5 21.3 20.4

North America

Total 240.7 233.9 222.7

West Europe % Change 27.5 -2.8 -4.8

Asia Jan-Jun 120.1 112.6 103.0 105.1

China % Change 87.2 -6.2 -8.8 2.1

Source: METI (Ministry of Economy, Trade and Industry)

POLYACETAL

North America Exports Of Polyamide Polymers From Japan (2009-2013)

(1,000 Metric Tons)

West Europe

China 2010 2011 2012 2013

Jan 7.5 6.1 6.1 5.5

PBT

Feb 7.0 9.5 7.2 6.5

North America Mar 8.8 9.6 7.8 7.9

West Europe Apr 7.5 8.3 6.9 6.5

Asia May 7.2 6.6 7.0 6.7

Jun 7.3 6.2 6.5 6.5

China

Jul 7.3 5.8 7.2

ABS & SAN Aug 6.7 5.8 7.0

Sep 6.8 6.2 6.9

North America

Oct 7.5 5.9 7.2

West Europe Nov 6.6 6.0 6.8

Asia Dec 7.3 6.1 6.3

China Total 87.6 82.4 82.8

% Change 17.9 -5.9 0.5

MATERIALS and Jan-Jun 45.3 46.2 41.5 39.6

Processing FOCUS % Change 57.5 1.8 -10.1 -4.7

Source: Ministry of Finance

Materials News

STRATEGY FOCUS Remarks: The above numbers include only HS code 3908.10-000 (PA6, 11, 12, 66, 610, etc.). HS code

3908.90-000 is not included.

Company News

Project News

ECONOMIC NEWS

STUDIES

FEEDSTOCKS

Market Trends

Price Monitor

Access Tecnon

orbichem online

Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

Imports Of Polyamide Polymers Into Japan (2009-2013)

POLYMER PRICE MONITOR (1,000 Tons)

KEY DATA AND STATISTICS 2010 2011 2012 2013

Jan 8.8 8.5 9.0 8.9

Regional Price Graphs

Feb 7.7 7.4 8.1 6.1

Key Trade Data Mar 8.2 7.3 7.5 6.5

Apr 8.0 7.9 7.4 9.4

POLYAMIDE 6 & 66

May 6.9 6.1 8.6 9.6

North America Jun 8.3 5.3 7.5 8.6

West Europe Jul 7.5 6.0 8.1

Asia Aug 7.5 7.1 9.1

Sep 7.8 8.4 7.4

China

Oct 7.9 8.5 8.8

POLYCARBONATE Nov 8.2 9.3 8.6

Dec 6.6 7.9 5.9

North America

Total 93.4 89.7 95.9

West Europe % Change 84.3 -3.9 6.8

Asia Jan-Jun 47.8 42.5 48.0 49.1

China % Change 212.2 -11.2 13.0 2.3

Source: Ministry of Finance

POLYACETAL

North America Remarks: The above numbers include only HS code 3908.10-000 (PA6, 11, 12, 66, 610, etc.). HS code

3908.90-000 is not included.

West Europe

China In Taiwan, polyamide 6 polymer prices decreased by around $30/ton in July after a decrease in feedstock

caprolactam prices and in a climate of weak downstream demand. Virgin polyamide 6 polymer prices

PBT

were heard done at $2650-2660/ton cif, L/C 90 days, in late July and early August.

North America

West Europe July caprolactam contract deals in Taiwan were concluded at $2360/ton cfr, but this is quoted as a

Asia provisional contract price as only a limited number of deals were done. Spot caprolactam prices in Taiwan

were quoted at $2300-2340/ton in late July, and some business was heard at $2270-2320/ton cfr, L/C

China

90 days, $60-90/ton lower than the price in the third week of June.

ABS & SAN

The Taiwanese polyamide 6 polymer market became quiet in early August as most of business for the

North America

month was concluded ahead of time. Downstream users are reluctant to accept current prices as several

West Europe filament plants have reduced their operating rates. A big polyamide 6 polymer producer in Taiwan

Asia decreased its operating rate to 50% in mid-July due to weak downstream demand; the other polyamide

China 6 polymer producers are running at around 60-70%. In July, the average operating rate for polyamide 6

polymer in Taiwan was around 65%.

