MCKINSEY ON INVESTING - PERSPECTIVES AND RESEARCH FOR THE INVESTING INDUSTRY NUMBER 5, NOVEMBER 2019

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

McKinsey on Investing Editorial Board: McKinsey Practice Publications

is written by experts and Pooneh Baghai, Alejandro Beltran

practitioners in McKinsey’s global de Miguel, Onur Erzan, Martin Editor in Chief:

investor-focused practices, Huber, Duncan Kauffman, Bryce Lucia Rahilly

including our Private Equity & Klempner (lead), Hasan Muzaffar,

Principal Investors, Wealth & Asset Rob Palter, Alex Panas, Vivek Executive Editors:

Management, and Capital Projects Pandit, Mark Staples, Marcos Michael T. Borruso,

& Infrastructure Practices. Tarnowski Bill Javetski,

Mark Staples

To send comments or request Editor: Mark Staples

copies, email us: Copyright © 2019 McKinsey &

Investing@McKinsey.com. Contributing Editors: Company. All rights reserved.

Roberta Fusaro, Heather Ploog,

Cover image: Josh Rosenfield This publication is not intended to

© Mike_Kiev/Getty Images be used as the basis for trading in

Art Direction and Design: the shares of any company or for

Leff Communications undertaking any other complex or

significant financial transaction

Manager, Media Relations: without consulting appropriate

Alistair Duncan professional advisers.

Data Visualization: No part of this publication may be

Richard Johnson, copied or redistributed in any form

Jonathon Rivait without the prior written consent of

McKinsey & Company.

Managing Editors:

Heather Byer, Venetia Simcock

Editorial Production:

Elizabeth Brown, Roger Draper,

Gwyn Herbein, Pamela Norton,

Katya Petriwsky, Charmaine Rice,

John C. Sanchez, Dana Sand,

Sneha Vats, Pooja Yadav,

Belinda YuContents

3 More than values: The value-based

sustainability reporting that 42 Is a leverage reckoning coming?

Not yet. Despite rising corporate-

investors want debt levels, research shows

Nonfinancial reports helped stimulate companies can cover their obligations

the growth of sustainable investing. for now. But they should prepare for

Now investors are questioning current a possible downturn by stress-testing

practices—and calling for changes their capital structure.

that executives and board members

must understand.

11 Catalyzing the growth of the

impact economy 48 Private equity opportunities in

healthcare tech

A mature impact economy would Although private equity firms have

help power economic growth been hesitant to invest in healthcare

while solving global social and tech, they have reason to invest in

environmental challenges. Here’s promising targets now.

what it will take to accelerate the

impact economy’s development.

22 Advanced analytics in asset

management: Beyond the buzz 57 How private equity can maximize

value in US financial services

Leading firms are applying advanced The industry may be on the cusp

analytics across the full asset- of a new and less forgiving era.

management value chain—and Private owners can take steps now

getting results. to get ready.

29 Pricing: The next frontier of value

creation in private equity 65 A turning point for real estate

investment management

Few private equity firms focus on As institutional investors flock to real

pricing transformations, though such estate, investment managers must

programs can create substantial avoid getting stuck in the middle of the

value. Here’s how pricing value can be market—too big to be nimble yet too

captured at any stage in the deal cycle. small to reach scale.

36 Private equity exit excellence:

Getting the story right 73 Highlights from McKinsey’s

2019 sector research

While a successful exit has many This year has seen intriguing new

elements, a clear and evidence-backed dynamics in many sectors. In this

equity story detailing an asset’s compilation, McKinsey experts break

potential may be the most important. them down. All articles and reports

Three key principles can help funds are available on McKinsey.com.

maximize exit returns.Introduction

Welcome to the fifth volume of McKinsey on Investing, developed to share the best of our recent research

and thinking relevant to investors. Colleagues from around the world and across many disciplines—

including asset management, infrastructure, institutional investing, and private equity—collaborated to

develop these insights. We hope this combination of perspectives will provoke reflection and dialogue

and prove an insightful guide to some of the best current practice in the investment industry.

We begin with a pair of articles drawn from our latest research on responsible investing. The first piece looks

into investors’ desire for greater consistency and reliability in sustainability metrics—an urgent need as

sustainable-investment strategies swell to more than $30 trillion in assets. The second draws on interviews

with more than 100 investors and others to sketch out what a true impact economy might look like.

Four more articles offer a range of strategies for private investing. One explores how leading asset

managers are already deriving considerable benefits from advanced analytics. Another investigates pricing,

a lever that many GPs have not fully tapped. As the economic cycle winds down, exits are top of mind for

many GPs; the third article in this section offers insights into how to craft a persuasive exit narrative. And a

fourth article considers the current state of leverage across the corporate landscape.

Finally, we are pleased to offer in-depth looks at opportunities for private managers in three sectors:

European healthcare technology, US financial services, and global real estate. We close the issue with

capsule summaries of some of the most investor-relevant industry research published by McKinsey in 2019.

We hope you enjoy these articles and find in them ideas worthy of your consideration. Please let us know

what you think: you can reach us at Investing@McKinsey.com. You can also view these articles and many

others relevant to investing at McKinsey.com and in our McKinsey Insights app, available for Android and iOS.

