A STUDY OF IMPACT OF COVID-19 ON THE ECONOMY AND ITS EFFECTS ON THE INDIAN STOCK MARKET.

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Aut Aut Research Journal ISSN NO: 0005-0601

A STUDY OF IMPACT OF COVID-19 ON THE ECONOMY

AND ITS EFFECTS ON THE INDIAN STOCK MARKET.

Prof. G Suman, Vice President Corporate Relations- Universal Business School

Avnish Pal Singh, Abhyudaya Vikram Singh, Universal Business School

____________________________________________________________________

Abstract:

The study is an analysis of the Indian Equity Stock market of India post the lockdown period.

It is an in-depth probe into the indices of the Indian Equity market which include the NSE’s

Nifty 50 and the BSE Sensex, whose volatility is analysed during pre and post COVID

period. The research records the impact of a multitude of factors guiding the stock market and

investor sentiments. It also throws light upon the shift in trends that are being seen due to the

introduction of cryptocurrency.

Through our research, we aim to shed light on a variety of global factors and topics that shape

the financial markets and give insights into the future of the upcoming trends in the Indian

equity market.

Keywords: Financial crisis, Covid-19, India, Capital Markets, Equity market, Economy

Introduction:

Corona-virus disease or popularly known through the acronym COVID-19 is one of the

ravaging pandemics in the world causing one of the biggest blows to the financial markets

after the recession in 2008. The pandemic kicked off China, in November 2019, which was

then reported a global emergency by the WHO in January 2020. Though there have been

many pandemics in the world having higher fatality rate, such as ZIKA, Ebola and the

COVID is a severe threat due to its ability to get transferred undetected making the world

vulnerable to it.

Financial markets are guided by investor sentiments. The havoc created due to the outbreak

globally led to impositions of the lockdown of major economies of the world including USA,

UK, France, Italy, India and a lot more, making the whole investor sentiment bearish and

highly volatile.

India is known to be the world’s largest democracy and the fifth richest country developing

country of the world by GDP. It was one of the only countries to have survived the global

depression and has seen a rally of bulls since. The advent of a stable government in 2014 and

removal of the cap from the FDI had further increased investor confidence in the market

giving the market an all-time high of BSE at 42346 points and NSE Nifty50 at 12377 in

January 2020. (NSE-INDIA, 2009)

2) Literature Review:

Covid-19 is an unknown devil which has shaken the global economy. The stoppage of the

global supply chain and the lockdown in India(Chakrabarty, 2020) took a heavy toll on the

financial markets.The stock market crisis is viewed as a black swan in the financial

Volume XI, Issue XII, December/2020 Page No:186Aut Aut Research Journal ISSN NO: 0005-0601

world(Scott, 1999).The stock markets fluctuated enormously as investor sentiments turned

negative which led to a sharp fall as shown before. Many previous studies can be related to as

one studies the effect of pandemics on the stock market. We shall see the economic and

financial impact previous pandemics have caused and the literature related to this virus.

Further, we shall see the literature regarding the healthcare sector of India and its preparation

for the Covid-19 impact.

Economic impact on the world:

The coronavirus will likely lead the world to a recession, but economists are less sure about

the prospects for a quick growth shot. The basis case for forecasters is that in the second half

of 2020 a rebound, maybe a good one, is taking place. However, with the pandemic spreading

across Europe and the Americas, and a better awareness of the broad range of knock-on

effects, caution is accumulating. The Covid-19, which has largely been ignored as it spread

across China, reacted strongly on global financial markets when the virus spread to Europe

and the Middle East, encouraging fears about a global pandemic. By then, the threats of

Covid-19 have been so vigorously priced across different asset classes that others are worried

about stagnation in the global economy.

Although market sentiments can be deceptive, there is real recession danger. While inflation

has accelerated and expansions in various countries are now less capable of sustaining

shocks, the instability of global economies like the US economy has increased. The winters

are said to worsen the COVID-19 situation. This can be seen with the rising cases and deaths

in the European region.(News, 2020) .This is one of the major reasons why economists are

believing slower recovery.

In the past, all pandemics have shown a V-shaped recovery as shown in the figure below.

(Szlezak, et al., 2020)

Volume XI, Issue XII, December/2020 Page No:187Aut Aut Research Journal ISSN NO: 0005-0601

Impact on the Indian economy:

In India, the economic effect of the 2020 coronavirus pandemic has been largely destructive.

According to the Ministry of Statistics, India's growth decreased to 3.1% in the fourth quarter

of the fiscal year 2020. The Chief Economic Advisor to the Government of India said that

this decline is mainly due to the coronavirus pandemic impact on the Indian economy. India

has experienced a pre-pandemic recession, and according to the World Bank, the new

pandemic has "magnified pre-existing threats to India's economic outlook."(Bank,

2020)India's FY2021 growth was originally updated by The World Bank and rating agencies,

and India's lowest estimates have existed three decades ago since India liberalized its

economy in the 1990s. But the Indian GDP estimate decreased even further to negative

estimates, suggesting a deep recession even after the economic package announced in the

middle of May.