MATERIALS and

Processing FOCUS China

Materials News

Prices for medium- and low-quality polyamide 6 polymer in China decreased by Rmb500-1000/ton from

STRATEGY FOCUS early July to early August and are being quoted at Rmb18500-19500/ton. The market has mainly been

driven down by the decrease in caprolactam prices and a weak downstream market.

Company News

Project News The caprolactam market experienced a slight dip in the second half of July with the restart of several plants

ECONOMIC NEWS after maintenance shutdowns. At the same time, downstream demand remained flat. In late July, Sinopec

settled its July price at Rmb18600/ton, which was somewhat higher than expected. The market became

STUDIES steadier with the news that two 100 ktpa caprolactam plants would close for maintenance. Although one

FEEDSTOCKS new plant came on stream at the end of July, its output remains limited and has not greatly affected the

Market Trends market. August spot prices in the domestic caprolactam market are Rmb17700-18000/ton. Demand is

Price Monitor roughly balanced with domestic production and imported supply.

Access Tecnon

orbichem online

Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

Prices for virgin polyamide 6 resin for engineering plastics applications and industrial applications in early

POLYMER PRICE MONITOR August were quoted at Rmb18500-19500/ton ddp, L/C 90-180 days, Rmb500-1000/ton lower than

in early July. Prices for high speed spinning polymer decreased by Rmb400-600/ton in July and have

KEY DATA AND STATISTICS stabilised at Rmb20100-20800/ton, L/C 90-180 days, in early August. Chinese polyamide 6 polymer

producers were running their facilities at 72-75% on average in July.

Regional Price Graphs

Key Trade Data In early August, BOPA film polymer prices were unchanged from the second half of July, but down by

Rmb500/ton from the levels of early July. Prices were quoted at Rmb20500-21200/ton ddp, L/C 90

POLYAMIDE 6 & 66

days, in early August. BOPA film polymer demand has been essentially flat with no sign of a seasonal

North America recovery. BOPA film producers have been running at around 75% of capacity, down from around 80%

West Europe in early July due to limitations on electricity supplied for industrial use in the summer peak period mainly

Asia in Jiangsu and Zhejiang provinces. BOPA film prices are stable at Rmb26000-26500/ton for composite

grade, and there are no signs of upward pressure in the market.

China

POLYCARBONATE The polyamide 66 polymer market in July and early August remained flat on the whole, although a few deals

were heard at decreased prices. The downstream market has seen no obvious recovery from seasonal

North America

lows and buying interest remains thin. Some producers have reduced prices by around Rmb500/ton to

West Europe move material.

Asia

China Chinese polyamide 66 polymer producers were running at an average of around 70% in July. Inventories

are described as reasonable. Steady supply and demand suggest that the market will remain flat until

POLYACETAL September.

North America

In early August, virgin polyamide 66 polymer prices were quoted at Rmb21800-22500/ton ddp, L/C

West Europe

basis. Prices for imported virgin polyamide 66 polymer were around $50-100/ton lower than in July at

China $2750-2900/ton cif, L/C 90 days.

PBT

POLYCARBONATE

North America

West Europe North America

Asia

The production of BPA has eased back through June and July as the balance of trade in both BPA and

China

derivatives has deteriorated. This is largely a consequence of the new plants in Northeast Asia and product

ABS & SAN looking for a home in the export market. BPA prices, however, have remained largely stable in the range

90-95 c/lb ($1984-2094/ton) ddp. How long US producers can maintain price stability remains to be

North America

seen, as two more plants are due to start up in Northeast Asia, one in China and one in South Korea.

West Europe

Asia Consumer confidence in May was 81.4%, the highest since January 2008. This bodes well for continued

China economic growth based on consumer spending and purchases of IT items such as tablets and iPhones.

MATERIALS and The strength of the US car market continues unabated. July sales of passenger cars and light trucks were

Processing FOCUS 1.32 million, almost 15% higher than the 1.15 million vehicles sold in July 2012, according to Autodata.

