MARKETBEAT Queenstown Residential - Bayleys Research ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Autumn 2015

MARKETBEAT RESEARCH NEWSLETTER

Queenstown Residential

A strongly performing economy, which has lead to job creation, low interest rates, the attraction of the area’s lifestyle advantages

and increasing amenity have seen Queenstown’s population expand rapidly over recent years with further significant growth

forecast.

Recent years have also seen a marked change in occupation trends within the town. Traditionally Queenstown’s population

would vary significantly on a seasonal basis, peaking during the ski season and falling either side of it. Recently however

Queenstown has become a year round tourism destination which has seen the fluctuations in population becoming far less

pronounced. As the town grows it also generates more non tourism based jobs as there is a need for a larger service sector.

The above factors have combined to put pressure on the availability of housing, both for rental and owner occupation, forcing up

rental and capital values and driving an increase in section sales and development activity.

Usually Resident Population Projected Population

Increase

2001 2006 2013 2006-2013 2018 2023 2028 2033 2038 2043

Queenstown 17,043 22,956 28,224 22.9% 33,800 37,300 40,700 44,000 47,300 50,600

Source: StatsNZ

The latest Census figures show that Queenstown’s

population has reached 28,224, an increase of 5,268

people or 22.9% since 2006. the rate of growth eclipses

that registered in both the Auckland Region, 8.5%, and

of New Zealand as a whole, which grew by 5.3% over the

same time period. Population growth across the Country

has accelerated over the last year due to record breaking

migration levels to New Zealand of over 50,000 people in

2014. While Auckland is the main recipient of immigrants the

last two years has seen Central Otago attract far more long

Bridesdale Farm term migrants than has been the case over recent years. With

the region having a net gain of 1,475 people in the year to

January 2015 compared with 42 in the 12 months to January 2013.

While these record levels of migration will not be maintained over the long term, Queenstown Lakes District is forecast to have

the fastest population growth of any district between 2013 and 2043. Projections published by Statistics New Zealand are for

between 1.2% and 2.3% annual growth for the area until 2043 which while lower than the 3% annual growth recorded for the

2006-2013 Census period will still run ahead of the national average.

Catering for the influx of residents and tourists alike, Queenstown Airport continues its strong performance with December

international passenger numbers 34.4% higher than the corresponding period last year. Total passenger numbers were up

16.3% with an increased summer flight schedule, with as many as eight international flights per day, and the addition of Jetstar’s

Gold Coast service, making access to the resort town progressively more accessible. With the busiest and most lucrative

summer on record in Queenstown, immigration rules were relaxed in a trial temporary move. Until June 2015 employers will no

BAYLEYS RESEARCH - MARKETBEAT - QUEENSTOWN RESIDENTIALlonger be required to check whether eligible New Zealand

Queenstown Dwellings

workers could fill vacancies in the resort which appears to

Increase

be no longer just a winter season resort town.

2001 2006 2013 2006-2013

The development sector is responding to this uplift in

Occupied 6,789 9,294 11,508 23.8%

demand, and between 2006 and 2013, development

Unoccupied 2,949 3,840 4,467 16.3%

of dwellings has kept pace with the population growth.

Source: StatsNZ

The total number of dwellings in Queenstown Lakes

District has increased by 23.8% taking the total to 15,975, a total which includes both occupied and holiday homes. The rate of

construction has been maintained post Census with numerous new housing developments underway, which we will dicuss in

further detail later.

Demonstrating a continued economic recovery, the level

of building consents has had a marked increase since mid

2013 and continues to climb to the highest levels seen

since the Global Financial Crisis (GFC) in 2008. Building

consent numbers peaked at 171 in the Queenstown

District in the June 2014 quarter, and lulled slightly at the

December 2014 year end, to 161 consents. Since June

2013 when consents near doubled from the quarter prior,

building consent numbers have been comfortably above

the long term average number of 114.

Source: Bayleys Research

Queenstown Median Price Hot Spots

Unsurprisingly the rising population and

demand for housing in Queenstown has

put pressure on housing stock and, in

turn, both rental and capital values. As

stated above the population make-up of

stable residents has increased noticably

which has led to far less ‘churn’ within

the rental market. The result is that

residential rental agencies are reporting

a real shortage of properties for rent with

no vacancy. This has put landlords in a

strong negotiating position with tenants

now typically being locked in for longer

term leases, usually twelve months,

with rental prices up 10-15% over the

past 2 years, in a similar pattern to the

Auckland rental market.

The latests residential sales statistics published by the Real Estate Institute of New Zealand (REINZ) show that the residential

property market in Queenstown continues to perform strongly. Over the period between December 2011 and December

2014 the median sales price has increased by 15.9% from $448,750 to $520,000. The median price reached its peak in the

September 2014 quarter at $546,500.