The Indian industry during April reported the worst month-on-month fall in market operation

ever. The extreme plunge in the employment index, which dropped by more than 40 points,

shows us that the strict lockdown measures resulted in the sector being essentially shut down.

The unemployment rate shot up to a historic high of 27.11% in May which is still above 15%

in the current time. Around February and April 2020, the percentage of households suffering

a decline in income shot up to almost 46 per cent. Inflation rates were projected to increase

later this year on goods and services, including food items and coal. Social distancing

contributed to job losses, particularly the lower economic strata of the Indian community.

Several households have terminated facilities of domestic help – basically an unorganized,

monthly paying work. Most Indians spend a considerable amount of time involving

themselves in household tasks, along with working from home. Though offices have opened

post lockdown due to opening up of the economy a new culture of Work from Home has

evolved that is seen in various industries especially the IT sector (Roy, 2020). The country

has seen a reduction in the unemployment rate in June and July which now stands at 11.6%

rate that is quite positive. Indian economy shall be revived due to the increase in the

employment rate.

Financial Impact:

India was one of the worst-hit nations through the COVID-19 financially, because its

economy was struggling to recover from the harsh moves of the government of

demonetisation and Imposition of GST. The only positivity lied in the increase of the FDI and

a massive youth population that was attracting countries from all over the world. An

imposition of lockdown at the moment blocked the movement of funds which ended into high

volatility. The volatility index of India, preferably known as the VIX index skyrocketed to a

level of 82.40 points from a low of 22 that indicated huge volatility and deadly crash, which

was witnessed consequently, in March 2020. Both the equity indexes of India suffered

causing a loss of almost 103.55 lakh crores to the investor’s money, equivalent to 40% of

GDP and 7 times the fiscal deficit of India.

NIFTY50 India crashed to an all-time low of 7583 crashing almost 4794 points and BSE

SENSEX to a low of 25987 giving thus crashing 16359 points,

A list of equity indices shared the same story which can be seen below:

Volume XI, Issue XII, December/2020 Page No:189Aut Aut Research Journal ISSN NO: 0005-0601

Stock market Price before Price after Percentage drop Current price

index crash (date:19th Crash (24th (date: 5th Nov

Feb2020) march 2020) 2020)

NIFTY 50 12407.24 7501.96 39.53% 12095

NASDAQ 9627.83 6994.29 27.35% 11890.93

FTSE 100 7464.85 5156.01 30.90% 5906.20

SZSE 11509.37 9596.23 16.62% 13894.50

NIKKEI225 23329.50 16590.95 28.88% 23776.20

(Source:Yahoo Finance)

One can see that the stock markets are again turning bullish with market positions gaining

very quickly as economic activity is set forth again. Indian stock market seems to have

revived very quickly giving high investor confidence to the small-scale investors. Amidst

ever-rising cases of COVID-19, the market is giving a positive direction to the investors

where the world is set towards a global recession. This research paper gives an insight into

both the bullish and bearish perspective of the Indian equity market and includes various

parameters that can help an individual to evaluate the market to be a cautious investor. We

shall discuss the data of the factors of GDP and then the movement of the Indian Indices to

predict the movement of the share market in the coming months.(Mudgil, 2020).

Healthcare in India:

In India,thehealthcare sector is the primary concern apart from other factors.

Health is one of the Fundamental Rights of a citizen of India, but the expenditure of the

government for building the infrastructure of the health of the country was not appropriate

before corona. The total expense of GDP towards healthcare was 1.28% in 2017-18 which is

very less as per global standards.(CHANDNA, 2019)The number of beds over 1000 people is

1.3 which is way less than world standards. The coronavirus was unprecedented that has

affected millions and those with poor health infrastructure have suffered. India having a

massive population of more than 130 crores is not a wealthy country in terms of health.

Though, the government has given a boost to this sector by the introduction of Ayushman

Bharat (CHANDNA, 2019) and various other measures the figure is far from adequate.

Another major reason is the implication of lockdown. Coronavirus has been said as the

biggest emergency that has been seen since Independence by Raghuram Rajan, former RBI

governor (Sheith, 2020). The slowdown has been seen in almost every performing sector

which is alarmingThe same has been discussed below with greater detail.

Data and Methodology:

Sources of Data Collection:

The stock market has tons of data which is generated every day. The data for each trading

session is recorded and mined authentically by Securities and Exchange Board of India. The

other sources of data for the report involved interaction with traders and investors of reputed

organisations, students, and working professionals.

Primary data:The interview, or questionnaire. The questionnaire used here is written and

completed by the individual being examined, which is a face-to-face interview or an

interview through telephonic means.

Volume XI, Issue XII, December/2020 Page No:190Aut Aut Research Journal ISSN NO: 0005-0601

The questionnaire was formed through google forms which were distributed among people

with varied occupations and age. The various methods used in the questionnaire were:

a) Structured questions

b) Multiple-choice questions

c) Ranking methods.

Secondary data: Itwas obtained through multiple sources. An added advantage was the

availability of clear and true data of indices through money control and NSE/BSE websites

that helped the research being more effective. Other sources of information include credible

newspaper articles, journals, research papers and websites.