The year-to-date figures through to July were 9.14 million, an 8.4% increase on the corresponding figures

Materials News

for 2012. This strong market is supported by earnings figures now coming through from major producers

STRATEGY FOCUS such as Ford whose Q2 net income was $1.2 billion, a 20% increase on a year ago. Moreover, its outlook

remains bullish for Q3 and the industry is currently producing at the annual rate of 16 million units.

Company News

Project News Builder confidence in the market for new single-family homes is also rising and, although building permits

ECONOMIC NEWS fell by 7.5% in June to an annual rate of 911,000, they were still 16.1% higher than June 2012.

STUDIES From a polycarbonate resin perspective the strong automotive sector is good but prospects in a number of

FEEDSTOCKS other sectors are quite patchy. Construction is still on the way up and it will be a year or two before it has

Market Trends achieved a reasonable size again. Outside automotive lenses and glazing, which is a very competitive

Price Monitor volume market, optical media is pretty flat. CDs and DVDs have been in decline for some years but have

yet to be replaced (outside automotive) with other new high-tech optical uses of any size.

Access Tecnon

orbichem online Overall polycarbonate resin prices are quite stable at present and have been for several months. There

have been some low-priced spot deals for imported Asian product but generally these are limited.

10 Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

West Europe

POLYMER PRICE MONITOR

There has been no improvement in the demand for BPA in Europe and, if anything, production declined in

KEY DATA AND STATISTICS July. This is supported by the phenol numbers. As with North America, competition from imports has been

increasing with reports of BPA on offer from South Korea at $1400/ton cfr Northwest Europe. Contract

Regional Price Graphs

prices declined by €40/ton to €1520-1550/ton ddp, although margins have improved a little for a while at

Key Trade Data least due to the reduction in manufacturing costs of €59/ton, the result of lower benzene prices.

POLYAMIDE 6 & 66

Taken as a whole the EU economy remains weak; unemployment figures remain stubbornly high (and at

North America 12.2% for May are edging higher) and the Markit Eurozone Manufacturing Index, although improving, is

West Europe still sub 50. By sector, new car registrations in the EU fell in June to the lowest level recorded since 1996. A

Asia total of 1.134 million units were registered in June, down 5.6% on June 2012, according to the European

Manufacturers’ Association (ACEA). At 6.205 million first half figures were 6.6% less than the same period

China

last year. The construction industry also remains generally weak with EU production down 5.5% in May on

POLYCARBONATE a year on year basis.

North America

Recent monthly figures have shown some sign of improvement, however. There are also other signs that

West Europe things are improving with the German consumer spending index up and also a general feeling in some parts

Asia of industry that the ‘doom and gloom’ reporting from the media has been overdone.

China

This said, the majority of volume polycarbonate resin contract prices rolled over in Q3 though there is also

POLYACETAL word of some small price increases (€5-10/ton) in more speciality instances.

North America

Styron Europe has made Velox its European distributor for polycarbonate resin medical application products.

West Europe

The deal also includes some other engineering thermoplastics.

China

The distributor and compounder of polycarbonate resins (and other Engineering Thermoplastics), Ter Plastics

PBT

Polymer Group, is shutting down its production plant at Herne in Germany. It will outsource the compounding

North America operation to partner companies. This is so that it can expand its international business where it is taking on

West Europe more sales staff.

Asia

The latest generation of laptops are the so called ‘ultra-notebooks’. These are light enough to be taken

China

anywhere, razor thin, powerful and long-lasting. Bayer is launching a new polycarbonate material for such

ABS & SAN housings (see Materials News).

North America

The balance of trade in polycarbonate resins was quite stable in April and May. Exports were virtually

West Europe unchanged at 26-27 kt in the period whilst imports were somewhat down due to the weak state of the

Asia European market.

China

Asia

MATERIALS and

Processing FOCUS The BPA spot import price for China from Northeast Asian suppliers declined further in July to around $1550-

1580/ton cfr, some $80/ton lower than in June. It is little wonder, therefore, that the operating rates of some

Materials News

regional producers have been curtailed. Kumho P&B has officially reduced its rate to a maximum of 80%

STRATEGY FOCUS on both its No 3 and No 4 plants at Yeosu. The No2 plant has been idled since May. Other producers

in Japan, Taiwan and South Korea are thought to have cut back their output but so far there have been no

Company News

official announcements. The average BPA plant operating rate in the region is estimated to be around 75%,

Project News though this is still higher than in the US or Europe.