The Editorial Board

Pooneh Baghai Duncan Kauffman Alex Panas

Alejandro Beltran de Miguel Bryce Klempner Vivek Pandit

Onur Erzan Hasan Muzaffar Mark Staples

Martin Huber Rob Palter Marcos Tarnowski

2 McKinsey on Investing Number 5, November 2019More than values:

The value-based

sustainability reporting

that investors want

Nonfinancial reports helped stimulate the growth of sustainable

investing. Now investors are questioning current reporting

practices—and calling for changes that executives and board

members must understand.

by Sara Bernow, Jonathan Godsall, Bryce Klempner, and Charlotte Merten

© Vgajic/Getty Images

More than values: The value-based sustainability reporting that investors want 3As evidence mounts that the financial performance findings might not surprise readers involved with

of companies corresponds to how well they sustainable investing or sustainability reporting, it

contend with environmental, social, governance was striking to learn that investors also support legal

(ESG), and other nonfinancial matters, more mandates requiring companies to issue sustainability

investors are seeking to determine whether reports (Exhibit 1). In this article, we offer executives,

executives are running their businesses with such directors, and investors a look at how sustainability

issues in mind. When companies report on ESG- reporting has evolved, what further changes

related activities, they have largely continued investors say they want, and how investors can bring

to address the diverse interests of their many about those changes.

stakeholders—a long-standing practice that

involves compiling extensive sustainability reports

and filling out stacks of questionnaires. Despite Reporting today: Focused

all that effort, a recent McKinsey survey uncovered on externalities, inconsistent,

something that should concern corporate executives yet informative

and board members: investors say they cannot The current practice of sustainability reporting

readily use companies’ sustainability disclosures to developed in the 1990s as civil-society groups,

inform investment decisions and advice accurately.¹ governments, and other constituencies called

on companies to account for their impact on nature

What’s unusual and challenging about sustainability- and on the communities where they operate. A

focused investment analysis is that companies’ milestone was passed in 2000, when the Global

sustainability disclosures needn’t conform to shared Reporting Initiative (GRI) published its first

standards in the way their financial disclosures must. sustainability-reporting guidelines. The following

Years of effort by standard-setting groups have year, the World Business Council for Sustainable

produced nearly a dozen major reporting frameworks Development and the World Resources Institute

and standards, which businesses have discretion released the Greenhouse Gas Protocol. The

to apply as they see fit (see sidebar, “A short glossary same period also saw the creation of voluntary

of sustainability-reporting terms”). Investors initiatives, such as the UN Global Compact and

must therefore reconcile corporate sustainability the Carbon Disclosure Project (now CDP),

disclosures as best they can before trying to draw encouraging corporations to disclose information

comparisons among companies. on sustainability. Since the financial crisis,

additional frameworks and standards have

Corporate executives and investors alike recognize emerged to help companies and their investors

that sustainability reporting could improve in some develop a greater understanding of the risks and

respects. One advance that executives and investors benefits of ESG and nonfinancial factors. For

strongly support, according to our survey, is reducing example, the International Integrated Reporting

the number of standards for sustainability reporting. Council (IIRC) advocates integration of financial

Many executive respondents said they believe this and nonfinancial reports, the Sustainability

would aid their efforts to manage sustainability Accounting Standards Board (SASB) identifies

impact and respond to sustainability-related trends, material sustainability factors across industries,

such as climate change and water scarcity. And many and the Embankment Project for Inclusive

investors said they expect greater standardization Capitalism assembles investors and companies to

of sustainability reports to help them allocate capital define a pragmatic set of metrics to measure and

and engage companies more effectively. While these demonstrate long-term value to financial markets.

1

For this research, we conducted a survey of 107 executives and investors, representing 50 companies, 27 asset managers, and 30 asset

owners. The survey, carried out in January and February of 2019, covered Asia, Europe, and the United States. We also conducted interviews

with 26 representatives of asset managers, asset owners, corporations, standard-setting organizations, nonprofit organizations, and

academic institutions.

4 McKinsey on Investing Number 5, November 2019More than values: The value-based sustainability reporting that investors want

Exhibit 1 of 4

Exhibit 1

Investors and executives say that reducing the number of sustainability-reporting standards

would be beneficial—and even that there should be legal mandates for reporting.

Respondents who agree with statement,¹ %

Companies should be required by

law to issue sustainability reports

There should be fewer sustainability-

reporting standards than there are today 14

82

28

66

There should be 1 sustainability-

reporting standard 75

58

Investors Executives Investors Executives

% of investors who agree or strongly agree that more standardization % of executives who agree or strongly agree that more standardization

of sustainability reporting would enable the following actions1: of sustainability reporting would enable the following actions1:

enhance my

help my firm help my firm help my company

company’s ability

allocate capital manage risk benchmark itself

to create value

more effectively more effectively against its peers

or mitigate risk

85 83 80

68

1

Respondents who answered “agree” or “strongly agree.” For investors, n = 57; for executives, n = 50.

Source: McKinsey Sustainability Reporting Survey

Given the proliferation of reporting frameworks for increased disclosure about how companies

and standards, companies have had to decide for address opportunities and risks related to

themselves which ones to apply. These frameworks sustainability trends, such as climate change and

and standards allow businesses considerable water scarcity, which can meaningfully affect

freedom to choose their sustainability disclosures. a company’s assets, operations, and reputation.

Many companies select their disclosures by

consulting members of stakeholder groups— The scope and depth of these disclosures differ

consumers, local communities, employees, govern- considerably as a result of the subjective choices

ments, and investors, among others—about which companies make about their approaches to

externalities, or impacts, matter most to them sustainability reporting: which frameworks and

and then tallying the stakeholders’ interests in standards to follow, which stakeholders to address,

some way. More recently, stakeholders have asked and which information to make public. According

More than values: The value-based sustainability reporting that investors want 5A short glossary of sustainability-reporting terms

In this article, we use the following can be a stand-alone document or a disclosures a sustainability report

terms for certain elements of sustain- component of the annual report. should cover. The International

ability reporting: Integrated Reporting Framework,

—— Sustainability-reporting published by the International

—— Sustainability disclosure. This requirement. This requirement is Integrated Reporting Council (IIRC),

disclosure is an item of qualitative or a mandate from an authority (such is one example.

quantitative information about as a regulator, a stock exchange,

a company’s performance on a or a civil-society group) about a —— Sustainability-reporting standard.

topic not addressed by standard sustainability report’s content and This standard is a set of specifications

financial and operational disclosures. nature. Some requirements apply to for measuring and disseminating

Sustainability disclosures ordinarily all companies in a given jurisdiction— sustainability disclosures. Examples

relate to environmental, social, and for example, Directive 2014/95/EU include the Global Reporting

governance matters, including of the European Parliament and the Initiative’s GRI Standards and the

companies’ sustainability impact and European Council, requiring some 77 industry-specific standards

responses to external sustainability large companies to issue nonfinancial published by the Sustainability

trends. These disclosures sometimes disclosures. Others, such as the Accounting Standards Board.

encompass other topics, too, such as UN Global Compact, apply only to

HR and intellectual property. companies that have voluntarily

pledged to abide by them.