Sampling Method:

The method used was the convenient sampling method. It takes a sample by taking a

convenient sample from the overall population.

Analysis of Data:

The analysis of data was done through Google forms, sheets and Microsoft Excel and

Tableau.

Data analysed was in the form of:

1) Bar graphs

2) Pie charts

3) Line diagrams

4) Mountain charts

5) Candlestick charts

Indian Economy, GDP components and related factors:

GDP or the Gross Domestic Product is the measure of all goods and services produced by all

the industries that give a sketch of the economy and its growth. GDP encompasses various

attributes which can be compiled into 4 major parts namely:

1) Private Consumption: Consumption refers to the private consumption of people of

India. This reflects the demand and has the maximum weightage in terms of GDP. In

the previous year,private consumption accounted for 56.4% of GDP. India has

expanded its national lockdown into containment zones areas where people have

tested positive for COVID-19 – through June 30 amidthegradual reopening of its

economy.India's GDP contractedby 23.9% in the last quarter ended, the slowest in 11

years, and is forecast to fall by 6.8% in the current fiscal year.India's rates of

unemployment increased, and household income suffered as a result of the COVID-19

shock and because of that household consumption also decreases.The economic

turmoil caused by the lockout in India is dire. Almost 84% of Indian households have

seen a decrease in income since the lockdown began.

2) InvestmentSpending:Investments refer to the business investment in terms of assets

and equipment, but this not include the exchange of existing assets. The more the

investment in the economy of the country the better the GDP. The previous year,

accounted for 32% of the total portion of GDP. The total projects that were completed

in the quarter of April to June were 145million which was 1.3billion short from the

Volume XI, Issue XII, December/2020 Page No:191Aut Aut Research Journal ISSN NO: 0005-0601

past year. Several projects that were to be commissioned in June were deferred. This

shows the drastic downfall of new investment that will be a big blow to the economy.

(Ltd., 2020)

3) Government Spending:Government spending in the past year showed a fiscal deficit

of 4.6% from 3.5% in the previous year. The major problem with the Government is

the revenue expenditure which was seen at 133% of the revised estimate whereas the

capital expenditure was seen to be at 97% of the targeted expenditure. The capital

expenditure is expenditure on fixed assets which shall generate future revenues,

example infrastructure, hospitals etc. and revenue expense is expenditure on day to

day nature example salaries and maintenance. The increase in fiscal deficit is a major

concern for the nation. The government spending though has increased but it is not

proportionate to the mammoth decline in private consumption and investment. Due to

Covid-19, this estimate is further expected to increase which will be crucial to the

nation.

4) Net Exports: Indian imports and exports contracted making a huge trade deficit of

6.76 billion. The month of April, India's exports shrank to $10.36 billion by a historic

60.28% and Imports plummeting by 58.65% to $17.12 billion. This deficit of $6.76

billion led to a decrease in the real income of the major export houses. The country

has seen an increase in the net exports this year which is positive but the overall

demand can be seen to decline which shows that both the exports and imports have

gone cheap and reduced. (Industry, 2020)

The recovery of the exports is deemed to be faster, in the long run, owing to the ease

in lockdown and improvement in the supply chain. The global supply chain has still

not recovered which shall slowdown the recovery rate. The results in May improved

by 30% which can be better in the days to come.

(Source: Indian Express)

If we further dig into the macro components of GDP, the four points mentioned above are

affected fundamentally by the following factors.

1) Interest Rates:The emergence of the pandemic in COVID-19 has resulted in huge

market liquidity from central banks all over the world to avoid the economic

downturn. The RBI has also announced a series of steps for the battle against

Volume XI, Issue XII, December/2020 Page No:192Aut Aut Research Journal ISSN NO: 0005-0601

depression over a period of time. In various tranches, the RBI has lowered its repo

rate to 4%, which stood at 6% in April 2019. The cumulative decrease was 160 bps

for the FY20.As of last week, of March 2019, the department reported the 10-year

GSec return was 7.24 percent. By March 27, 2020, it dropped by around 60 bps. The

rate of response (change in interest variable to change the percentage repo rate) was

therefore 70 percent. 'Subsequently, the response to the 75-bps repo rate decrease was

higher than expected until 22 May, at almost 140 percent with a 100-bps reduction to

5.75 percent. Yet the performance remained unchanged in the third stage of the 40-

bps reduction in the repo rate of May.

2) Fiscal and Current Account: Fiscal deficit explains the difference between revenue

(taxes and non-debt capital receipts) and expenditure. Fiscal account deficit situation

occurs when the government expenditure exceeds the income. In the previous fiscal

the government faced a decline in revenue of 16.82 crores which was 91% of the

target whereas spending was 99.5% of the planned expense which was 26.56 cr. The

fiscal deficit of 9.34 lakh crores. Thus the fiscal deficit was 4.6% in 2019-20 of the

GDP which was a massive increase of 3.5 from 2018-19. The projected estimates of

the fiscal deficit this year was 3.5% of GDP, which has now been doubled to 6.7-

7.6% as the economy has seen a lockdown in the first two months and the movement

has been sluggish since.

