November 2019 - Giga Metals Corporation

←

→

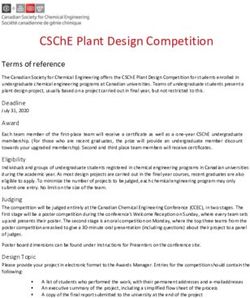

Page content transcription

If your browser does not render page correctly, please read the page content below

Disclaimer

This presentation (“Presentation”) is being issued by Giga Metals Corporation (the “Company” or “Giga Metals”) for information purposes only. Reliance on this

Presentation for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all of the property or other assets invested.

The Preliminary Economic Assessment (PEA) results released on October 20, 2011 were authored by AMC Mining Consultants (Canada) Ltd. The PEA includes the use of

inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as

mineral reserves. The study is preliminary in nature and there is no assurance the mining, metal production or cash flow scenarios outlined in this report would ever be

realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. While the Company believes certain elements of the PEA are

consistent with the Company’s current approach and ongoing evaluation of the project, the PEA can no longer be considered current.

Cautionary Statements Concerning Forward-Looking Statements

Certain information set forth in this Presentation contains “forward-looking statements” and “forward-looking information” under applicable securities laws (referred to

herein as forward-looking statements), which include management’s assessment of future plans and operations and are based on current expectations, estimates,

projections, assumptions and beliefs, which may prove to be incorrect. Some of the forward-looking statements may be identified by words such as “may”, “will”, “should”,

“could”, “anticipate”, “believe”, “expect”, “intend”, “potential”, “continue”, “target”, “estimate”, “proposed”, “preliminary” and similar expressions. Such forward-looking

statements include, but are not limited to, production capacity and timing, mining and processing methods, by-products, product pricing, capital and operating cost

estimates, project economics, future plans, the growth in the electric vehicle market and its impact on the demand for nickel and cobalt, and future supply of nickel and

cobalt.

By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from

those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the

plans and events described herein. Forward-looking statements contained in this Presentation regarding past trends or activities should not be taken as a representation

that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. You should not place undue reliance on forward-looking statements, which speak only as of the date of this

Presentation. Readers are advised to consider such forward-looking statements in light of the risks set forth in the Company’s continuous disclosure filings as found at

www.sedar.com.

Cautionary Note to U.S. Readers Regarding Estimates of Resources

This Presentation uses the terms "measured" and "indicated" mineral resources and "inferred" mineral resources. The Company advises U.S. investors that while these terms

are recognized and required by Canadian securities administrators, they are not recognized by the U.S. Securities and Exchange Commission. The estimation of "measured"

and "indicated" mineral resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. The

estimation of "inferred" resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. It cannot

be assumed that all or any part of a "measured", "indicated" or "inferred" mineral resource will ever be upgraded to a higher category.

Scientific and technical information disclosed in this document has been reviewed and approved by Lyle Trytten, M.Sc., P.Eng., Martin Vydra, P. Eng. and Greg Ross, P.Geo.;

Qualified Persons as defined by NI 43-101.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 1

.Core Project: Turnagain

▪ NI 43-101 resource* containing:

Measured & Indicated 5.2 billion pounds of nickel and 312 million pounds of cobalt

Inferred 5.5 billion pounds of nickel and 327 million pounds of cobalt

▪ Less than 25% of the nickel prospective geology has been drilled to date.

▪ Engineering studies are underway. The goal is to lower the Capex by reducing the start-up size.

▪ Recent metallurgical work indicates a clean concentrate grading greater than 20% nickel and 1% cobalt is

achievable using proven simple and reliable processing technology.

▪ Turnagain concentrate is amenable to pressure oxidation for production as nickel and cobalt sulphates.

*Source: See updated resource estimate, news release dated September 19, 2019 available at www.gigametals.com and www.sedar.com.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 2Dominant EV Battery Chemistries Require Ni & Co

Dominant EV Battery Types

▪ Nickel and Cobalt are used in cathodes of 2 of the EV Battery Type Comparison

3 dominant battery chemistries for EVs – NMC (i.e.