—— Sustainability report. This report

is a document containing a set of —— Sustainability-reporting framework.

sustainability disclosures from an This framework is a set of guidelines

organization for a period of time. It for determining what topics and

to the executives and investors we surveyed, the trends in companies’ responses to sustainability

diversity of these disclosures is a defining feature of issues but compare and rank businesses as well.

sustainability reporting as we know it—and a source

of difficulty, as we explain in the following section of Analysts in academia, government, and the

this article. private sector have also used these sustainability

disclosures to examine the link between sustain-

Thirty-odd years of sustainability reporting have ability performance and financial performance. A

produced a trove of useful data. Stakeholders substantial body of research shows that companies

can use this information to track the relative that manage sustainability issues well achieve

sustainability performance of companies from year superior financial results.² (Research has shown

to year. By aggregating data from many companies, only that these two phenomena are correlated,

stakeholders can not only discern patterns and not that effective sustainability management leads

to better financial outcomes.)

2

Alexander Bassen, Timo Busch, and Gunnar Friede, “ESG and financial performance: Aggregated evidence from more than 2000 empirical

studies,” Journal of Sustainable Finance & Investment, 2015, Volume 5, Issue 4, pp. 210–33; Robert G. Eccles, Ioannis Ioannou, and George

Serafeim, “The impact of corporate sustainability on organizational processes and performance,” Management Science, 2014, Volume 60,

Issue 11, pp. 2835–57; Gordon L. Clark, Andreas Feiner, and Michael Viehs, From the stockholder to the stakeholder: How sustainability can

drive financial outperformance, a joint report from Arabesque and University of Oxford, March 2015, insights.arabesque.com; “Sustainability:

The future of investing,” BlackRock, February 1, 2019, blackrock.com.

6 McKinsey on Investing Number 5, November 2019Investors and asset owners appear to be taking note From our interviews and survey results, it is

of corporate sustainability disclosures and adapting apparent that investors want companies to provide

their investment strategies accordingly. The Global more sustainability disclosures that are material

Sustainable Investment Alliance has found that to financial performance. According to a senior

the quantity of global assets managed according sustainable-investing officer at one top 20 asset

to sustainable-investment strategies more than manager, “Corporations do not provide systematic

doubled from 2012 to 2018, rising from $13.3 trillion data on one-third of the sustainability factors

to $30.7 trillion.³ BlackRock reports that assets in [that we consider] material.” This could change

sustainable mutual funds and exchange-traded funds as more companies issue reports in line with

in Europe and the United States increased by more the sector-specific standards that SASB created

than 67 percent from 2013 to 2019 and now amount in consultation with industry experts and investors.

to $760 billion.⁴ And research by Morgan Stanley

indicates that a majority of large asset owners are Government authorities and civil-society

integrating sustainability factors into their investment organizations also appear to be coming around

processes. Many of those asset owners started to do to investors’ views about the material connection

so only during the four years before the survey.⁵ between a company’s handling of sustainability

factors and its financial performance. The European

Union’s 2014 directive on nonfinancial reporting

What investors want: Financial and the Financial Stability Board’s creation of the

materiality, consistency, and reliability Task Force on Climate-related Financial Disclosures

With so much capital at stake, investors have in 2015 are two signals that financial regulators

begun to question prevailing sustainability- realize sustainability-related activities can materially

reporting practices. The shortcomings investors affect the financial standing of companies and

now highlight have existed for some time but were should be reported accordingly.

mostly acceptable to early sustainable investors

and the diverse civil-society stakeholders that Consistency

used to be the primary readers of sustainability With so many reporting frameworks and guidelines

reports. But now that more asset owners and asset to choose from and so many potential stakeholder

managers are making investment and engagement interests to address, companies rarely make

decisions with sustainability in mind, a louder sustainability disclosures that can be compared

call has gone out for sustainability disclosures that as neatly as their financial disclosures can. This

meet the following three criteria. circumstance makes the job of investors more

difficult, as they indicated in response to our survey

Financial materiality (Exhibit 2). As the head of sustainable investing at a

Investors acknowledge that their expectations for major asset manager explained, “We have positions

sustainability disclosures have shifted. As the head in over 4,500 companies. Unless [sustainability

of responsible investing at a large global pension information] is comparable, hard data, it is of little

fund remarked, “The early days of sustainable use to us.”

investing were values based: How can our investing

live up to our values? Now, it is value based: How Inconsistencies among sustainability disclosures,

does sustainability add value to our investments?” which arise through no fault of the companies

producing them, can also create problems for the

3

Global Sustainable Investment Review 2012 and Global Sustainable Investment Review 2018, Global Sustainable Investment Alliance,

gsi-alliance.org.

4

“Sustainability: The future of investing,” BlackRock, February 1, 2019, blackrock.com.

5

“Sustainable signals: Asset owners embrace sustainability,” Morgan Stanley, June 18, 2018, morganstanley.com.