BAYLEYS RESEARCH - MARKETBEAT - QUEENSTOWN RESIDENTIALSource: REINZ, Bayleys Research Source: REINZ, Bayleys Research

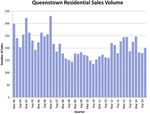

Sales volumes have been climbing steadily since the low

Jan 2015 Long Term Average

of 2008, when the impact of the GFC and New Zealand’s

Listings 235 278

recession was at its greatest. During the 2008 calendar year

REINZ recorded only 630 sales across the Queenstown region. Sales 119 100

Sales activity climbed steadily from this point with 901 sales Inventory 1,287 1,812

being recorded in 2013. The 2014 figure falls slightly short of the Weeks to Sell 46.9 86.6

2013 figure, which is likely down to the Reserve Bank of New Source: REINZ, Bayleys Research

Zealand’s (RBNZ) loan to value ratio (LVR) restrictions being

implemented in October 2013 but also a shortage of listings being brought to market as illustrated in the table above. The time

that it would take to sell the area’s total inventory currently sits at 46.9 weeks, which is historically low when compared with the

long term average of 86.6 weeks to sell all stock. The cause of this is sales numbers are up with 119 sales in January 2015, and

total new listings are lower at 233, resulting in total inventory being about 500 fewer properties than is usually on the market in the

region.

Days on the market figure bottomed out in the December quarter of 2013 with homes taking on average 56 days to sell. This

stretched out to 71 days to sell in the final quarter of 2014, with the long term average in Queenstown being 63 days on the

market.

While the relatively small number of sales recorded in Queenstown tend to make quarterly medians volatile, as illustrated in the

graph above, save fluctuations, the median has trended upwards since mid 2013 after a plateau since 2008, reaching $520,000

in the December quarter of 2014.

Glenorchy, a settlement to the north west of Queenstown on the shores of Lake Wakatipu, experienced a 40.5% median increase

from 2013 to 2014, with affluent Queenstown peninsular suburb Kelvin Heights growing 31% in twelve months.

Queenstown central also saw significant increases in its median sale price from $450,000 in 2013 to $533,000 in 2014, an 18.4%

increase. Fringe suburb Fernhill increased from $450,000 to $465,000 in 2014 and new development areas Lake Hayes and

Jacks Point rose just over 2% in the past twelve

Queenstown Suburb Breakdown

months.

2013 2014 % Growth

Glenorchy $370,000 $520,000 40.5% Unsurprisingly the housing shortage has

resulted in a significant lift in section sales with

Kelvin Heights $685,000 $897,000 31.0%

purchasers looking to secure sites for new

Queenstown $450,000 $533,000 18.4%

homes. The sales are occurring across all value

Fernhill $450,000 $465,000 3.3% bands. Agency reports advise of a noticeable

Lake Hayes $610,000 $624,750 2.4% lift in section sales within the exclusive Jacks

Jacks Point $806,000 $824,000 2.2% Point development where 40 sections have

Source: REINZ, Bayleys Research

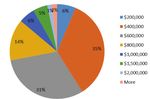

BAYLEYS RESEARCH - MARKETBEAT - QUEENSTOWN RESIDENTIALQueenstown Price Bracket Breakdown 2008

Jacks Point

Source: REINZ, Bayleys Research

sold since August last year, with the majority of buyers

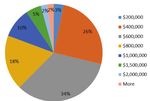

Queenstown Price Bracket Breakdown 2012

coming from Queenstown and neighbouring regions. Entry

level sections are available from $200,000 to $340,000 for

between 500m² and nearly 2000m² sites, with room for only

1,300 homes when the development is completed.

Among a number of new residential developments in the

Queenstown area, Bridesdale Farm in its initial release

weekend, had 60 of its total 147 sections sold pre title,

with titles expected in 14 months time. Bridesdale Farm

is designed to have a proportion of affordable homes as

outlined in the governments Housing Accord. With strict

design guidelines, purchasers can choose from nine different

architecturally designed plans for the sites, each site is

Source: REINZ, Bayleys Research

allocated a garden plot in the Bridesdale Farm Garden area.

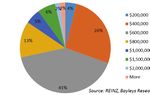

All sites are approximately 500m², and will be on freehold Queenstown Price Bracket Breakdown 2014

titles with no body corporate fees. Shotover Country is

another affordable new residential development neighbouring

Bridesdale Farm. This was sold directly by the developer

with no design guidelines and most purchasers being first

home buyers. Sections in Shotover Country start from

500m² fetching above $200,000 and when completed the

development will house 700-900 dwellings.

Source: REINZ, Bayleys Research

BAYLEYS RESEARCH - MARKETBEAT - QUEENSTOWN RESIDENTIALYou can also read