MEXICO BMI Market Report 2022 - BMI Global

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

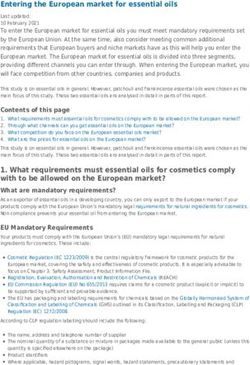

contents

1 Introduction

2 Enrolments in Mexico

3 Enrolments in key destinations

4 Market trends

5 Conclusion

6 Improving your recruitment results

Click on each topicMarket Report: Mexico

Our latest Market Report offers a deep dive

into Mexico’s education and recruitment

scene.

Our research continues to help

higher education leaders to:

We begin with a review of Mexico’s

enrolments across key states in the

country, and then turn our gaze outwards,

presenting a lengthy track record of

1

Guide marketing, recruitment and

statistics for destination markets. Mexico’s internationalisation strategies.

story is further played out via a wide

range of figures and insights covering the

economy, social media, latest trends and 2

growth opportunities. Understand the strength of Mexico

as an international education

This is the third report BMI has co-produced market and source of student

with education marketing experts Jackfruit recruitment.

Marketing. Based on the appeal of

previous reports (on Vietnam and China’s

Tier 2 Cities), we are pleased to share our 3

research and knowledge of Latin America Discover how the market is

- a region which is home to the world’s changing and where enrolment

most lively and energetic students who are opportunities exist.

sure to invigorate your campuses as well

as your belief in the power of international

education.

contents

4 | bmi market report: mexico • introductionMarket Report: Mexico’s states

baja

california sonora

chihuahua

coahuila

baja

california sur sinaloa nuevo

leon

durango

cas

ate

zac tamaulipas

san luis querétaro

aguascalientes potosí

hidalgo

nayarit

guanajuato yucatán

tlaxcala

jalisco

morelos quintana

n roo

michoacá ve

colima puebla ra tabasco campeche

cr

uz

north estado de guerrero

méxico

centre oaxaca

distrito federal chiapas

pacific coast (méxico city)

mexico city & surrounding states

gulf of mexico & yucatan peninsula

contents

5 | bmi market report: mexico • introductionENROLMENTS IN MEXICO: SCHOOLS

Mexico is a key Latin American outbound market

– second only to Brazil in terms of the size of its

population and economy.

Total population,

according to INEGI:

• 126,014,024 in 2020,

• 112 million in 2010,

• 97 million in 2000.

school system:

Pre-School...............3 Years compulsory

Primary....................Grades 1-6

Secondary................Grades 7-9

Upper Secondary.....Grades 10-12

Superior...................Vocational studies

contents

7 | bmi market report: mexico • STUDENT ENROLMENTSENROLMENTS IN MEXICO: k-12

Targeting by population

In line with the population, the biggest school

enrolments are found in the states of:

1/ Mexico

2/ Mexico City

3/ Jalisco

4/ Veracruz de Ignacio de la Llave

5/ Puebla

Targeting by private schools

Looking beyond the top five states and

concentrating on the Upper Secondary Statistics on the number of students per

level as an undergraduate recruitment school type are difficult to obtain, but

pipeline, you may want to add several key estimates show that approximately 18.5%

states to your recruitment list: Guanajuato, of high school students attend some type

Chiapas, Nuevo León, and Michoacán de of private school. Based on 2008 data,

Ocampo. Upon continued examination of private school attendance was shown to

the Upper Secondary level, certain states be higher in Aguascalientes, Guanajuato,

buck total enrolment trends and could Hidalgo, San Luis Potosi, Tamaulipas and

move further up your priority list, such as Yucatan.