More than values: The value-based sustainability reporting that investors want 7many investors that obtain sustainability data companies do not have the systems in place to collect

from third-party services rather than individual quality data for [sustainability] reporting.” For certain

sustainability reports. These services use different tangible sustainability factors, such as greenhouse-

methods to estimate missing information, so there gas emissions, performance-measurement systems

are discrepancies among data sets. Some services are generally well established. For other factors, such

normalize sustainability information, replacing as corporate culture, human capital, and diversity

actual performance data (such as measurements and inclusion, clear ways to gauge performance are

of greenhouse-gas emissions) with performance more elusive.

scores calculated by methods the services don’t

reveal. Research shows a low level of correlation Investors also harbor doubts about corporate

among the data providers’ ratings of performance sustainability disclosures because few of them

on the same sustainability factor.⁶ undergo third-party audits. Nearly all the investors

we surveyed—97 percent—said that sustainability

Similarly, proprietary indexes and rankings of disclosures should be audited in some way, and

sustainable companies, which some asset managers 67 percent said that sustainability audits should be

use to construct index-fund portfolios, can also as rigorous as financial audits (Exhibit 3).

diverge greatly. It is not unusual for a company to

be rated a top sustainability performer by one index

and a poor performer by another.⁷ And some data Refining the practice of

services fail to include sustainability data companies sustainability reporting

have disclosed.⁸ In our survey and interviews, one priority for

improving sustainability reporting stood out: ironing

Reliability out the differences among reporting frameworks

As the head of responsible investing for one of the and standards. When we asked survey respondents

world’s five largest pension funds put it, “Many to assess the challenges of sustainability reporting,

GES 2019

More than values: The value-based sustainability reporting that investors want

Exhibit 2 of 4 6

Gregor Dorfleitner, Gerhard Halbritter, and Mai Nguyen, “Measuring the level and risk of corporate responsibility—an empirical comparison of

different ESG rating approaches,” Journal of Asset Management, 2015, Volume 16, Issue 7, pp. 450–66. The correlation between ratings of the

same performance factor is typically less than 0.6 and can fall to as low as 0.05. By comparison, credit ratings are highly correlated (0.9).

7

James Mackintosh, “Is Tesla or Exxon more sustainable? It depends whom you ask,” Wall Street Journal, September 17, 2018, wsj.com.

8

“Sustainability: The future of investing,” BlackRock, February 1, 2019, blackrock.com.

Exhibit 2

Investors report that the main shortcomings of current sustainability-reporting practices are

inconsistency, incomparability, and lack of alignment in standards.

Top challenges associated with current sustainability-reporting practices,1 mean rating on 1–5 scale, where 5 is

most challenging

Inconsistency, incomparability,

or lack of alignment in standards 3.47

Too costly or time intensive 3.33

Unclear benefits or value added 3.11

0 1 2 3 4 5

1

n = 57.

Source: McKinsey Sustainability Reporting Survey

8 McKinsey on Investing Number 5, November 2019executives and investors both rated “inconsistency, Most of the investors we surveyed—63 percent—

incomparability, or lack of alignment in standards” also said they believe that greater standardization

as the most significant challenge. A majority of will attract more capital to sustainable-investment

respondents to our survey—67 percent—said there strategies. However, about one-fifth of the surveyed

should be only one standard, and an additional investors said that uniform reporting standards

21 percent said there should be fewer than exist now. would level the playing field, diminishing their

opportunities to develop proprietary research

The investors and executives who participated insights or investment products (Exhibit 4).

in our research also described several benefits

of making reporting frameworks and standards Executives made clear, in our conversations,

more uniform. Investors expect greater uniformity that they devote excessive effort and expense

to help companies disclose more consistent, to answering numerous specialized requests

financially material data, thereby enabling for what is essentially the same information, such

investors to save time on research and analysis as greenhouse-gas emissions data that must

GESto2019

and arrive at better investment decisions. be tabulated in different ways to conform to

More than values:

Some efficiency The value-based

gains would accrue as third-party different standards.

sustainability reporting

data providers begin aggregating thatsustainability

investors

want

information as consistent as the information they This kind of burden would be lessened if the

Exhibit

get 3 of 4 financial statements.

from corporate providers of reporting frameworks and standards

combined or rationalized their rules and thereby

reduced the number of major frameworks and

Exhibit 3

standards to one or two. Companies could then use

More investors believe that sustain- the same disclosures to fulfill the reporting demands

of multiple authorities. (They could still develop

ability reports should be audited and

additional sustainability disclosures if they chose to

that the audits should be full audits, address stakeholder queries or concerns that the

similar to financial ones. main mechanism didn’t cover.) Establishing one or

Respondents who agree with statement,¹ % two reporting standards would also simplify the task

of auditing sustainability disclosures, making it more

Sustainability reports Sustainability reports economical for companies to have their reports

should undergo some audit should undergo full audit,

similar to a financial audit independently verified.

97

88

How investors can help effect change

Reducing the number of reporting frameworks

67 and standards will probably involve several more

years of effort by businesses, investors, and

standard-setting organizations—which have

begun to identify gaps and redundancies among

disclosures—and by other stakeholders, such as

36

civil-society groups and regulators. As it is, many

investors avoid participating in standard-setting

efforts. Some we interviewed said they distance

themselves because they feel that standard setting

should address their needs as a matter of course.

Investors Executives Investors Executives Yet some standard setters told us they assume

1

Respondents who answered “agree” or “strongly agree.” For

that investors can readily obtain the sustainability

investors, n = 57; for executives, n = 50. information they value and therefore focus on the

Source: McKinsey Sustainability Reporting Survey interests of other stakeholders.

More than values: The value-based sustainability reporting that investors want 9More than values: The value-based sustainability reporting that investors want

Exhibit 4 of 4

Exhibit 4

Many investors believe that harmonized sustainability-reporting standards will attract more

capital to sustainable investors, though some express concern about losing an edge.

Investors who agree with statement about effect of harmonized standards, % of respondents1

Will weaken proprietary Will have

Will help attract more capital insights or specialized both effects

to sustainable investments or differentiated products described

63 19 15

100

Note: Figures may not sum to 100%, because of rounding.