The current account showed a surplus of 0.1% of 19.8 billion in the year 20-21 which

was not due to the increase in exports but due to the low oil prices which are not

expected to be in the long run, due to the slow recovery of exports and gradual

recovery of demand.

3) Real Income of People:The current Covid-19 crisis could lead to a 5.4% fall, above

the nominal GDP decline of 3.8%, in the per capita income (PCI) of Indians in FY 21

to Rs 1.43.The decrease between states, with a total of eight states and union

territories (UTs), which make up 47 percent of India's GDP, was expected to see a

double-digit decrease in PCI in FY21.Delhi and Chandigarh may see a decline of

15.4% and 13.9% respectively, which would be nearly three times the decline at all-

India levels. "This is because these are the urban areas (and red zones too) where

lockdowns were most seriously enforced, "the study said about 8 states and UTs

where the decline in PCI was likely in double digits. "Stores, retail malls and centres

harmed the sales of these markets. Only after markets have been opened (in phased

ways), 70% to 80% fewer than average times are available to consumers.

4) Foreign Policy:The world of post-pandemic would be a fascinating one. Not only

will the virus bring micro-level behavioural, social, and political changes and cause

indelible domestic changes, it will also have a macro-level effect on nation-states.

Economic vulnerabilities will be revealed, and global sand shifts will be intensified.

This would also even out the playing field and make the global order vulnerable to the

emergence of middle powers.If geopolitical position derives from the economic

strength of a country, then we might already have seen the lopsided effect of COVID-

19 where the harm done by the virus is directly proportional to the economic status of

a country. The outbreak affects all of the world's economies, but the major ones based

on the data points we have at this stage appear to have sustained greater harm.

Volume XI, Issue XII, December/2020 Page No:193Aut Aut Research Journal ISSN NO: 0005-0601

5) Unemployment Rate: The unemployment rate was significantly high during the

lockdown, between March and May, households with a decline in income shot up to

nearly 46 per cent. Unemployment rose to 27.11% which has still not recovered. The

rate of unemployment in June is still a high of 13.65% that is way beyond the 8%

mark. Rates of inflation on products and services like food and fuel is projected to rise

later this year. Social distancing led to job losses, in particular the lower economic

strata of Indian society. Domestic aid programs are terminated by many households –

effectively and unorganized monthly-paying task. Most Indians themselves spent a

great deal of time engaged in household tasks, rendering it the most commonly

performed lockout operation.

(Source: Statista.com)

6) Inflation: High inflation rate is generally a bad signature and according to the Data

from the central statistical division shows that the retail inflation rose to 6.93% in

July from 6.25% in May.

The factors mentioned above are not exclusive only to the economy of the country but also

the share market. If we look through the eye of an economist, the share market is also an

important sentiment factor that guides the GDP of the country and is an indicator of the

trends of the economy. Now we shall see the impact of the covid-19 on the sectors.

Contribution by major sectors as in 2018-19:

(Source:Statistictimes.com)

Volume XI, Issue XII, December/2020 Page No:194Aut Aut Research Journal ISSN NO: 0005-0601

Impact on major sectors:

Agriculture & Allied Sector:

The country-wide coronavirus shutdown brought the economic operation to a near halt, the

agriculture sector is the silver lining for the Indian economy as it is expected to develop at a

pace of 3 per cent for 2020-21, according to NITI Aayog. The growth rate in real terms for

the agriculture sector in 2019-20 was 3.7 per cent which can be deduced at 11.3 per cent in

current prices. The monsoon being a blessing and other factors such as the availability of

clean water for agriculture purposes gave a better outlook to the agriculture sector. A big

advantage to this sector was the approval of agriculture and allied sectors to run partially

which helped the economy to sustain till the manufacturing and other sectors were stopped.

Agriculture contributes to about 17% to the Indian economy which is more than the

manufacturing sector combined.

There were major measures taken up by the government during the phase of lockdown to

help the farmers and the economy to sustain. Few of them were

a) E-nam app for trading in agricultural commodities

b) PM-KISAN: PM Kisan or the Pradhan Mantri Kisan Samman Nidhi benefitted

farmers by allotting 17986 cr, since the advent of lockdown.

c) Agri call services for any problems related to the farmers.

Secondary and Tertiary Sectors:

The secondary sector also called the manufacturing sector is one which is responsible for the

processing and production of goods in the country. The tertiary sector is the sector which

supports the primary and the secondary sector by providing the workforce for performance.

The performance of the sectorsis divided into positive and negative performing sectors.

Volume XI, Issue XII, December/2020 Page No:195Aut Aut Research Journal ISSN NO: 0005-0601

Negative performing sectors:

1) Tourism and hospitality:The tourism industry is in a unique situation because

transport serves as a vector for spreading the virus therefore it is usually targeted

for breaking the chain of the spread of the virus. Tourism has a dynamic element

which involves movements and this invariably fuels the spread of viruses. The

movement of people via air travel increases the risk of the spread of viruses at a

much faster pace than normal. Thus, tourism is both a catalyst for the spread of

viruses and a victim of the spread. The tourism industry in India supports 9.2% of

India’s GDP and is said to give 8.1% of its total employment. The growth rate was

7.5% which was increasing due to the increase in income of the middle class of

India. The is said to face a loss of 10 lakh crore due to the impact of Covid-19.