Baja California or Chihuahua as opposed

to Oaxaca or Guerrero.

contents

9 | bmi market report: mexico • STUDENT ENROLMENTSENROLMENTS IN MEXICO: HIGHER EDUCATION

Higher Education

Enrolments in Mexico 2020/21

Aguascalientes 62,661

Baja California 149,726

Baja California Sur 25,342

Campeche 40,432

Chiapas 124,559

According to ANUIES, total university Chihuahua 148,769

enrolment has nearly doubled in the last Ciudad de México 849,320

Coahuila de Zaragoza 131,823

13 years. Colima 27,323

Durango 59,561

Guanajuato 198,138

Guerrero 84,018

In 2007/08, total higher education Hidalgo 114,880

enrolment in Mexico was 2,528,664. Jalisco 286,039

México 540,228

Michoacán de Ocampo 134,981

By 2013/14, that number increased by Morelos 74,567

nearly 42% to hit 3,587,221. Nayarit 51,726

Nuevo León 284,940

Oaxaca 82,524

And in 2020/21, enrolments reached Puebla 312,755

4,983,204 – a 97% increase over 2007/08. Querétaro 96,940

Quintana Roo 51,932

San Luis Potosí 98,972

Sinaloa 161,482

Sonora 128,808

Tabasco 88,786

Tamaulipas 140,675

Tlaxcala 37,777

Veracruz de Ignacio de la Llave 249,379

Yucatán 86,276

bmiglobaled.com/market-reports/mexico Zacatecas 57,865

Source: The National Association of Universities Total 4,983,204

and Institutions of Higher Education (ANUIES)

contents

10 | bmi market report: mexico • STUDENT ENROLMENTSStudent enrolments in key destinations

DESTINATION: USA

The US is still the number one destination for Mexicans, however, numbers

have been on a steady decline for the past six years. Doctorate degrees

are the only sector showing steady growth since 2014, alongside marginal

growth for Flight Training.

contents

12 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: USA

In 2000/01, Mexico was the 10th most

popular origin market for the USA with

10,670 students, a .6% increase over the

previous year.

By 2005/06, thanks to steady growth and

a 6.6% increase over the previous year,

Mexico became America’s 7th leading

origin country. Enrolments were looking

fairly stable with a high of 14,850 in 2008/09.

Following a dip the next year, enrolments

then steadily climbed again until 2014/15.

Since then, numbers have been sputtering

downwards and by 2019/20, Mexico fell

back to the 10th origin position.

As of 2019, Mexico is currently valued at

US$ 524 million in terms of its international

student economic impact, according to

the Bureau of Economic Analysis, U.S.

Department of Commerce.

contents

13 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: USA

contents

14 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: USA

Top 10 states in USA for Mexican students

In addition to proximity, Texas’ appeal

0 2500 5000 7500

can be attributed to its common policy of 4,088

5,073

offering more affordable, in-state tuition Texas 6,095

6,630

to Mexicans (normally reserved only for 1,577

Americans). California

1,849

2,032

2,060

829

1,033

New York 1,103

1,149

605

814

Massachusetts 864

927

591

594

Florida 701

605

485

531

Arizona 561

592

427

423

Utah

390

336

410 June 2021

478

Illinois

473

394

270

July 2018

284

New Mexico

380

421

July 2016

215

Georgia 207

190

147 July 2014

contents

15 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: USA

Alabama

The only states in the top 10 that have been Georgia

showing growth since 2014 are Utah and Georgia. Idaho

All states showing growth since 2014 include: Nevada

Utah

States showing flat or marginal States showing a rise in 2016 or Following the overall trend for States exhibiting sporadic

growth in enrolment since 2014: 2018 and then a decline since Mexican enrolments in the USA, enrolment trends:

then: the following states have been

• Alaska on a steady decline since July • Connecticut

• Colorado • Arkansas 2014: • Kansas

• Montana • Florida • Kentucky

• Nebraska • Hawaii • Arizona • Louisiana

• New Jersey • Illinois • California • Maine

• Oregon • Indiana • Delaware • Mississippi

• South Dakota • Iowa • Guam • North Dakota

• Tennessee • Maryland • Massachusetts • Rhode Island

• Wyoming • Michigan • Minnesota • Vermont

• New Hampshire • Missouri • West Virginia

• North Carolina • New Mexico

• Ohio • New York

• Oklahoma • Puerto Rico

• Pennsylvania • South Carolina

• Virginia • Texas

• Washington • Washington DC

• Wisconsin

contents

16 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: canada

The figures below apply to the higher education sector only.