ECONOMIC NEWS

There are growing concerns in the region over the future development of demand, even though there has only

STUDIES been a modest slowdown in Chinese economic activity so far. These concerns are more about both the total

FEEDSTOCKS level of GDP growth going forward and its mix. This in turn is due to the weakness of demand for Chinese

Market Trends exports, particularly from Europe, and the loss of competitiveness to other Asian countries and Mexico, for

Price Monitor example.

Access Tecnon

orbichem online

11 Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

Despite the fall in lower end polycarbonate resin prices in China over the last month, so far spot import

POLYMER PRICE MONITOR prices have been quite stable at $2440-2610/ton cfr for general purpose moulding grades and $2190-

2300/ton cfr for optical media grades. With lower BPA prices working through the system, this may be

KEY DATA AND STATISTICS about to change, however.

Regional Price Graphs

In Taiwan Chi Mei has restarted production of its polycarbonate resins at around 50%. Formosa Idemitsu

Key Trade Data Petrochemical is running only one unit and that at 40% operation rate.

POLYAMIDE 6 & 66

China

North America

West Europe The BPA price has fluctuated in the last month; down in early July and up later in the month. Market prices

Asia are Rmb12800/ton in both East China and North China.

China

The operating rate is around 80% for Nantong Xingchen’s BPA plant with output mainly for captive use,

POLYCARBONATE that is, downstream epoxy resin production, but some is exported to certain customers. Bayer’s BPA plant

operates at around 70% and product is mainly used for downstream polycarbonate resin production with

North America

only a small amount for exports. Sinopec Mitsui is running well at full capacity, mainly supplying a number

West Europe of key customers. It is planned to have a three-week turnaround for maintenance in August. Sinopec

Asia Mitsubishi is also operating at around 70%. BPA is produced for downstream polycarbonate production

China and certain customers. The BPA operating rate of the Changshu plant of Changchun is around 50%, with

supply mainly for downstream production.

POLYACETAL

North America BPA imports into China in June reached 44,032 tons, of which 13,526 tons were from Taiwan, 12,464

tons from Thailand, 10,330 tons from South Korea, 2,835 tons from Russia, 1,935 tons from Singapore

West Europe

and 1,782 tons from Japan.

China

In Q2 China’s GDP was reported as 7.5% just 0.2% down on the first quarter. In the construction sector,

PBT

house prices are generally on the increase and the floor space of new buildings started in the first half

North America increased by 3.8%, on a year on year basis. Car sales were 1.403 million in June up 9.3% on June 2012

West Europe and cumulative first half sales were 8.665 million, an increase of 13.8% on the previous period.

Asia

Teijin Polycarbonate China’s plant operated at around 70% through the first half of July and then commenced

China

a month-long maintenance turnaround from the end of July. Its prices are around Rmb18500/ton. Bayer’s

ABS & SAN plant runs smoothly at around 60% and offers are made around Rmb18200-18300/ton. Ling You

Engineering-Plastics resumed production around the end of July and its prices are around Rmb18600-

North America

18800/ton. Sinopec Mitsubishi Chemical operates around 70%.

West Europe

Asia The ex-works prices of polycarbonate resins are still declining. Overall, the range of polycarbonate resin

China prices in China for July was Rmb17800-21000/ton ddp for general purpose injection moulding grades

and around Rmb19000/ton ddp for optical media grades.

MATERIALS and

Processing FOCUS Upstream, the price of BPA has improved gradually and producers are facing more price pressure. A

new round of negotiations has just started. Some producers are trying to raise the price because of the

Materials News

continuous increases in feedstock costs, but the market conditions are weak and buyers are cautious. Deals

STRATEGY FOCUS are tending to rely solely on immediate physical demand.

Company News

Polycarbonate imports into China in June were 107,211 tons, of which 25,772 tons from South Korea,

Project News 13,819 tons from Thailand, 13,789 tons from Taiwan, 9,201 tons from Saudi Arabia, 8,427 tons from

ECONOMIC NEWS Japan, 6,655 tons from Holland, 5,298 tons from Singapore and 4,775 tons from the US.