LFP NCA NMC

Chevy Bolt) and NCA (Tesla). Also, nickel metal

hydride batteries are the dominant chemistry in Cathode Lithium Lithium Lithium

materials Iron Nickel Nickel

hybrid vehicles. Phosphate Cobalt Oxide Cobalt Oxide

Aluminum Manganese

▪ Battery manufacturers are moving towards higher- Anode materials Graphite Graphite Graphite

nickel, lower cobalt chemistries (migration from Cost Low High High

NMC 111/622 to NMC 811).

Energy density Low High High

Battery life Long Short Long

▪ NMC 811 to make up 75% of NMC battery mix by

2025 – nickel dominant. Safety High Mid Mid

Companies Chinese battery Japanese battery Samsung SDI,

makers including makers including LG Chem

▪ Drivers for increasing Ni-content are desire for BYD and ATL Panasonic (Tesla)

greater range on a single charge and ethical

concerns about Co sourcing.

NMC Cell Chemistry (300 kg battery)

▪ Giga Metals’ Turnagain Project will produce both NMC 811 to

nickel and cobalt thereby giving investors exposure weight in kg Cobalt Nickel make up 75%

NMC 111 23.7 23.6 of NMC

to both metals used in the NMC battery and

battery mix

protection against future changes in the chemistry NMC 622 14.8 44.2

by 2025

preferred by manufacturers. NMC 811 7.4 58.7

Sources: UBS; Bloomberg New Energy Finance & TD Securities Inc.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 3Nickel is in a Structural Deficit

Inventories are dropping – new supply is not growing

to match new demand

▪ Inventories at multi-year lows as demand ▪ Incentive price needed to bring on new

continues to outpace supply. supply is much higher than current prices.

▪ The gap is forecast to widen over the next five ▪ For large greenfield Class 1 nickel projects,

years. long-term incentive price estimate is

Sources: Bloomberg, TD Securities Inc.

US$12/lb according to Wood MacKenzie.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 4Not All Nickel is Created Equal

▪ Only Class I nickel (purity > 99.8%) is suitable for batteries. World Nickel Market

~2 million tonnes per annum

▪ Class II nickel (ferronickel and nickel pig iron) is only suitable

for stainless steel due to iron content and impurities.

▪ Sources of Class I nickel are sulphide deposits such as

Turnagain, and limonite deposits processed with high

pressure, high temperature acid leach (HPAL) technology.

Sulphide Ni Projects

ᅳ Reliable, proven processing technology.

ᅳ Ni concentrate sold to smelters to produce Class I

nickel. Can also be converted to sulphates with a

pressure oxidation circuit.

HPAL Projects

ᅳ Prone to technical issues. Nickel demand for batteries has doubled from 3% of demand in

ᅳ High capital intensity. 2017 to 6% in 2018. This rapidly increasing demand is already

over 12% of Class 1 nickel production.

ᅳ Many projects have environmental challenges.

Sources: Vale Presentation, October 2017 – Wood MacKenzie, CRU, Vale Analysis (Statistics for 2017e); Bank of America Merrill Lynch, October 2017, BloombergNEF 2018.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 6Turnagain is competitive with HPAL projects

Project Turnagain NPI HPAL Existing HPAL Greenfield

Jurisdiction Canada – West China, Australia, Cuba, Madagascar, Indonesia, Philippines,

Coast Indonesia New Caledonia, Papua New Australia?

Guinea, Philippines

Project Type Sulphide Laterite Laterite Laterite

Product 20% Ni Conc Low-grade FeNi 30-50% Ni Intermediate 30-50% Ni Intermediate

Battery Suitable Yes No Yes Yes

Ratings (1 = excellent, 5 =poor)

Infrastructure 3 2-4 2-4 2-4

Product Quality 1 3 1 1

Complexity 1 2 5 5

Environmental Impact 1-2 3-4 3-5 3-5

Capital Intensity* $30-$60,000 $10-$20,000 $75-$90,000* $75-$90,000

(USD/annual tonne of Ni)

*Capital Intensity calculated for 2019 basis from published information. Turnagain capital intensity approx. $45,000 in 2011 PEA; Range quoted is from internal trade-off

studies.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 7Large Projects Will Require Higher Ni Prices To Get Built

Incentive Price required to generate a

15% pre-tax IRR

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 8Turnagain PEA1 at WoodMac Incentive Pricing

A pre-tax IRR of 15% requires a

Nickel price of US$6.85/lb.