1

Respondents who answered “agree” or “strongly agree”; n = 57.

Source: McKinsey Sustainability Reporting Survey

Our conversations lead us to believe that there’s and disclosures. Some investors have developed

some truth to both viewpoints. Yet our survey findings algorithms that automatically gather nonfinancial

and interviews also suggest that investors could data from public sources (such as government

make valuable contributions to standard-setting databases of health and safety incidents or websites

efforts if they chose to increase their participation. where people post comments about their employers)

Active investors are likelier to do so, since they and scan these data for patterns that relate

pay more attention than index investors to the meaningfully to corporate financial performance.

sustainability disclosures of individual companies.

Until investors clarify which sustainability disclosures

they want and help to rationalize frameworks and

standards, sustainability reports might continue to As the market for sustainable investments expands,

deliver less material information than they would like. more investors are taking a keen interest in

sustainability reports from companies. Yet the

Investors can do several other things to make information these investors find seldom meets

better use of the sustainability-related information their expectations. From an investor’s standpoint,

companies now make available. First, they can sustainability disclosures tend to be loosely related

articulate the sustainability disclosures that matter to financial performance, difficult to compare

most for their investment decisions and convey from one company to another, and less than reliable.

these interests to businesses. Going a step further, Investors who take part in efforts to improve

more investors could engage companies (through sustainability-reporting practices could gain an

direct dialogue and shareholder voting) about their edge over their more detached peers. Executives

approach to managing sustainability issues. and board members should stay attuned to these

efforts, and even participate in them, to maintain

More investors could also adopt the still-uncommon their companies’ standing with shareholders.

practice of collecting and analyzing data from

sources other than corporate sustainability reports

Sara Bernow is a partner in McKinsey’s Stockholm office, where Charlotte Merten is a consultant; Jonathan Godsall is a

partner in the New York office; and Bryce Klempner is a partner in the Boston office.

The authors wish to thank Lisen Follin, Conor Kehoe, and Taylor Ray for their contributions to this article.

Copyright © 2019 McKinsey & Company. All rights reserved.

10 McKinsey on Investing Number 5, November 2019Catalyzing the growth

of the impact economy

A mature impact economy would help power economic growth while

solving global social and environmental challenges. Here’s what it will

take to accelerate the impact economy’s development.

by David Fine, Hugo Hickson, Vivek Pandit, and Philip Tuinenburg

© d3sign/Getty Images

Catalyzing the growth of the impact economy 11Since the term “impact investment” was introduced that various impact-economy constituencies—

in 2007, the field of impact investing has grown and investors, asset managers, entrepreneurs,

diversified in notable ways. Impact-fund managers governments, and philanthropists foremost among

have amassed record sums, continuing a trend that them—would play in a mature impact economy.

can be traced back at least five years. Funds have Finally, we present three potential developments that

streamed money to impact investments from a would enable the impact economy to mature fully:

variety of sources, and asset managers are making

more investments outside the sectors that formerly —— instituting public policies that provide incentives

attracted the lion’s share of capital. Researchers and disincentives and create certainty

have engineered novel ways of tracking and reporting

impact, giving investors greater confidence that —— achieving a broad commitment to mutually

their money is producing social benefits and helping reinforcing operational, measurement, and

entrepreneurs make more effective decisions about reporting norms for fund managers, social entre-

their strategies and business models. preneurs, and impact-economy intermediaries

—— creating an industry body that promotes

Amid these encouraging developments, it is

policies and standards of excellence and moves

possible to define a sharper vision for a healthy,

all participants to adopt them

mature impact economy that involves a wider range

of actors and institutions than today’s impact- These changes would enable and encourage

investing industry. In an impact economy, the stakeholders to reset some of capitalism’s

norms—practices, policies, and standards—that assumptions and rules so that two goals receive

are attached to the pursuit of social impact would equal priority: powering economic growth and

be as widely accepted, consistent, and stable as wealth creation while also solving global social and

the norms that are associated with the pursuit environmental challenges.

of profit. Encouraged by the added measure of

certainty and transparency surrounding their

activities, investors large and small would allocate Envisioning a mature impact economy

more capital to the financing of social initiatives, Although some of the ideas and practices that

and entrepreneurs would devise business models are fundamental to impact investment and social

whose ambition and growth potential match entrepreneurship originated decades ago, it was

investor and market demand. Consumers would in 2007 that a group of foundations and investors

direct greater shares of their spending to social convened by the Rockefeller Foundation originated

enterprises, thereby spurring large mainstream the term “impact investing,” which was later

companies to measure and pursue impact. Overall, defined as “investments intended to create positive

the impact economy would achieve breakthrough impact beyond financial return.”¹ (Others have

increases in scale and productivity, with capital proposed varying definitions of impact investment,

delivering higher risk-adjusted levels of social although we do not seek to join that debate.²)

impact than we now see in many cases. Extending the idea at the heart of that definition—

the creation of social or environmental impact in

In this article, which incorporates findings from our addition to financial return—to all other economic

in-depth interviews with more than 100 investors, activities makes it possible to define an impact

fund managers, social entrepreneurs, and other economy as a system in which institutions and

impact-economy stakeholders, we consider what it individuals give equal priority to social impact and

will take for the impact economy to reach maturity. financial impact when making decisions about how

We begin by exploring the vision for the impact to allocate resources.

economy outlined above. We then look at the roles

1

argot Brandenburg, Antony Bugg-Levine, Christina Leijonhufvud, Nick O’Donohoe, and Yasemin Saltuk, “Impact investments: An emerging

M

asset class,” JPMorgan Chase, the Rockefeller Foundation, and Global Impact Investing Network, November 29, 2010, jpmorganchase.com.

² For example, the Global Impact Investing Network defines impact investments as “investments made into companies, organizations, and funds

with the intention to generate social and environmental impact alongside a financial return.” American Development Bank, 2017, publications

.iadb.org.