Further, it did not get any relief in the Atmanirbhar package of 2000000 crores

announced by the government. The data below shows the loss if the demand lifts

in October to November otherwise it may exceed this level if a proper vaccine is

not generated and people do not travel. (Lamba, 2020)

2) Aviation sector: Airline business is a high fixed cost business with major

expenses including fuel costs (around 30-35 per cent of total costs), lease charges

(around 30-35 per cent of total costs), and O&M (operations and maintenance)

costs (around 15-20 per cent of total costs) constituting more than 85-90 per cent

of the total costs. However, unlike manufacturing companies, the revenues for

airlines are perishable. During the lockdown, when airlines were operating only

cargo flights, the oil retailers had slashed the prices of aviation turbine fuel by

almost two-thirds but started raising the prices soon after operations resumed. This

led to airlines looking for alternative avenues to reduce their overheads at a time

when they have been unable to realise full revenues due to weak demand for air

travel. Credit rating agency CRISIL has estimated that the Indian aviation sector,

including airlines and airports, will witness revenue losses of ₹24,000–25,000

crore, as air travel remains suspended due to the national lockdown. Though this

sector does not contribute much to the GDP the other sectors and the supply chain

need to run. A lot of cargo, tourism and other businesses thrive on proper aviation.

The halt in aviation is deadly for the economy.

3) Automobile sector: The auto industry comprises 7.5% of the total GDP and 49%

of the total manufacturing sector of India. A large number of purchases are done

in the festive and wedding season of October to December, preparations for which

are done beforehand. The loss of the manufacturing due to non-availability of raw

material such as steel, tyres etc., coupled with the increase of work-from-home

culture, was a further deterioration to the sector. The industry was already

sluggish before COVID-19 pandemic which further deteriorated due to the

scenario. The positivity though lies in the fact that the Online/e-commerce

services demand shot up due to obvious reasons that increased the demand of 2

Volume XI, Issue XII, December/2020 Page No:196Aut Aut Research Journal ISSN NO: 0005-0601

wheelers into the market. Nifty auto is still recovering from the blow it has

received during the lockdown though it is far from reaching its actual position.

(Source: Investing.com)

4) Real Estate Sector: Real estate sector is one of the most globally recognized

sectors. It comprises of four sub-sectors - housing, retail, hospitality, and

commercial. The growth of this sector is well complemented by the growth in the

corporate environment and the demand for office space as well as urban and semi-

urban accommodations. Employment wise the real estate is the second-largest

employment provider to the Indian population. Majority of the unorganised sector

also depends upon it. This sector was ruthlessly stumbled upon by covid-19

making millions jobless and homeless. There has been a reversal of migrant

workers and labourers due to the nationwide lockdown. The current rate as on

June 2020, stands at 24.11% which is alarming. The loss of jobs due to closure

and halt various projects further increased unemployment and will further

dissuade its recovery. The following KPMG report tells the impact of the

lockdown on real-estate.

Volume XI, Issue XII, December/2020 Page No:197Aut Aut Research Journal ISSN NO: 0005-0601

(Source: KPMG report)

Nifty Reality is far from recovering this year as can be judged from the graph below.

(Source: Investing.com)

5) Banking Sector The banking sector is the backbone of the economy which is

responsible for lending as well as controlling the other sectors. Financial

Institutions such as the Banks and NBFCs were already facing issues such as low

capital adequacy, high NPA’s, evasion of loan etc. Recent incidents such as the

Volume XI, Issue XII, December/2020 Page No:198Aut Aut Research Journal ISSN NO: 0005-0601

PNB loan default and the ILFS crisis was another hit to the banking sector. Many

Private Banks were hit due to false ratings by the credit agencies. The banking

sector, though had started gaining momentum again after the formation of the

IBC, a body that gave authority to banks to recover loan defaults, the same body

was slashed from its power, due to lockdown. This shall result in an increase in

the NPAs that will negatively impact the sector. The moratorium shall be a major

cause of downfall for this sector and may impact its growth ahead. Nifty Bank can

be seen recovering as the private banks have shown positive growth in the June

Quarter but the PSUs are largely down due to the poor performance and have seen

a great loss. Though they are assured by the RBI and the government, the sector

has a long way to recover in the coming future.

(Source: Investing.com)

6) Entertainment Industry: The Media and Entertainment (M&E) industry has

multiple segments that combine into one vertical. Movies/Cinema, Television,

Music, Publishing, Radio, Internet, Advertising and Gaming. The Impact on the

media and entertainment. The covid-19’s lockdown cracked the entertainment

industry resulting in a loss of almost a loss of 1000 Cr. per day. The entertainment

industry employs almost 60 million people came to a standstill. The industry

which was expected to grow at a growth rate of 13.7% p.a gave a grey look due to

stoppage of supply chains and related factors. Movie theatres such as PVR and

INOX had zero footfall during those days. This is not supposed to get lifted until

the august end though the majority of the productions have started their work.