Secondary school programmes reported 1,965 Mexicans in 2017.

contents

17 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: canada

Like students in many origin markets,

Mexicans have demonstrated significant Language learning trends:

increased interest in Canada over the last Based on membership data from

ten years due to several factors such as: Languages Canada

In 2018, there were 14,206 Mexican ELT

• Proximity and ease of travel students in Canada and Mexico accounted

• Relatives and friends already living for 51% of all student weeks (up to 55% in

in Canada 2019).

• Cultural similarities to the USA,

but perceived as a more welcoming In 2019, there were 17,065 Mexican ELT

environment and culture students, a 20% increase over 2018 which

• Clear pathway for emigration made it the only market in Canada’s top

10 source countries to post year-on-year

growth and also gave Mexico the title as the

fastest growing top 10 source country.

In 2016, Canada relaxed short term (less

than 6 months) visa requirements for 951 Mexicans were studying French in

Mexicans, further stimulating demand and Canada in 2018. This number jumped to

country appeal. 1,441 in 2019.

contents

18 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: AUSTRALIA

Since 2002, the total number of Mexicans enrolling in Australia has been

steadily growing due mainly to the VET sector’s double-digit percentage

growth nearly every year, followed by a fairly reliable performance from the

ELICOS and Higher Education sectors.

Mexicans only comprise a tiny percentage of all international students in

Australia (.36% in 2020 vs. .21% in 2002), and there is great potential for

further growth across all sectors.

contents

19 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: FRANCE

Mexicans appear to have a growing interest in French culture, language, history and society.

Like the USA, Mexican enrolments in Doctorate degrees in France have maintained steady

growth since 2014.

contents

20 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: FRANCE

Looking at trends across Mexican enrolment When comparing top fields of study across

in France’s LMD system - Bachelor (Licence), all school and degree types, 2018/19 data

Master, Doctorate - between 2014 and 2018, shows:

we see a 4% increase overall, broken down

as follows:

• 43.3% languages and humanities

• 30.7% science and sports studies

• 41% of enrolments at Level L, • 14.1% economics and social

a 12% decrease since 2014 administration

• 13.8% engineering schools

• 39% of enrolments at Level M, • 10.1% business schools

a 14% increase • 9.4% law and political science

• 4.3% architecture schools

• 20% of enrolments at Level D,

a 31% increase • 2.5% health, medicine, pharmacy

and dentistry

contents

21 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: FRANCE

contents

22 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: uk

higher education

Mexican enrolment in the UK has exhibited a meandering seesaw pattern in the last six years.

Once considered to be the second most popular destination for Mexican students, enrolments

have generally stayed flat when looking at the last decade, with an estimated 1,970 students in

2011/12 vs. 1,915 in 2019/20.

English Language Learning

Historically, the UK had appeal as an English English UK’s 2020 report, based on 358

language destination due to international private- and 50 state-sector ELT centres,

students’ desire to experience “the birthplace revealed that the total number of student

of English” and British culture, although a weeks had fallen from over 17,330 in 2009 to

2015 study by the British Council found that 15,634 in 2018 (with 3,492 students) to 14,867

“learning American English was seen as in 2019 (with 3,065 students).

slightly more attractive than British English,

and this trend was more apparent within

younger generations”, who may perhaps be

swayed by the closer, more prevalent presence

of American culture, firmly entrenched in

film, music, media, and so on.

contents

23 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: uk

contents

24 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: china

Of all the Latin American countries, Mexico has the most frequent exchanges with China in education,

culture, sports and tourism. It cooperates with China in over ten fields, including e-commerce,

tourism management, engineering and big data. Approximately 60 Chinese companies, including

Huawei and Didi, have set up offices in Mexico.

Government-funded Scholarships: Privately-funded Scholarships:

• From 1972 to 2000, Mexico provided 20 • In 2019, 230 Mexican students (up from

government scholarships to China every 37 the year before) received scholarships

year. from the China-ASEAN Education and

• In 2005, the number of scholarships grew Training Alliance.

thanks to annul allocations of 32 funded • The alliance aims to promote cooperation

by China and 30 provided by the Mexican on talent training between 28 Chinese

government. universities, governments involved in

• By 2013, both countries pledged to fund the Belt and Road Initiative, and Chinese

over 300 students in the next 3 years. companies operating overseas.