PEA Model at Base Case PEA1 PEA Model at

15% Pre-Tax IRR2 December 2011 US$12/lb. Ni Price2

Assumptions

Nickel Price (US$/lb.) $6.85 $8.50 $12.00

Cobalt price and Cobalt Price (US$/lb.) $20.00 $14.00 $20.00

exchange rate updated

to estimated long-term Exchange Rate (CAN:USD) 0.76 0.95 0.76

price of $20/lb. and rate

of 0.76, respectively.

Ni Recovery (%) 56.4 56.4 56.4

Ni Concentrate Grade (%) 18.0 18.0 18.0

Smelter Netback (%) 72.4 72.4 72.4

At the $12/lb.

Incentive Nickel

Project Economics Price, Turnagain

Pre-tax NPV @ 8% $949M $1,295M $4,497M has a NPV of

$2.8B after tax

Pre-Tax IRR 15.0% 15.9% 34.5% and 29.5% IRR.

After-tax NPV @ 8% $499M $724M $2,792M

After-tax IRR 12.6% 13.5% 29.5%

1. The PEA includes the use of inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. The study is

preliminary in nature and there is no assurance the mining, metal production, or cash flow scenarios outlined in this report would ever be realized. Mineral resources are not mineral reserves and do not have demonstrated economic

viability. While the Company believes certain elements of the PEA dated December 2011, authored by AMC Consulting, are consistent with the Company’s current approach and ongoing evaluation of the project, the PEA can no longer

be considered current.

2. Sensitivity analyses on assumptions in the PEA financial model have been conducted internally and results should be considered indicative only. There is no guarantee that these assumptions, including metal prices, will ever be realized.

Source: Turnagain Project PEA dated December 2, 2011 available at www.gigametals.com and www.sedar.com.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 9PEA Summary (December 2011)

The PEA1 evaluated the development of the Turnagain deposit by conventional open-pit methods with trucks and shovels.

Material was assumed to be processed using a conventional concentrator to produce smelter grade concentrate.

Key Metrics US$ Production Metric Yr 1 – 5 Yr 6 – 21 Avg LOM6

C1 Cash Cost2 $4.26/lb Strip Ratio (%) 0.74 0.83 0.82

Capital Expenditure Annual Mill Throughput (Mt) 15.8 31.3 28.1

Initial Capex $1,357M Average Mill Feed Grade

Expansion Capex in Year 53 $492M Nickel (%) 0.261 0.246 0.233

Project Economics4 Cobalt (%) 0.014 0.013 0.013

After-tax NPV@ 8% $724M Average Recovery

After-tax IRR (100% equity) 13.5% Nickel (%) 58.0 57.7 56.4

Payback Period 7.3 years Annual Metal Production in Concentrate5

Project Life Nickel (tonnes) 23,912 44,394 36,558

Mill operation6 27.2 years Cobalt (tonnes) 1,280 2,433 2,063

Annual Concentrate Production

Annual Metal Production (Yr 6 - 21)

Dry (tonnes) 132,846 246,633 203,101

98 million pounds Nickel

5.4 million pounds Cobalt

1. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

2. The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as

Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are

applied. Mineral resource tonnage and contained metal have been rounded and numbers may not add due to rounding.

3. Mineral Resource is reported using a 0.1% Ni cut-off grade.

4. Mineral Resource has been prepared by AMC Mining Consultants (Canada) Ltd., December 2, 2011. While the Company believes certain elements of the PEA authored by AMC are consistent with the Company’s current

approach and ongoing evaluation of the project, the PEA can no longer be considered current.

5. Cobalt recovery assumed equivalent to nickel recovery, based on limited testwork. Additional testwork required to define a more rigorous cobalt recovery model. Cobalt recovery has minor impact on financial modelling.