STUDIES POLYACETAL

FEEDSTOCKS

Market Trends North America

Price Monitor

The polyacetal market was clicking along at a decent pace in the third quarter as indicators continued to

Access Tecnon show the US economy growing steadily.

orbichem online

12 Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

There was some talk heard of higher prices for homopolymer in response to tighter supplies during the

POLYMER PRICE MONITOR second quarter. The tighter market conditions seem to have been short-lived, however, and there was no

further talk heard in early August. Homopolymer prices, however, did increase by a couple of cents during

KEY DATA AND STATISTICS the months of June and July, market participants said.

Regional Price Graphs

Copolymer polyacetal supplies reportedly were balanced. Demand for copolymer has not decreased in

Key Trade Data the third quarter, with demand driven by the automotive and industrial markets. Feedstock and energy

prices have been steady, meaning there was little pressure from the production cost side during the third

POLYAMIDE 6 & 66

quarter.

North America

West Europe Through the first half of 2013, the US exported 46.7 kt of polyacetal resin, a slight decrease of 1.07%

Asia compared to the same period in 2012. The top five destinations were China (11.4 kt, down 15%), Mexico

(10.5 kt, up 7.3%), Brazil (6.4 kt, up 31%), Canada (4.2 kt, down 7%) and Japan (2.9 kt, up 5.7%). The

China

US imported 11.8 kt during the first half of 2013, down 4% compared to the same period in 2012. South

POLYCARBONATE Korea (5.7 kt, down 2%) and Thailand (2.1 kt, up 4%) were the only importing countries with more than

2 kt shipped to the US market.

North America

West Europe Methanex rolled over its June non-discounted methanol contract price into August at 160 c/gal, and

Asia Southern Chemical rolled its price at 162 c/gal into August. Spot market prices were still around 140

China c/gal fob US Gulf Coast in early August. Methanol production has been affected off-and-on for several

months by natural gas supply restrictions in Trinidad & Tobago, and further restrictions are expected in

POLYACETAL September. However, there are methanol and ammonia plant turnarounds scheduled during September

North America which could nullify some of the effects of the natural gas cutbacks.

West Europe

West Europe

China

The European polyacetal market reverted to normal seasonal activity during late July/early August as many

PBT

market participants were away for holidays. Not that the polyacetal market had been extremely busy

North America anyway; quite the reverse; market conditions have been tough throughout 2013.

West Europe

Asia The main reason for this is the poor car market in Europe, which is the major downstream market for

polyacetal resin. Producers reportedly have dialled down the production rates in order to keep supplies

China

balanced. It is understood that the market has been steady in terms of demand over the last two months

ABS & SAN despite the poor car market. Prices for the third quarter were not fully confirmed, but a rollover is likely the

best that producers could hope for in light of current demand levels.

North America

West Europe Methanol spot market prices firmed in July due to concerns over tightening supplies due to various global

Asia production problems and steady demand in some downstream applications. In early July, spot prices

China increased €20/ton and deals were heard done between €360-365/ton fob Rotterdam. By the middle

of the month, prices had surged to €370-375/ton and stayed in that range late in the month. Spot prices

MATERIALS and eased back to €365/ton in early August for spot barges.

Processing FOCUS

China

Materials News

STRATEGY FOCUS Domestic polyacetal market prices continued to increase in July and were around Rmb300-400/ton higher

compared to the previous month. Market participants estimate that domestic market prices will continue to

Company News

increase because the domestic producers have been facing a loss-making situation for a very long time and

Project News prices are now still hovering along the production cost line.

ECONOMIC NEWS

Polyacetal resin prices for material produced by joint-venture companies, however, decreased in July.

STUDIES Market participants said this was mainly because the target markets of the joint-venture companies are

FEEDSTOCKS different than the domestic producers. Joint-venture companies’ main competitors are import products, and

Market Trends because the polyacetal resin demand in other countries was not good, import prices decreased. This put

Price Monitor pressure on the joint-venture companies to decrease prices.