On a positive note, the entertainment industry had an advantage due to the digital

aspect. Data has shown a drastic shift in demand in this sector. OTTs or Over-the-

top platforms have been on a rise during the lockdown. There has been a high

number of subscriptions of Netflix, Amazon Prime and Disney+ Hotstar. Even

high rated Bollywood movies like Angrezi Medium, GulaboSitabo and the recent

Dil Bechara were released on OTTs which attracted several people in the segment.

The investment by the mavericks such as Jio and Airtel Giga Fiber gave a

tremendous opportunity for the OTTs to expand during the lockdown. Television

Theatre gave a positive outlook with anecdotes such as Ramayana, Mahabharata

that received a record-breaking viewership of over 650 million people a day.

Volume XI, Issue XII, December/2020 Page No:199Aut Aut Research Journal ISSN NO: 0005-0601

Though the industry still contributes to about 0.38 % of the total GDP but the

contribution towards employment is massive. The delay in release in films and the

break-in making of tv serials will take a lot of time to recover. The overall impact

can be seen from neutral to negative though the sector is likely to recover in the

coming future.

(Source: Investing.com

Positive performing sectors:

1) Pharma Sector: On the back of coronavirus-induced shutdown, decrease in elective

surgery, decrease in injectable sales, decrease in patients visiting physicians, the

pharmaceutical sector is likely to record weakness in the current fiscal quarter

earnings for April-June. In the June quarter of the current fiscal year, the Nifty

pharma index rose by 42 per cent compared to a decline of 10.8 per cent in March of

the previous fiscal. While in the January-March period of FY20, the wider Nifty 50

indices decreased nearly 30 per cent, rising 25% in the first period of the 2020-21

financial year as we can see in below graph.

Chart Title

15000 20000000

15000000

10000

10000000

5000

50000000

0 0

25-Feb-20 25-Mar-20 25-Apr-20 25-May-20 25-Jun-20 25-Jul-20

Open High Low Close Shares Traded Turnover (Rs. Cr)

(Source: NSE India)

2) FMCG SECTOR:In June the FMCG industry expanded rapidly and recovered to

pre-covid levels as India pushed into a three-month economic lock-down after the

latest coronavirus broke out.Although both rural and urban markets are improving,

rural areas are coming back faster than before. But, since urban markets account for

60-65% of FMCGs, urban markets' recovery is significant. We can see through the

Volume XI, Issue XII, December/2020 Page No:200Aut Aut Research Journal ISSN NO: 0005-0601

graph that it restored its previous position.

Chart Title

25000000

20000000

15000000

10000000

50000000

0

25-Feb-20 25-Mar-20 25-Apr-20 25-May-20 25-Jun-20 25-Jul-20

Open High Low Close Shares Traded Turnover (Rs. Cr)

Source(NSE India)

3) MEDIA and Entertainment:The M&E industry is a sunrise sector of India as is

making major advances. The Indian M&E industry is at the heart of a strong stage of

growth, backed by increased customer demand and improved advertisement revenues,

showing its resilience to the world. Digitalisation and higher Internet usage have

largely driven the industry in the last decade. For most people, the internet has

become a popular medium for entertainment. Content consumed is a wide variety of

technologies, from TV, films, OOH, radio, animation and visual effect (VFX), to

music, gambling and digital advertisement.Over FY19-FY24 the M&E industry will

expand to 13.5% in CAGR. By 2024, Rs 3.1 lakh crore (USD 43.93 million) is

projected to cross.India is expected to grow by 10.62% to Rs 85.250 crore ($12.06

billion) by 2021. Indian market is projected to grow. In 2019, Indian spending on ads

reached Rs 67 603 (US$ 9.67 billion ) , up 11% a year. The third-largest

advertisement medium in India was digital advertising. In 2019, Rs. 15,467 (US$ 2.21

billion) produced revenues. By 2021, Digital will be contributing 29% of the ad

revenue.

(Source: NSE India)

Volume XI, Issue XII, December/2020 Page No:201Aut Aut Research Journal ISSN NO: 0005-0601

4) Information Technology-In the quarter to June, Indian IT companies will face the

full impact of market intervention in the United States and Europe due to the Covid

19-lockdown as research companies expect to recorded a decrease in revenues of 5-10

percent due to clients cancelling or postponing development expenditure for the three-

month period. But due to more and more adaption of technology It sector begin to rise

in this lockdown period. We can clearly see through graph that it restored its previous

position.

Nifty IT

20000 25000000

20000000

15000

15000000

10000

10000000

5000

50000000

0 0

25-Feb-20 25-Mar-20 25-Apr-20 25-May-20 25-Jun-20 25-Jul-20

Open High Low Close Shares Traded Turnover (Rs. Cr)

(Source: NSE India)

5) CONSUMER DURABLES-In 2019 the Indian appliance market reached Rs 76,400

(US$ 10.93 billion) in electronics. After corona19 impact also this sector keeps on

growing. It is expected to double in Rs 1.48 lakh crore (USD 21.18 billion), the

consumer electronics and equipment industry, by 2025.The country's electronic

hardware production rose from Rs 1.90 trillion in FY14 to Rs 4.58 trillion (the US

$65.53 billion) in FY19. in FY19. In India, the demand for hardware electronics is

forecast at 400 billion US dollars by FY24. The DNP aims to create one trillion

mobile devices by 2025.It is projected that the Indian television industry in 2019 will

cross Rs 787 billion and by the year 2021, Rs 955 billion.We can see in the graph that

its previous position had been restored.