6. LOM model includes 6 years of milling low-grade resources that were previously mined, reducing the strip ratio to an effective 0.42 (true waste: total mill feed)

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 10Updated Mineral Resource, September 2019

Turnagain Mineral Resource1,2,3,4,5

Tonnes Ni Co Contained Contained Contained Contained

Resource Category (000’s) (%) (%) Ni (tonnes) Co (tonnes) Ni (Mlbs) Co (Mlbs)

Measured 360,913 0.230 0.014 831,182 49,806 1,832 110

Indicated 712,406 0.215 0.013 1,530,248 91,900 3,374 203

Measured & Indicated 1,073,319 0.220 0.013 2,361,430 141,707 5,206 312

Inferred 1,142,101 0.217 0.013 2,482,926 148,473 5,473 327

(1) All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under National Instrument

43-101 (“NI 43-101”).

(2) Mineral resources are reported in relation to a conceptual pit shell in order to demonstrate reasonable expectation of eventual economic extraction, as required under NI 43-101;

mineralization lying outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

(3) Mineral resources are reported at a cut-off grade of 0.1% Ni. Cut-off grades are based on a price of US $8.50 per pound and a number of operating cost and recovery assumptions, plus

a contingency as reported in the December 2011 PEA authored by AMC Consulting.

(4) Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves.

However, it is reasonably expected that the majority of Inferred mineral resources could be upgraded to Indicated.

(5) Due to rounding, numbers presented may not add up precisely to the totals provided and percentages my not precisely reflect absolute figures.

Measured & Indicated: 5.2 Billion pounds of nickel and 312 Million pounds of cobalt

Inferred: 5.5 Billion pounds of nickel and 327 Million pounds of cobalt

Garth Kirkham, P.Geo. and Greg Ross, P.Geo., Qualified Persons as defined by NI 43-101, have reviewed and approved the contents of this resource estimate.

Source: See updated resource estimate, news release dated September 19, 2019 available at www.gigametals.com and www.sedar.com

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 11Potentially One of the Largest Ni Sulphide Operations

Nickel Mine Production from Sulphide Operations

kt Ni

250

2016 Production Estimated Turnagain Production (at full capacity)*

207

200

150

100

72

66

51

50 44

38 33 30

0

Norilsk Jinchuan Vale Sudbury Voisey's Bay Turnagain* Raglan Terrafame Mount Keith

* The PEA includes the use of inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. The study is

preliminary in nature and there is no assurance the mining, metal production, or cash flow scenarios outlined in this report would ever be realized. Mineral resources are not mineral reserves and do not have demonstrated economic

viability. The first 5 years assume 50% of full capacity with the plant throughput averaging 15.8 Mtpa, then 31.3 Mtpa for years 6-21 and 29.9 Mtpa for years 22-28. While the Company believes certain elements of the PEA authored by

AMC Consulting are consistent with the Company’s current approach and ongoing evaluation of the project, the PEA can no longer be considered current.

Source: 2016 Mine Production – Wood Mackenzie; Turnagain Project PEA dated December 2, 2011 available at www.gigametals.com and www.sedar.com.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 12Concentrate Quality

Turnagain metallurgy indicates production of some of the highest nickel grade

concentrate available when compared to existing operations

Turnagain

concentrate is on

par with current

Voisey’s Bay

concentrate

The VBN (Voisey’s) concentrate contains about 20% Ni, 1% Co, 2% Cu, 40% Fe and 35% S*

Turnagain concentrate is competitive to production of MHP or mixed sulphide intermediate via much more

capital intensive HPAL process and directly amenable to NiSO4 production via pressure oxidation.

*DEVELOPMENT OF A CADMIUM REMOVAL PROCESS FOR VALE’S LONG HARBOUR HYDROMETALLURGY PLANT 1. Concentrate specifications based on metallurgical

P. C. Holloway, M. J. Collins, R. Lopetinsky, I. M. Masters, and A. Tshilombo , Sherritt International Corporation, Fort Saskatchewan, Alberta, Canada, (*Corresponding test work conducted after December 2011 PEA

author: preston.holloway@sherritt.com) T. Xue and I. Mihaylov, Vale Base Metals Technology Innovation Centre, Mississauga, Ontario, Canada L5K 1Z9, M. Reid, J. Wall,

M. Jones, and J. van Puymbroeck, Vale Long Harbour Operations, Long Harbour, NL, Canada

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 13Safe, Mining Friendly Jurisdiction

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 14Good Terrain for Open Pit Mining

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 15Room to Expand an Already Enormous Resource

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 16Investment Thesis

✓ Optionality

▪ Giant resource offers strong leverage to nickel and cobalt prices.