12 McKinsey on Investing Number 5, November 2019An impact economy is thus a very different kind Investment deployment

of system from a traditional capitalist economy The past few years have seen capital flow into

that prioritizes only financial returns. In an impact impact investments from a wide variety of sources

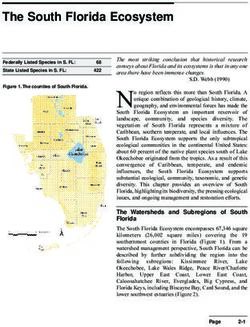

economy, consumers and shareholders will (Exhibit 1). Overall, impact fund managers have

challenge entrepreneurs and executives to show amassed record quantities of assets under

that they generate their profits in a manner that management: more than $228 billion, according

contributes to the public good. This approach to one estimate.³ Yet even this amount of money

to doing business is already being enacted by is small compared with the annual capital outlay—

some organizations on several levels—in making estimated at $1.4 trillion to $2.5 trillion of additional

strategic choices, in managing their supply chains, spending—required to achieve the Sustainable

in allocating funds to investments—and by some Development Goals (SDGs) set forth by the United

municipal authorities. But we have yet to see it Nations by 2030. To close the gap, asset owners

embraced comprehensively by entire industries or and fund managers will need to adopt investment

national economies. As such, we determined the strategies that put still more emphasis on positive

social outcomes, rather than strategies that merely

McK on Investingmajor

2019 dimensions of a full-fledged impact economy

to be investment deployment, asset management, seek to minimize or prevent negative outcomes.

Catalyzing the growth

delivery of solutions, and measurement and reporting.

Exhibit 1 of 4

³ Rachel Bass, Hannah Dithrich, and Abhilash Mudaliar, Annual impact investor survey 2018, Global Impact Investing Network, June 2018,

thegiin.org.

Exhibit 1

Capital flows into impact investments from a variety of sources.

Impact investing assets under management by investment source,¹ % of total

6

5

20

3

Pension funds and

insurance companies

5 Family offices and

8 22

high-net-worth individuals

15 6 Development-finance

institutions

2014, $46 billion 2018, $228 billion

Banks and diversified

17 financial institutions

16

Retail investors

17 12

Foundations

48 Others2

¹ Assets under management reported as of beginning of year. Figures combine direct investments into companies, projects, or real assets and indirect investments made

through intermediaries such as fund managers. Data are based on the Global Impact Investing Network’s annual investor surveys and not intended to be exhaustive.

² Includes funds of funds, sovereign-wealth funds, and others.

Source: Global Impact Investing Network; McKinsey analysis

Catalyzing the growth of the impact economy 13Investment trends appear to be moving in that with a correspondingly diverse variety of ambitions.

direction. Based on surveys showing that a The past few years have seen a trend in this direction,

substantial number of investors, including “main- as asset managers have directed an increasing

stream” investors, are seeking impact-investment proportion of investments beyond the financial-

products, there may be significant latent demand services and microfinance sectors (Exhibit 2).

for impact investments. In a mature impact

economy, then, we would expect to see more asset We would argue that a mature impact economy will

owners prioritizing the financing of solutions to also be characterized by a wide variety in the types

environmental and social challenges, and a major of investment instruments that asset managers offer

increase in commitments of capital to impact- clients. Impact-investing assets under management

seeking investment vehicles. are more evenly spread among different types of

investment instruments than they were just three

Asset management years ago, with private placements of debt and

Considering that the 17 SDGs address a wide range equity making up a considerably smaller share of the

McK on Investingof2019

issues—from human-development challenges market (Exhibit 3).

Catalyzing the growth

such as poverty, health, and gender equality to

Exhibit 2 of 4 environmental concerns such as climate change and Delivery of solutions

water scarcity—asset managers in a mature impact A mature impact economy would feature a

economy might be expected to back enterprises market-clearing quantity of solutions to social

Exhibit 2

Impact investors are broadening into sectors beyond financial services and microfinance.

Impact investing assets under management by investment sector,¹ % of total

4

4

5 19

Financial services²

1 6

Microfinance

6 3

21 Other³

8

Energy

8 9

8 Housing

2014, $46 billion 2018, $228 billion

Food and agriculture

11 21

Healthcare

Education

21

14 Water, sanitation,

and hygiene

31

¹ Assets under management reported as of beginning of year. Data are based on the Global Impact Investing Network’s annual investor surveys and not intended to be

exhaustive.

² Other than microfinance.

³ Includes arts and culture, conservation, information and communication technologies, manufacturing, and others.

Source: Global Impact Investing Network; McKinsey analysis

14 McKinsey on Investing Number 5, November 2019and environmental challenges. In other words, impact investors and social enterprises, more

impact enterprises would crop up to address than 80 percent of social enterprises have annual

environmental or social challenges that might be revenues of less than £1 million.

profitably addressed, although there will remain

a large set of such challenges that cannot be In addition, the “buy side” of the “market” for social

solved with for-profit models. Moreover, these impact remains underdeveloped. Consumers are

social enterprises would be no more likely to go increasingly aware of the social and environmental

unfunded than enterprises that measure their impact of businesses, and more consumers have

returns strictly in terms of profit (see sidebar, “A stated a preference for goods and services that

glimpse into the future of the impact economy”). help make a positive impact. This preference has

This is not the situation today. Impact-focused become prevalent enough that companies can no

McK on Investingenterprises

2019 have proliferated, and many of them longer afford to ignore it. Indeed, we are seeing large

operate on a modest scale, solving a particular

Catalyzing the growth companies make greater efforts to align their market

Exhibit 3 of 4 problem in a single locale or a small number strategies with their customers’ social compass,

of locales. In the United Kingdom, for example, while new enterprises are emerging that have social

which has a relatively well-developed cohort of impact built into their business models.