Volume XI, Issue XII, December/2020 Page No:202Aut Aut Research Journal ISSN NO: 0005-0601

40000000 Nifty Consumer Durables

35000000

30000000

25000000

20000000

15000000

10000000

5000000

0

19-Apr-20 09-May-20 29-May-20 18-Jun-20 08-Jul-20 28-Jul-20 17-Aug-20 06-Sep-20

(Source NSE India)

Research Methodology:

Research Type:

The research is exploratory and descriptive research that seeks to get a detailed explanation of

the movement of the stock market and the factors that contribute to it. It judges indices as a

measure of GDP and looks upon various sentiments of the stock market with the GDP. The

research paper is designed to explain the sentiments of the retail investors’ and the actual

position of the economy as to why the stock market is behaving in such a manner even after

the economy has weakened due to the lockdown.

Objectives of the study:

To evaluate the components that contribute to the GDP of the Indian Economy and

their impact on the equity market.

Analysis of significant events and investor sentiments, both bullish and bearish that

can have an impact on the equity markets.

Analysis of data of historical events of market downfall and its recovery.

To predict the future growth of the Indian equity markets based on the above factors.

Limitations of the study:

The study involved the use of financial knowledge and a majority of the people in the stock

market do not offer much research. People are hugely guided by sentiments in the stock

market and they do not do much research on the same. Thus, their opinions might be guided

by news rather than data. This may have resulted in:

People falsely filling the surveys

Loss of accuracy while evaluating the scenario

This limitation is also evaluated in this research to get a clear picture of the behaviour of the

stock market in near future.

Volume XI, Issue XII, December/2020 Page No:203Aut Aut Research Journal ISSN NO: 0005-0601

Data Analysis and Interpretation:

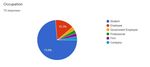

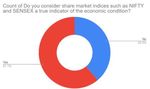

There were a total of 72 responses to the research paper by people of various occupations.

The questionnaire was diversified and thus helped make better research. The first question

was a question that helped determine the thought process of the people filling the forms and

to judge their evaluation of the stock market as a measure of the economy. The following

responses were recorded:

A positive response of 61.1% shows that people do consider the stock market as an indicator

though not a great but a good indicator.

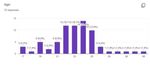

Age and Occupation:

Volume XI, Issue XII, December/2020 Page No:204Aut Aut Research Journal ISSN NO: 0005-0601

One can see through the above graphs that there were people of ages spread from 17 to 58

years of various domains that have filled out the survey.

The majority of which are millennials, who are currently invested or have started investment

into the markets as can be seen from the third graph. Almost 42% percent of the people who

have filled the survey has opened Demat accounts or invested in SIPs, equity markets or

mutual funds since the lockdown started. This shows that the stock market has seen a great

increase in the increase in funds post lockdown into nifty50 and nifty100 companies, which

can be related to why the nifty has increased and recovered at a relatively fast pace, despite a

crashing economy.As per moneycontrol.com, there has been an increase in 1.2 million

increase in the Demat account since lockdown which is an increase of 53%.

A section of the people is employees-both government and private, company and firm which

may have a greater amount invested in the markets with a strategic approach.

Volume XI, Issue XII, December/2020 Page No:205Aut Aut Research Journal ISSN NO: 0005-0601

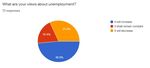

Sentiments of people regarding the performance of the economy and its sectors:

The questions to judge the sentiments regarding the performance were as follows and results

to were obtained accordingly.

Global Recession:

Dilution of economy:

Volume XI, Issue XII, December/2020 Page No:206Aut Aut Research Journal ISSN NO: 0005-0601

Performance of sectors:

Sentiments of people for a global recession seems to be neutral which may be because the

recent performance of the Global indices which is the NASDAQ and the FTSE. They have

shown positive growth and the companies have shown a better performance than expected.

The sentiments regarding the performance of sectors can be seen in the above charts which

are negative for almost all the major sectors of the economy. The distribution is given to give

a clear picture of the contribution of all the sectors of the economy.

Volume XI, Issue XII, December/2020 Page No:207Aut Aut Research Journal ISSN NO: 0005-0601

Sentiments regarding recovery of the economy:

Unemployment rate:

Collapse of Indian stock market:

Recovery rate of the economy:

Volume XI, Issue XII, December/2020 Page No:208Aut Aut Research Journal ISSN NO: 0005-0601

Development of vaccine:

The sentiment shows that though people are negative about the share market and

unemployment levels currently, they expect a fall of the markets shortly. Data from the NSO

show otherwise. According to the National Statistical office, unemployment has decreased

and it will soon be at the same level as before lockdown in India. The recovery of the

economy is said to be till the end of 2021 which is at par with most of the experts and the

professional analysts. The increasing recovery rate of coronavirus in India is also a positive

sign for the recovery of the economy and the share market. The sentiment is neutral to

positive in terms of the development of a vaccine which should result in sustaining the

economy. The negative sentiments regarding the stock market might be due to the earlier

negative performance of the sectors that have been further ruined due to the covid-19 impact.