Access Tecnon Market participants were worried that if the import price does not increase, domestic producers may lose

orbichem online market share or take longer to increase market share. The average operating rate in July in China was

around 70%.

13 Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

China exported 4,993 tons of polyacetal in June, a 6.71% drop from May but an increase of 3.96%

POLYMER PRICE MONITOR year-on-year. China imported 20,453 tons in June, a 3.9% drop from May, but an increase of 15.4%

year-on-year. Imports are mainly from Asia, with 4,084 tons from Taiwan, 3,654 tons from South Korea,

KEY DATA AND STATISTICS 2,021 tons from Japan and 1,947 tons from the US.

Regional Price Graphs

China’s domestic market prices were quoted at Rmb9500-10000/ton exw for on-spec copolymer from

Key Trade Data domestic producers, and Rmb10800-13000/ton for copolymer produced by joint-venture companies and

some imported products. The off-spec grades were quoted at Rmb9300-9500/ton. Some producers said

POLYAMIDE 6 & 66

supplies of off-spec material were quite tight. Copolymer import prices were $1410-1550/ton cfr China

North America Main Port, down $10/ton from the previous month. Export prices were stable compared to the previous

West Europe month.

Asia

The market price for homopolymer was quoted at Rmb22000-22500/ton for “500P” grade and

China

Rmb30200/ton for “100P” grade. The homopolymer import price for 500 grade was around $2930-

POLYCARBONATE 2950/ton cfr China Main Port, and $3650-3720/ton cfr China Main Port for “100P” grade.

North America

The 60 ktpa polyacetal unit at Yuntianhua’s Chongqing facility and the 30 ktpa unit at Yuntianhua’s Yunnan

West Europe plant were both running at around 60-70% rates in early August. Shanghai Bluestar’s 60 ktpa plant

Asia reportedly was operating at high rates.

China

PTM Engineering Plastics at Nantong was operating its 60 ktpa unit at normal rates in August. The plant

POLYACETAL reportedly will be shut for a maintenance turnaround in September. The 20 ktpa unit at Asahi-DuPont POM

North America in Zhangjiagang shut for maintenance in early July and is supposed to restart in mid September. Tianjin

Soda Plant was operating one of its two polyacetal units at high rates in early August. Henan Kaifeng

West Europe

Longyu Chemical Co was running its plant at around 70%.

China

Inner Mongolia Tianye Chemical was running one of its three plants at high rates in July. Shenhua Ningxia

PBT

Coal Group was operating its 60 ktpa unit at around 60%.

North America

West Europe Shandong Yankuang Lunan Fertilizer Plant is mechanically complete but has not started to sell its virgin

Asia polyacetal resin into the merchant market. The company will also sell modified polyacetal resin in the

future.

China

ABS & SAN PBT (POLYBUTYLENE TEREPHTHALATE)

North America

North America

West Europe

Asia North American PBT polymer and compound shipments have followed expected patterns over the last

China month. Volumes began to weaken modestly as June closed and the supply chain prepared for the 4 July

holiday. After the holiday period demand improved and by late July shipments were equal or above

MATERIALS and early June levels. Producers have commented this July’s downturn was less than in past years. Although

Processing FOCUS compound volumes are strong in early August, producers are reporting normal deliveries and no shortages

of polymer or compounding materials.

Materials News

STRATEGY FOCUS PBT demand in North America continues to be driven by increasing automotive production and penetration

rates. July automotive sales remained robust and coupled with reduced production due to changeovers

Company News

during the last couple of months have resulted in thin inventories. Ramped up automotive production over

Project News the next several months should continue to push PBT volumes higher.

ECONOMIC NEWS

Despite dramatic improvement in automotive sales over the last two years, a recent survey by R.L. Polk

STUDIES indicated the average age of cars and light trucks in the US is at an all time high of 11.4 years. To return to

FEEDSTOCKS the average in 2002 of 9.6 years, automotive sales should remain in the 16 million/year range for several

Market Trends years to come. In addition to the automotive sector, PBT volumes to housing/construction markets should

Price Monitor increase in the next several years as this industry continues to recover from the last four dismal years.