2013 2014 2015 2016 2017 2018

Students with scholarships 111 124 152 168 166 148

Self-funded students 1665 1763 1690 1932 2016 1392

Total Mexican students in China 1776 1887 1842 2100 2182 1540

contents

25 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: NEW ZEALAND

Like Australia, the percentage of Mexicans

enrolled in New Zealand as compared to all

international students in these four sectors

is small, but steadily growing, from .21% in

2012 to .32% in 2020.

The English language sector is the only

sector to have shown consistent growth in

Mexican enrolments year on year, except for

2020. Other sectors have experienced more

sporadic enrolment patterns in the last

decade.

Mexico is New Zealand’s fourth most popular

enrolment source country in Central and

South America (preceded by Brazil, Colombia,

and Chile).

contents

26 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: ireland

Mexico was the 25th most popular sending

country for Ireland as of 2019/20. But in

The most popular subjects for Mexicans

looking at just the postgraduate level, Mexico

in Irish higher education include:

tied with Vietnam as the 19th largest sender.

Education in Ireland estimates there are

• Arts and humanities;

2,000 English language students from Mexico

• Business, administration and law;

and between 400 to 500 students from Mexico

• Engineering, manufacturing and

in all Irish tertiary institutions.

construction;

• Education.

contents

27 | bmi market report: mexico • ENROLMENTS ABROADDESTINATION: ireland

The Ireland Higher Education Authority provides

data from 22 technical colleges and public

universities. These numbers will be higher

when private tertiary institutions are included.

contents

28 | bmi market report: mexico • ENROLMENTS ABROADother DESTINATIONs

spain

3,143 Mexicans studied at the tertiary level in 2019, up from 2,880 in 2011, according to UNESCO

data. These figures are lower than what ANUIES reports: 3,200 Mexicans in Spain in 2008.

germany

According to UNESCO data, 2,922 Mexicans studied at the tertiary level in 2019 (up from 2,458 in

2017), which reflects a steady increase from the past. ANUIES cited 1,174 Mexicans in Germany in

2008.

Enrolment figures according to DAAD:

• 2,714 in 2014/15

• 1,695 in 2010/11

• 1,231 in 2005/06

Across all education levels and time frames, in 2020, DAAD reported that they sponsored 277

Mexicans, and 766 Mexicans received funding from elsewhere.

argentina

979 Mexicans studied at the tertiary level in 2019, up from 689 in 2017, according to UNESCO data.

colombia

472 Mexicans studied at the tertiary level in 2019, up from 530 in 2017, according to UNESCO data.

contents

29 | bmi market report: mexico • ENROLMENTS ABROADmarket trends economic landscape • MARKETING TIPS

MACRO TRENDS: CURRENCIES

The Mexican peso has been fairly steady

Apart from a significant dip between March and May of 2020, due to height of the pandemic, the

MXN/USD exchange rate has held fairly steady over the last five years, making it easier for families to

manage their budget for international education.

Source: xe.com

contents

31 | bmi market report: mexico • MARKET TRENDSMACRO TRENDS: INCOME VS. SPENDING

On average, households in Mexico have an

income of approximately 50,309 MXN (2,515

USD) and outgoing expenses of 29,910 MXN

(1,496 USD).

top states by average quarterly income:

1/ Nuevo León

2/ Baja California

3/ Ciudad de México

4/ Baja California Sur

5/ Sonora

6/ Querétaro

7/ Chihuahua

top states by average quarterly spending:

1/ Ciudad de México

2/ Baja California

3/ Nuevo León

4/ Querétaro

5/ Baja California Sur

6/ Aguascalientes

7/ Jalisco

contents

32 | bmi market report: mexico • MARKET TRENDSMACRO TRENDS: middle and upper classes

By combining Mexico’s population and economic data, you can create a targeted list of states

in which to concentrate your recruitment efforts.