Conclusion: What will be the movement of the stock market in the coming period?

The stock market has shown sharp recovery since the economy has opened up but the

economy is still sluggish with less demand. The fall of GDP in the first quarter of 23.9% was

a very negative sign which shall take time to recover and this fiscal growth shall be negative.

The economic stimulus package provided by the government did not have a heavy impact

over the stock market as it shall not give a great push to the demand side with banks creating

provisions for increasing doubtful debts. The positive sign is the upward movement of the

market which has crossed its levels before lockdown. The market capitalisation to GDP ratio

has already shown overvaluation, but there has been a rally of bulls. The US elections had a

positive impact with Joe Biden victory over Trump and investment by large corporate giants

of the US into India has boomedstocks of nifty 50, such as reliance, TCS and HDFC. and

which have shown upward movement during corona.

The primary data shows that people are assuming economic recovery by 2021 end and

unemployment to increase. The world has set into a global recession which shall be

compensated by the opening up of global supply chains but the winter is said to increase the

impact of corona which might disrupt the virus.

The stock market of India as per the analysis is set for another major correction shortly

according to the current situation as the stocks have been in a great rally without major

corrections. The stock market is currently not showing the true picture of the economy as

many of the companies which have faced losses are not listed but a domino effect may occur

if adequate stimulus packages are not announced soon. The mutual fund's holdings have

decreased by 241 cr by 5256 cr as compared to the quarter1 of the previous year but a surge

Volume XI, Issue XII, December/2020 Page No:209Aut Aut Research Journal ISSN NO: 0005-0601

in Demat accounts have increased liquidity in the market which is again worrying the

investors.

One can hope of a faster economic recovery if the vaccine is developed but it shall take time.

The Indian markets are set for one correction by the end of this fiscal once the numbers come

out but till then one can enjoy the volatility as a trader.

Bibliography

Bank, W., 2020. The World Bank India: Covid-19. [Online]

Available at: https://www.worldbank.org/en/country/india/overview

[Accessed 20 october 2020].

Chakrabarty, D. S. P., 2020. Lockdown and Beyond: Impact of COVID-19 pandemic on

global employment sector with special reference to India. NUJS Journal of Regulatory

Studies:Journal of the Centre for Regulatory Studies, Governance and Public Policy,

1(Special edition), pp. 2456-4605.

CHANDNA, H., 2019. At 1.28% of GDP, India’s expenditure on health is still low although

higher than before. ThePrint, 31 12, p. 5.

Industry, M. o. C. &., 2020. https://pib.gov.in/PressReleasePage.aspx?PRID=1638804.

[Online]

Available at: https://pib.gov.in/PressReleasePage.aspx?PRID=1638804

[Accessed 23 10 2020].

Lamba, M. S., 2020. BWHotelier. [Online]

Available at: http://bwhotelier.businessworld.in/article/COVID-19-Impact-on-the-Indian-

Hotels-Sector-A-Report-by-HVS/10-04-2020-188770/

[Accessed 23 10 2020].

Ltd., C. f. M. I. E. P., 2020. Centre for Monitoring Indian Economy Pvt. Ltd.. [Online]

Available at: https://www.cmie.com/kommon/bin/sr.php?kall=warticle&dt=2020-07-

02%2012:36:22&msec=533

[Accessed 22 10 2020].

Mudgil, A., 2020. Stocks rout wipes off wealth that equals 40% of GDP, 7 times India’s

fiscal deficit. ET-Markets, 24 March, p. 1.

News, B.-., 2020. Coronavirus: Europe's daily deaths rise by nearly 40% compared with last

week - WHO. [Online]

Available at: https://www.bbc.com/news/world-europe-54704677

[Accessed 16 10 2020].

NSE-INDIA, 2009. Nifty50. [Online]

Available at: https://www.moneycontrol.com/indian-indices/cnx-nifty-9.html

[Accessed 18 11 2020].

Roy, S., 2020. Will work from home be the new normal for India?. The Economic Times, 8

May , p. 6.

Volume XI, Issue XII, December/2020 Page No:210Aut Aut Research Journal ISSN NO: 0005-0601

Scott, G., 1999. Investopedia. [Online]

Available at: https://www.investopedia.com/terms/b/blackswan.asp

[Accessed 17 oct 2020].

Sheith, H., 2020. Covid-19: India faces greatest economic emergency since Independence,

says Raghuram Rajan. The Hindu Business Line, 06 April, p. 7.

Szlezak, P. C., Reeves, M. & Swartz, P., 2020. What Coronavirus Could Mean for the Global

Economy. Harvard Business Review, 03 March , p. 4.

Volume XI, Issue XII, December/2020 Page No:211You can also read