Access Tecnon

orbichem online

14 Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

PBT and compound prices have remained steady into August. BDO prices for Q3 are modestly lower (0.5-

POLYMER PRICE MONITOR 2.5 c/lb) than Q2. Paraxylene and PTA prices, which have been relatively stable the last three months, will

likely increase when the North America PX contract is settled mid-month based on current Asian contract

KEY DATA AND STATISTICS and spot prices. As a result August costs will change very little for PBT producers.

Regional Price Graphs

West Europe

Key Trade Data

Although total automotive regional sales remain depressed, some automotive producers seem to have

POLYAMIDE 6 & 66

succeeded in developing alternative markets to some extent, and others have plans to build new

North America manufacturing facilities. However, this is the situation for only a limited number of players and others have

West Europe had to continue with plans for cost-saving programmes and factory relocations or closures.

Asia

Overall, automotive demand for PBT and its compounds is expected to remain flat, in line with that for

China

other end uses such as electrical/electronics and household appliances. There is little sign of a significant

POLYCARBONATE improvement in the market in the second half of the year, and likewise, while the situation could worsen, it

seems unlikely it will trend significantly downwards either.

North America

West Europe Prices for PBT and related compounds were rolled over in many cases for Q3. As commented last month,

Asia some players anticipated this outcome given the prevailing conditions in the market. As in previous months

China this year, PBT contract prices in West Europe for August are quoted for virgin PBT at approximately €2200-

2400/ton ddp, unreinforced modified PBT resin at around €3050-3350/ton ddp, and reinforced modified

POLYACETAL PBT resin with glass fibres or minerals, as per product specification, at plus/minus €30-50/ton. Flame

North America retardant unreinforced or reinforced modified PBT resin grades are at about €3900-4200/ton or higher

depending on product specifications.

West Europe

China New passenger car registrations in the EU fell in June to the lowest level recorded since 1996. A total

of 1.134 million units were registered in June, down 5.6% compared to June 2012, according to the

PBT

European Automobile Manufacturers’ Association (ACEA). In the first half of 2013, a total of 6.205 million

North America cars were registered in the EU, 6.6% less than in the same period of 2012. The UK was again the only

West Europe major market to expand in June, up 13.4%. Spain slipped by 0.7% , Germany was down 4.7%, Italy fell

Asia 5.5% and France dropped 8.4%.

China

Asia

ABS & SAN

In South Korea, transaction prices for imported PBT in the second week of August were around $1980-

North America

2000/ton.

West Europe

Asia South Korean car domestic sales showed an unexpected year on year increase of 2.9% in July to 124,963

China units. July is usually regarded as the low season for car sales, but volumes were boosted by a new car

launch.

MATERIALS and

Processing FOCUS In Taiwan, PTA prices are increasing due to higher paraxylene prices, but the BDO price has remained

stable. There is no particular issue regarding BDO supply.

Materials News

STRATEGY FOCUS Demand for PBT resin from Turkey and India has remained steady, while demand from South Korea has

shown some improvement. However, PBT resin demand from China remains poor, and it is unclear when

Company News

it might recover.

Project News

ECONOMIC NEWS Additional electricity costs with effect from June 2013 have pushed production costs higher for PBT resin

in Taiwan. Rising PTA prices have also put more pressure on PBT resin costs. One PBT resin producer

STUDIES said PTA price is likely to continuing increasing this month while the BDO price is expected to remain

FEEDSTOCKS unchanged.

Market Trends

Price Monitor As a result, PBT resin producers in Taiwan are trying to increase offer prices, but there has been strong

resistance from customers.

Access Tecnon

orbichem online

15 Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013ENGINEERING THERMOPLASTICS

including polyamide 6 & 66, polycarbonate, polyacetal, polybutylene terephthalate, ABS, SAN

Front PAGE

China

POLYMER PRICE MONITOR

Demand for PBT in China has remained weak in the last month and is showing no sign of recovery. Recent

KEY DATA AND STATISTICS hot weather has led to production cutbacks at some downstream plants in Zhejiang province. However, a

PBT compounder said that power restrictions have had a limited impact on PBT resin demand so far. Many

Regional Price Graphs

market participants are still pessimistic about the outlook for the PBT market for the rest of 2013.