Mexico has a growing youth population and middle class, however, there is an uneven

distribution of wealth. The states with the highest GDP per capita are in the North, as well as

the capital of Mexico City, and those in the Yucatan Peninsula.

According to Mexico’s National Institute

of Statistics and Geography (INEGI):

• In 2000, 38.4% of households were

middle class, which was 35.2% of

the population or 34,144,000 people. In upper class households with children,

64.1% send them to private schools vs.

• In 2010, 42.42% of households were 28.7% from the middle class.

middle class, which was 39.2% of

the population or 43,859,200 people.

PUBLIC SCHOOL PRIVATE SCHOOL

• In urban areas, the middle class Upper Class 47.8% 64.1%

equals 50% of households and 47%

of the population. Middle Class 82.3% 28.7%

• In rural areas, 28% of households Lower Class 97.3% 5.3%

and 26% of people belong to the Numbers total more than 100% due to multiple

middle class. children per household.

contents

33 | bmi market report: mexico • MARKET TRENDSMACRO TRENDS: funding for education

Government funding for outbound

mobility has been cut

recruitment tips!

President Andrés Manuel López Obrador is

concentrating on strengthening the country from

within. For example, much of the funds that would

have normally gone to CONACYT to support Mexicans • Create institutional scholarships just for

studying abroad have been redirected towards Mexican students who fit a certain profile.

funding to Mexico’s (local) public universities and to

in-country scholarships. • Build talent training programmes

with corporations that can provide work

Meanwhile if you look elsewhere in Latin America experience and potential scholarships.

(Colombia, Peru, etc.) you find that their governments

are increasing scholarship funds and getting more • Offer flexible tuition payment plans.

active in promoting education abroad to their

students. • Provide personal support to help

Mexicans get part-time employment

Luckily, where financial support from the Mexican during studies.

government (i.e., outbound scholarships) may

be drying up, the private sector has stepped in. • Share financially-relevant marketing

Independent organisations like FUNED continue content: stories of Mexican students who

to provide scholarships and encourage mobility work on campus or have internships, cost

overseas (e.g. 110 postgraduate scholarships were of living charts, etc.

offered in 2020).

contents

34 | bmi market report: mexico • MARKET TRENDSfunding providers in mexico

• Fundación Mexicana para la Educación, la Tecnología y la Ciencia – FUNED

Postgrad… 110 scholarships in 2020

• The National Council of Science and Technology of Mexico – CONACYT

Postgrad… 1100 scholarships in 2019

• Institute of Finance and Information for Education

Non-Degree, Undergrad, Postgrad… 4000 scholarships in 2020

• Fundación Beca

Non-Degree, Undergrad, Postgrad… 75 scholarships in 2020

• Fund for Culture and the Arts – FONCA

Postgrad… 40 scholarships in 2020

Meet these providers at BMI’s exclusive events

london May 16 & 17, 2022 bogotá Oct 3 & 4, 2022

contents

35 | bmi market report: mexico • MARKET TRENDSMACRO TRENDS: Geopolitics and growth opportunities

Launched in 2020, the United States-Mexico-Canada

Agreement (USMCA) is designed to strengthen

relationships and economic growth across North

America. While the US and Canada can provide

capital and advanced technology, Mexico can

leverage its labour force (spurred on by a bulging

youth population) and potential to become a global

manufacturing hub.

TIP! Manufacturing will also drive GDP growth for

Vietnam (as mentioned in that market report).

The Mexican National Infrastructure Programme

aims to attract foreign investment from public-

private partnerships (PPPs), worth in excess of US$

100 billion, in value-added logistics, transportation

and services sectors that will require skilled English

language speaking personnel.

contents

36 | bmi market report: mexico • MARKET TRENDSMACRO TRENDS: english language learning

Top findings from a 2015 study by the British Council – English in Mexico: An examination of policy, perceptions

and influencing factors – include:

“The total size of the English language learning “The geography of Mexico has a profound effect on

market in Mexico is around 23.9 million people, levels of English, dividing the country in three:

roughly 21% of the population. This figure includes

students learning English via all possible channels: • The northern states that border the US that have

public and private institutions at primary, secondary a strong tradition of English learning levels and a

and tertiary levels. It also includes individuals and legacy of developed public English programmes;

organisations learning English privately or via self-

access learning.” • The central region that comprises the largest

proportion of Mexico’s middle class that use

“51% of the total employers surveyed said their English in their daily working lives;

company offered English language training and

development for existing staff or new staff; 30% said • The states that join Mexico to Central America

they had a training partnership with a private external where there is much less need for English and,

company; 18% said they provided funding for English therefore, proficiency declines.”

tutoring; 16% had internal provision and 14% said

they offered online training.”

contents

37 | bmi market report: mexico • MARKET TRENDSMARKETING TIPS: SOCIAL MEDIA TRENDS

It’s no secret that Mexicans have an above average addiction to

social media.

At an average of 3 hours and 27 minutes a day, Mexico ranks

7th amongst the top countries worldwide that spend the most

time on social media (one full hour more than the global

average).

When it comes to brand discovery, 42.5% of Internet users

aged 16 to 64 find new brands via ads on social media - more

than any other channel - bucking global trends which show

most users initially finding brands via search engines, tv, word

of mouth, or brand websites. Moreover, 64.7% of Mexicans use

social networks to research brands, again beating out search

engines, websites or reviews.

We zoom in on three important channels for institutions

to utilise when engaging with Mexicans online.

contents

38 | bmi market report: mexico • MARKET TRENDSMARKETING TIPS: facebook

As of February 2022, there

were over 80 million Facebook

users in Mexico. With nearly

55% between the ages of 18-34

years old, Mexicans are proving

that the platform is still popular

with university-aged audiences.

contents

39 | bmi market report: mexico • MARKET TRENDSMARKETING TIPS: facebook

Mexicans spend 26.2 hours

per month on Facebook’s app,

which is significantly more than

the global average and twice

that of Brazil.

contents

40 | bmi market report: mexico • MARKET TRENDSMARKETING TIPS: tiktok

TikTok now has more than 1

billion monthly active users

around the world with 46.02

million in Mexico, making it

the 5th largest user population

worldwide.

It was the #1 most downloaded

app in Mexico in 2020.

contents

41 | bmi market report: mexico • MARKET TRENDSMARKETING TIPS: tiktok

Just like their Facebook usage,

Mexico again beats the global

average with 23.4 hours per

month spent on TikTok.

contents

42 | bmi market report: mexico • MARKET TRENDSMARKETING TIPS: PODCASTS

A great avenue for reaching

parents and postgraduate

prospects (but teens are here

too!), globally, more than 1 in 5

working-age Internet users now

listen to podcasts every week.

Which country listens the

most? Mexico, with 33% of the

population tuned in weekly.

People are spending more time

listening too, with the typical

Internet user now spending

almost an hour per day listening

to podcast content, comparable

to radio or music streaming

services.

Total population, according to INEGI: 126,014,024 in 2020

33% = 41,584,628 Mexicans tuned in weekly

contents

43 | bmi market report: mexico • MARKET TRENDSCONCLUSION

DESTINATION TRENDS

UNESCO’s figures, while widely cited, often under-report the actual figures when we compare them

with destination government data. Nevertheless, they can serve as a rough reference for the level of

outbound mobility.

Using destination government data (and when not available, UNESCO data) the top 15 destinations

for Mexicans are listed below, with 2019 data included for some nations to serve as a more accurate

representation of enrolment pre-pandemic.

1 / USA................. 14,348 at the tertiary level in 2019/20 Total Mexicans

2 / Canada........... 6,425 at the tertiary level in 2020 / 8,680 in 2019 studying abroad

(UNESCO)

3 / Australia......... 3,204 in all sectors in 2020 / 3,788 in 2019

4 / France............ 3,199 in all sectors in 2019

5 / Spain............... 3,143 at the tertiary level in 2019 • 15,818 in 2000

6 / Germany......... 2,922 at the tertiary level in 2019 • 26,864 in 2011

7 / UK................... 1,915 at the tertiary level in 2019/20 • 29,401 in 2016