Exhibit 3

While various investment instruments are in use, government pay-for-performance services

remain underdeveloped.

Impact investing assets under management by type of instrument,¹ % of total

0.3

14

0.3

6

3

9 Private debt

41

11 Private equity

Other²

2014, $46 billion 2018, $141 billion⁴

53 Public debt

24 Public equity

21 Pay for performance³

18

¹ Assets under management reported as of beginning of year. Data are based on the Global Impact Investing Network’s annual investor surveys and not intended to be

exhaustive. Figures may not sum, due to rounding.

² Including real assets, guarantees, and leases.

³ Outcome-based contracts, such as social-impact bonds, that pay investors when enterprises achieve preagreed social outcomes.

⁴ The 2018 total given here differs from the 2018 total given in Exhibits 1 and 2 of this article because it excludes the particularly large pools of capital managed by two

respondents to the Global Impact Investing Network survey.

Source: Global Impact Investing Network; Social Finance; McKinsey analysis

Catalyzing the growth of the impact economy 15A glimpse into the future of the impact economy

Even when social entrepreneurs can are low. (Some loans have a minimum of these revenue-based mezzanine loans

show potential investors that their monthly payment; enterprises can and other quasi-debt instruments. The

companies have good prospects of reduce the principal they owe by paying fund invested in seven small and medium-

achieving profitability, they sometimes more than the minimum.) The loan also size impact businesses in the healthcare,

have difficulty raising funds if they includes an equity-conversion option at education, low-income-housing, and

cannot offer a clear exit strategy. Adobe a predefined multiple. The convertible alternative-energy sectors. One of these

Capital, an impact-investment company amount decreases as the principal is businesses, NatGas, converts vehicles to

focused on small Mexican companies repaid, which allows the founder to engines that run on gasoline and natural

with strong growth potential, developed retain more equity. And if the enterprise gas and operates compressed-natural-gas

a new financing structure for early-stage surpasses expectations and chooses filling stations. It also offers a financing

enterprises that have begun to generate to prepay the loan at the fixed multiple, program that helps its customers, mostly

revenue: a revenue-based mezzanine loan the investment’s internal rate of return taxi and bus drivers with unstable incomes,

with flexible schedules and a repayment (IRR) increases. An underperforming to make smaller up-front investments.

grace period. enterprise can still produce an IRR of ASMF I made an 18 million peso investment

20 percent in US dollars. in 2014. The company achieved profitability

Because the payments are revenue- that year and saw its revenues grow through

based, the peso-denominated loan Adobe Capital launched its $20 million 2016. In 2017, ASMF I exited NatGas,

allows an enterprise to avoid large loan Adobe Social Mezzanine Fund I (ASMF I) realizing a 22 percent IRR and a 1.5 multiple

payments during periods when revenues in 2012 to make investments in the form of the original investment.¹

1

ndrea Armeni and Miguel Ferreyra de Bone, Innovations in financing structures for impact enterprises: Spotlight on Latin America, Inter-American Development Bank, 2017,

A

publications.iadb.org.

At the institutional level, though, there is only and reporting social and environmental impact, which

modest demand for what social enterprises can would help to quantify the value of social outcomes,

provide. Social enterprises are not yet widely support accurate tracking of progress toward the

recognized as potential bidders for public tenders SDGs, and create the transparency that stakeholders

or as partners for large companies, and government need to make effective resource-allocation decisions.

pay-for-performance schemes (outcome-based Such standards would represent the impact-

contracts such as social-impact bonds) have economy equivalent of the Generally Accepted

limited uptake. In a mature impact economy, where Accounting Principles to which US companies

social enterprises will come to be seen as reliable adhere, or the International Financial Reporting

producers of social goods, we might expect such Standards used in many countries across the world.

pay-for-performance schemes to account for more (It is worth noting that even for financial accounting

of the impact-investing market. and reporting, there are still multiple sets of standards

in use.) Impact-economy standards would ideally

Measurement and reporting supersede or harmonize existing frameworks, such

A mature impact economy would operate according as the Impact Reporting and Investment Standards

to generally accepted sets of standards for measuring (IRIS) and Social Return on Investment (SROI).

16 McKinsey on Investing Number 5, November 2019It is reasonable to expect that even in a mature social and environmental performance that

impact economy some enterprises and investors will consistently exceeds industry benchmarks.

choose to define their impact goals in unique ways

that don’t conform to generally accepted standards Social entrepreneurs would undergo a radical

and track their performance against those goals. change in composition: away from the private-

Such idiosyncratic approaches, however, will likely sector stars whom many investors and fund

become much less prevalent than they are today managers now hope to attract into executive roles,

and occur only in contexts where generally accepted and toward proven “public-sector champions.”

standards can’t be applied easily. These are seasoned government officials and civil

servants who have firsthand experience dealing with

environmental and social problems that are rooted

Redefining the roles of impact- in market failures and therefore resistant to market-

economy stakeholders based solutions. As executives and managers at

Transitioning to a mature impact economy will social enterprises, these public-sector champions

involve significant changes in the ways that its not only commit to developing their own skills as

various constituencies, or stakeholders, conduct leaders, they also assemble capable teams to pursue

their business. Governments, for example, would major opportunities for both revenue and impact,

pay for social outcomes that have been measured tapping into an expanding pool of millennials who are

and verified, instead of paying service providers interested in impact-economy careers.

to do work that may or may not have the sought-

after impact. Some stakeholders will find that Governments would make a significant change

a mature impact economy no longer requires them to their operating model that sees them partner

to perform the same functions they performed actively with private-sector organizations to deliver

when the impact economy was less developed, and social outcomes. Amid rising costs (government

so they will take on different roles (Exhibit 4). spending is more than one-third of global GDP)

and strained budgets (the global public-sector

Asset allocators, such as foundations and pension deficit is nearly $4 trillion a year), governments’

funds, would gradually progress from screening long-standing approach to financing and

companies or sectors out of their portfolios implementing public services appears increasingly

depending on whether they fail to meet specific unsustainable. In a mature impact economy,

thresholds for social or environmental performance governments would work with other stakeholders