Key Trade Data

Operating rates for PBT resin are reported to be low in August, and some major PBT resin producers will

POLYAMIDE 6 & 66

have maintenance shutdowns. However, there is unlikely to be much impact on prices because producers

North America have sufficient inventory.

West Europe

Asia The BDO price has dropped slightly in the last month, to Rmb13300-13600/ton in the second week of

August from Rmb13500-13800/ton in early July. Average BDO operating rates are understood to be low

China

due to sluggish demand from downstream sectors, in particular PBT, as well as limited margins. Although

POLYCARBONATE demand for spandex is reported to be improving slightly in August for seasonal reasons, it is still not strong

enough to lift demand for BDO. PBT producers said there is limited room for the BDO price to be changed.

North America

There is no sign of any improvement in demand from PBT, and in addition there are no BDO supply issues

West Europe expected in August.

Asia

China The PTA price has increased slightly in the last month. Domestic spot PTA prices firmed to Rmb7810/ton

in early August from Rmb7750/ton in early July. Spot prices for imported material are reported to be at

POLYACETAL around $1115-1120/ton. PBT resin producers expect the PTA price may increase further during August,

North America reflecting high paraxylene prices and in line with stable demand for polyester fibre and PET resin.

West Europe

Shipments of PBT resin to China were reported agreed in the second week of August in the range $1890-

China 1900/ton cfr. Chinese domestic PBT transaction price also remained similar to the previous month at

Rmb12800-13300/ton ddp in August. The issue of overcapacity is expected to continue dominating the

PBT

Chinese PBT market for the rest of 2013, and market participants expect there will be limited room to see

North America the PBT price increase.

West Europe

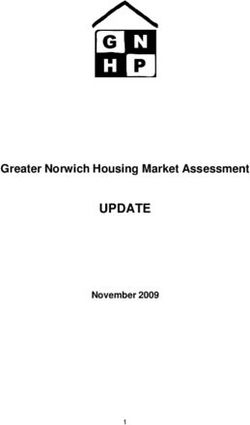

Asia New PBT Capacity Onstream In China In 2013

(1,000 Metric Tons)

China

ABS & SAN Company Location Capacity Start-Up Timing

Yingkou Kanghui (Hengli Group) Yingkou (Liaoning) 80 Mar

North America

Jiangyin Jihua (Sanfangxiang Group) Jiangyin (Jiangsu) 30 Apr

West Europe Yingkou Kanghui (Hengli Group) Yingkou (Liaoning) 80 Jun

Asia Henan Kaixiang Chemicals Yima (Henan) 100 Q4

China Changchun Plastics Changshu (Jiangsu) 120 Q4

Fujian Meizhou Bay Quanzhou (Fujian) 60 Year-end

MATERIALS and Total 470

Processing FOCUS Source: Tecnon OrbiChem data

Materials News

In 2013, a total of 470 ktpa of new nameplate capacity is starting up in China, increasing the effective

STRATEGY FOCUS capacity for this year by an estimated 187 ktpa. Total effective capacity for PBT base resin capacity this

year in China will increase to around 507 ktpa, up 61% in comparison with 2012. In 2012, actual

Company News

effective capacity was 315 ktpa as Sinopec Yizheng (60 ktpa) started up. Total Chinese nameplate

Project News capacity will increase to 790 ktpa by end-2013.

ECONOMIC NEWS

However, it is not yet clear whether all of the further planned new capacity due on stream later this year

STUDIES and in early 2014 will be started on time or delayed because of poor market conditions. Lower overall

FEEDSTOCKS operating rates for PBT resin are expected once the new plants are on stream.

Market Trends

Price Monitor Henan Kaixiang’s new PBT resin production (100 ktpa) has again been delayed, to Q4 2013. Due

to the poor market conditions, there is no clear indication about its startup date yet. Originally, Henan

Access Tecnon Kaixiang Chemical planned to start its 100 ktpa PBT resin from April 2013. In addition to this first project,

orbichem online Kaixiang also plans to have start up a second PBT project (100 ktpa) in 2014, but the exact timing is not

yet confirmed.

16 Tecnon OrbiChem ISSUE NUMBER 61 / 13TH AUGUST 2013You can also read