8 / China............... 1,540 at the tertiary level in 2018 • 34,319 in 2019

9 / Argentina........ 979 at the tertiary level in 2019

10 / Colombia....... 472 at the tertiary level in 2019

11 / Italy................ 359 at the tertiary level in 2019

12 / Chile.............. 267 at the tertiary level in 2019

13 / NZ................. 240 in all sectors in 2020 / 425 in 2019

14 / Ireland.......... 229 in all sectors in 2019

15 / Brazil............ 209 at the tertiary level in 2019

contents

45 | bmi market report: mexico • conclusionDESTINATION TRENDS

Leaving aside the impact of Covid-19 on enrolments

from 2020 onwards, we’ve observed several clear

positive trends in certain markets:

Prior to the pandemic, Canada and Australia had • Doctorate degrees in USA and France have

experienced steady growth from Mexico – exactly maintained steady growth since 2014.

as the USA saw a steady decline (with the latest • Only 5 out of 50 USA states have experienced

figures putting the US at around the same Mexican Mexican enrolment growth since 2014: Alabama,

enrolment level as seen in 2013). The year 2019/20 Georgia, Idaho, Nevada and Utah.

saw a slight increase (1.5%) in US graduate • Canada has had steady growth in Mexican

enrolments, with the doctorate sector being the enrolments in its higher education and language

only one to maintain steady growth since 2014. sectors over the last ten years.

The UK has been fairly flat since 2011, with current • Australia has seen steady growth, mainly lead

figures nearly identical to 2014. by its VET sector however its secondary school

Mexican enrolments lag behind those of New

While the US has always had a strong pull for Zealand and Ireland (much further behind than

Mexicans, the diversity of top destinations and we’d expect).

increasing interest in non-English speaking • Mexicans appear to have a growing interest in

countries illustrates Mexicans’ appetite for French culture, language, history and society.

adventure and global curiosity. • China continues to nip at the heels of competitor

destinations, with rising 2016/17 enrolments

Apart from language advantages, cultural and scholarship programmes to boost numbers

familiarity, or geographic proximity, other factors higher.

that influence Mexicans’ choice of destination • New Zealand’s numbers have been heading

include affordability, employment opportunities upwards, with their English language sector as

during and after studies, and emigration pathways. the only one to have shown consistent growth in

Mexican enrolments year on year.

contents

46 | bmi market report: mexico • conclusionrecruitment tips

Given the market potential in Mexico and the

increasing need for institutions to grow and diversify

their enrolments, we believe the findings from this

report clearly illustrate the strategic imperative in

increasing a brand’s marketing and recruitment

efforts in the country.

Mexico’s decentralised education system and cultural

diversity make this a fascinating recruitment market.

Meanwhile, the country’s growing middle class

and youth population give clear signs of increasing

potential for international education.

Statistics from 2010 revealed that 50% of households

in urban areas were considered to be middle class,

and nearly 29% of those households sent their

children to fee-paying private secondary schools. For

the upper class, that number more than doubles,

with 64% of wealthy families enrolling their children

in private schools.

As with many recruitment countries and especially

in one the size of Mexico, we encourage institutions

to go beyond capital cities and dig deeper into the

market, exploring the nuances in demand across the

country and tailoring messaging to suit employment

and growth opportunities within each state.

contents

47 | bmi market report: mexico • conclusionmarketing tips

For both institution-led outreach and marketing Make sure you’re sharing valuable information that

activities conducted by agencies and partners, prospective students are looking for across your

strengthen your position through consistent social channels, such as YouTube and Instagram,

branding, clear messaging, and Mexican-specific to showcase videos of daily life on campus, student

strategies. and alumni success stories, student support, the

link between education and employability, degree-

Take the time to craft marketing messages that specific accolades, and curricula.

address key concerns for Mexican students, such as

those related to safety, affordability, work experience, Embrace new platforms and experiment with

and education outcomes. different forms of marketing content. Mexico is the

top country for podcast listeners with 33% of the

Moreover, be proactive in utilising a wide variety population (nearly 41.6 million Mexicans) tuned

of marketing channels, paying extra attention to in weekly. Meanwhile, Mexico has the fifth largest

social media, which Mexicans use more than search TikTok user population in the world.

engines for initial brand discovery or research,

bucking global trends.

contents

48 | bmi market report: mexico • conclusionImproving your recruitment results

How BMI helps you recruit

international students

Established in 1987, BMI offers a variety of solutions

to provide international education professionals with

a multi-touch recruitment strategy covering both

online and offline activities across Africa, Asia, Brazil,

Europe, India, Latin America and the Middle East.