(a “no negatives” requirement) and toward actively to produce social outcomes that governments

targeting companies that intend to help solve lack the capacity to deliver and to boost the

social and environmental challenges (a “positive” productivity of public spending on core services.

or “positive offset” requirement). This approach would require policy makers and civil

servants to first adopt the mind-set that private-

Fund managers, responding to the needs and sector collaboration offers a means of increasing

expectations of asset allocators, would devote less governments’ effectiveness. Governments will

time and effort to seeding and nurturing early- also need the ingenuity to finance the delivery of

stage impact models and more time to financing social outcomes in a way that aligns the interests

the expansion of organizations with large-scale of private investors and enterprises with the

impact potential. Some fund managers would interests of citizens. That will mean reassigning

also consider financing carve-outs and major their most talented and creative people to engineer

transformations of organizations that can have a governments’ collaborations with the private sector.

disproportionate impact on social or environmental

opportunities. For fund managers, the ability to Just as important, governments would enact public

help impact enterprises scale up their activities policies that favor the continued development of

to a significant degree would become an enduring the impact economy by providing incentives and

source of what might be called “impact alpha”— reducing uncertainty for investors, entrepreneurs,

Catalyzing the growth of the impact economy 17Catalyzing the growth

Exhibit 4 of 4

Exhibit 4

Each stakeholder’s part will change as the impact economy matures.

Stakeholders by

level of maturity Seedling Burgeoning Mature

Asset allocators Major allocators adopt screening Allocators of all sizes apply “no Broad targeting and support of impact

requirements negatives” requirements at minimum enterprises

Fund managers Narrow range of investment Wider array of investment Comprehensive array of institutional

products for institutional clients, products, including some retail and retail products; sophisticated

targeting relatively few sectors offerings; broader sector coverage financing models

Social Small-scale enterprises with Large- and small-scale enterprises Numerous large social enterprises

entrepreneurs limited public profiles with greater visibility with strong reputations and

experienced leaders

Governments Desire to learn from other countries Substantial reliance on pay-for- Policies that incentivize the continuous

and to introduce pilot programs performance schemes; increased development of impact economy

supporting the impact economy support of social enterprises

Social-sector Small-scale efforts to seed and Greater investment in R&D to Consistent generation of ideas for

organizations launch enterprises according to drive business innovation and talent large-scale enterprises; endowments

proven models acquisition are invested for impact

Intermediaries Primary function is defining and Major functions include convening Independent rating agencies and

explaining “rules of the road” stakeholders and promoting professional-certification bodies

knowledge exchange create transparency and establish

economy-wide norms

Consumers

Participation largely limited to Closer alignment of stated Impact-oriented purchasing is

communication and dialogue; preferences and spending patterns a mainstream practice; active

some spending directed toward signals the narrowing of the attitude- engagement with companies regarding

social enterprises behavior gap key causes

Media and analysts Intermittent coverage that treats Serious coverage of impact High-profile coverage of impact

impact enterprises as curiosities economy featured frequently in economy, on par with coverage of

business press traditional businesses

18 McKinsey on Investing Number 5, November 2019and other stakeholders about the viability of the activity further, intermediaries might develop and

social sector. For example, the National Institution administer professional-certification programs

for Transforming India (also known as NITI Aayog), for fund managers and other impact-economy

a think-tank-style branch of India’s government, participants, thereby acting as gatekeepers for the

has mapped the activities of various government impact economy.

ministries against the SDGs and tracks the social

outcomes they produce. Consumers would shift out of their relatively passive

roles, in which they have weak affiliations with

Social-sector organizations would pursue fewer organizations that support progress toward positive

innovations in cost containment and excellence in environmental and social outcomes, and adopt

donor management, and more innovations in scaling patterns of actively consuming goods and services

and excellence in outcomes. This would represent from social enterprises and sustainable brands. This

a significant shift away from the risk-averse mode shift would represent the closure of the so-called

in which many social-sector organizations now attitude-behavior gap that separates consumers’

operate, by which they adhere to such practices as stated preferences from their spending habits.

keeping employees’ salaries low to avoid criticism Consumers would also help drive the development of

for excessive spending on administrative activities. an impact economy by engaging in local communities

Instead, social-sector organizations in an impact and political systems and expressing their views

economy would increase their spending in research directly to institutions through traditional media,

and development or use part of their long-term social media, and other channels.

endowment to make impact investments. These

approaches would embolden impact investors and Media organizations and analysts would take

social entrepreneurs to invest more in their own a more sophisticated approach to appraising

institutional capabilities and people. and documenting the impact economy and its

stakeholders. As the impact economy matures,

Intermediaries would move beyond merely media organizations would have less need to publish

explaining how to use various impact measures stories about the market distortions caused by

and instead compile and publish impact ratings in traditional capitalism and could offer more stories

a new role as independent rating agencies. This about the positive outcomes produced by social

activity would create greater transparency across enterprises and sustainability-focused enterprises.

the impact economy and reinforce demand for Top-tier media outlets would offer serious and

consistent, reliable ratings among asset allocators, high-profile coverage of the impact economy, as

investors, impact organizations, and policy makers. they do for the rest of the business world—think of

Highly rated agencies would be rewarded for an “Impact 500” business ranking that commands

their work and interventions, such that they would as much attention as annual rankings of the

receive more or lower-cost funds. Taking this largest companies, wealthiest individuals, and

Some stakeholders will find that

a mature impact economy no longer

requires them to perform the same

functions they performed when the

impact economy was less developed, and

so they will take on different roles.

Catalyzing the growth of the impact economy 19You can also read