▪ Small market capitalization – lots of room to be rerated in rising commodity cycle.

✓ Exploration Upside

▪ Copper, Platinum, Palladium targets in the Attic zone.

▪ Less than 25% of the nickel prospective geology has been drilled.

✓ Management

▪ Strong Management team with deep experience in minerals business.

▪ Board of Directors includes former senior executives from Sherritt’s and Vale’s Nickel & Cobalt businesses.

▪ Well connected with capital markets.

✓ The Right Plan

▪ Advance the project to feasibility.

▪ Initiate permitting and advance towards a production decision.

✓ Large, Quality Ni & Co Resource

▪ Turnagain is among the largest undeveloped sulphide nickel-cobalt resources in the world.

▪ Sulphide nickel ore is most suitable to be refined into Class I nickel required by battery manufacturers.

▪ Cobalt supply from stable jurisdictions will be preferred over Democratic Republic of Congo (currently 65% of supply).

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 17Board of Directors

Mark Jarvis, CEO

Mr. Jarvis has more than 30 years of experience in exploration and development of oil and gas and metals. After a career in

financing exploration projects as a stockbroker, he moved to the corporate side of the business in 1996. He joined the board of Ultra

Petroleum, which at the time had a large, unconventional gas prospect that ultimately became 3 TCF of proved reserves.

Lyle Davis, P.Eng. (Alberta) MBA

Mr. Davis is a director and CEO of Condor Resources Inc., a copper and gold exploration company active in Latin America. He

previously worked in the corporate finance practices of Ernst & Young, and in a similar capacity at C.M. Oliver, a brokerage firm.

Before that, Mr. Davis was with the Vancouver Stock Exchange. He is a member of the Association of Professional Engineers,

Geologists and Geophysicists of Alberta.

Robert Morris

Mr. Morris is a former senior executive with Vale S.A., the largest nickel producer in the world, and most recently as Executive Vice

President with global accountability for sales and marketing of Vale's base metals portfolio, including Nickel, Copper, Cobalt and

Precious Metals. He was an officer of the company and member of the senior management committee. His knowledge of the rapidly

evolving market for nickel and cobalt products is extensive and includes marketing battery materials to battery manufacturers.

Anthony Milewski

Mr. Milewski is the Chairman and CEO of Cobalt 27 Capital Corp. He spent his career in various aspects of the mining industry,

including as a company director, advisor, founder and investor. In particular, he has been active in battery metals including

investing in cobalt and actively trading physical cobalt. Anthony was a member of the London Metals Exchange Cobalt Committee

and has previously worked at Pala Investments, Firebird Management, and Renaissance Capital.

Martin Vydra, P.Eng.

Mr. Vydra is a former executive with Sherritt International and current Head of Strategy at Cobalt 27 Capital Corp. Martin is widely

recognized as an expert in nickel and cobalt extraction, processing and refining including the development and application of

advanced technologies to maximize the recovery of valuable metals such as nickel and cobalt from a variety of feeds.

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 18Share Structure

Share Structure as of August 28, 2019

Stock Exchanges

TSX Venture GIGA

OTC Markets HNCKF

Frankfurt BRR2

Share Capital (October 7, 2019)

Turnagain camp

Shares Outstanding 55,104,015

Warrants 12,185,000

Options 5,210,000

Fully-diluted 72,499,015

Market Capitalization

Share Price (October 7, 2019) C$0.39

Market Capitalization C$21.5 M Drill work

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 19Contact Information

Suite 203 – 700 West Pender Street

Vancouver, British Columbia

Canada

V6C 1G8

Phone: (604) 681-2300

Email: info@gigametals.com

www.gigametals.com

TSX.V: GIGA | OTCQB: HNCKF | FSE: BRR2 20You can also read