BMI runs nearly 200 in-person and virtual events

across five continents every year.

BMI’s online marketing solutions also enable

institutions to connect with over 1.5 million students

a year. The company is a proud partner of UNICEF

and works with national government bodies including

The British Council, Education in Ireland, EduCanada,

Education USA, the European Commission and the

Ministries of Education of almost every European

country as well as dozens more around the world.

Explore BMI’s website

contents

50 | bmi market report: mexico • improve your recruitment resultsSurvey feedback from Mexican students

BMI surveyed the attendees of their in-person events (Expo Estudiante and Expo Posgrados) which took

place across several Mexican cities from Feb 17 to 24, 2022. Respondents were an average age of 26.

Study Abroad Drivers

“I’m looking for developing my communication skills,

to prove myself that I can be successful outside my

• Better quality education outside of Mexico

comfort zone, to connect with new people and new

• Programme not offered in Mexico ideas, to learn about other’s cultures and use that

• Global curiosity knowledge to create greater good.”

TIP!

Talk with your marketing team to learn how you’re altering the info you give to prospects based on their

reasons for seeking an education abroad.

contents

51 | bmi market report: mexico • improve your recruitment resultsSurvey feedback from Mexican students

Country choices and perceptions TIPS!

• Nearly every student surveyed chose 2-3

countries, and most of those were on different Use video and strong visuals to showcase your

continents. Plenty of students mentioned 5 or 6 country’s culture.

countries.

Showcase part-time employment options and

• A country’s culture has strong pull factor, with

Career Services.

students using words such as “love, fascinated

by, modern, first world”.

• 100% of students said they plan to work part-

• Country choice is often driven by the time during their studies, a majority said they

programmes offered. prefer in their field of study but many also said

anywhere they could get work.

contents

52 | bmi market report: mexico • improve your recruitment resultsSurvey feedback from Mexican students

What do students do after an event?

1 / Check websites.

TIP!

2 / Work out a budget, look for scholarships.

3 / Social media (YouTube, Instagram): search

for student experiences, contact students For each student fair you attend,

or alumni. create dedicated landing pages

and mini email campaigns which

4 / Ask questions via email. address these topics in a series

to help them in their decision

5 / Investigate deadlines. making journey.

6 / Talk to my advisor.

contents

53 | bmi market report: mexico • improve your recruitment resultsHow Jackfruit Marketing helps improve

your international student recruitment

Jackfruit Marketing is a boutique consultancy,

project management and training company

dedicated to the international education industry.

Working with clients around the world and across

each level of international education, from K-12

up to postgraduate, Jackfruit Marketing enables

institutions and organisations to gain a competitive

advantage through brand differentiation, innovative

marketing techniques, and highly targeted creative

content.

Acting as a personal, trusted advisor, Jackfruit

Marketing can help improve your international

recruitment, retention, marketing and growth

strategies. Owner and Managing Director Jacqueline

Kassteen also regularly gives training sessions,

interactive masterclasses and plenaries around the

world for audiences as large as 1500 people.

EXPLORE JACKFRUIT MARKETING’S WEBSITE

contents

54 | bmi market report: mexico • improve your recruitment resultsBMI Market Report: MEXICO

2022

Rupert Merrick

Director

BMI

Web: bmiglobaled.com

Email: rupert@bmiglobaled.com

Phone: +44 (0) 208 952 1392

Jacqueline Kassteen

Report Author

Founder & Managing Director

Jackfruit Marketing

Web: jackfruitmarketing.com

Email: jackie@jackfruitmarketing.com

Phone: +44 (0) 7454747096You can also read